Escolar Documentos

Profissional Documentos

Cultura Documentos

CONCENTRIX SERVICES INDIA PRIVATE LIMITED FULL & FINAL SETTLEMENT

Enviado por

Abhishek SinghDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

CONCENTRIX SERVICES INDIA PRIVATE LIMITED FULL & FINAL SETTLEMENT

Enviado por

Abhishek SinghDireitos autorais:

Formatos disponíveis

CONCENTRIX SERVICES INDIA PRIVATE LIMITED 10 Oct 2017

FULL & FINAL SETTLEMENT

Employee Code 5018709 Designation Representative Operations

Employee Name ABHISHEK SINGH Bank A/c No / Name 232801516551 ICICI

Date Of Joining 17 May 2017 PAN CXEPS6720A /

PF No ESI No 5345010076

UAN_NO LWD 31 Aug 2017

PRAN NO

EL Balance (Days) 4.00 OT Hours 0.00

Notice Period Recovery(Days) 15.00 Attendance Arrear (Days) -5.00

Payable/Recoverable (Days) -11.00

EARNINGS DEDUCTIONS

Description Amount Arrear Total Description Amount

HOLD SALARY AUG 17 9,319.00 9,319.00 PF Recovery

BASIC -2,365.71 -1,075.32 -3,441.03 Notice Period Recovery 7,306.00

EL 1,948.00 1,948.00 ESI

Personal Pay -808.32 -367.42 -1,175.74 Income Tax

HRA -1,182.68 -537.58 -1,720.26

CONVEYANCE -567.74 -258.06 -825.81

Statutory Bonus -260.10 -118.23 -378.32

Total Earnings 3,725.84 Total Deductions 7,306.00

Net Full & Final Payment : -3,580.16

Gratuity Amount : 0.00

Income Tax Calculation Sheet For The Year 2017-2018

1.Total Basic 17,205.17 HRA Calculation

Basic For HRA Calculation

2.Total HRA 8,601.29 1.HRA Received 20,646.20

3.Total FBP 10,321.55

2.Rent Paid Over 10% Of Salary

4.Employer Contribution Towards NPS 0.00 3.50/40% Of Salary -2,064.62

5.All Other Income 10,146.97 HRA Exemption(Least of the Above) 8,258.48

6.Add : Income from Previous Employer

CLA Calculation

7.Add : Perquisite Value of Loan CLA Gross Salary

8.Add : Income From House Property 1.Rent Paid By The company

9.Less : HRA Exemption 2.15% Of Salary

10.Less : Conveyance \Leave Exemption 4,955.00 Perquisite Value(Least of the Above)

11.Less : Other Recovery 378.32

12.Add : Perquisite Value of CLA Section 80 C Investment

13.Less : Total Professional Tax 200.00 PF 3,323.00

LIC

14.Less :Loss from H/P & Deductions u/s 80s 3,323.00

NSC

15.Total Taxable Income 32,980.00

16.Tax on the Above NSC INT

17. Exemption Under 87A 0.00 Housing Loan Principle

18.Tax After 87A Exemption 0.00 Bond

19.Surcharge UTI/ULIP/Mutual Fund

20.Education Cess Exp. On Child Education

21.Tax Deducted so far Fixed Deposits Receipt

22.Net Tax Payable (18+19+20) Pension Fund

23.Tax on One Time Payment Public Provident Fund

LIC Jeevan Suraksha

24.Tax Deduction for this Month

Prev. Employer PF

National Saving Scheme

Chapter VI Deductions Mutual Funds Pension

U/S80DD Any Other Invest U/S 80C

U/S80D VPF 0.00

U/S80E Total

U/S80DDB 3,323.00

U/S80U

U/S80CCD (1B) 0.00

U/S80CCG 0.00

U/S80CCD(2) 0.00

3rd Floor, Millennium Towers, ITPL Road, Brookefields, Bangalore - 560037 India

For Any Query On Your Full & Final Calculation, Please Write at full.final@concentrix.com

This is a system generated statement and it does not require any signature.

Você também pode gostar

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Applying for 501(c)(3) Tax-Exempt Status GuideDocumento14 páginasApplying for 501(c)(3) Tax-Exempt Status GuideJikker Gigi Phatbeatzz BarrowAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- Correcting Erroneous Information Returns, Form #04.001Documento144 páginasCorrecting Erroneous Information Returns, Form #04.001Sovereignty Education and Defense Ministry (SEDM)50% (2)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- pf1 Chap 1 en CaDocumento42 páginaspf1 Chap 1 en CaSaira Fazal0% (1)

- Province of Pampanga Vs Executive Secretary Alberto RomuloDocumento16 páginasProvince of Pampanga Vs Executive Secretary Alberto RomuloRica Corsica Lazana100% (1)

- Comparative Analysis 8424 and 10963Documento31 páginasComparative Analysis 8424 and 10963Rizza Angela Mangalleno100% (2)

- Weiss, Dieter, Ibn Khaldun On Econ TransformationDocumento10 páginasWeiss, Dieter, Ibn Khaldun On Econ TransformationOvamir AnjumAinda não há avaliações

- ChandanDocumento1 páginaChandanAbhishek SinghAinda não há avaliações

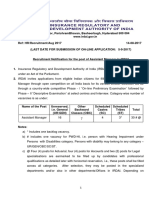

- 14-08-2017 - IRDAI AMs Rectt NotificationDocumento1 página14-08-2017 - IRDAI AMs Rectt NotificationAbhishek SinghAinda não há avaliações

- ACFrOgDQbIzn1OwLtNUv8K2dgw3rlnkqpzIyc0bJ7TRIaqhDFscJgvJhLGv3Fo tpqtNeLb 0ZdliBlhSX uWqjEO2ZO71HOl50Ti0qI4dAhQxb83OMAvpPL2mxO - S0Documento2 páginasACFrOgDQbIzn1OwLtNUv8K2dgw3rlnkqpzIyc0bJ7TRIaqhDFscJgvJhLGv3Fo tpqtNeLb 0ZdliBlhSX uWqjEO2ZO71HOl50Ti0qI4dAhQxb83OMAvpPL2mxO - S0Abhishek SinghAinda não há avaliações

- ACFrOgDQbIzn1OwLtNUv8K2dgw3rlnkqpzIyc0bJ7TRIaqhDFscJgvJhLGv3Fo tpqtNeLb 0ZdliBlhSX uWqjEO2ZO71HOl50Ti0qI4dAhQxb83OMAvpPL2mxO - S0Documento2 páginasACFrOgDQbIzn1OwLtNUv8K2dgw3rlnkqpzIyc0bJ7TRIaqhDFscJgvJhLGv3Fo tpqtNeLb 0ZdliBlhSX uWqjEO2ZO71HOl50Ti0qI4dAhQxb83OMAvpPL2mxO - S0Abhishek SinghAinda não há avaliações

- IRDA Recruitment Assistant Managers 2017 - Official NotificationDocumento28 páginasIRDA Recruitment Assistant Managers 2017 - Official NotificationKshitija100% (1)

- Dena Bank PO Recruitment 2017Documento15 páginasDena Bank PO Recruitment 2017Kshitija100% (3)

- ACFrOgDQbIzn1OwLtNUv8K2dgw3rlnkqpzIyc0bJ7TRIaqhDFscJgvJhLGv3Fo tpqtNeLb 0ZdliBlhSX uWqjEO2ZO71HOl50Ti0qI4dAhQxb83OMAvpPL2mxO - S0Documento2 páginasACFrOgDQbIzn1OwLtNUv8K2dgw3rlnkqpzIyc0bJ7TRIaqhDFscJgvJhLGv3Fo tpqtNeLb 0ZdliBlhSX uWqjEO2ZO71HOl50Ti0qI4dAhQxb83OMAvpPL2mxO - S0Abhishek SinghAinda não há avaliações

- Rec Amity PGDBFDocumento1 páginaRec Amity PGDBFAbhishek SinghAinda não há avaliações

- Government Schemes 2017Documento9 páginasGovernment Schemes 2017Gnana PugazhAinda não há avaliações

- IRDA Recruitment Assistant Managers 2017 - Official NotificationDocumento28 páginasIRDA Recruitment Assistant Managers 2017 - Official NotificationKshitija100% (1)

- Average Problem Solutions ExplainedDocumento10 páginasAverage Problem Solutions ExplainedWolf AlphaAinda não há avaliações

- M.P.prasad and Sunayana DagarDocumento11 páginasM.P.prasad and Sunayana DagarAbhishek SinghAinda não há avaliações

- BBC AudienceDocumento138 páginasBBC AudienceporukeslikeAinda não há avaliações

- Publication 4491 Examples and CasesDocumento54 páginasPublication 4491 Examples and CasesNorma WahnonAinda não há avaliações

- Gasbill 2864608891 202307 20230721180052Documento1 páginaGasbill 2864608891 202307 20230721180052Shahhussain HussainAinda não há avaliações

- Ds8 Japan TaxesDocumento2 páginasDs8 Japan TaxesVishwesh SinghAinda não há avaliações

- Accounts Guru Conclave - Mock Paper EcoDocumento6 páginasAccounts Guru Conclave - Mock Paper EcoRaj KadamAinda não há avaliações

- Dost It Di 2017 Technologies Compen DereDocumento217 páginasDost It Di 2017 Technologies Compen DereRcs CheAinda não há avaliações

- 2006 BIR-RMC ContentsDocumento22 páginas2006 BIR-RMC ContentsMary Grace Caguioa AgasAinda não há avaliações

- Solution Manual For South Western Federal Taxation 2020 Individual Income Taxes 43rd Edition James C YoungDocumento24 páginasSolution Manual For South Western Federal Taxation 2020 Individual Income Taxes 43rd Edition James C YoungJohnValenciaajgq100% (34)

- G.R. No. L-19727Documento14 páginasG.R. No. L-19727Amicus CuriaeAinda não há avaliações

- Instant Download Ebook PDF Fundamental Accounting Principles Volume 2 15th Canadian Edition PDF ScribdDocumento41 páginasInstant Download Ebook PDF Fundamental Accounting Principles Volume 2 15th Canadian Edition PDF Scribdjudi.hawkins744100% (37)

- ComputationDocumento6 páginasComputationRipfeelingsAinda não há avaliações

- Assessment 1 - Written or Oral QuestionsDocumento7 páginasAssessment 1 - Written or Oral Questionswilson garzonAinda não há avaliações

- IASbaba's March Monthly Magazine PDFDocumento203 páginasIASbaba's March Monthly Magazine PDFsmilealways20Ainda não há avaliações

- Chevron vs CIR; PAL Excise Tax RefundDocumento4 páginasChevron vs CIR; PAL Excise Tax RefundcharmainejalaAinda não há avaliações

- Monthly Documentary Stamp Tax Declaration/Return: For Bir Use Only BCS/ ItemDocumento2 páginasMonthly Documentary Stamp Tax Declaration/Return: For Bir Use Only BCS/ ItemRomer Lesondato100% (1)

- Ani SecDocumento149 páginasAni SecMarivic ChuangAinda não há avaliações

- TAX INVOICE DETAILSDocumento1 páginaTAX INVOICE DETAILSJNPAinda não há avaliações

- Generational Wealth Management: A Guide For Fostering Global Family WealthDocumento28 páginasGenerational Wealth Management: A Guide For Fostering Global Family WealthRavi Kumar100% (1)

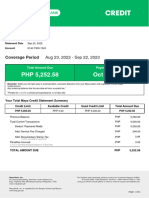

- MayaCredit SoA 2023SEPDocumento3 páginasMayaCredit SoA 2023SEPjepoy palaruanAinda não há avaliações

- Metkon PPT 1 Ch. 2, 9, 11 - Group 4Documento111 páginasMetkon PPT 1 Ch. 2, 9, 11 - Group 4Dian Ratri CAinda não há avaliações

- Atrill Capital Structure SlidesDocumento8 páginasAtrill Capital Structure SlidesEYmran RExa XaYdiAinda não há avaliações

- Accounting for Inventory Valuation Methods Research ProposalDocumento66 páginasAccounting for Inventory Valuation Methods Research ProposalAyman Ahmed Cheema100% (1)

- Self Employment and Small Scale Industry in NepalDocumento16 páginasSelf Employment and Small Scale Industry in NepalsamyogforuAinda não há avaliações

- Federal Insurance Contributions ActDocumento3 páginasFederal Insurance Contributions ActMaryAinda não há avaliações