Escolar Documentos

Profissional Documentos

Cultura Documentos

Quiz - Ppe Cost 2

Enviado por

Ana Mae HernandezTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Quiz - Ppe Cost 2

Enviado por

Ana Mae HernandezDireitos autorais:

Formatos disponíveis

College of Business Administration

ACTG 109A – APPLIED AUDITING

Audit of Property, Plant and Equipment

NAME:_____________________________________________COURSE & YEAR: __________SCORE:______

Problem 1

In connection with your audit of Cuyapo Company’s financial statement for the year 2010, you noted the

following transactions affecting the property and equipment items of the company:

Jan. 1 Purchase real property for ₱5,026,000, which included a charge of ₱146,000 presenting property

tax for 2010 that had been prepaid by the vendor; 20% of the purchase price is deemed

applicable to land and the balance to buildings. A mortgage of ₱3,000,000 was assumed by

Cuyapo on the purchase. Cash was paid for the balance.

Jan. 15 Previous owners had failed to take care of normal maintenance and repair requirements on the

buildings, necessitating current reconditioning at a cost of ₱236,800.

Feb. 15 Demolished garage in the rear of the building, ₱36,000 being recovered on the lumber salvage.

The company proceeded to construct a warehouse. The cost of such warehouse was ₱540,800,

which was ₱90,000 less than the average bids made on the construction by independent

contractors. Upon completion of construction, city inspectors ordered extensive modifications to

the building as a result of failure on the part of the company to comply with building safety

code. Such modifications, which could have been avoided, cost ₱76,800.

Mar. 1 The company exchanged its own shares with a fair value of ₱320,000 (par ₱24,000) for a patent

and a new equipment. The new equipment has a fair value of ₱200,000.

Apr. 1 The new machinery for the new building arrived. In addition, a new franchise was acquired from

the manufacturer of the machinery. Payment was made by issuing bonds with a face value of

₱400,000 and by paying cash of ₱144,000. The value of the franchise is set at ₱160,000, while

the machine’s fair value is ₱360,000.

May 1 The company contracted for parking lots and waiting sheds at a cost ₱360,000 and ₱76,800,

respectively. The work was completed and paid for on June 1.

Dec. 31 The business was closed to permit taking the year-end inventory. During this time, required

relocating and repairs were completed at a cost of ₱60,000.

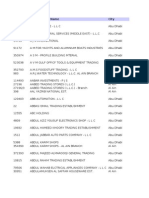

Based on the result of your audit, determine the cost of the following:

1. Land

a. ₱940,000 b. ₱1,005,200 c. ₱976,000 d. ₱1,052,800

2. Buildings

a. ₱4,645,600 b. ₱5,005,600 c. ₱4,762,400 d. ₱4,681,600

3. Machinery and Equipment

a. ₱360,000 b. ₱560,000 c. ₱576,615 d. ₱659,692

4. Land Improvements

a. ₱360,000 b. ₱76,800 c. ₱436,800 d. ₱0

5. Total property, plant and equipment

a. ₱6,764,400 b. ₱6,731,200 c. ₱6,718,092 d. ₱6,618,400

Problem 2

Anxious Company acquired two items of machinery as follows:

On December 31, 2009, Anxious Company purchased a machine in exchange for a noninterest bearing

note requiring ten payments of P500,000. The first payment was made on December 31, 2010, and the

others are due annually on December 31. The prevailing rate of interest for this type of note at date of

issuance was 12%. The present value of an ordinary annuity of 1 at 12% id 5.33 for nine periods and

5.65 for ten periods.

On December 31, 2009, Anxious Company acquired used machinery by issuing the seller a two-year,

noninterest bearing note for P3,000,000. In recent borrowing, Anxious has paid a 12% interest for this

type of note. The present value of 1 at 12% for 2 years is .80 and the present value of an ordinary

annuity of 1 at 12% for 2 years is 1.69.

What is the total cost of the machinery? 5,225,000

Problem 3

Faith, Inc. has a fiscal year ending April 30. On May 1, 2017, Faith borrowed P10,000,000 at 15% to finance

construction of its own building. Repayments of the loan are to commence on the month following completion

of the building. During the year ended, April 30, 2018 expenditures for the partially completed structure total

P6,000,000. These expenditures were incurred evenly after the year. Interest earned on the unexpected portion

of the loan amount to P400, 000 for the year. How much should be shown as capitalized interest on

Faith’s financial statement at April 30, 2018 under the alternative treatment? 450,000

Page 1 “Libyae Lustare”

Você também pode gostar

- Act 20-Ap 04 PpeDocumento7 páginasAct 20-Ap 04 PpeJomar VillenaAinda não há avaliações

- Audit of PPE accounts and related valuationDocumento8 páginasAudit of PPE accounts and related valuationAlyna JAinda não há avaliações

- Audit PpeDocumento4 páginasAudit Ppenicole bancoroAinda não há avaliações

- Questionnaire Expenditure CycleDocumento1 páginaQuestionnaire Expenditure Cycleleodenin tulangAinda não há avaliações

- Cengage Eco Dev Chapter 13 - The Environment and Sustainable Development in AsiaDocumento32 páginasCengage Eco Dev Chapter 13 - The Environment and Sustainable Development in AsiaArcy LeeAinda não há avaliações

- Far Eastern University - Makati: Discussion ProblemsDocumento2 páginasFar Eastern University - Makati: Discussion ProblemsMarielle SidayonAinda não há avaliações

- Unit Vi - Audit of Leases - Final - T11415 PDFDocumento4 páginasUnit Vi - Audit of Leases - Final - T11415 PDFSed ReyesAinda não há avaliações

- Year Sales Actual Warranty ExpendituresDocumento5 páginasYear Sales Actual Warranty ExpendituresMinie KimAinda não há avaliações

- Borrowing Costs - Assignment - For PostingDocumento1 páginaBorrowing Costs - Assignment - For Postingemman neriAinda não há avaliações

- Cost Terminology and Cost Behaviors: Learning ObjectivesDocumento17 páginasCost Terminology and Cost Behaviors: Learning ObjectivesJonnah ArriolaAinda não há avaliações

- HW 2. Problems Cash and Cash Equivalents - StudentDocumento2 páginasHW 2. Problems Cash and Cash Equivalents - StudentAngelo TipaneroAinda não há avaliações

- Chapter 4 (Acc)Documento25 páginasChapter 4 (Acc)shafAinda não há avaliações

- Auditing Problems Review: Key Equity and Bond CalculationsDocumento2 páginasAuditing Problems Review: Key Equity and Bond CalculationsgbenjielizonAinda não há avaliações

- Ellen Company Cash Bank ReconciliationDocumento8 páginasEllen Company Cash Bank ReconciliationShaine PacsonAinda não há avaliações

- Audit of Ppe, Int. AssetsDocumento5 páginasAudit of Ppe, Int. AssetsJon SagabayAinda não há avaliações

- Long Quiz Investments Class IJ (5:30-7:30 TWFS)Documento5 páginasLong Quiz Investments Class IJ (5:30-7:30 TWFS)Jolina AynganAinda não há avaliações

- BSA181A Interim Assessment Bapaud3X: PointsDocumento8 páginasBSA181A Interim Assessment Bapaud3X: PointsMary DenizeAinda não há avaliações

- Quiz-2 AnswerDocumento1 páginaQuiz-2 AnswerChandanMatoliaAinda não há avaliações

- PRACTICAL ACCOUNTING 1 Part 2Documento9 páginasPRACTICAL ACCOUNTING 1 Part 2Sophia Christina BalagAinda não há avaliações

- Intermediate Accounting 1 WeekDocumento32 páginasIntermediate Accounting 1 Weekimsana minatozakiAinda não há avaliações

- Exercise 2Documento2 páginasExercise 2nur shahibah nusaibah50% (2)

- REVIEWer Take Home QuizDocumento3 páginasREVIEWer Take Home QuizNeirish fainsan0% (1)

- BPS Quiz Intangibles PRINTDocumento3 páginasBPS Quiz Intangibles PRINTSheena CalderonAinda não há avaliações

- Conceptual Framework and Accounting Standards Ms. Leslie Anne T. GandiaDocumento2 páginasConceptual Framework and Accounting Standards Ms. Leslie Anne T. GandiaJm SevallaAinda não há avaliações

- Mock Cost Quiz 1Documento8 páginasMock Cost Quiz 1May Zablan PangilinanAinda não há avaliações

- Differential Cost AnalysisDocumento7 páginasDifferential Cost AnalysisSalman AzeemAinda não há avaliações

- Management Accounting & Decisions II - Activity-Based CostingDocumento24 páginasManagement Accounting & Decisions II - Activity-Based CostingDouglas Leong Jian-HaoAinda não há avaliações

- Heats Corporation Current and Noncurrent LiabilitiesDocumento1 páginaHeats Corporation Current and Noncurrent LiabilitiesjhobsAinda não há avaliações

- Toaz - Info Quiz 3 PRDocumento25 páginasToaz - Info Quiz 3 PRAprille Xay TupasAinda não há avaliações

- Cost Quizzer6Documento6 páginasCost Quizzer6LumingAinda não há avaliações

- PPE Accounting Guide for Asset Acquisition, Depreciation and DisposalDocumento18 páginasPPE Accounting Guide for Asset Acquisition, Depreciation and DisposalJustz LimAinda não há avaliações

- Ex. 10-135-Nonmonetary ExchangeDocumento4 páginasEx. 10-135-Nonmonetary ExchangeCarlo ParasAinda não há avaliações

- Rich Angelie Muñez - Assignment 4 Adjusting EntriesDocumento2 páginasRich Angelie Muñez - Assignment 4 Adjusting EntriesRich Angelie MuñezAinda não há avaliações

- Batch 18 1st Preboard (P1)Documento14 páginasBatch 18 1st Preboard (P1)Jericho PedragosaAinda não há avaliações

- Ourladyoffatimauniversity: The Problem and ItDocumento19 páginasOurladyoffatimauniversity: The Problem and ItOwen PacenioAinda não há avaliações

- Acctg13 PPE ProblemsDocumento4 páginasAcctg13 PPE ProblemsKristel Keith NievaAinda não há avaliações

- VAT Computation Part 2 GuideDocumento2 páginasVAT Computation Part 2 GuideNe BzAinda não há avaliações

- DLSU CPA Cash and Cash EquivalentsDocumento3 páginasDLSU CPA Cash and Cash EquivalentsEuniceChungAinda não há avaliações

- UCP: CVP Analysis and ExercisesDocumento10 páginasUCP: CVP Analysis and ExercisesDin Rose GonzalesAinda não há avaliações

- Ac102 ch2Documento21 páginasAc102 ch2Fisseha GebruAinda não há avaliações

- ToA Quizzer 1 - Intro To PFRS (3TAY1617)Documento6 páginasToA Quizzer 1 - Intro To PFRS (3TAY1617)Kyle ParisAinda não há avaliações

- Business Combination Drill PDFDocumento2 páginasBusiness Combination Drill PDFMelvin MendozaAinda não há avaliações

- As 12 - Full Notes For Accounting For Government GrantDocumento6 páginasAs 12 - Full Notes For Accounting For Government GrantShrey KunjAinda não há avaliações

- Pract 1 - Exam2Documento2 páginasPract 1 - Exam2Sharmaine Rivera MiguelAinda não há avaliações

- Peer Mentoring PostTestDocumento7 páginasPeer Mentoring PostTestronnelAinda não há avaliações

- Final Exam Joint Arrangements - ACTG341 Advanced Financial Accounting and Reporting 1Documento7 páginasFinal Exam Joint Arrangements - ACTG341 Advanced Financial Accounting and Reporting 1Marilou Arcillas PanisalesAinda não há avaliações

- Financial Management - Part 1 For PrintingDocumento13 páginasFinancial Management - Part 1 For PrintingKimberly Pilapil MaragañasAinda não há avaliações

- MIdterm ExamDocumento8 páginasMIdterm ExamMarcellana ArianeAinda não há avaliações

- Shareholder's Equity: ReviewDocumento12 páginasShareholder's Equity: ReviewG7 HexagonAinda não há avaliações

- ReceivablesDocumento4 páginasReceivablesKentaro Panergo NumasawaAinda não há avaliações

- Seatwork For BA202.SaturdayDocumento2 páginasSeatwork For BA202.SaturdayMelcanie Tiala YatAinda não há avaliações

- AnswerQuiz - Module 8Documento4 páginasAnswerQuiz - Module 8Alyanna AlcantaraAinda não há avaliações

- Reviewing key accounting conceptsDocumento13 páginasReviewing key accounting conceptschristine anglaAinda não há avaliações

- Vertical Analysis To Financial StatementsDocumento8 páginasVertical Analysis To Financial StatementsumeshAinda não há avaliações

- Las 6Documento4 páginasLas 6Venus Abarico Banque-AbenionAinda não há avaliações

- AP 5903Q PPE IntangiblesDocumento5 páginasAP 5903Q PPE IntangiblesSuzette VillalinoAinda não há avaliações

- Libyae Lustare - Audit Cash & Equivalents Under 40 CharactersDocumento1 páginaLibyae Lustare - Audit Cash & Equivalents Under 40 CharactersAna Mae HernandezAinda não há avaliações

- Ppe&ia PDFDocumento19 páginasPpe&ia PDFNicole BernardoAinda não há avaliações

- Non Current Assets 2019ADocumento4 páginasNon Current Assets 2019AKezy Mae GabatAinda não há avaliações

- Fin2bsat Quiz1 InvProperty Fund PpeDocumento5 páginasFin2bsat Quiz1 InvProperty Fund PpeMarvin San JuanAinda não há avaliações

- Quiz - Inventories CostingDocumento1 páginaQuiz - Inventories CostingAna Mae Hernandez67% (3)

- Ppe Test BankDocumento10 páginasPpe Test BankAna Mae HernandezAinda não há avaliações

- Libyae Lustare - Audit of Inventories College of Business AdministrationDocumento1 páginaLibyae Lustare - Audit of Inventories College of Business AdministrationAna Mae HernandezAinda não há avaliações

- Quiz - Inventories Cut-Off Test 2Documento1 páginaQuiz - Inventories Cut-Off Test 2Ana Mae HernandezAinda não há avaliações

- College: of Business AdministrationDocumento5 páginasCollege: of Business AdministrationAna Mae HernandezAinda não há avaliações

- Quiz - Compound Fin InstDocumento1 páginaQuiz - Compound Fin InstAna Mae HernandezAinda não há avaliações

- Libyae Lustare - Audit Cash & Equivalents Under 40 CharactersDocumento1 páginaLibyae Lustare - Audit Cash & Equivalents Under 40 CharactersAna Mae HernandezAinda não há avaliações

- Quiz - IntangiblesDocumento1 páginaQuiz - IntangiblesAna Mae HernandezAinda não há avaliações

- Quiz - Current LiabDocumento2 páginasQuiz - Current LiabAna Mae HernandezAinda não há avaliações

- Plants, Property and EquipmentDocumento21 páginasPlants, Property and EquipmentAna Mae HernandezAinda não há avaliações

- Quiz - Acts PayableDocumento2 páginasQuiz - Acts PayableAna Mae HernandezAinda não há avaliações

- Quiz - Ppe DepreciationDocumento1 páginaQuiz - Ppe DepreciationAna Mae HernandezAinda não há avaliações

- Analyzing Trading Securities TransactionsDocumento6 páginasAnalyzing Trading Securities TransactionsAna Mae Hernandez33% (3)

- Quiz - Recl FinancingDocumento1 páginaQuiz - Recl FinancingAna Mae HernandezAinda não há avaliações

- Quiz - Receivables FinalDocumento1 páginaQuiz - Receivables FinalAna Mae HernandezAinda não há avaliações

- Quiz - ReceivablesDocumento2 páginasQuiz - ReceivablesAna Mae HernandezAinda não há avaliações

- Quiz - Ppe CostDocumento2 páginasQuiz - Ppe CostAna Mae HernandezAinda não há avaliações

- Quiz - ReceivableDocumento2 páginasQuiz - ReceivableAna Mae Hernandez0% (1)

- Quiz - Ppe Borrowing CostDocumento1 páginaQuiz - Ppe Borrowing CostAna Mae HernandezAinda não há avaliações

- OpTransactionHistoryTpr09 04 2019 PDFDocumento9 páginasOpTransactionHistoryTpr09 04 2019 PDFSAMEER AHMADAinda não há avaliações

- Equity vs. EqualityDocumento5 páginasEquity vs. Equalityapi-242298926Ainda não há avaliações

- AUH DataDocumento702 páginasAUH DataParag Babar33% (3)

- Navi Mumbai MidcDocumento132 páginasNavi Mumbai MidcKedar Parab67% (15)

- Contem ReviewerDocumento9 páginasContem ReviewerKenAinda não há avaliações

- COA - M2017-014 Cost of Audit Services Rendered To Water DistrictsDocumento5 páginasCOA - M2017-014 Cost of Audit Services Rendered To Water DistrictsJuan Luis Lusong67% (3)

- Nifty MasterDocumento35 páginasNifty MasterAshok Singh BhatiAinda não há avaliações

- 1511099786441enterprise Information Systems PDFDocumento396 páginas1511099786441enterprise Information Systems PDFFortune CA100% (1)

- Siddharth Sheth - Review Sheet ProjectDocumento2 páginasSiddharth Sheth - Review Sheet ProjectSiddharth ShethAinda não há avaliações

- China Resists Outside InfluenceDocumento1 páginaChina Resists Outside InfluenceOliver Bustamante SAinda não há avaliações

- Upstox ApplicationDocumento40 páginasUpstox ApplicationMilan K VachhaniAinda não há avaliações

- Financial Management Strategy Nov 2007Documento4 páginasFinancial Management Strategy Nov 2007samuel_dwumfourAinda não há avaliações

- YMCA 2010 Annual Report - RevisedDocumento8 páginasYMCA 2010 Annual Report - Revisedkoga1Ainda não há avaliações

- Safari - Nov 2, 2017 at 4:13 PM PDFDocumento1 páginaSafari - Nov 2, 2017 at 4:13 PM PDFAmy HernandezAinda não há avaliações

- Dhakras Bhairavi SDocumento137 páginasDhakras Bhairavi SReshma PawarAinda não há avaliações

- Espresso Cash Flow Statement SolutionDocumento2 páginasEspresso Cash Flow Statement SolutionraviAinda não há avaliações

- IAS 33 EPS Calculation and PresentationDocumento3 páginasIAS 33 EPS Calculation and Presentationismat jahanAinda não há avaliações

- Damodaran PDFDocumento79 páginasDamodaran PDFLokesh Damani0% (1)

- Aviation EconomicsDocumento23 páginasAviation EconomicsAniruddh Mukherjee100% (1)

- CIR vs. First Express PawnshopDocumento1 páginaCIR vs. First Express PawnshopTogz Mape100% (1)

- MBA Strategic Management Midterm ExamDocumento5 páginasMBA Strategic Management Midterm Exammaksoud_ahmed100% (1)

- Real Estate Project Feasibility Study ComponentsDocumento2 páginasReal Estate Project Feasibility Study ComponentsSudhakar Ganjikunta100% (1)

- Reimbursement Receipt FormDocumento2 páginasReimbursement Receipt Formsplef lguAinda não há avaliações

- Interpreting The Feelings of Other People Is Not Always EasyDocumento4 páginasInterpreting The Feelings of Other People Is Not Always EasyEs TrungdungAinda não há avaliações

- Vestige Marketing InvoiceDocumento1 páginaVestige Marketing Invoicesangrur midlcpAinda não há avaliações

- Study of Supply Chain at Big BasketDocumento10 páginasStudy of Supply Chain at Big BasketPratul Batra100% (1)

- Request Travel Approval Email TemplateDocumento1 páginaRequest Travel Approval Email TemplateM AsaduzzamanAinda não há avaliações

- NSE ProjectDocumento24 páginasNSE ProjectRonnie KapoorAinda não há avaliações

- Inflation Title: Price Stability Definition, Causes, EffectsDocumento20 páginasInflation Title: Price Stability Definition, Causes, EffectsSadj GHorbyAinda não há avaliações

- 01 Fairness Cream ResearchDocumento13 páginas01 Fairness Cream ResearchgirijAinda não há avaliações