Escolar Documentos

Profissional Documentos

Cultura Documentos

OCWEN

Enviado por

ALLtyDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

OCWEN

Enviado por

ALLtyDireitos autorais:

Formatos disponíveis

OCWEN

William C. Erbey

(Exec. Chairman and Chairman of Exec. Committee)

Ronald M. Faris

(President, CEO and Director of Exec. Committee)

Share price: 35.01(NYSE)

Background: Ocwen Financial Corporation is a provider of residential and commercial mortgage loan

servicing, special servicing and asset management services. Ocwen is headquartered in Dunwoody,

Georgia, with additional offices in West Palm Beach, Orlando, Florida, Houston, Texas, St. Croix, the

U.S. Virgin Islands and Washington, D.C.. It also has support operations in Uruguay and India.

Ocwen is the industry leader in servicing high-risk loans. Ocwen works with customers in a variety of

ways to make their loans worth more, including purchasing of mortgage servicing rights, sub-

servicing, special servicing and stand-by servicing. We can also support companies that wish to

utilize our best-in-class technology and know-how to support improvements in their own operations.

Key Acquisitions:

In September 2010, Ocwen, through Ocwen Loan Servicing, LLC (OLS), a wholly owned subsidiary of

Ocwen, acquired the U.S. non-prime mortgage servicing business of Barclays Bank PLC, known as

HomEq servicing. While the transaction did not result in the transfer of ownership of any legal

entities, OLS acquired the mortgage servicing rights (MSRs) and associated servicer advances of the

business as well as the servicing platforms based in Sacramento, California and Raleigh, North

Carolina for an initial aggregate purchase price of $1.2 billion. With the close of the HomEq

acquisition, Ocwen boarded onto its servicing platform approximately 134,000 residential mortgage

loans with an aggregate UPB of approximately $22.4 billion.

In September 2011, Ocwen completed its acquisition of outstanding partnership interests of Litton

Loan Servicing LP and certain interest-only servicing securities previously owned by Goldman Sachs

& Co. from Goldman Sachs. Following this $247.2 million worth acquisition, Ocwen became the

largest subprime mortgage servicer in the U.S.[5] The Litton acquisition increased Ocwen's servicing

portfolio by 245,000 residential mortgage loans with an aggregate UPB of approximately $38.6

billion.

In April 2012, Ocwen closed on the purchase of approximately $22 billion of mortgage servicing

rights from Saxon Mortgage Services, a unit of Morgan Stanley.

In June 2012, Ocwen completed its purchase of Aurora Bank's commercial servicing rights portfolio.

In October 2012, Ocwen announced plans to buy Homeward Residential Holdings, Inc. from WL Ross

& Co. for $750 million.

Você também pode gostar

- Capitalmind - In-What The HDFC Bank Merger Really Means FornbspinvestorsDocumento9 páginasCapitalmind - In-What The HDFC Bank Merger Really Means FornbspinvestorsALLtyAinda não há avaliações

- (Kotak) Strategy, December 09, 2021Documento5 páginas(Kotak) Strategy, December 09, 2021ALLtyAinda não há avaliações

- Lendingkart (Captable)Documento7 páginasLendingkart (Captable)ALLtyAinda não há avaliações

- Bain Digest India Fintech Report 2022Documento36 páginasBain Digest India Fintech Report 2022ALLtyAinda não há avaliações

- Shopsy (The Ken)Documento9 páginasShopsy (The Ken)ALLtyAinda não há avaliações

- 09september2022 India DailyDocumento75 páginas09september2022 India DailyALLtyAinda não há avaliações

- Dead of Winter - DoombergDocumento8 páginasDead of Winter - DoombergALLtyAinda não há avaliações

- Dinodia Capital AdvisorsDocumento2 páginasDinodia Capital AdvisorsALLtyAinda não há avaliações

- How 1mg Is Changing Under Tata DigitalDocumento10 páginasHow 1mg Is Changing Under Tata DigitalALLtyAinda não há avaliações

- ONDC Charts New Strategy As It Races Against Time To Meet DeadlineDocumento6 páginasONDC Charts New Strategy As It Races Against Time To Meet DeadlineALLtyAinda não há avaliações

- Ally-Consult Club in Partnership With Bain & Co. Lets Get Brains Together-Towards More Inclusive WorkspacesDocumento2 páginasAlly-Consult Club in Partnership With Bain & Co. Lets Get Brains Together-Towards More Inclusive WorkspacesALLtyAinda não há avaliações

- Samara CapitalDocumento1 páginaSamara CapitalALLtyAinda não há avaliações

- Kanpur Confectionaries - 25 JuneDocumento1 páginaKanpur Confectionaries - 25 JuneALLtyAinda não há avaliações

- Tempus Capital ProfileDocumento1 páginaTempus Capital ProfileALLtyAinda não há avaliações

- History: Wholesale BankingDocumento3 páginasHistory: Wholesale BankingALLtyAinda não há avaliações

- Ompany Rofile: Company Profile - CRISIL About The CompanyDocumento3 páginasOmpany Rofile: Company Profile - CRISIL About The CompanyALLtyAinda não há avaliações

- CHAPTER 4: Practice Questions (Page 82)Documento4 páginasCHAPTER 4: Practice Questions (Page 82)ALLtyAinda não há avaliações

- BETA - The Finance and Investments Club of IIMA: General Awareness Preparation SuggestionsDocumento2 páginasBETA - The Finance and Investments Club of IIMA: General Awareness Preparation SuggestionsALLtyAinda não há avaliações

- IVFA True NorthDocumento8 páginasIVFA True NorthALLtyAinda não há avaliações

- Baroda Pioneer Asset Management Company LTDDocumento2 páginasBaroda Pioneer Asset Management Company LTDALLtyAinda não há avaliações

- RBL Bank PDFDocumento2 páginasRBL Bank PDFALLtyAinda não há avaliações

- Alti SourceDocumento1 páginaAlti SourceALLtyAinda não há avaliações

- FiniqDocumento1 páginaFiniqALLtyAinda não há avaliações

- IVFA True NorthDocumento8 páginasIVFA True NorthALLtyAinda não há avaliações

- Guide To Hedge FundsDocumento5 páginasGuide To Hedge FundsALLtyAinda não há avaliações

- Kedaara CapitalDocumento3 páginasKedaara CapitalALLtyAinda não há avaliações

- True North (India Value Fund Advisors)Documento1 páginaTrue North (India Value Fund Advisors)ALLtyAinda não há avaliações

- Yes BankDocumento1 páginaYes BankALLtyAinda não há avaliações

- Development Bank of SingaporeDocumento1 páginaDevelopment Bank of SingaporeALLtyAinda não há avaliações

- BNY MellonDocumento2 páginasBNY MellonALLtyAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Circular PuzzleDocumento72 páginasCircular PuzzleVishwambarAinda não há avaliações

- International Trade Documentation At: Reva Textiles Pvt. LTDDocumento30 páginasInternational Trade Documentation At: Reva Textiles Pvt. LTDMohnish NagpalAinda não há avaliações

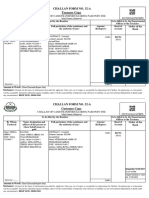

- Challan Form No. 32-A Treasury Copy: Challan of Cash/Transfer/Clearing Paid Into TheDocumento1 páginaChallan Form No. 32-A Treasury Copy: Challan of Cash/Transfer/Clearing Paid Into Theآرنولڈ دا فینAinda não há avaliações

- Components of A Sound Credit Risk Management ProgramDocumento8 páginasComponents of A Sound Credit Risk Management ProgramArslan AshfaqAinda não há avaliações

- Ebacl Ips 20161130 Ips Functional Description v09 Draft PWG CleanDocumento59 páginasEbacl Ips 20161130 Ips Functional Description v09 Draft PWG CleanDnyaneshwar PatilAinda não há avaliações

- Amaravati Circle & BranchesDocumento312 páginasAmaravati Circle & BranchesUday kumarAinda não há avaliações

- Republic of The Philippines V. Sandiganbayan, Et Al. G.R. Nos. 166859, 169203 and 180702, 12 April 2011, EN BANC (Bersamin, J.) Doctrine of The CaseDocumento5 páginasRepublic of The Philippines V. Sandiganbayan, Et Al. G.R. Nos. 166859, 169203 and 180702, 12 April 2011, EN BANC (Bersamin, J.) Doctrine of The CaseJerald-Edz Tam AbonAinda não há avaliações

- Proforma Invoice: Jose Andres Casanova Segovia Post Code:CHF57 Bolivia Cochabamba CityDocumento1 páginaProforma Invoice: Jose Andres Casanova Segovia Post Code:CHF57 Bolivia Cochabamba CityJosé AndrésCasanovaSegoviaAinda não há avaliações

- Calgary Reduce: RowentaDocumento44 páginasCalgary Reduce: RowentaModernBeautyAinda não há avaliações

- Request Form For Documents: University of The Philippines Open University Office of The University RegistrarDocumento2 páginasRequest Form For Documents: University of The Philippines Open University Office of The University RegistrarAlexander LigawadAinda não há avaliações

- HSBC Rewards and Cashback Sales Deck A4 Digital Final Q1Documento15 páginasHSBC Rewards and Cashback Sales Deck A4 Digital Final Q1Madhuritha RajapakseAinda não há avaliações

- Industrial Finance ProjectDocumento62 páginasIndustrial Finance ProjectSantosh PawarAinda não há avaliações

- VP Service Delivery Manager in Dallas FT Worth TX Resume Rebecca Faith StoneDocumento1 páginaVP Service Delivery Manager in Dallas FT Worth TX Resume Rebecca Faith StoneRebeccaFaithStoneAinda não há avaliações

- Banking Law - Law Relating To Dishonour of Cheques in India: An Analysis of Section 138 of The Negotiable Instruments ActDocumento37 páginasBanking Law - Law Relating To Dishonour of Cheques in India: An Analysis of Section 138 of The Negotiable Instruments ActKashyap Kumar NaikAinda não há avaliações

- Corporate Governance Report Bangladesh PDFDocumento311 páginasCorporate Governance Report Bangladesh PDFAsiburRahmanAinda não há avaliações

- Internet BankingDocumento2 páginasInternet Bankingapi-323535487Ainda não há avaliações

- Assignment 1 IISDocumento4 páginasAssignment 1 IISZulqarnain KambohAinda não há avaliações

- GSISDocumento96 páginasGSISHoven MacasinagAinda não há avaliações

- SRS Internet Banking SystemDocumento44 páginasSRS Internet Banking SystemRahul Khanchandani83% (6)

- Tufs BookletDocumento274 páginasTufs Booklettiwariparvesh100% (1)

- PWC Roadmap To An Ipo PDFDocumento100 páginasPWC Roadmap To An Ipo PDFVenp Pe100% (1)

- PNBDocumento20 páginasPNBShuchita BhutaniAinda não há avaliações

- Foreign Exchange ManagementDocumento21 páginasForeign Exchange ManagementSreekanth GhilliAinda não há avaliações

- The Mystery of Money by Allyn YoungDocumento57 páginasThe Mystery of Money by Allyn YoungLDaggersonAinda não há avaliações

- Chapter Ten: The Investment Function in Banking and Financial Services ManagementDocumento16 páginasChapter Ten: The Investment Function in Banking and Financial Services Managementcharlie simoAinda não há avaliações

- Eurocity Corporate Structure 2Documento6 páginasEurocity Corporate Structure 2simon1608Ainda não há avaliações

- CPC First DraftDocumento15 páginasCPC First DraftPratik IrpatgireAinda não há avaliações

- Instructor Manual For Financial Managerial Accounting 16th Sixteenth Edition by Jan R Williams Sue F Haka Mark S Bettner Joseph V CarcelloDocumento14 páginasInstructor Manual For Financial Managerial Accounting 16th Sixteenth Edition by Jan R Williams Sue F Haka Mark S Bettner Joseph V CarcelloLindaCruzykeaz100% (81)

- Banking - IntroductionDocumento15 páginasBanking - Introductionsridevi gopalakrishnanAinda não há avaliações

- Form A Scss Ac Opening Form 28 Nov 2016Documento3 páginasForm A Scss Ac Opening Form 28 Nov 2016Suraj KumarAinda não há avaliações