Escolar Documentos

Profissional Documentos

Cultura Documentos

Annex B4

Enviado por

Idan AguirreDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Annex B4

Enviado por

Idan AguirreDireitos autorais:

Formatos disponíveis

Annex B4

Donor’s Tax Return

CHECKLIST OF DOCUMENTARY REQUIREMENTS

Important:

1. Processing of transactions commence only upon submission of COMPLETE DOCUMENTS.

2. Mark “ ” for submitted documents and “X” for lacking documents.

Mandatory

Notarized Deed of Donation but only photocopied documents shall be retained by BIR.

TIN of Donor and Donee/s

Proof of claimed tax credit, if applicable;

Duly Notarized Special Power of Attorney (SPA) for the transacting party if the latter is not one of the parties to the Deed of Donation

Official Receipt/Deposit Slip and duly validated return as proof of payment

Copy of Tax Debit Memo used as payment, if applicable.

For Real Properties:

Certified True Copy/ies of the Original/Transfer/Condominium Certificate/s of Title (front and back pages) of the donated property, if

applicable;

Certified True Copy/ies of the Tax Declaration at the time or nearest to the date of the transaction issued by the Local Assessor’s Office

for land and improvement, if applicable;

Sworn Declaration of No Improvement by at least one (1) of the transferees or Certificate of No Improvement issued by the Assessor’s

Office, if applicable

For Personal Properties:

Proof of valuation of shares of stock at the time of donation, if applicable;

a. For shares of stocks not listed/not traded - Latest Audited Financial Statement of the issuing corporation with computation

of the book value per share

b. For shares of stocks listed/traded - Price index from the PSE/latest FMV published in the newspaper at the time of transaction

c. For club shares - Price published in newspapers on the transaction date or nearest to the transaction date

Photocopy of stock certificate

Proof of valuation of other types of personal properties, if applicable;

Proof of claimed deductions, if applicable.

Certificate of deposit/investment/indebtedness/stocks for donated cash or securities

Certificate of registration of motor vehicle, if any.

Other Additional Requirements, if applicable:

Special Power of Attorney (SPA), if the person transacting/processing the transfer is not a party to the transaction

Certification from the Philippine Consulate if document is executed abroad

Location Plan/Vicinity map if zonal value cannot be readily determined from the documents submitted

Certificate of Exemption/BIR Ruling issued by the Commissioner of Internal Revenue or his authorized representative, if tax exempt

Such other documents as may be required by law/rulings/regulations/etc.

Submitted by: ____________________________ Date: ____________

Name of Taxpayer

Received by: ____________________________ Date: ____________

Acknowledgement of applicant:

I _________________________ , of legal age, hereby acknowledge the identified lacking documentary

requirement/s (marked with “X”) which I commit to submit within five (5) working days. I understand that my application

will only be processed upon submission of complete document/s.

____________________________________ Date: ____________

Name of Taxpayer/Representative

(Signature over printed name)

NOTE: The BIR shall dispose all pending applications with incomplete requirements after thirty (30) calendar days from

receipt of application.

Você também pode gostar

- Deed of Sole HeirDocumento1 páginaDeed of Sole HeirLuisa LopezAinda não há avaliações

- Alteration of Title JurisprudenceDocumento24 páginasAlteration of Title JurisprudenceGabriel UyAinda não há avaliações

- TREASURER'S AFFIDAVIT - IncreaseDocumento2 páginasTREASURER'S AFFIDAVIT - IncreaseFernando GapuzAinda não há avaliações

- Affidavit of SettlementDocumento1 páginaAffidavit of SettlementClear RiddleAinda não há avaliações

- SEC Form 17-C report on changes in control or assetsDocumento12 páginasSEC Form 17-C report on changes in control or assetscamileholicAinda não há avaliações

- Revenue Memorandum Order No. 35-1990Documento2 páginasRevenue Memorandum Order No. 35-1990Kaye MendozaAinda não há avaliações

- Sec Memo Circular No.6 Series of 2008 Section 3Documento2 páginasSec Memo Circular No.6 Series of 2008 Section 3orlyAinda não há avaliações

- Requirements Merger-ConsolidationDocumento1 páginaRequirements Merger-ConsolidationmarjAinda não há avaliações

- Affidavit LtoDocumento1 páginaAffidavit LtoChristian Rivera100% (1)

- Procedure For Land AcquisitionDocumento25 páginasProcedure For Land AcquisitionRob ClosasAinda não há avaliações

- Memorandum of Understanding For LGUDocumento4 páginasMemorandum of Understanding For LGUNikki Mayor-Ong100% (1)

- Certificate of Officer Taking Deposition - SAMPLE FOR ACADEMIC USE ONLYDocumento4 páginasCertificate of Officer Taking Deposition - SAMPLE FOR ACADEMIC USE ONLYEJ CruzAinda não há avaliações

- Joint Affidavit of CohabitationDocumento1 páginaJoint Affidavit of CohabitationthepathfinderformercuryAinda não há avaliações

- Affidavit of AdjudicationDocumento5 páginasAffidavit of AdjudicationRickyCheryll Bay AmparoAinda não há avaliações

- Petition To Substitute UnitDocumento2 páginasPetition To Substitute UnitKristine JanAinda não há avaliações

- Affidavit of Supplemental ReportDocumento1 páginaAffidavit of Supplemental ReportBikoy EstoqueAinda não há avaliações

- Articles of Incorporation (Sample)Documento8 páginasArticles of Incorporation (Sample)jeni mae pillotesAinda não há avaliações

- HLF065 ChecklistRequirementsWindow1Accounts V05Documento2 páginasHLF065 ChecklistRequirementsWindow1Accounts V05Jerson OboAinda não há avaliações

- Application Form For Business Permit Office of The City Mayor Business Permit & Licensing DivisionDocumento2 páginasApplication Form For Business Permit Office of The City Mayor Business Permit & Licensing Divisionvivian deocampoAinda não há avaliações

- Affidavit of Discrepancy: IN WITNESS WHEREOF, I Have Hereunto Set My Hand ThisDocumento2 páginasAffidavit of Discrepancy: IN WITNESS WHEREOF, I Have Hereunto Set My Hand ThisPen PanasilanAinda não há avaliações

- Bulk Sales Law SummaryDocumento12 páginasBulk Sales Law SummaryManuel VillanuevaAinda não há avaliações

- Reasons for Pag-IBIG loan delinquency and non-availment of penalty condonationDocumento1 páginaReasons for Pag-IBIG loan delinquency and non-availment of penalty condonationWerner SchlagerAinda não há avaliações

- Affidavit Landholding Under 5 HectaresDocumento4 páginasAffidavit Landholding Under 5 HectaresJhoana Parica FranciscoAinda não há avaliações

- Sample Board ResolutionDocumento2 páginasSample Board ResolutionJen GamilAinda não há avaliações

- Philippines Real Estate Mortgage DocumentDocumento2 páginasPhilippines Real Estate Mortgage DocumentLia LBAinda não há avaliações

- AFFIDAVITDocumento1 páginaAFFIDAVITLouizeAinda não há avaliações

- Retirement of Business Form-FinalDocumento1 páginaRetirement of Business Form-Finalfrancis helbert magallanesAinda não há avaliações

- Affidavit of InsertionDocumento2 páginasAffidavit of InsertionMCDDA SERVEAinda não há avaliações

- Affidavit of Undertaking For AEP Format 16dec2020 Rev.1Documento2 páginasAffidavit of Undertaking For AEP Format 16dec2020 Rev.1Princess GarciaAinda não há avaliações

- Guidelines For Application of NPS in PhilDocumento2 páginasGuidelines For Application of NPS in Phil데이브자바이Ainda não há avaliações

- Deed of Conditional Sale AgreementDocumento3 páginasDeed of Conditional Sale AgreementJohari ForcadasAinda não há avaliações

- AFFIDAVIT Authenticity SampleDocumento1 páginaAFFIDAVIT Authenticity SampleManuel LikiganAinda não há avaliações

- OCA Circular No. 204-2022-AADocumento3 páginasOCA Circular No. 204-2022-AAMTCC Branch1Ainda não há avaliações

- Receipt for land paymentDocumento1 páginaReceipt for land paymentMichael Ramirez SorbitoAinda não há avaliações

- Cancellation of Annotation - Petition.uploadDocumento5 páginasCancellation of Annotation - Petition.uploadJef Didulo100% (1)

- Torres vs. Philippines Amusement and Gaming CorporationDocumento13 páginasTorres vs. Philippines Amusement and Gaming Corporationpoiuytrewq9115Ainda não há avaliações

- Extra Judicial Settlement of EstateDocumento9 páginasExtra Judicial Settlement of EstatekealaAinda não há avaliações

- Affidavit of Damage To VehicleDocumento1 páginaAffidavit of Damage To VehicleJohn Mark OpenianoAinda não há avaliações

- Extrajudicial Settlement and Partition of Real EstateDocumento2 páginasExtrajudicial Settlement and Partition of Real EstateElyssa MalaranAinda não há avaliações

- AAF118 - Cancellation Release of DOA of CTS - v01Documento2 páginasAAF118 - Cancellation Release of DOA of CTS - v01maxx villaAinda não há avaliações

- Real Estate Mortgage Know All Men by These PresentsDocumento2 páginasReal Estate Mortgage Know All Men by These PresentsKatrine ManaoAinda não há avaliações

- LOG-2-6-WAREHOUSE-TEMPLATE-Warehouse Rental Contract-RCRCS PDFDocumento3 páginasLOG-2-6-WAREHOUSE-TEMPLATE-Warehouse Rental Contract-RCRCS PDFG Vishwanath ReddyAinda não há avaliações

- Affidavit DTI Change NameDocumento1 páginaAffidavit DTI Change NameKernell Sonny SalazarAinda não há avaliações

- Philippines Mortgage Foreclosure RequestDocumento1 páginaPhilippines Mortgage Foreclosure RequestGerwin100% (1)

- Affidavit of Lost ID and MoneyDocumento1 páginaAffidavit of Lost ID and Moneychastine baldagoAinda não há avaliações

- SPADocumento1 páginaSPAPaul CasajeAinda não há avaliações

- Stirling HomexDocumento3 páginasStirling HomexAnne cutieAinda não há avaliações

- Deed of Sale of Motor VehicleDocumento3 páginasDeed of Sale of Motor VehicleCham LamegAinda não há avaliações

- Release of MortgageDocumento2 páginasRelease of MortgageroginAinda não há avaliações

- Affidavit For Delayed Registration of BirthDocumento1 páginaAffidavit For Delayed Registration of BirtheliiiiiiiAinda não há avaliações

- REAL ESTATE MORTGAGE CabatoDocumento3 páginasREAL ESTATE MORTGAGE CabatoHash IbrahimAinda não há avaliações

- Sworn Statement of Accountability of The ProponentDocumento1 páginaSworn Statement of Accountability of The ProponentJohn Paul AloyAinda não há avaliações

- Affidavit of Two Disinterested PartyDocumento1 páginaAffidavit of Two Disinterested PartyJoseph MalelangAinda não há avaliações

- Motion For ReconsiderationDocumento8 páginasMotion For ReconsiderationManny B. Victor VIIIAinda não há avaliações

- Deed of Absolute Sale of Protion of Registered Lan2Documento2 páginasDeed of Absolute Sale of Protion of Registered Lan2Bongeh RagantaAinda não há avaliações

- Philippines Army Candidate Affidavit Legal BeneficiaryDocumento1 páginaPhilippines Army Candidate Affidavit Legal BeneficiaryEligene PatalinghugAinda não há avaliações

- Affidavit attesting business name changeDocumento2 páginasAffidavit attesting business name changePaulo VillarinAinda não há avaliações

- PRC Request Form for Dislodging SalespersonsDocumento1 páginaPRC Request Form for Dislodging SalespersonsNASSER DUGASANAinda não há avaliações

- Waiver of Rights - Dionisio DomingoDocumento1 páginaWaiver of Rights - Dionisio Domingomichael lumboyAinda não há avaliações

- Withholding Tax Remittance Return ChecklistDocumento2 páginasWithholding Tax Remittance Return ChecklistJulliene AbatAinda não há avaliações

- Kalakip NG AwitinDocumento2 páginasKalakip NG AwitinIdan AguirreAinda não há avaliações

- Accounting For Construction ContractsDocumento26 páginasAccounting For Construction ContractsIdan Aguirre100% (3)

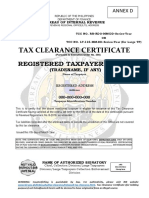

- ANNEX D TAX CLEARANCE CERTIFICATEDocumento1 páginaANNEX D TAX CLEARANCE CERTIFICATEIdan Aguirre50% (2)

- Sworn Application For Tax Clearance - Non-IndDocumento1 páginaSworn Application For Tax Clearance - Non-IndIdan AguirreAinda não há avaliações

- MAT & AMT ProvisionsDocumento164 páginasMAT & AMT ProvisionsSrinivas JayantiAinda não há avaliações

- Sample QuestionsDocumento2 páginasSample QuestionsSavanAinda não há avaliações

- Boing AirbusDocumento16 páginasBoing AirbusJUAN PIMINCHUMOAinda não há avaliações

- Indian Salon Industry ReportDocumento26 páginasIndian Salon Industry ReportReevolv Advisory Services Private Limited0% (1)

- Tax Accounting Jones CH 4 HW SolutionsDocumento7 páginasTax Accounting Jones CH 4 HW SolutionsLolaLaTraileraAinda não há avaliações

- Derivative Unit IIIDocumento19 páginasDerivative Unit IIIumar zaid khanAinda não há avaliações

- Download Form 990 for Don and Mary Mitchell FoundationDocumento1 páginaDownload Form 990 for Don and Mary Mitchell FoundationSarah SportingAinda não há avaliações

- FI018 05 Investment Management - Budget Use - Settlement To FA PDFDocumento57 páginasFI018 05 Investment Management - Budget Use - Settlement To FA PDFArambamSunitikumarAinda não há avaliações

- 2018CGFD Checklist of Requirements Product HighlightDocumento3 páginas2018CGFD Checklist of Requirements Product HighlightLegal DeptAinda não há avaliações

- 4-Direct Material Yield Variance - Formula - Example - AnalysisDocumento8 páginas4-Direct Material Yield Variance - Formula - Example - AnalysisVashirAhmadAinda não há avaliações

- Vat On Sale of Services AND Use or Lease of PropertyDocumento67 páginasVat On Sale of Services AND Use or Lease of PropertyZvioule Ma FuentesAinda não há avaliações

- Profitero On March With 9m War Chest - Ireland - The Sunday TimesDocumento4 páginasProfitero On March With 9m War Chest - Ireland - The Sunday TimesVladAinda não há avaliações

- Fundamentals of Real Estate FinanceDocumento16 páginasFundamentals of Real Estate Financemudge2008Ainda não há avaliações

- University of CebuDocumento5 páginasUniversity of CebuLouelie Jean AlfornonAinda não há avaliações

- Investigation Report 5 PDFDocumento153 páginasInvestigation Report 5 PDFBinod Kumar SinghAinda não há avaliações

- ReconciliationDocumento15 páginasReconciliationManisha AmudaAinda não há avaliações

- Non-Disclosure Real Estate Deal Fee PactDocumento7 páginasNon-Disclosure Real Estate Deal Fee PactabhitagsAinda não há avaliações

- Retail Scenario in IndiaDocumento10 páginasRetail Scenario in IndiaSeemaNegiAinda não há avaliações

- ZuluTrade WSJ ArticleDocumento2 páginasZuluTrade WSJ ArticleMinura MevanAinda não há avaliações

- PEFINDO Key Success FactorsDocumento2 páginasPEFINDO Key Success Factorsanubhav saxenaAinda não há avaliações

- Islamic Insurance (Takaful) : Help One Another in Virtue, Righteousness and PietyDocumento29 páginasIslamic Insurance (Takaful) : Help One Another in Virtue, Righteousness and Pietydatu9dinnoAinda não há avaliações

- Understanding 2011 Rate Case Primer for Carolinas Electric UtilitiesDocumento3 páginasUnderstanding 2011 Rate Case Primer for Carolinas Electric UtilitiesShanthi SelvamAinda não há avaliações

- Malik Pims An Essential Part of Good Business ManagementDocumento7 páginasMalik Pims An Essential Part of Good Business ManagementManisha NagpalAinda não há avaliações

- Introduction To Investment BankingDocumento45 páginasIntroduction To Investment BankingNgọc Phan Thị BíchAinda não há avaliações

- BOP Components and TransactionsDocumento6 páginasBOP Components and TransactionsAnitha GirigoudruAinda não há avaliações

- WNS Fiscal 2014 Annual Report On Form 20-FDocumento596 páginasWNS Fiscal 2014 Annual Report On Form 20-FSaurabh ShitutAinda não há avaliações

- Equipment Replacement PolicyDocumento4 páginasEquipment Replacement PolicyRohan DhandAinda não há avaliações

- Atul Ltd.Documento4 páginasAtul Ltd.Fast SwiftAinda não há avaliações

- Session 18Documento32 páginasSession 18Sayantan 'Ace' DasAinda não há avaliações

- Waterloo ACTSC372 Lec 7Documento21 páginasWaterloo ACTSC372 Lec 7Claire ZhangAinda não há avaliações