Escolar Documentos

Profissional Documentos

Cultura Documentos

Master of Finance Curriculum Overview: Intake 2018 / Class of 2020

Enviado por

Pussy Destroyer0 notas0% acharam este documento útil (0 voto)

25 visualizações1 páginaThe curriculum overview provides the course structure and requirements for a Master of Finance program intake in 2018. The program is divided into 4 semesters over 2 years. Semesters 1 and 2 focus on core modules in areas like statistics, economics, and corporate finance. Semester 3 allows students to specialize in concentrations like capital markets, corporate finance, or risk management. Semester 4 involves completing two electives and a 18 ECTS master's thesis to complete the degree.

Descrição original:

Título original

Curriculum.pdf

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoThe curriculum overview provides the course structure and requirements for a Master of Finance program intake in 2018. The program is divided into 4 semesters over 2 years. Semesters 1 and 2 focus on core modules in areas like statistics, economics, and corporate finance. Semester 3 allows students to specialize in concentrations like capital markets, corporate finance, or risk management. Semester 4 involves completing two electives and a 18 ECTS master's thesis to complete the degree.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

25 visualizações1 páginaMaster of Finance Curriculum Overview: Intake 2018 / Class of 2020

Enviado por

Pussy DestroyerThe curriculum overview provides the course structure and requirements for a Master of Finance program intake in 2018. The program is divided into 4 semesters over 2 years. Semesters 1 and 2 focus on core modules in areas like statistics, economics, and corporate finance. Semester 3 allows students to specialize in concentrations like capital markets, corporate finance, or risk management. Semester 4 involves completing two electives and a 18 ECTS master's thesis to complete the degree.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 1

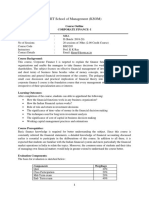

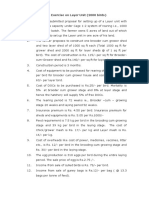

Master of Finance Curriculum Overview: Intake 2018 / Class of 2020

ECTS SEMESTER 1: CORE MODULES

st

1 Quarter: September-October 2018

6 Statistics & Econometrics

6 Financial Statement Analysis

6 Foundations of Finance

nd

2 Quarter: November-December 2018

6 Macro- & Monetary Economics

6 Financial Products & Modelling

SEMESTER 2: CORE MODULES

International Finance Offsite

nd

3 Quarter: February-March 2019

6 Responsible Management in Finance

6 Corporate Finance

6 Risk Management

th

4 Quarter: April-May 2019

6 Data Analytics and Machine Learning in Finance

6 TBD

SEMESTER 3: CONCENTRATION MODULES

st

1 Quarter: September-October 2019

Capital Markets Corporate Finance Risk Management Financial Advisory

Risk Governance &

6 Derivative Analysis Equity Finance M&A Accounting

Organisation

Structured Products & Interest Structured Products & Interest Restructuring & Strategic

6 Debt Finance

Rate Models Rate Models Management Control

Quantitative Portfolio Derivatives for Corporate Financial Information &

6 Portfolio Risk Management

Management Finance Decision-Making

nd

2 Quarter: November-December 2019

Credit Risk, Default Models & Credit Risk, Default Models &

6 Corporate Valuation Corporate Valuation

Credit Derivatives Credit Derivatives

Case Studies in Investment

6 Financial Engineering Risk Modelling Advisory Project

Banking

SEMESTER 4

rd

3 Quarter: February-March

&

th

4 Quarter: April-May 2020

12 Choose two Electives (6 ECTS each)

18 MASTER’S THESIS

As of 12/05/2018; subject to change

Você também pode gostar

- NYIF Williams Credit Risk Analysis II 2018Documento106 páginasNYIF Williams Credit Risk Analysis II 2018jojozie100% (1)

- Executive MBADocumento15 páginasExecutive MBAShreya JainAinda não há avaliações

- BFM Sem Vi 1920Documento8 páginasBFM Sem Vi 1920Hitesh BaneAinda não há avaliações

- 20 Page Commerce & AccountancyDocumento20 páginas20 Page Commerce & Accountancymikasha977Ainda não há avaliações

- Third Year B'Com (Banking & Insurance) Revised Syllabus 2017-18 Semester 5 1. Marketing in Banking and InsuranceDocumento3 páginasThird Year B'Com (Banking & Insurance) Revised Syllabus 2017-18 Semester 5 1. Marketing in Banking and InsuranceVineet ShettyAinda não há avaliações

- CF - Co - MaDocumento32 páginasCF - Co - MaANKIT GUPTAAinda não há avaliações

- 3.FINA211 Financial ManagementDocumento5 páginas3.FINA211 Financial ManagementIqtidar Khan0% (1)

- 4.287 Master of Management Studies MMS Sem III IV PDFDocumento226 páginas4.287 Master of Management Studies MMS Sem III IV PDFMayurAinda não há avaliações

- List of Project TopicsDocumento1 páginaList of Project TopicsASHISH PATILAinda não há avaliações

- Bba NbuDocumento45 páginasBba NbuAshis Gupta0% (1)

- ISC EconomicsDocumento49 páginasISC Economicskrittika190% (1)

- Course Structure 2019 20Documento8 páginasCourse Structure 2019 20lakshyaAinda não há avaliações

- Study PlannerDocumento13 páginasStudy PlannerMohammed NasserAinda não há avaliações

- Canopius Reinsurance AG Financial Condition Report 2018Documento50 páginasCanopius Reinsurance AG Financial Condition Report 2018saxobobAinda não há avaliações

- Best FM Outline COurseDocumento4 páginasBest FM Outline COurseBiswa Mohan PatiAinda não há avaliações

- Lesson 2 Introduction To Financial ManagementDocumento33 páginasLesson 2 Introduction To Financial ManagementNombulelo NdlovuAinda não há avaliações

- CF - CO Section - BDocumento31 páginasCF - CO Section - BAditya SinghAinda não há avaliações

- Syllabus MbaDocumento37 páginasSyllabus MbaRitik MAinda não há avaliações

- BBA MBA Integrated - Information Brochure - 25042022Documento5 páginasBBA MBA Integrated - Information Brochure - 25042022nishant ChaudharyAinda não há avaliações

- Financial Modeling Planning Analysis Toolkit - Overview and ApproachDocumento52 páginasFinancial Modeling Planning Analysis Toolkit - Overview and ApproachmajorkonigAinda não há avaliações

- Financial Management IIDocumento3 páginasFinancial Management IIjakartiAinda não há avaliações

- Teaching Schedule - Theory No. Topic Points To Be CoveredDocumento2 páginasTeaching Schedule - Theory No. Topic Points To Be Coveredडॉ. प्रशांत पवारAinda não há avaliações

- UT Dallas Syllabus For Sysm6312.0u1.11u Taught by David Springate (Spring8)Documento6 páginasUT Dallas Syllabus For Sysm6312.0u1.11u Taught by David Springate (Spring8)UT Dallas Provost's Technology GroupAinda não há avaliações

- FM Course Outline & Materials-Thappar UnivDocumento74 páginasFM Course Outline & Materials-Thappar Univharsimranjitsidhu661Ainda não há avaliações

- LU1 Overview of Financial Statement AnalysisDocumento36 páginasLU1 Overview of Financial Statement AnalysisPriyah ThaiyalanAinda não há avaliações

- Upgrad Campus - Financial Modelling & Analysis Program With PWC IndiaDocumento11 páginasUpgrad Campus - Financial Modelling & Analysis Program With PWC Indiarakesh naskarAinda não há avaliações

- MGT 401Documento6 páginasMGT 401Ali Akbar MalikAinda não há avaliações

- FInanceDocumento11 páginasFInanceAtluri HaricharanAinda não há avaliações

- TextBook BusinessFinanceDocumento7 páginasTextBook BusinessFinanceJot BawaAinda não há avaliações

- Rating Oil & Gas CompaniesDocumento15 páginasRating Oil & Gas CompaniesGAinda não há avaliações

- Performance: An Examination of The Impact of HRM Intensity On The Productivity and Financial Performance of Small Small and Medium-Sized FirmsDocumento3 páginasPerformance: An Examination of The Impact of HRM Intensity On The Productivity and Financial Performance of Small Small and Medium-Sized Firmskapoorrajat859500Ainda não há avaliações

- Finance at NSUDocumento31 páginasFinance at NSUDuDuWarAinda não há avaliações

- Fin242 Lesson Plan March 2021Documento2 páginasFin242 Lesson Plan March 2021Hazieq AushafAinda não há avaliações

- Priyanka Singh MBAfall22 JDDocumento3 páginasPriyanka Singh MBAfall22 JDSauharda SigdelAinda não há avaliações

- NYIF Williams Credit Risk Analysis I Aug-2016Documento117 páginasNYIF Williams Credit Risk Analysis I Aug-2016victor andrésAinda não há avaliações

- 2023 Advanced Master Course Syllabus FinanceDocumento5 páginas2023 Advanced Master Course Syllabus Financemathieu652540Ainda não há avaliações

- PWC Actuarial Services India - Vacancy DescriptionDocumento14 páginasPWC Actuarial Services India - Vacancy DescriptionMohit Kohli100% (1)

- 4.287 Master of Management Studies MMS Sem III IV PDFDocumento224 páginas4.287 Master of Management Studies MMS Sem III IV PDFSayali Utekar100% (1)

- CV 2023062810202090Documento3 páginasCV 2023062810202090Kumar SinghAinda não há avaliações

- Course Outline - Fin 223Documento3 páginasCourse Outline - Fin 223DenisAinda não há avaliações

- Introduction To Financial ManagementDocumento14 páginasIntroduction To Financial ManagementAyush GuptaAinda não há avaliações

- FmdaDocumento4 páginasFmdaSridhanyas kitchenAinda não há avaliações

- The Topics Covered Under The Syllabus of Advance Bank Management As Per The CAIIB Syllabus 2020 Are As Given BelowDocumento7 páginasThe Topics Covered Under The Syllabus of Advance Bank Management As Per The CAIIB Syllabus 2020 Are As Given BelowCBS CKSBAinda não há avaliações

- Chapter 1 - BFMDocumento60 páginasChapter 1 - BFMTricia Kate TungalaAinda não há avaliações

- Chapter 1 402 26Documento44 páginasChapter 1 402 26boishakh38512Ainda não há avaliações

- RURAL Banking in India Project - 218154828Documento57 páginasRURAL Banking in India Project - 218154828Rohit VishwakarmaAinda não há avaliações

- AY 2022-23 Mcom Part I and II (Accountancy) SyllabusDocumento68 páginasAY 2022-23 Mcom Part I and II (Accountancy) Syllabusdipeshbandabe123Ainda não há avaliações

- Mayank Talesara ResumeDocumento3 páginasMayank Talesara ResumeKumar SinghAinda não há avaliações

- Cost Management AssignmentDocumento14 páginasCost Management AssignmentHimasha NilumindaAinda não há avaliações

- MS-FIN FRM Track BrochureDocumento4 páginasMS-FIN FRM Track BrochureYawAinda não há avaliações

- MSC510 Corporate FinanceDocumento1 páginaMSC510 Corporate FinanceRahul PandeyAinda não há avaliações

- Accountancy Paper III Advance Financial Management Final BookDocumento395 páginasAccountancy Paper III Advance Financial Management Final Books.muthu100% (1)

- Md. S. U. ZamanDocumento7 páginasMd. S. U. Zamanshamim0008Ainda não há avaliações

- 2023 CFA L2 Book 2 FRA - CI-2Documento100 páginas2023 CFA L2 Book 2 FRA - CI-2PR100% (1)

- MBA Católica Finance - 2 Term 2005/2006 Prof. Nuno FernandesDocumento4 páginasMBA Católica Finance - 2 Term 2005/2006 Prof. Nuno FernandesShukri Abdi YakubAinda não há avaliações

- Second Year Courses For 2010-12Documento11 páginasSecond Year Courses For 2010-12Abhinandan UniyalAinda não há avaliações

- ASM SOC B. Sc. Finance Course Syllabus 2019-20Documento90 páginasASM SOC B. Sc. Finance Course Syllabus 2019-20Tapas BarikAinda não há avaliações

- Course Outline-CF-I PDFDocumento3 páginasCourse Outline-CF-I PDFAkankshya PanigrahiAinda não há avaliações

- Zero Trust Deployment Plan 1672220669Documento1 páginaZero Trust Deployment Plan 1672220669Raj SinghAinda não há avaliações

- Week 5 6 Diass 3.0Documento7 páginasWeek 5 6 Diass 3.0Jonathan ReyesAinda não há avaliações

- KGBV Bassi Profile NewDocumento5 páginasKGBV Bassi Profile NewAbhilash MohapatraAinda não há avaliações

- Wearables & Homestyle Accomplishment Report - CY 2023Documento6 páginasWearables & Homestyle Accomplishment Report - CY 2023Jonathan LarozaAinda não há avaliações

- Signal Man For RiggerDocumento1 páginaSignal Man For RiggerAndi ZoellAinda não há avaliações

- CPAR FLashcardDocumento3 páginasCPAR FLashcardJax LetcherAinda não há avaliações

- Army Aviation Digest - Jan 1994Documento56 páginasArmy Aviation Digest - Jan 1994Aviation/Space History Library100% (1)

- Capability' Brown & The Landscapes of Middle EnglandDocumento17 páginasCapability' Brown & The Landscapes of Middle EnglandRogério PêgoAinda não há avaliações

- Business Plan FinalDocumento28 páginasBusiness Plan FinalErica Millicent TenecioAinda não há avaliações

- Resume: Md. Saiful IslamDocumento2 páginasResume: Md. Saiful IslamSaiful IslamAinda não há avaliações

- Aud Prob Compilation 1Documento31 páginasAud Prob Compilation 1Chammy TeyAinda não há avaliações

- Table of Penalties For Crimes Committed Under The Revised Penal CodeDocumento6 páginasTable of Penalties For Crimes Committed Under The Revised Penal CodeElaine Grace R. AntenorAinda não há avaliações

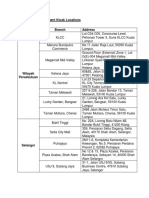

- Debit Card Replacement Kiosk Locations v2Documento3 páginasDebit Card Replacement Kiosk Locations v2aiaiyaya33% (3)

- Rolando Solar's Erroneous Contention: The Evidence OnDocumento6 páginasRolando Solar's Erroneous Contention: The Evidence OnLuis LopezAinda não há avaliações

- Sama Vedi Upakarma Mantra 2019Documento12 páginasSama Vedi Upakarma Mantra 2019ramdausAinda não há avaliações

- The River Systems of India Can Be Classified Into Four GroupsDocumento14 páginasThe River Systems of India Can Be Classified Into Four Groupsem297Ainda não há avaliações

- Malayalam International TransliterationDocumento89 páginasMalayalam International TransliterationSASHMIRA MENONAinda não há avaliações

- S 1 SdresourceswalkthroughDocumento57 páginasS 1 SdresourceswalkthroughJanine Marcos75% (4)

- Workplace Wellness Survey Report - FinalDocumento43 páginasWorkplace Wellness Survey Report - FinalMeeraAinda não há avaliações

- Roman-Macedonian Wars Part 1Documento2 páginasRoman-Macedonian Wars Part 1Alxthgr8Ainda não há avaliações

- KALIC J - Palata Srpskih Despota U Budimu (Zograf 6, 1975)Documento9 páginasKALIC J - Palata Srpskih Despota U Budimu (Zograf 6, 1975)neven81Ainda não há avaliações

- MidtermDocumento30 páginasMidtermRona CabuguasonAinda não há avaliações

- Math Review 10 20222023Documento1 páginaMath Review 10 20222023Bui VyAinda não há avaliações

- (Digest) Marcos II V CADocumento7 páginas(Digest) Marcos II V CAGuiller C. MagsumbolAinda não há avaliações

- University of The Philippines Open University Faculty of Management and Development Studies Master of Management ProgramDocumento10 páginasUniversity of The Philippines Open University Faculty of Management and Development Studies Master of Management ProgramRoldan TalaugonAinda não há avaliações

- HirarchaddonDocumento5 páginasHirarchaddonawe_emAinda não há avaliações

- CrackJPSC Mains Paper III Module A HistoryDocumento172 páginasCrackJPSC Mains Paper III Module A HistoryL S KalundiaAinda não há avaliações

- ARI - Final 2Documento62 páginasARI - Final 2BinayaAinda não há avaliações

- Bakst - Music and Soviet RealismDocumento9 páginasBakst - Music and Soviet RealismMaurício FunciaAinda não há avaliações

- Case Exercise On Layer Unit (2000 Birds)Documento2 páginasCase Exercise On Layer Unit (2000 Birds)Priya KalraAinda não há avaliações