Escolar Documentos

Profissional Documentos

Cultura Documentos

The Trial Balance of Gagne Company Shown Below Does Not Balance

Enviado por

Friedeagle OilTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

The Trial Balance of Gagne Company Shown Below Does Not Balance

Enviado por

Friedeagle OilDireitos autorais:

Formatos disponíveis

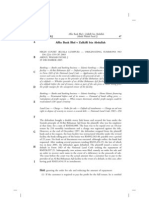

The trial balance of Gagne Company shown below does not balance

GAGNE COMPANY

Trial Balance

June 30, 2008

Debit Credit

Cash $2,600

Accounts receivable 7,600

Supplies 600

Equipment 8,300

Accounts Payable $9,766

Gagne, Capital 1,952

Gagne, Drawing 1,500

Service Revenue 15,200

Wage Expense 3,800

Repair Expense 1,600

__Total $26,000 $26,918

As examination of the ledger and journal reveals the following errors:

1. Each of the above listed accounts has a normal balance per the general ledger

2. Cash of $360 received from a customer on account was debited to Cash $630 and

credited to Accounts Receivable $630

3. A withdrawal of $300 by the owner was posted as a credit to Gagne, Drawing, $300 and

credited to Cash $30

4. A debit of $300 was not posted to Wages Expense

5. The purchase of equipment on account for $700 was recorded as a debit to Repair

Expense and a credit to Accounts Payable for $700

6. Services werer performed on account for a customer, $510, for which Accounts

Receivable was debited $510 and Service Revenue was credited $51

7. A payment on account for $225 was credited to Cash for $225 and credited to Accounts

Payable for $252

Prepare a correct the Trial Balance (correct or adjust error ).

Answer:

GAGNE COMPANY

Trial Balance

June 30, 2008

Debit Credit

Cash $2,330 (1)

Accounts receivable 7,870 (2)

Supplies 600

Equipment 9,000 (3)

Accounts Payable $9,289 (4)

Gagne, Capital 1,952

Gagne, Drawing 2,100 (5)

Service Revenue 15,659 (6)

Wage Expense 4,100 (7)

Repair Expense 900 (8)

__Total $26,900 $26,900

Calculation:

1. 2600 - 630 +360 = 2330

2. 7600 + 630 - 300 = 7870

3. 8300 + 700 = 9000

4. 9766 - 252 - 225 = 9,289

5. 15000 + 300 + 300 = 21,000

6. 15200 - 51 + 510 = 15,659

7. 3800 + 300 = 4,100

8. 1600 - 700 = 900

Você também pode gostar

- Describing The Business Transaction (20 Items X 2 Points) : Property of STIDocumento1 páginaDescribing The Business Transaction (20 Items X 2 Points) : Property of STInew genshinAinda não há avaliações

- Assessment MerchandisingDocumento2 páginasAssessment MerchandisingPauline BiancaAinda não há avaliações

- Ch05-Accounting PrincipleDocumento9 páginasCh05-Accounting PrincipleEthanAhamed100% (2)

- Partnership FormationDocumento13 páginasPartnership FormationAllen GonzagaAinda não há avaliações

- Jcps Accounting 04 Activity 1Documento4 páginasJcps Accounting 04 Activity 1Daphne Robles100% (1)

- 06 BasicAccTP1 SantosDocumento3 páginas06 BasicAccTP1 SantosJohn Santos100% (1)

- Nelson Daganta CashDocumento10 páginasNelson Daganta CashDan RioAinda não há avaliações

- Sue Feria Travel AgencyDocumento5 páginasSue Feria Travel AgencyMa Sophia Mikaela Erece100% (1)

- Far 1Documento2 páginasFar 1Stephanie Jane0% (1)

- E2-7 Answer KeyDocumento1 páginaE2-7 Answer Keyusenix1100% (1)

- Financial Ac Counting An D Reporting: Prof. Justiniano L. Santo S, Cpa, MbaDocumento41 páginasFinancial Ac Counting An D Reporting: Prof. Justiniano L. Santo S, Cpa, MbaEthan Manuel Del ValleAinda não há avaliações

- Accounting For Merchandizing Operations Problem 1-A) O'Quinn Co. Distributes Suitcases To Retail Stores and Extends Credit Terms of 1/10Documento4 páginasAccounting For Merchandizing Operations Problem 1-A) O'Quinn Co. Distributes Suitcases To Retail Stores and Extends Credit Terms of 1/10Qasim Khan0% (1)

- Exercise 3: 1. Initial Capital Investments (Compound Entry) DR CRDocumento4 páginasExercise 3: 1. Initial Capital Investments (Compound Entry) DR CRasdfAinda não há avaliações

- Chapter 1 Multiple Choice PGDocumento1 páginaChapter 1 Multiple Choice PGstudentone50% (2)

- 24-Month Note Due To BDODocumento3 páginas24-Month Note Due To BDOEliza CruzAinda não há avaliações

- BOND ValuationDocumento12 páginasBOND ValuationLemery0% (1)

- Quiz 1: 11. Which of The Following Is Not A Step in The Accounting Process?Documento39 páginasQuiz 1: 11. Which of The Following Is Not A Step in The Accounting Process?Thu Hien NguyenAinda não há avaliações

- AccountingDocumento5 páginasAccountingMarinie CabagbagAinda não há avaliações

- Solution To Selected Exercises Partnership Formation of ManuelDocumento5 páginasSolution To Selected Exercises Partnership Formation of ManuelShayne Pagwagan100% (1)

- Accbp100 2nd Exam Part 1Documento2 páginasAccbp100 2nd Exam Part 1emem resuento100% (1)

- P2 01Documento10 páginasP2 01Herald GangcuangcoAinda não há avaliações

- Para and Luman: Partnership InvestmentDocumento6 páginasPara and Luman: Partnership InvestmentDaphne RoblesAinda não há avaliações

- Exercise 5 - Completing The Accounting Cycle For Merchandising and Service BusinessDocumento4 páginasExercise 5 - Completing The Accounting Cycle For Merchandising and Service BusinessShiela Rengel0% (2)

- Problem 1: Lump Sum LiquidationDocumento2 páginasProblem 1: Lump Sum LiquidationAina Aguirre100% (2)

- When Goods Are Purchased:: Journal Entries in A Perpetual Inventory SystemDocumento27 páginasWhen Goods Are Purchased:: Journal Entries in A Perpetual Inventory SystemFami FamzAinda não há avaliações

- Chapter 5 PartnershipDocumento3 páginasChapter 5 PartnershipRose Ayson0% (1)

- Dr. Janet Dantes' JournalDocumento2 páginasDr. Janet Dantes' JournalShayne Pagwagan50% (2)

- University of Caloocan City: Name: Score: Course/Year & Section: DateDocumento3 páginasUniversity of Caloocan City: Name: Score: Course/Year & Section: DatePatricia Camille Austria0% (1)

- Special Journals - Kathy Concepcion #4 Page287Documento9 páginasSpecial Journals - Kathy Concepcion #4 Page287Joana Trinidad100% (3)

- IFRS Edition-2nd: The Accounting Information SystemDocumento88 páginasIFRS Edition-2nd: The Accounting Information SystemmariaAinda não há avaliações

- Group 6Documento8 páginasGroup 6Parkiee JamsAinda não há avaliações

- Midterm Task PerformanceDocumento7 páginasMidterm Task PerformanceSol Luna100% (1)

- ACCOUNTING 2 ReviewDocumento4 páginasACCOUNTING 2 ReviewAhnJello100% (1)

- Acc and BMDocumento8 páginasAcc and BMShawn Mendez100% (1)

- Financial PositionDocumento2 páginasFinancial PositionKatherine BorjaAinda não há avaliações

- Activity No. 3 - Principles of Accounting: AnswersDocumento2 páginasActivity No. 3 - Principles of Accounting: AnswersLagasca Iris100% (1)

- Teaching Note On Case Study 1 Midsouth Chamber of Commerce (A) : The Role of The Operating Manager in Information SystemsDocumento5 páginasTeaching Note On Case Study 1 Midsouth Chamber of Commerce (A) : The Role of The Operating Manager in Information SystemsM HAFIDZ RAMADHAN RAMADHAN100% (1)

- Adjusting and Closing Entries - Accruals Demonstration Problem 1 Anderson ArchitectsDocumento31 páginasAdjusting and Closing Entries - Accruals Demonstration Problem 1 Anderson ArchitectsFlorenz AmbasAinda não há avaliações

- Problem 6 1Documento2 páginasProblem 6 1SerdenRoseAinda não há avaliações

- Lesson 3Documento19 páginasLesson 3Rizza Joy Comodero Ballesteros100% (1)

- Chapter 4 CVP Analysis PDFDocumento57 páginasChapter 4 CVP Analysis PDFcindhyAinda não há avaliações

- Chapter 5 Double Entry Bookkeeping For A Service ProviderDocumento8 páginasChapter 5 Double Entry Bookkeeping For A Service ProviderPaw Verdillo100% (1)

- Bac MQ2 1Documento3 páginasBac MQ2 1JESSON VILLAAinda não há avaliações

- 1.2. Partnership Operations and Distributions of Profits or LossesDocumento4 páginas1.2. Partnership Operations and Distributions of Profits or LossesKPoPNyx EditsAinda não há avaliações

- Accounting Note or SampleDocumento2 páginasAccounting Note or Samplenilo bia100% (1)

- Instructions: Compute The Amount of Ayesa's Capital Account at September 1, 2014Documento10 páginasInstructions: Compute The Amount of Ayesa's Capital Account at September 1, 2014Nicole Fidelson0% (1)

- Perpetual System, Problem #17Documento2 páginasPerpetual System, Problem #17Feiya LiuAinda não há avaliações

- ACCTG 124 Chapter 4Documento2 páginasACCTG 124 Chapter 4John Vincent A DioAinda não há avaliações

- PARCORDocumento1 páginaPARCORRhea Royce Cabuhat43% (7)

- 2811501Documento12 páginas2811501mohitgaba19100% (1)

- 21-22 - Assignment - FOH - Part 2Documento4 páginas21-22 - Assignment - FOH - Part 2Oliviane Theodora WennoAinda não há avaliações

- Manufacturing Cost AccountingDocumento27 páginasManufacturing Cost AccountingYean SoramyAinda não há avaliações

- Prepare Journal Entries 2Documento1 páginaPrepare Journal Entries 2Rie CabigonAinda não há avaliações

- Activites & Seatwork in Acctg 1Documento6 páginasActivites & Seatwork in Acctg 1Ian Santos0% (1)

- Partnership FormationDocumento13 páginasPartnership FormationPhilip Dan Jayson LarozaAinda não há avaliações

- Far - 1st Quiz Midterm - Ay 2019-2020Documento1 páginaFar - 1st Quiz Midterm - Ay 2019-2020Renalyn Paras33% (3)

- Credo Auto SupplyDocumento4 páginasCredo Auto SupplyShinji0% (1)

- Group Assignment - Questions - RevisedDocumento6 páginasGroup Assignment - Questions - Revised31231023949Ainda não há avaliações

- ACCT10002 Tutorial 2 Exercises, 2020 SM1Documento6 páginasACCT10002 Tutorial 2 Exercises, 2020 SM1JING NIEAinda não há avaliações

- Soal Latihan DDADocumento1 páginaSoal Latihan DDAMutia AzzahraAinda não há avaliações

- AT-02: TO Auditing: - T R S ADocumento2 páginasAT-02: TO Auditing: - T R S AFriedeagle OilAinda não há avaliações

- TX 201 PDFDocumento5 páginasTX 201 PDFFriedeagle OilAinda não há avaliações

- T R S A: HE Eview Chool of CcountancyDocumento4 páginasT R S A: HE Eview Chool of CcountancyFriedeagle OilAinda não há avaliações

- RFBT 01 Law On ObligationsDocumento8 páginasRFBT 01 Law On ObligationsFriedeagle OilAinda não há avaliações

- 1800 Jan 2018 ENCS FinalDocumento2 páginas1800 Jan 2018 ENCS FinalJewelyn C. Espares-CioconAinda não há avaliações

- Corruption in Finance and AccountingDocumento20 páginasCorruption in Finance and AccountingFriedeagle OilAinda não há avaliações

- 1801 - Estate Tax ReturnDocumento2 páginas1801 - Estate Tax ReturnErikajane BolimaAinda não há avaliações

- TAX-101: Estate Taxation: - T R S ADocumento10 páginasTAX-101: Estate Taxation: - T R S AFriedeagle OilAinda não há avaliações

- Philippine Financial Reporting Standard (PFRS) 15: The New Revenue Recognition StandardDocumento18 páginasPhilippine Financial Reporting Standard (PFRS) 15: The New Revenue Recognition StandardWa TuZi100% (1)

- Ifrs 15 REVENUE FROM CONTRACT WITH CUSTOMERSDocumento22 páginasIfrs 15 REVENUE FROM CONTRACT WITH CUSTOMERSHasnain amjad ranaAinda não há avaliações

- Amendments To The Corporation CodeDocumento95 páginasAmendments To The Corporation CodejaciemAinda não há avaliações

- Ifrs 15Documento78 páginasIfrs 15KunalArunPawarAinda não há avaliações

- Principle 9Documento4 páginasPrinciple 9Friedeagle OilAinda não há avaliações

- Ifrs15 Revenue Handbook PDFDocumento369 páginasIfrs15 Revenue Handbook PDFFriedeagle OilAinda não há avaliações

- NegoDocumento22 páginasNegoFriedeagle OilAinda não há avaliações

- Law NotesDocumento21 páginasLaw NotesVic FabeAinda não há avaliações

- Ca en Audit Clearly Ifrs Joint Arrangements Ifrs 11 PDFDocumento20 páginasCa en Audit Clearly Ifrs Joint Arrangements Ifrs 11 PDFKen PioAinda não há avaliações

- Principle 9Documento4 páginasPrinciple 9Friedeagle OilAinda não há avaliações

- 03 PayrollDocumento22 páginas03 PayrollFriedeagle OilAinda não há avaliações

- Principle 9Documento4 páginasPrinciple 9Friedeagle OilAinda não há avaliações

- Summary of El FiliDocumento4 páginasSummary of El FiliFriedeagle OilAinda não há avaliações

- Summary of El FiliDocumento4 páginasSummary of El FiliFriedeagle OilAinda não há avaliações

- Privacy and InfDocumento13 páginasPrivacy and InfFriedeagle OilAinda não há avaliações

- La Vieilli HotelDocumento5 páginasLa Vieilli HotelFriedeagle OilAinda não há avaliações

- Summary of El FiliDocumento3 páginasSummary of El FiliFriedeagle OilAinda não há avaliações

- Rms InfoDocumento1 páginaRms InfoFriedeagle OilAinda não há avaliações

- Report in RizalDocumento2 páginasReport in RizalFriedeagle OilAinda não há avaliações

- Lua NetErrorDocumento181 páginasLua NetErrorFriedeagle OilAinda não há avaliações

- Chapter03 - Audit of The Revenue and Collection Cycle - UnlockedDocumento13 páginasChapter03 - Audit of The Revenue and Collection Cycle - UnlockedMark Kenneth Chan BalicantaAinda não há avaliações

- Science 6q4week 8day1 Rotation Period of Inner and Outer PlanetsDocumento28 páginasScience 6q4week 8day1 Rotation Period of Inner and Outer PlanetsFriedeagle Oil50% (2)

- Thd04e 1Documento2 páginasThd04e 1Thao100% (1)

- MCSE Sample QuestionsDocumento19 páginasMCSE Sample QuestionsSuchitKAinda não há avaliações

- MANITOUDocumento2 páginasMANITOUmozollis22Ainda não há avaliações

- Exploring The OriginsDocumento12 páginasExploring The OriginsAlexander ZetaAinda não há avaliações

- Community Based Nutrition CMNPDocumento38 páginasCommunity Based Nutrition CMNPHamid Wafa100% (4)

- Practice Ch5Documento10 páginasPractice Ch5Ali_Asad_1932Ainda não há avaliações

- Third Party Intervention in The Criminal TrialDocumento8 páginasThird Party Intervention in The Criminal TrialVenkat Raman JAinda não há avaliações

- 02 - Zapatos Vs PeopleDocumento2 páginas02 - Zapatos Vs PeopleRhev Xandra Acuña67% (3)

- 2 - (Accounting For Foreign Currency Transaction)Documento25 páginas2 - (Accounting For Foreign Currency Transaction)Stephiel SumpAinda não há avaliações

- Pam ApplicationDocumento3 páginasPam Applicationapi-534834656Ainda não há avaliações

- Shaping School Culture Case StudyDocumento7 páginasShaping School Culture Case Studyapi-524477308Ainda não há avaliações

- Athletic KnitDocumento31 páginasAthletic KnitNish A0% (1)

- Bos 22393Documento64 páginasBos 22393mooorthuAinda não há avaliações

- Ad&d - Poison Costs & Poison CraftDocumento4 páginasAd&d - Poison Costs & Poison Craftweb moriccaAinda não há avaliações

- Power & Leadership PWDocumento26 páginasPower & Leadership PWdidato.junjun.rtc10Ainda não há avaliações

- 18 Month QuestionnaireDocumento6 páginas18 Month QuestionnaireAnnie AbreuAinda não há avaliações

- SMA Releases Online Version of Sunny Design For PV System ConfigurationDocumento3 páginasSMA Releases Online Version of Sunny Design For PV System ConfigurationlakliraAinda não há avaliações

- Strama-Ayala Land, Inc.Documento5 páginasStrama-Ayala Land, Inc.Akako MatsumotoAinda não há avaliações

- Medical Secretary: A. Duties and TasksDocumento3 páginasMedical Secretary: A. Duties and TasksNoona PlaysAinda não há avaliações

- Grade 4 Fsa Warm-UpsDocumento32 páginasGrade 4 Fsa Warm-Upsapi-290541111100% (3)

- Petition For Bail Nonbailable LampaDocumento3 páginasPetition For Bail Nonbailable LampaNikki MendozaAinda não há avaliações

- Freedom International School Class 3 - EnglishDocumento2 páginasFreedom International School Class 3 - Englishshreyas100% (1)

- TM201 - Session 1-2 Paper - Introduction To The Field of Technology Management - AFVeneracion - 201910816Documento1 páginaTM201 - Session 1-2 Paper - Introduction To The Field of Technology Management - AFVeneracion - 201910816Nicky Galang IIAinda não há avaliações

- Pier Cap Corbel 30m SGDocumento3 páginasPier Cap Corbel 30m SGSM ConsultantsAinda não há avaliações

- Robbins FOM10ge C05Documento35 páginasRobbins FOM10ge C05Ahmed Mostafa ElmowafyAinda não há avaliações

- MELSEC System Q: QJ71MES96 MES Interface ModuleDocumento364 páginasMELSEC System Q: QJ71MES96 MES Interface ModuleFajri AsyukronAinda não há avaliações

- The SU Electric Fuel Pump Type Car Reference List AUA 214Documento4 páginasThe SU Electric Fuel Pump Type Car Reference List AUA 214Anonymous aOXD9JuqdAinda não há avaliações

- BCMSN30SG Vol.2 PDFDocumento394 páginasBCMSN30SG Vol.2 PDFShemariyahAinda não há avaliações

- Affin Bank V Zulkifli - 2006Documento15 páginasAffin Bank V Zulkifli - 2006sheika_11Ainda não há avaliações

- Past Paper1Documento8 páginasPast Paper1Ne''ma Khalid Said Al HinaiAinda não há avaliações