Escolar Documentos

Profissional Documentos

Cultura Documentos

Wilkerson Case

Enviado por

ashibhallauDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Wilkerson Case

Enviado por

ashibhallauDireitos autorais:

Formatos disponíveis

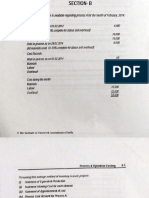

University Inn's most recent monthly expense analysis report revealed significant cost overruns.

The manager was asked to explain the deviations. Below is the "budget v. actual" expense report

for the month in question.

University Inn

Budget v. Actual Expense Report

For the Month Ending October 31, 2007

Actual (at 96% Budget (established at Variance

capacity) 80% capacity)

Utilities $ 52,000 $ 45,000 $ (7,000)

Laundry 20,000 18,000 (2,000)

Food service 41,000 35,000 (6,000)

Rent/taxes 60,000 60,000 -

Staff wages 57,000 55,000 (2,000)

Management salaries 43,500 45,000 1,500

Water 13,000 10,000 (3,000)

Maintenance 15,200 15,000 (200)

$ 301,700 $ 283,000 $ (18,700)

The Inn has observed that utilities, water, food service, staff wages, and laundry costs all vary

with activity. The other costs are fixed. The budget reflected above was based upon an assumed

80% occupancy rate. The university's football team was on a winning streak and numerous

alumni were returning to campus in October, resulting in a 96% occupancy rate during the

month.

Prepare a "flexible budget" based upon a 96% occupancy rate, and identify whether the Inn is

being efficiently or inefficiently run. Comment on specific costs, and note why a flexible budget

can improve performance evaluations.

An example of the first line of the budget is provided below:

Actual Budget Variance

Utilities $52,000 $54,000 $2,000 under budget

Actual is already at The budget was

96% capacity 45,000 assuming 80%

capacity. To convert to

96% capacity: 54,000

divide by 0.8 =

56,2560 (representing

100% capacity) X >

0.96 = 54,000

Você também pode gostar

- BUS 3301 - Discussion Forum Unit 7Documento3 páginasBUS 3301 - Discussion Forum Unit 7AdilAinda não há avaliações

- Flexible Budgeting Lecture: Fixed/Static BudgetsDocumento4 páginasFlexible Budgeting Lecture: Fixed/Static BudgetsSeana GeddesAinda não há avaliações

- MbaDocumento3 páginasMbaThiru VenkatAinda não há avaliações

- Accounting For OverheadsDocumento14 páginasAccounting For OverheadsSaad Khan YTAinda não há avaliações

- Budgetory Control Flexible Budget With SolutionsDocumento6 páginasBudgetory Control Flexible Budget With SolutionsJash SanghviAinda não há avaliações

- 2) Solution To Problem No 2 On Flexible BudgetDocumento7 páginas2) Solution To Problem No 2 On Flexible BudgetVikas guptaAinda não há avaliações

- Activity Cost BehaviorDocumento28 páginasActivity Cost Behaviorangel caoAinda não há avaliações

- Unit 5 Module - 8: Budgets & Budgetary Control Practical Problems (With Solutions)Documento18 páginasUnit 5 Module - 8: Budgets & Budgetary Control Practical Problems (With Solutions)Nadine MillaminaAinda não há avaliações

- Budgetory Control Flexible Budget - QuestionsDocumento2 páginasBudgetory Control Flexible Budget - QuestionsJash SanghviAinda não há avaliações

- Accounting For OverheadsDocumento13 páginasAccounting For OverheadsfyrAinda não há avaliações

- Proyeksi Penjualan Dan PengeluaranDocumento1 páginaProyeksi Penjualan Dan PengeluaranDina LukitoAinda não há avaliações

- RMK 5 Flexibel Budget Kel 1Documento14 páginasRMK 5 Flexibel Budget Kel 1FandiAinda não há avaliações

- Budgetary Control - Practical ProblemsDocumento18 páginasBudgetary Control - Practical Problemsdfljmls,100% (2)

- CA TM 2nd Edition Chapter 22 EngDocumento38 páginasCA TM 2nd Edition Chapter 22 EngIp NicoleAinda não há avaliações

- Unit V BAP 2023 1700566379097Documento68 páginasUnit V BAP 2023 1700566379097kannandharani82Ainda não há avaliações

- Business Budget Excercise ProblemsDocumento5 páginasBusiness Budget Excercise ProblemsSHARATH JAinda não há avaliações

- Budgetary Control AssignmentDocumento4 páginasBudgetary Control AssignmentYash AggarwalAinda não há avaliações

- Practicals Budgetory ControlDocumento18 páginasPracticals Budgetory Controlvihanjangid223Ainda não há avaliações

- Review Session 2024 SolutionsDocumento3 páginasReview Session 2024 SolutionsHitesh MehtaAinda não há avaliações

- Fishery (Icdp)Documento3 páginasFishery (Icdp)Shyamal Dutta100% (1)

- Q2 Answer PG 5-6Documento8 páginasQ2 Answer PG 5-6Aina Syazwana ZulkefliAinda não há avaliações

- Budgetary ControlDocumento7 páginasBudgetary ControlKuldeep NAinda não há avaliações

- Solution Manual-Module 1: Acc 311 - Acctg For Special Transactions and Business CombinationsDocumento11 páginasSolution Manual-Module 1: Acc 311 - Acctg For Special Transactions and Business CombinationsJoy SantosAinda não há avaliações

- Book 1Documento12 páginasBook 1Vincent Luigil AlceraAinda não há avaliações

- Manage Finances 2Documento7 páginasManage Finances 2Ashish JaatAinda não há avaliações

- OM Group2Documento3 páginasOM Group2Saumya ChaturvediAinda não há avaliações

- Illustration1: For The Production of 10000 Units of A Product, The Following Are The Budgeted ExpensesDocumento4 páginasIllustration1: For The Production of 10000 Units of A Product, The Following Are The Budgeted ExpensesGabriel BelmonteAinda não há avaliações

- FIN427 Home Work 01 AnswerDocumento3 páginasFIN427 Home Work 01 AnswerB M Rakib HassanAinda não há avaliações

- Actual Cost Vs Plan Projection: Your Company NameDocumento25 páginasActual Cost Vs Plan Projection: Your Company NameShamsAinda não há avaliações

- Proposal Sarawati IVF jUNE 2019Documento8 páginasProposal Sarawati IVF jUNE 2019Gaurav WankhedeAinda não há avaliações

- Flexible BudgetsDocumento23 páginasFlexible BudgetsscienceplexAinda não há avaliações

- Breakeven Price Computation For A 20-Unit Computer Shop Cost Computation AmountDocumento2 páginasBreakeven Price Computation For A 20-Unit Computer Shop Cost Computation AmountNicole PaedAinda não há avaliações

- Wiam ACHERGUIDocumento6 páginasWiam ACHERGUIHouda AzouzAinda não há avaliações

- Citra Dewi - 4112001008 - AM 4A Pagi - Study Case Chapter 4Documento16 páginasCitra Dewi - 4112001008 - AM 4A Pagi - Study Case Chapter 4Citra DewiAinda não há avaliações

- Pension Cash Pension Plan Expense Contributionasset/Liability Dbo AssetsDocumento1 páginaPension Cash Pension Plan Expense Contributionasset/Liability Dbo AssetsNam TranAinda não há avaliações

- Kaorakhali ProposedBudgetDocumento9 páginasKaorakhali ProposedBudgetapi-3802659100% (2)

- Chapter 10 QuestionsDocumento6 páginasChapter 10 QuestionsAgatha AgatonAinda não há avaliações

- Chapter 9 Exercises: Exercise 9 1Documento8 páginasChapter 9 Exercises: Exercise 9 1karenmae intangAinda não há avaliações

- DR Rachna Mahalwla - B.Com III Year Management Accounting Flexible BudgetingDocumento6 páginasDR Rachna Mahalwla - B.Com III Year Management Accounting Flexible BudgetingSaumya JainAinda não há avaliações

- Marginal Costing - Flexed BudgetDocumento4 páginasMarginal Costing - Flexed BudgetMUSTHARI KHANAinda não há avaliações

- Charles AKMENDocumento11 páginasCharles AKMENCharles GohAinda não há avaliações

- Process and Operating CostingDocumento20 páginasProcess and Operating CostingBHANU PRATAP SINGHAinda não há avaliações

- Budgets and Budgetary Control: by Dr. Aleem AnsariDocumento26 páginasBudgets and Budgetary Control: by Dr. Aleem AnsariPRIYAL GUPTAAinda não há avaliações

- Suggested Answer - Syl2008 - June2015 - Paper - 8Documento2 páginasSuggested Answer - Syl2008 - June2015 - Paper - 8Mohammed RafiAinda não há avaliações

- HQ01 Costs and Costs Concepts PDFDocumento6 páginasHQ01 Costs and Costs Concepts PDFKrishia Marnelle PeñasAinda não há avaliações

- Joint Products - by ProductsDocumento3 páginasJoint Products - by ProductsShivansh NahataAinda não há avaliações

- Chapter 8 OCT 7Documento4 páginasChapter 8 OCT 7Kinley Tshering BidhaAinda não há avaliações

- MGT AC - Prob-NewDocumento276 páginasMGT AC - Prob-Newrandom122Ainda não há avaliações

- Financial Statements and Indicators: Urbanization Villa Del ReyDocumento6 páginasFinancial Statements and Indicators: Urbanization Villa Del ReywendyAinda não há avaliações

- Course Code: ACT 201 Course Title: Cost & Management Accounting Section: 2Documento4 páginasCourse Code: ACT 201 Course Title: Cost & Management Accounting Section: 2Wild GhostAinda não há avaliações

- Budgetary Control AssignmentDocumento6 páginasBudgetary Control AssignmentBhavvyam BhatnagarAinda não há avaliações

- Isna Wirda Lutfiyah - 17 - 4-17Documento10 páginasIsna Wirda Lutfiyah - 17 - 4-17DewaSatriaAinda não há avaliações

- Ca Ipcc Costing Guideline Answer For May 2016 ExamDocumento10 páginasCa Ipcc Costing Guideline Answer For May 2016 ExamAishwarya GangawaneAinda não há avaliações

- Masters of Business Administration MBADocumento12 páginasMasters of Business Administration MBASachin KirolaAinda não há avaliações

- Stand CostingDocumento38 páginasStand CostingaydhaAinda não há avaliações

- 2020 Expenses: What SUP, Inc. Income Statement For The Year EndedDocumento5 páginas2020 Expenses: What SUP, Inc. Income Statement For The Year EndedRi BAinda não há avaliações

- Chapter 11 Mini Case: Cash Flow EstimationDocumento60 páginasChapter 11 Mini Case: Cash Flow EstimationafiAinda não há avaliações

- Chapter 15: Allocating Support Costs: Example 1: Dual Rate SystemDocumento4 páginasChapter 15: Allocating Support Costs: Example 1: Dual Rate SystemAmelaAinda não há avaliações

- HorizontalDocumento7 páginasHorizontalMarquez, Lynn Andrea L.Ainda não há avaliações

- The Changing Wealth of Nations 2021: Managing Assets for the FutureNo EverandThe Changing Wealth of Nations 2021: Managing Assets for the FutureAinda não há avaliações

- Chapter 22 HomeworkDocumento19 páginasChapter 22 HomeworkashibhallauAinda não há avaliações

- XLSXDocumento20 páginasXLSXashibhallau100% (3)

- Chapter 22 HomeworkDocumento19 páginasChapter 22 HomeworkashibhallauAinda não há avaliações

- Acc 620 Milestone Three Guidelines and Rubric U40pr3j1Documento2 páginasAcc 620 Milestone Three Guidelines and Rubric U40pr3j1ashibhallauAinda não há avaliações

- Concepts in Federal Taxation Hiring Incentives To Restore Employment ActDocumento9 páginasConcepts in Federal Taxation Hiring Incentives To Restore Employment ActashibhallauAinda não há avaliações

- Evaluation of Capital ProjectsDocumento3 páginasEvaluation of Capital ProjectsashibhallauAinda não há avaliações

- URL Fixed (Y/N)Documento6 páginasURL Fixed (Y/N)ashibhallauAinda não há avaliações

- APC308 Assignment Question - June 17 SubmissionDocumento6 páginasAPC308 Assignment Question - June 17 Submissionashibhallau0% (2)

- Chapter 19. CH 19-06 Build A ModelDocumento2 páginasChapter 19. CH 19-06 Build A ModelashibhallauAinda não há avaliações

- Risk Anaylis of Londonkingsxlsx 61549xlsx 61753Documento1 páginaRisk Anaylis of Londonkingsxlsx 61549xlsx 61753ashibhallauAinda não há avaliações

- SECTION #1 Financial StatementDocumento3 páginasSECTION #1 Financial StatementashibhallauAinda não há avaliações

- No. of Repairs Mid-Point FrequencyDocumento1 páginaNo. of Repairs Mid-Point FrequencyashibhallauAinda não há avaliações

- The Following Cumulative Frequency Histogram and Polygon Shows The Examination Scores For A Class of Management Studies StudentsDocumento1 páginaThe Following Cumulative Frequency Histogram and Polygon Shows The Examination Scores For A Class of Management Studies StudentsashibhallauAinda não há avaliações

- Assessment Task 1: Produce Sourdough ProductsDocumento3 páginasAssessment Task 1: Produce Sourdough ProductsashibhallauAinda não há avaliações

- Xlsxi SeeeDocumento23 páginasXlsxi SeeeashibhallauAinda não há avaliações

- Assignment Questions: Wilkerson Case: Chaitali Gala (0122/50)Documento2 páginasAssignment Questions: Wilkerson Case: Chaitali Gala (0122/50)ashibhallauAinda não há avaliações

- Exercise 8 13 TemplateDocumento4 páginasExercise 8 13 TemplateashibhallauAinda não há avaliações

- GRO Branch Wise DetailsDocumento20 páginasGRO Branch Wise DetailsashibhallauAinda não há avaliações

- FIN 620 Module One Journal Guidelines and Rubric 82141436Documento1 páginaFIN 620 Module One Journal Guidelines and Rubric 82141436ashibhallauAinda não há avaliações

- The Accounting Cycle: During The Period Review Questions: Question 2-1Documento77 páginasThe Accounting Cycle: During The Period Review Questions: Question 2-1ashibhallauAinda não há avaliações

- Accounting Method IIDocumento3 páginasAccounting Method IIashibhallauAinda não há avaliações

- Books of PDocumento13 páginasBooks of PicadeliciafebAinda não há avaliações

- Final Financial Accounting (Pulkit)Documento14 páginasFinal Financial Accounting (Pulkit)nitish_goel91Ainda não há avaliações

- Opportunities in The Global Halal MarketDocumento31 páginasOpportunities in The Global Halal MarketMubashir KhawajaAinda não há avaliações

- IRS Depreciation Guide With Optional Rate TablesDocumento118 páginasIRS Depreciation Guide With Optional Rate TablesManthan ShahAinda não há avaliações

- 007 City of Baguio vs. NAWASADocumento13 páginas007 City of Baguio vs. NAWASARonald MorenoAinda não há avaliações

- CH 5 Answers To Homework AssignmentsDocumento13 páginasCH 5 Answers To Homework AssignmentsJan Spanton100% (1)

- Rodrigo Rene Robles ResumeDocumento1 páginaRodrigo Rene Robles Resumeapi-530692408Ainda não há avaliações

- Health and Safety Policy DocumentDocumento4 páginasHealth and Safety Policy DocumentbnmqweAinda não há avaliações

- Hall Mark ScamDocumento4 páginasHall Mark ScamSharika NahidAinda não há avaliações

- Conocimiento de Embarque BLDocumento10 páginasConocimiento de Embarque BLMaryuri MendozaAinda não há avaliações

- Section 3b Elasticity of Demand & SupplyDocumento15 páginasSection 3b Elasticity of Demand & SupplyNeikelle CummingsAinda não há avaliações

- ID Pengaruh Kualitas Produk Harga Dan LokasDocumento12 páginasID Pengaruh Kualitas Produk Harga Dan LokasAnnisaa DiindaAinda não há avaliações

- Tugas Review Jurnal PDFDocumento71 páginasTugas Review Jurnal PDFMelpa GuspariniAinda não há avaliações

- Ejb3.0 Simplified APIDocumento6 páginasEjb3.0 Simplified APIRushabh ParekhAinda não há avaliações

- Amity School of Engineering & Technology: B. Tech. (MAE), V Semester Rdbms Sunil VyasDocumento13 páginasAmity School of Engineering & Technology: B. Tech. (MAE), V Semester Rdbms Sunil VyasJose AntonyAinda não há avaliações

- 22 Qualities That Make A Great LeaderDocumento6 páginas22 Qualities That Make A Great LeaderSalisu BorodoAinda não há avaliações

- Top 10 Forex Trading RulesDocumento3 páginasTop 10 Forex Trading Rulescool_cyrusAinda não há avaliações

- BPR MethodologiesDocumento29 páginasBPR MethodologiesOsamah S. Alshaya100% (1)

- Quiz1 2, PrelimDocumento14 páginasQuiz1 2, PrelimKyla Mae MurphyAinda não há avaliações

- Application For Subsequent Release of Educational Assistance LoanDocumento2 páginasApplication For Subsequent Release of Educational Assistance LoanNikkiQuiranteAinda não há avaliações

- Isa 600Documento27 páginasIsa 600Anser Raza100% (1)

- Half Yearly Examination, 201 Half Yearly Examination, 201 Half Yearly Examination, 201 Half Yearly Examination, 2018 8 8 8 - 19 19 19 19Documento5 páginasHalf Yearly Examination, 201 Half Yearly Examination, 201 Half Yearly Examination, 201 Half Yearly Examination, 2018 8 8 8 - 19 19 19 19Krish BansalAinda não há avaliações

- Handover NoteDocumento3 páginasHandover NoteEmmAinda não há avaliações

- Glossary: Industry Terms and What They Really MeanDocumento4 páginasGlossary: Industry Terms and What They Really MeanJessica MarsAinda não há avaliações

- Corporations PDFDocumento16 páginasCorporations PDFkylee MaranteeAinda não há avaliações

- totallyMAd - 18 January 2008Documento2 páginastotallyMAd - 18 January 2008NewsclipAinda não há avaliações

- Which Public Goods Should Be Public/privateDocumento12 páginasWhich Public Goods Should Be Public/privateRozyAinda não há avaliações

- Abm 115 TRMDocumento329 páginasAbm 115 TRMgurubabAinda não há avaliações

- Module 6 - Operating SegmentsDocumento3 páginasModule 6 - Operating SegmentsChristine Joyce BascoAinda não há avaliações

- BL-COMP-6103-LEC-1933T CURRENT Trends and IssuesDocumento6 páginasBL-COMP-6103-LEC-1933T CURRENT Trends and Issuesaudrey mae faeldoniaAinda não há avaliações