Escolar Documentos

Profissional Documentos

Cultura Documentos

Person (Section 2 (31) )

Enviado por

Tejas PandeyDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Person (Section 2 (31) )

Enviado por

Tejas PandeyDireitos autorais:

Formatos disponíveis

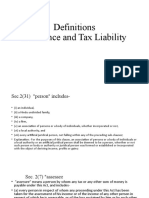

PERSON [SECTION 2(31)]

Income-tax is charged in respect of the total income of the previous year of every person. Hence, it is

important to know the definition of the word person. As per section 2(31), Person includes:

– an individual:

– a Hindu undivided family:

– a company

– a firm

– an association of persons or a body of individuals whether incorporated or not:

– a local authority: every artificial, juridical person, not falling within any of the above categories

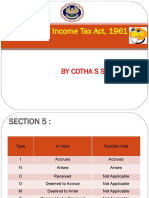

Scope of Total income has been defined on the basis of Residential status Section5

(A) Resident and Ordinarily Resident Assessee According to Sub-section (1) of Section 5 of the Act

the total income of a resident and ordinarily resident assessee would consist of:

(i) income received or deemed to be received in India during the accounting year by or on behalf of

such person;

(ii) income which accrues or arises or is deemed to accrue or arise to him in India during the

accounting year;

(iii) income which accrues or arises to him outside India during the accounting year. It is important to

note that under clause (iii) only income accruing or arising outside India is included. Income deemed

to accrue or arise outside India is not includible

(B) Resident but Not Ordinarily Resident In India Proviso to section (1) of section 5 the total income

in case of resident but not ordinarily resident in India

(i) income received or deemed to be received in India during the accounting year by or on behalf of

such person;

(ii) income which accrues or arises or is deemed to accrue or arise to him in India during the

accounting year;

(iii) income which accrues or arises to him outside India during the previous year if it is derived from

a business controlled in or a profession set up in India.

(C) Non-Resident Sub-section (2) of Section 5 provides that the total income of a non-resident would

comprise of:

(i) income received or deemed to be received in India in the accounting year by or on behalf of such

person;

(ii) income which accrues or arises or is deemed to accrue or arise to him in India during the previous

year

Você também pode gostar

- What You Must Know About Incorporate a Company in IndiaNo EverandWhat You Must Know About Incorporate a Company in IndiaAinda não há avaliações

- Section 5 of Income Tax ActDocumento4 páginasSection 5 of Income Tax ActParth PandeyAinda não há avaliações

- Scope of Total Income and Residential StatusDocumento3 páginasScope of Total Income and Residential StatusSandeep SinghAinda não há avaliações

- Day4 Residential Status and Incidence of Tax (9 Oct)Documento12 páginasDay4 Residential Status and Incidence of Tax (9 Oct)1986anuAinda não há avaliações

- Scope of Total IncomeDocumento7 páginasScope of Total IncomeSatinderpal KaurAinda não há avaliações

- CHAPTER:-1 Definitions U/s - 2, Basis of Charge and Exclusions From Total IncomeDocumento12 páginasCHAPTER:-1 Definitions U/s - 2, Basis of Charge and Exclusions From Total IncomeshyamiliAinda não há avaliações

- TaxationDocumento15 páginasTaxationharshithaaba8Ainda não há avaliações

- E Text Week 1 Module 1.5Documento5 páginasE Text Week 1 Module 1.5bsc slpAinda não há avaliações

- CTPM ProblemsDocumento31 páginasCTPM ProblemsViraja GuruAinda não há avaliações

- Income Tax Law & PracticeDocumento32 páginasIncome Tax Law & PracticeGautam TamtaAinda não há avaliações

- Unit 3Documento20 páginasUnit 3Ram KrishnaAinda não há avaliações

- UNIT 1 - CT - Part 1Documento39 páginasUNIT 1 - CT - Part 1Amogh AroraAinda não há avaliações

- The Direct Taxes CodeDocumento3 páginasThe Direct Taxes Codeanuj91Ainda não há avaliações

- Income Tax Act, 1961: Section - 5: Scope of Total IncomeDocumento15 páginasIncome Tax Act, 1961: Section - 5: Scope of Total IncomeNisseem KrishnaAinda não há avaliações

- Residential Status DC 2023-24Documento11 páginasResidential Status DC 2023-24avinashhpv7785Ainda não há avaliações

- Principle of TaxationDocumento7 páginasPrinciple of TaxationAnas YawarAinda não há avaliações

- Tax AljamiaDocumento22 páginasTax AljamiaFlash Light100% (2)

- Residential Status and Tax IncidenceDocumento3 páginasResidential Status and Tax Incidenceambarishan mrAinda não há avaliações

- Income Tax ActDocumento12 páginasIncome Tax ActSomnath GuptaAinda não há avaliações

- Taxation Final ProjectDocumento12 páginasTaxation Final ProjectShreya KalyaniAinda não há avaliações

- Corporate Tax Planning Unit-2 E-Text Module 5 & 6: Residential Status & Taxation of Companies Scope of Total Incidence of Tax (Section 5)Documento10 páginasCorporate Tax Planning Unit-2 E-Text Module 5 & 6: Residential Status & Taxation of Companies Scope of Total Incidence of Tax (Section 5)imamAinda não há avaliações

- Question 1: Write Note On: ST STDocumento3 páginasQuestion 1: Write Note On: ST STViren KamaniAinda não há avaliações

- Residential Status and Incidence of Tax - Study MaterialDocumento6 páginasResidential Status and Incidence of Tax - Study MaterialEmeline SoroAinda não há avaliações

- Q1) (A) Person - Section 2Documento5 páginasQ1) (A) Person - Section 2Minal GandhiAinda não há avaliações

- Introduction To ResidenceDocumento4 páginasIntroduction To ResidenceNiya Maria NixonAinda não há avaliações

- Residential Status and Incidence of Tax On Income Under Income Tax ActDocumento6 páginasResidential Status and Incidence of Tax On Income Under Income Tax ActhaseefaAinda não há avaliações

- Week 4-7Documento9 páginasWeek 4-7Vijayant DalalAinda não há avaliações

- Income Tax Planning-1Documento32 páginasIncome Tax Planning-1Ashutosh ShuklaAinda não há avaliações

- Definitions Residence and Tax LiabilityDocumento23 páginasDefinitions Residence and Tax LiabilityVicky DAinda não há avaliações

- Sia - Itax-2018-19Documento17 páginasSia - Itax-2018-19Abhay Pethani.Ainda não há avaliações

- 01 Section 9Documento54 páginas01 Section 9ABHIJEETAinda não há avaliações

- ch-11 Taxation of NRIsDocumento25 páginasch-11 Taxation of NRIsdean.socAinda não há avaliações

- MB FM 03 TAX PLANNING AND FINANCIAL REPORTING New-1Documento70 páginasMB FM 03 TAX PLANNING AND FINANCIAL REPORTING New-1Khushboo SinghAinda não há avaliações

- Chapter-3 Basics of Income TaxDocumento15 páginasChapter-3 Basics of Income TaxSakibul Haque NavinAinda não há avaliações

- Income Deemed To Arise in IndiaDocumento7 páginasIncome Deemed To Arise in IndiaDebaAinda não há avaliações

- 16 Taxtreatment Offoreign Income of Resident CRC 1Documento68 páginas16 Taxtreatment Offoreign Income of Resident CRC 1Vaibhavi NarAinda não há avaliações

- Residential Status AssignmentDocumento4 páginasResidential Status AssignmentSimran Kaur Khurana100% (1)

- Unit 1 Notes TaxDocumento14 páginasUnit 1 Notes TaxSuryansh MunjalAinda não há avaliações

- Direct Tax Summary NotesDocumento88 páginasDirect Tax Summary NotesAlisha LukeAinda não há avaliações

- Incomtax Lectures PDFDocumento99 páginasIncomtax Lectures PDFMIR FAISAL YOUSUFAinda não há avaliações

- e Book PDF PDFDocumento91 páginase Book PDF PDFGiri SukumarAinda não há avaliações

- CTP MergedDocumento146 páginasCTP MergedRadhika ShingankuliAinda não há avaliações

- Model Answers Taxation 1. Residential Status of Assessee Under IT Act ?Documento44 páginasModel Answers Taxation 1. Residential Status of Assessee Under IT Act ?Tejasvini KhemajiAinda não há avaliações

- Model Answers Taxation 1. Residential Status of Assessee Under IT Act ?Documento47 páginasModel Answers Taxation 1. Residential Status of Assessee Under IT Act ?Samata BohraAinda não há avaliações

- Section - 5Documento1 páginaSection - 5waqtkeebaatein12Ainda não há avaliações

- Army Institute of Law: Concept of Income and Total IncomeDocumento17 páginasArmy Institute of Law: Concept of Income and Total IncomeMehr MunjalAinda não há avaliações

- Document .36Documento15 páginasDocument .36jyotisingh6908501Ainda não há avaliações

- Income Tax Test 1 & 2Documento6 páginasIncome Tax Test 1 & 2Shital PujaraAinda não há avaliações

- It - Lesson 3Documento14 páginasIt - Lesson 3Sugandha AgarwalAinda não há avaliações

- Income Tax II UnitDocumento3 páginasIncome Tax II UnitSheena ShahnawazAinda não há avaliações

- SeemaDocumento61 páginasSeemaAkash ShewadeAinda não há avaliações

- Income Tax Law & Practice-I (Ucm20302J) Unit IDocumento7 páginasIncome Tax Law & Practice-I (Ucm20302J) Unit IRohithAinda não há avaliações

- Unit VI Income Tax ActDocumento29 páginasUnit VI Income Tax ActNeha GeorgeAinda não há avaliações

- Unit VI5942Documento29 páginasUnit VI5942Neha GeorgeAinda não há avaliações

- Section 5 Which Defines The "Scope of Income" Section 6 Which Defines The "The Residential Status" of The PersonDocumento8 páginasSection 5 Which Defines The "Scope of Income" Section 6 Which Defines The "The Residential Status" of The PersondipxxxAinda não há avaliações

- Section 9Documento7 páginasSection 9Achulendra Ji PushkarAinda não há avaliações

- Model Answers Law of TaxationDocumento46 páginasModel Answers Law of Taxationlavkush1234Ainda não há avaliações

- Tax NotesDocumento11 páginasTax NotesVishal DeshwalAinda não há avaliações

- Residential StatusDocumento13 páginasResidential StatusABC 123Ainda não há avaliações

- Anti-Suit Injunctions and Other Jurisdictional Remedies in The Marine Context Sean Gibbons, Partner, Stephenson HarwoodDocumento16 páginasAnti-Suit Injunctions and Other Jurisdictional Remedies in The Marine Context Sean Gibbons, Partner, Stephenson HarwoodTejas PandeyAinda não há avaliações

- Salem Advocate Bar Association Tamil Nad 2 PDFDocumento9 páginasSalem Advocate Bar Association Tamil Nad 2 PDFTejas PandeyAinda não há avaliações

- Issue 2 Right To Health: Article 21 Reads AsDocumento7 páginasIssue 2 Right To Health: Article 21 Reads AsTejas PandeyAinda não há avaliações

- 08 ChapterDocumento28 páginas08 ChapterTejas PandeyAinda não há avaliações

- Res Judicata Difference Between Estoppel and Res Judicata)Documento3 páginasRes Judicata Difference Between Estoppel and Res Judicata)Tejas PandeyAinda não há avaliações

- Anticipatary Bail-Cr.P.C Some Important Case LawsDocumento42 páginasAnticipatary Bail-Cr.P.C Some Important Case LawsTejas PandeyAinda não há avaliações

- Payam Essay Atrocities On WomenDocumento4 páginasPayam Essay Atrocities On WomenTejas Pandey100% (1)