Escolar Documentos

Profissional Documentos

Cultura Documentos

Tdi 1

Enviado por

Clelio Gomes SouzaDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Tdi 1

Enviado por

Clelio Gomes SouzaDireitos autorais:

Formatos disponíveis

Hi guys,

I've been looking at this site and have gone through almost all of the Trading Strategies. I'm just new to Forex markets and previously dealt

with the Traditional Equtiy Market for a long time. Currently, I'm working on CFD (Contract for Difference) market where I buy and sell thefollowing:

1. Stock Indices (ASX in morning, FTSE and DAX in evening and DJIA during late night hours)

2. Commodities (mainly Gold, Crude and Silver)

3. Forex (Just started to look at Forex Trading, thanks to your site)

I've a trading system which I've used for a long time. Of course, like any trading strategy, its not the best system in world and has its

shortcomings. The major shortcoming I've seen is the fake (and perhaps too many) signals generated when the market is trading sideways.

If anyone has ideas on how to improve the strategy then it will be most welcome.

Here goes the strategy:

--------------------------------

THOSE 4 INDICATORS:

--------------------------------

Timeframe: 15 mins, 30 mins, 1 hour or 4 hours

Indicators:

1. CCI (Commodity Channel Index) with default setting of 14

2. Stochastic with default setting of 14, 2

3. Directional Movement Index with default setting of 14

4. MACD with 8 and 40 as MA and 8 as Signal lineGO LONG WHEN:

1. (CCI >= 0) AND

2. (Stochastic >= 50) AND

3. (MACD >= 0 OR DI >=0)

GO SHORT WHEN:

1. (CCI <= 0) AND

2. (Stochastic <= 50) AND

3. (MACD <= 0 OR DI <=0)

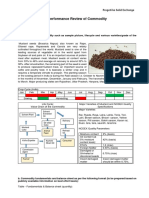

The Strategy has worked very well (for years) with Equities with high Volume (NASDAQ and FTSE being my favourite) and it has given amazingly

accurate signals on Stock Indices. I've posted two different examples to look at. First one is this morning's (27th May) ASX (Australian

ndex) session. The other one is USDCHF Pair from 26thMay. You'll also see three Moving Averages on chart which I plot as a visual help,

these are EMA5, 20 and 100.

Important Points:

1. Note that I'm based in Australia that is why I said I trade on Wall street when its late night here in Brisbane

2. Also note that in the screenshot example (ASX Index) every single Point has a value of 25 AUD (to give you some idea on Profit or ROI) 3. In this particular example

(ASX Index), the Spread is 2 points for Long Positions and 3 points for Short Positions

4. I'm sure, this question will come up so I thought to answer it in advance. There is no Stop Loss method used as such, its just that Ifollow the Signals quite religiously

and exit the trade as soon as the Signal has changed from Long to Short or the other way round5. PSAR Indicator can be used (as you can see in chart) as an

additional confirmation

Cheers and happy trading,

Nariman Ghanghro

Você também pode gostar

- Who Really Drives The Forex Market?: Learn To Trade Forex With Smart Money - Part 1Documento10 páginasWho Really Drives The Forex Market?: Learn To Trade Forex With Smart Money - Part 1Pori WeduAinda não há avaliações

- Stop Hunt Set UpDocumento3 páginasStop Hunt Set UpAamirAbbasAinda não há avaliações

- FX Cog MasterDocumento19 páginasFX Cog MasterNarashimma Kumar100% (1)

- Moving Average Crossover StrategyDocumento6 páginasMoving Average Crossover StrategyDunia IssaAinda não há avaliações

- The Empowered Forex Trader: Strategies to Transform Pains into GainsNo EverandThe Empowered Forex Trader: Strategies to Transform Pains into GainsAinda não há avaliações

- System Sync Highly Profitable Trading System PDFDocumento5 páginasSystem Sync Highly Profitable Trading System PDFAchmad HidayatAinda não há avaliações

- Proprietary Trading A Complete Guide - 2020 EditionNo EverandProprietary Trading A Complete Guide - 2020 EditionAinda não há avaliações

- Woodie Panel Heart Trading System - Forex Strategies - Forex Resources - Forex Trading-Free Forex Trading Signals and FX ForecastDocumento6 páginasWoodie Panel Heart Trading System - Forex Strategies - Forex Resources - Forex Trading-Free Forex Trading Signals and FX ForecastPapy RysAinda não há avaliações

- From WoodiesDocumento12 páginasFrom WoodiesalexandremorenoasuarAinda não há avaliações

- The First Battle Edition 3Documento33 páginasThe First Battle Edition 3Athimoolam SubramaniyamAinda não há avaliações

- Andromeda About UsDocumento2 páginasAndromeda About UsPratik ChhedaAinda não há avaliações

- Forex Virtuoso PDFDocumento19 páginasForex Virtuoso PDFHARISH_IJTAinda não há avaliações

- Currency Action Entry Entry Price Valid Date GMT Time Strategy Exit Exit Price 11:51Documento28 páginasCurrency Action Entry Entry Price Valid Date GMT Time Strategy Exit Exit Price 11:51masterg99Ainda não há avaliações

- Firststrike 1 PDFDocumento8 páginasFirststrike 1 PDFgrigoreceliluminatAinda não há avaliações

- Bunny Girl ForexDocumento33 páginasBunny Girl ForexCristian MedinaAinda não há avaliações

- Report Big Three StrategyDocumento18 páginasReport Big Three StrategyCladel100% (1)

- Forex Ghost Scalper StrategyDocumento6 páginasForex Ghost Scalper StrategyDon Mell0% (1)

- Proprietary trading The Ultimate Step-By-Step GuideNo EverandProprietary trading The Ultimate Step-By-Step GuideAinda não há avaliações

- Precision Probability Index (Elf)Documento20 páginasPrecision Probability Index (Elf)EdsonnSPBrAinda não há avaliações

- Simple Forex StrategiesDocumento4 páginasSimple Forex Strategieszeina32Ainda não há avaliações

- Simplicity User Guide Ver1.0.0 RevADocumento15 páginasSimplicity User Guide Ver1.0.0 RevAbuk ipahAinda não há avaliações

- Scientificscalper Com PDFDocumento13 páginasScientificscalper Com PDFDinesh MishraAinda não há avaliações

- Lifespan Investing: Building the Best Portfolio for Every Stage of Your LifeNo EverandLifespan Investing: Building the Best Portfolio for Every Stage of Your LifeAinda não há avaliações

- Upload ProfitableStrategy PDFDocumento6 páginasUpload ProfitableStrategy PDFmohanAinda não há avaliações

- Suddenly It Was the Last Day of My Life: I Thought I Had More TimeNo EverandSuddenly It Was the Last Day of My Life: I Thought I Had More TimeNota: 5 de 5 estrelas5/5 (1)

- Trading Systems IndicatorsDocumento3 páginasTrading Systems IndicatorsKam MusAinda não há avaliações

- Custom IndicatorsDocumento52 páginasCustom Indicatorslilli-pilliAinda não há avaliações

- The Fat Cat : A Modern Day Forex StrategyNo EverandThe Fat Cat : A Modern Day Forex StrategyAinda não há avaliações

- 4707 Russ Horn Secret MethodDocumento2 páginas4707 Russ Horn Secret Methodseehari100% (1)

- Reversal Trading - A Beginner's Guide Forex4noobsDocumento8 páginasReversal Trading - A Beginner's Guide Forex4noobsVasco JosephAinda não há avaliações

- Forex 101Documento13 páginasForex 101Manojkumar NairAinda não há avaliações

- FirstStrike PlusDocumento5 páginasFirstStrike Plusartus14Ainda não há avaliações

- FX Floor Trader StrategyDocumento14 páginasFX Floor Trader StrategyAlvin CardonaAinda não há avaliações

- Hybrid System of 3 Successful Traders - Engulfing W Pivot & SMADocumento8 páginasHybrid System of 3 Successful Traders - Engulfing W Pivot & SMAeduardo montanhaAinda não há avaliações

- How To Trade Ranging Markets: 1. General InformationDocumento7 páginasHow To Trade Ranging Markets: 1. General InformationZayminhtet McAinda não há avaliações

- Forex For Beginners: "Rapid Quick Start Manual" by Brian CampbellDocumento10 páginasForex For Beginners: "Rapid Quick Start Manual" by Brian CampbellBudi MulyonoAinda não há avaliações

- The Skinny On Forex TradingDocumento113 páginasThe Skinny On Forex TradingnobleconsultantsAinda não há avaliações

- High-Frequency Trading - Reaching The LimitsDocumento5 páginasHigh-Frequency Trading - Reaching The LimitsBartoszSowulAinda não há avaliações

- ForexRebellion V1Documento63 páginasForexRebellion V1ghighAinda não há avaliações

- Pair Strength AnalyzerDocumento7 páginasPair Strength Analyzerkhairil2781Ainda não há avaliações

- Synergy Synergy: Trading Method Trading MethodDocumento22 páginasSynergy Synergy: Trading Method Trading MethodRabiu Ahmed OluwasegunAinda não há avaliações

- Eu Rome Strategy Guide PDFDocumento2 páginasEu Rome Strategy Guide PDFScottAinda não há avaliações

- Renko Scalper EA Users Manual GuideDocumento2 páginasRenko Scalper EA Users Manual GuideRedeemedAinda não há avaliações

- SSRN Id3596245 PDFDocumento64 páginasSSRN Id3596245 PDFAkil LawyerAinda não há avaliações

- Moda Trendus ManualDocumento9 páginasModa Trendus ManualCapitanu IulianAinda não há avaliações

- Adaptive CciDocumento38 páginasAdaptive CciFábio Trevisan100% (1)

- Eurex Equity Spreading TacticsDocumento57 páginasEurex Equity Spreading TacticsKaustubh KeskarAinda não há avaliações

- What Is Scalping?: The Lazy River Scalping StrategyDocumento10 páginasWhat Is Scalping?: The Lazy River Scalping StrategyTheGod LinesAinda não há avaliações

- Trix Strategy Trading System - Forex Strategies - Forex Resources - Forex Trading-Free Forex Trading Signals and FX ForecastDocumento6 páginasTrix Strategy Trading System - Forex Strategies - Forex Resources - Forex Trading-Free Forex Trading Signals and FX ForecastPapy RysAinda não há avaliações

- Trader Nexus - Advanced Trailing Stop Metastock Stop Loss PluginDocumento6 páginasTrader Nexus - Advanced Trailing Stop Metastock Stop Loss PluginlenovojiAinda não há avaliações

- Gold Etf FinalDocumento32 páginasGold Etf FinalMRINAL KUMAR100% (3)

- Binary Options Ebook PDFDocumento19 páginasBinary Options Ebook PDFDan ȘtețAinda não há avaliações

- DETAILS ON GROUP and INDIVIDUAL ASSIGNMENTDocumento1 páginaDETAILS ON GROUP and INDIVIDUAL ASSIGNMENTANIS SURAYA NOOR AZIZANAinda não há avaliações

- Draft LOI GCV ADB 5500Documento2 páginasDraft LOI GCV ADB 5500Edy GunawanAinda não há avaliações

- Chapter 3Documento66 páginasChapter 3Can BayirAinda não há avaliações

- Chapter 1 Malaysian Derivatives MarketDocumento16 páginasChapter 1 Malaysian Derivatives MarketAsyraf SalihinAinda não há avaliações

- Cover Block (8383837083)Documento7 páginasCover Block (8383837083)BALAJI ENTERPRISESAinda não há avaliações

- DailyFX Guide Fundamentals of Trend TradingDocumento17 páginasDailyFX Guide Fundamentals of Trend TradingexercitusjesseAinda não há avaliações

- Bullish Trend Bearish Trend: Bull Pattern Bear PatternDocumento2 páginasBullish Trend Bearish Trend: Bull Pattern Bear PatternJefry R SiregarAinda não há avaliações

- 9801 Manufacturers AffidavitDocumento2 páginas9801 Manufacturers AffidavitThomas VanMovericAinda não há avaliações

- Llesson 4 International Trade Theory Comparative AdvantageDocumento3 páginasLlesson 4 International Trade Theory Comparative AdvantageSaidulAinda não há avaliações

- Emmett T.J. Fibonacci Forecast ExamplesDocumento9 páginasEmmett T.J. Fibonacci Forecast ExamplesAnantJaiswal100% (1)

- Determinants of Forward and Futures PricesDocumento24 páginasDeterminants of Forward and Futures PricesSHUBHAM SRIVASTAVAAinda não há avaliações

- Cot Report Trading StrategyDocumento6 páginasCot Report Trading Strategypkaz1Ainda não há avaliações

- Proposal For Economics ClubDocumento6 páginasProposal For Economics ClubVanya AgarwalAinda não há avaliações

- Gujarat Technological UniversityDocumento5 páginasGujarat Technological UniversitySagar ModiAinda não há avaliações

- Mustard Seed - Performance Review FY 2019-20Documento14 páginasMustard Seed - Performance Review FY 2019-20Arunava BandyopadhyayAinda não há avaliações

- Why Trade Forex Forex vs. FuturesDocumento1 páginaWhy Trade Forex Forex vs. FuturesDickson MakoriAinda não há avaliações

- ISDA SIMM v2.1 PUBLICDocumento29 páginasISDA SIMM v2.1 PUBLICAndy willAinda não há avaliações

- Span MethodologyDocumento26 páginasSpan MethodologyMarco PoloAinda não há avaliações

- Assignment 1: Daniella AlemaniaDocumento4 páginasAssignment 1: Daniella AlemaniaDaniella AlemaniaAinda não há avaliações

- Forex Source:: COT Currency ReportDocumento5 páginasForex Source:: COT Currency ReportMuruganandamGanesan100% (1)

- Second ExercisesDocumento4 páginasSecond Exerciseslord3iadbb7Ainda não há avaliações

- Financial Markets (Chapter 4)Documento2 páginasFinancial Markets (Chapter 4)Kyla DayawonAinda não há avaliações

- International Cha 2Documento26 páginasInternational Cha 2felekebirhanu7Ainda não há avaliações

- Chapter 2 - Forex RateDocumento20 páginasChapter 2 - Forex RateTrần Minh PhụngAinda não há avaliações

- 63e3d96ecd160 EbookDocumento51 páginas63e3d96ecd160 Ebookkhin khinsan100% (5)

- True TraderDocumento21 páginasTrue TraderHarshal PatilAinda não há avaliações

- Understanding Indicators TADocumento43 páginasUnderstanding Indicators TARaúl Guerrero RodasAinda não há avaliações

- Price Effect - Substitution and Income EffectDocumento26 páginasPrice Effect - Substitution and Income Effectjayti desaiAinda não há avaliações