Escolar Documentos

Profissional Documentos

Cultura Documentos

Monetarism IMF

Enviado por

Praveen KumarDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Monetarism IMF

Enviado por

Praveen KumarDireitos autorais:

Formatos disponíveis

BACK TO BASICS

What Is Monetarism?

Its emphasis on money’s importance gained sway

in the 1970s

Sarwat Jahan and Chris Papageorgiou

J

ust how important is money? Few would deny that it velocity as generally stable, which implies that nominal

plays a key role in the economy. income is largely a function of the money supply. Variations

But one school of economic thought, called monetar- in nominal income reflect changes in real economic activity

ism, maintains that the money supply (the total amount of (the number of goods and services sold) and inflation (the

money in an economy) is the chief determinant of current dol- average price paid for them).

lar GDP in the short run and the price level over longer periods. The quantity theory is the basis for several key tenets and

Monetary policy, one of the tools governments have to affect prescriptions of monetarism:

the overall performance of the economy, uses instruments • Long-run monetary neutrality: An increase in the

such as interest rates to adjust the amount of money in the money stock would be followed by an increase in the general

economy. Monetarists believe that the objectives of monetary price level in the long run, with no effects on real factors such

policy are best met by targeting the growth rate of the money as consumption or output.

supply. Monetarism gained prominence in the 1970s—bringing • Short-run monetary nonneutrality: An increase in the

down inflation in the United States and United Kingdom—and stock of money has temporary effects on real output (GDP)

greatly influenced the U.S. central bank’s decision to stimulate and employment in the short run because wages and prices

the economy during the global recession of 2007–09. take time to adjust (they are sticky, in economic parlance).

Today, monetarism is mainly associated with Nobel Prize– • Constant money growth rule: Friedman, who died in

winning economist Milton Friedman. In his seminal work 2006, proposed a fixed monetary rule, which states that the

A Monetary History of the United States, 1867–1960, which Fed should be required to target the growth rate of money

he wrote with fellow economist Anna Schwartz in 1963, to equal the growth rate of real GDP, leaving the price level

Friedman argued that poor monetary policy by the U.S. central unchanged. If the economy is expected to grow at 2 percent

bank, the Federal Reserve, was the primary cause of the Great in a given year, the Fed should allow the money supply to

b2b, corrected 2/3/2014

Depression in the United States in the 1930s. In their view, the increase by 2 percent. The Fed should be bound to fixed rules

failure of the Fed (as it is usually called) to offset forces that in conducting monetary policy because discretionary power

were putting downward pressure on the money supply and its can destabilize the economy.

actions to reduce the stock of money were the opposite of what

should have been done. They also argued that because markets

naturally move toward a stable center, an incorrectly set money Varying velocity

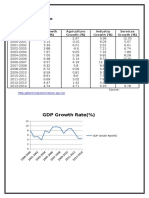

supply caused markets to behave erratically. When dollars changed hands at a predictable pace before 1981,

Monetarism gained prominence in the 1970s. In 1979, money and output grew together. But when velocity became

with U.S. inflation peaking at 20 percent, the Fed switched volatile, the relationship fell apart.

its operating strategy to reflect monetarist theory. But mon- (billions of dollars) (units per year)

2,500 12

etarism faded in the following decades as its ability to explain GDP (left scale)

the U.S. economy seemed to wane. Nevertheless, some of the 2,000

Money supply (left scale)

10

insights monetarists brought to economic analysis have been Velocity (right scale)

adopted by nonmonetarist economists. 1,500 8

Pre-1981 trend in

At its most basic 1,000 velocity 6

The foundation of monetarism is the Quantity Theory of

Money. The theory is an accounting identity—that is, it must 500 4

be true. It says that the money supply multiplied by veloc-

ity (the rate at which money changes hands) equals nomi- 0 2

1960 65 70 75 80 85 90 95 2000 05 10

nal expenditures in the economy (the number of goods and

Source: Board of Governors, U.S. Federal Reserve System.

services sold multiplied by the average price paid for them). Note: Quarterly data are seasonally adjusted. Money supply = cash in circulation and checking

As an accounting identity, this equation is uncontroversial. accounts (M1). Velocity = the number of times a dollar changes hands in a year. GDP is reduced by

a factor of 10 to fit on the chart.

What is controversial is velocity. Monetarist theory views

38 Finance & Development March 2014

• Interest rate flexibility: The money growth rule was In the 1970s velocity increased at a fairly constant rate

intended to allow interest rates, which affect the cost of and it appeared that the quantity theory of money was

credit, to be flexible to enable borrowers and lenders to take a good one (see chart). The rate of growth of money,

account of expected inflation as well as the variations in real adjusted for a predictable level of velocity, determined

interest rates.

Many monetarists also believe that markets are inherently

stable in the absence of major unexpected fluctuations in the The relationship between money and

money supply. They also assert that government interven-

tion can often destabilize the economy more than help it.

economic performance changed.

Monetarists also believe that there is no long-run trade-off

between inflation and unemployment because the economy nominal GDP. But in the 1980s and 1990s velocity became

settles at long-run equilibrium at a full employment level highly unstable with unpredictable periods of increases

of output (see “What Is the Output Gap?” in the September and declines. The link between the money supply and

2013 F&D). nominal GDP broke down, and the usefulness of the

quantity theory of money came into question. Many econ-

The great debate omists who had been convinced by monetarism in the

Although monetarism gained in importance in the 1970s, it 1970s abandoned the approach.

was critiqued by the school of thought that it sought to sup- Most economists think the change in velocity’s predictabil-

plant—Keynesianism. Keynesians, who took their inspira- ity was primarily the result of changes in banking rules and

tion from the great British economist John Maynard Keynes, other financial innovations. In the 1980s banks were allowed

believe that demand for goods and services is the key to to offer interest-earning checking accounts, eroding some

economic output. They contend that monetarism falters as of the distinction between checking and savings accounts.

an adequate explanation of the economy because velocity is Moreover, many people found that money markets, mutual

inherently unstable and attach little or no significance to the funds, and other assets were better alternatives to traditional

quantity theory of money and the monetarist call for rules. bank deposits. As a result, the relationship between money

Because the economy is subject to deep swings and periodic and economic performance changed.

instability, it is dangerous to make the Fed slave to a preor-

dained money target, they believe—the Fed should have Relevant still

some leeway or “discretion” in conducting policy. Keynesians Still, the monetarist interpretation of the Great Depression

also do not believe that markets adjust to disruptions and was not entirely forgotten. In a speech during a celebration

quickly return to a full employment level of output. of Milton Friedman’s 90th birthday in late 2002, then-Fed

Keynesianism held sway for the first quarter century after governor Ben S. Bernanke, who would become chairman

World War II. But the monetarist challenge to the traditional four years later, said, “ I would like to say to Milton and Anna

Keynesian theory strengthened during the 1970s, a decade [Schwartz]: Regarding the Great Depression, you’re right. We

characterized by high and rising inflation and slow eco- [the Fed] did it. We’re very sorry. But thanks to you, we won’t

nomic growth. Keynesian theory had no appropriate policy do it again.” Fed Chairman Bernanke mentioned the work of

responses, while Friedman and other monetarists argued Friedman and Schwartz in his decision to lower interest rates

convincingly that the high rates of inflation were due to rapid and increase money supply to stimulate the economy during

increases in the money supply, making control of the money the global recession that began in 2007 in the United States.

supply the key to good policy. Prominent monetarists (including Schwartz) argued that the

In 1979, Paul A. Volcker became chairman of the Fed Fed stimulus would lead to extremely high inflation. Instead,

and made fighting inflation its primary objective. The velocity dropped sharply and deflation is seen as a much

Fed restricted the money supply (in accordance with the more serious risk.

Friedman rule) to tame inflation and succeeded. Inflation Although most economists today reject the slavish atten-

subsided dramatically, although at the cost of a big recession. tion to money growth that is at the heart of monetarist

Monetarism had another triumph in Britain. When analysis, some important tenets of monetarism have found

Margaret Thatcher was elected prime minister in 1979, their way into modern nonmonetarist analysis, muddying

Britain had endured several years of severe inflation. the distinction between monetarism and Keynesianism

Thatcher implemented monetarism as the weapon against that seemed so clear three decades ago. Probably the most

rising prices, and succeeded in halving inflation, to less than important is that inflation cannot continue indefinitely

5 percent by 1983. without increases in the money supply, and controlling it

But monetarism’s ascendance was brief. The money supply should be a primary, if not the only, responsibility of the

is useful as a policy target only if the relationship between

money and nominal GDP, and therefore inflation, is stable

central bank. ■

and predictable. That is, if the supply of money rises, so does Sarwat Jahan is an Economist and Chris Papageorgiou is

nominal GDP, and vice versa. To achieve that direct effect, a Deputy Division Chief in the IMF’s Strategy, Policy, and

though, the velocity of money must be predictable. Review Department.

Finance & Development March 2014 39

Você também pode gostar

- Lecture 7 General Equilibrium PDFDocumento61 páginasLecture 7 General Equilibrium PDFJoyce FranciscoAinda não há avaliações

- General Equilibrium: An Exchange Economy: Varian, Chapter 31Documento14 páginasGeneral Equilibrium: An Exchange Economy: Varian, Chapter 31SheidaHaAinda não há avaliações

- Business Policy & Strategic MGT PDFDocumento3 páginasBusiness Policy & Strategic MGT PDFPrashant MahanandAinda não há avaliações

- Chapter 1 Page 25Documento25 páginasChapter 1 Page 25Sangheethaa SukumaranAinda não há avaliações

- The Economics of Money, Banking, and Financial Markets: Sixth Canadian EditionDocumento28 páginasThe Economics of Money, Banking, and Financial Markets: Sixth Canadian Editionchristian rodriguexAinda não há avaliações

- This Is Nigeria: Thank You. Jesunifemi OgunleyeDocumento1 páginaThis Is Nigeria: Thank You. Jesunifemi OgunleyeJesunifemi Ogunleye100% (2)

- Egory Mankiw Chapter 1Documento12 páginasEgory Mankiw Chapter 1Dyna MadinaAinda não há avaliações

- Pol 431Documento177 páginasPol 431Adeniyi Adedolapo OLanrewajuAinda não há avaliações

- 1991 India Economic CrisisDocumento2 páginas1991 India Economic CrisisAakash AsheshAinda não há avaliações

- Mankiw Taylor PPT002Documento36 páginasMankiw Taylor PPT002Jan KranenkampAinda não há avaliações

- EC 102 Revisions Lectures - Macro - 2015Documento54 páginasEC 102 Revisions Lectures - Macro - 2015TylerTangTengYangAinda não há avaliações

- 1997 (Jack Johnston, John Dinardo) Econometric Methods PDFDocumento514 páginas1997 (Jack Johnston, John Dinardo) Econometric Methods PDFtitan10084% (19)

- World Trade: An: Eleventh EditionDocumento33 páginasWorld Trade: An: Eleventh EditionYUJIA HUAinda não há avaliações

- Coach Huber AP Macroeconomics: Gross Domestic ProductDocumento18 páginasCoach Huber AP Macroeconomics: Gross Domestic Productapi-255899090Ainda não há avaliações

- ECON 1269 Midterm 2 Offer Curves Knowledge Summary NewDocumento2 páginasECON 1269 Midterm 2 Offer Curves Knowledge Summary NewRetratss0% (1)

- Market Equilibrium and ForcesDocumento6 páginasMarket Equilibrium and ForcesThais HernandezAinda não há avaliações

- Fiscal Policy and Deficit FinancingDocumento4 páginasFiscal Policy and Deficit FinancingAnkit JainAinda não há avaliações

- Macro CH 11Documento48 páginasMacro CH 11maria37066100% (3)

- MGEA02 DoccsDocumento39 páginasMGEA02 DoccsShivam Kapila100% (1)

- Income Distribution and PovertyDocumento31 páginasIncome Distribution and PovertyEd Leen ÜAinda não há avaliações

- Mankiw Chapter 1 Science of MacroeconomicsDocumento29 páginasMankiw Chapter 1 Science of MacroeconomicsSEKAR SAHIDAinda não há avaliações

- Parkinmacro15 1300Documento17 páginasParkinmacro15 1300Avijit Pratap RoyAinda não há avaliações

- Namma Kalvi Economics Unit 5 Surya Economics Guide emDocumento31 páginasNamma Kalvi Economics Unit 5 Surya Economics Guide emAakaash C.K.Ainda não há avaliações

- Chapter 3 Money and Monetary PolicyDocumento35 páginasChapter 3 Money and Monetary PolicyZaid Harithah100% (1)

- Chapter 3 (National Income - Where It Comes From and Where It Goes)Documento16 páginasChapter 3 (National Income - Where It Comes From and Where It Goes)Khadeeza ShammeeAinda não há avaliações

- CSS Economics Paper Questions For Goal 1 Paper 1: 2000-2019Documento2 páginasCSS Economics Paper Questions For Goal 1 Paper 1: 2000-2019MaryamAinda não há avaliações

- Economics 01Documento26 páginasEconomics 01Chimmie Mphaka33% (3)

- ECON 4301 Midterm Solutions PDFDocumento8 páginasECON 4301 Midterm Solutions PDFHumam HassanAinda não há avaliações

- Mankiw8e Student PPTs Chapter 1Documento12 páginasMankiw8e Student PPTs Chapter 1karina2227Ainda não há avaliações

- Chapter 12Documento38 páginasChapter 12Nguyễn Vinh QuangAinda não há avaliações

- ECON1000 Course OutlineDocumento2 páginasECON1000 Course Outlinesexyshanqaz9700Ainda não há avaliações

- How rapid growth conflicts with inflation, trade, and sustainabilityDocumento3 páginasHow rapid growth conflicts with inflation, trade, and sustainabilityLamise Hassan Al-Kazaz100% (2)

- ECONOMIC PRINCIPLES Seven Ideas For Thinking About Almost AnythingDocumento390 páginasECONOMIC PRINCIPLES Seven Ideas For Thinking About Almost AnythingJan Doe0% (1)

- Friedmans Restatement of Quantity Theory of MoneuDocumento7 páginasFriedmans Restatement of Quantity Theory of MoneuRitesh kumarAinda não há avaliações

- Tax Incentives in SADC: Improving Effectiveness and Reducing Harmful CompetitionDocumento169 páginasTax Incentives in SADC: Improving Effectiveness and Reducing Harmful CompetitionNazareth117100% (1)

- ECN 2215 - Topic - 2 PDFDocumento54 páginasECN 2215 - Topic - 2 PDFKalenga AlexAinda não há avaliações

- The International Labor Organization On Co-OperativesDocumento86 páginasThe International Labor Organization On Co-OperativesPapers and Powerpoints from UNTL-VU Joint Conferenes in DiliAinda não há avaliações

- Rural Development Programms: A Tool For Alleviation of Rural PovertyDocumento10 páginasRural Development Programms: A Tool For Alleviation of Rural PovertyIJAR JOURNALAinda não há avaliações

- MNC and Foreign Direct InvestmentDocumento31 páginasMNC and Foreign Direct InvestmentSamanth GodiAinda não há avaliações

- George F Warren Farm Economist by StantonDocumento539 páginasGeorge F Warren Farm Economist by StantonCoolidgeLowAinda não há avaliações

- Chapter 1: The Ricardian Model of International Trade: Learning ObjectivesDocumento9 páginasChapter 1: The Ricardian Model of International Trade: Learning ObjectivesTze Wei GohAinda não há avaliações

- The Data of Macroeconomics: AcroeconomicsDocumento54 páginasThe Data of Macroeconomics: Acroeconomicsaditya prudhviAinda não há avaliações

- Aggregate Demand WorksheetDocumento6 páginasAggregate Demand WorksheetDanaAinda não há avaliações

- Intro to Macro Midterm Boot Camp Assignment 1 ReviewDocumento104 páginasIntro to Macro Midterm Boot Camp Assignment 1 Reviewmaged famAinda não há avaliações

- Measuring US GDP over the last decadeDocumento3 páginasMeasuring US GDP over the last decadeDamonPerkinsAinda não há avaliações

- Assessing The Economic Policies of President Lula Da Silva in BrazilDocumento26 páginasAssessing The Economic Policies of President Lula Da Silva in BrazilcabamaroAinda não há avaliações

- Principles of Macroeconomics Practice AssignmentDocumento4 páginasPrinciples of Macroeconomics Practice AssignmentAnonymous xUb9GnoFAinda não há avaliações

- BBA 2011 - Historical link between inflation and unemploymentDocumento35 páginasBBA 2011 - Historical link between inflation and unemploymentluvpriyaAinda não há avaliações

- The Englewood, NJ School Conflict: A Case Study of Decision-Making and Racial Segregation, 1930-1963 by Robert Lewis La Frankie Part 2Documento136 páginasThe Englewood, NJ School Conflict: A Case Study of Decision-Making and Racial Segregation, 1930-1963 by Robert Lewis La Frankie Part 2Englewood Public LibraryAinda não há avaliações

- CBSC Class XI - Accounting For BusinessDocumento228 páginasCBSC Class XI - Accounting For BusinessSachin KheveriaAinda não há avaliações

- Macro 95 Ex 2Documento17 páginasMacro 95 Ex 2Engr Fizza AkbarAinda não há avaliações

- MonetarismDocumento2 páginasMonetarismNida KaradenizAinda não há avaliações

- Monetary Policy Guide for StudentsDocumento15 páginasMonetary Policy Guide for StudentsThamilnila GowthamAinda não há avaliações

- Lecture Notes - MonetarismDocumento5 páginasLecture Notes - MonetarismJomit C PAinda não há avaliações

- Me PresDocumento11 páginasMe PresImaan KhawarAinda não há avaliações

- Rabin A Monetary Theory - 246 250Documento5 páginasRabin A Monetary Theory - 246 250Anonymous T2LhplUAinda não há avaliações

- Demand for Money Function Stability in IndiaDocumento29 páginasDemand for Money Function Stability in IndiaNawazish KhanAinda não há avaliações

- Monetarists Vs Rational E, PresentationDocumento34 páginasMonetarists Vs Rational E, PresentationTinotenda Dube100% (2)

- Summary: Animal Spirits: Review and Analysis of Akerlof and Shiller's BookNo EverandSummary: Animal Spirits: Review and Analysis of Akerlof and Shiller's BookAinda não há avaliações

- HPCL earnings driven by marketing marginsDocumento6 páginasHPCL earnings driven by marketing marginsPraveen KumarAinda não há avaliações

- ICMR-NIE Walk-In Interviews for Project PostsDocumento6 páginasICMR-NIE Walk-In Interviews for Project PostsPraveen KumarAinda não há avaliações

- Irctc Advertisement PDFDocumento4 páginasIrctc Advertisement PDFJaydeep JainAinda não há avaliações

- Sr. No. Annexure 1 Post Graduate Program in Management (PGPM) Class of 2017Documento2 páginasSr. No. Annexure 1 Post Graduate Program in Management (PGPM) Class of 2017Praveen KumarAinda não há avaliações

- Engineers India (ENGR IN) Rating: BUY | CMP: Rs108 | TP: Rs139Documento7 páginasEngineers India (ENGR IN) Rating: BUY | CMP: Rs108 | TP: Rs139Praveen KumarAinda não há avaliações

- Indian Oil Corporation (IOCL IN) : Q4FY19 Result UpdateDocumento7 páginasIndian Oil Corporation (IOCL IN) : Q4FY19 Result UpdatePraveen KumarAinda não há avaliações

- JSW Steel (JSTL In) : Q4FY19 Result UpdateDocumento6 páginasJSW Steel (JSTL In) : Q4FY19 Result UpdatePraveen KumarAinda não há avaliações

- Indian Oil Corporation (IOCL IN) : Q4FY19 Result UpdateDocumento7 páginasIndian Oil Corporation (IOCL IN) : Q4FY19 Result UpdatePraveen KumarAinda não há avaliações

- FleetCor PM1 Case Study 1Documento2 páginasFleetCor PM1 Case Study 1Praveen KumarAinda não há avaliações

- Keynesian Economics PDFDocumento2 páginasKeynesian Economics PDFPraveen KumarAinda não há avaliações

- Rating Criteria For Banks and Financial InstitutionsDocumento14 páginasRating Criteria For Banks and Financial InstitutionsPraveen KumarAinda não há avaliações

- EfqmDocumento6 páginasEfqmPraveen KumarAinda não há avaliações

- Sai Vrat Katha in HindiDocumento9 páginasSai Vrat Katha in Hindiankit jAinda não há avaliações

- Electronic GovtDocumento20 páginasElectronic GovtPraveen KumarAinda não há avaliações

- Economics - Market StructuresDocumento5 páginasEconomics - Market Structureshelixate67% (3)

- A - Arranger Certification Project FinanceDocumento41 páginasA - Arranger Certification Project FinancePraveen KumarAinda não há avaliações

- December 2016), Based On General Indices and Cfpis Are Given As FollowsDocumento5 páginasDecember 2016), Based On General Indices and Cfpis Are Given As FollowspvaibhyAinda não há avaliações

- Hemotask2018 PDFDocumento3 páginasHemotask2018 PDFPraveen KumarAinda não há avaliações

- Leakages and InjectionsDocumento1 páginaLeakages and InjectionsPraveen KumarAinda não há avaliações

- Negotiable Instruments Types & PartiesDocumento4 páginasNegotiable Instruments Types & PartiesPraveen KumarAinda não há avaliações

- Flashcards - Oper3100 Exam 5Documento7 páginasFlashcards - Oper3100 Exam 5Praveen KumarAinda não há avaliações

- Advance Esimate GDP 2017Documento10 páginasAdvance Esimate GDP 2017Praveen KumarAinda não há avaliações

- Fuel Economy: How Much Fuel Are Your Trucks Really Burning?Documento5 páginasFuel Economy: How Much Fuel Are Your Trucks Really Burning?Praveen KumarAinda não há avaliações

- BondDocumento13 páginasBondPraveen KumarAinda não há avaliações

- ELIGIBILITY CRITERIA ABOUT THE WORKSHOPDocumento3 páginasELIGIBILITY CRITERIA ABOUT THE WORKSHOPPraveen KumarAinda não há avaliações

- Technology Capital Markets Fintech History Article June 2015Documento4 páginasTechnology Capital Markets Fintech History Article June 2015Praveen KumarAinda não há avaliações

- EAC OpinionDocumento4 páginasEAC OpinionPraveen KumarAinda não há avaliações

- Big Data Analytics Opportunities for AuditingDocumento5 páginasBig Data Analytics Opportunities for AuditingPraveen KumarAinda não há avaliações

- Tata Power-Ddl DSM Case Study Ceo&MdDocumento4 páginasTata Power-Ddl DSM Case Study Ceo&MdPraveen KumarAinda não há avaliações

- Factors affecting demand for money in IndiaDocumento26 páginasFactors affecting demand for money in IndiaNidhi AroraAinda não há avaliações

- Introduction To Economic Fluctuations: AcroeconomicsDocumento40 páginasIntroduction To Economic Fluctuations: AcroeconomicsIla PandeyAinda não há avaliações

- Currency System in India RBI RoleDocumento11 páginasCurrency System in India RBI RoleSharon NunesAinda não há avaliações

- RBI Cuts Key Interest RatesDocumento5 páginasRBI Cuts Key Interest RatesJagmohan SinghAinda não há avaliações

- Importance of MacroeconomicsDocumento2 páginasImportance of MacroeconomicsLawrence MosesAinda não há avaliações

- India's Trade Policy Evolution: Pre-Independence to Post-LiberalisationDocumento4 páginasIndia's Trade Policy Evolution: Pre-Independence to Post-LiberalisationMegha SharmaAinda não há avaliações

- Trade AgreementsDocumento9 páginasTrade AgreementsHammad NaeemAinda não há avaliações

- " by Nils Gottfries (2013), Palgrave Macmillan. This Is An AdvancedDocumento6 páginas" by Nils Gottfries (2013), Palgrave Macmillan. This Is An AdvancedlawAinda não há avaliações

- H2 Economics Detailed SummaryDocumento84 páginasH2 Economics Detailed Summaryragul96100% (1)

- Scoring Rubric For The Catalog ProjectDocumento2 páginasScoring Rubric For The Catalog Projectapi-325408313Ainda não há avaliações

- Role of IMFDocumento20 páginasRole of IMFSwati Sharma100% (1)

- Public Finances in EMU - 2011Documento226 páginasPublic Finances in EMU - 2011ClaseVirtualAinda não há avaliações

- What Is A RecessionDocumento3 páginasWhat Is A Recessionsamina123Ainda não há avaliações

- Money's Functions and Economic EfficiencyDocumento47 páginasMoney's Functions and Economic EfficiencyلبليايلاAinda não há avaliações

- Exchange Rate Policy at The Monetary Authority of SingaporeDocumento17 páginasExchange Rate Policy at The Monetary Authority of SingaporeDexpistolAinda não há avaliações

- ECO403 Quizez 1Documento13 páginasECO403 Quizez 1ZahaAliAinda não há avaliações

- Hall 1993 Policy ParadigmsDocumento23 páginasHall 1993 Policy ParadigmsJennifer RockettAinda não há avaliações

- EPOPTEIADocumento6 páginasEPOPTEIAEconomy 365Ainda não há avaliações

- Neihbourhood Planning and Urban DesignDocumento12 páginasNeihbourhood Planning and Urban DesignLalit SisodiaAinda não há avaliações

- Tax Deductions, Brackets, and EquityDocumento3 páginasTax Deductions, Brackets, and Equitycollegegirl69Ainda não há avaliações

- City of South Fulton Feasibility StudyDocumento17 páginasCity of South Fulton Feasibility StudyAndre WalkerAinda não há avaliações

- Maths PercentageDocumento4 páginasMaths PercentageniharikaAinda não há avaliações

- Economic Liberalisation in India PDFDocumento7 páginasEconomic Liberalisation in India PDFAjay Reddy100% (1)

- Fundamental Analysis of INFOSYSDocumento25 páginasFundamental Analysis of INFOSYSsohelrangrej21Ainda não há avaliações

- Bbki 4103Documento6 páginasBbki 4103surren0% (1)

- Sen Zubiri Request Funding Rehab Projects Barangay DagumbaanDocumento3 páginasSen Zubiri Request Funding Rehab Projects Barangay Dagumbaanslumba100% (1)

- Definition of TaxDocumento3 páginasDefinition of TaxAbdullah Al Asem0% (1)

- Hedge Clippers White Paper No.4: How Hedge Funds Purchased Albany's LawmakersDocumento184 páginasHedge Clippers White Paper No.4: How Hedge Funds Purchased Albany's LawmakersHedge Clippers100% (2)

- Budget AnalysisDocumento13 páginasBudget AnalysisRamneet ParmarAinda não há avaliações

- Tax Analysis: Company Name: Year EndDocumento14 páginasTax Analysis: Company Name: Year EndJohn LLoyd BacsarsaAinda não há avaliações