Escolar Documentos

Profissional Documentos

Cultura Documentos

Student Guard Brochure PDF

Enviado por

AjuTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Student Guard Brochure PDF

Enviado por

AjuDireitos autorais:

Formatos disponíveis

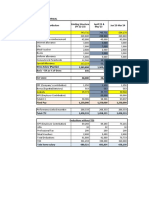

Coverages “SI” in US$ Plan A Plan B Ultimate Ultimate Supreme Premium Table Amount in INR^

Student Guard - Overseas Health Insurance Plan UIN: IRDAI/NL-HLT/TAGI/P-T/V.II/237/14-15

Student Guard - Overseas Health Insurance Plan UIN: IRDAI/NL-HLT/TAGI/P-T/V.II/237/14-15

Plus

*Excluding Americas *Including Americas

AD & D 24 Hours 10,000 25,000 25,000 30,000 50,000

Trip Band Plan A Plan B Ultimate Ultimate Plus Supreme Plan A Plan B Ultimate Ultimate Plus Supreme

Felonious Assault (AD & D) 5,000 5,000 25,000 25,000 25,000

0-30 1,240 1,382 1,614 1,785 1,886 2,846 3,185 3,529 3,823 4,132

Accident & Sickness Medical 50,000 1,00,000 2,50,000 5,00,000 5,00,000

31-60 2,164 2,447 2,912 3,254 3,454 5,376 6,053 6,744 7,330 7,948

Expenses Reimbursement1 Deductible 100 100 100 100 100

61-90 3,152 3,587 4,300 4,825 5,132 8,081 9,120 10,179 11,080 12,028

Child care benefits 250 500 1,000 1,250 1,500 91-120 3,789 4,322 5,196 5,837 6,214 9,826 11,099 12,396 13,499 14,659

Coverage for Pre existing 120-180 6,019 6,895 8,328 9,383 10,002 15,932 18,025 20,153 21,965 23,870

500 1,000 2,500 5,000 5,000

Conditions under A&S**

181-270 8,823 10,129 12,268 13,841 14,763 23,611 26,731 29,905 32,608 35,451

Maternity Benefit (Only Inpatient

Treatment incl 1 month post 271-365 10,891 12,515 15,174 17,130 18,275 29,273 33,151 37,098 40,457 43,990

500 1,000 2,000 2,500 3,000

Natal Cover) - Waiting Period -

Premium Chart (inclusive of 18% GST)

10 Months

Age Band – 16 to 35 years – Maximum Trip Duration 365 Days

Ambulance Charges 250 250 250 500 500 Premium rates are subject to change with prior approval from IRDA of India

Treatment for mental and nervous

disorders: including alcoholism - 500 1,000 2,000 2,500

and drug dependency. Salient Features & Benefits^^

Cancer screening and

250 500 1,500 2,500 3,000

mammography examinations2

Physiotherapy 500 500 500 500 500

Sickness Dental Relief3 250 300 400 500 500

Accident & Sickness Cancer screening Sickness Dental Study Bail Bond5 Missed Connection/

Deductible 100 100 100 100 100 3

Medical Expenses & mammography Relief Interruption4 Missed Departure6

Assistance Services Included Included Included Included Included

Reimbursement1 examinations2

Emergency Evacuation 5,000 10,000 15,000 25,000 25,000 ^^For complete list of detailed benefits please refer to policy wordings.

Continuing Treatment (following

Medical Repatriation to your NA NA NA NA 20,000 Renewal Condition:

Country of Origin)## (i) The Single Trip Insurance – The Single Trip Insurance is non-renewable, not cancelable and not refundable while

Repatriation of Remains 2,500 5,000 7,500 10,000 10,000 effective. Cancellation of the Policy may be done only prior to the Effective Date stated in the Policy Schedule and will be

subject to deduction of cancellation charge of Rs 350/- by Us.

Checked Baggage Loss* 500 1,000 2,000 2,500 2,500

(ii) Annual Trip Insurance - The Annual Trip Insurance may be renewed with Our consent by the payment in advance of the

Checked Baggage Delay# total premium specified by Us, which premium shall be at Our premium rate in force at the time of renewal. • Cancellation

(After 12 hours only) - 50 150 250 250

of the Policy may be done prior to the Effective Date stated in the Policy Schedule and will be subject to deduction of

Loss of passport 250 250 250 250 250 cancellation charge of Rs 350/- by Us • The policy shall be ordinarily renewable upon payment of premium unless the

Deductible 30 30 30 30 30 Insured Person or any one acting on behalf of an Insured Person has acted in an improper, dishonest or fraudulent manner

or due to non cooperation by the Insured or any misrepresentation under or in relation to this policy or poses a moral

Personal Liability 1,00,000 1,00,000 5,00,000 5,00,000 5,00,000

hazard. • Grace period in payment up to 30 days from the premium due date is allowed where you can still pay your

Deductible 200 200 200 200 200 premium and continue your policy. Coverage would not be available for the period for which no premium has been

Study Interruption4 7,500 7,500 15,000 25,000 25,000 received. • We may extend the renewal automatically if opted by You in the Proposal Form and provided You are eligible for

Sponsor Protection 10,000 10,000 20,000 25,000 25,000 renewal as per age criteria as per Policy terms and paid the premium. • You may enhance the sum insured only at the time

of renewal of the policy. However the quantum of increase shall be subject to underwriting guidelines of the company. • We

Compassionate Visit ( 2-Way) Visit 1,500 5,000 7,500 10,000 10,000 will not apply any additional loading on your policy premium at renewal based on claim experience.• Your renewal

Bail Bond5 500 1,000 5,000 5,000 5,000 premium for this policy will not change unless we have revised the premium and obtained due approval from Authority.

Your premium will also change if you move into a higher age group, or change the plan. • This policy will be renewed till the

100 per day 100 per day 100 per day 100 per day 100 per day Insured attains a completed age of 35 years thereafter it will not be renewed • In the likelihood of this policy being withdrawn

Hijack Cash Benefit (Max 500) (Max 500) (Max 500) (Max 500) (Max 500) in future, we will intimate you about the same 3 months prior to expiry of the policy. You will have the option to migrate to

Deductible 1 Day 1 Day 1 Day 1 Day 1 Day any Travel insurance policy available with us. • Any revision / modification in the product will be done with the approval of

the Insurance Regulatory and Development Authority of India and will be intimated to You atleast 3 months in advance.

Missed Connection/ 250 500 750 1,000 1,000

Missed Departure6 Deductible 25 50 75 100 100

Free Look Period:

10 per 12 hr 10 per 12 hr 10 per 12 hr 10 per 12 hr 10 per 12 hr

(Max 100) (Max 100) (Max 100) (Max 100) (Max 100) (i) Single Trip Insurance – Free look period is not applicable.

Trip Delay

(ii) Annual Trip Insurance - You have a period of 15 days from the date of receipt of the Policy document to review

Deductible 12 Hrs 12 Hrs 12 Hrs 12 Hrs 12 Hrs the terms and conditions of this Policy provided no trip has been commenced. If You have any objections to any

Fraudulent Charges(Payment of the terms and conditions, You have the option of cancelling the Policy stating the reasons for cancellation and

500 1,000 1,500 2,000 2,000

Card Security) You will be refunded the premium paid by You after adjusting the amounts spent on stamp duty charges and

#Reimbursement of purchase of necessary personal effect, due to baggage delay overseas. proportionate risk premium. You can cancel Your Policy only if You have not made any claims under the Policy. All

*The maximum amount to be reimbursed per bag is 50%, and the maximum value per article contained in any bag is 10% Your rights under this Policy will immediately stand extinguished on the free look cancellation of the Policy. Free

** Pre-existing condition is covered only in case of life threatening unforeseen emergency. look provision is not applicable and available at the time of renewal of the Policy.

##coverage is applicable within 60 days from the date of your return to your country of Origin.

Você também pode gostar

- Revenue: Recurring Service Consulting Support Partnershi Ps Other/Man Ual AdjustmentsDocumento6 páginasRevenue: Recurring Service Consulting Support Partnershi Ps Other/Man Ual AdjustmentsGolam Samdanee TaneemAinda não há avaliações

- AUDITDocumento12 páginasAUDITdavid giriAinda não há avaliações

- WaferDocumento6 páginasWafertakanahgroup.coAinda não há avaliações

- Contributions and Benefits 1 July 2021: Cimas Comprehensive (ZWL) Cimas Standard (ZWL)Documento1 páginaContributions and Benefits 1 July 2021: Cimas Comprehensive (ZWL) Cimas Standard (ZWL)Matthew MatawoAinda não há avaliações

- Calculation of Salary Income PDFDocumento1 páginaCalculation of Salary Income PDFAl SukranAinda não há avaliações

- Family Protection & Retirement Planning ToolDocumento4 páginasFamily Protection & Retirement Planning ToolSiddu MangaloreAinda não há avaliações

- CTC Structure Jan DemoDocumento4 páginasCTC Structure Jan DemoPrashant BedaseAinda não há avaliações

- Key financial information for insurance companies in Pakistan for 2018Documento1 páginaKey financial information for insurance companies in Pakistan for 2018Fahad SiddiquiAinda não há avaliações

- Prepaid Expenses 31.03.2019Documento5 páginasPrepaid Expenses 31.03.2019pradeep vermaAinda não há avaliações

- e9d87bc9-eedc-4eb0-b2db-e9d75e5bf992Documento2 páginase9d87bc9-eedc-4eb0-b2db-e9d75e5bf992Fawzar SabirAinda não há avaliações

- Project Report 5Documento27 páginasProject Report 5adwait kulkarniAinda não há avaliações

- Schwinn 12 Month Cash FlowDocumento2 páginasSchwinn 12 Month Cash Flowrozav13Ainda não há avaliações

- Feb 2018 FinancialsDocumento2 páginasFeb 2018 Financialsthe kingfishAinda não há avaliações

- Hyperion Master Sheet NL 2013 FinalDocumento22 páginasHyperion Master Sheet NL 2013 Finalannemarie van zadelhoffAinda não há avaliações

- Plant Assets - Riovaldo & SyifaDocumento14 páginasPlant Assets - Riovaldo & SyifaMuhammad RafiAinda não há avaliações

- Exp Head Wise Summery Jan15 - Dec15Documento2 páginasExp Head Wise Summery Jan15 - Dec15shoaibAinda não há avaliações

- JMA 2021 BudgetDocumento8 páginasJMA 2021 BudgetJerryJoshuaDiazAinda não há avaliações

- 0 Neel - Rajendra JainDocumento11 páginas0 Neel - Rajendra JainDrJd ChandrapalAinda não há avaliações

- Bajrabarahi Sana Krishi Firm Income ProjectionsDocumento5 páginasBajrabarahi Sana Krishi Firm Income ProjectionsheroAinda não há avaliações

- Manage FinanceDocumento11 páginasManage FinanceGurjinder Hanjra100% (2)

- Chandak Insurance IllustrationDocumento5 páginasChandak Insurance IllustrationMohit DhakaAinda não há avaliações

- Dep EDDocumento74 páginasDep EDRenante SorianoAinda não há avaliações

- 945 - Jeevan UmangDocumento6 páginas945 - Jeevan UmangSaro SaravananAinda não há avaliações

- PT DigitalInstincts Teknologi Arus Kas (Langsung) Dari Periode Agustus 2019 s/d Agustus 2019Documento45 páginasPT DigitalInstincts Teknologi Arus Kas (Langsung) Dari Periode Agustus 2019 s/d Agustus 2019Suhunan PilipAinda não há avaliações

- Expenditure Program, by Object, Fy 2019 (In Thousand Pesos) Table B.1Documento6 páginasExpenditure Program, by Object, Fy 2019 (In Thousand Pesos) Table B.1Sean BuencaminoAinda não há avaliações

- Programmed Appropriation and Obligation by Object of ExpenditureDocumento7 páginasProgrammed Appropriation and Obligation by Object of ExpenditureKristin Villaseñor-MercadoAinda não há avaliações

- PC Depot Trial Balance - Hezekiah PardedeDocumento5 páginasPC Depot Trial Balance - Hezekiah PardedeHezekiah PardedeAinda não há avaliações

- Dermatology Express LLC - Confidential Year 1 RevenueDocumento9 páginasDermatology Express LLC - Confidential Year 1 RevenueBob SpoontAinda não há avaliações

- Quiz 02Documento2 páginasQuiz 02elmer subaAinda não há avaliações

- GoSecure BroDocumento2 páginasGoSecure BrogreatdsaAinda não há avaliações

- Income Tax Calculation WorksheetDocumento2 páginasIncome Tax Calculation Worksheetbabasahebjawale 5207Ainda não há avaliações

- 13 Mainit2020 - Part4 Annexes - A DDocumento13 páginas13 Mainit2020 - Part4 Annexes - A DLeo SindolAinda não há avaliações

- Prolongation Cost RevisedDocumento2 páginasProlongation Cost RevisedSvh KameshAinda não há avaliações

- NDTV Q2-09 ResultsDocumento8 páginasNDTV Q2-09 ResultsmixedbagAinda não há avaliações

- Profit & Loss Accounts: Wing Chair GirogioDocumento3 páginasProfit & Loss Accounts: Wing Chair Girogiofarsi786Ainda não há avaliações

- 0 Aayush - Rajendra JainDocumento10 páginas0 Aayush - Rajendra JainDrJd ChandrapalAinda não há avaliações

- MDRRMODocumento4 páginasMDRRMOSum WhosinAinda não há avaliações

- Johnson Turnaround (Appendices)Documento13 páginasJohnson Turnaround (Appendices)RAVEENA DEVI A/P VENGADESWARA RAOAinda não há avaliações

- Noman Ahmed Consulting - Profit and LossDocumento2 páginasNoman Ahmed Consulting - Profit and LossNoman ChoudharyAinda não há avaliações

- MboDocumento4 páginasMboSum WhosinAinda não há avaliações

- Anurag Revised Salary Breakup FY23-24Documento2 páginasAnurag Revised Salary Breakup FY23-24SathyanarayanaAmbatiAinda não há avaliações

- Fol Haws Catering Service Exercise-1Documento16 páginasFol Haws Catering Service Exercise-1Guiana WacasAinda não há avaliações

- ICICI form-nl-7-operating-expenses-scheduleDocumento2 páginasICICI form-nl-7-operating-expenses-scheduleSatyamSinghAinda não há avaliações

- Cost Accounting Problems and SolutionsDocumento6 páginasCost Accounting Problems and SolutionsDaniel John GapasAinda não há avaliações

- Part 3Documento1 páginaPart 3sanjay mouryaAinda não há avaliações

- Annex A - Cagayan State University 2023 Financial PlanDocumento4 páginasAnnex A - Cagayan State University 2023 Financial PlanWhenng LopezAinda não há avaliações

- Excel-Corporate Finance FGVDocumento2 páginasExcel-Corporate Finance FGVVictorAinda não há avaliações

- BSBFIM601Documento16 páginasBSBFIM601WalldecorpakistanAinda não há avaliações

- #75 Busns CombinationDocumento3 páginas#75 Busns CombinationJon Dumagil InocentesAinda não há avaliações

- Langkah Langkah Zahir OkDocumento156 páginasLangkah Langkah Zahir OkekachristinerebecaAinda não há avaliações

- SaaS Financial Model Template by ChargebeeDocumento15 páginasSaaS Financial Model Template by ChargebeeNikunj Borad0% (1)

- (FM) AssignmentDocumento7 páginas(FM) Assignmentnuraini putriAinda não há avaliações

- 01 Levelized Cost EnergyDocumento6 páginas01 Levelized Cost EnergySopanghadgeAinda não há avaliações

- Revised Standalone Financial Results For December 31, 2016 (Result)Documento4 páginasRevised Standalone Financial Results For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Black Hole Futsal & Café Projected Balance SheetDocumento9 páginasBlack Hole Futsal & Café Projected Balance Sheetkalpana BaralAinda não há avaliações

- Jamil InsuranceDocumento5 páginasJamil InsuranceAli HamzaAinda não há avaliações

- Saaob DetailedDocumento3 páginasSaaob DetailedzcacctgauditAinda não há avaliações

- Cashflow ProjectionsDocumento1 páginaCashflow ProjectionsJoe MageroAinda não há avaliações

- 2016 AP Micro FRQ - Consumer ChoiceDocumento2 páginas2016 AP Micro FRQ - Consumer ChoiceiuhdoiAinda não há avaliações

- Anders LassenDocumento12 páginasAnders LassenClaus Jørgen PetersenAinda não há avaliações

- Marijuana Advertising Order Denying Preliminary InjunctionDocumento6 páginasMarijuana Advertising Order Denying Preliminary InjunctionMichael_Lee_RobertsAinda não há avaliações

- Aztec CodicesDocumento9 páginasAztec CodicessorinAinda não há avaliações

- Invitation to Kids Camp in Sta. Maria, BulacanDocumento2 páginasInvitation to Kids Camp in Sta. Maria, BulacanLeuan Javighn BucadAinda não há avaliações

- Harmony Ville, Purok 3, Cupang, Muntinlupa CityDocumento2 páginasHarmony Ville, Purok 3, Cupang, Muntinlupa CityJesmar Quirino TutingAinda não há avaliações

- Case Study 2, Domino?s Sizzles With Pizza TrackerDocumento3 páginasCase Study 2, Domino?s Sizzles With Pizza TrackerAman GoelAinda não há avaliações

- Teaching Portfolio Showcases Skills and AchievementsDocumento37 páginasTeaching Portfolio Showcases Skills and AchievementsIj CamataAinda não há avaliações

- Our Common Future, Chapter 2 Towards Sustainable Development - A42427 Annex, CHDocumento17 páginasOur Common Future, Chapter 2 Towards Sustainable Development - A42427 Annex, CHShakila PathiranaAinda não há avaliações

- Amplus SolarDocumento4 páginasAmplus SolarAbhishek AbhiAinda não há avaliações

- List of applicants for admission to Non-UT Pool categoryDocumento102 páginasList of applicants for admission to Non-UT Pool categoryvishalAinda não há avaliações

- Self Concept's Role in Buying BehaviorDocumento6 páginasSelf Concept's Role in Buying BehaviorMadhavi GundabattulaAinda não há avaliações

- The 5000 Year Leap Study Guide-THE MIRACLE THAT CHANGED THE WORLDDocumento25 páginasThe 5000 Year Leap Study Guide-THE MIRACLE THAT CHANGED THE WORLDMichele Austin100% (5)

- City of Baguio vs. NiñoDocumento11 páginasCity of Baguio vs. NiñoFD BalitaAinda não há avaliações

- TaclobanCity2017 Audit Report PDFDocumento170 páginasTaclobanCity2017 Audit Report PDFJulPadayaoAinda não há avaliações

- Dunn, David Christopher vs. Methodist Hospital (Court 189)Documento1 páginaDunn, David Christopher vs. Methodist Hospital (Court 189)kassi_marksAinda não há avaliações

- Reflection Paper AristotleDocumento3 páginasReflection Paper AristotleMelissa Sullivan67% (9)

- 5658 1Documento5 páginas5658 1Afsheen ZaidiAinda não há avaliações

- Introduction To Distribution ManagementDocumento18 páginasIntroduction To Distribution ManagementGaurav VermaAinda não há avaliações

- Build - Companion - HarrimiDocumento3 páginasBuild - Companion - HarrimiandrechapettaAinda não há avaliações

- Janice Perlman, FavelaDocumento3 páginasJanice Perlman, FavelaOrlando Deavila PertuzAinda não há avaliações

- The Wife of Bath's Feminist PortrayalDocumento8 páginasThe Wife of Bath's Feminist PortrayalPapu PatraAinda não há avaliações

- The Sanctuary Made Simple Lawrence NelsonDocumento101 páginasThe Sanctuary Made Simple Lawrence NelsonSulphur92% (12)

- Omoluabi Perspectives To Value and Chara PDFDocumento11 páginasOmoluabi Perspectives To Value and Chara PDFJuan Daniel Botero JaramilloAinda não há avaliações

- History Project: (For Ist Semester)Documento27 páginasHistory Project: (For Ist Semester)Jp YadavAinda não há avaliações

- Resume With Leadership New 2Documento2 páginasResume With Leadership New 2api-356808363Ainda não há avaliações

- TAX-402 (Other Percentage Taxes - Part 2)Documento5 páginasTAX-402 (Other Percentage Taxes - Part 2)lyndon delfinAinda não há avaliações

- Mitul IntreprinzatoruluiDocumento2 páginasMitul IntreprinzatoruluiOana100% (2)

- Paper 1 Notes Islamiat - ColourDocumento104 páginasPaper 1 Notes Islamiat - ColourSyed Zeeshan Shahid100% (1)

- Case No. 23 - Maderada Vs MediodeaDocumento3 páginasCase No. 23 - Maderada Vs MediodeaAbbyAlvarezAinda não há avaliações