Escolar Documentos

Profissional Documentos

Cultura Documentos

Employment Income Assignment

Enviado por

Jack LeeTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Employment Income Assignment

Enviado por

Jack LeeDireitos autorais:

Formatos disponíveis

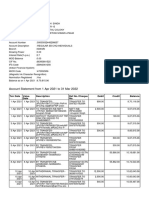

Assignment 2

1) Housing Subsidy

Hotel Suite fee 5,000.00

Martha's rent 2,000.00

Martha's Benefit 3,000.00 (6 months rent) 18,000.00

2) Housing Loss

GME Compensation 67,500.00

Allowable amount 15,000.00

Benefit 52,500.00 (50% is taxable) 26,250.00

3) Interest Free Housing Loan

Prescribed Interest 2% x 100,000 x (245/365) 1,342.47

Interest Paid 0.00

Imputed Interest 1,342.47

4) Salary & Bonuses

Salary 175,000.00

5) RPP Contribution

GME Contribution (2,500.00)

6) Medical Coverage

Private medical coverage is not taxable 0.00

7) Non-cash Gifts

Ski pass 1,000.00

non-taxable portion 500.00

500.00

Gift certificate 100.00

Benefit 600.00

8) Grief Counselling

Benefit derived from counselling for mental health is not taxable 0.00

9) Employee Discounts

Benefits relating to corporate discounts are not taxable 0.00

10) Stock Option Benefit

Exercise price 100.00

FMV (grant) 94.00

FMV (exercise) 123.00

Stock option benefit 50*(123-100) 1,150.00

110(1)(d) Dedeuction - Exercise price>FMV (grant) (575.00)

575.00

11) Recreational Facility / Meals and Drinks

It appears that the Blackcomb membership is only given to

Martha and is therefore taxable 5,000.00

The meals and drinks reimbursement is employment

related since it's used for client meetings, therefore non-taxable 0.00

12) Company Automobile

Standby charge 12,000 * (2%*120,000*12) 17,276.54

(1,667*12)

Operating cost 0.26*12,000 3,120.00

20,396.54

13) Home Office

Monthly Maintenance Fee deduction (5,400)*600/2,222 (1,458.15)

Hyrdo deduction (450)*600/2,222 (121.51)

(1,579.66)

14) Home Allowance

Monthly maintenance allowance 400.00 6 months 2,400.00

NET EMPLOYMENT INCOME 245,484.35

Você também pode gostar

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Statment PDFDocumento1 páginaStatment PDFAnonymous oPpOqo100% (1)

- Teresita Buenaflor ShoesDocumento19 páginasTeresita Buenaflor ShoesGiselle Martinez87% (30)

- 1909200284Documento1 página1909200284Roni WibowoAinda não há avaliações

- Payment Gateway in EcommerceDocumento3 páginasPayment Gateway in Ecommercesachin sandbhorAinda não há avaliações

- Inventory - PPT Presentation For Inventory MangmentDocumento71 páginasInventory - PPT Presentation For Inventory MangmentPSYCHOTHEWALLAinda não há avaliações

- Statement 50358898708 20230601 132252 2Documento1 páginaStatement 50358898708 20230601 132252 2Jameer HasanAinda não há avaliações

- NTUC Supply Chain ManagementDocumento26 páginasNTUC Supply Chain ManagementPatRick NgAinda não há avaliações

- 2016 - Summer - MidtermDocumento13 páginas2016 - Summer - MidtermJack LeeAinda não há avaliações

- 2014 - Summer - MidtermDocumento12 páginas2014 - Summer - MidtermJack LeeAinda não há avaliações

- Chapter 1 DefinitionsDocumento1 páginaChapter 1 DefinitionsJack LeeAinda não há avaliações

- Liberty and EqualityDocumento3 páginasLiberty and EqualityJack LeeAinda não há avaliações

- PWD - TNsandDocumento2 páginasPWD - TNsandSivaAinda não há avaliações

- Challanform 1570936550Documento1 páginaChallanform 1570936550malik awanAinda não há avaliações

- ICP Receipt - ICP 384036Documento2 páginasICP Receipt - ICP 384036Salman TamboliAinda não há avaliações

- CE 199 TEG Bendicio, Pongos - Research Summary ReportDocumento8 páginasCE 199 TEG Bendicio, Pongos - Research Summary ReportArfil BendicioAinda não há avaliações

- Reg No 139 Obligatory Use of Sales RegisterDocumento11 páginasReg No 139 Obligatory Use of Sales RegisterbiniAinda não há avaliações

- Form 16: Wipro LimitedDocumento6 páginasForm 16: Wipro LimitedSanjay RamuAinda não há avaliações

- Stat 240120 174404Documento103 páginasStat 240120 174404romeoahmed687Ainda não há avaliações

- It 000141511985 2022 00Documento1 páginaIt 000141511985 2022 00Abdul Basit KtkAinda não há avaliações

- Corporate Office: Reliance Communications Limited, Dhirubhai Ambani Knowledge City, Navi Mumbai 400709, IndiaDocumento1 páginaCorporate Office: Reliance Communications Limited, Dhirubhai Ambani Knowledge City, Navi Mumbai 400709, IndiaKamal SarinAinda não há avaliações

- Formulir Perjanjian Sewa MobilDocumento1 páginaFormulir Perjanjian Sewa Mobilmax5trikeAinda não há avaliações

- Audit Prob Cash AnsDocumento7 páginasAudit Prob Cash AnsNoreen BinagAinda não há avaliações

- Mobile Bank AccountDocumento15 páginasMobile Bank AccountMazhar SaeedAinda não há avaliações

- C. Identification, Recording, Communication.: ExceptDocumento9 páginasC. Identification, Recording, Communication.: ExceptSylvia Al-a'maAinda não há avaliações

- Bill PDFDocumento1 páginaBill PDFSyedAhsanKamalAinda não há avaliações

- Import of Vehicles Rules FDRDocumento14 páginasImport of Vehicles Rules FDRHamid AliAinda não há avaliações

- Evaluation Sheet: (Abatement or Cancellation of Taxes, Penalties And/Or Interest)Documento5 páginasEvaluation Sheet: (Abatement or Cancellation of Taxes, Penalties And/Or Interest)Hanabishi RekkaAinda não há avaliações

- Account Statement From 1 Apr 2021 To 31 Mar 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocumento12 páginasAccount Statement From 1 Apr 2021 To 31 Mar 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceNiwadi PremiAinda não há avaliações

- Schmitz Transport and Brokerage Corp. vs. Transport Venture Inc. (Gr. No. 150255)Documento1 páginaSchmitz Transport and Brokerage Corp. vs. Transport Venture Inc. (Gr. No. 150255)Pinoy Doto Best DotoAinda não há avaliações

- Mr. Praveen Kumar S PNR: Kc8Whw/Sg: Pune (T1) SG 774 Chennai (T1)Documento1 páginaMr. Praveen Kumar S PNR: Kc8Whw/Sg: Pune (T1) SG 774 Chennai (T1)Praveen kumarAinda não há avaliações

- AVROTO M2814-11S V3 - Cedric BourgoinDocumento3 páginasAVROTO M2814-11S V3 - Cedric BourgoinHector MercadoAinda não há avaliações

- Challan MUHAMMAD KHUBAIB ASLAM-1Documento1 páginaChallan MUHAMMAD KHUBAIB ASLAM-1Khubaib AslamAinda não há avaliações

- Allowable DeductionsDocumento17 páginasAllowable DeductionsShanelle SilmaroAinda não há avaliações

- Week 05 - Compendium V - Factoring & Forfaiting v3Documento16 páginasWeek 05 - Compendium V - Factoring & Forfaiting v3ximenaAinda não há avaliações