Escolar Documentos

Profissional Documentos

Cultura Documentos

Analisis Minat Kerjaya Holland 2

Enviado por

nesanDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Analisis Minat Kerjaya Holland 2

Enviado por

nesanDireitos autorais:

Formatos disponíveis

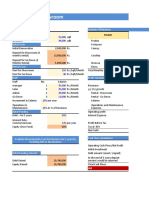

EXTRACT FROM MALAYSIA INSTITUTE OF MALAYSIA

BY LAW : PHRASE 6

Recommended Audit Fee in Malaysia

The Malaysian Institute of Accountants (“MIA”), had in 2010, issued a Recommended Practice Guide 7 (Revised) on the charging

of audit fees. This is a replacement to the earlier practice guide issue in 2007. All auditors in Malaysia are required to abide by

this practice guide.

Purpose

The MIA issued this Practice Guide because of the following reasons:-

1. Increased in compliance burden due to higher auditing standards requirements

2. Increased in operating costs, mainly salaries

3. To ensure auditors professionalism are not affected due to “price wars” among auditors

Audit fee rates computation

The general method of determining audit fees is based on either Turnover or Total Assets. Methods used are according to nature of

business. Example, for a trading company will use Turnover as audit fees, whereas an asset based company will use the Total

Assets method.

(i) Gross Turnover or Total Assets Basis

Cumulative

Gross Assets or Turnover Rate Fees Cumulative Fees

Amounts

(RM) (%) (RM) (RM)

(RM)

The first 100,000 100,000 1.000% 1,000 1,000

The next 150,000 250,000 0.438% 657 1,657

The next 250,000 500,000 0.313% 783 2,440

The next 500,000 1,000,000 0.188% 940 3,380

The next 1,500,000 2,500,000 0.125% 1,875 5,255

The next 2,500,000 5,000,000 0.100% 2,500 7,755

The next 5,000,000 10,000,000 0.094% 4,700 12,455

1,000 for every RM1,000,000

10,000,000 to 20,000,000 increase of a fraction thereof

up to RM20,000,000

Negotiable (but should not be

Above 20,000,000 less than RM20,000 per

assignment)

In cases where the above methods are not practical to be used, the method below will be applied instead. An example where a

company has Turnover of RM10 million, Total Assets of only RM5,000, and operating expenses of RM2 million.

(ii) Total Operating Expenditure Basis

Cumulative

Gross Assets or Turnover Rate Fees Cumulative Fees

Ringgit

(RM) (%) (RM) (RM)

(RM)

The first 50,000 50,000 2.500% 1,250 1,250

The next 150,000 200,000 1.250% 1,875 3,125

The next 800,000 1,000,000 0.625% 5,000 8,125

The next 1,000,000 2,000,000 0.250% 2,500 10,625

Above 2,000,000 0.125%

Lastly, the Practice Guide also mentioned specifically that the audit fee for a Dormant Company shall be a minimum of RM1000.

Você também pode gostar

- Chase Sapphire: Creating A Millennial Cult Brand: Group 10Documento7 páginasChase Sapphire: Creating A Millennial Cult Brand: Group 10Sumit GauravAinda não há avaliações

- Noise Complaints Part 90 PDFDocumento426 páginasNoise Complaints Part 90 PDFRecordTrac - City of OaklandAinda não há avaliações

- Chart of Accounts-Fast FoodDocumento6 páginasChart of Accounts-Fast Foodgenie1970Ainda não há avaliações

- Outsourcing Checklist What Should Be Included Outsourcing AgreementDocumento6 páginasOutsourcing Checklist What Should Be Included Outsourcing AgreementamitAinda não há avaliações

- CAPITAL STRUCTURE Sums OnlinePGDMDocumento6 páginasCAPITAL STRUCTURE Sums OnlinePGDMSoumendra RoyAinda não há avaliações

- Songkick v. Live Nation 12.22.15Documento68 páginasSongkick v. Live Nation 12.22.15JasonNewmanAinda não há avaliações

- Bot Law: RA 6957, Amended by RA 7718Documento31 páginasBot Law: RA 6957, Amended by RA 7718boguz nonameAinda não há avaliações

- Q1Documento31 páginasQ1Bhaskkar SinhaAinda não há avaliações

- Fast-Track Tax Reform: Lessons from the MaldivesNo EverandFast-Track Tax Reform: Lessons from the MaldivesAinda não há avaliações

- FINMAN Decision AnalysisDocumento5 páginasFINMAN Decision AnalysisTrish GarridoAinda não há avaliações

- Pekeliling Perbendaharaan Fee PerundingDocumento18 páginasPekeliling Perbendaharaan Fee PerundinglarysubAinda não há avaliações

- SIAM/MSI: An Introduction to Service Integration and Management/ Multi-Sourcing Integration for IT Service ManagementNo EverandSIAM/MSI: An Introduction to Service Integration and Management/ Multi-Sourcing Integration for IT Service ManagementNota: 4 de 5 estrelas4/5 (1)

- Share & Business Valuation Case Study Question and SolutionDocumento6 páginasShare & Business Valuation Case Study Question and SolutionSarannyaRajendraAinda não há avaliações

- ISO/IEC 20000: An Introduction to the global standard for service managementNo EverandISO/IEC 20000: An Introduction to the global standard for service managementAinda não há avaliações

- Internet Sample Proposal - DepedDocumento6 páginasInternet Sample Proposal - DepedChelie Trangia100% (4)

- I Recommended Audit Fees in MalaysiaDocumento2 páginasI Recommended Audit Fees in MalaysiaSelva Bavani SelwaduraiAinda não há avaliações

- Income Statement For 3 YearsDocumento5 páginasIncome Statement For 3 YearsATticFistAinda não há avaliações

- Capital Structure Debt Equity - ProblemsDocumento5 páginasCapital Structure Debt Equity - ProblemsSaumya SinghAinda não há avaliações

- Test 2Documento7 páginasTest 2khowcatherine2000Ainda não há avaliações

- Girum Tsega PerfectDocumento13 páginasGirum Tsega PerfectMesi YE GIAinda não há avaliações

- Test 1Documento6 páginasTest 1khowcatherine2000Ainda não há avaliações

- Solution Manual For Managerial Economics Applications Strategies and Tactics 13th Edition DownloadDocumento7 páginasSolution Manual For Managerial Economics Applications Strategies and Tactics 13th Edition DownloadStephenWolfpdiz100% (46)

- Faculty - Accountancy - 2022 - Session 2 - Diploma - Tax317Documento12 páginasFaculty - Accountancy - 2022 - Session 2 - Diploma - Tax317Lyana InaniAinda não há avaliações

- Franchise - CarDocumento14 páginasFranchise - Carshrish guptaAinda não há avaliações

- SIP AmrutleelaDocumento14 páginasSIP AmrutleelapremAinda não há avaliações

- Initial Investment Fixed Cost Variable Cost Particulars Amount (RS.) Particulars Amount (RS.) ParticularsDocumento5 páginasInitial Investment Fixed Cost Variable Cost Particulars Amount (RS.) Particulars Amount (RS.) ParticularsPrince JoshiAinda não há avaliações

- 2008 09 e Line Bota Training LevyDocumento4 páginas2008 09 e Line Bota Training LevySanjay ThakkarAinda não há avaliações

- Slides of Lecture#09 Corporate Finance (FIN-622)Documento4 páginasSlides of Lecture#09 Corporate Finance (FIN-622)sukhiesAinda não há avaliações

- Notes - Help For BPDocumento21 páginasNotes - Help For BPmitemkt9683Ainda não há avaliações

- Wallet Sized Commission Table For SR & RPDocumento4 páginasWallet Sized Commission Table For SR & RPSara Danish Year 2 AAinda não há avaliações

- Corporate 1Documento10 páginasCorporate 1Adeel AhmadAinda não há avaliações

- Initial Investment Fixed Cost (Monthly) Particulars Amount (RS.) Particulars Amount (RS.)Documento6 páginasInitial Investment Fixed Cost (Monthly) Particulars Amount (RS.) Particulars Amount (RS.)Prince JoshiAinda não há avaliações

- F6mys QPDocumento14 páginasF6mys QPTenny LeeAinda não há avaliações

- LEVERAGE - Hons.Documento7 páginasLEVERAGE - Hons.BISHAL ROYAinda não há avaliações

- Taxation Question 2017 SeptemberDocumento16 páginasTaxation Question 2017 Septemberzezu zazaAinda não há avaliações

- Robinsons Bank Convert To Cash Processing FeesDocumento1 páginaRobinsons Bank Convert To Cash Processing FeesGen MacaleAinda não há avaliações

- FBF Final Project Report (Financial Plan)Documento6 páginasFBF Final Project Report (Financial Plan)Afaq BhuttaAinda não há avaliações

- Taxation Question 2018 MarchDocumento17 páginasTaxation Question 2018 MarchNg GraceAinda não há avaliações

- 3.0 Strategic Finance Projections & EvaluationDocumento6 páginas3.0 Strategic Finance Projections & EvaluationFatin Zafirah Binti Zurila A21A3251Ainda não há avaliações

- Biruk Zewdie AFM AssignmentDocumento3 páginasBiruk Zewdie AFM AssignmentBura ZeAinda não há avaliações

- StoqnamadruateDocumento4 páginasStoqnamadruateDela cruz, Hainrich (Hain)Ainda não há avaliações

- Liv - Smart CalculationsDocumento33 páginasLiv - Smart CalculationsAaditya BhawsarAinda não há avaliações

- MentorApp Financial Planning and Forecasting Template - AS - Edits - 27 Oct2022-1667381837161Documento23 páginasMentorApp Financial Planning and Forecasting Template - AS - Edits - 27 Oct2022-1667381837161Jainnah HadloconAinda não há avaliações

- Capital Structure Theories of Financing Decision Capital StructureDocumento10 páginasCapital Structure Theories of Financing Decision Capital StructureBaken D DhungyelAinda não há avaliações

- Taxation (Malaysia) : Specimen Exam Applicable From December 2015Documento22 páginasTaxation (Malaysia) : Specimen Exam Applicable From December 2015cytan828Ainda não há avaliações

- PBIG - Investment Services FeesDocumento6 páginasPBIG - Investment Services FeesfomichrcAinda não há avaliações

- Chartered Institute of Taxation of NigeriaDocumento8 páginasChartered Institute of Taxation of NigeriaAfolabi OladunniAinda não há avaliações

- Same Questions - F303 - 1st MidDocumento5 páginasSame Questions - F303 - 1st MidRafid Al Abid SpondonAinda não há avaliações

- Christ CIA FM MidtermDocumento6 páginasChrist CIA FM MidtermKSHITIZ CHOUDHARYAinda não há avaliações

- TaxationDocumento11 páginasTaxationkhowcatherine2000Ainda não há avaliações

- Candy Live Policy-2.05Documento5 páginasCandy Live Policy-2.05Gesang FirmansyahAinda não há avaliações

- Memory Plus Gold For Mas5Documento8 páginasMemory Plus Gold For Mas5Ashianna KimAinda não há avaliações

- AF Ch. 4 - Analysis FS - ExcelDocumento9 páginasAF Ch. 4 - Analysis FS - ExcelAlfiandriAdinAinda não há avaliações

- Financial Plan (Illustration)Documento6 páginasFinancial Plan (Illustration)rana samiAinda não há avaliações

- Requirement 1 Hypothetical Data Assumption: Company Name: Super Glass Bangles LLPDocumento9 páginasRequirement 1 Hypothetical Data Assumption: Company Name: Super Glass Bangles LLPYahya ZafarAinda não há avaliações

- Investment/ Financing Decisions: S.ClementDocumento33 páginasInvestment/ Financing Decisions: S.Clementjohnkm28Ainda não há avaliações

- Silvia Caffe - SolutionDocumento1 páginaSilvia Caffe - SolutionMurtaza BadriAinda não há avaliações

- The Dilemma at Day ProDocumento7 páginasThe Dilemma at Day ProQistinaAinda não há avaliações

- Corporate FinanceDocumento8 páginasCorporate Financedivyakashyapbharat1Ainda não há avaliações

- F6mys 2009 Dec QDocumento10 páginasF6mys 2009 Dec QDave Loh Chong HowAinda não há avaliações

- Reg. No.: Q.P. Code: (07 DMB 03)Documento3 páginasReg. No.: Q.P. Code: (07 DMB 03)umamaheswari palanisamyAinda não há avaliações

- Capital BudgetingDocumento6 páginasCapital BudgetingMohammad Umair SheraziAinda não há avaliações

- Managerial Finance 4B - Assignment 1 - 0Documento8 páginasManagerial Finance 4B - Assignment 1 - 0IbrahimAinda não há avaliações

- 23 Nov 2018 Mixed Questions With Solutions PDFDocumento9 páginas23 Nov 2018 Mixed Questions With Solutions PDFLaston MilanziAinda não há avaliações

- p11 29Documento5 páginasp11 29Saeful AzizAinda não há avaliações

- Financial Management-Coursework 2Documento11 páginasFinancial Management-Coursework 2Tariq KhanAinda não há avaliações

- 2016 Nestle ExtratedDocumento7 páginas2016 Nestle ExtratednesanAinda não há avaliações

- When Buying A House in PJDocumento1 páginaWhen Buying A House in PJnesanAinda não há avaliações

- Kolej Gemilang: Chartered Institute of Management Accounting - CIMA (Foreign) 2014Documento2 páginasKolej Gemilang: Chartered Institute of Management Accounting - CIMA (Foreign) 2014nesanAinda não há avaliações

- Module 2: General Working ConditionsDocumento52 páginasModule 2: General Working ConditionsnesanAinda não há avaliações

- Exercise 1Documento2 páginasExercise 1nesanAinda não há avaliações

- RCPI v. Secretary of LaborDocumento4 páginasRCPI v. Secretary of LaborFrancis Guinoo0% (1)

- Certificate of Registration: Don Honorio Ventura State UniversityDocumento1 páginaCertificate of Registration: Don Honorio Ventura State UniversityDuduts EnterprisesAinda não há avaliações

- Intraupsee - Nic.in AL Letter CC GenerateAl LetterAICAT - AsDocumento537 páginasIntraupsee - Nic.in AL Letter CC GenerateAl LetterAICAT - Asgopalpathak2Ainda não há avaliações

- V TransDocumento6 páginasV TransRupak BhattacharjeeAinda não há avaliações

- Up Form C: University of The Philippines Manila (The Health Sciences Center) Padre Faura Street, ManilaDocumento6 páginasUp Form C: University of The Philippines Manila (The Health Sciences Center) Padre Faura Street, ManilaMary Joyce VelardeAinda não há avaliações

- Electrical - Bill - BTKP NDP6481 - 2024 06 2 15 41 46Documento1 páginaElectrical - Bill - BTKP NDP6481 - 2024 06 2 15 41 46sameemgridAinda não há avaliações

- Notice: Accessing Student Financing ServicesDocumento1 páginaNotice: Accessing Student Financing ServicesLamar TaylorAinda não há avaliações

- Credit Card ReconciliationDocumento8 páginasCredit Card Reconciliationapi-456055243Ainda não há avaliações

- Account StatementDocumento4 páginasAccount Statementdosak1305Ainda não há avaliações

- Maulana Azad National Institute of Technology, Bhopal-462003Documento10 páginasMaulana Azad National Institute of Technology, Bhopal-462003Rohit RaiAinda não há avaliações

- Wedding Photography Package ScottyDocumento6 páginasWedding Photography Package ScottymaktendyAinda não há avaliações

- Statements of Estimated Annual Operating Results ExampleDocumento9 páginasStatements of Estimated Annual Operating Results ExampleAnna Bella SatyaAinda não há avaliações

- Metodologia de La Investigacion Sexta Edicion - CompressedDocumento3 páginasMetodologia de La Investigacion Sexta Edicion - CompressedCarlos Tupa OrtizAinda não há avaliações

- Tuition Fees Fakulti Kedokteran UKM MalaysiaDocumento21 páginasTuition Fees Fakulti Kedokteran UKM MalaysiaSye Q. NPAinda não há avaliações

- CHAP - 03 - Managing and Pricing Deposit ServicesDocumento60 páginasCHAP - 03 - Managing and Pricing Deposit ServicesTran Thanh NganAinda não há avaliações

- Repairs To Farmers Committee Room MehdipatnamDocumento66 páginasRepairs To Farmers Committee Room MehdipatnamAbu MariamAinda não há avaliações

- Vietcombank LC ServiceDocumento3 páginasVietcombank LC ServiceK60 Nguyễn Bích VânAinda não há avaliações

- Corporate Family Vacation CertificateDocumento2 páginasCorporate Family Vacation Certificateapi-97214214Ainda não há avaliações

- ARTA PresentationDocumento45 páginasARTA PresentationRaissa Almojuela Del Valle0% (1)

- Procurement and Materials Management - Question Paper For IM - 2021 - PMMDocumento8 páginasProcurement and Materials Management - Question Paper For IM - 2021 - PMMLiterally No-oneAinda não há avaliações

- BillSTMT 4588260003735455Documento2 páginasBillSTMT 4588260003735455Safwan SadiqAinda não há avaliações

- 4 - 01 - Product Catalog For 450connectDocumento100 páginas4 - 01 - Product Catalog For 450connectAdil MuradAinda não há avaliações

- Form I (See Rule 29 (1) ) Application For Opening of A New SchoolDocumento3 páginasForm I (See Rule 29 (1) ) Application For Opening of A New Schoolmahi6065Ainda não há avaliações