Escolar Documentos

Profissional Documentos

Cultura Documentos

IT Audit CH 3

Enviado por

JC MoralesTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

IT Audit CH 3

Enviado por

JC MoralesDireitos autorais:

Formatos disponíveis

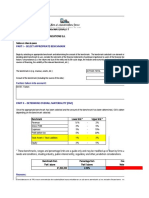

MATERIALITY DETERMINATION 0420.

MPQ

Sign-off: Initials Date

Client name: Prepared:

Reviewed:

Partner:

Period end:

EQCR:

This form completed annually is to document the calculation of initial planning materiality (calculated at planning stage) which

will be used to guide the overall scope (nature, extent and timing) of the audit procedures to be performed.

The adequacy of planning materiality is reassessed throughout the audit to ensure that sufficient audit procedures are being

performed.

Revised materiality 710.MPQ should be done at the end of the audit.

Part 1 Overall Materiality

No. Audit Procedure Comment and/or Ref.

Identify the principal users of the financial Higher Management,

1.

statements.

Describe the nature and impact of qualitative

considerations (i.e., profitability trends,

2.

regulations, particular sensitivities, compliance

with loan covenants, user expectations, etc.)

3. Selecting a Numerical Threshold

Benchmark Percentage Range Percentage Applied

Total assets 0.5% - 2%

Revenues 0.5% - 2% 2%

Net assets 3% - 5%

Normalised income from continuing operations before taxes 5% - 10%

Other N/A

A typical characteristic of a manufacturing firm is uniform

net income and tax throughout the life of a company. Upon

Reason for selecting an alternative benchmark and percentage prior research this company is a service type firm that is a

applied: big user of human resource. Therefore, we chose revenues

as the benchmark for the client’s threshold because the

total assets of this firm is relatively small.

4. Determine quantitative materiality

This period anticipated Last Period

Normalized Income from continuing operations

£ £

Estimated income pre tax (1,018,121.87) (1,217,231.42)

Adjustments for non-recurring items, discontinued operations

MATERIALITY DETERMINATION 0420.MPQ

This period anticipated Last Period

Normalized Income from continuing operations

£ £

and misstatements brought forward:

a)

b)

c)

Total Normalized Income from continuing operations (pre tax):

Based on the above considerations, the planning materiality is:

OVERALL MATERIALITY LIMIT - QUALITATIVE

FACTORS

Document qualitative factors, if any, which, in the auditor's

judgment, indicate that a smaller overall materiality limit that

might be otherwise appropriate. (The figure in this section

cannot be higher than the materiality based on quantitative

factors).

The overall materiality with consideration of qualitative factors £

for the engagement is (= Benchmark × Percentage):

Prior year materiality was £

The Overall Materiality for the engagement is: £

Part 2 Performance Materiality

Performance Materiality - Quantitative Factors

Based on the overall audit risk as assessed in 210.MPQ, the £

performance materiality is:

(If Overall Audit Risk is LOW, then 80% of Overall Materiality /

If Overall audit Risk is HIGH, then 70% of Overall Materiality)

Performance Materiality – Qualitative Factors Yes or No Comment or Ref

Are there qualitative factors that, in your judgement, would

require the performance materiality to be reduced? If Yes,

explain.

If Yes then, the Performance Materiality with consideration of £

qualitative factors for the engagement is:

Specific Performance Materiality - Qualitative Factors Yes or No Comment or Ref

Are there qualitative factors that, in your judgement, would

require a lower performance materiality for a specific account or

class of transactions?

If Yes then, List Areas below and determine Specific

Performance Materiality:

MATERIALITY DETERMINATION 0420.MPQ

Specific Performance Materiality - Qualitative Factors Yes or No Comment or Ref

£

£

£

Part 3 Summary Of Unadjusted Differences

Amount below which misstatements are not carried to SUD £

(before tax) (3% of Overall Materiality)

MATERIALITY DETERMINATION 0420.MPQ

Guidance

The primary purpose of this form is to document the calculation of planning materiality. Planning materiality will then be used to

guide the extent of the audit procedures performed. Planning materiality will be used at the end of the audit (MAP 722.MPQ) in

the evaluation phase - as will an assessment of quantitative materiality based on the results of the business.

An initial determination of materiality is required at the planning stage of the engagement. Materiality and audit risk are used to

plan the overall scope (nature, extent, and timing) of the audit procedures to be performed. At the end of the audit, we must

evaluate the total effect of the adjustments or potential adjustments to the financial statements to ensure that materiality does

not have to be significantly revised. Therefore, in practice, the adequacy of planning materiality is reassessed throughout the

audit to ensure that sufficient audit procedures are being performed.

Materiality in this MAP will be calculated on a pre-tax basis (if based on normalized earnings before income taxes), however,

materiality may be calculated on an after tax basis.

Guidance for Part 1

Overall Materiality shall be used to:

Determine whether, quantitatively, the value of each class of transactions, account balances or disclosures are

material; and

Evaluate, at the conclusion of the audit, whether misstatements identified from audit procedures are material, both

individually and in aggregate.

Guidance for Question 3

This section provides guidance on the selection of an appropriate base and percentage for the calculation of materiality. These

guidelines are not exhaustive, nor do they replace professional judgement.

Guidance for Performance Materiality - Quantitative Factors

Planning the audit solely to detect individually material misstatements overlooks the fact that the aggregate of individually

immaterial misstatements may cause the financial statements to be materially misstated, and leaves no margin for possible

undetected misstatements.

Performance materiality (which, as defined, is one or more amounts) is set to reduce to an appropriately low level the probability

that the aggregate of uncorrected and undetected misstatements in the financial statements exceeds materiality for the financial

statements as a whole.

Similarly, performance materiality relating to a materiality level determined for a particular class of transactions, account

balances or disclosures is set to reduce to an appropriately low level the probability that the aggregate of uncorrected and

undetected misstatements in that particular class of transactions, account balances or disclosures exceeds the materiality level

for that particular class of transactions, account balance or disclosures.

The determination of performance materiality is not a simple mechanical calculation and involves the exercise of professional

judgment. It is affected by the auditor‘s understanding of the entity, updated during the performance of the risk assessment

procedures and the nature and extent of misstatements identified in previous audits and, thereby, the auditor‘s expectations in

relation to misstatements in the current period.

The auditor shall determine Performance Materiality by applying (by means of multiplication) the following percentages to

Overall Materiality:

Low overall audit risk = 80%; or

High overall audit risk = 70%

Performance Materiality = Overall Materiality × Overall Audit Risk Percentage (70% or 80%)

Performance Materiality shall be used to determine the nature, timing and extent of audit procedures.

MATERIALITY DETERMINATION 0420.MPQ

Guidance for Specific Performance Materiality - Qualitative Factors

Transactions, Account Balances or Disclosures

Certain transactions, account balances and disclosures in the financial statements are by their nature more sensitive than

others. In these cases the auditor may need to determine a Specific Performance Materiality for such items. Typically, the

following transactions, account balances and disclosures may require particular consideration:

Related party balances and transactions

Certain profit and loss account balances of financial institutions, charities and pension schemes

Management estimates or valuations

Directors‘ remuneration (where there may be extra reporting responsibilities)

Directors‘ expense accounts

Disclosure of auditors‘ remuneration and (where relevant) non-audit fees

Commissions payable (particularly overseas commissions); and

Other sensitive expense accounts.

In respect of Fair Value Measurements, when auditing the valuation assertion related to significant accounting estimates the

following percentages may be applied (by means of multiplication) to Overall Materiality to determine Specific Performance

Materiality for these account balances:

Low overall audit risk = 40%

High overall audit risk = 30%; or

Listed clients = 20%.

Você também pode gostar

- Paladin - Sacred Oaths PDFDocumento3 páginasPaladin - Sacred Oaths PDFCarlos Rafael Rodrigues FilhoAinda não há avaliações

- Conflict of Laws Bar ExamDocumento9 páginasConflict of Laws Bar ExamAndrew Edward BatemanAinda não há avaliações

- 1.2.1 Financial Performance RatiosDocumento135 páginas1.2.1 Financial Performance RatiosGary AAinda não há avaliações

- Keys of The Kingdom-EbookDocumento18 páginasKeys of The Kingdom-EbookBernard Kolala0% (1)

- 06 Materiality TemplateDocumento9 páginas06 Materiality TemplateRussel SarachoAinda não há avaliações

- Audit Risk Alert: Employee Benefit Plans Industry Developments, 2018No EverandAudit Risk Alert: Employee Benefit Plans Industry Developments, 2018Ainda não há avaliações

- Chapter 10.audit ProceduresDocumento43 páginasChapter 10.audit Proceduresnychan99100% (10)

- IVS 2017 & Valuation For Secured LendingDocumento53 páginasIVS 2017 & Valuation For Secured LendingRanganathan Krishnan0% (1)

- Panay Autobus v. Public Service Commission (1933)Documento2 páginasPanay Autobus v. Public Service Commission (1933)xxxaaxxxAinda não há avaliações

- Audit MethodologyDocumento20 páginasAudit MethodologyVikasAgarwalAinda não há avaliações

- Criminal Law. L.b.reyesDocumento8 páginasCriminal Law. L.b.reyeserikha_araneta100% (1)

- Unit 5 Materiality Audit Strategy and PlanDocumento24 páginasUnit 5 Materiality Audit Strategy and PlanVincent LyAinda não há avaliações

- Determination of MaterialityDocumento4 páginasDetermination of Materialitynataliecheung324Ainda não há avaliações

- Audit Programme TaxDocumento6 páginasAudit Programme Taxaah_mundrawalaAinda não há avaliações

- 3317C 8 Materiality SummaryDocumento2 páginas3317C 8 Materiality SummaryShahi AlamAinda não há avaliações

- Sa 320Documento4 páginasSa 320SAI Charan GoudAinda não há avaliações

- 600 - Materiality AvayaDocumento19 páginas600 - Materiality AvayaBrayan Nicolás Martínez RomeroAinda não há avaliações

- At.3207-Considering Materiality and Audit RiskDocumento5 páginasAt.3207-Considering Materiality and Audit RiskDenny June CraususAinda não há avaliações

- TESCO 2019 FindingsDocumento4 páginasTESCO 2019 Findingssuraj lamaAinda não há avaliações

- Lesson 2.1 Materiality in Audit of FSDocumento5 páginasLesson 2.1 Materiality in Audit of FSrylAinda não há avaliações

- Answers: 高顿财经ACCA acca.gaodun.cnDocumento12 páginasAnswers: 高顿财经ACCA acca.gaodun.cnIskandar BudionoAinda não há avaliações

- Audit Planning - Analytical ProceduresDocumento35 páginasAudit Planning - Analytical ProceduresVenus Lyka LomocsoAinda não há avaliações

- Chapter 3: Sampling & Materiality: SA 320 - Materiality in Planning & Performing An AuditDocumento14 páginasChapter 3: Sampling & Materiality: SA 320 - Materiality in Planning & Performing An AuditlohitacademyAinda não há avaliações

- Audit PlanningDocumento16 páginasAudit PlanningNyaba NaimAinda não há avaliações

- Calculate Materiality: Assignment 2Documento3 páginasCalculate Materiality: Assignment 2ge baijingAinda não há avaliações

- Planning Kaplan Chapter 6: Acca Paper F8 Int Audit and AssuranceDocumento38 páginasPlanning Kaplan Chapter 6: Acca Paper F8 Int Audit and Assurancehaddad2020Ainda não há avaliações

- Basic Data: Operation ProfileDocumento11 páginasBasic Data: Operation ProfileAlan GarcíaAinda não há avaliações

- LS 2.90 - PSA 320 Materiality in The Planning and Performing An AuditDocumento6 páginasLS 2.90 - PSA 320 Materiality in The Planning and Performing An AuditSkye Lee100% (1)

- Lecture 5-Audit MaterialityDocumento3 páginasLecture 5-Audit Materialityakii ramAinda não há avaliações

- HBC Quarterly Performance Report Q1 2021-22Documento23 páginasHBC Quarterly Performance Report Q1 2021-22John KimAinda não há avaliações

- Unit 5. Financial Statement Analysis IIDocumento32 páginasUnit 5. Financial Statement Analysis IIsikute kamongwaAinda não há avaliações

- G - Materiality TemplateDocumento2 páginasG - Materiality TemplateMyda RafaelAinda não há avaliações

- 06 Materiality TemplateDocumento9 páginas06 Materiality TemplaterickmortyAinda não há avaliações

- Considering Materiality and Audit RiskDocumento3 páginasConsidering Materiality and Audit RiskIrish SanchezAinda não há avaliações

- A Forensic Accountants Take On MaterialityDocumento3 páginasA Forensic Accountants Take On MaterialityAbdifatah AbdilahiAinda não há avaliações

- MIS and Reporting For SAAS - 29092020Documento14 páginasMIS and Reporting For SAAS - 29092020Subscription SampleAinda não há avaliações

- Ias 320Documento4 páginasIas 320Bilal RazaAinda não há avaliações

- Chapter 9Documento4 páginasChapter 9Andrin LlemosAinda não há avaliações

- CAF 08 Test 7 - Suggested SolutionDocumento3 páginasCAF 08 Test 7 - Suggested SolutionUsama TariqAinda não há avaliações

- ISA 320 Materiality in Planning and Performing An AuditDocumento8 páginasISA 320 Materiality in Planning and Performing An AuditDarren LowAinda não há avaliações

- AT.109 - Materiality and RisksDocumento7 páginasAT.109 - Materiality and Risksandrew dacullaAinda não há avaliações

- CH 10Documento4 páginasCH 10Minh Thu Võ NgọcAinda não há avaliações

- Ke ToanDocumento5 páginasKe ToanThinh Ngo VanAinda não há avaliações

- Group 9 - BBB Audit Plan - V2-NCDocumento21 páginasGroup 9 - BBB Audit Plan - V2-NCNicholas CoxAinda não há avaliações

- Auditing and AccountingDocumento38 páginasAuditing and Accountingberihun admassuAinda não há avaliações

- Key Performance IndicatorsDocumento3 páginasKey Performance IndicatorsASHWIN RATHIAinda não há avaliações

- Breakeven Analysis DaburDocumento15 páginasBreakeven Analysis DaburblieAinda não há avaliações

- Module 1 AUDIT PLANNINGDocumento3 páginasModule 1 AUDIT PLANNINGLady BirdAinda não há avaliações

- GTHW 2010 Chapter 7 MaterialityDocumento9 páginasGTHW 2010 Chapter 7 MaterialityasaAinda não há avaliações

- Independent Auditors' Report: Basis For OpinionDocumento10 páginasIndependent Auditors' Report: Basis For OpiniondeepakAinda não há avaliações

- Audit MaterialityDocumento4 páginasAudit MaterialityJohn diggleAinda não há avaliações

- Interim Financial ReportingDocumento16 páginasInterim Financial ReportingUAinda não há avaliações

- The Balanced Scorecard Approach To Performance Management PDFDocumento3 páginasThe Balanced Scorecard Approach To Performance Management PDFTolulope Abiodun100% (1)

- Chapter 1: Demand For Audit & Other Assurance Services AuditingDocumento31 páginasChapter 1: Demand For Audit & Other Assurance Services AuditingBaka RulesAinda não há avaliações

- Monthly Performance Report Craig Design and LandscapingDocumento14 páginasMonthly Performance Report Craig Design and LandscapingShahnawaz JavedAinda não há avaliações

- Praneel Nag Audit Test 2Documento4 páginasPraneel Nag Audit Test 2Praneel NagAinda não há avaliações

- Audit Planning StepsDocumento42 páginasAudit Planning StepsYismawAinda não há avaliações

- Lesson 9 Determining MaterialityDocumento5 páginasLesson 9 Determining MaterialityMark TaysonAinda não há avaliações

- Session - 6 - MaterialityDocumento20 páginasSession - 6 - MaterialityIrandi UthpalaaAinda não há avaliações

- Lecture 1 Intro To FA Jan2018Documento33 páginasLecture 1 Intro To FA Jan2018IssacAinda não há avaliações

- Aa CH10Documento26 páginasAa CH10Thuỳ DươngAinda não há avaliações

- Sak Case 20.3Documento14 páginasSak Case 20.3Kemala Putri AyundaAinda não há avaliações

- Standard Costing and Variance AnalysisDocumento26 páginasStandard Costing and Variance Analysislloyd madanhireAinda não há avaliações

- Balanced ScorecardDocumento18 páginasBalanced ScorecardOnder YardasAinda não há avaliações

- Balance Score Card: Rajiv KumarDocumento14 páginasBalance Score Card: Rajiv KumarJigar PatelAinda não há avaliações

- Operation Profile: Basic DataDocumento13 páginasOperation Profile: Basic DataAlan GarcíaAinda não há avaliações

- List of Cases Selected For Audit Through Computer Ballot - Income TaxDocumento49 páginasList of Cases Selected For Audit Through Computer Ballot - Income TaxFahid AslamAinda não há avaliações

- Bullet Proof G WashingtonDocumento5 páginasBullet Proof G Washingtonapi-239094488Ainda não há avaliações

- PVL2602 Assignment 1Documento3 páginasPVL2602 Assignment 1milandaAinda não há avaliações

- Concept of Workman' Under Labour Law Legislations:: With Special Reference TO Industrial Disputes ACTDocumento17 páginasConcept of Workman' Under Labour Law Legislations:: With Special Reference TO Industrial Disputes ACTakshataAinda não há avaliações

- L Final Endorsement Letter To SLMB Constitution Without National FedDocumento8 páginasL Final Endorsement Letter To SLMB Constitution Without National FedJerson AgsiAinda não há avaliações

- September PDFDocumento402 páginasSeptember PDFNihal JamadarAinda não há avaliações

- DeviceHQ Dev User GuideDocumento13 páginasDeviceHQ Dev User GuidekediteheAinda não há avaliações

- Required Documents For EnrolmentDocumento7 páginasRequired Documents For EnrolmentCamillus Carillo AngelesAinda não há avaliações

- G.R. No. 68166 February 12, 1997 Heirs of Emiliano Navarro, Petitioner, Intermediate Appellate Court & Heirs of Sinforoso Pascual, RespondentsDocumento3 páginasG.R. No. 68166 February 12, 1997 Heirs of Emiliano Navarro, Petitioner, Intermediate Appellate Court & Heirs of Sinforoso Pascual, RespondentssophiabarnacheaAinda não há avaliações

- Notes 1. All Dimensions Are in Millimetres. 2. No Dimension Shall Be Scaled Off, Only Written Dimension To Be FollowedDocumento4 páginasNotes 1. All Dimensions Are in Millimetres. 2. No Dimension Shall Be Scaled Off, Only Written Dimension To Be FollowednidhisasidharanAinda não há avaliações

- Business Law Dissertation TopicsDocumento7 páginasBusiness Law Dissertation TopicsCustomWrittenCollegePapersSingapore100% (1)

- JibranDocumento15 páginasJibranMuhammad Qamar ShehzadAinda não há avaliações

- M-K-I-, AXXX XXX 691 (BIA March 9, 2017)Documento43 páginasM-K-I-, AXXX XXX 691 (BIA March 9, 2017)Immigrant & Refugee Appellate Center, LLC100% (2)

- Farooq e Azam Ka Khuaf e KhudaDocumento42 páginasFarooq e Azam Ka Khuaf e KhudaAneeka SyedAinda não há avaliações

- Aguinaldo DoctrineDocumento7 páginasAguinaldo Doctrineapril75Ainda não há avaliações

- The Oecd Principles of Corporate GovernanceDocumento8 páginasThe Oecd Principles of Corporate GovernanceNazifaAinda não há avaliações

- Sea Freight Sop Our Sales Routing OrderDocumento7 páginasSea Freight Sop Our Sales Routing OrderDeepak JhaAinda não há avaliações

- IPC Chapter 09A: Chapter IXA - of Offences Relating To ElectionsDocumento18 páginasIPC Chapter 09A: Chapter IXA - of Offences Relating To ElectionsAdnan MoquaddamAinda não há avaliações

- Schumer's AI One PagerDocumento1 páginaSchumer's AI One PagerWashington ExaminerAinda não há avaliações

- Reducing Samples of Aggregate To Testing Size: Standard Practice ForDocumento5 páginasReducing Samples of Aggregate To Testing Size: Standard Practice FormickyfelixAinda não há avaliações

- Cash and Cash EquivalentDocumento2 páginasCash and Cash EquivalentJovani Laña100% (1)

- Varieties of CapitalismDocumento4 páginasVarieties of CapitalismZaira AsakilAinda não há avaliações

- And Prescribed by The National Office." (Italics and Emphasis Supplied)Documento2 páginasAnd Prescribed by The National Office." (Italics and Emphasis Supplied)Ckey ArAinda não há avaliações

- Deed of Absolute Sale of Real Property in A More Elaborate Form PDFDocumento2 páginasDeed of Absolute Sale of Real Property in A More Elaborate Form PDFAnonymous FExJPnC100% (2)