Escolar Documentos

Profissional Documentos

Cultura Documentos

Basics of CGD For MBA Oil - Gas Students

Enviado por

UJJWALTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Basics of CGD For MBA Oil - Gas Students

Enviado por

UJJWALDireitos autorais:

Formatos disponíveis

For internal circulation only

Index

Page

Chapter 1 Natural Gas in Overall Energy Scenario of India

Introduction 2

Natural Gas Industry 3

Exploration and Production (E&P) sector of India 5

LNG Supply Scenario in India 6

Advantages of Natural Gas 6

Chapter 2 City Gas Distribution (CGD) Network

Introduction 8

Evolution of CGD in India 8

Demand 9

Demand drivers for CGD Networks 10

Gas Transmission & Distribution System 12

Demand Estimation 13

Designing of a CGD Network 14

Integrated GIS for Gas Distribution System 21

Petroleum & Natural Gas Regulatory Board (PNGRB) on 30

CGDNs

Commercial issues in development and operations of a 35

CGD Network

Chapter 3 Compressed Natural Gas

Introduction 38

Economics 40

Factors that influence demand for CNG 42

Compression of Natural Gas 43

CNG Stations, Dispensing of CNG & CNG transportation 44

in Cascades

Chapter 4 Piped Natural Gas (PNG) for Domestic, Commercial

& Industrial Consumers

Introduction 50

Application of PNG in a CGD Network 50

City Gas Distribution 1

For internal circulation only

Chapter 1: Natural Gas in Overall Energy Scenario of India

This chapter discusses the importance of natural gas in the overall energy mix of India, about the natural gas industry, gas

exploration & production activities, LNG supply scenario and also brings out the advantages of natural gas.

Energy is the prime mover of economic growth and is vital to the sustenance

of a modern economy. Future economic growth crucially depends on the long-

term availability of energy from sources that are affordable, accessible and

environmentally friendly. India ranks sixth in the world in total energy

consumption and needs to accelerate the development of the sector to meet

its growth aspirations. The country, though rich in coal and abundantly

endowed with renewable energy in the form of solar, wind, hydro and bio-

energy has very small hydrocarbon reserves (0.4% of the world’s reserve).

India, like many other developing countries, is a net importer of energy, more

than 25 percent of primary energy needs being met through imports mainly in

the form of crude oil and natural gas. The rising oil import bill has been the

focus of serious concerns due to the pressure it has placed on scarce foreign

exchange resources and is also largely responsible for energy supply

shortages. The sub-optimal consumption of commercial energy adversely

affects the productive sectors, which in turn hampers economic growth. If we

look at the pattern of energy production, coal and oil account for 54 percent

and 34 percent respectively with natural gas, hydro and nuclear contributing

to the balance. In the power generation front, nearly 62 percent of power

generation is from coal fired thermal power plants and 70 percent of the coal

produced every year in India has been used for thermal generation.

The distribution of primary commercial energy resources in India is quite

skewed. 70 percent of the total hydro potential is located in the Northern and

North-eastern regions, whereas the Eastern region accounts for nearly 70

percent of the total coal reserves in the country. The Southern region, which

has only 6 percent of the total coal reserves and 10 percent of the total hydro

potential, has most of the lignite deposits occurring in the country. On the

City Gas Distribution 2

For internal circulation only

consumption front, the industrial sector in India is a major energy user

accounting for about 52 percent of commercial energy consumption. Per

capita energy consumption in India is one of the lowest in the world. But,

energy intensity, which is energy consumption per unit of GDP, is one of the

highest in comparison to other developed and developing countries. For

example, it is 3.7 times that of Japan, 1.55 times that of the United States,

1.47 times that of Asia and 1.5 times that of the world average.

During the pre-reform period, the commercial energy sector was totally

regulated by the government. The economic reform and liberalization, in the

post 90s, has gradually welcomed private sector participation in the coal, oil,

gas and electricity sectors in India. Energy prices in India have been under an

administrated regime with subsidies provided to meet certain socio-economic

needs of the public. This has led to distortion and inefficiency in the use of

different sources of energy. The government has taken serious steps to

deregulate the energy price from an Administered Price Mechanism (APM)

regime. The prices of all grades of coal and petroleum products have already

been deregulated. But still cooking fuels i.e. Kerosene and LPG remain highly

subsidized causing a serious fiscal deficit in the balance sheets of OMC’s.

Also the prices of transportation fuel (Gasoline and Diesel) still remain under

GOI influence due to various political motives which further the burden on

OMC’s.

Natural Gas Industry

Natural Gas sector in India is in a critical stage of development and has

witnessed a flurry of activity over the recent past. The market was initially

closely regulated due to the supply security concerns as well as the politically

sensitive nature of the downstream product prices. However having

recognized the need to attract private capital to develop the sector, the

Government initiated the New Exploration and Licensing Policy (NELP). This

allowed private players to participate in the exploration and development of oil

and gas fields. Subsequently Natural gas prices from these wells were linked

City Gas Distribution 3

For internal circulation only

to international crude prices and the recent government efforts are being

channelled towards drawing up a comprehensive policy for sector

development.

Natural gas is a mixture of hydrocarbon gases and is a colorless, odorless

fuel, environment friendly energy source, which burns cleaner than many

other traditional fossil fuels. It is highly flammable hydrocarbon gas chiefly

consisting methane CH4 and on the basis of the concentration of methane it

is also termed as Dry and Wet gas. In addition to it natural gas may also

include other gases such as oxygen, nitrogen, hydrogen, ethane, ethylene,

propane and even some helium. As far as its occurrence is concerned it

occurs deep below the surface of the earth in three principal forms-

associated gas, non- associated gas and gas condensate.

Associated gas is found in crude oil reservoirs, either dissolved in the crude

oil or in conjunction with the crude oil deposits while Non-Associated gas

occurs in reservoirs separate from crude oil wells. It is also termed as dry gas.

Gas Condensate is the hydrocarbon liquid dissolved in saturated natural gas

that comes out of solution when pressure drops below dew point. Natural gas

is used mainly in the industrial, commercial, transportation, and domestic

sectors out of which power and fertilizer sector consume maximum amount of

natural gas in India.

Natural Gas occupies about 8.5% of the total energy basket of the country

which is much lesser than the world average of 24%. However, the scenario is

fast changing, largely because of the expected increase in the availability of

natural gas in the country. The structure of primary energy consumption in

India shows that coal (51%) still dominates as the major energy source.

Hydrocarbon (45%) is the next available energy provider of the nation.

Natural gas is fast emerging as an alternative; it meets around 9% of the

primary energy needs. Considering the global trend of shift in energy axis

from oil to gas, the share of gas in consumption pattern, in the Indian context

is expected to increase exponentially in the days to come.

City Gas Distribution 4

For internal circulation only

Natural gas is used by the end user in different ways as per need. The various

ways or applications of natural gas in industry as well as household needs

are:

a) Natural gas as a fuel in electricity generation by utilities;

b) Natural gas as a clean fuel in cooking and household needs in the form of

Piped Natural Gas;

c) Natural gas as a fuel for the boilers, furnaces, baking ovens and air

conditioning in Industries;

d) Natural gas as a motor fuel in the form of Compressed Natural Gas (CNG)

and;

e) As a petrochemical and fertilizer industry feedstock.

Exploration and Production (E&P) sector of India

The E&P activities were promoted with the introduction of New Exploration

and Licensing Policy (NELP I) in 1997 which became effective in year 1999.

So far 6 NELP rounds have been successfully undertaken in which 162

shallow water, deep water and on land blocks are awarded to the National Oil

Companies (NOC), PSUs, JVs and other foreign exploration companies. The

initial discoveries of Cambay basin, Mahanadi basin and Krishna Godavari

(KG) offshore were found to be interesting enough to promote more and more

NELP bidding rounds. Similarly, significant discoveries were also made in

Rajasthan. As per the draft utilization Policy-2007 of GoI E&P activities

accounts for nearly 36% of total estimated demand for the current year and it

is supposed to increase in the coming future. According to the DGH, GoI is

committed to offer exploration blocks in coming years and in the next five

years, area under exploration for Indian sedimentary basins is expected to

increase from 44% at present to 80%. By 2015, whole sedimentary basin area

is planned to be brought under exploration.

Assuming India’s additional gas import requirements are all met by LNG,

India’s total LNG imports in the reference case could reach 10 million tonnes

in 2015, 21 million tonnes in 2020, and 31 million tonnes in 2025.

City Gas Distribution 5

For internal circulation only

LNG supply scenario in India

With the growing energy demand and the current state of energy deficiency,

Qatar LNG came out as a boon and the future of Indian energy scenario

heavily depends on the LNG supplies from new sources. Shell Hazira terminal

was set-up as a merchant facility based on aggregation of gas demand on

spot or short-term basis. India is focusing on development of new gas

terminals with long term contracted LNG supply at Kochi, Ennore and possibly

at Mangalore and Mundra in addition to the existing terminals at Dahej, Hazira

and Ratnagiri. The overall demand-supply projections for natural gas are

clearly shows that R-LNG is a huge potential for growth in the country:-

Supply

10-11 11-12 12-13 13-14 14-15 15-16

Domestic – Existing 139.75 139.75 139.75 139.75 139.75 139.75

Domestic – Additional 10.25 46.25 46.25 46.25 65.25

R-LNG – Existing 27.00 27.00 27.00 27.00 27.00 27.00

Total Supplies 166.75 177.00 213.00 213.00 213.00 232.00

Demand-Supply Gap (*) (44.49) (112.39) (96.92) (180.05) (229.21) (245.38)

(*) Proposed to be bridged through Additional R-LNG imports

Sectoral Demand Supply Gap

2009-10 Unmet

10-11 11-12 12-13 13-14 14-15 15-16

incldg LNG demand

Fertilizer 43.39 1.10 1.10 1.62 2.57 42.93 42.93 37.61

Power 66.86 13.00 13.00 17.45 5.83 34.99 64.16 85.35

CGD 6.26 1.47 1.47 6.55 9.31 15.31 21.31 25.60

Others 50.24 36.71 28.92 86.78 79.22 86.82 100.82 96.83

Total Demand 166.75 52.28 44.49 112.39 96.92 180.05 229.21 245.38

Advantage of using Natural Gas

Natural Gas offers multitude of advantages pertaining to the environment as

well as the energy efficiency. Some major advantages or benefits that it offers

are:

I) It is a clean, efficient, safe and environment friendly fuel hence offers more

efficiency without sacrificing the environmental concern;

City Gas Distribution 6

For internal circulation only

II) It does not required storage yard as the gas is directly delivered to the

pipeline hence offer less chances of any mishap due to storage leakage

and spillage of storage tanks;

III) There is no risk of breakdown in fuel supply due to order processing

delays to replenish the fuel inventory;

IV) It minimizes the manpower and mechanical power required for handling

the fuel;

V) In terms of the current global oil scarcity it offers the advantage of being

the most efficient and profitable alternative fuel.

City Gas Distribution 7

For internal circulation only

Chapter 2: City Gas Distribution (CGD) Network

This Chapter discusses brings about the concept of a CGD Network, how has the same evolved in India, demand in a

CGD network and the drivers, gas transmission and distribution activities, designing of a CGD Network, concept of GIS

in a CGD Network, Petroleum & Natural Gas Regulatory Board’s role in development of CGD networks and commercial

issues in the development of CGD Networks.

As the name suggests, CGD is the last component in the natural gas value

chain delivering natural gas to end users in towns and cities. While large

customers such as the power and fertilizer industry receive natural gas

directly through the high pressure interstate transmission pipelines, CGD is

provided through the network of medium to low pressure distribution pipelines

by a local distribution company. The tap off point from where the city

distribution network takes its supply from the transmission system for the city

distribution system is referred to as the city gate. CGD involves movement of

small volumes of gas through small diameter, low pressure pipelines to a

large number of retail customers. Typically, the network comprises

compressed natural gas (CNG) dispensing stations throughout the network

that supplies natural gas for automotive use, and a piped natural gas network

that provides natural gas as a fuel for city-based commercial/ industrial/

domestic purposes. Since natural gas is odourless and colourless, Mercaptan

is added to it and when it enters the CGD network, which gives it a typical

smell of rotten eggs to ease leak detections.

Evolution of CGD in India

CGD is not a new business for India. A review of its history reveals that the

gas retail business in the country started as early as 1880 by the Calcutta Gas

Company, which is operating even today. The company runs on coal gas and

faces losses. The other CGD operator, which has now gone out of business,

was the Bombay Gas Company that started way back in 1900 and went out of

business during the 1960s. The Delhi Municipal Corporation operated a gas

distribution system in Okhla with biogas, which worked for a long time. The

City Gas Distribution 8

For internal circulation only

system has now been converted to natural gas. Some of the smaller initiatives

in city gas include the networks in ONGC townships in Mehsana, Hazira, etc.

Another such social initiative was by Assam Gas in Duliajan, which was

targeted at disadvantaged sections of the population. The big impetus for the

CGD network came in the 1998 when the Supreme Court issued orders to

convert all public transport vehicles plying in Delhi to CNG in response to a

public interest litigation on account of rising air pollution in Delhi. This was

followed by a similar initiative in Mumbai. Eighty CNG stations were set up by

2000. Thereafter, it rolled into other cities like Agra, Lucknow, Pune, etc, in

2002, and further to Ahmedabad, Kanpur, Mumbai, Kolkatta, Chennai, etc, in

2003. The Gujarat Gas Company Limited (GGCL) started with a few CNG

stations in Surat and Ankleshwar. Adani came in this business in 2002 and

GSPC Gas is the latest entrant in this sector.

Demand

The two biggest natural gas customer segments in India are power plants and

fertilizer producers. These are followed by the petrochemicals sector, CGD,

liquefied petroleum gas (LPG)/ other liquid hydrocarbons, and the sponge

steel sector. The demand from the power segment comes from gas-fired

power plants, located along the HVJ pipeline and in Tamil Nadu, Andhra

Pradesh, and Maharashtra, including Mumbai. NTPC is the biggest consumer.

Other key customers include the Maharashtra State Electricity Board (MSEB),

Gujarat Powergen Energy Corporation Limited (GPEC), GVK Power and

Infrastructure (GVK), and Spectrum Power Generation Limited. The

customers in the fertilizer segment are urea-producers with nitrogen-based

plants, the biggest of which include Indian Farmers Cooperation (IFFCO),

National Fertilizers Limited, Oswal Fertilizers, and Rashtriya Chemicals and

Fertilizers. Industrial users are mainly from the sponge iron, petrochemicals,

textiles, and glass industries. Major industrial customers include Indian

Petrochemicals Limited (IPCL), Essar Steel, Ispat Steel, Usha and Maruti

Udyog. The PNG and CNG segments are growing fast, too. In the domestic

segment, the key growth drivers are gas distribution companies like GGCL,

City Gas Distribution 9

For internal circulation only

IGL and MGL, which are developing the necessary infrastructure. Along with

that, the increasing price of LPG prompts consumers to switch over to PNG.

In addition, the use of CNG in the transportation sector is rising because of

court-backed environmental measures against the use of diesel and other

polluting fuels. The total natural gas demand in 2007-08 was 179 MMSCMD.

The demand from the CGD segment of the industry was estimated to be

approximately 12.08 MMSCMD.

Demand Drivers for CGD Networks

There has been a low geographical spread of CGD projects, which are limited

to a few select cities. Private sector participation has been limited. Further,

limited gas allocation to this segment of the natural gas value chain, no clear

long-term strategic plan for CGD development by the government and no role

by the state governments, have all meant slow development of the CGD

market in the country. Except in Gujarat, CGD development has been mainly

driven by environment factors.

However, since experiences has indicated that the CGD market is not as

price-sensitive as the power and fertilizer sectors, there is a growing interest

to tap more cities for CGD among gas suppliers, as gas prices are

increasingly moving upwards. In addition, for the coming years, the

government policy favors coal for the power sector. Of the likely capacity

addition during the Eleventh Five Year Plan period of around 66,000 MW, the

major thrust is on coal and hydel projects with limited new capacity expected

from gas. Gas demand in the fertilizer sector would be driven by alternate

feedstock urea units as the new policy for switching from alternate feedstock

to gas/ LNG allows for mop up of efficiency gains to pay back the capital

expenditure incurred on revamps to gas based units. In future, it is expected

that there will be a more definitive move towards private ownership of CGD

projects. This is expected to lead to more aggressive market development

attempts leading to greater value propositions for investors in the CGD

business. Not surprisingly, about Rs 90 billion of investment is envisaged in

City Gas Distribution 10

For internal circulation only

the Eleventh Five Year Plan period on the development CGD infrastructure.

More than 200 cities are expected to be on the pipeline network in the next 10

years, which is primarily expected to be driven by the future larger availability

of gas. Apart from these factors, CGD companies have also seen changes in

the mainframes of their consumers. Previously, while complying with the

needs of domestic consumers, CGD companies had been offering a “bundled

service” including infrastructure and gas supply. Gas usage had been limited

to cooking and heating in some households. However, air conditioning has

now begun to be considered as a viable option as well. With the government

gradually reducing the subsidy provided on domestic LPG connections, CGD

companies hope to achieve higher penetration in the domestic cooking fuel

market with an increasing number of households switching from LPG to pipe

gas. The increase in consumer density has the potential to increase business

margins for entities from this segment. For the commercial and industrial

segment, apart from lighting and heating, cooling has emerged to be viable,

similar to that in the domestic sector. Moreover, the need for gas to operate a

backup power facility is emerging to be a major driver for CGD in these two

segments of customers. In the small industrial segment, gas competes well

with alternatives like fuel oil in terms of price economics. There is also scope

for gaining carbon credits by the industrial segment using gas. The transport

sector attracts attention for CNG, as pollution with petrol/diesel is highly

visible, and the Supreme Court and other environmental agencies are

becoming very strict with their norms. The sector demands gas not only to

reduce emissions, but also to reduce their dependence on imported oil, which

affects their financials heavily.

Large scale conversion of petrol driven private vehicles to CNG, introduction

of CNG variant models by car manufacturers, new models of CNG light

commercial vehicles, the demand from Northern Railways for running their

diesel multiple units on a mix of diesel and CNG, and the introduction of radio

taxis and high capacity buses in view of the Commonwealth Games, all

indicate potential increase in CNG usage.

City Gas Distribution 11

For internal circulation only

Gas Transmission & Distribution System

Natural gas that is received at the City Gate Stations is mostly passed through

a cleaner to remove liquids and dust. The primary function of the city gate

station is to measure the amount (volume) of incoming gas. It is generally

measured through orifice meters. Another function is to reduce the pressure

of the gas to be sent for distribution, as the distribution system requires much

lesser pressure than that in long distance transmission. Mechanical devices

called pressure regulators lower the gas pressure and helps to control the

flow rate to maintain desired pressure level throughout the distribution system.

With the reduction in pressure, the natural gas also becomes cooler, so

sometimes it has to be heated up in regions where the temperature is below

zero degree. Last but not the least, at the City Gate station, the odourisation

of the natural gas takes place. Different types of odorants are used, so that

the “smell” makes the presence of the escaping, unburnt gas recognizable at

very low concentrations. This serves as a warning well before the gas

accumulates to hazardous levels; a mixture of air and natural gas are

explosive over the range of 5% to 15% natural gas. To ensure safety,

odorized natural gas is detectable at concentration of just 1%.

The piping system also forms a major part in City Gas Distribution. Mainly

there are 4 types of piping systems other than supply mains:-

a) Feeder mains transport gas from the pressure regulator or supply main

to the distribution mains. Feeder mains might also have some lines

connected to large industrial users.

b) Distribution mains supply gas primarily to residential, commercial, and

smaller industrial consumers.

c) Service lines deliver gas from the distribution main in the street to the

consumer’s meter. Service lines are usually the property and

City Gas Distribution 12

For internal circulation only

responsibility of the utility. However, some utilities own only the portion of

the service lines in the public domain.

d) Fuel lines are customer piping beyond the meter to various appliances.

These lines are the property and responsibility of the building owner. City

Gate Station is the tap-offs at the main pipeline. These are the

termination station for a city where the various processes like pressure

reduction, filtration, and odourization is done. The gas from the main

pipeline is brought down to a pressure of 19-22 bars and then transferred

through steel pipeline to DRS.

District Regulation Station are installed where the distribution is to be done

like in the industrial area and commercial segment. Gas to the various

consumers is transferred after being maintained at a pressure of about 4-5

bar. Then the gas is transmitted to Single Stream Regulator (SR) through 4

bar medium pressure PE pipelines. SR further reduces the pressure from

4bar to 100 mbar. From SR the gas is supplied through a 100 mbar low

pressure PE pipeline to a G.I. Riser Isolation wall. From this valve the gas is

carried through a G.I. (Galvanized Iron) 100 mbar pipelines to end user. The

control valve is placed at the height of 5 ft which controls the flow in City Gas

Distribution wherein a regulator is installed which brings down the pressure to

21 mbar for basic home users. A meter is installed which tells the amount of

gas being used depending on which they are charged.

Demand Estimation

Natural gas has long been considered as an alternative fuel for the

transportation sector. In fact, natural gas has been used to fuel vehicles since

the 1930's! New stringent state emissions laws require an improvement in

vehicle emissions over the foreseeable future. Natural gas, being the cleanest

burning alternative transportation fuel available today, offers an opportunity to

meet these stringent environmental emissions standards. Natural gas vehicles

are much cleaner burning than traditionally fuelled vehicles due to the

City Gas Distribution 13

For internal circulation only

chemical composition of natural gas. It is estimated that vehicles on the road

main source of pollution in form of hydrocarbon emissions, nitrogen oxide

(NOx) emissions and carbon monoxide. All of these emissions released into

the atmosphere contribute to smog pollution, and increase the levels of

dangerous ground level ozone. The environmental effects of natural gas

vehicles (NGV) are much less detrimental than traditionally fuelled vehicles. In

addition, natural gas is very safe. Being lighter than air, in the event of an

accident natural gas simply dissipates into the air, instead of forming a

dangerous flammable pool on the ground like other liquid fuels. This also

prevents the pollution of ground water in the event of a spill. Natural gas fuel

storage tanks on current NGVs are stronger and sturdier than gasoline tanks.

Natural gas is also an economic alternative to gasoline and other

transportation fuels. Traditionally, natural gas vehicles have been around 30

percent cheaper than gasoline vehicles to refuel, and in many cases the

maintenance costs for NGVs is lower than traditional gasoline vehicles.

Natural gas vehicles as they exist today are best suited for large fleets of

vehicles that drive many miles a day. Taxicabs, transit and school buses,

airport shuttles, delivery vehicles, and public works vehicles are all well suited

to natural gas fuelling. Because these vehicles are centrally maintained and

fuelled, it is economical and beneficial to convert to natural gas.

Designing of a CGD Network

In order to meet the projected gas demand for City gas distribution network for

automobile, commercial, industrial and domestic sector consumption, a

pipeline is envisaged to connect the city from the City Gate Station (CGS)

from main gas transmission pipeline.

Tap-off point

Gas tap-off point is a gas outlet provided on main gas transmission trunk line

laid by gas producer or transmission network operator for transportation of

gas from wellhead to far away location in the region. The gas pressure at tap-

off point can be a high pressure ranging from 49 to 99 bar. The bulk supplier

City Gas Distribution 14

For internal circulation only

may have gas metering facility at tap-off point for measuring the gas quantity

before dispatch to City Gate Station. The Gas tapped off from bulk suppliers

trunk line travels up to CGS through Spur line.

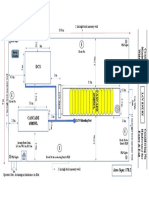

City Gate Station

The City Gate Station (CGS) is a facility for receiving, measuring and

conditioning the gas for distribution in city. The equipments installed at CGS

measure the quantity of gas received and regulate its pressure to 19 bar or

less for safe distribution of natural gas in the city. The gas received at CGS is

odorized by mixing odorant chemical in required proportion for easy detection

by human nose in the event of leakage/escape. The CGS also houses control

room and other facilities like spares stores, small workshop, SCADA system,

stand by power source and fire fighting facility etc. Natural Gas is generally

made available at the downstream of CGS at a pressure of 19 bars to cater to

the demand of automobile, commercial, industrial and domestic sectors.

Some of the major installations at CGS are described below-

a) Odourizing Facilities

It is good practice to odorize natural gas to ensure a safe natural gas

distribution system. The natural gas in the existing HBJ pipeline is un-

odorized and therefore it is necessary to install odorizing plants. It is

envisaged to install one automatic, gas flow rate based odourant injection

system at CGS. This system will odorize incoming un-odourized gas by

injecting odourant in the natural gas. The technical, safety standards &

specifications of the PNGRB requires odourization to the extent of 12.5

PPM dosage. The odorant usually consists of sulphur based chemical

compounds and a combination of two odorants [30% tetra-hydro-

thiophane (THT) and 70% tetra butyl mercaptan (TBM)] provides a better

odour impact than a single odorant, especially if there is substantial

background odour such as in a mildly polluted environment. Indian style of

City Gas Distribution 15

For internal circulation only

cooking with pungent condiments and high foul smell level due to open

drainage in town also will require higher level of odourisation.

b) SCADA System

SCADA system in a CGD network ensures effective and reliable control,

management and supervision of the pipeline from CGS using (RTUs)

located along the pipeline at suitable locations. The pipeline, DRS and

CNG station performance are monitored and controlled from central

SCADA system control centre installed at CGS. The SCADA System

Control is linked through fiber optics cable or remote terminal unit (RTUs)

located along pipeline. RTUs will be used for scanning and tele-metering

of pipeline parameters such as flow, temperature, pressure, valves status,

CP parameters, etc., to update the computer data.

Main Grid Line

A CGD network has a Steel Main Ring route originating from the CGS and

consists of steel pipelines and spur lines of various sizes (generally of sizes

19”, 12”, 10”, 8”, 6” or 4”) based on the design load and future demand of gas.

Sectionalizing valves are provided in main steel line as well as in spur-lines at

designed intervals for future extension and isolation purpose. The regulations

of the PNGRB require steel pipeline connectivity to all online CNG stations for

compression of CNG. Provisions are also made for safe blow down of gas into

the atmosphere through vent either at the DRS or at suitable safe distance

from the sectionalizing valve assembly.

Cathodic Protection System

For efficient and satisfactory functioning of the main grid line system, both

from safety and economic point of view, the pipeline must be protected

against corrosion. External protection shall be provided for prevention of

pipeline corrosion. This external protection is a combination of anti-corrosion

coating and cathodic protection techniques. Conventional coating of pipelines

by 3-layer Polyethylene (PE) / Coal tar / Fusion Bonded Epoxy coating are

City Gas Distribution 16

For internal circulation only

used as "passive" protection. Complete corrosion protection cannot be

achieved practically by coating, as it is impossible to fully avoid minor defects

such as pores or cracks in the coating. Welded pipelines are particularly

subject to corrosion at coating holidays because of their low longitudinal

resistance, i.e., they practically do not resist the flow of current through the

pipeline. At these holidays, dangerous pitting corrosion is initiated because of

the high corrosion current density; this phenomenon often causes rapid

corrosion and failure of pipeline.

Cathodic protection is a method for protecting the pipe reliably even at

undetected coating holidays. The protective current supplies electrons to the

structure to be protected and prevents corrosion. Based on the experience

and other relevant data as well as indigenous availability, PE/ FBE coating

shall be provided as external corrosion coating for the pipeline. The field joints

are coated by heat shrink sleeves.

Salient features of the CP system for Main Grid Line are as follows:

a) The main grid line is cathodically protected by an impressed current CP

system as a permanent facility.

b) Measures adopted to mitigate stray current interference due to the

interference along the pipelines

c) Temporary Cathodic Protection (TCP) is provided during project

construction phase.

d) All the used road/ rail crossings are provided with proper insulating

spacers, end seals, drain and vent pipes. The casing pipes is

independently protected by sacrificial anodes, wherever necessary.

e) For monitoring purposes in normal cases, test stations are installed at

closer intervals in case of congested areas. In addition, test points are

provided at all crossings and near insulating joints. The transformer

Rectifier and Control panel have monitoring gauges for indicating

protection current and voltage.

City Gas Distribution 17

For internal circulation only

f) Interference effects, wherever suspected or observed are duly investigated

and remedial measures provided for, wherever necessary.

g) Insulating joints are provided on the pipelines at all necessary locations,

where electrical isolation is desirable such as at CNG Stations and DRS.

The grounding cells/ spark gap arresters are also installed across

insulating joints.

Distribution system

The city gas distribution network is designed to operate with natural gas at a

pressure of 19 bar for distribution to domestic and commercial consumers and

the distribution system comprises of the following-

a) District Regulatory Stations (DRS)

DRS encompasses a pressure reduction system, metering equipment,

condensate removing facility and cold venting facility fitted in a single self-

contained skid mounted cabinet. This regulator brings down the gas

pressure from 19 bar (max) to 4 bar. The capacity of DRS varies from

2,500 SCMH and 5,000 SCMH @ 4 bar. Filter Separator are provided at

the inlet of each run of the pressure reduction metering assembly with

filtration efficiency of 99.9% for the removal of all particles from 5 micron

size onwards. The flow measurement meter is of turbine type. The

regulating assembly is a dual run assembly with each run designed for the

full flow capacity required for the station and manual isolating valves

provided to facilitate servicing of each run without shutdown of the station.

Number and Phasing of DRS is a function of demand and deliverable

pressure.

b) HDPE pipe network

For commercial and domestic consumers low pressure, generally 4 bar

underground network is provided, as it is safe for inhabited areas, easy to

lay and economical. The low pressure PE pipeline network in the

downstream of Service Regulator (SR) operates at 75 to 100 milli bar

City Gas Distribution 18

For internal circulation only

pressure. For industrial areas large diameter PE100, SDR11 pipelines

originating from Industrial DRS are laid for supply of gas to small and

medium industrial consumers at 4 bar pressure. These lines will be laid as

per the market penetration. The distribution system in a CGD network is

constructed from HDPE pipes of 125, 90, 63, 32 and 20 mm diameter

pipes of SDR 11 grade (Standard Dimension Ratio: Ratio of outside

diameter to minimum wall thickness) joined by electro-fusion jointing

system. The polyethylene fused joints are as strong as the parent pipe,

ensuring the integrity of the pipe system. The polyethylene compound

used in the manufacture of pipes shall be free from cadmium. Only virgin

material is used for extrusion of these pipes and fittings.

The Distribution network is divided in two categories as per operating

pressures. The medium pressure network operates at 4 bar pressure. This

network is laid between DRS and Service Regulator. The low pressure

network operating at 75 to 100 milli bars is aid between Service Regulator

and Domestic connection.

c) Medium Pressure Distribution Mains

The Medium pressure Distribution mains carry gas from DRS to Service

Regulator with standardized sizes of 125 mm, 90 mm and 63 mm and are

of PE 100 grade orange material. The wall thickness of these pipes is also

as per SDR 11. These pipes are laid underground in specially prepared

trenches at one meter depth below the ground. The pipes are padded and

back filled with sieved fine sand for protection against third party damage.

Warning tape is installed on the pipeline to warn third party against

accidental damage. These pipelines also have isolation valves at regular

intervals and before branch off.

d) Low Pressure distribution services

Similar to the medium pressure distribution line, low pressure distribution

pipeline / service lines are also laid underground in trenches with padding

City Gas Distribution 19

For internal circulation only

and warning tape laid on pipelines. The service lines (size 63 mm, 32 mm

& 20 mm) originate from the Service Regulator (SR) to reach domestic

consumers and are of PE 100 grade SDR 11 orange colour.

e) Natural Gas Connection and Gas Metering

(i) Domestic Connection

The domestic connection is given from service line through a transition

fitting which is used to connect PE pipe line to GI pipeline network

inside the household. A meter regulator is installed on inlet of domestic

gas meter to reduce the gas pressure from 75 milibar to 21 milibar. The

GI pipeline is installed in the household through shortest route to reach

up to kitchen stove.

(ii) Commercial Connection

The gas supply connection to commercial consumers is given either

from service lines or distribution mains depending upon gas

requirement. However, large commercial consumer can be connected

from medium pressure lines and the pressure regulator and meter for

such consumer are accordingly selected. Small commercial consumers

can be given connection from service lines and the meter regulator

arrangement for this consumer will be similar to domestic connection

except metering capacity.

(iii) Industrial Connection

The natural gas supply connection to industrial consumer can be either

provided directly by tapping steel mains or through industrial DRS

located in industrial estate. Direct connection from steel mains requires

dedicated pressure reduction and metering system. The gas meter can

be ultrasonic, turbine or rotary positive displacement type depending

upon flow rate.

City Gas Distribution 20

For internal circulation only

The peak flow rate based pipe line sizing is done to optimize on steel

pipelines. The sum total of all the DRS and CNG stations hourly flow rates

governs the basic sizing of the steel network. The PE pipelines are sized to

flow this gas to various charged areas in a CGD Network. The DRS has peak

flow capacity of 5000 SCMH and 2500 SCMH and Service Regulators have

peak flow capacity of 500 SCMH. The DRS and Online CNG stations are

located on steel network. The peak flow capacity of District Regulating Station

(DRS) governs design and sizing of Medium Pressure Polyethylene (MPPE)

and Low Pressure Polyethylene Pipelines (LPPE). City Gas Distribution

system is designed as per the technical, safety standards & specifications

Regulation of the PNGRB for a City Gas Distribution project are ANSI/ ASME

B 31.8, “Gas Transmission and Distribution Piping System”. Since ASME B

31.8 does not adequately cover plastic pipes, for this ISO:4431 ‘Buried

Polyethylene (PE) pipes for the supply of gaseous fuels - Metric Services

Specifications’ is followed for design of polyethylene pipes.

Integrated GIS for Gas Distribution System

A Geographic Information System (GIS) is playing a pivotal role for utilities

with applications for planning, designing, decision-making, network analysis

and monitoring of environmental degradation. Globally, use of this technology

in gas distribution utilities has expanded tremendously in the last decade. GIS

applications were built to model geospatial information and processes that

support gas distribution utility network and operations in the real world.

GIS software companies have come up with solutions for different purpose

such as outage management System, engineering design, transmission

corridor management, and network asset management. Gas distribution

companies have implemented these products separately to support their

business workflows in various departments, such as services groups,

consumer groups, operations groups, billing groups, etc. The importance of

common single workflow process phenomena across all departments has led

to the conception of integrated GIS for gas distribution.

City Gas Distribution 21

For internal circulation only

The following discussion outlines the details of GIS bearing on gas distribution

system; concept of integrated GIS for gas distribution and how single-vendor

based integrated GIS is evolving as a solution for a single workflow for a gas

distribution company’s business processes.

Gas Distribution System

Gas distribution system is a connected pipeline system that carries natural

gas from a source such as a city gate station or regulator station to the

customer premises. A typical gas distribution system consists of assets such

as main pipes and service pipes to distribute gas, valves, and regulator

devices to control and regulate gas flow, joins and fittings to join different

pipes and meters to measure inlet and outlet of gas. Gas transmission

pipelines reach city borders and convert to gas distribution at city gate station.

Gas is typically, regulated, odourized, filtered and measured at city gate

station. Then gas may pass through several main pipelines to different

localities within the city. Generally, service pipes connected to mains carry

gas from mains to customer locations. Gas distribution system is complex, in

contrast to gas and electric transmission systems, as it consists of many small

segments of various diameter pipes joined by various types of fittings and gas

control components placed at regular lengths of network. The pipes usually

run up on one street and down on next, forming loops. What most

distinguishes city gas distribution from gas transmission is that distribution

companies’ supply fuel to retail customers.

Therefore, gas utilities may like to manage inventory of their Gas distribution

assets. They may be interested to know information such as particulars of gas

leak locations and impact of environment on their assets. They may like to

know what to put back into working order and what to replace. They may also

like to know which of their assets impact other utilities, nearby to their own

assets such as underground electric systems. Since gas distribution lines are

underground, they must protect those lines from delinquent backhoe

operators digging the ground for other pipelines or cables.

City Gas Distribution 22

For internal circulation only

Besides finding suitable site for new assets, losses in gas distribution and the

growing concern over environmental issues are areas of concern that a gas

utility must address. This requires the utility to accurately keep track of its

assets in the field, such as asset location, size, status and spatial behaviour.

This task can be overwhelming for the utility without a GIS.

GIS for Gas Distribution System

Gas distribution companies are using GIS software products to support their

engineering and operations functions and are realizing enhanced customer

service, increased network reliability and reduced cost. GIS helps to maintain

asset knowledge, which enables better use of available capacity such as size,

pressure and inlet quantity of gas at station making it possible to use existing

pipeline infrastructure before embarking on an expensive new build. With the

recent advances in web-applications and adoption of broadband networks, it

is now possible to integrate GIS with other business processes of the utility

enterprise. For example, a work order that is raised for maintenance of an

underground pipeline segment can have a link to online GIS map to locate not

only the area of work, but also to get information such as depth at which the

pipeline is buried, valves to be closed to isolate the maintenance region and

details of other assets in the neighbourhood.

Integrity Management in Gas Distribution

In the past, governments paid more attention to high pressure gas

transmission pipeline integrity and wanted transmission companies to publish

their integrity reports. However, in recent times, governments, pipeline safety

regulators and many industry representatives have realized that integrity

management has to be extended to the gas distribution networks too,

considering their vicinity to living areas of people. Implementing integrity

management enhances safety and also reduces risk to public property,

improves gas distribution company’s asset life and builds up customer

confidence.

City Gas Distribution 23

For internal circulation only

In the future, integrity management for gas distribution system can become

more formal. Just like transmission, issues can occur in gas distribution in the

form of leaks, corrosion, excavation damages and unplanned outages. Gas

distribution companies have to formulate programs to tackle integrity

requirements. One prerequisite to integrity management is to understand the

existing network elements such as mains, services, valves, regulators,

cathodic sections, meters etc. This is easily achieved with the help of a GIS,

which provides information about material used for piping, diameter, operating

pressure, if the pipe is exposed or cased, leaks on pipes and their repair and

maintenance history. This information helps in identifying threats to

distribution system’s integrity that can be risky in the form of unpredictable

damages to assets and people.

Leak Management

A GIS can identify nearest valves or structures that need to be closed, to

separate the leak area from rest of network to mitigate loss. After an accident

or leak, the network has to be restored and damaged pipe segments have to

be replaced. GIS applications can help in building the footage network that will

replace failed network by identifying types of pipes (cast iron or steel), length

of pipes and number of pipe segments. Leak analysis is another priority for

integrity management. GIS interacts with leak database and discovers leak

locations. A cluster analysis on leaks can be performed to determine the

areas, which need immediate attention.

Risk Management

GIS can interact with pipe corrosion detection systems and show unprotected

and exposed pipes in an area. If customer demand is expected to increase in

that area, then gas distribution company can immediately make plans to

replace the weak pipes or protect the vulnerable pipes to reduce risk of

damage.

City Gas Distribution 24

For internal circulation only

Safety

Most of the times it is a regulation that requires reporting performance and

health of the system. For example, under certain conditions of pressure, it is

recommended to have excess flow valve on a single line connection to reduce

hazards and safeguard homes. GIS can maintain history of leaks on service

lines and visually analyse this historical data to help make decisions about

excess valve installations.

Apart from above, there are two most important areas to be assessed under

distribution integrity. One is to supplement data for One Call Tickets to do risk

analysis and provide to excavators and another is corrosion management to

protect pipes.

One Call Analysis

Many countries have mandated a regulation on making a telephone call to the

“call before you dig” centre or one call centre, before doing any kind of

excavation in order to avoid damages to utility networks, due to digging the

ground. Based on the maps provided by utilities in proposed digging area,

One call centre determines if the excavator is digging in an unsafe area that

can cause damage to gas or any other utility electrical lines and pipes buried

under ground. The centre then notifies the gas or concerned utility by creating

a one call ticket. It is now the gas (utility) company’s responsibility to provide

full details on locations of their pipes that may be hit if excavation is done, and

provide any other such instructions to carry out excavation without any

damage by excavators. GIS plays a key role in this activity by directly locating

the excavation area on map and displaying the pipeline details buried in that

region. A full-scale report on these details can be produced from GIS that the

gas (utility) company can submit to the one call centre, which in turn instructs

the excavators accordingly.

Corrosion Management

City Gas Distribution 25

For internal circulation only

For corrosion management, it is important to identify pipe segments that may

need protection. The underground pipes, which are made of steel and iron

other than plastic, corrode due to the proximity to earth. If a pipe segment is

steel, it may require to be cathodically protected. GIS can be of great use for

corrosion management as it can visually display the pipe segments covered

by cathodic protection on the map and those that are not covered.

Integrated GIS

Due to the many advantages of using a GIS, Utilities are increasingly adopting

GIS enabled solutions to meet their needs. A distinct trend towards deploying

an Integrated GIS is being seen, by integrating the traditional GIS with other

business applications such as engineering management tools, mobile

workforce management system, outage management system, SCADA, and

analysis tools.

An integrated GIS builds seamless interoperability among GIS and other

systems to share data and services. Due to the growth in middleware

technology, GIS vendors have come up with adaptors and connectors to

middleware servers. This enables GIS to connect with multi-vendor supported

enterprise systems, thus making GIS, a true enterprise application.

Integrated GIS for Gas Distribution System

If a new pipeline is to be laid, a design can be prepared in GIS by the

engineering design department. It is also seen that there is a need to publish

this design for review or approval or execution to different departments.

During actual gas network layout, field engineers plan regular on-site

inspections. A field engineer can view the gas network details in a GIS map

on his personal digital assistant (PDA) and even enter comments, such as

incorrect positioning of a fitting, or changed owner name of a gas meter. This

has led to acceptance of web publishing technology for sharing data and

publishing field data and the unremitting advancement of mobile platforms for

field inspections.

City Gas Distribution 26

For internal circulation only

Also, the growing need for a common workflow across various departments

has led to integration of GIS system with in-house dedicated systems. GIS

should integrate with operational support and service-delivery applications,

enabling these systems to cooperate seamlessly in managing planning,

design, construction, operations, maintenance, integrity, risk and emergency

response functions of gas distribution and pipeline networks. GIS at enterprise

level is required to provide geospatial data across the enterprise with full

integration at all levels of systems and applications with full access to view

and update data for a gas distribution system.

Additionally, there is a growing use of Internet GIS and industry standard

platforms. Another such paradigm is component based programming, which

provides state-of-art development environment for building custom

applications for easy system extendability and custom-made capability of a

modern GIS system. This increased the need for interoperability between

prevalent systems.

Hence, requirement for integrated GIS solutions for gas distribution is on the

rise. An integrated GIS empowers gas utilities to share information about

mains, services, cathodic sections or one-call tickets of any size instantly and

seamlessly across the enterprise. This helps in planning for safety system

such as cathodic protection for new pipelines or helps in locating all the

assets for a one-call ticket. Hence, an integrated GIS helps in fast decision-

making, maintain health of the system, improve customer service and

optimize business processes.

Challenges in Integrated GIS

A succinct life cycle of gas distribution network consists of following phases-

1) Planning gas network with regulation stations, mains, services, valves,

etc.

2) Creating an engineering design for the network, based on

City Gas Distribution 27

For internal circulation only

a) Best cost model

b) Available material through enterprise resource planning (ERP)

system

3) Performing analysis on proposed and existing networks for optimization

4) Approving engineering designs

5) Procuring material

6) Field inspections during network construction

7) Energizing the as-built network

8) Service provisioning

9) Asset management

10) Gas outage management

11) Operations and maintenance

12) Leak analysis

13) Cathodic protection

Historically, various departments of a corporate enterprise using departmental

based systems carried out the above requirements individually. A new trend

of enterprise application integration paved way into this space integrating

different systems eliminating duplication of data and reducing complexity in

maintenance of several systems. In this streamlining, gas distribution

companies have concentrated on the need to include geospatial information.

Even the recent propagation of online maps, Global Positioning System

(GPS) and Location Based Services (LBS), all lean towards integrated GIS.

This also led to growth of spatially enabled databases. A new revolution thus

demands gas distribution companies to leverage integrated GIS to meet

above requirements.

An integrated GIS has interfaces to different enterprise systems to form a

single workflow, as can be seen below.

City Gas Distribution 28

For internal circulation only

Industry Standard

Engineering Design Gas Distribution

Tools Analysis Tool

GIS for Gas

ERP & Application Databases

Distribution System

Servers

Customer

Information System Field GIS

Internet

Challenges come in the following situations:

1. Building a common data model across all products and applications

2. What common standards to be followed

3. Coordination between various departments

4. Lead time for licenses can be longer as it amounts to the last license

delivered

5. New installations/upgrades for individual systems is cumulative

In view of the above, trend now is to provide departmental-based systems

from a single vendor for gas distribution solution.

Single Vendor-based Integrated GIS is the future

A single vendor means a common data model and a common de facto

standard for all individual systems. Upgrades and releases are done at the

same time with out-of-box compatibility built within systems. Licenses can

also be received in a single-go, thus reducing otherwise long waiting time for

City Gas Distribution 29

For internal circulation only

various systems. Some GIS vendors have realized the need for single vendor-

based systems for enterprises. One such vendor is GE Energy, which recently

released a product portfolio called Smallworld Office Suite. GE Energy’s office

suite for gas utilities has products such as, Smallworld Gas Distribution Office,

Smallworld Global Transmission office, Smallworld Design Manager for

engineering design, Smallworld Enterprise Application Integration (EAI) toolkit

for integration with legacy and other systems such as customer information

systems and gas analysis systems. It has Smallworld Internet Application

Server (SIAS) to publish gas distribution network information and maps on

Internet and intranet. It also consists of Smallworld Field Information System

that enables a field engineer to carry and update spatial information into the

field.

Usage of a GIS for planning and operational purposes is increasing by the

day in gas industry. Standards and specifications are continuing to evolve to

achieve smooth interoperability between various GIS and non-GIS

applications needed by the gas utilities. Based on the experiences of early

adopters, a clear trend is being seen in the form of the gas utilities preferring

an integrated GIS from a single vendor.

Petroleum & Natural Gas Regulatory Board (PNGRB) on CGDNs

The PNGRB established on October 1, 2007 (appointed day) under the

PNGRB Act, 2006 is the downstream regulator, which amongst other

functions authorizes entities for laying, building, operating and expansion of

CGD Networks. In this respect, the CGD Networks which were in existence

prior to the appointed day are considered as deemed authorized. PNGRB has

notified following regulations governing the activities of CGD networks-

1. Regulations for authorizing entities to lay, build, operate or expand CGD

Networks

2. Regulations for authorizing network tariff and online compression charge

for CNG in respect CGD networks in existence as on the appointed day

City Gas Distribution 30

For internal circulation only

3. Access code for CGD Networks

4. Technical Standards and Specifications including Safety Standards for

CGD networks

5. Affiliate code

6. Exclusivity for CGD Networks

These regulations have major impact on the way the CGD networks would

develop in future and can be studied in detail after downloading from the

website of the PNGRB (http://www.pngrb.gov.in/) under the scroll window

Orders/ Notifications. The salient features of these Regulations are discussed

as below.

Authorization Regulations classify the CGD networks before and after the

appointed day. In respect of the CGDNs existing before the appointed day,

the authorization would be decided in terms of the provision of Regulation 18

of the Authorization regulations. Therefore, the entity would have to

demonstrate already achieved physical progress of at least 25% and financial

commitment of 50% in terms of the approved DFR/ existing business plan as

on that day. CGDNs already authorized by MoP&NG (like, IGL, MGL, etc.) by

virtue of gas allocation would be deemed authorized as per provisions of

Regulation 17. Further, in respect of CGDNs proposed after the appointed

day, as per Regulation 5, such cases would be processed based on

evaluation of two-part bids received in response to the EOI by any entity for a

geographical area. The PNGRB can also suo-motu call for bidding for such

geographical areas as it may deem fit. PNGRB may decide to either go ahead

or modify or reject the EOI considering availability of natural gas and gas

transmission pipeline for brining natural gas to the proposed city gate. A

squatter advantage to any incumbent developer of a CGD network without

source of gas and pipeline would not be in the interest of competition and

customers. The geographical area proposed in the EOI is firmed-up through

public consultation process based on the principles of geographical contiguity

and techno-economic feasibility and could include municipal limits, city, town,

City Gas Distribution 31

For internal circulation only

district or a combination thereof. The purpose of having a firmed-up GA is to

allow bidding on common parameters.

The technical criteria envisages requisite experience of laying, building,

operating or expansion (including for O&M) of CGD Networks or hydrocarbon

pipelines or having a credible plan (to be demonstrated) through technical tie-

up/ requisite technical manpower, minimum net-worth linked to the population

in the geographical area, etc. Thus, the regulations provide only a basic

hurdle to be crossed in order to become technically eligible and no weightage

is assigned to this criterion. The financial bidding has been envisaged with

weights against each of the following criteria requiring calculation of scores on

a relative scale-

Criterion Weightage Rationale

1 Lowness of PV of network 40% Network Tariff is tariff attributed to

tariff over economic life of pipelines in CGD network (including

25 years up to Last Mile Connectivity: riser to

burner tip of PNG domestic

household)

2 Lowness of PV of online 10% Online compression charge

compression charge for attributed to charge for compression

CNG over economic life of of CNG & recoverable in addition to

25 years network tariff from CNG consumers

only

3 Highness of PV of inch- 20% Inch-Kilometer implies sigma of

kilometer of steel pipelines product of outer diameter of steel

in CGD network during pipelines over their respective

period of exclusivity distances in CGD network & is

required upfront (before end of

exclusivity)

4 Highness of PV of PNG 30% PNG domestic connections bid each

domestic connections to be year of exclusivity period. Post-

bid during period of exclusivity PNG domestic

exclusivity connections on demand

Note:

a) The composite weighted score shall be calculated for all technically eligible bids on a

relative (percentile) basis.

b) The discount rate for the Present Value (PV) shall be 14%.

c) Bidder with highest composite score is the winner.

City Gas Distribution 32

For internal circulation only

Thus, it may be observed that there is an equal weightage assigned to the

financial and technical criteria and the underlying logic is to promote quick and

upfront network infrastructure, incentivize balanced and integrated

development of network to meet future demand from all consumer segments

at lowest possible network tariffs and compression charge for CNG. Since the

price of natural gas is not regulated, the entity is free to adopt suitable

strategies for product pricing.

The Regulations also provide for volume restrictions on supply of natural gas

in the CGD network to an individual customer-

a) not exceeding 50,000 SCMD to be necessarily sourced from the CGD

network;

b) between 50,001 SCMD and 1,00,000 SCMD to be sourced as per

customer choice from the CGD network or any other supplier not through

the CGD network; and

c) Above 100,001 SCMD to be necessarily sourced from any supplier but not

through the CGD network.

The above volume restrictions are intended to ensure volume comfort to the

CGD network while also protecting the CGD network on the other hand

against network imbalances due to peaking requirements of a large volume

customer.

Entity authorized for a CGD network has a physical exclusivity of 25 years

implying that no other entity can lay, build, operate or expand in a CGD

network. This has the effect of imposing service obligation on the authorized

entity to ensure that future natural gas demand requirements of all consumer

segments in a GA are met through network expansion. A CGD network would

have customers with different volume requirements and affordable price of

natural gas, for example, an industrial customer may afford gas price at a

marginal discount to furnace oil, whereas a domestic customer may not be

willing to pay price for piped natural gas (for an annual volume requirement of

City Gas Distribution 33

For internal circulation only

not be more than 110-140 SCM) more than the domestic LPG price, which is

subsidized. The economics of connecting an industrial load far exceeds that

of a domestic PNG connection in terms of the selling margins and volumes. A

commercial load may have LPG non-domestic as alternative fuel, which is not

subsidized. A CNG customer tends to see the economics based on the price

of automotive fuels, cost of conversion/ CNG kit, CNG availability, re-fuelling

comfort, mileage, etc. In order to prevent varying economics resulting in

“cherry picking” of customers, the PNGRB has ensured in the design of the

bidding parameters that maximum network coverage in a GA is assured

through upfront investments and on the other allowed a limited marketing

exclusivity” to the authorized entity for five years. During the pendency of such

period, no other entity can market its natural gas and after the end of such

period, the CGD network is opened for use by third parties on common carrier

or contract carrier on payment of network tariff and compression charge for

CNG.

The limited marketing exclusivity is envisaged for ensuring an integrated

development of network and provides the authorized entity upfront incentive

to quickly reach the industrial and commercial segments as well as CNG

market to ensure adequate revenue generation to service heavy debt burden

during initial years. The PNGRB Act, 2006 has also provided for segregation

of gas transmission and marketing activities, which implies that the entity may

be required to unbundle its regulated activities of network operation from the

unregulated activities of gas marketing. Such unbundling of services may

assume the form of accounting, legal, ownership or management control

segregations with an underlying position that the entity owning and controlling

monopoly assets (of gas network) should not, in the long-term, be in a

position to exercise significant market domination and gas marketing

opportunities are available to other shippers using the same network on

principles of common carrier or contract carrier so as to allow development of

competitive gas markets. In the short and medium term, the PNGRB has

City Gas Distribution 34

For internal circulation only

provided that the entity would maintain separate books of accounts and not

engage in transfer pricing between regulated and non-regulated activities.

While the service obligations and stiff bidding conditions ensures the network

of pipelines covers all charge areas (sub-sets within a GA) and into the non-

lucrative domestic consumer segments. PNGRB has also stipulated quality of

service standards for protecting individual domestic consumer interests. For

example, requirement for display of network tariff and online compression

charge for CNG, consumer freedom to choose natural gas supplier post-

marketing exclusivity, refundable security deposit for PNG domestic

connection not to exceed Rs.5,000, connectivity on demand after the end of

marketing exclusivity, uniform network tariffs from all consumer segments

irrespective of volumes, etc. have been envisaged to protect domestic

consumer’s interests. The technical standards are aimed at having

compliance with the HSE issues both during and post commissioning phases.

The provisions of bid bond and performance bond (with 25% encashment on

first default, 50% on the next and top-up within 15 days of each default)

coupled with strict proviso for cancellation of authorization are aimed at

ensuring that entity remains committed to the development of CGD network

as well as the interests of consumer and third party shippers are protected.

Commercial issues in development and operations of a CGD Network

A CGD network is designed for meeting demand over its economic life of 25

years and significant investments are therefore required over the project’s life

cycle. Phasing of capex to meet demand is important to ensure optimum

asset utilization and generation of tariff revenues. The ability to reach all

consumer segments through pervasive and all-inclusive network development

and creation of demand for gas, sourcing of gas on most competitive terms,

outsourcing of non-critical operations, like invoicing and payment collection,

alternative revenue models (like, utilization of SCDA network for DTH,

telephony, internet, CRM, etc.) and quality of service would help the entity to

retain its market share post-marketing exclusivity.

City Gas Distribution 35

For internal circulation only

Issues like policy on taxation of fuels, prices of alternative fuels, mandated

conversion to CNG, re-siting of polluting industries or conversion to natural

gas, expansion of city limits, development of industrial zones, single window

clearing mechanism for all statutory/ local governmental clearances impact

the economics of a CGD network. The entity also has an opportunity to

market natural gas in contiguous CGD networks after the end of marketing

exclusivity in such areas and with an aggressive marketing and pricing

policies can target cornering gas markets.

Optimization in a CGD network in terms of using existing retail pump outlets of

oil marketing companies and bus depots for setting-up online compressors,

daughter-booster stations and dispensers improves the economics of CNG. It

is important to note that an expanded gas market benefits all. Efforts should

be made to work with OEM to facilitate quicker and economical conversion to

natural gas both in the automotive and industrial segments. The entity also

need to work with service providers in creating of a seamless operational and

maintenance environment for vehicle engines, CNG kits and boilers including

periodic mandatory safety checks. Such initiatives go a long way in creating

consumer awareness and convenience, which in turn boosts demand for

natural gas.

Major threat to CNG is expected from Euro V fuels, which are expected to be

cleaner and are expected to become the mandated fuels in a few years time

and most of the Indian refineries are either already Euro V compliant or are

investing heavily to become so. Further, the increasing traffic congestions and

wasteful energy consumption are driving metro cities to develop mass rapid

transport systems, which may also impact the growth of auto fuel

consumption in the years to come. Therefore, unlike the experience of

Indraprastha Gas Limited, CNG may no longer be a key driver for boosting

the economics of a CGD network. A CGD network of future would therefore

need to focus on demand creation from domestic customers particularly from

City Gas Distribution 36

For internal circulation only

large and up-scale real estate community development projects, shopping

malls, multiplexes and offices through innovative, economic and reliable

energy solutions, like power generation on distributed basis with air-

conditioning on combined cycle.

City Gas Distribution 37

For internal circulation only

Chapter 3: Compressed Natural Gas (CNG)

This Chapter discusses on the concept of CNG as automotive fuel, comparison of CNG with other conventional fuels in

term of operational efficiency, economics, emissions and operating conditions, demand of CNG and its drivers, how gas is

compressed into CNG, operations in a CNG station, dispensing & transportation of CNG by cascades.

This chapter discusses the operating characteristics of automotive fuel

product Compressed Natural Gas (CNG), how natural gas is compressed into

CNG, CNG’s comparative operating efficiency & economics in relation to

other automotive fuels- MS & HSD, demand for CNG and its drivers, how

CNG is dispensed, main facilities in a CNG station operates and how CNG is

transported in cascades.

What is CNG? CNG stands for Compressed Natural Gas. It is a gaseous fuel

and is a mixture of hydrocarbons, mainly methane (simplest hydrocarbon) in

the range of 95%, it is much cleaner and efficient fuel. Due to its low density, it

is compressed to a pressure of 200 bar to enhance the vehicle on-board

storage capacity. It is safe owing to its inherent property of being lighter than

air, and therefore in case of leakage it disperses into the atmosphere rapidly.

Its high auto-ignition temperature of 540 degrees centigrade as against

petrol’s 360 degrees centigrade makes it even more safe fuel. CNG also has

a narrow inflammability range of 5% to 15%, making it much safer than other

fuels. CNG emissions being non-toxic, non-corrosive and non-carcinogenic,

its usage improves public health, as harmful exhaust gas emissions like

carbon monoxide, nitrogen dioxide and sulphur dioxide which causes harmful

diseases like cancer, asthama etc. are significantly reduced. CNG also helps

in reducing the effects of global warming. CNG does not contaminate or dilute

crank case oil, giving engine an extended life besides increased life of

lubricating oils. Due to the absence of any lead or benzene content in CNG,

the lead fouling of spark plugs is eliminated.

For example, an engine running on petrol for 100 km emits 22,000 grams of

CO2, while covering the same distance on CNG emits only 16,275 grams of

City Gas Distribution 38

For internal circulation only

CO2. [CNG is essentially methane, i.e. CH4 with a calorific value of 900 Kj/

mol. This burns with Oxygen to produce 1 mol of CO2 and 2 mol of H2O. By

comparison, petrol can be regarded as essentially Benzene or similar, C6H6