Escolar Documentos

Profissional Documentos

Cultura Documentos

Quiz - Inventories Cut-Off Test

Enviado por

Ana Mae HernandezTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Quiz - Inventories Cut-Off Test

Enviado por

Ana Mae HernandezDireitos autorais:

Formatos disponíveis

College of Business Administration

ACTG 109A – APPLIED AUDITING

Audit of Inventories

NAME:_____________________________________________COURSE & YEAR: __________________

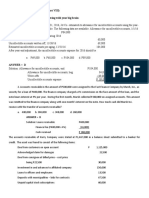

Problem 1

1. The following data were found during your audit of Astig Company, who operates on a calendar year basis:

a. Goods in transit shipped FOB destination by a supplier, in the amount of P150,000, had been

excluded from the inventory, and further testing revealed that the purchase had been recorded.

b. Goods costing P75,000 had been received, included in inventory, and recorded as a purchase.

However, upon your inspection, the goods were found to be defective and would be immediately

returned.

c. Materials costing P375,000 and billed on December 30 at a selling price of P480,000 had been

segregated in the warehouse for shipment to a customer. The materials had been excluded from

inventory as a signed purchase order had been received from the customer. Terms: fob destination.

d. Goods costing P105,000 was out on consignment with Hagupit Company. Since the monthly

statement from Hagupit Company listed those materials as on hand, the items had been exclulded

from the final inventory and invoiced on December 31 at P120,000.

e. The sale of P225,000 worth of materials and costing P180,000 had been shipped fob point of

shipment on December 31. However, this inventory were part of the final inventory. The sale was

properly recorded 2017.

f. Goods costing P150,000 and selling for P210,000 had been segregated, but not shipped at

December 31, and were not included in the inventory. A review of the customer’s purchase order

set forth terms as fob destination. The sale had not been recorded.

g. Your client has an invoice from a supplier, terms fob shipping point but the goods had not arrived

as yet. However, these materials costing P255,000 had been included in the inventory count, but

no entry had been made for their purchase.

h. Merchandise costing P300,000 had been recorded as a purchase but not included as inventory.

Terms of sale are fob shipping point according to the supplier’s invoice which had arrived at

December 31.

Further inspection of the client’s records revealed the following:

December 31, 2017 balances:

o Inventory: P1,650,000

o Accounts receivable: P870,000

o Accounts payable: P1,035,000

o Net Sales: P7,575,000

o Net purchases: P3,450,000

o Net income: P765,000

Based on the information above and results of your audit, determine the adjusted balance of following as of

December 31, 2017:

1. Inventory

a. 1,845,000 c. 2,325,000

b. 2,475,000 d. 2,220,000

2. Accounts payable

a. 1,065,000 c. 1,215,000

b. 810,000 d. 1,140,000

3. Net sales

a. 6,825,000 c. 7,095,000

b. 6,975,000 d. 7,455,000

4. Net purchases

a. 3,555,000 c. 3,225,000

b. 3,630,000 d. 3,480,000

5. Net income

a. 330,000 c. 810,000

b. 435,000 d. 825,000

Page 1 “Libyae Lustare”

Você também pode gostar

- Quiz - Inventories Cut-Off Test 2Documento1 páginaQuiz - Inventories Cut-Off Test 2Ana Mae HernandezAinda não há avaliações

- Aud ProbDocumento9 páginasAud ProbKulet AkoAinda não há avaliações

- Audit of Current LiabilitiesDocumento4 páginasAudit of Current LiabilitiesMark Anthony TibuleAinda não há avaliações

- Handouts 1 P1Documento3 páginasHandouts 1 P1Cristopher IanAinda não há avaliações

- Aud2 CashDocumento6 páginasAud2 CashMaryJoyBernalesAinda não há avaliações

- Audit of Inventories - Part 1Documento5 páginasAudit of Inventories - Part 1Mark Lawrence YusiAinda não há avaliações

- National Federation of Junior Philipinne Institute of Accountants - National Capital Region Auditing (Aud)Documento14 páginasNational Federation of Junior Philipinne Institute of Accountants - National Capital Region Auditing (Aud)Tricia Jen TobiasAinda não há avaliações

- Quiz - CashDocumento1 páginaQuiz - CashAna Mae HernandezAinda não há avaliações

- Receivables Problem 1: Account Is One To Six Months ClassificationDocumento4 páginasReceivables Problem 1: Account Is One To Six Months ClassificationMary Grace NaragAinda não há avaliações

- Quiz - Acts PayableDocumento2 páginasQuiz - Acts PayableAna Mae HernandezAinda não há avaliações

- PROBLEM 1 RESA Anna Corp. Uses The Direct Method To Prepare Its Statement of Cash Flows. Anna Corp.'s TrialDocumento16 páginasPROBLEM 1 RESA Anna Corp. Uses The Direct Method To Prepare Its Statement of Cash Flows. Anna Corp.'s TrialJomar Villena100% (2)

- Afar 106 - Home Office and Branch Accounting PDFDocumento3 páginasAfar 106 - Home Office and Branch Accounting PDFReyn Saplad PeralesAinda não há avaliações

- On January 1 Accounintg ProlbemDocumento3 páginasOn January 1 Accounintg Prolbemelsana philipAinda não há avaliações

- CHAPTER 8 - Audit of Liabilities: Problem 1Documento27 páginasCHAPTER 8 - Audit of Liabilities: Problem 1Chinee CastilloAinda não há avaliações

- Investments in Financial Instruments CompleteDocumento34 páginasInvestments in Financial Instruments CompleteDenise CruzAinda não há avaliações

- Problem Set For AR (Ctto)Documento16 páginasProblem Set For AR (Ctto)Mariane Jean Guerrero100% (1)

- REVIEWer Take Home QuizDocumento3 páginasREVIEWer Take Home QuizNeirish fainsan0% (1)

- Cash and Cash Equivalents - MidtermDocumento9 páginasCash and Cash Equivalents - MidtermDan RyanAinda não há avaliações

- CASH QuestionsDocumento9 páginasCASH QuestionsKenncyAinda não há avaliações

- Karkits Corporation PDFDocumento4 páginasKarkits Corporation PDFRachel LeachonAinda não há avaliações

- CAE 10 CG Strategic Cost ManagementDocumento23 páginasCAE 10 CG Strategic Cost ManagementAmie Jane MirandaAinda não há avaliações

- TEST BANK Reviewer - INT Assets TEST BANK Reviewer - INT AssetsDocumento24 páginasTEST BANK Reviewer - INT Assets TEST BANK Reviewer - INT AssetsClarisse PelayoAinda não há avaliações

- Audit of ReceivablesDocumento5 páginasAudit of ReceivablesandreamrieAinda não há avaliações

- AP - Loans & ReceivablesDocumento11 páginasAP - Loans & ReceivablesDiane PascualAinda não há avaliações

- Ac20 Quiz 3 - DGCDocumento10 páginasAc20 Quiz 3 - DGCMaricar PinedaAinda não há avaliações

- Reviewer 1st PB P1 1920Documento7 páginasReviewer 1st PB P1 1920Therese AcostaAinda não há avaliações

- At.3213 - Application of Audit Process To Transaction Cycles Part 1Documento9 páginasAt.3213 - Application of Audit Process To Transaction Cycles Part 1Denny June CraususAinda não há avaliações

- BPS Quiz Intangibles PRINTDocumento3 páginasBPS Quiz Intangibles PRINTSheena CalderonAinda não há avaliações

- Substantive Tests of Receivables and SalesDocumento5 páginasSubstantive Tests of Receivables and SalesEricaAinda não há avaliações

- Pas 2 - Inventories (Continuation of Part 1)Documento3 páginasPas 2 - Inventories (Continuation of Part 1)Michelle Wing San TsangAinda não há avaliações

- Problems CCEDocumento10 páginasProblems CCERafael Renz DayaoAinda não há avaliações

- Accounting 4 Module 1 3Documento3 páginasAccounting 4 Module 1 3Micaela EncinasAinda não há avaliações

- Problem 1Documento23 páginasProblem 1cynthia reyesAinda não há avaliações

- Acc 11 HandoutDocumento5 páginasAcc 11 HandoutRenalyn MadeloAinda não há avaliações

- Prelims - AuditDocumento15 páginasPrelims - AuditJayson CerradoAinda não há avaliações

- Reviewer in InventoriesDocumento2 páginasReviewer in InventoriesNicole AutrizAinda não há avaliações

- This Study Resource Was: Multiple ChoiceDocumento6 páginasThis Study Resource Was: Multiple ChoiceNicah AcojonAinda não há avaliações

- Development For ProductionDocumento6 páginasDevelopment For Productiongazer beamAinda não há avaliações

- Cash, Cash Equivalent and Bank ReconDocumento7 páginasCash, Cash Equivalent and Bank ReconPrincess ReyesAinda não há avaliações

- Discussion Problems: FAR.2928-Notes Payable OCTOBER 2020Documento3 páginasDiscussion Problems: FAR.2928-Notes Payable OCTOBER 2020John Nathan KinglyAinda não há avaliações

- Reviewer ErrorDocumento13 páginasReviewer ErrorPatriciaSamaritaAinda não há avaliações

- Cebu Cpar Practical Accounting 1 Cash Flow - UmDocumento9 páginasCebu Cpar Practical Accounting 1 Cash Flow - UmJomarAinda não há avaliações

- Quiz 1Documento9 páginasQuiz 1Czarhiena SantiagoAinda não há avaliações

- 01 - Audit of Cash & Cash EquivalentsDocumento4 páginas01 - Audit of Cash & Cash EquivalentsEARL JOHN RosalesAinda não há avaliações

- Ap-500Q: Quizzer On Purchasing/Disbursement Production and Revenue/Receipt Cycles: Audit of Inventories, Receivables and Cash and Cash EquivalentsDocumento27 páginasAp-500Q: Quizzer On Purchasing/Disbursement Production and Revenue/Receipt Cycles: Audit of Inventories, Receivables and Cash and Cash Equivalentsruel c armillaAinda não há avaliações

- Intermediate Acctg A 1 10Documento10 páginasIntermediate Acctg A 1 10Leonila RiveraAinda não há avaliações

- Acctg Ats1Documento2 páginasAcctg Ats1Christian N MagsinoAinda não há avaliações

- Assignment 01:audit of Intangible Assets Problem 1Documento3 páginasAssignment 01:audit of Intangible Assets Problem 1Dan Andrei BongoAinda não há avaliações

- Quiz VIII - ARDocumento3 páginasQuiz VIII - ARBLACKPINKLisaRoseJisooJennieAinda não há avaliações

- Correction of ErrorsDocumento4 páginasCorrection of ErrorsKris Van HalenAinda não há avaliações

- AFAR ReviewDocumento11 páginasAFAR ReviewPaupauAinda não há avaliações

- Cash and Cash Equivalents Quizzer #2Documento3 páginasCash and Cash Equivalents Quizzer #2Al-Habbyel Baliola YusophAinda não há avaliações

- Afar 02 - Partnership DissolutionDocumento8 páginasAfar 02 - Partnership DissolutionMarie GonzalesAinda não há avaliações

- Auditing Quizzer 3Documento4 páginasAuditing Quizzer 3KathleenAinda não há avaliações

- Parcor QuizbowlDocumento38 páginasParcor QuizbowlKrestyl Ann GabaldaAinda não há avaliações

- Chapter 9: Substantive Test of Receivables and Sales The Audit of Receivables and Revenue Represents Significant Audit Risk BecauseDocumento4 páginasChapter 9: Substantive Test of Receivables and Sales The Audit of Receivables and Revenue Represents Significant Audit Risk BecauseGirlie SisonAinda não há avaliações

- Chapter 6C 2 24 Ex 26 PB 54Documento5 páginasChapter 6C 2 24 Ex 26 PB 54ruqayya muhammedAinda não há avaliações

- Far Review - Notes and Receivable AssessmentDocumento6 páginasFar Review - Notes and Receivable AssessmentLuisa Janelle BoquirenAinda não há avaliações

- Quiz 1 Inventory and InvestmentsDocumento7 páginasQuiz 1 Inventory and InvestmentsMark Lawrence YusiAinda não há avaliações

- Applied - 3 MidtermDocumento7 páginasApplied - 3 MidtermMarjorieAinda não há avaliações

- Quiz - Inventories CostingDocumento1 páginaQuiz - Inventories CostingAna Mae Hernandez67% (3)

- Quiz - IntangiblesDocumento1 páginaQuiz - IntangiblesAna Mae HernandezAinda não há avaliações

- Quiz - CashDocumento1 páginaQuiz - CashAna Mae HernandezAinda não há avaliações

- Quiz - Compound Fin InstDocumento1 páginaQuiz - Compound Fin InstAna Mae HernandezAinda não há avaliações

- Quiz - Current LiabDocumento2 páginasQuiz - Current LiabAna Mae HernandezAinda não há avaliações

- Quiz - Acts PayableDocumento2 páginasQuiz - Acts PayableAna Mae HernandezAinda não há avaliações

- Investments Test BankDocumento6 páginasInvestments Test BankAna Mae Hernandez33% (3)

- Quiz - Ppe DepreciationDocumento1 páginaQuiz - Ppe DepreciationAna Mae HernandezAinda não há avaliações

- Plants, Property and EquipmentDocumento21 páginasPlants, Property and EquipmentAna Mae HernandezAinda não há avaliações

- College: of Business AdministrationDocumento5 páginasCollege: of Business AdministrationAna Mae HernandezAinda não há avaliações

- Ppe Test BankDocumento10 páginasPpe Test BankAna Mae HernandezAinda não há avaliações

- Quiz - ReceivablesDocumento2 páginasQuiz - ReceivablesAna Mae HernandezAinda não há avaliações

- Quiz - Recl FinancingDocumento1 páginaQuiz - Recl FinancingAna Mae HernandezAinda não há avaliações

- Quiz - Receivables FinalDocumento1 páginaQuiz - Receivables FinalAna Mae HernandezAinda não há avaliações

- Quiz - ReceivableDocumento2 páginasQuiz - ReceivableAna Mae Hernandez0% (1)

- Quiz - Ppe CostDocumento2 páginasQuiz - Ppe CostAna Mae HernandezAinda não há avaliações

- Quiz - Ppe Cost 2Documento1 páginaQuiz - Ppe Cost 2Ana Mae HernandezAinda não há avaliações

- Quiz - Ppe Borrowing CostDocumento1 páginaQuiz - Ppe Borrowing CostAna Mae HernandezAinda não há avaliações

- LDSD - Mulugeta & SirgutDocumento30 páginasLDSD - Mulugeta & SirgutSirgut TesfayeAinda não há avaliações

- AP03 Audit of Inventories QDocumento6 páginasAP03 Audit of Inventories Qbobo kaAinda não há avaliações

- Accounting For A Merchandising BusinessDocumento5 páginasAccounting For A Merchandising BusinessMarvin AlmariaAinda não há avaliações

- Merchandising AccountsDocumento17 páginasMerchandising AccountsshawtyAinda não há avaliações

- ESP 311 - Inglés Técnico para Comercio Exterior Esp. International Trade Duoc UC Viña Del MarDocumento12 páginasESP 311 - Inglés Técnico para Comercio Exterior Esp. International Trade Duoc UC Viña Del MarCArlos ChávezAinda não há avaliações

- Exercises - Sept. 29Documento3 páginasExercises - Sept. 29Keitheia QuidlatAinda não há avaliações

- CHAPTER 16-Inventories: Far SummaryDocumento3 páginasCHAPTER 16-Inventories: Far SummaryFuturamaramaAinda não há avaliações

- International Freight Crash Course - FreightosDocumento6 páginasInternational Freight Crash Course - FreightosDrew StewartAinda não há avaliações

- Declaration: (Harpreet Kaur)Documento42 páginasDeclaration: (Harpreet Kaur)Preet Kaur GirnAinda não há avaliações

- Chapter # 5 & 6 Pricing Strategies VVDocumento23 páginasChapter # 5 & 6 Pricing Strategies VVishfaqahmadchdAinda não há avaliações

- LNG Market Analysis & Fundamentals of Chartering Negotiations - UniPi-March 2021Documento16 páginasLNG Market Analysis & Fundamentals of Chartering Negotiations - UniPi-March 2021yaAinda não há avaliações

- LC Issue (Swift) - 240131 - 142055-1Documento4 páginasLC Issue (Swift) - 240131 - 142055-1ali.soleman12Ainda não há avaliações

- IncoDocs Trade Guide March 2020Documento24 páginasIncoDocs Trade Guide March 2020Evgeniy TruniakovAinda não há avaliações

- FOB Contracts PDFDocumento11 páginasFOB Contracts PDFNicholas KoutsouvanosAinda não há avaliações

- Transportation Costs, Problem #11Documento3 páginasTransportation Costs, Problem #11Feiya LiuAinda não há avaliações

- Chapter 23Documento422 páginasChapter 23DIANA FAITH TAYCOAinda não há avaliações

- TBJ 1350 3F 1.0 MS SMR PDFDocumento10 páginasTBJ 1350 3F 1.0 MS SMR PDFAsdrubal Fredy Gutierrez100% (1)

- Fireye Price Book CG 14 - 2019Documento108 páginasFireye Price Book CG 14 - 2019caiosicAinda não há avaliações

- Challenge Apparels Limited: Commercial InvoiceDocumento1 páginaChallenge Apparels Limited: Commercial InvoiceAdnan YaseenAinda não há avaliações

- Abm 11Documento19 páginasAbm 11Charishann PerolAinda não há avaliações

- Emailing SEED Preparatory Material - OperationsDocumento79 páginasEmailing SEED Preparatory Material - OperationsVaibhav AryaAinda não há avaliações

- Marked Exam Answers With Assessor FeedbackDocumento18 páginasMarked Exam Answers With Assessor FeedbackMicheal100% (1)

- Olympus Lock 2014 PriceListDocumento36 páginasOlympus Lock 2014 PriceListSecurity Lock DistributorsAinda não há avaliações

- A Presentation By: Prof. Thadeus Abilla, CPADocumento52 páginasA Presentation By: Prof. Thadeus Abilla, CPApamela_pardo_3Ainda não há avaliações

- Spare Parts List: Lever Hoists & Chain HoistsDocumento8 páginasSpare Parts List: Lever Hoists & Chain HoistsJESUSCALVILLOAinda não há avaliações

- Internship Project - HimanshuDocumento31 páginasInternship Project - Himanshuhimanshu maurya100% (1)

- Ca. Prabin Raj Kafle: Summary of Custom Act, 2064 & Custom Rules, 2064Documento77 páginasCa. Prabin Raj Kafle: Summary of Custom Act, 2064 & Custom Rules, 2064Amrit NeupaneAinda não há avaliações

- Audit-Of Inventory ACHA - KJDocumento47 páginasAudit-Of Inventory ACHA - KJKhrisna Joy AchaAinda não há avaliações

- Selected Transactions During August Between Summit Company and Beartooth CoDocumento1 páginaSelected Transactions During August Between Summit Company and Beartooth CoAmit PandeyAinda não há avaliações