Escolar Documentos

Profissional Documentos

Cultura Documentos

ANG NDP Top1000 Juliol14

Enviado por

Kai SanTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

ANG NDP Top1000 Juliol14

Enviado por

Kai SanDireitos autorais:

Formatos disponíveis

press release 22/07/2014

1/3

THE FINANCIAL TIMES PLACES CRÈDIT ANDORRÀ AS THE FIRST

ANDORRAN BANK IN ITS TOP 1000 RANKING

• The Group has been recognised by this prestigious financial publication for its

high capitalisation, with its Tier 1 capital totalling 683 million dollars

• It comes 783rd in the world ranking and is first among Andorran banks

Andorra la Vella, 22 July 2014

Once again, Crèdit Andorrà is Andorra's leading bank in the annual Top 1000 ranking drawn

up by the Financial Times Group, a ranking based on the capitalisation of financial institutions

and published every year in the July issue of the magazine The Banker. Crèdit Andorrà once

again leads the field of Andorran banks, with its Tier 1 capital totalling 683 million dollars and

the Group’s solvency and liquidity ratios at the year-end 2013 at 19.14% and 59.89%

respectively.

The Financial Times has thereby confirmed Crèdit Andorrà's sustained leadership and role as

a benchmark in the Principality of Andorra, at the same time as continuing to recognise its

prominent position among the leading banks in the world.

Every year, The Banker produces a list of the top 1,000 banks in the world in terms of their

financial strength, assessed principally via each bank's capitalisation. Crèdit Andorrà has own

funds of 575 million euro, the highest among Andorran banks, a financial strength which gives

security and confidence to customers and guarantees the sustained growth of the Group.

This year, the Andorran financial sector financer is represented by three institutions. Crèdit

Andorrà holds 783rd position on the world scale and is number 1 in Andorra, while the other

Andorran banks in the ranking occupy positions 908 and 928.

The general ranking is headed by two Chinese banks, Industrial and Commercial Bank of

China (ICBC), China Construction Bank, followed by two US institutions: JPMorgan Chase &

Co and Bank of America. HSBC Holdings, Citigroup, Bank of China, Wells Fargo & Co,

Agricultural Bank of China and Mitsubishi UFJ Financial Group complete the first ten

positions in the ranking. The ranking produced by The Banker is one of the highest respected

in the industry as an assessment of the financial strengths of different banks.

Rànquing Top 1000 de Financial Times www.creditandorra.ad

press release 22/07/2014

The Crèdit Andorrà Group closed 2013 as a benchmark for the sector in the country, with a

business volume of 15,472 million euro, 7.36% up on 2012, and assets under management of

12,418 million euro, up by 9.82%. The bank also maintained its credit investment, which was

3,053 million.

These figures are impressively solid, with a solvency ratio of 19.14%, nearly double the legal

requirement of 10%, and well above the 17.80% of 2012, and a liquidity ratio of 59.89%,

where the legal minimum is 40%, which evidences the strength of Crèdit Andorrà.

In the same line as the Top 1000, in June Fitch Ratings maintained all the ratings for Crèdit

Andorrà: long term 'A-' and short term 'F2’ with an improvement in prospects to stable. Fitch

Ratings thus confirms the latest rating for Crèdit Andorrà.

Fitch based its decision on “Crèdit Andorrà’s leading position in the country’s banks”, and on

the “stimulus in private banking business and international asset management, which allowed

an increase in the total volume of business in 2013, with continued growth in assets under

management”, which reached a figure of 12,418 million euro, 10% up on 2012.

Again, the rating agency emphasised the Bank’s great capacity to generate profits steadily

and its conservative policy on the distribution of dividends and appropriations to provisions,

facts which allowed even further improvements in the Bank’s strength, with high solvency and

capitalisation levels.

Rànquing Top 1000 de Financial Times www.creditandorra.ad

FOR MORE INFORMATION:

Crèdit Andorrà

Corporate Communication Bureau

comunicaciocorporativa@creditandorra.ad

Tel.: +376 88 86 35 / +376 88 80 26

Fax: +376 88 95 24

www.creditandorra.ad

Você também pode gostar

- Santander Recognised As The Most Sustainable Bank in The World in The 2019 Dow Jones Sustainability IndexDocumento2 páginasSantander Recognised As The Most Sustainable Bank in The World in The 2019 Dow Jones Sustainability IndexDavid BriggsAinda não há avaliações

- Careers in Financial MarketsDocumento64 páginasCareers in Financial MarketsSanket KothariAinda não há avaliações

- Trade Finance ReviewDocumento54 páginasTrade Finance ReviewSuper 247Ainda não há avaliações

- Jpmorgan Chase & Co.: Company OverviewDocumento4 páginasJpmorgan Chase & Co.: Company OverviewIsh SelinAinda não há avaliações

- Top 10 DIGITAL BanksDocumento11 páginasTop 10 DIGITAL BanksPMilagrosAinda não há avaliações

- Santander's Acquisition of Abbey: Banking Across BordersDocumento29 páginasSantander's Acquisition of Abbey: Banking Across BordersJawad FarisiAinda não há avaliações

- 2012 - Careers in Financial Markets - EfinancialDocumento88 páginas2012 - Careers in Financial Markets - EfinanciallcombalieAinda não há avaliações

- AnnualReport2013 EDocumento167 páginasAnnualReport2013 EMohammad AldehneeAinda não há avaliações

- Deutsc HE Bank: Central BankingDocumento16 páginasDeutsc HE Bank: Central BankingAkash JangidAinda não há avaliações

- Careers in Financial Markets 2014 (Efinancialcareers)Documento64 páginasCareers in Financial Markets 2014 (Efinancialcareers)Cups upAinda não há avaliações

- UntitledDocumento8 páginasUntitledapi-239404108Ainda não há avaliações

- ING Bank: Căldărușe Andrei Cristian, Călin Angela Alexandra, REI An 3, 943, ADocumento3 páginasING Bank: Căldărușe Andrei Cristian, Călin Angela Alexandra, REI An 3, 943, AAngela A. CălinAinda não há avaliações

- Risk ManagementDocumento26 páginasRisk ManagementAbdullahAmerAinda não há avaliações

- Nordea Annual Report 2013Documento220 páginasNordea Annual Report 2013MadalinaAndreeaaaAinda não há avaliações

- An Assessment of The Emirates NBD BankDocumento25 páginasAn Assessment of The Emirates NBD BankHND Assignment Help100% (1)

- Assessment 1: Vikas Gurudev, ID NO: 11010560Documento10 páginasAssessment 1: Vikas Gurudev, ID NO: 11010560Vikas GurudevAinda não há avaliações

- Chapter 1: Introduction: A. Company BackgroundDocumento34 páginasChapter 1: Introduction: A. Company Backgroundwangyu roqueAinda não há avaliações

- 13 04 17 Press Release Prémio EMEA Finance ENDocumento1 página13 04 17 Press Release Prémio EMEA Finance ENSachin PalAinda não há avaliações

- 2014.01.17 Credit Agricole Haunted by Rating Agency Appeasement PDFDocumento2 páginas2014.01.17 Credit Agricole Haunted by Rating Agency Appeasement PDFAnonymous uiD5GJBgAinda não há avaliações

- Case Study - Corporate Strategy of Canadian BanksDocumento9 páginasCase Study - Corporate Strategy of Canadian BanksRupeshAinda não há avaliações

- J.P. MorganDocumento17 páginasJ.P. MorganNoemi_QrzAinda não há avaliações

- Markets - Factsheet - Annual Overview of 2012Documento1 páginaMarkets - Factsheet - Annual Overview of 2012Jerimiah DickeyAinda não há avaliações

- IslamicFinance PressRelease 2010Documento2 páginasIslamicFinance PressRelease 2010ejazali_syedAinda não há avaliações

- (Type Here) (Type Here) (Type Here)Documento6 páginas(Type Here) (Type Here) (Type Here)Sumedh KakdeAinda não há avaliações

- Argentina: Cash and Treasury ManagementDocumento45 páginasArgentina: Cash and Treasury Managementshahid2opuAinda não há avaliações

- Introduction To CRMDocumento16 páginasIntroduction To CRMkrupal_desaiAinda não há avaliações

- 40.Magazine-Depository Receipts in SSADocumento9 páginas40.Magazine-Depository Receipts in SSAEli DhoroAinda não há avaliações

- The Guide To Find A Job in The Financial SectorDocumento88 páginasThe Guide To Find A Job in The Financial SectorCaroline BaillezAinda não há avaliações

- Annual Report and Consolidated Financial Statements For The Year Ended 31 March 2018Documento47 páginasAnnual Report and Consolidated Financial Statements For The Year Ended 31 March 2018CrowdfundInsiderAinda não há avaliações

- Advanced Translation - Week 4Documento4 páginasAdvanced Translation - Week 4Trần ThảoAinda não há avaliações

- Wealth MGMTDocumento23 páginasWealth MGMTnagsen thokeAinda não há avaliações

- ING Group - Annual Report 2014Documento418 páginasING Group - Annual Report 2014Laurentiu CazanAinda não há avaliações

- Chapter 1: Introduction: A. Company BackgroundDocumento30 páginasChapter 1: Introduction: A. Company Backgroundwangyu roqueAinda não há avaliações

- The Handbook of Corporate Financial Risk ManagementDocumento413 páginasThe Handbook of Corporate Financial Risk ManagementLaanteywaaj94% (17)

- Internship Report On Customer Satisfaction Level of SCBDocumento74 páginasInternship Report On Customer Satisfaction Level of SCBroyal123456789Ainda não há avaliações

- 3 Methods and ProceduresDocumento1 página3 Methods and ProceduresnguyenthinhvinhkhaAinda não há avaliações

- BRDDocumento3 páginasBRDCostache FeliciaAinda não há avaliações

- Global High Net Worth Population Increases Slightly As Their Investable Wealth Declines, Finds World Wealth Report - News - Capgemini WorldwideDocumento2 páginasGlobal High Net Worth Population Increases Slightly As Their Investable Wealth Declines, Finds World Wealth Report - News - Capgemini Worldwidehans652Ainda não há avaliações

- Risk Management Presentation November 12 2012Documento203 páginasRisk Management Presentation November 12 2012George LekatisAinda não há avaliações

- Payday Startups ExpertReportDocumento26 páginasPayday Startups ExpertReportCuong NguyenAinda não há avaliações

- Annual Report 2014Documento499 páginasAnnual Report 2014borisg3Ainda não há avaliações

- Together. This Is The Word That Best Describes How WeDocumento12 páginasTogether. This Is The Word That Best Describes How WeCostache FeliciaAinda não há avaliações

- Case Study - Royal Bank of Canada, 2013 - Suitable For Solution Using Internal Factor Evaluation Analyis PDFDocumento7 páginasCase Study - Royal Bank of Canada, 2013 - Suitable For Solution Using Internal Factor Evaluation Analyis PDFFaizan SiddiqueAinda não há avaliações

- Mock Exam Mock Exam Banking Finance AntwoordenDocumento7 páginasMock Exam Mock Exam Banking Finance Antwoordenми саAinda não há avaliações

- Tarjetas de Credito EcuadorDocumento11 páginasTarjetas de Credito EcuadorMichael GarzonAinda não há avaliações

- Venture Capital and Credit RatingDocumento25 páginasVenture Capital and Credit RatingMinhaz AlamAinda não há avaliações

- International Capital MarketsDocumento12 páginasInternational Capital Marketschmon100% (1)

- Financial Analysis and Management-Darko Jovanović 2015Documento22 páginasFinancial Analysis and Management-Darko Jovanović 2015Darko JovanovicAinda não há avaliações

- ICICI-Bank Strategic ImplementationDocumento52 páginasICICI-Bank Strategic ImplementationJazz KhannaAinda não há avaliações

- Microfinance in Myanmar Sector Assessment (Jan 2013) - 1 PDFDocumento54 páginasMicrofinance in Myanmar Sector Assessment (Jan 2013) - 1 PDFliftfundAinda não há avaliações

- CSCF T1 - P20Documento20 páginasCSCF T1 - P20asialbhAinda não há avaliações

- Top 3 Euro BanksDocumento8 páginasTop 3 Euro BanksRachit KhannaAinda não há avaliações

- BNP CSR 2006Documento231 páginasBNP CSR 2006Gabriel DaiaAinda não há avaliações

- Financial Accounting Coursework BDocumento6 páginasFinancial Accounting Coursework BDanny ToligiAinda não há avaliações

- SHARED 1 A Introduction To Intl FinanceDocumento15 páginasSHARED 1 A Introduction To Intl FinanceRitik MishraAinda não há avaliações

- Raport Anual 2010Documento180 páginasRaport Anual 2010boanciaAinda não há avaliações

- Risk Management Fundamentals: An introduction to risk management in the financial services industry in the 21st centuryNo EverandRisk Management Fundamentals: An introduction to risk management in the financial services industry in the 21st centuryNota: 5 de 5 estrelas5/5 (1)

- International Trade Finance: A NOVICE'S GUIDE TO GLOBAL COMMERCENo EverandInternational Trade Finance: A NOVICE'S GUIDE TO GLOBAL COMMERCEAinda não há avaliações

- EIB Activity in Africa, the Caribbean, the Pacific and the Overseas Countries and Territories: Annual Report 2018No EverandEIB Activity in Africa, the Caribbean, the Pacific and the Overseas Countries and Territories: Annual Report 2018Ainda não há avaliações

- 65b FlyktDocumento3 páginas65b FlyktKai SanAinda não há avaliações

- Ipi 18017Documento3 páginasIpi 18017Kai SanAinda não há avaliações

- Dattabot GE Predix Case StudyDocumento9 páginasDattabot GE Predix Case StudyKai SanAinda não há avaliações

- Brand Book Med Co EnergiDocumento50 páginasBrand Book Med Co EnergiKai SanAinda não há avaliações

- 2Q13Documento67 páginas2Q13Kai SanAinda não há avaliações

- PART 2 Coran Pediatric Surgery, 7th Ed PDFDocumento350 páginasPART 2 Coran Pediatric Surgery, 7th Ed PDFKai SanAinda não há avaliações

- 131228121253PT. Newmont Nusa TenggaraDocumento147 páginas131228121253PT. Newmont Nusa TenggaraKai SanAinda não há avaliações

- HARA Token White Paper v20180923Documento60 páginasHARA Token White Paper v20180923Kai SanAinda não há avaliações

- Principality of Andorra: Parliamentary Elections 1 March 2015Documento11 páginasPrincipality of Andorra: Parliamentary Elections 1 March 2015Kai SanAinda não há avaliações

- NDP Resultats Grupcreditandorra2017 EngDocumento5 páginasNDP Resultats Grupcreditandorra2017 EngKai SanAinda não há avaliações

- Merchant Company and Enterprise in AndorraDocumento9 páginasMerchant Company and Enterprise in AndorraKai SanAinda não há avaliações

- Andorra 2016 International Religious Freedom Report Executive SummaryDocumento4 páginasAndorra 2016 International Religious Freedom Report Executive SummaryKai SanAinda não há avaliações

- NoneDocumento15 páginasNoneKai SanAinda não há avaliações

- 8769 1Documento5 páginas8769 1Kai SanAinda não há avaliações

- GrpastrepidsaDocumento17 páginasGrpastrepidsaDrashua AshuaAinda não há avaliações

- Annual Report 2015Documento198 páginasAnnual Report 2015Nelva Meyriani GintingAinda não há avaliações

- Phakic Intraocular Lenses - Hardten, Lindstrom, Davis - 2004Documento239 páginasPhakic Intraocular Lenses - Hardten, Lindstrom, Davis - 2004Kai SanAinda não há avaliações

- EcologyDocumento4 páginasEcologyKai SanAinda não há avaliações

- Ahok PDFDocumento13 páginasAhok PDFKai SanAinda não há avaliações

- Closure Letter of PT SMLDocumento1 páginaClosure Letter of PT SMLKai SanAinda não há avaliações

- Sawit Sumber Mas Sarana 150907 CRR ReportDocumento34 páginasSawit Sumber Mas Sarana 150907 CRR ReportAnonymous Hnv6u54HAinda não há avaliações

- Sawit Sumber Mas Sarana 150907 CRR ReportDocumento38 páginasSawit Sumber Mas Sarana 150907 CRR ReportKai SanAinda não há avaliações

- Ar 2017Documento248 páginasAr 2017Kai SanAinda não há avaliações

- GrpastrepidsaDocumento17 páginasGrpastrepidsaDrashua AshuaAinda não há avaliações

- ESC Aortic Diseases 2014Documento62 páginasESC Aortic Diseases 2014Didi SAinda não há avaliações

- Biodata Ariel Dari Band Noah'Documento1 páginaBiodata Ariel Dari Band Noah'Dedy RosyadiAinda não há avaliações

- Phakic Intraocular Lenses - Hardten, Lindstrom, Davis - 2004Documento239 páginasPhakic Intraocular Lenses - Hardten, Lindstrom, Davis - 2004Kai SanAinda não há avaliações

- PART 1 Coran Pediatric Surgery, 7th Ed PDFDocumento402 páginasPART 1 Coran Pediatric Surgery, 7th Ed PDFCarmen Chivu100% (17)

- 11-0015 Report 2Documento64 páginas11-0015 Report 2RecordTrac - City of OaklandAinda não há avaliações

- HDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971Documento2 páginasHDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971sumit keshriAinda não há avaliações

- Peer Educators AllowanceDocumento4 páginasPeer Educators AllowanceKealeboga Duece ThoboloAinda não há avaliações

- Impact of Banking Sector Reforms in India - R01Documento11 páginasImpact of Banking Sector Reforms in India - R01Ravi Pratap Singh Tomar0% (1)

- Monetary Policy and Operating ProcedureDocumento3 páginasMonetary Policy and Operating ProcedureLado BahadurAinda não há avaliações

- Statement of Axis Account No:916010072653730 For The Period (From: 19-11-2020 To: 18-11-2021)Documento7 páginasStatement of Axis Account No:916010072653730 For The Period (From: 19-11-2020 To: 18-11-2021)asphalt 9 legendsAinda não há avaliações

- Liberalised Remittance Scheme of USD 200,000Documento3 páginasLiberalised Remittance Scheme of USD 200,000hakecAinda não há avaliações

- Bank Statement SampleDocumento3 páginasBank Statement SampleJer Emy JoerAinda não há avaliações

- WM 3Documento7 páginasWM 3Konsul Detox100% (1)

- HLB BSDocumento6 páginasHLB BSanisAinda não há avaliações

- Product Dissection For PaytmDocumento9 páginasProduct Dissection For PaytmSahil ShirkeAinda não há avaliações

- 8212-ALNABIYAH-UNIT:8216 P.O.BOX 394 ALKHOBAR 31952 Saudi ArabiaDocumento5 páginas8212-ALNABIYAH-UNIT:8216 P.O.BOX 394 ALKHOBAR 31952 Saudi ArabiaIbrahim SamiAinda não há avaliações

- E PassbookDocumento5 páginasE PassbookJASVINDER SINGHAinda não há avaliações

- Compound Interest DiscussionDocumento8 páginasCompound Interest DiscussionBaoooAinda não há avaliações

- True Money and M-PESA: Two Unique Paths To ScaleDocumento9 páginasTrue Money and M-PESA: Two Unique Paths To ScaleRavish PatelAinda não há avaliações

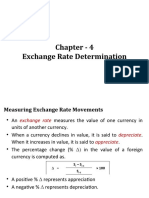

- Chapter - 4 Exchange Rate DeterminationDocumento14 páginasChapter - 4 Exchange Rate DeterminationAshiqur RahmanAinda não há avaliações

- TameeeeDocumento28 páginasTameeeetamebirhanu696Ainda não há avaliações

- The Rationale of The Saving DecisionDocumento9 páginasThe Rationale of The Saving DecisionCharisa SamsonAinda não há avaliações

- Moratorium Clix Capital Services Pvt. Ltd.Documento7 páginasMoratorium Clix Capital Services Pvt. Ltd.YogeshAinda não há avaliações

- Urban Dictionary - AsdfghjkDocumento3 páginasUrban Dictionary - AsdfghjkPRASHANTH B SAinda não há avaliações

- SHERMAN FURAYI - 2022-04-23 - 2022-05-23 - StampedDocumento3 páginasSHERMAN FURAYI - 2022-04-23 - 2022-05-23 - StampedshermanAinda não há avaliações

- Money Laundering Case StudyDocumento2 páginasMoney Laundering Case StudyNamal Jakkody100% (1)

- Call Money Market in IndiaDocumento37 páginasCall Money Market in IndiaDivya71% (7)

- Fria List of CasesDocumento2 páginasFria List of CasesJhomel Delos ReyesAinda não há avaliações

- Banking: Industries in IndiaDocumento41 páginasBanking: Industries in IndiaManavAinda não há avaliações

- Adresses ExchangesDocumento4 páginasAdresses ExchangesJulien CryptoAddictAinda não há avaliações

- Opening and Operating Bank AccountsDocumento25 páginasOpening and Operating Bank Accountssagarg94gmailcom100% (1)

- Atm DDDocumento5 páginasAtm DDVrushali KhatpeAinda não há avaliações

- Axis Interest Certificate 2021 2022 1668998098463Documento2 páginasAxis Interest Certificate 2021 2022 1668998098463Lovely PavaniAinda não há avaliações

- Cash App - Statement 2020Documento4 páginasCash App - Statement 2020ss ds67% (3)