Escolar Documentos

Profissional Documentos

Cultura Documentos

Industry Profile Banking Industry in India:: Study On Agricultural Credit Facility of Canara Bank

Enviado por

Goutham BindigaTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Industry Profile Banking Industry in India:: Study On Agricultural Credit Facility of Canara Bank

Enviado por

Goutham BindigaDireitos autorais:

Formatos disponíveis

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

CHAPTER 1

INDUSTRY PROFILE

Banking Industry in India:-

The world economy today is driven by the way the banks in the world perform. The

economical position of the country is also driven by the performance of banks. Banks, by

extending their services to areas hitherto untouched and making themselves accessible to the

common man, have become a part of our lives. The banking institutions in the past performed

very limited functions such as receiving deposits against bank notes and then issuing notes in the

country, as the time advanced and with the progress of commerce and industry, the scope of

banking also expanded. Modern banking institution is a large corporate giant with large

resources and a vast field of activity. Since the nationalization of some big commercial banks in

India in the year 1969, there has been a great surge of banking industry throughout the world

with the growing number of banking offices. The banking business today has become highly

critical and competitive between various classes of banks in offering a greater variety of services

nationally and internationally. With globalization setting in, banks are also modernizing

operations with a view to satisfying modern customers with an aim to improve bank operations

with a view to maintain high standard banking system that involves applications of better

management techniques. In India, class banking has given way to mass banking, bringing in its

fold very large number of customers. Banks are now looked upon as development agents instead

of purveyors of credit to the large industries and big business companies. Apart from providing

credit to trade, industry and agriculture it is also involved in offering pension for retired

employees, government servants and collection of utility bills.

The Indian banking system can be classified into nationalized, private and specialized banking

institutions. The industry is highly fragmented with 30 banking units contributing to almost

50%of deposits and 60% of advances. The Reserve Bank of India is the foremost monitoring

body in the Indian Financial sector.

Department of M.B.A, AIT, Chikmagalure Page | 1

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

It is a centralized body that monitors discrepancies and short comings in the system. Industry

estimates indicate that out of 274 commercial banks operating in the country, 223 banks are in

the public sector and 51 are in the private sector. These private sector banks include 24 foreign

banks that have begun their operations here. The specialized banking institutions that include

cooperatives, rural banks, etc. form a part of the nationalized banks category

The Indian banking system is financially stable and resilient to the shocks that may arise due to

higher non-performing assets (NPAs) and the global economic crisis, according to a stress test

done by the Reserve Bank of India (RBi). Significantly, the RBI has the tenth largest gold

reserves in the world after spending US$ 6.7 billion for the purchase of 200 metric tones of gold

from the International Monetary Fund (IMF). The purchase has increased RBIs share of gold

holdings from approximately 4% to 6%.In the annual international ranking conducted by UK-

based Brand Finance Plc,20 Indian banks have been included in the Brand Finance Global

Banking 500. The State Bank of India has become the first Indian bank to be ranked among the

Top 50 banks in the world, capturing the 36th rank, as per the Brand Finance study. The brand

value of SBI increased from US$ 1.5 billion in 2009 to US$ 4.6 billion in 2010.ICICIBank also

made it to the Top 100 list with a brand value of US$ 2.2 billion. The total brand value of the

20Indian banks featured in the list stood at US$ 13 billion.

Department of M.B.A, AIT, Chikmagalure Page | 2

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

Following the recent financial crisis, new deposits have gravitated towards the public

sector banks. According to RBI's 'Quarterly Statistics on Deposits and Credits of Scheduled

Commercial Banks :December 2009, nationalized banks, as a group, accounted for 50.9% of the

aggregate deposits, while State Bank of India and its associates accounted for 23.4%. The share

of other scheduled commercial banks, foreign banks and regional rural banks in aggregated

deposits were 17.1%, 5.5% and 3% respectively. With respect to gross bank credit,

nationalized banks hold the highest share of 50.6% in the total bank credit, with SBI and its

associates at23.8% and other scheduled commercial banks at 17.8%. Foreign banks and regional

,rural bank shad a share of 5.3% and 2.5% respectively in the total bank credit.

The confidence of non-resident Indians (NRIs) in the Indian economy is reviving again.

NRI deposits have increased by nearly US$ 47.8 billion on March 2010, as per the RBIs June

2010 bulletin. Most of this has come through Foreign Currency Non-resident (FCNR) accounts

and Non-resident External Rupee Accounts. Foreign exchange reserves were up by US$ 1.69

billion to US$ 272.8 trillion, for the week ending June 11, on account of revaluation gains.

June 21,2010

Department of M.B.A, AIT, Chikmagalure Page | 3

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

CHAPTER 2

COMPANY PROFILE

CanaraBank :

A good bank is not only the financial heart of the community, but also one with an obligation of

helping in every possible manner to improve the economic conditions of the common people

2. a. BACKGROUND AND INCEPTION OF THE COMPANY

Canara Bank was founded by ShriAmmembalSubbaRaoPai, a great visionary and philanthropist,

in July 1906, at Mangalore, then a small port in Karnataka. It was started as 'Canara Bank Hindu

Permanent Fund’s in 1906. This small seed blossomed into a limited company as' CanaraBank

Ltd .' in 1910 with its head office in Bangalore. The Bank has gone through the various phases of

its growth trajectory over the hundred years of its existence. In1958, the Reserve Bank of India

(RBI) ordered Canara Bank to acquire G. RaghumathmulBank,in Hyderabad. This bank had

been established in 1870, and had converted to a limited company in 1925. At the time of the

acquisition the bank had five branches. The growth of Canara Bank was phenomenal, especially

after nationalization by the Government of India along with 13 other major banks in the country

in the year 1969.It has attained the status of a national level player in terms of geographical reach

and clientele segment . In 1976, Canara Bank inaugurated its 1000th branch.

Eighties was characterized by business diversification for the Bank. In the year 1985 Canara

Bank opened its first overseas office in London and also established a subsidiary in Hong Kong,

Indo Hong Kong International Finance Ltd and opened its third foreign branch, this one in

Shanghai. It has established in the areas of mutual funds, venture capital and factoring .It is the

First Bank to be conferred with ISO 9002 certification for one of its branches in Bangalore and is

the maiden bank to start Initial Public Offering (IPO). It has launched internet and

mobile banking services.

Department of M.B.A, AIT, Chikmagalure Page | 4

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

In June 2006, the Bank completed a century of operation in the Indian banking industry. This

event full journey of the Bank has been characterized by several memorable milestones. Today

,Canara Bank occupies a premier position in the comity of Indian banks. With an unbroken

record of profits since its inception, Canara Bank has several firsts to its credit. These include

Launching of Inter-City ATM Network

Obtaining ISO Certification for a Branch

Articulation of Good Banking Bank’s Citizen Charter

Commissioning of Exclusive Mahila Banking Branch

Launching of Exclusive Subsidiary for IT Consultancy

Issuing credit card for farmers

Providing Agricultural Consultancy Services

Over the years, the Bank has been scaling up its market position to emerge as a major 'Financial

Conglomerate' with as many as nine subsidiaries/sponsored institutions/joint ventures in India and

abroad

Can fin Homes Limited

Can bank Factors Limited

Can bank Venture Capital Fund Limited

Can bank Computer Services Limited

Gilt Securities Trading Limited

CanaraRobeco Asset Management Company Limited

Can bank Financial Services Limited

Canara HSBC Oriental Life Insurance Company Limited

As at March 2010, the Bank has further expanded its domestic presence, with 3043 branches

spread across all geographical segments. Keeping customer convenience at the forefront, the

Bank provides a wide array of alternative delivery channels that include over 2000 ATMs- one

of the highest among nationalized banks- covering 728 centers, 1959 branches providing Internet

Department of M.B.A, AIT, Chikmagalure Page | 5

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

and Mobile Banking (IMB) services and 2091 branches offering' Anywhere Banking' services.

Canara bank made a partnership with UNEP to initiate a successful solar loan program. It was a

four-year $7.6 million effort, launched in April 2003 to help accelerate the market for financing

solar home systems in southern India.

Canara Bank had a major IT initiative to network all branches and move them to a single

software platform. Canara Bank chose Flex cube from I-flex solutions as the application. The

Bank entered into an agreement with IBM for rolling out flex cube to over 1000 branches as part

of Phase I. The all India network of Canara Bank boasts of multiple branches in all the

major cities like Chennai, Pune , Bangalore, Mumbai, New Delhi, Gurgaon , Kolkata, Lucknow

and Hyderabad. The Canara Bank official site gives us an ATM and branch locator that can give

you the exact location and address of your nearest Canara Bank branches and ATM's

2. b. NATURE OF THE BUSINESS CARRIED

Canara Bank is a Public Sector Company undertaking which is running under the Administrative

Control of Govt of India. The total share capital is Rs 410 crores of which government capital is

300 crores, others Rs 110 crores and, the total business of the Bank reached 403,986 crore.

Canara Bank was ranked at 1299 in the Forbes Global 2000 list.

Canara bank offers its services to the industry, NRI’s and all the classes of people such as

Personal Banking, Corporate Banking, NRI banking, Priority credit and other services etc. It has

come to the forefront of the commercial and financial services and established a leadership in the

financial services. The Bank has also carved a distinctive mark, in various corporate social

responsibilities, namely, serving national priorities, promoting rural development, enhancing

rural self-employment through several training institutes and spearheading financial inclusion

objective.

Department of M.B.A, AIT, Chikmagalure Page | 6

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

2. c. VISION , MISSION AND QUALITY POLICY

VISION

“To emerge as a Best Practices Bank by pursuing global benchmarks in profitability, operational

efficiency, asset quality, risk management and expanding the global reach.”

MISSION

“To provide quality banking services with enhanced customer orientation, higher value creation

for stakeholders and to continue as a responsive corporate social citizen by effectively blending

commercial pursuits with social banking”.

QUALITY POLICY

To remove Superstition and ignorance.

To spread education among all to sub-serve the first principle.

To inculcate the habit of thrift and savings.

To transform the financial institution not only as the financial heart of the community but

the social heart as well.

To assist the needy.

To work with sense of service and dedication.

To develop a concern for fellow human being and sensitivity to the surroundings with a

view to make changes/remove hardships and sufferings

Department of M.B.A, AIT, Chikmagalure Page | 7

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

2. d. PRODUCTS AND SERVICES OF CANARA BANK

(Table 1)

Personal Banking Corporate Banking NRI Banking Priority and SME

Credit

Savings and Deposits Account and deposits Deposits Products Schemes

Loan Products Cash Management Loan and Advances SME Business

Service

Technology Product Loan and Advance Remittance Facilities RRB Division

Mutual Funds Syndication Service Consultancy Service Agri- Marketing

Insurance Business IPO Monitoring Other Service Agri – Consultancy

Activity

International Service Merchant Banking Rural Development

Service

Card Service TUF schemes Social Banking

Consultancy Service Canara e-tax CED for Women

Depository Service One time settlement

for M and S E

Ancillary Service

Department of M.B.A, AIT, Chikmagalure Page | 8

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

Personal Banking (Table 2)

Deposits 2 Loan products 3Credit service 4Consultancy

Current account Housing loan Cash credit for Tax assistance

working capital service

Fixed deposits Home improvement loan Bill discounting Trustee service

private and charitable

Recurring deposits Canara cash (shares) Bank guarantee Debenture trusteeship

Kamdhenu deposits Canara mobile vehical Loan for SME’s Security trusteeship

Canara Flexi Deposit Canara site loan Finance to SSI’s Attorney ship

Savings bank gold Teacher’s loan Agricultural loan Estate and will

service

Canara champ Canara budget-Personal

deposit scheme loan

Canarasaral savings Canara pensions

account

Canara tax saver Canara rent

scheme

Ashraya deposit Canara Trade

scheme

Canara bank Auto Canara mortgage

Renewal deposit

Canara super savings Doctor’s choice

salary account

Savings Deposits Education loan

Swarna loan

5 card service 6 Mutual funds 7Ancillary service 8 Other service

Canaravis a classic CanaraRobecoMFproduct Safe deposit lockers Insurance (life and

Department of M.B.A, AIT, Chikmagalure Page | 9

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

general)

Canara global gold Safe custody Technology

card services products(ATM)

Canara corporate 7day banking Depository service

DD shoppe

Extended banking

hrs

Corporate Banking (Table 3)

Account and deposits Cash management Loans and advances Other service

service

Current deposits Super fast service Term loans Canara e-tax

Fixed deposits Bulk collection Gold card scheme for TUF scheme

service exporters

Kamdhenu deposits Fast track service Infrastructural Merchant banking

financing service

Recurring deposits Working capital IPO Monitoring

finance activity

Export finance Syndication service

Department of M.B.A, AIT, Chikmagalure Page | 10

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

NRI Services (Table 4)

Deposits Loans and Remittance Consultancy Other service

products advance facilities service

NRE (non- Housing loan CAN bank remit NRI consultancy Safe custody

resdident money scheme

external rupee)

account

NRO(non- Home Bank Western Safe deposit

resident improvement union remittance locker

ordinary) loan scheme

account

FCNR (foreign CAN jewel Swift Nomination

currency non facility

resident) account

CAN cash Rupee drawing Investment

(shares) arrangement

CAN mortgage Attorney ship

service

CAN mobile NRI service

(vehicle) centre

CAN site Facilities for

Returning

Indians

Loan against

deposits

Department of M.B.A, AIT, Chikmagalure Page | 11

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

Priority Credit Finance (Table 5)

Agriculture and Education loan and RRB Division Rural Others

rural credit scheme other priority sector Development

loan scheme

Kisan credit card Loan for students Pragatigrameen Rural clinic GOVT.

bank service Sponsered

scheme (SJSRY

and SGSY)

Loan for agri-clinics LaghuUdyami South Malabar Rural service Lead bank

credit card scheme Gramin bank Volunteer scheme initiative 26 dist

Minor irrigation Loan for retail ShreyasGramin Jalyoga scheme SME Business

loan traders bank unit

Farm development Loan for solar HarikalyanaYojna SEM marketing

loan Water Heating unit

system

Gold loan for Direct financing to Rural Resources Agri-Business

agricultural purpose SHG’s Development Marketing Unit

KisanTatkal Lending to MCG’s Mobile Sale Van Agri-

(for helping Consultancy

women service

entrepreneur in

marketing)

KrishiMitra cards Finance to CED for women

scheme NGO/MFI for on

lending to SHG

General credit card Social Banking

Department of M.B.A, AIT, Chikmagalure Page | 12

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

2. e. AREAS OF OPERATION

Over the years, Canara Bank has a reputation as a top quality service provider to its customers

and it believes in the centricity of its customers. Canara Bank of India has a network of

3046 branches, spread over 25 States/4 Union Territories of the country .It has its Head office in

Bangalore along with 34 circle offices and 1 international division. The bank also has

international presence in several centers, including London, Hong Kong, Moscow, Shanghai

,Doha, and Dubai. In terms of business it is one of the largest nationalized commercial banks in

India. Canara Bank has international division which supervises the functioning of its various

foreign departments to give the required thrust to foreign exchange business especially exports

and to meet the requirements of NRI’s

2. f. OWNERSHIP PATTERNS

The board consists of a whole time Chairman and Managing Director and two executives

director and one director representing Govt. of India and one representing Reserve bank of India

and four part times Non-official Director. Canara bank is a public sector undertaking

(PSU),73.17% of its share his held by Govt. of India and mutual fund/other institutions 5.75%

private corporate bodies 3.33% and public ownership is 17.75%. The bank is listed NSE, BSE

and Bangalore Stock Exchange

Department of M.B.A, AIT, Chikmagalure Page | 13

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

Ownership Pattern of Canara Bank (Table 6)

Category Number of shares %of equity

Promoters central govt./state govt 300000000 73.17

Institutional Investors

Mutual funds/UTI 8070610 1.96

Financial institutions 420940 0.10

Insurance companies 31064973 7.58

Foreign Institutional Investors 47581514 11.61

Non institutions Bodies corporate 1983985 0.48

Individuals –Individual shareholders 2006041 4.89

holding

nominal share capital uptoRs. 1 lakh.

Individual shareholders holding nominal 489984 0.12

Share capital in excess of Rs. 1 lakh

Trusts 5560 0.00

Clearing Members 74085 0.02

Non-resident

India 252308 0.06

Total 410000000 100

Department of M.B.A, AIT, Chikmagalure Page | 14

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

Ownership pattern of Canara Bank

central/state Govt. mutual funds/UTIs financial instn./Insurance cos Foreign Instnl. Investors

Bodies corporate Indian public NRI/OCB Trusts

(figure 1)

0% 0%

0%

5%

12%

central/state govt

mutual funds/uti

8% financial instn/insurance cos

foreign instnl,investors

3% bodies corporate

indian public

NRI/OCB

72% Trusts

Department of M.B.A, AIT, Chikmagalure Page | 15

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

2. g. COMPETTIORS INFORMATION

1 State Bank of India:

The State Bank Group, with over 16000 branches, has the largest branch network in India and the

bank has 141 overseas offices spread over 32 countries. State Bank of India is one of the Big

Four Banks of India with ICICI Bank, Axis Bank and HDFC Bank.The State bank of India is

29th most reputable company in the world according to Forbes. The products of the bank are

Loans Credit Cards, Savings ,Investment, vehicles, SBI Life Insurance etc

2 ICICI Bank:

It is India's largest private sector bank by market capitalization and second largest overall in

terms of assets. The Bank also has a network of 1,640 branches and about4,816 ATMs in India

and presence in 18 countries, as well as some 24 million customers. ICICI Bank offers a wide

range of banking products and financial services to corporate and retail customers through a

variety of delivery channels. ICICI Bank is also the largest issuer of credit cards in India.

3 Bank of India:

It was established on 7 September 1906 is with its headquarters in Mumbai. Government-owned

since nationalization in 1969, It is one of India's leading banks, with about 3101 branches

including 27 branches outside India. Bank of India is a founder member of SWIFT (Society for

Worldwide Inter Bank Financial Telecommunications) in India which facilitates provision of

cost-effective financial processing and communication services.

Department of M.B.A, AIT, Chikmagalure Page | 16

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

2.h. INFRASTRUCTURAL FACILITY

Canara bank is located in the centre of the city where the bank has multi-floor building

where it has separate partition for all the departments.

The bank is fully computerized and well furnished with air condition facility to the

employees

The bank provides medical facilities to its employees

It also provides educational facility to the employees and their children.

The bank also provides vehicle faculty or traveling allowances to their employees

The bank also has provided with quarters facilities to its employees (officers).

The bank has established its own training centre to develop the employee knowledge,

skill & attitude.

Department of M.B.A, AIT, Chikmagalure Page | 17

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

2.i. Organization Structure of Canara Bank (figure 2)

Board of Directors

Chairman

Managing Director

Executive Director

General Manager

Deputy General Manager

Assistant General Manager

Chief Manager

Senior Manager

Manager

Officers

Clerical Staff

At tenders

Department of M.B.A, AIT, Chikmagalure Page | 18

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

Work Flow Model For Loan Section (figure 3)

Account holder

Request for loan to the

Branch

Approval /Rejection by the

Branch / C.O/ H.o

Figure 3 :- The loan sanction process

The bank has a two way approach in its work flow pattern. Let’s consider a loan sanction model

,the person who requires the loan needs to fill an application and submit it to the

respective branch authority. Each branch has certain limitations regarding the loan amount; bank

needs to check the authentication of the details and information produced by the party. Loan can

be sanctioned only if the securities pledged are valid and are free from legal considerations.

The loan is sanctioned by the bank authorities if the requirements are fulfilled; else if the loan

mount is exceeding the limits of the branch, the request is forwarded to the circle office or

the23head office. The circle or the head office verifies and approves or rejects the proposal. The

order (approved/rejected) is sent back to the respective branch, and hence sent to the person. The

figure above provides a clear understanding of the same

Department of M.B.A, AIT, Chikmagalure Page | 19

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

2.j. AWARDS/ACHIEVEMENTS

First National Award, instituted by the Ministry of Micro, Small & Medium Enterprises,

Govt. of India for 'Excellence in Micro & Small Enterprises (MSE) Lending 'for 2006-07.

Golden Peacock Award for Corporate Social Responsibility for the year 2007. Canara Bank is

the first PSB to receive the award since its institution in the year 1991.

Golden Peacock National Training Award-2007 instituted by the Institute of Directors, New

Delhi, a pioneer in Quality Revolution.

Conferred the Business Super brands Status for 2008.

The Organization of the Year Award- for PR Excellence instituted by Public Relations

Council of India.

Excellence in the field of Khadi& Village Industries in South Zone for the year 2006-

07,instituted by Khadi& Village Industries Commission, Ministry of Micro, Small &

Medium Enterprises, Government of India.

Received during 2008-09Conferred First Rank in India s Best Banks awards under the

category Strength and Soundness for 2006-07 by a survey conducted by Ernst & Young.

Best Performing Bank under Rural Employment Generation Programme , (REGP) of Khadi

and Village Industries Commission (KVIC), in South Zone for the year 2007-

08,instituted by the Ministry of MSME, Government of India

. Golden Peacock National Training Award 2008 for excellence in training.

Global HR excellence in Training , an award conferred by the Asia Pacific HR Congress ,the

largest rendezvous of HR Professionals, at its Employer Branding Talent Management

Congress held on 22nd and 23rd August 2008, Delhi.

Best Corporate Social Responsibility Practice Award, instituted by BSE, NASSCOM and

Times Foundation

The Bank won two Silver Corporate Collateral Awards for Best Corporate Ad in the Print

Media and Best Corporate Film on Corporate Social Responsibility at the Public Relations

Council of India Awards 2009.

Department of M.B.A, AIT, Chikmagalure Page | 20

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

Best Bank in South Zone Award for the year 2008-09 in respect of lending under KVIC and

PMEGP Schemes. The award was handed over by Dr.Manmohan Singh, Honorable

Prime Minister of India

The Bank received the Credit Guarantee Approval Certificate issued by CGTMSE from

ShriPranab Mukherjee, Honorable Finance Minister of India

2.k. FUTURE GROWTH AND PROSPECT

The Bank aims to reach an aggregate business figure of Rs.5 lakh crore, comprising total

deposits of Rs.285000 crore and advances of Rs.215000 crore.

The Bank will continue to focus on core business, with the objective of

augmenting profits and profitability.

Expanding global footprints, the Bank is likely to open a Representative Office at Sharjah

shortly in addition to RBI approval already obtained in 9 international centres.

Targets to achieve 100% CBS coverage by June 2010

The Bank has plans to open over 200 new branches during FY2011

Department of M.B.A, AIT, Chikmagalure Page | 21

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

CHAPTER 3

McKINSEY’S 7s FRAMEWORK

The Mckinsey’s 7s plays a vital role for the success of any organization. There are hard and soft

components. The figure below shows the frame work (.Figure. 4: Mckinsey’sFramewok)

STRUCTURE

STRATEGY SYSTEM

URE

SHAREDVALUE

SKILL

STYLE

STAFF

1 Structure

The design of organizational structure is a downward communication of information in the bank.

The information flows top down, i.e. from top-level management to lower levels. The chairman

and managing director have the sole authority in the organization. They give instructions to the

executive director and the general manager who in turn give instructions to the lower level

managers. The middle level management consists of general manager and company secretary.

Among these departments the General Manager division is very large .It consists of many

sections and sub sections. All sectional heads will communicate or report their

sectional performance or activities regularly to the general manager.

Department of M.B.A, AIT, Chikmagalure Page | 22

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

2 Skills

The important software for the success any organization is the skills of the

employees & of the management. The Canara bank is having highly skilled employees. The

skills of the organization are

Credit Skills:

They face the challenges in improving the asset quality suitable training programs for upgrading

the appraisal & credit monitoring skills, pre-sanction & post-sanction supervision, including

monitoring of stocks, financial statements, etc., will be provided. The rigor of NPA discipline &

provisioning will only increase in the days to come & they have to equip themselves for this task.

Technology Skills:

Canara bank is having a very good brand equity & loyalty of customers. Bank has already

introduced product like, Tele-Banking, credit cards, ATMs etc., cross selling of other financial

services like insurance, mutual funds, government securities. Increasing non-funding come,

personal segment advances & trades finance in order to improve the profitability & to make

growth in business volumes more sustainable .Importance has also been given to areas like low

cost deposits, NPAs/AUCs recovery & reduction in operating expenses to improve efficiency of

their operations.

Operating Skills:

Bank has to increasing non-fund income, personal segment advances & trades finance in order to

improve the profitability & to make growth in business volumes more sustainable.

Importance has also been given to area like low cost deposits, reduction in operating expenses

taken sufficient measures to identify measure, monitor & manage various risks associated with

the Banking business in the areas of credit, interest rate & liquidity

Department of M.B.A, AIT, Chikmagalure Page | 23

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

3 Style

The style of an organization according to the Mckinsey framework becomes evident through

the pattern of actions taken by members of top management team over a period of time.

Leadership Style in Canara Bank

It has been observed in the Canara bank that the behavior of superior towards the subordinate

is pleasant. They motivate fresher who are working under them. The superior tells subordinates

what exactly he has to do. The object of the work is clearly defined to them. Otherwise the

superior councils the subordinate, superiors who act as leaders conduct meetings,

discussions, presentation etc, on regular basis and take suggestions and ideas given by

subordinates. The leader takes the final decisions only. This style of leadership is called

conservative leadership

4Strategy

Strategy indicates a specific program of action for achieving the organization objectives by

efficiently employing the firms resources. It involves preparing oneself for meeting unforeseen

factors. It is also concerned with meeting the challenges posed by the policies and actions

of other competitors in the market. The policies are operational efficiency , asset quality, and

also in risk management

5 Systems

Training System :

The Bank under various categories were imparted training in diverse functional areas such as

assets liability management, consumer credit, housing finance, retail finance Recovery, trade

finance. The Bank adopts its own training system with the help of their training centers. Training

mainly helps with updating skills, knowledge improvement etc

Department of M.B.A, AIT, Chikmagalure Page | 24

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

Technology System:

The bank has initiated business process re-engineering with an effort to stay at the top in the

competition. It has enabled Core-Banking Service, has its own Cheque Processing unit, and has

initiated installation of ATM’s in all the areas. The Bank has taken necessary steps to implement

structured financial messaging system(SFMS) a modularized software solution for financial

message communication in a highly secured environment.

Recruitment & Selection System:

The sources of recruitment at the organization in the form of both external & internal. The Bank

follows the recruitment & selection processes that are commonly followed by public sector

Banks.

Systems and Procedures:

Many systems and procedures in the Bank were received re-oriented and simplified during the

year without diluting any controls. Noteworthy among the initiatives were revision/updating of

all ten credit manuals, rationalization of entire applications in retail lending schemes,

simplification of documentation against valuable securities, rationalization of printing supply

and usage of forms, pilot implementation of single window system at select branches revision of

DD payment procedures & streamlining of procedures or scanning of signature at branches

6 Staff

The bank is motivated to harness the unique assets of the human resources for growth of the

institution and to imbibe team spirit for self and mutual development among bank’s staff.

The bank has made inroads towards establishment of quality circle concept among its employees.

Training & Development Canara bank has been a fore runner in establishment of its own training

college at Bangalore,supported by 13 regional training centers spread over length & breadth of

the country. These centers take care of knowledge, skill & attitudinal development of the

employees.

Department of M.B.A, AIT, Chikmagalure Page | 25

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

7 Shared values

Improve market share on rural & semi-urban markets.

Increase number of performing branches and eliminate below performing branches.

To develop competent and vibrant human work force.

To develop the competencies and skills of the employees through training (Internal

&external) and other HRD measures.

To improve the work environment in the bank through welfare measures and healthy

Industrial relations.

To encourage employees to share knowledge and information about the various activities

in the bank through the House Magazine and other publications.

To encourage employees for implementation of office language in their day to day work.

The wing will continually improve all the processes involved during the performance

of the above functions for Total satisfaction of customer´ (Internal) by implementing

quality management system requirements of all personal of the Bank as

per IS/ISO9001:2000

Department of M.B.A, AIT, Chikmagalure Page | 26

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

CHAPTER 4

SWOT ANALYSIS

The bank had envisioned to not only offer financial services but also fulfill social causes

such as removal of superstitions and ignorance, promotion of habit of saving, providing

assistance to the people in need and develop a sense of humanity among the people.

Strengths

It is the first bank in India to have launched Inter-City ATM network

It is the first bank to have been awarded ISO Certification for providing credit card

for farmers for the first time in India along with offering Agricultural Consultancy Services

It has established more than 3500 branches across the nation as of March of 2010.

it has the maximum number of ATM installations among all the nationalized banks

summing up to more than 2000 of them at 698 centers

1959 branches of the bank provide Internet and Mobile Banking (IMB) services

Anywhere Banking services are being provided at 2091 of its branches

All the branches of Canara Bank are enabled with Real Time Gross Settlement (RTGS)

and National Electronic Fund Transfer (NEFT) transaction facilities

Bank also offers Personal Banking Services, Corporate Banking Services, NRI

Banking Services and Priority & SME Credit Services

Weakness

Still sticks to most of the traditional banking systems

Requires training program due to introduction of many new schemes & technologies

Weak research team

Staff take time to get adjusted to the new inventions

It provides less facilities to the employee when compare to other banks

Department of M.B.A, AIT, Chikmagalure Page | 27

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

Opportunities

To improvise on mutual funds, to lead the banks into MF transactions

To adapt to the new technological inventions, to stay at the top in the competitive market

To provide enough training facilities to the staff, to deliver efficient & effective services

To provide extra privileges to the customers to maintain & retain customers

To attract customers with good loan offers at very impressive rates, against the

competitors.

To be aware of the changes in the market, & provide space for instantaneous changes

Conducting road shows twice or trice in a year under head office guidance in circle office

to promote banking products to customer

Threats

Establishment of private banks, increasing the competition

Introduction of new technologies in the new banks with high infrastructure

Innovative interest rates & attractive customer care services by other banks

Adoption of many technologies & banking systems from abroad

Very efficient research team, who are always tracking the new inventions in the market

Most of the private banks provide 24hrs facility

Department of M.B.A, AIT, Chikmagalure Page | 28

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

CHAPTER 5

Financial statement

Ratios ForCanara Bank (Table 7)

Mar' Mar'

12 11

PER SHARE RATIOS

Adjusted E P S (Rs.) 74.08 90.87

Adjusted Cash EPS (Rs.) 77.62 94.28

Reported EPS (Rs.) 74.10 90.88

Reported Cash EPS (Rs.) 77.64 94.29

Dividend Per Share 11.00 11.00

Operating Profit Per Share (Rs.) 76.06 89.40

Book Value (Excl Rev Res) Per Share 465.57 405.00

(Rs.)

Book Value (Incl Rev Res) Per Share 512.19 452.37

(Rs.)

Net Operating Income Per Share (Rs.) 730.06 552.37

Free Reserves Per Share (Rs.) 229.02 202.26

PROFITABILITY RATIOS

Operating Margin (%) 10.41 16.18

Gross Profit Margin (%) 9.93 15.56

Net Profit Margin (%) 9.76 15.65

Adjusted Cash Margin (%) 10.22 16.23

Adjusted Return On Net Worth (%) 15.91 22.43

Reported Return On Net Worth (%) 15.91 22.43

Return On long Term Funds (%) 132.08 112.95

LEVERAGE RATIOS

Long Term Debt / Equity 0.00 0.00

Department of M.B.A, AIT, Chikmagalure Page | 29

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

Total Debt/Equity 15.86 16.39

Owners fund as % of total Source 5.93 5.75

Fixed Assets Turnover Ratio 0.09 5.22

LIQUIDITY RATIOS

Current Ratio 0.96 0.81

Current Ratio (Inc. ST Loans) 0.02 0.02

Quick Ratio 29.11 30.86

Inventory Turnover Ratio 0.00 0.00

PAYOUT RATIOS

Dividend payout Ratio (Net Profit) 17.28 14.09

Dividend payout Ratio (Cash Profit) 16.49 13.58

Earning Retention Ratio 82.72 85.91

Cash Earnings Retention Ratio 83.51 86.42

COVERAGE RATIOS

Adjusted Cash Flow Time Total Debt 95.11 70.38

Financial Charges Coverage Ratio 0.20 0.34

Fin. Charges Cov.Ratio (Post Tax) 1.15 1.27

COMPONENT RATIOS

Material Cost Component(% earnings) 0.00 0.00

Selling Cost Component 0.08 0.09

Exports as percent of Total Sales 0.00 0.00

Import Comp. in Raw Mat. Consumed 0.00 0.00

Long term assets / Total Assets 0.92 0.92

Bonus Component In Equity Capital (%) 0.00 0.00

Department of M.B.A, AIT, Chikmagalure Page | 30

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

Profit & Loss ForCanara Bank (Table 8)

Mar' 12 Mar' 11

Income :

Operating Income 32,341.82 24,470.09

Expenses

Material Consumed 0.00 0.00

Manufacturing Expenses 0.00 0.00

Personnel Expenses 2,973.09 2,954.84

Selling Expenses 26.67 24.38

Adminstrative Expenses 2,811.16 2,289.91

Expenses Capitalised 0.00 0.00

Cost Of Sales 28,972.23 20,509.87

Operating Profit 3,369.60 3,960.22

Other Recurring Income 1,281.52 1,253.90

Adjusted PBDIT 4,651.12 5,214.12

Financial Expenses 23,161.31 15,240.74

Depreciation 156.89 151.36

Other Write offs 0.00 0.00

Adjusted PBT 4,081.71 5,025.44

Tax Charges 800.00 1,000.00

Adjusted PAT 3,281.71 4,025.44

Non Recurring Items 1.00 0.45

Other Non Cash adjustments 0.00 0.00

Reported Net Profit 3,282.71 4,025.89

Earnigs Before Appropriation 3,282.71 4,025.89

Equity Dividend 487.30 487.30

Preference Dividend 0.00 0.00

Dividend Tax 80.00 80.00

Retained Earnings 2,715.41 3,458.59

Department of M.B.A, AIT, Chikmagalure Page | 31

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

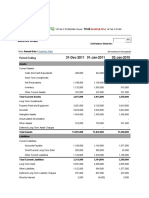

Balance Sheet for Canara Bank (Table 9)

Mar' 12 Mar' 11

SOURCES OF FUNDS

Owners' Fund

Equity Share Capital 443.00 443.00

Share Application Money 0.00 0.00

Peference Share Capital 0.00 0.00

Reserves & Surplus 20,181.82 17,498.46

Loan Funds

Secured Loans 0.00 0.00

Unsecured Loans 327,053.73 293,972.65

Total 347,678.54 311,914.11

USES OF FUNDS

Fixed Assets

Gross Block 4,858.37 4,686.15

Less: Revaluation Reserve 2,065.14 2,098.36

Less: Accumulated 2,000.84 1,841.74

Depreciation

Net Block 792.40 746.05

Capital Work-in-progress 0.00 0.00

Investments 102,057.43 83,699.92

Net Current Assets

Current Assets, Loans & 8,576.01 6,359.15

Advances

Less : Current Liabilities & 8,891.12 7,804.64

Provisions

Total Net Current Assets -315.11 -1,445.49

Department of M.B.A, AIT, Chikmagalure Page | 32

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

Miscellaneous Expenses not 0.00 0.00

written

Total 102,534.72 83,000.48

Note

Book Value of Unqouted 0.00 0.00

Investment

Market Value of Qouted 0.00 0.00

Investment

Contingent liabilities 202,552.87 140,847.47

Number of Equity shares 4,430.00 4,430.00

outstanding (in Lacs)

Interpretation

The reserves and surplus are increasing ,it indicates good performance of the bank

(20,181.82 in 2012 and 17,498.46 in 2011).

Investment are increasing it provides sources of income to the bank (102,057.43 in 2012

and 83,699.92 in 2012).

Bank not have optimum level of current asset it indicates difficult to discharge the

liability (-315.11 in 2012 and -1,445.49 in 2011)

Accumulated depreciation is increasing indirectly profit to the bank . bank can get tax

benefits (2,00.84 in 2012 and 1,841.74 in 2011)

Current liabilities and provision is increased compared to previous year it is burden to the

bank (8,89.12 in 2012 and 7,804.64 in 2011)

Department of M.B.A, AIT, Chikmagalure Page | 33

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

CHAPTER 6

LEARNING AND EXPERIENCE

Project training conducted for 10 weeks helped to gain a lot of practical experience. The data has

been collected by interacting with the external guide and employees of the company.

The project has helped me to know the importance of agriculture loan, what is the procedure of

agriculture loan, performance of agriculture loan in last 3 years, how information technology and

various system have reduced the time of an activity and documentation, how different employees

have different skills, talent, ability etc.,, and how they are being utilized in optimum manner in

achieving organization goals. It also helped me to get to know how decision are communicated,

the flow of decision process in recovery of agriculture loan .

Department of M.B.A, AIT, Chikmagalure Page | 34

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

CHAPTER 7

General Introduction:

Finance is an essentially requirement for every productive activity. Agriculture is no exception to

it. Its importance in India needs no further emphasiswith agriculture being most predominant

sector in the economy even today. Indian agriculture is the largest private sector enterprise in the

country of over 100 million farmers.

It is also the major sources of income of the people. It also provides employment opportunities to

the large number of people in the country. Agriculture not only provides job opportunities &

employment to the people but its role is more significant in so for as the generation of

employment opportunities are concerned.

Banking sector in India plays a vital role in the development of the Indian economy by providing

the financial assistance to the needy persons of the India.

The users of credit service are heterogeneous & include farmers, households, planters, petty

businessmen’s, agri-business entrepreneurs , non -farm micro enterprises & dairy enterprises,

who demand for short term working capital as well as long term investment loan and also

consumption loans. The Canara Bank is one such major bank in the banking fraternity which is

offering this kind of credit facilities to agricultural sector.

Indian credit facilities characterized by a variety of finance service it may be micro or macro

finance facilities. Availing these credit facilities includes various procedure and compliance to

policies stipulated by the competent authorities.

Credit is a key factor in agricultural development. In the context of technological up gradation &

commercialization of agriculture which is envisaged in the coming years. It is necessary that

credit support to agriculture sector is stepped up considerably.

Department of M.B.A, AIT, Chikmagalure Page | 35

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

a. Statement of the problem:

The study on recent trend in financing to agriculture is taken up in order to know what variation

are happened in financing from the Canara bank , shimoga for past 3 years. Particularly this

topic is take for the study as agriculture is important for the development of the Nation.

b. Objectives of the Study

The primary objective of the study carried out in canara bank is to gain knowledge about

lending of loans for agriculture sector.

To study the progress and movement of Agriculture lending of the bank during past 3

years

To study which of the loan scheme is having more demand among the various type of

agriculture loan offered by the canara bank

To study the criteria like interest rate , repayment period, recovery, security, etc., which

are significant while considering sanctioning of agriculture loans.

c. Scope of the study

The scope of the study is restricted to Shimoga region and helps to create awareness about

the variety of agriculture loan products offered by the Canara Bank and performance in the

last 3 years in shimoga . This study was mainly concentrated on agriculture credit facility

being adopted by the Canara bank. The procedure followed by the bank to give advances

and further actions for satisfying the requirement of customer .

Department of M.B.A, AIT, Chikmagalure Page | 36

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

The procedure for give the advance will influence more on the profit of the canara bank .

So the study of agriculture credit facility has vital role to understand the efficient system of the

bank.

d. Methodology

The data collection for the study based on survey method employing both primary &

secondary.

Primary data: primary data is collectedthrough personal interview with the manger ,and

officials.

Secondary data: The data is collectedthrough bank website, annual reports of the bank and

canara bank loan manual, journals , magazines of the bank.

Tools for data analysis: Data analysis is done with the help of graphs.

e. Limitation of the Study

The study has focused on the borrowers of village but the study reflects the silent feature

& problems of the borrower & the agriculture people in the study area.

Due to lack of time it was not possible to make a broad study on the credit

policies.

Lack of information due to busy schedule of the work in the bank.

More information based on secondary sources due to every short period given for

the collection of the information.

Department of M.B.A, AIT, Chikmagalure Page | 37

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

In information agricultural credit has less important role of play because credit is used

for maintenance rather than expanding agriculture activities, credit is used for storage, marketing

& processing of the agriculture surplus for the purpose of ensuring steady supply to consumer

throughout the year.

In modern agriculture the high quantum of credit is needed. Various short term cash

inputs like use of improved seeds, fertilizers, medium & long term investment for irrigation, land

improvement etc

f. THEORETICAL FRAME WORK

Introduction

India in predominantly an agriculture country. A vast majority of people i.e. 82% use to

live in villages70% of people directly as indirectly depend on agriculture for their livelihood. On

the accounts of rural indebtedness the farmers are not able to provide their own funds finance for

the development of agriculture.

Agriculture finance in essential service which is much needed for development of

enterprises and establishment in the field of agriculture.

Agricultural credit is an integral part of the process of modernization of agriculture and

commercialization of the rural economy. The introduction of easy and cheap credit is the

quickest way for boosting agricultural production. Therefore it was the prime policy of all the

successive government to meet the credit requirement the farming community.

Credit is the back bone for any business and more for agriculture which has traditional

been a non monetary activities for the rural population.

Agriculture as a sector depends more on credit than any other sector of economy because

of the seasonal variation in the farmers returns and changing trend from subsistence to

commercial farming.

Department of M.B.A, AIT, Chikmagalure Page | 38

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

In traditional agriculture credit has been important role to play because credit is used for

maintained rather than expanding agriculture activities, generally, credit is used for storage,

marketing and processing of ensuring steady supply to consumers throughout the year. Besides

these needs the credit is also used to meet the case requirement of the cultivators.

On other hand, in modern agriculture the high quantum of credit is needed various short term

cash inputs like use of improved seeds, fertilizers ,etc,. The modern agriculture also requires co-

ordinations of various activities like appropriate estimate of credit, timely and adequate supply of

inputs repayment arrangement favourable to framers efficient machinery for recovery of loans

adequate marketing accommodations.

So in modern agricultural introduction of institution channels of credit is necessary

further in such cases where credit is required to make a significant impact on agricultural, it is

necessary that the credit machinery should be expanded fastly to meet the growing credit needs

of the cultivator. Formers tended towards replacement of traditional methods of farming with

scientific and developed methods. Due to this the farmers compulsory depends upon borrowed

funds. This cause the increasing demand for disbursing credit to most of the farmers, so in

respect of transformation traditional and importance of the agricultural credit has increased

comparatively more.

Essential Features of Agricultural credit Systems

With a view to fulfil the credit needs of the farmers and to ensure that it serve the national

economy a dynamic factor it is essential that a sound systems of credit should build up such

system should be able to commence the present static credit into dynamic credit. Because the

static credit does not increased the output .Income and assets at the time of maturity i.e. end of

the credit period contrary to it under dynamic of credit a satisfactory increase in output income

and assets may be notified after the maturity of credit. In the other words as credit systems

should be efficient to promote the development.

Department of M.B.A, AIT, Chikmagalure Page | 39

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

The criteria a registered a good credit system for agricultural financial have been

produced by many expert. As for the agricultural credit in concerned it must be provided from

another angle. While dealing with Indian farmers who are uneducated and ignorant in respect of

implication of various aspects of agricultural credit. So, the credit system should be scientific and

flexible, this credit system should also be able to encourage the farmers for increasing their

production and also a higher standard of living. It may be possible by the favourable support

from government and its agencies.

Various criteria for a good credit system

The agricultural credit should be provided for a satisfactory long period and it should

commensurate with the operational for which it is desired to facilitate.

It should be provided at lower rate of interest.

With a view to present the abuse of credit it should be adequately secured but the security

should not be necessary be material.

The credit should be granted against personal security of the borrowers and on the basis

of farming ability.

Credit should be provided according to the average yield of the farmers and capacity to

repay specially in the times of economic depression.

The credit should be provided through institutions the officials of which have analyzed

special training and have actual banking experience.

Department of M.B.A, AIT, Chikmagalure Page | 40

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

According to RBI agricultural credit system should have following

The credit systems for modern agriculture should integrated the credit with services for

ensuring the arrangement of inputs and service along with credit.

Under the credit systems all areas and farmers should be covered. In other words the

credit system should be so efficient to expanded its activities horizontally as well as

vertically.

Under a good system of credit for modern agricultural emphases should be given to be

for production purposes. But the consumption loans should not be prohibited completely.

In a credit system the cost of handling credit and service should be recovers. In the

absence of this most the farmers will any credit. Which may cause a burden beyond their

repaying capacity.

The credit system should be such which mobilises sufficient resources to provided

finance for purpose of investment required for modern agriculture.

Some feature of a sound agricultural credit system has been determined by the All-

India Rural Credit Survey Committee. These includes,

It should have the strength of adequate resources and of well trained personnel.

It should be an effective alternative to the private agencies of credit.

It should lend not merely on security of land and other usual forms of security but also on

the security of anticipated crops.

It should effectively supervise the use of credit and consequently bear in mind the

borrowers legitimate needs and interest.

Department of M.B.A, AIT, Chikmagalure Page | 41

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

From the above discussion suitable criteria for a good and sound system of agricultural

credit can be given,

All the credit needs- short, medium and long term of the farmers should be net.

Credit should be made available as at near to the door step as possible and where needed

by the farmer.

It should generate savings and accelerates economic growth.

Supply and other services too should be made available to them.

The lending agency should be geared to financing the entire farming system.

The credit agency should be in a position to inter lines with marketing agencies to ensure

full recovery of loans.

Thus, in a good and sound system of agricultural credit there should be a provision of

continuous evaluating of the credit programmes. This respect will assist to estimate

quantitatively the impact on improvement. In respect of farm production, cropping pattern

cropping intensity, farm output employment opportunities and actual farm income, under the

secondary credit system, guidance should be available to credit institutions in this regard from

time to time. In the words of E.C Johnson, The fundamental problems the agricultural credit is to

increased the income of farmers improve their capacity to repay and raise their stand and of

living.

Agricultural finance has to play significant and crucial role in the growth of agricultural so

for the problems of agriculture are concerned they might be put into two categories one is the

institutional problems, another in the technological problems.

NABARD was establish in terms of the preamble to the act for providing credit for the

promotion of agriculture, small scale industries, handcrafts and other allied economic activities

in rural area with a view to promotion integrated rural development and securing prosperity of

Department of M.B.A, AIT, Chikmagalure Page | 42

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

rural area. It took over the function of while agricultural credit development and rural planning

and credit cell of the RBI and ARDC, after the establishment NABARD. The entire under taking

of the ARDC including all business property assets and liabilities, right interest privileges and

obligation of whatever nature have been transferred to and vested in the national bank.

It diverse credit needs of the agricultural and rural credit. The bank is a specified institution

in the field of agriculture credit and in able to tackle the problems arising from integrated rural

development.

The modern and the latest technology of production are essentially required for the purpose of

stepping up production. Irrigational facility is necessary required for the introduction and

applicable of modern sophisticated scientific techniques.

Agricultural credit system in India

The government of India and RBI approved the proposed of CRAFICARD. The parliament

though the act of 1981 approved its setting up the NABARD act was passed by the parliament on

1st December 1981. It came in to existence on July 12 1982 and started functioning with effects

from July 15 1982. The bank was dedicated to the service of the nation by the hobble prime

minister Smt. Indira Gandhi on Nov 5 1982.Storage a rural enterprises for this the bank will

combine in itself the development and financial role.

Credit flow to the agriculture sector as exceeded the targets since, announcement of farm

credit package in 2004 and overall farm credit as expanded despite such expansion on of rural

credit nearly 7.3% of farmers in his country who own been than 2 hectares of land are not

reached by institutional credit.

The CRAFL CARD considered various names for the national bank, namely agricultural

development bank of India rural development bank of India and national bank for agriculture and

rural development.

Department of M.B.A, AIT, Chikmagalure Page | 43

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

Institutional it is concerned with policy planning and operation in the field of agriculture’s in

rural area.

Types of Agricultural Credit Schemes

1.Kisan credit card

Canara bank is the pioneer in implementing credit card schemes for farmers.

The schemes is called as Canara Bank Krishi card schemes and the credit card is renamed

is” Krishi card’.

Purpose

For meeting the cultivation needs of farmers and others and host term requirement including

those of subsidiary / consumption needs.It is an innovative attempt to make the agricultural

credit more easily available to farmers.

Eligibility

Any farmer who are cultivating authorized leased lands are also eligible. The farmer

should not be a defaulter of any financial institution.

Any credit worthy farmer borrowers agricultural credit facility from bank and repayment

is considered eligible for extending credit under the Krishi card scheme.

The farmer should own minimum 2 crore of agricultural land and his production credit

requirement should not be less than Rs. 500/-

Limit of credit

Minimum limit under Krishi card schemes is fixed as Rs 5000 and minimum limit as at Rs.

50000/-.minimum cost of farm equipment and other agricultural expenses included in the loan

amounts.

Department of M.B.A, AIT, Chikmagalure Page | 44

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

Rate of interest

Attractive interest rare 9 to 10% depending on loan amount.

1. General credit card scheme

It advised by RBI to scheduled commercial banks for providing credit facility to area.

Objectives

General Credit Card Schemes has been introduced as important measure in the

area of financial inclusion.

To provide has free credit to rural and semi-urban households without insistence

on security purpose or end use of the credit.

Loan can be sanctioned for any general purpose including that of consumption.

Eligibility

All rural/ semi- urban households are eligible irrespective of their activity whether agricultural

and non agricultural and income level. To meet the obligation on demand in eligible to cover

under the scheme.

2. Quantum of loan

Loan quantum shall be 50% of the net annual income of the entire household maximum limit

is restricted to Rs. 25000/-

Margin

No margin shall be insisted.

Tenability

Limit extended is of overdraft nature tenable for 3 years.

Department of M.B.A, AIT, Chikmagalure Page | 45

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

Security

No security is insisted third party guarantee.

3.KisanSuvidha

Purpose

For meeting the comprehensive credit needs of farmers.

Working capital requirement for crop cultivation expenses, maintenance of farm

machinery/ equipments, non farm sector activities and consumption needs.

Term loans requirement like purchase of agricultural implements land development

purchase of bullocks and carts, purchase of farm machinery, minor irrigation

Eligibility

Agriculturists can avail finance for working capital requirements either under kisan credit

card schemes KisanSuvidha and not under both the schemes

4.CanaraKisan OD

Purpose

To provided a hassle free overdraft facility for working capital expenses of agriculturist

to be incurred for allied activities repairs and replacement of farm machinery and for non farm

sector activities and consumption needs subject to handling of each type of expenses.

The account can also be operated by ATM card or cheque leakers.

Eligibility

Agriculturist having satisfactory repayment record for the past 1 year the scheme is

operational only in select branches of the banks.

Department of M.B.A, AIT, Chikmagalure Page | 46

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

5.KrishiMitra Card Schemes

Objectives

To provided easy credit to individual tenant farmers oral lessees share croppers and

farmers cultivating lands without proper records.

Purpose

Cultivation of crops

Maintenance of animals and farm machinery

Repair and replacement of machinery

Loan quantum

Maximum of Rs. 50000/- subject to scale of finance and a maximum of 50% of the value of the

produce.

Tenability

Extended either as an operative limits with a tenability of 3 years or as single transaction

limit, repayable in 5 years in quarterly or yearly instalments.

Security

Hypothecation of crops

Department of M.B.A, AIT, Chikmagalure Page | 47

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

6.KisanTatkal

Objectives

To provided credit for meeting the post harvest expenses of the farmer who have availed

KCCS loans

Purpose

To meet the expenditure towards storing processing treatment of food grain go down

charges etc.

Loan quantum

Minimum of Rs.1000/-

Maximum of Rs 50000/- but not to exceed 50% of KCCS limits 25% of annual income

Repayment

In 3-5 years in half yearly/ annual instalments

Security

Collateral of security extended to KCCS loans.

7. Gold Loans for Agricultural Purposes:

Objective

To provide loans to farmers for various agricultural purpose against the pledge of gold

jewelleries.

Purpose

To meet all farm requirement of the farmers.

Department of M.B.A, AIT, Chikmagalure Page | 48

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

Loan Quantum

Maximum of Rs.300000/- subject to 80% of the appraised value or per gram.

Repayment

Within 12 months.

Security

Pledge of gold jewelleries.

8. Farm Development Loan

Purpose

Development loan are considered for digging/depending of wells, construction of tanks, ponds,

and repairs thereof, bounding land reclamation, leveling of land, terracing conversion of dry

lands into wet irrigable lands. Development of farm drainage, laying lining irrigation channels,

fencing, construction of farm houses, cattle and poultry sheds and other development activities of

the farm. Where the investment made will result in creation of immovable asset resulting in

increase in the value of land and income of the farmers.

Eligibility

The farmers should be a owner of the land.

The should own an economic land holding with a minimum of 2 acres. However loans

can be considered even if the benefiting area is less than 2 acres provided the farmers is

able to sell the surplus water or the viability of the project is ensured.

Margin

Up to Rs. 50000/- - Nil

Department of M.B.A, AIT, Chikmagalure Page | 49

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

Above Rs.50000/- - 15.25%

In case of land based activities where value of the mortgaged land and building is twice

the exposure for loans above Rs. 50000/- but up to Rs.2 lakh the margin requirement is 10% to

15%.

Security

The following are the security norms,

Up to Rs. 50000/- No Security.

Above Rs. 50000/- Mortgaged of lands property.

General Aspects

For loans granted for land development such as land leveling and other on farm

development the landed property on which the development are proposed to be carried

out are to be mortgaged.

However, if the sanctioning authority feels that is need for additional collaterals

depending on risk factors the same may be insisted for loan above Rs.50000/-.

Department of M.B.A, AIT, Chikmagalure Page | 50

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

9. Crop Loans

Purpose

Crop loans are granted for meeting the cost of seasonal operation to raise crops viz, cost of seeds,

fertilizers, pesticides, irrigation charges, labour charges etc.

Eligibility

The applicant should be either owners cultivator or tenant or share cropper.

Crop loans can be granted to farmers duly ensuring viability.

The applicant should not be a default to any financing agency and generally free

from any outside liabilities..

Crops loans can be granted both under irrigation and rain fed conditions.

The respect of borrowers of land not exceeding Rs. 50000 may be considered on

production of no objection certificate and no over due certificate and same should not

be dated more than 15 days prior to the date of approach.

Department of M.B.A, AIT, Chikmagalure Page | 51

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

Security (Table 10)

Extent Of Limit Security

For crop loan limit up to Rs.50000/- Hypothecation of crops

within the overall agriculture limit of

Rs.65000/-

1. For crop loan limits of above 1. Hypothecation of crops

Rs.50000/-

2. In cases crops loan limits is less than 2. Mortgage of landed property.

Rs.50000/- but overall limit under

agriculture exceeds Rs.65000/-.

Repayment

The period of repayment should always coincide with harvesting and marketing of produce. In

any case, it should not be more than a months in respect of short duration crops of like paddy,

ragi, etc. and 15 months in cases of long duration crops like sugarcane, pineapple, etc. In respect

of coffee crops loan the repayment should be linked within marketing of produce. Normally

coffee crops loans granted during the year are to t be cleared before 30th June of next year.

Department of M.B.A, AIT, Chikmagalure Page | 52

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

10. Special Purpose Agriculture Credit

Purpose

SPAC is to assist farmers for carrying out repair and replacement to the farm machinery vehicle

and implements such as tractor power tillers, pump sets, grain threshers, fishing boats, nets,

bullock carts, machineries, utilized in dairy and poultry farming, loans can also be made

available for purchase of new tyres for tractors, bullock carts fitted with pneumatic tyres. Loans

can also be granted for improving the efficiency of pump sets already installed repayment of

undersized/defective piping system foot value and correcting installation/other defects in existing

pump sets installed.

Eligibility

Farmers satisfying following criteria are eligible for availing loan assistance under the

scheme.

Machinery/implement/vehicle for which repair are to be carried out must have

o Either been purchased through our finance, if so the account should not be

overdue.

o If purchased through outside borrowings or from other financial institution, it

must have been cleared leaving no charge of vehicle for which the proposed

repair are to be carried out.

Loans can also be considered to agro service centre, other service organization

including state owned corporations.

Margin

Up to Rs,50000/- Nil

Above Rs.50000/- 15-25%

Department of M.B.A, AIT, Chikmagalure Page | 53

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

Security

Up to Rs.50000/- --- Hypothecation of farm machinery.

Above Rs.50000/- ----Hypothecation of farm machinery + mortgaged of landed

property.

Repayment

The loans are to be repaid over a period of 3 years either in monthly/ quarterly/half years

or annual instalment depending upon income generation. The periodicity of instalments shall be

decided taking into consideration the quantum of loan, economic life of the

implement/machinery proposed to be repaired. The installment amount is to be determined based

on cropping pattern, other sources of income, surplus available etc.

Summary:

Agriculture is the backbone of the Indian economy as nearly 60% of Population of the

country depends on agriculture. Credit facilities is essential Service which is much needed for

development of agriculture. Credit was the prime policy of all the successive government to meet

the credit requirement of the farming community. Credit facilities are sponsored by government

of India. NABARD, RBI for agricultural development. It improve the agriculture from Tradition

to modern by adopt machinery, technology, and Canara Bank providing different schemes to

rural area for development of agriculture field. Under the credit system, Canara Bank provides

the finance for purpose of investment required for modern agriculture. The Canara Bank has

been financing to farm mechanization and minor irrigation activities since its inception.

Agricultural credit scheme is provided by Bank to rural area. In different amount

loan and different rate of interest and repayment of loan at given period of time.

Department of M.B.A, AIT, Chikmagalure Page | 54

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

CHAPTER 7

ANALISIS AND INTERPRITATION

1. Contribution of canara bank to agricultural sector. (table 11)

Year Total advance in shimoga Agriculture advance in

(Rs. In crore ) shimoga (Rs. In crores)

2010 1287 792

2011 1390 820

2012 1520 985

(Graph:2)

1600 1520

1390

1400 1287

1200

985

1000

792 820

800

600 Total advance in shimoga(rs in

crores)

400

200

agricultural advance in

0 shimoga(rs in crores)

2010 2011 2012

ANALYSIS AND INTERPRETATION:

The above table reveals that annual growth rate , there were margin variation in credit of Canara

Bank . Agriculture loan and advance of Canara Bank increased absolute terms in present reform

period from Rs. 1287 crores in 2010 to Rs.1390 crores in 2011 and also compare to previous

years it is little bit increase from Rs.1520 crores in 2012 .In 2012 agriculture loan is improved

and utilization of credit is increased and it more improve than actual from years to years.

Department of M.B.A, AIT, Chikmagalure Page | 55

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

2. Target achieved in agricultural loan. (table 12)

Year Targets ( rs in crores) Achieved (rs in crores)

2010 980 792

2011 1070 820

2012 1075 985

(Graph:3)

1200

1070 1075

980 985

1000

820

792

800

target(rs in crores)

600

achieved (rs in crores)

400

200

0

2010 2011 2012

ANALYSIS AND INTERPRETATION:

From the above table we can analyze thattarget achieved in agricultural loan in 2010 is 792

, 2011 is 820 and 2012 is 985 .

From the above analysis we can interpret that, the target are achieved are increasing year

by year

Department of M.B.A, AIT, Chikmagalure Page | 56

STUDY ON AGRICULTURAL CREDIT FACILITY OF CANARA BANK

3. Type of deposits offered by canara bank to the farmers in shimoga branch (table 13)

Year Aggregate deposits Current deposits (rs Savings deposits (rs

(rs in crores) in crores) in crores)

2010 1670 45 720

2011 1750 60 750

2012 1820 72 800

(Graph:4)

2000

1820

1800 1670

1600

1400

1200

aggregate deposits (rs in crores)

1000

800 Current deposits (rs in crores)

800 720

Savings deposits (rs in crores)

600

400

250

170

200 60 72

45

0

2010 2011 2012

ANALYSIS AND INTERPRETATION:

The above table it is clear that the total deposit from Canara bank is increased from year to years,