Escolar Documentos

Profissional Documentos

Cultura Documentos

E Flier Credit Notes Revised

Enviado por

Jyothi Hari PrasadTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

E Flier Credit Notes Revised

Enviado por

Jyothi Hari PrasadDireitos autorais:

Formatos disponíveis

GST (GOODS AND SERVICES TAX)

Credit Note in GST

Introduction or both, may issue to the recipient what is called as a credit

note containing the prescribed particulars.

A supplier of goods or services or both is mandatorily

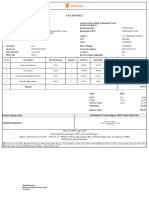

Format

required to issue a tax invoice.However, during the course

of trade or commerce, after the invoice has been issued There is no prescribed format butcredit note issued by a supplier must

there could be situations like: contain the following particulars, namely:

(a) name, address and Goods and Services Tax Identification Number

• The supplier has erroneously declared a value which of the supplier;

is more than the actual value of the goods or services

provided. (b) nature of the document;

(c) a consecutive serial number not exceeding sixteen characters, in

• The supplier has erroneously declared a higher tax rate

one or multiple series, containing alphabets or numerals or special

than what is applicable for the kind of the goods or characters hyphen or dash and slash symbolised as “-” and “/”

services or both supplied. respectively, and any combination thereof, unique for a financial

year;

• The quantity received by the recipient is less than what

has been declared in the tax invoice. (d) date of issue;

• The quality of the goods or services or both supplied is not (e) name, address and Goods and Services Tax Identification Number

or Unique Identity Number, if registered, of the recipient;

to the satisfaction of the recipient thereby necessitating

a partial or total reimbursement on the invoice value.

(f) name and address of the recipient and the address of delivery,

along with the name of State and its code, if such recipient is

• Any other similar reasons. un-registered;

In order to regularize these kinds of situations the supplier is (g) serial number and date of the corresponding tax invoice or, as the

allowed to issue what is called as credit note to the recipient. case may be, bill of supply;

Once the credit note has been issued, the tax liability of the

supplier will reduce. (h) value of taxable supply of goods or services, rate of tax and the

amount of the tax credited to the recipient; and

Meaning (i) signature or digital signature of the supplier or his authorised

representative.

Where a tax invoice has been issued for supply of any goods

or services or both and the taxable value or tax charged

in that tax invoice is found to exceed the taxable value or Adjustment of tax liability

tax payable in respect of such supply, or where the goods

The person who issues a credit note in relation to a supply of goods

supplied are returned by the recipient, or where goods or or services or both must declare the details of such credit note in the

services or both supplied are found to be deficient, the return for the month during which such credit note has been issued

registered person, who has supplied such goods or services but not later than September following the end of the financial year in

Directorate General of Taxpayer Services

CENTRAL BOARD OF EXCISE & CUSTOMS

www.cbec.gov.in

v

GST (GOODS AND SERVICES TAX)

Credit Note in GST

which such supply was made, or the date of furnishing of the Records

relevant annual return, whichever is earlier. In other words,

the output tax liability cannot be reduced in cases where The records of the credit have to be retained until the expiry of

credit note has been issued after September. seventy-two months from the due date of furnishing of annual

return for the year pertaining to such accounts and records.

The output tax liability of the supplier gets reduced once Where such accounts and documents are maintained manually,

the credit note is issued and it is matched. The details of it should be kept at every related place of business mentioned

the credit note relating to outward supply furnished by the in the certificate of registration and shall be accessible at every

supplierfor a tax period shall, be matched: related place of business where such accounts and documents

are maintained digitally.Conclusion

(a) with the corresponding reduction in the claim for input

tax credit by the recipient in his valid return for the same The credit note is therefore a convenient and legal method by which

tax period or any subsequent tax period; and the value of the goods or services in the original tax invoice can be

(b) for duplication of claims for reduction in output tax amended or revised. The issuance of the credit note will easily allow

the supplier to decrease his tax liability in his returns without requiring

liability.

him to undertake any tedious process of refunds.

The claim for reduction in output tax liability by the supplier

that matches with the corresponding reduction in the claim

for input tax credit by the recipient shall be finally accepted

and communicated to the supplier. The reduction in output

tax liability of the supplier shall not be permitted, if the CREDIT NOTE

incidence of tax and interest on such supply has been passed IN GST

on to any other person. Date:

INVOICE:

Where the reduction of output tax liability in respect of

outward supplies exceeds the corresponding reduction in

the claim for input tax credit or the corresponding credit Description Qty Unit Unit Price Total

note is not declared by the recipient in his valid returns, the

discrepancy shall be communicated to both such persons.

Whereas, the duplication of claims for reduction in output

tax liability shall be communicated to the supplier.

The amount in respect of which any discrepancy is

communicated and which is not rectified by the recipient

in his valid return for the month in which discrepancy is

communicated shall be added to the output tax liability

of the supplier in his return for the month succeeding the

month in which the discrepancy is communicated.

The amount in respect of any reduction in output tax liability

that is found to be on account of duplication of claims shall be

added to the output tax liability of the supplier in his return

for the month in which such duplication is communicated.

Prepared by: National Academy of Customs, Indirect Taxes & Narcotics

Follow us on:

@CBEC_India

cbecindia

@askGST_GoI

Você também pode gostar

- Debit Note in GST: (Goods and Services Tax)Documento2 páginasDebit Note in GST: (Goods and Services Tax)Jyothi Hari PrasadAinda não há avaliações

- GST Seminar Key HighlightsDocumento40 páginasGST Seminar Key HighlightsNavneetAinda não há avaliações

- debit or credit noteDocumento6 páginasdebit or credit noteamolisrivastava8Ainda não há avaliações

- Tax Invoice: SEC 34: Credit and Debit NotesDocumento4 páginasTax Invoice: SEC 34: Credit and Debit NotesManish K JadhavAinda não há avaliações

- Mahatma Education Society's Pillai College of Arts, Commerce and Science (Autonomous) New Panvel ISO 9001:2015 CertifiedDocumento17 páginasMahatma Education Society's Pillai College of Arts, Commerce and Science (Autonomous) New Panvel ISO 9001:2015 CertifiedAbizer KachwalaAinda não há avaliações

- Tax Invoice and Other Such Instruments: Central Board of Excise & CustomsDocumento4 páginasTax Invoice and Other Such Instruments: Central Board of Excise & CustomsAvinash DangwalAinda não há avaliações

- Tax Invoice and Other NewDocumento6 páginasTax Invoice and Other NewTax NatureAinda não há avaliações

- GST Invoice Rules, GST Tax Invoice, Download GST Invoice FormatDocumento6 páginasGST Invoice Rules, GST Tax Invoice, Download GST Invoice Formatiiftgscm batch2Ainda não há avaliações

- Unit 2:GST Procedures Topic: Credit and Debit NotesDocumento20 páginasUnit 2:GST Procedures Topic: Credit and Debit NotesManada SachdevaAinda não há avaliações

- 4 GST Time and Value of Supply NotesDocumento6 páginas4 GST Time and Value of Supply NotesMurali Krishnan RAinda não há avaliações

- Important GST Amendments in Budget 2023 - Taxguru - in PDFDocumento10 páginasImportant GST Amendments in Budget 2023 - Taxguru - in PDFPawan AswaniAinda não há avaliações

- GST declaration formDocumento1 páginaGST declaration formAnanta Engineering SolutionAinda não há avaliações

- Getting Invoicing in GST rightDocumento5 páginasGetting Invoicing in GST rightNivedita DodamaniAinda não há avaliações

- Tax Invoice, Credit and Debit Notes (Section 31-34 of CGST Act)Documento16 páginasTax Invoice, Credit and Debit Notes (Section 31-34 of CGST Act)Nikhil PahariaAinda não há avaliações

- VAT Tax ReportDocumento8 páginasVAT Tax ReportMichelle Marie TablizoAinda não há avaliações

- Cbec/gst/tax Invoice Efliers PDFDocumento8 páginasCbec/gst/tax Invoice Efliers PDFRenuka KhatkarAinda não há avaliações

- Credit Note and Debit Note Under GST - Masters IndiaDocumento5 páginasCredit Note and Debit Note Under GST - Masters Indiaarun alwaysAinda não há avaliações

- Credit Note - Zoho BooksDocumento4 páginasCredit Note - Zoho Booksarun alwaysAinda não há avaliações

- Girish GSTDocumento11 páginasGirish GSTAshiAinda não há avaliações

- Tax Invoice Under GSTDocumento3 páginasTax Invoice Under GSTkoushiki mishraAinda não há avaliações

- GST DocumentationDocumento32 páginasGST DocumentationTeju PawarAinda não há avaliações

- Income tax credit for April 15 deadlineDocumento2 páginasIncome tax credit for April 15 deadlinebrainAinda não há avaliações

- EY - GST News Alert: Executive SummaryDocumento6 páginasEY - GST News Alert: Executive SummaryAmit GargAinda não há avaliações

- Casual Taxable Person Brochure - 10 November 2022Documento2 páginasCasual Taxable Person Brochure - 10 November 2022KumariAinda não há avaliações

- B4-NOV-MSDocumento13 páginasB4-NOV-MSCerealis FelicianAinda não há avaliações

- BIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsDocumento1 páginaBIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsdreaAinda não há avaliações

- BIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsDocumento1 páginaBIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsdreaAinda não há avaliações

- BIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsDocumento1 páginaBIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsdreaAinda não há avaliações

- GST Weekly Update - 45 - 2023-24Documento5 páginasGST Weekly Update - 45 - 2023-24guptaharshit2204Ainda não há avaliações

- Atlas Consolidated Mining and Development Corporation vs. CIRDocumento54 páginasAtlas Consolidated Mining and Development Corporation vs. CIRChristian Adrian CepilloAinda não há avaliações

- Time of Supply of ServicesDocumento10 páginasTime of Supply of ServicesShiwang AgrawalAinda não há avaliações

- 6-GST - Declaration Form For GSTDocumento1 página6-GST - Declaration Form For GSTvishal.nithamAinda não há avaliações

- 46787bosfinal p8 Part1 Cp10Documento47 páginas46787bosfinal p8 Part1 Cp10virmani123Ainda não há avaliações

- TAX-304 (VAT Compliance Requirements)Documento5 páginasTAX-304 (VAT Compliance Requirements)Edith DalidaAinda não há avaliações

- Tax Brief August 2010Documento10 páginasTax Brief August 2010jae123Ainda não há avaliações

- GST 1 Maps Buyer132Documento1 páginaGST 1 Maps Buyer132MKTG THE SALEM AEROPARKAinda não há avaliações

- Tendernotice - 1 (3) 5Documento1 páginaTendernotice - 1 (3) 5SRARAinda não há avaliações

- S. 16: Eligibility & Conditions: Receipt of Document Forward Charge Cases (FCM)Documento3 páginasS. 16: Eligibility & Conditions: Receipt of Document Forward Charge Cases (FCM)MANU SHANKARAinda não há avaliações

- P&G Vs CIR - Vat RulingDocumento7 páginasP&G Vs CIR - Vat Rulingcaren kay b. adolfoAinda não há avaliações

- GST Annexure: Timely Provision of Invoices/debit Note/Credit Note/Other Applicable DocumentsDocumento3 páginasGST Annexure: Timely Provision of Invoices/debit Note/Credit Note/Other Applicable Documentsshuklaankit704_24016Ainda não há avaliações

- Revenue and Expense Recognition ReviewDocumento7 páginasRevenue and Expense Recognition ReviewPaupauAinda não há avaliações

- GST Advance ReceiptsDocumento4 páginasGST Advance ReceiptsmanukleoAinda não há avaliações

- Atlas Consolidated Mining vs. CIRDocumento51 páginasAtlas Consolidated Mining vs. CIRCamille Yasmeen SamsonAinda não há avaliações

- Draft Invoice RulesDocumento6 páginasDraft Invoice RulesSandeep KaundinyaAinda não há avaliações

- VAT Refund Audit ProgramDocumento5 páginasVAT Refund Audit ProgramCha Gamboa De LeonAinda não há avaliações

- REMEDIES by J. DimaampaoDocumento2 páginasREMEDIES by J. DimaampaoJeninah Arriola CalimlimAinda não há avaliações

- CA Ashish Chaudhary 1Documento30 páginasCA Ashish Chaudhary 1sonapakhi nandyAinda não há avaliações

- 03 - Claims For Excise Tax Refund InquiryDocumento5 páginas03 - Claims For Excise Tax Refund InquiryAhyz DyAinda não há avaliações

- GST - Tax Invoice, Debit or Credit Notes, Returns, Payment of Tax PDFDocumento78 páginasGST - Tax Invoice, Debit or Credit Notes, Returns, Payment of Tax PDFSapna MalikAinda não há avaliações

- Reverse Charge MechanismDocumento3 páginasReverse Charge MechanismARJUNAinda não há avaliações

- Fate of "Unjust Enrichment" Principle Under GSTDocumento2 páginasFate of "Unjust Enrichment" Principle Under GSTRajula Gurva ReddyAinda não há avaliações

- Tax InvoiceDocumento52 páginasTax InvoicesidhantAinda não há avaliações

- Tax Deductions for Professional Fees Under Accrual MethodDocumento2 páginasTax Deductions for Professional Fees Under Accrual MethodRenmarc JuangcoAinda não há avaliações

- 56454bosinter p4 Maynov2020secb cp8Documento68 páginas56454bosinter p4 Maynov2020secb cp8Vijesh SoniAinda não há avaliações

- Withholding VAT Guideline (2017-18)Documento29 páginasWithholding VAT Guideline (2017-18)banglauserAinda não há avaliações

- Deductions From Gross Income 2Documento3 páginasDeductions From Gross Income 2Pilyang SweetAinda não há avaliações

- Revisiting The Rules On Claiming Withholding Tax CreditsDocumento3 páginasRevisiting The Rules On Claiming Withholding Tax Creditsarnelo sarmientoAinda não há avaliações

- Voluntary Assessment and Payment Program (VAPP) : Bureau of Internal Revenue Revenue Region No. 38 - North, Quezon CityDocumento29 páginasVoluntary Assessment and Payment Program (VAPP) : Bureau of Internal Revenue Revenue Region No. 38 - North, Quezon CityEdward GanAinda não há avaliações

- BIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsDocumento1 páginaBIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsdreaAinda não há avaliações

- The Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703No EverandThe Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703Ainda não há avaliações

- On Submission of SFT in Form 61A PDFDocumento36 páginasOn Submission of SFT in Form 61A PDFajinkya ghevadeAinda não há avaliações

- List of Services Under Reverse ChargeDocumento5 páginasList of Services Under Reverse ChargeMoneycontrol News100% (18)

- GST Expanse RateDocumento2 páginasGST Expanse RateSneha AgarwalAinda não há avaliações

- Draft Return Formats 26092016 PDFDocumento129 páginasDraft Return Formats 26092016 PDFBharatAinda não há avaliações

- Faq MiningDocumento10 páginasFaq MiningSneha AgarwalAinda não há avaliações

- GST Accounts & RecordsDocumento12 páginasGST Accounts & RecordsSneha AgarwalAinda não há avaliações

- GST FAQs on Handicraft SectorDocumento6 páginasGST FAQs on Handicraft SectorSneha AgarwalAinda não há avaliações

- ICDS - Trading DisclosuresDocumento3 páginasICDS - Trading DisclosuresSneha AgarwalAinda não há avaliações

- E Book On How To Get Registered Under GST 1aug2017Documento132 páginasE Book On How To Get Registered Under GST 1aug2017Sneha AgarwalAinda não há avaliações

- Annotation RubricDocumento5 páginasAnnotation RubriclearnerivanAinda não há avaliações

- Read President Trump's Fiscal Year 2019 BudgetDocumento160 páginasRead President Trump's Fiscal Year 2019 Budgetkballuck1100% (6)

- GST Revision (Marathon) Notes-May'24Documento89 páginasGST Revision (Marathon) Notes-May'24AmruthaAinda não há avaliações

- PPE Costs and ExchangesDocumento2 páginasPPE Costs and ExchangesRex AdarmeAinda não há avaliações

- Report On Financial Reporting PDFFFDocumento38 páginasReport On Financial Reporting PDFFFMohit AroraAinda não há avaliações

- Chevron PH Vs Commissioner of BOCDocumento4 páginasChevron PH Vs Commissioner of BOCTenet Manzano100% (1)

- BBC AudienceDocumento138 páginasBBC AudienceporukeslikeAinda não há avaliações

- Employment Income - Derivation, Exemptions, Types and DeductionsDocumento57 páginasEmployment Income - Derivation, Exemptions, Types and DeductionsTeh Chu Leong100% (1)

- Macro Economic Trends of Sri LankaDocumento13 páginasMacro Economic Trends of Sri LankathilangacAinda não há avaliações

- Lesson 15: TaxationDocumento2 páginasLesson 15: TaxationMa. Luisa RenidoAinda não há avaliações

- Coursera University of Melbourne Macro Economics Course Peer Assessment AssignmentDocumento7 páginasCoursera University of Melbourne Macro Economics Course Peer Assessment AssignmentpsstquestionAinda não há avaliações

- Milestone 1Documento11 páginasMilestone 1Nandish Patel100% (1)

- MayaCredit SoA 2023SEPDocumento3 páginasMayaCredit SoA 2023SEPjepoy palaruanAinda não há avaliações

- Taco 0088166061500044Documento1 páginaTaco 0088166061500044Sourav ChakrabortyAinda não há avaliações

- 11 Biggest Challenges of International BusinessDocumento8 páginas11 Biggest Challenges of International BusinesspranshuAinda não há avaliações

- Tata Dealership Form and RequirementsDocumento21 páginasTata Dealership Form and Requirementskrishnaaul100% (1)

- Estate Planning & Administration OutlineDocumento9 páginasEstate Planning & Administration OutlineSean Robertson100% (1)

- RMC No. 73-2018Documento3 páginasRMC No. 73-2018Madi KomoaAinda não há avaliações

- Bir Rao 01 03Documento3 páginasBir Rao 01 03Benedict Jonathan BermudezAinda não há avaliações

- The Effects of Education On CrimeDocumento12 páginasThe Effects of Education On CrimeMicaela FORSCHBERG CASTORINOAinda não há avaliações

- Risk Analysis ExampleDocumento8 páginasRisk Analysis ExampleRyan SooknarineAinda não há avaliações

- Cooperative Code of The PhilippinesDocumento16 páginasCooperative Code of The PhilippinesJeean BeldaAinda não há avaliações

- Patterns of Philippine ExpendituresDocumento13 páginasPatterns of Philippine ExpendituresTrisha AlmonteAinda não há avaliações

- TrustDocumento91 páginasTrustmohiuddinduo593% (14)

- 3Documento26 páginas3JDAinda não há avaliações

- Constitution of India, 1949 - Bare Acts - Law Library - AdvocateKhojDocumento12 páginasConstitution of India, 1949 - Bare Acts - Law Library - AdvocateKhojAmitKumar100% (1)

- Tax Planning With Reference To Managerial DecisionsDocumento22 páginasTax Planning With Reference To Managerial DecisionsdharuvAinda não há avaliações

- Lec 3 SalaryDocumento28 páginasLec 3 SalaryManasi PatilAinda não há avaliações

- Lass 12 Subject Economics Paper Set 1 With Solutions: (Macro Economics) Question 1: (Marks 1)Documento10 páginasLass 12 Subject Economics Paper Set 1 With Solutions: (Macro Economics) Question 1: (Marks 1)sandeep11116Ainda não há avaliações

- Correcting Erroneous Information Returns, Form #04.001Documento144 páginasCorrecting Erroneous Information Returns, Form #04.001Sovereignty Education and Defense Ministry (SEDM)50% (2)