Escolar Documentos

Profissional Documentos

Cultura Documentos

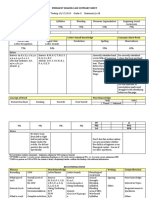

Rem Digest Credit 1

Enviado por

bcarDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Rem Digest Credit 1

Enviado por

bcarDireitos autorais:

Formatos disponíveis

GARCIA VS VILLAR - Villar, in her Answer, claimed that the complaint

stated no cause of action and that the second

FACTS: mortgage was done in bad faith as it was without

her consent and knowledge.

- Lourdes V. Galas (Galas) was the original owner - Villar alleged that she only discovered the second

of a piece of property (subject property) located mortgage when she had the Deed of Sale

at Malindang St., Quezon City. registered.

- On July 6, 1993, Galas, with her daughter, - Villar blamed Garcia for the controversy as he

Ophelia G. Pingol (Pingol), as co-maker, accepted the second mortgage without prior

mortgaged the subject property to Yolanda consent from her. She averred that there could be

Valdez Villar (Villar) as security for a loan in the no subrogation as the assignment of credit was

amount of Two Million Two Hundred Thousand done with neither her knowledge nor prior

Pesos (P2,200,000.00). consent.

- On October 10, 1994, Galas, again with Pingol as - Villar added that Garcia should seek recourse

her co-maker, mortgaged the same subject against Galas and Pingol, with whom he had

property to Pablo P. Garcia (Garcia) to secure her privity insofar as the second mortgage of property

loan of One Million Eight Hundred Thousand is concerned

Pesos (P1,800,000.00).

- Both mortgages were annotated at the back of RTC RULING:

TCT No. RT-67970 (253279).

- On November 21, 1996, Galas sold the subject - RTC ruled in favor of Garcia.

property to Villar for One Million Five Hundred - The RTC declared that the direct sale of

Thousand Pesos (P1,500,000.00), and declared in the subject property to Villar, the first

the Deed of Sale that such property was free and mortgagee, could not operate to deprive

clear of all liens and encumbrances of any kind Garcia of his right as a second

whatsoever. mortgagee.

- On December 3, 1996, the Deed of Sale was - The RTC said that upon Galas’ failure to

registered and TCT No. N-168361 was issued in pay her obligation, Villar should have

the name of Villar. foreclosed the subject property pursuant

- Both Villars and Garcias mortgages were carried to Act No. 3135 as amended, to provide

over and annotated at the back of Villars new junior mortgagees like Garcia, the

TCT. opportunity to satisfy their claims from

- Garcia filed a Petition for Mandamus with the residue, if any, of the foreclosure sale

Damages against Villar before the RTC, Branch proceeds. This, the RTC added, would

92 of Quezon City. have resulted in the extinguishment of

- Garcia subsequently amended his petition to a the mortgages.

Complaint for Foreclosure of Real Estate - The RTC held that the second mortgage

Mortgage with Damages. constituted in Garcia’s favor had not

- Garcia alleged that when Villar purchased the been discharged, and that Villar, as the

subject property, she acted in bad faith and with new registered owner of the subject

malice as she knowingly and willfully property with a subsisting mortgage, was

disregarded the provisions on laws on judicial liable for it.

and extrajudicial foreclosure of mortgaged

property. CA RULING:

- Garcia further claimed that when Villar

purchased the subject property, Galas was - CA reversed the decision of RTC and ruled in

relieved of her contractual obligation and the favor of Villar.

characters of creditor and debtor were merged in - In dismissing the complaint for judicial

the person of Villar. foreclosure of real estate mortgage with damages,

- Therefore, Garcia argued, he, as the second the Court of Appeals held that Garcia had no

mortgagee, was subrogated to Villars original cause of action against Villar in the absence of

status as first mortgagee, which is the creditor evidence showing that the second mortgage

with the right to foreclose. Garcia further asserted executed in his favor by Lourdes V. Galas [had]

that he had demanded payment from Villar, been violated and that he [had] made a demand

whose refusal compelled him to incur expenses in on the latter for the payment of the obligation

filing an action in court.

secured by said mortgage prior to the institution II. Prohibition on pactum commissorium

of his complaint against Villar.

- Motion for Reconsideration denied. - Garcia claims that the stipulation appointing

- Garcia is now before this Court, with the same Villar, the mortgagee, as the mortgagors attorney-

arguments he posited before the lower courts. In in-fact, to sell the property in case of default in

his Memorandum, he added that the Deed of Real the payment of the loan, is in violation of the

Estate Mortgage contained a stipulation, which is prohibition on pactum commissorium, as stated

violative of the prohibition on pactum under Article 2088 of the Civil Code, viz:

commissorium.

Art. 2088. The creditor cannot

appropriate the things given by way of

ISSUES: pledge or mortgage, or dispose of

them. Any stipulation to the contrary is

1. Whether or not the second mortgage to Garcia was null and void.

valid - YES

2. Whether or not the sale of the subject property to The following are the elements of pactum

Villar was valid - YES commissorium:

3. Whether or not the sale of the subject property to (1) There should be a property mortgaged by way

Villar was in violation of the prohibition on pactum of security for the payment of the principal obligation; and

commissorium - NO (2) There should be a stipulation for automatic

4. Whether or not Garcia’s action for foreclosure of appropriation by the creditor of the thing mortgaged in

mortgage on the subject property can prosper - NO case of non-payment of the principal obligation within the

stipulated period.

RULING:

Villars purchase of the subject property did

I. Validity of second mortgage to Garcia not violate the prohibition on pactum commissorium.

and sale of subject property to Villar

- The power of attorney provision above did not

- We agree with the Court of Appeals that both provide that the ownership over the subject

second mortgage and sale are valid under the property would automatically pass to Villar upon

terms and conditions of the Deed of Real Estate Galass failure to pay the loan on time.

Mortgage executed by Galas and Villar. - What it granted was the mere appointment of

- While it is true that the annotation of the first Villar as attorney-in-fact, with authority to sell or

mortgage to Villar on Galas’ TCT contained a otherwise dispose of the subject property, and to

restriction on further encumbrances without the apply the proceeds to the payment of the loan.

mortgagees prior consent, this restriction was - This provision is customary in mortgage

nowhere to be found in the Deed of Real Estate contracts, and is in conformity with Article 2087

Mortgage. of the Civil Code, which reads:

- Neither did this Deed proscribe the sale or

alienation of the subject property during the life Art. 2087. It is also of the essence of

of the mortgages. Garcia’s insistence that Villar these contracts that when the principal

should have judicially or extrajudicially obligation becomes due, the things in

foreclosed the mortgage to satisfy Galas’ debt is which the pledge or mortgage consists

misplaced. may be alienated for the payment to the

- The Deed of Real Estate Mortgage merely creditor.

provided for the options Villar may undertake in

case Galas or Pingol fail to pay their loan. - Galass decision to eventually sell the subject

- Nowhere was it stated in the Deed that Galas property to Villar for an additional P1,500,000.00

could not opt to sell the subject property to Villar, was well within the scope of her rights as the

or to any other person. Such stipulation would owner of the subject property.

have been void anyway, as it is not allowed under - The subject property was transferred to Villar by

Article 2130 of the Civil Code, to wit: virtue of another and separate contract, which is

the Deed of Sale.

Art. 2130. A stipulation - Garcia never alleged that the transfer of the

forbidding the owner from alienating the subject property to Villar was automatic upon

immovable mortgaged shall be void. Galas’ failure to discharge her debt, or that the

sale was simulated to cover up such automatic against the will of the latter, but not

transfer. without the consent of the

creditor. Payment by the new debtor

III. Propriety of Garcias action gives him the rights mentioned in articles

for foreclosure of mortgage 1236 and 1237.

The real nature of a mortgage is described in - Therefore, the obligation to pay the mortgage

Article 2126 of the Civil Code, to wit: indebtedness remains with the original debtors

Galas and Pingol.

Art. 2126. The mortgage - In view of the foregoing, Garcia has no cause of

directly and immediately subjects the action against Villar in the absence of evidence to

property upon which it is imposed, show that the second mortgage executed in favor

whoever the possessor may be, to the of Garcia has been violated by his debtors, Galas

fulfillment of the obligation for whose and Pingol, i.e., specifically that Garcia has made

security it was constituted. a demand on said debtors for the payment of the

obligation secured by the second mortgage and

Simply put, a mortgage is a real right, which they have failed to pay.

follows the property, even after subsequent transfers by - WHEREFORE, this Court

the mortgagor. A registered mortgage lien is considered hereby AFFIRMS the February 27, 2003

inseparable from the property inasmuch as it is a right Decision and March 8, 2003 Resolution of the

in rem. Court of Appeals in CA-G.R. SP No. 72714.

The sale or transfer of the mortgaged property

cannot affect or release the mortgage; thus the purchaser

or transferee is necessarily bound to acknowledge and

respect the encumbrance. In fact, under Article 2129 of

the Civil Code, the mortgage on the property may still be

foreclosed despite the transfer, viz:

Art. 2129. The creditor may

claim from a third person in possession

of the mortgaged property, the payment

of the part of the credit secured by the

property which said third person

possesses, in terms and with the

formalities which the law establishes.

- While we agree with Garcia that since the second

mortgage, of which he is the mortgagee, has not

yet been discharged, we find that said mortgage

subsists and is still enforceable.

- However, Villar, in buying the subject property

with notice that it was mortgaged, only undertook

to pay such mortgage or allow the subject

property to be sold upon failure of the mortgage

creditor to obtain payment from the principal

debtor once the debt matures.

- Villar did not obligate herself to replace the

debtor in the principal obligation, and could not

do so in law without the creditors consent. Article

1293 of the Civil Code provides:

Art. 1293. Novation which

consists in substituting a new debtor in

the place of the original one, may be

made even without the knowledge or

KOREA EXCHANGE BANK VS FILKOR RULING:

BUSINESS INTEGRATED

It was an action for foreclosure of a real estate

FACTS: mortgage. Petitioner’s allegations in its complaint, and

its prayer that the mortgaged property be foreclosed and

Respondent Filkor had three transactions with the

sold at public auction, indicate that petitioner’s action

petitioner Korea Exchange Bank:

was one for foreclosure of real estate mortgage.

1. Borrowed US$ 140,000.00, of which only

In petitioner’s complaint before the trial court,

US$ 40,000.00 was paid;

petitioner alleges:

2. Executed nine (9) trust receipt but failed to

turn over the proceeds of the goods or the To secure payment of the obligations of

goods themselves; and defendant Corporation under the First to

the Twenty-Seventh Cause of Action,

3. Negotiated the proceeds of seventeen (17) on February 9, 1996, defendant

letters of credit, which were all dishonored Corporation executed a Real Estate

because of discrepancies. Mortgage by virtue of which it

mortgaged to plaintiff the

improvements standing on Block 13,

- To secure payment for these obligations

respondent Filkor executed a Real Estate Lot 1, Cavite Export Processing Zone,

Mortgage. It mortgaged to the bank the Rosario, Cavite, belonging to defendant

improvements it constructed on the lot it was Corporation covered by Tax

leasing in Cavite Export Processing Zone Declaration No. 5906-1 and consisting

Authority. of a one-story building called

- Respondents Kim Eung Joe and Lee Han Sang on warehouse and spooling area, the

their part executed a Continuing Suretyship guardhouse, the cutting/sewing area

binding themselves jointly and severally with building and the packing area building.

Filkor to pay the obligations to the bank. (A copy of the Real Estate Mortgage is

- When Filkor breached all its obligations, attached hereto as Annex “SS” and

petitioner Korea Exchange Bank filed a civil case made an integral part hereof.)

with the RTC of Cavite.

- The petitioner sought to be paid for 27 causes of This allegation satisfies in part the requirements of

action and that the mortgaged property be Section 1, Rule 68 of the 1997 Rules of Civil

foreclosed and sold at a public auction in case the

Procedure on foreclosure of real estate mortgage,

respondent fails to pay within ninety days from

the entry of judgment. which provides:

- The trial court rendered a judgment in favor of the

petitioner for all 27 actions but failed to order the SECTION 1. Complaint in action for

foreclosure and public auction of the mortgaged foreclosure. – In an action for the

property in the event that Filkor fails to pay its foreclosure of a mortgage or other

obligation. encumbrance upon real estate, the

- Petitioner filed a motion for partial complaint shall set forth the date and

reconsideration seeking that the relief of due execution of the mortgage; its

foreclosure be granted but such motion was assignments, if any; the names and

denied saying that the petitioner in opting to file residences of the mortgagor and the

a civil action for the collection of the defendant’s

mortgagee; a description of the

obligation, has abandoned its mortgaged lien on

the property subject of the real estate mortgage. mortgaged property; a statement of the

date of the note or other documentary

ISSUE: Whether or not petitioner’s complaint before evidence of the obligation secured by

the trial court was an action for foreclosure of a real the mortgage, the amount claimed to be

estate mortgage, or an action for collection of a sum of unpaid thereon; and the names and

money. residences of all persons having or

claiming an interest in the property

subordinate in right to that of the holder

of the mortgage, all of whom shall be

made defendants in the action.

Prayer of the complaint before the trial court

reads as follows:

WHEREFORE, it is respectfully prayed

that judgment be rendered:

x xx

2. Ordering that the property

mortgaged be foreclosed and sold at

public auction in case defendants fail to

pay plaintiff within ninety (90) days

from entry of judgment.

Petitioner’s action being one for foreclosure of real

estate mortgage the trial should have ordered the

foreclosure and public auction of the mortgaged

property in the event that respondent Filkor fails to

pay its outstanding obligations. This is pursuant to

Section 2 of Rule 68 of the 1997 Rules of Civil

Procedure, which provides:

SEC. 2. Judgment on foreclosure for

payment or sale.- If upon the trial in

such action the court shall find the facts

set forth in the complaint to be true, it

shall ascertain the amount due to the

plaintiff upon the mortgage debt or

obligation, including interest and other

charges as approved by the court, and

costs, and shall render judgment for the

sum so found due and order that the same

be paid to the court or to the judgment

obligee within a period of not less than

ninety (90) days nor more than one

hundred twenty (120) days from entry of

judgment, and that in default of such

payment the property shall be sold at

public auction to satisfy the judgment.

- WHEREFORE, the petition is

GRANTED The Order dated March 12,

1999, of the Regional Trial Court of

Cavite City, Branch 88, in Civil Case No.

N-6689 is hereby MODIFIED, to state

that the mortgaged property of

respondent Filkor be ordered foreclosed

and sold at public auction in the event

said respondent fails to pay its

obligations to petitioner within ninety

(90) days from entry of judgment.

HUERTA ALBA RESORT, INC. VS. CA AND subject judgment had become final and executory

SYNDICATED MANAGEMENT GROUP, INC. and consequently, execution thereof was a matter

of right and the issuance of the corresponding

FACTS:

writ of execution became its ministerial duty.

- Private respondent sought the foreclosure of four

- Petitioner filed once more with the Court of

(4) parcels of land mortgaged by petitioner to Appeals another petition for certiorari and

Intercon Fund Resource, Inc. (Intercon). prohibition with preliminary injunction.

- Private respondent SMGI instituted as

mortgagee-assignee of a loan amounting to P8.5 - On September 6, 1994, the scheduled auction sale

million obtained by petitioner from Intercon, in of subject pieces of properties proceeded and the

private respondent was declared the highest

whose favor petitioner mortgaged the aforesaid

bidder.

parcels of land as security for the said loan.

- In its answer, petitioner questioned the - Thus, private respondent was awarded subject

assignment by Intercon of its mortgage right bidded pieces of property. The covering

thereover to the private respondent, on the ground Certificate of Sale issued in its favor was

that the same was ultra vires. registered with the Registry of Deeds on October

- On April 30, 1992, the trial court came out with 21, 1994.

its decision granting herein private respondent - On September 7, 1994, petitioner presented an

SMGI’s complaint for judicial foreclosure of Ex-Parte Motion for Clarification asking the trial

mortgage. court to clarify whether or not the twelve (12)

- Payment must be given within a period of not less month period of redemption for ordinary

than 150 days from receipt hereof by the execution applied in the case.

defendant. In default of such payment, the four - On September 26, 1994, the trial court ruled that

parcels of land subject matter of the suit including the period of redemption of subject property

its improvements shall be sold to realize the should be governed by the rule on the sale of

mortgage debt and costs, in the manner and under judicially foreclosed property under Rule 68 of

the regulations that govern sales of real estate the Rules of Court.

under execution.

- Thereafter, petitioner then filed an Exception to

- Petitioner appealed the decision to the Court of the Order dated September 26, 1994 and Motion

Appeals which dismissed the case on June 29, to Set Aside Said Order, contending that the said

1993 on the ground of late payment of docket Order materially altered the Decision dated April

fees. 30, 1992 which declared that the satisfaction of

- petitioner came to SC via a petition for certiorari the judgment shall be in the manner and under the

which this court resolved to dismiss on December regulation that govern sale of real estate under

13, 1993, on the finding that the Court of Appeals execution.

erred not in dismissing the appeal of petitioner. - Meanwhile, in its Decision of September 30,

- Motion for reconsideration denied. 1994, the Court of Appeals resolved the issues

- Private respondent filed with the trial court of raised by the petitioner, holding that the 150 day

origin a motion for execution of the Decision and period within which petitioner may redeem

said motion was granted on July 13, 1994. subject properties should be computed from the

- Accordingly, a writ of execution issued and, on date petitioner was notified of the Entry of

July 20, 1994, a Notice of Levy and Execution Judgment and that the 150-day period within

was issued by the Sheriff concerned, who issued which petitioner may exercise its equity of

a Notice of Sheriffs Sale for the auction of subject redemption expired on September 11, 1994.

properties. - On March 31, 1995, the private respondent filed

- Petitioner filed with the same trial court an a Motion for Issuance of Writ of Possession with

Urgent Motion to Quash and Set Aside Writ of the trial court.

Execution ascribing to it grave abuse of - On May 2, 1995, in opposition to private

discretion in issuing the questioned Writ of respondents Motion for Issuance of writ of

Execution. Possession, petitioner filed a Motion to Compel

- The lower court denied petitioners urgent motion Private Respondent to Accept Redemption. It was

to quash the writ of execution, opining that the first time petitioner ever asserted the right to

redeem subject properties under Section 78 of - Where the foreclosure is judicially effected, however, no

R.A. No. 337, the General Banking Act; equivalent right of redemption exists.

theorizing that the original mortgagee, being a

credit institution, its assignment of the mortgage - No such right of redemption exists in case of judicial

credit to petitioner did not remove petitioner from foreclosure of a mortgage if the mortgagee is not the PNB

the coverage of Section 78 of R.A. No. 337. or a bank or banking institution.

- In its Order of July 21, 1995, the trial court denied

private respondents motion for a writ of - In such a case, the foreclosure sale, when confirmed by

possession, opining that Section 78 of the General an order of the court. x x shall operate to divest the rights

Banking Act was applicable and therefore, the of all the parties to the action and to vest their rights in the

petitioner had until October 21, 1995 to redeem purchaser. There then exists only what is known as

the equity of redemption.

the said parcels of land.

- Private respondent interposed a Motion for

- This is simply the right of the defendant mortgagor to

Reconsideration seeking the reversal of the Order

extinguish the mortgage and retain ownership of the

but to no avail. In its Order dated September 4, property by paying the secured debt within the 90-day

1995, the trial court denied the same. period after the judgment becomes final, in accordance

- To attack and challenge the aforesaid order of the with Rule 68, or even after the foreclosure sale but prior

trial court, the private respondent filed with this to its confirmation.

court a Petition for Certiorari, Prohibition and

Mandamus but absent any special and cogent What exists only now is the Equity of Redemption –

reason shown for entertaining the same, the Court right of the mortgagor to extinguish the mortgage and

referred the petition to the Court of Appeals, for retain ownership by paying the debt within the 90 day

proper determination. period after judgment becomes final.

- Court of Appeals gave due course to the petition

and set aside the trial courts Order dated July 21, Section 2, Rule 68 provides that – x x If upon the trial

1995 and Order dated September 4, 1995. x x the court shall find the facts set forth in the

- In its Resolution of March 11, 1997, the Court of complaint to be true, it shall ascertain the amount due

to the plaintiff upon the mortgage debt or obligation,

Appeals denied petitioners Motion for

including interest and costs, and shall render

Reconsideration of the Decision.

judgment for the sum so found due and order the same

- Undaunted, petitioner has come to this Court via to be paid into court within a period of not less

the present petition. than ninety (90) days from the date of the service of

ISSUE: Whether or not Huerta Alba Resort has the one such order, and that in default of such payment the

property be sold to realize the mortgage debt and

year right of redemption under Sec. 78 of RA No. 337 –

costs.

NO.

This is the equity of redemption – it may even be

RULING: exercised beyond the 90 day period from date of

service of the order, as long as its before the order of

- Various decisions show that Huerta has been adjudged confirmation of the sale. (After such order of

to have only the Equity of Redemption, not the Right of confirmation, there is no more redemption possible)

Redemption (Court cited Limpin v. IAC)

- Petitioner did not seasonably invoke its purported right

- The right of redemption in relation to a mortgage - under Sec 78 of RA 337.

understood in the sense of a prerogative to re-acquire

mortgaged property after registration of the foreclosure - Earliest opportunity – when it submitted its answer to

sale – exists only in extrajudicial mortgage. the complaint for foreclosure (essentially, they should

have filed a counterclaim).

- No right recognized in judicial foreclosure unless

mortgagee is PNB or a banking institution - Huerta should have asserted their right under Sec 78 of

RA 337 as a counterclaim in its answer.

- Where a mortgage is foreclosed extrajudicially, Act

3135 grants to the mortgagor the right of redemption - Counterclaims allow the whole controversy between

within one (1) year from the registration of the sheriff’s parties to be disposed of in one action.

certificate of foreclosure sale.

- The applicability of Sec 78 RA 337 hinged on a factual

question

- The question whether Intercon is a credit institution was

never squarely brought before the court.

The claim of benefits under Sec 78 RA 337 is in

the nature of a compulsory counterclaim that

should have been in the answer to the complaint.

- Failure of Huerta to assert this alleged right precludes it

from doing so at the late stage of litigation

- Estoppel may successfully be invoked.

- A party who failed to invoke his claim in the main case,

while having opportunity to do so, will be precluded from

invoking this claim subsequently.

- Huerta should have alleged at the very start that Intercon

was a credit institution, in order for Sec 78 RA 335 to

apply.

- Hence, in conformity with the ruling in Limpin, the sale

of the subject properties, as confirmed by the Order dated

February 10, 1995 of the trial court operated to divest the

rights of all the parties to the action and to vest their rights

in private respondent.

- There then existed only what is known as the equity of

redemption, which is simply the right of the petitioner to

extinguish the mortgage and retain ownership of the

property by paying the secured debt within the 90-day

period after the judgment became final.

- There being an explicit finding on the part of the Court

of Appeals in its Decision of September 30, 1994 in CA-

G.R. No. 35086 - that the herein petitioner failed to

exercise its equity of redemption within the prescribed

period, redemption can no longer be effected.

- The confirmation of the sale and the issuance of the

transfer certificates of title covering the subject properties

to private respondent was then, in order. The trial court

therefore, has the ministerial duty to place private

respondent in the possession of subject properties.

- WHEREFORE, the petition is DENIED, and the

assailed decision of the Court of Appeals, declaring null

and void the Order dated 21 July 1995 and Order dated 4

September 1997 of the Regional Trial Court of Makati

City in Civil Case No. 89-5424, AFFIRMED. No

pronouncement as to costs.

Você também pode gostar

- People of The Philippines, vs. Joel Crisostomo Y MalliarDocumento16 páginasPeople of The Philippines, vs. Joel Crisostomo Y MalliarbcarAinda não há avaliações

- Freddie A. Guillen V. Atty. Audie Arnado A.C. No. 10547, November 08, 2017 Peralta, J. FactsDocumento2 páginasFreddie A. Guillen V. Atty. Audie Arnado A.C. No. 10547, November 08, 2017 Peralta, J. FactsbcarAinda não há avaliações

- TORTS CasesDocumento8 páginasTORTS CasesbcarAinda não há avaliações

- Case 24Documento4 páginasCase 24bcarAinda não há avaliações

- Freddie A. Guillen V. Atty. Audie Arnado A.C. No. 10547, November 08, 2017 Peralta, J. FactsDocumento2 páginasFreddie A. Guillen V. Atty. Audie Arnado A.C. No. 10547, November 08, 2017 Peralta, J. Factsbcar100% (1)

- LABOR Cases Prelims ReviewerDocumento15 páginasLABOR Cases Prelims ReviewerbcarAinda não há avaliações

- CONSTIREV Compilation of CasesDocumento23 páginasCONSTIREV Compilation of CasesbcarAinda não há avaliações

- TORTS Digest Page 1-3Documento40 páginasTORTS Digest Page 1-3bcarAinda não há avaliações

- LEGFORMS 2004 Rules On Notarial PracticeDocumento10 páginasLEGFORMS 2004 Rules On Notarial PracticebcarAinda não há avaliações

- Supreme Court rules Palawan not entitled to share in Malampaya gas proceedsDocumento6 páginasSupreme Court rules Palawan not entitled to share in Malampaya gas proceedsGeorginaAinda não há avaliações

- CONSTIREV Compilation of CasesDocumento23 páginasCONSTIREV Compilation of CasesbcarAinda não há avaliações

- 2017Documento2 páginas2017bcar100% (1)

- Sydeco Vs PeopleDocumento2 páginasSydeco Vs PeoplesakuraAinda não há avaliações

- Labor Law Notes: Part I: Labor StandardsDocumento11 páginasLabor Law Notes: Part I: Labor Standardsbcar0% (1)

- Pilmico-Mauri Foods Corp. tax case overturnedDocumento23 páginasPilmico-Mauri Foods Corp. tax case overturnedbcarAinda não há avaliações

- LABOR Cases Finals ReviewerDocumento15 páginasLABOR Cases Finals ReviewerbcarAinda não há avaliações

- People of The Philippines, vs. Joel Crisostomo Y MalliarDocumento15 páginasPeople of The Philippines, vs. Joel Crisostomo Y MalliarbcarAinda não há avaliações

- Fyfe V Philippine AirlinesDocumento1 páginaFyfe V Philippine AirlinesbcarAinda não há avaliações

- Credit Transaction Case DigestDocumento18 páginasCredit Transaction Case DigestbcarAinda não há avaliações

- SOC AG CasesDocumento2 páginasSOC AG CasesbcarAinda não há avaliações

- Quieting Title Action PrematureDocumento60 páginasQuieting Title Action PrematurebcarAinda não há avaliações

- GN NovDec2015 Jan-April2016Documento1 páginaGN NovDec2015 Jan-April2016bcarAinda não há avaliações

- TORTS Digest Page 1-3Documento39 páginasTORTS Digest Page 1-3bcarAinda não há avaliações

- SALES Reviewer (Delivery To Maceda)Documento7 páginasSALES Reviewer (Delivery To Maceda)bcarAinda não há avaliações

- Labor Law Cases I 22Documento21 páginasLabor Law Cases I 22bcarAinda não há avaliações

- LEGFORMS 2004 Rules On Notarial PracticeDocumento10 páginasLEGFORMS 2004 Rules On Notarial PracticebcarAinda não há avaliações

- HI Construction, Marina liable for damages despite hiring 2nd contractorDocumento7 páginasHI Construction, Marina liable for damages despite hiring 2nd contractorbcarAinda não há avaliações

- PALE Part 5Documento11 páginasPALE Part 5bcarAinda não há avaliações

- Labor Code and Special Laws Provisions on Child LaborDocumento4 páginasLabor Code and Special Laws Provisions on Child LaborbcarAinda não há avaliações

- Labor Law Cases 23 43Documento32 páginasLabor Law Cases 23 43bcarAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Opici Lecture 16 PDFDocumento3 páginasOpici Lecture 16 PDFMingu JeongAinda não há avaliações

- British Bee-Keepers Practical Notebook 1908Documento80 páginasBritish Bee-Keepers Practical Notebook 1908lover.foreverAinda não há avaliações

- Gomez FL Bar Complaint v. PerezDocumento6 páginasGomez FL Bar Complaint v. PerezJudgeHSAinda não há avaliações

- Chapter 3Documento32 páginasChapter 3MarcChicoriaAinda não há avaliações

- Reflections of The Breast PresentationDocumento20 páginasReflections of The Breast PresentationKaren SperlingAinda não há avaliações

- Chapter 2Documento16 páginasChapter 2Hayat Ali ShawAinda não há avaliações

- Itu-T G.691Documento48 páginasItu-T G.691Walter JerezanoAinda não há avaliações

- Psychological TypesDocumento4 páginasPsychological TypesStephen Matuszak0% (1)

- Diaphragmatic Breathing ScriptDocumento2 páginasDiaphragmatic Breathing ScriptDen IseAinda não há avaliações

- Accuracy and Precision Formal ReportDocumento6 páginasAccuracy and Precision Formal Reportgarehh60% (5)

- Crossing The Waves of Ecocriticism: Living During The AnthropoceneDocumento2 páginasCrossing The Waves of Ecocriticism: Living During The AnthropoceneMuHammAD ShArjeeLAinda não há avaliações

- How Social Influence Impacts Consumer BehaviorDocumento31 páginasHow Social Influence Impacts Consumer BehaviorayeshasarafAinda não há avaliações

- Artifact - Autobiography Assignment Educ5004Documento6 páginasArtifact - Autobiography Assignment Educ5004api-246369228Ainda não há avaliações

- Maria Elyssa Pia A. Razo: Psychological Association of The PhilippinesDocumento1 páginaMaria Elyssa Pia A. Razo: Psychological Association of The Philippineshairy basketballsAinda não há avaliações

- Birhau Ngan Identity Page4Documento19 páginasBirhau Ngan Identity Page420 18Ainda não há avaliações

- Gec001 NotesDocumento26 páginasGec001 NotesAdrianne Mae Almalvez RodrigoAinda não há avaliações

- Manuel L Quezon University SOAB Arts Integrated Review Statement of Financial Position Income StatementDocumento5 páginasManuel L Quezon University SOAB Arts Integrated Review Statement of Financial Position Income StatementP De GuzmanAinda não há avaliações

- Lesson Plan Everybody Up 1Documento2 páginasLesson Plan Everybody Up 1An Na ĐàoAinda não há avaliações

- Post Graduate Diploma in International Trade PgditDocumento13 páginasPost Graduate Diploma in International Trade PgditNeekhar SinhaAinda não há avaliações

- CFA Level 2 NotesDocumento21 páginasCFA Level 2 NotesFarhan Tariq100% (2)

- EbqDocumento4 páginasEbqSagaAinda não há avaliações

- Toaru Majutsu No Index SS - KanzakiDocumento2 páginasToaru Majutsu No Index SS - KanzakiJstar55555Ainda não há avaliações

- Emergent Reader Case Summary SheetDocumento2 páginasEmergent Reader Case Summary Sheetapi-503192153Ainda não há avaliações

- Report - Inclusive Education Experiences of Parents in MsiaDocumento13 páginasReport - Inclusive Education Experiences of Parents in MsiaSuhana AhmadAinda não há avaliações

- Spiritual Intimacies in Julia Ward Howe's NovelDocumento42 páginasSpiritual Intimacies in Julia Ward Howe's NovelKaouthar Ben GuiratAinda não há avaliações

- Brochure For KRC Lang Classes 1Documento2 páginasBrochure For KRC Lang Classes 1Jason FranklinAinda não há avaliações

- Letter From Julius Eckman To Solomon Nunes Carvalho, San Francisco 1855 (Transcription of Original Manuscript)Documento3 páginasLetter From Julius Eckman To Solomon Nunes Carvalho, San Francisco 1855 (Transcription of Original Manuscript)magnesmuseumAinda não há avaliações

- A Midsummer Night's DreamDocumento24 páginasA Midsummer Night's DreamMaria Iuga100% (1)

- Ma105 2019 D3 L1 PDFDocumento10 páginasMa105 2019 D3 L1 PDFManish MeenaAinda não há avaliações

- PreschoolerDocumento18 páginasPreschoolerapi-59739555Ainda não há avaliações