Escolar Documentos

Profissional Documentos

Cultura Documentos

A: P7,500 B: P5,000 C: (P2,500) D: - 0

Enviado por

PatOcampoDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

A: P7,500 B: P5,000 C: (P2,500) D: - 0

Enviado por

PatOcampoDireitos autorais:

Formatos disponíveis

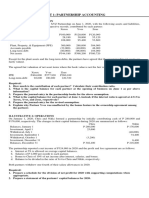

On Sept. 1, 20x7, Ben & Ben Co. sold merchandise to a foreign firm for ¥250,000.

Terms of the

sale require payment in yen on Feb. 1, 20x8. On Sept. 1, 20x7, the spot exchange rate was P1.20

per yen. At Dec. 31, 20x7, Ben & Ben’s year-end, the spot rate was P1.19, but the rate increased

to P1.22 by Feb. 1, 20x8, when payment was received. How much should Ben & Ben report as

foreign exchange transaction gain or loss in its 20x8 income statement?

A: P7,500

B: P5,000

C: (P2,500)

D: -0-

Cindy Corp. bought inventory items from a foreign supplier in Japan on Nov. 15, 20x7 for

100,000 yen, when the spot rate was P0.4295. At Cindy’s December 31, 20x7, year end, the

spot rate was P0.4245. On Jan. 15, 20x8, Cindy bought 100,000 yen at the spot rate of P0.4345

and paid the invoice. How much should Cindy report in its income statements for 20x7 and

20x8 as FOREX gain or loss?

A: P500; (P1,000)

B: (P500); P1,000

C: P1,000; (P500)

D: (P1,000); P500

Você também pode gostar

- Forex ProbsDocumento1 páginaForex ProbsJULLIE CARMELLE H. CHATTOAinda não há avaliações

- ForexDocumento1 páginaForexArceeAinda não há avaliações

- AFAR-12 (Foreign Currrency)Documento22 páginasAFAR-12 (Foreign Currrency)MABI ESPENIDOAinda não há avaliações

- AFAR 3 AnswersDocumento5 páginasAFAR 3 AnswersTyrelle Dela CruzAinda não há avaliações

- AFAR3 QuestionnairesDocumento5 páginasAFAR3 QuestionnairesTyrelle Dela CruzAinda não há avaliações

- Advance Acctg Foreign Currency ProblemsDocumento6 páginasAdvance Acctg Foreign Currency ProblemsManila John20% (5)

- Drill Problems-Wps OfficeDocumento6 páginasDrill Problems-Wps OfficeJp Ayalde0% (1)

- University of Luzon College of AccountancyDocumento3 páginasUniversity of Luzon College of AccountancyJonalyn May De VeraAinda não há avaliações

- Accounts Receivable Accounts Payable: A. P19,500 GainDocumento6 páginasAccounts Receivable Accounts Payable: A. P19,500 GainTk KimAinda não há avaliações

- Quiz - Effects of ForexDocumento8 páginasQuiz - Effects of ForexVicky CastroAinda não há avaliações

- Forex PDFDocumento5 páginasForex PDFErika LanezAinda não há avaliações

- Sa 1Documento48 páginasSa 1MingAinda não há avaliações

- Quiz Foreign Currency Transaction, Hedging & Translation: U AnsweredDocumento25 páginasQuiz Foreign Currency Transaction, Hedging & Translation: U AnsweredDenise Jane RoqueAinda não há avaliações

- Forex TransactionsDocumento3 páginasForex TransactionsDing CostaAinda não há avaliações

- Notes On Foreign TranslationDocumento3 páginasNotes On Foreign TranslationcpacpacpaAinda não há avaliações

- Partnership-WPS OfficeDocumento3 páginasPartnership-WPS OfficeRanelene CutamoraAinda não há avaliações

- FOREX - LectureDocumento4 páginasFOREX - LectureJEP WalwalAinda não há avaliações

- Investment QuizDocumento4 páginasInvestment QuizEll VAinda não há avaliações

- Financial Assets at Fair Value ProblemsDocumento5 páginasFinancial Assets at Fair Value ProblemsJames R JunioAinda não há avaliações

- Apr 4/accounting For Business Combinations: General InstructionDocumento8 páginasApr 4/accounting For Business Combinations: General InstructionJoannah maeAinda não há avaliações

- BS4Documento4 páginasBS4Von Andrei MedinaAinda não há avaliações

- Finals-Business CombiDocumento5 páginasFinals-Business Combijhell de la cruzAinda não há avaliações

- Foreign Currency Transactions2019Documento6 páginasForeign Currency Transactions2019Jeann MuycoAinda não há avaliações

- CH 021Documento2 páginasCH 021Joana TrinidadAinda não há avaliações

- BS1Documento5 páginasBS1Von Andrei MedinaAinda não há avaliações

- Chapter 10Documento16 páginasChapter 10Kurt dela Torre0% (2)

- Accgov PDFDocumento11 páginasAccgov PDFRicardo PaduaAinda não há avaliações

- Forex&Derivative HODocumento7 páginasForex&Derivative HOMarielle SidayonAinda não há avaliações

- AccgovDocumento11 páginasAccgovJanella Patrizia100% (2)

- Accounting For Business Combinations Final Term ExaminationDocumento3 páginasAccounting For Business Combinations Final Term ExaminationJasper LuagueAinda não há avaliações

- Use The Following Information For The Next Three Questions:: Activity 3.2Documento11 páginasUse The Following Information For The Next Three Questions:: Activity 3.2Jade jade jadeAinda não há avaliações

- The Following Information Will Be Used For Question Nos. 8 and 9Documento5 páginasThe Following Information Will Be Used For Question Nos. 8 and 9jenieAinda não há avaliações

- ACC 5116 - MODULE 3 - Lecture NotesDocumento3 páginasACC 5116 - MODULE 3 - Lecture NotesCarl Dhaniel Garcia SalenAinda não há avaliações

- Partnership CE W Control Ans PDFDocumento10 páginasPartnership CE W Control Ans PDFRedAinda não há avaliações

- Pen and Paper Video Problem Solving Due Date: December 21, 2020 (You Can Submit Early) - Post The Link of Your Video in Our GC To Submit. Problem 1Documento2 páginasPen and Paper Video Problem Solving Due Date: December 21, 2020 (You Can Submit Early) - Post The Link of Your Video in Our GC To Submit. Problem 1Lea MachadoAinda não há avaliações

- Unit 1 - Partnership-AccountingDocumento3 páginasUnit 1 - Partnership-AccountingChristine Alysza AnquilanAinda não há avaliações

- The Next Two Items Are Based On The Following Information:: Activity 3.1.2Documento1 páginaThe Next Two Items Are Based On The Following Information:: Activity 3.1.2Tine Vasiana DuermeAinda não há avaliações

- Parco RSPDocumento5 páginasParco RSPElli Francis Tomenio0% (2)

- 04 Additional Exercises On InvestmentsDocumento3 páginas04 Additional Exercises On InvestmentsMaxin TanAinda não há avaliações

- EQUITY SECURITIES With Answer For Uploading PDFDocumento10 páginasEQUITY SECURITIES With Answer For Uploading PDFMaricon Berja100% (1)

- Finals Bcacc MQCDocumento12 páginasFinals Bcacc MQCLaurence BacaniAinda não há avaliações

- Foreign CurrencyDocumento6 páginasForeign CurrencyLJ AggabaoAinda não há avaliações

- Select The Correct ResponseDocumento43 páginasSelect The Correct ResponseCrizel Dario100% (1)

- Forex Testbank This Give Practical Examples For Students To Master The Different Concepts in - CompressDocumento12 páginasForex Testbank This Give Practical Examples For Students To Master The Different Concepts in - CompressMIKAELLA LALOGOAinda não há avaliações

- Prelim Take-Home ExamDocumento8 páginasPrelim Take-Home ExamMelanie SamsonaAinda não há avaliações

- ASSIGNMENT 407 - Audit of InvestmentsDocumento3 páginasASSIGNMENT 407 - Audit of InvestmentsWam OwnAinda não há avaliações

- Auditing Problems Audit of InvestmentsDocumento3 páginasAuditing Problems Audit of InvestmentsMarinel AbrilAinda não há avaliações

- AFARDocumento9 páginasAFARRed Christian PalustreAinda não há avaliações

- Module 07.5 - Foreign Currency Accounting PSDocumento5 páginasModule 07.5 - Foreign Currency Accounting PSFiona Morales100% (2)

- Accounting For SMEs Illustrative ProblemsDocumento5 páginasAccounting For SMEs Illustrative ProblemsKate AlvarezAinda não há avaliações

- Q3 Capital Gains TaxDocumento7 páginasQ3 Capital Gains TaxNhajAinda não há avaliações

- Foreign CurrencyDocumento6 páginasForeign CurrencykatieAinda não há avaliações

- A Owns Majority of The Outstanding Ordinary SharesDocumento2 páginasA Owns Majority of The Outstanding Ordinary Sharesasdfghjkl zxcvbnm100% (1)

- A Owns Majority of The Outstanding Ordinary SharesDocumento2 páginasA Owns Majority of The Outstanding Ordinary Sharesasdfghjkl zxcvbnmAinda não há avaliações

- Intercompany TransactionsDocumento5 páginasIntercompany Transactionsmisonim.eAinda não há avaliações

- MATERIALDocumento23 páginasMATERIALPocari OnceAinda não há avaliações

- Joint Arrangements AssessmentsDocumento9 páginasJoint Arrangements AssessmentsVon Andrei MedinaAinda não há avaliações

- Chapter 11 Test Bank PDFDocumento29 páginasChapter 11 Test Bank PDFYing LiuAinda não há avaliações

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeAinda não há avaliações

- ENT401 - Jeff BezosDocumento6 páginasENT401 - Jeff BezosPatOcampoAinda não há avaliações

- 2019form RevGIS Stock UpdatedDocumento12 páginas2019form RevGIS Stock Updatededgar sean galvezAinda não há avaliações

- Entrepreneur Whom I Admire: Ent401: Exploring The Fundamentals of EntrepreneurshipDocumento7 páginasEntrepreneur Whom I Admire: Ent401: Exploring The Fundamentals of EntrepreneurshipPatOcampoAinda não há avaliações

- Project 2020.bulletin BoardDocumento2 páginasProject 2020.bulletin BoardPatOcampoAinda não há avaliações

- Financial-Analysis-Procter&Gamble-vs-Reckitt BenckiserDocumento5 páginasFinancial-Analysis-Procter&Gamble-vs-Reckitt BenckiserPatOcampoAinda não há avaliações

- Auditing Theory-2018Documento26 páginasAuditing Theory-2018Suzette VillalinoAinda não há avaliações

- RR 11 2018 - Annex C - Withholding Agent Sworn DeclarationDocumento1 páginaRR 11 2018 - Annex C - Withholding Agent Sworn DeclarationPatOcampoAinda não há avaliações

- Performance Appraisal ReportDocumento1 páginaPerformance Appraisal ReportPatOcampoAinda não há avaliações

- Cash and Cash EquivalentsDocumento27 páginasCash and Cash EquivalentsPatOcampoAinda não há avaliações

- Mcqs Audit PRTC2Documento16 páginasMcqs Audit PRTC2PatOcampoAinda não há avaliações

- Practice SetDocumento5 páginasPractice SetPatOcampoAinda não há avaliações

- Date Itinerary Total Per Head x2 Rate (Est) : C/o Miss Pearl (7,000 3,500 Per Head) Taiwander (1,000/head)Documento1 páginaDate Itinerary Total Per Head x2 Rate (Est) : C/o Miss Pearl (7,000 3,500 Per Head) Taiwander (1,000/head)PatOcampoAinda não há avaliações

- Annalyn Maure/Adrian Labiano Snaaap Philippines Inc. Quezon City Library Consortium Inc. Potravina Company LimitedDocumento1 páginaAnnalyn Maure/Adrian Labiano Snaaap Philippines Inc. Quezon City Library Consortium Inc. Potravina Company LimitedPatOcampoAinda não há avaliações

- 1902 - BirDocumento2 páginas1902 - BirLilian Laurel Cariquitan50% (2)

- Projected Sales Volume (Daily) No of Customers Sales (Peso)Documento7 páginasProjected Sales Volume (Daily) No of Customers Sales (Peso)PatOcampoAinda não há avaliações

- Taiwan Travel (Updated)Documento2 páginasTaiwan Travel (Updated)PatOcampoAinda não há avaliações

- 8.5.2019 CABILIN, Vincent. - Authorization LetterDocumento1 página8.5.2019 CABILIN, Vincent. - Authorization LetterPatOcampoAinda não há avaliações

- President/Chief Executive OfficerDocumento2 páginasPresident/Chief Executive OfficerPatOcampoAinda não há avaliações

- RMO 12-2013, List of Unused-Expired ORsSIsCIs - Annex DDocumento1 páginaRMO 12-2013, List of Unused-Expired ORsSIsCIs - Annex DPatOcampo67% (3)

- Specimen Signature Form: InstructionsDocumento1 páginaSpecimen Signature Form: InstructionsPatOcampoAinda não há avaliações

- Inventory List of Unused/Expired Principal and Supplementary Receipts & Invoices As ofDocumento1 páginaInventory List of Unused/Expired Principal and Supplementary Receipts & Invoices As ofPatOcampo100% (2)

- Accounting For Corporation (Review)Documento2 páginasAccounting For Corporation (Review)PatOcampoAinda não há avaliações

- 2018 03 10.accounting 3b.activityDocumento2 páginas2018 03 10.accounting 3b.activityPatOcampo100% (2)