Escolar Documentos

Profissional Documentos

Cultura Documentos

Pillars of Retail Banking Operations

Enviado por

Jayakrishnaraj AJD0 notas0% acharam este documento útil (0 voto)

23 visualizações17 páginasPillars of Retail Banking Operations

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoPillars of Retail Banking Operations

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

23 visualizações17 páginasPillars of Retail Banking Operations

Enviado por

Jayakrishnaraj AJDPillars of Retail Banking Operations

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF ou leia online no Scribd

Você está na página 1de 17

The Pillars of Retail banking operations

Peele

SCs a eee Cd

rN aeON = a(n

This presentation is an overview of my past professional and academic

experience in the banking industry with regards to controlling and finance

Bilao elo CUMCOl No NI (ola Mikel. 0) sho PLO NROy

The topics mentioned here all purely based on my experience and

knowledge of how the retail banking functions, what are its main activities,

tools and techniques and what | learnt from their implementation in day to

EWA ola Ua Mice Ol Mial aan ancl MA tal eoiccl Med Ta) Ua) = 1eot oeTa)

Analyst/Branch officer .

This presentation is divided into two parts:

1. The first part explain the pillars of retail banking

2. The second part focus on my role and learning's

a iat-menrllan elles

Retail banking

Personal Loins} Tnicslenr-areyar-|| (eel g lel e-ic-)

banking banking Leer alit=4

Personal Banking

Why do we need personal banking?

lela

ls personal banking the need of hour and helps in generating more business

AViidaMal eke icelen-as-ld cadena Rage late

Yel TRS tU EM nto) acelin

Personal Banking refers to all the services like Savings Account Operations,

Current Account Operations, Provision of Personal Loans, Investments,

Credit Card Services, treasury management, trading and all other facilities

that the Banks offer to persons or individuals.

Division of activities in Personal banking

(eT eT)

Xe) een}

* aici

pre ecies neces

IU euAculs

Renae

internet banking

“Manage cash

inflow, outflow “Trading in

and turnover currencies,

shares and

other financial

reporting and oy

securities

account

‘customer Recineraien

accounts and closure.

controlling :

“Balance

Processing of cisromer:

customer analysis anc

r portfolio .

lant management reconciliation Developing

settlements peters

* *Cash pooling

and collections Internal _imemet

ahem itance auditing and “Maintain nts

reporting for operations - 5

Operation

and collection z

frauds liquidity by

services transactions

5 *Presentations racine through

‘Monthly i iglencland Forex, financial ey

Financial te | derivatives pees

reporting ae banking:

Business Banking

Whether a small firm, big company or an industry. Does Business banking

provides efficient solution for economical growth

Or

Does it help in providing a competitive edge to businessmen?

Well lets have a look at Business banking and its tools?

Acompany's financial dealings with an institution that provides business

loans, credit, savings and checking accounts specifically for companies and

not for individuals. Business banking is also known as commercial banking

and occurs when a bank, or division of a bank, only deals with businesses.

Division of activities in Business banking

er acotatectese lied

and services

*Managing

business

accounts

*Offering

payments and

collection

services

*Providing

international

transfers

“Financial

reporting and

database

controlling

ESS eee Ory

*vendor dealer

finance by

short, medium

and long term

loans

*Processing,

documentation

and closure.

*Presentations

to clients for

new offers and

transaction

"Settlement of

accounts and

daily business

Bice aula ey

“Ensuring

credit and

trade services

“Letter of

guarantees,

import-export

finance,

negotiations,

Forex services

“Contacting

international

partners for

networking

ENN eaytes

*advising

clients on

account

transaction

*Maintaining

account

reports,

analyzing

deviations and

reporting to

corporate

office

* Reporting

the new tends

in banking

International Banking

What happen when banks do international banking for the purpose of

expanding business

Or

How do business, individual or companies benefits from international

What does it includes?

When banking transactions crosses national boundaries then it becomes

HTaleclaarelecodarel ers al diay -auielm= cli) ("91 el Vea Kelme (elgalsrq(el Ta LeRe aired)

foreign residents, claims of foreign bank offices on, local residents, claims

of domestic bank offices on, domestic residents in foreign currency

deposits similarly classified by residence of bank or depositor, or currency

Division of activities in International banking

Bank

Accounts

* Opening

savings and

deposits

accounts

* Offering

Forex services

for remittances

and collection

*Providing

international

transfers

"Maintaining

account

transactions

Money

MelSicle

*international

cash

management

* Doing SWIFT,

NIFT, RTGS.

*Presentations

to clients for

new offers and

transaction

*Settlement of

payments and

receiving

through

corporate

office

Loans and

Tass Ue}

“Providing

loans for

property

purchase

* Offering

portfolio

investments.

schemes

*Offering

insurance plan

*Contacting

international

partners for

networking

Advisory

ae)

* Advising

clients on

account

transaction

“Maintaining

account

reports,

analyzing

deviations and

reporting to

corporate

office

* Maintaining

the data in

internal

system

Corporate banking

How do banks interact with each other and with companies in industrial

sector?

lolg

Can we assume that corporate banking plays a same role as an In-house

LT) -ta

The answer lies in.....

Financial services specifically offered to corporation such as cash management,

financing, underwriting and issuing of stocks, bonds or other instruments

can be termed as Corporate banking. Financial institution often maintain

specific divisions for handling the needs of corporate clients, separate

from consumer or retail banking activities for individual accounts.

When this function is done from Industry point of view, this can be termed as

Tate atoles-Mey-Tal aay od

Division of activities in Corporate banking

Cash

cout

ete eterna cy ole coe)

Rate

*Providing

short and

medium

financing

* Maintaining

cash in and

outflow from

dealers,

distributors

and suppliers

*Timely

execution of

collections and

disbursements

*Providing *Providing

different information on

accounts such ‘treasury and

as business global markets

Control over a/c, made to ‘Offering

foreign order, flexible trading in

payments and alc

Forex,

receivables

*Offering derivatives

electronic and metals,

*Providing transfer and reporting to

trade son internet corporate

through LOC, banking office

Busranteess *Assisting in * Providing

PNB Ee an business plans information

wentory on interest

financing wee

transaction

*Servicing

account

through

technology

and logistics

Task of an Analyst

ELICTTATION

The role of an

analyst in banking ——

is very important ALLOCATION

specially in retail

banking area

where an analyst

is required to deal

with different

customers and

perform various

tasks.

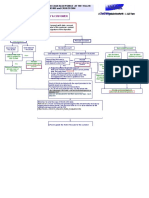

Division of activities of an Analyst

Although the role of an Analyst different from bank to bank. Still there are various

comparable activities which an analyst takeover in day to day banking business.

een Une AUER UC Rem ulnar sty

laren -ig

Me-latleislolt)

ean

Controlling Trade and

and ees

reporting creas}

Customer transaction banking

Account management

Database controlling Cash management

ONeluiiliaclecelaieCed elec)

Documentation Presentations

LOU cola latte choaey

Business development Maintaining service standards

Controlling and Reporting

Controlling cash and treasury functions

Monthly and quarterly reporting —_Liquidity forecasting and planning

CoN Cela ee ALMA IS

Risk and business evaluation Deviation reconciliation and reporting

eae Me oleae ielm Lacy

Filing of audit reports and statements OPEX (operating expenses) reporting

Trade and Advisory services

Forex transactions

International transfer and Networking with dealers and

remittances partners

Business credits, loans and advances Account transactions and settlements.

Utility services like billing, taxation for

Customer requirements analysis alerts

A Compact View

ON mold ay Me tal M eda ayaa Ste ANTAL Vance lms Con tLe el

that indeed it was a learning experience and help me to understand how

bank works, how customers are maintained and what exactly banking

eT NTA cm-I 1910.0

| hope this presentation gave you an idea of retail banking and also about

my role in it.

Miielencolmect-(eliit-4

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Decision Point Version 2 PDFDocumento51 páginasDecision Point Version 2 PDFJayakrishnaraj AJD100% (2)

- Worksmart 026 - Process For Handling Mutilated NotesDocumento27 páginasWorksmart 026 - Process For Handling Mutilated NotesJayakrishnaraj AJDAinda não há avaliações

- Nri Easy Savings AccountDocumento2 páginasNri Easy Savings AccountJayakrishnaraj AJDAinda não há avaliações

- About AxisbankDocumento1 páginaAbout AxisbankJayakrishnaraj AJDAinda não há avaliações

- ABS1 S1L1 010312 Hindipod101Documento6 páginasABS1 S1L1 010312 Hindipod101Jayakrishnaraj AJDAinda não há avaliações

- AddressDocumento1 páginaAddressJayakrishnaraj AJDAinda não há avaliações

- Burgundy Savings AccountDocumento2 páginasBurgundy Savings AccountJayakrishnaraj AJDAinda não há avaliações

- Prime Salary AccountDocumento2 páginasPrime Salary AccountJayakrishnaraj AJDAinda não há avaliações

- ABS1 S1L1 010312 Hindipod101 RecordingscriptDocumento8 páginasABS1 S1L1 010312 Hindipod101 RecordingscriptJayakrishnaraj AJDAinda não há avaliações

- Icici Ops StrategyDocumento30 páginasIcici Ops StrategyJayakrishnaraj AJDAinda não há avaliações

- Trading Setups 1) Gap Down Opening Below / Cutting Across Previous Day VPLDocumento20 páginasTrading Setups 1) Gap Down Opening Below / Cutting Across Previous Day VPLJayakrishnaraj AJDAinda não há avaliações

- Two Wheelers Policy WordingsDocumento9 páginasTwo Wheelers Policy WordingsAman BindAinda não há avaliações

- CON2015-487 Service Manager RL KMBL 23102015Documento2 páginasCON2015-487 Service Manager RL KMBL 23102015Jayakrishnaraj AJDAinda não há avaliações

- Swift FinalDocumento119 páginasSwift FinalJayakrishnaraj AJDAinda não há avaliações

- LTR Online Updation and ReviewDocumento4 páginasLTR Online Updation and ReviewJayakrishnaraj AJDAinda não há avaliações

- Trade FinanceDocumento23 páginasTrade FinanceJayakrishnaraj AJDAinda não há avaliações

- Handling Unprocessed Customer InstructionsDocumento1 páginaHandling Unprocessed Customer InstructionsJayakrishnaraj AJDAinda não há avaliações

- Documentation For NR Account OpeningDocumento17 páginasDocumentation For NR Account OpeningJayakrishnaraj AJDAinda não há avaliações

- Process of Cash AcceptanceDocumento5 páginasProcess of Cash AcceptanceJayakrishnaraj AJDAinda não há avaliações

- Net Interest Hdfcbank Xl2003 18jan13Documento4 páginasNet Interest Hdfcbank Xl2003 18jan13Jayakrishnaraj AJDAinda não há avaliações

- Provisioning Coverage Ratio - Part IIDocumento4 páginasProvisioning Coverage Ratio - Part IIJayakrishnaraj AJDAinda não há avaliações

- Worksmart - Re KYC ProcessDocumento5 páginasWorksmart - Re KYC ProcessJayakrishnaraj AJDAinda não há avaliações

- Amount of Monthly Instalment Rate of Interest RD Term - No. of Months Maturity ValueDocumento2 páginasAmount of Monthly Instalment Rate of Interest RD Term - No. of Months Maturity ValueJayakrishnaraj AJDAinda não há avaliações

- Worksmart 008 - Transaction CodesDocumento3 páginasWorksmart 008 - Transaction CodesJayakrishnaraj AJDAinda não há avaliações

- Transaction Charges of Credit Cards at A Glance PDFDocumento6 páginasTransaction Charges of Credit Cards at A Glance PDFJayakrishnaraj AJDAinda não há avaliações

- Eq Acc Opening Form Revised 3-6-17Documento8 páginasEq Acc Opening Form Revised 3-6-17Jayakrishnaraj AJDAinda não há avaliações

- Current Account FitmentDocumento1 páginaCurrent Account FitmentJayakrishnaraj AJDAinda não há avaliações

- Branch ReportsDocumento5 páginasBranch ReportsJayakrishnaraj AJDAinda não há avaliações

- Eq Acc Opening Form Revised 3-6-17Documento4 páginasEq Acc Opening Form Revised 3-6-17Jayakrishnaraj AJDAinda não há avaliações