Escolar Documentos

Profissional Documentos

Cultura Documentos

Behavioural Study of An Indian Stock Market

Enviado por

vijay vijTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Behavioural Study of An Indian Stock Market

Enviado por

vijay vijDireitos autorais:

Formatos disponíveis

BEHAVIOURAL STUDY OF AN INDIAN STOCK MARKET

INTRODUCTION:

All over the world have seen financial markets are more volatile over the years. Traditionally,

asset returns were measured based on the fundamentals, forecasting ability and market consensus

which produced prevalent results and this information influences the performance of the asset in

stock market. Due to this fact investor possible returns of stock and received returns differ, to

avoid this problem and to improve the quality of investment decisions of investors, behavioural

economists identify the importance of psychological biases on investment decision-making the

process of the investor.

Research has revealed that behaviour of the value of the share is

inconsistent with the prediction of well-known rational models as anticipated returns are not

steady over a period. Hence, there is need to develop studies and some models which can help

the investor to make better strategies for investment.

Different research studies provided evidence that behavioural biases and anomalies affect the

investment strategy of investors in financial markets. Behavioural biases and anomalies

contribute more when making investment decision-making process of investors. Among all of

the havioural biases, herding behaviour is one of the most common behaviours found in the

investors while understanding their psychology.

Herding behaviour can exist among the investor is when investor

suppressing his information and follow the market consensus over the time or follow the other

perspective instead of his self-recommendations, According to (Grinblatt et. al., 1995) and

(Nofsinger & Sias, 1999) proposed the more broad meaning of herding behaviour, as a group of

market participants conduct the trade similarly way for a given time. This relationship may

observe if factors and common information independently influence investors. Similarly, (Abhijit

V. Banerjee, 1992) also defined that herding occurs as individuals do what others do, even when

they are concealed information suggests they ought to obtain a different decision. Also, herding

behaviour could be explaining two different ways, i.e., rational and irrational views.

In rational view, herding can be defined as a tendency of investors irrationally

overlook their analysis and information and follow the market consent, even if the market

participant has prevailed information in their hand. On another side, Irrational herding mainly

happens due to protect reputational concerns of an investor. Similar to this scenario, the investor

usually pays no attention to their study of available information and starts to follow the decisions

of other investors by assuming that, decisions made by other investors are more consistent and

they had accessed the information from better sources. The realities of herding behaviour in

financial markets challenge the validation of the Efficient Market Hypothesis (EMH) and Capital

Asset Pricing Model.

NEED FOR THE STUDY:

Stock market is an important part of the economy of a country. the stock market plays a play a

pivotal role in the growth of the industry and commence of the country the eventually affects the

economy of the country to great event, that is reason that the government industry and even the

central bank of the country keep a close watch on the happenings of the stock market.

STATEMENT OF THE PROBLEM:

Due to the positive correlation between stock market and economy, the rise of stock market will

positively affect the development of the economy and vice versa. Thus, the decisions of

investors on stock market play an important role in defining the market trend, which then

influences the economy. To understand and give some suitable explanation for the investors’

decisions, it is important to explore which behavioural factors influence the decisions of

individual investors at the Indian Stock Exchange.

OBJECTIVES OF THE STUDY:

The study attempts to achieve the following objectives:

• To locate the factors influencing the decision of investment.

• To measure the extent to which an Indian investor has utilitarian or value-

expressive preferences.

• To study the effect of demographic factors (like age, gender and income) on

investor’s preference.

DATA SOURCES:

The database provides information regarding the daily opening, high, low, and close values of

the SENSEX and NATEX and BSE200 indices among other indices. The research is conducted

for Nifty 50 index & Nifty 50 stocks. It is based on the daily closing price of the trading sessions

for the period of 5 years that is from 1st April 2013 to 31st March 2018.

Você também pode gostar

- Project Dated 4-A STUDY OF RETAIL INVESTOR BEHAVIOR ON INVESTMENT DECISIONDocumento124 páginasProject Dated 4-A STUDY OF RETAIL INVESTOR BEHAVIOR ON INVESTMENT DECISIONSharanya SvAinda não há avaliações

- Factors Influencing Investment Decisions of Retail Investors - A Descriptive StudyDocumento4 páginasFactors Influencing Investment Decisions of Retail Investors - A Descriptive Studyinventionjournals100% (1)

- Emotion and InvestingDocumento10 páginasEmotion and InvestingkwongAinda não há avaliações

- Chapter - Ii: Review of LiteratureDocumento35 páginasChapter - Ii: Review of LiteratureSai VarunAinda não há avaliações

- UnfurledDocumento8 páginasUnfurledsowyam saleAinda não há avaliações

- Factors Influencing Investment Decision of Individual Investors in Stocks (With Reference To Indore City)Documento10 páginasFactors Influencing Investment Decision of Individual Investors in Stocks (With Reference To Indore City)Ankitha KavyaAinda não há avaliações

- UntitledDocumento44 páginasUntitledSkCharumathiAinda não há avaliações

- Business Research MethodsDocumento3 páginasBusiness Research Methodsmuhammad ashhadAinda não há avaliações

- Factors Influencing Investment Decisions of Individual Investors at Nepal Stock ExchangeDocumento16 páginasFactors Influencing Investment Decisions of Individual Investors at Nepal Stock ExchangeUdhithaa S K KotaAinda não há avaliações

- Gambler's Fallacy and Behavioral Finance in The Financial Markets: A Case Study of Bombay Stock ExchangeDocumento7 páginasGambler's Fallacy and Behavioral Finance in The Financial Markets: A Case Study of Bombay Stock ExchangeinventionjournalsAinda não há avaliações

- A Study On Relevance of Behavioural Finance Theories On Investor Decision MakingDocumento8 páginasA Study On Relevance of Behavioural Finance Theories On Investor Decision MakingAdesh DhakaneAinda não há avaliações

- ProjectDocumento15 páginasProjectwww.muhammedsalah07Ainda não há avaliações

- Newproject 160624075440Documento120 páginasNewproject 160624075440હિરેનપ્રફુલચંદ્રજોષીAinda não há avaliações

- Art 2Documento17 páginasArt 2raja.elasriAinda não há avaliações

- Effect of Cognitive and Emotional Biases On Investor Decisions: An Analytical Study of The Iraq Stock ExchangeDocumento18 páginasEffect of Cognitive and Emotional Biases On Investor Decisions: An Analytical Study of The Iraq Stock ExchangeBrightsideAinda não há avaliações

- Retracted Retracted Retracted Retracted: Determinants of Retail Investors Behavior and Its Impact On Investment DecisionDocumento13 páginasRetracted Retracted Retracted Retracted: Determinants of Retail Investors Behavior and Its Impact On Investment DecisionZarin IrfanAinda não há avaliações

- 030 - Investment Decision MakingDocumento9 páginas030 - Investment Decision MakingSwami PranaAinda não há avaliações

- Investor's Behavior and Preferences, A Case Study of Indian Stock Market PDFDocumento11 páginasInvestor's Behavior and Preferences, A Case Study of Indian Stock Market PDFSebastian Pulgarin RAinda não há avaliações

- 10 1108 - Jamr 03 2019 0041Documento18 páginas10 1108 - Jamr 03 2019 0041ANKIT RAIAinda não há avaliações

- Factors Influencing Indian Individual in PDFDocumento41 páginasFactors Influencing Indian Individual in PDFTarique HusenAinda não há avaliações

- Behavioral Biases Across The Stock Market Investors: Evidence From PakistanDocumento25 páginasBehavioral Biases Across The Stock Market Investors: Evidence From PakistanPeterAinda não há avaliações

- Synopsis On Volatile Market ConDocumento8 páginasSynopsis On Volatile Market ConVenky K VenkyAinda não há avaliações

- PROJECT REPORT On - Equity Research On Indian Banking SectorDocumento100 páginasPROJECT REPORT On - Equity Research On Indian Banking Sectoryogeshmahavirjadhav40% (5)

- Final Part 3Documento58 páginasFinal Part 3selvalakshmiAinda não há avaliações

- Devansh Gupta - FinanceDocumento39 páginasDevansh Gupta - FinanceRachna KathuriaAinda não há avaliações

- Microsoft Word - Financial Instruments Project ReportDocumento72 páginasMicrosoft Word - Financial Instruments Project ReportHimanshu Bhasin75% (32)

- Project Report1Documento5 páginasProject Report1sahilAinda não há avaliações

- Investment and Trading Pattern of Individuals Dealing in Stock MarketDocumento8 páginasInvestment and Trading Pattern of Individuals Dealing in Stock MarketthesijAinda não há avaliações

- SSRN Id3711301Documento14 páginasSSRN Id3711301019 Pooja DhebariyaAinda não há avaliações

- A Study of Determinants of Investors BehDocumento9 páginasA Study of Determinants of Investors BehMegha PatelAinda não há avaliações

- Research Paper On Investment BehaviourDocumento4 páginasResearch Paper On Investment Behaviouraflefvsva100% (1)

- Stock Market and Foreign Exchange Market: An Empirical GuidanceNo EverandStock Market and Foreign Exchange Market: An Empirical GuidanceAinda não há avaliações

- Sip ReportDocumento56 páginasSip ReportAli tubeAinda não há avaliações

- 20880-Article Text-66052-1-10-20180826Documento9 páginas20880-Article Text-66052-1-10-20180826shubham moonAinda não há avaliações

- Final Report - Plag (Revised)Documento39 páginasFinal Report - Plag (Revised)Rachna KathuriaAinda não há avaliações

- Implications of Behavioural Finance in The Derivative SegmentDocumento6 páginasImplications of Behavioural Finance in The Derivative SegmentIJRASETPublicationsAinda não há avaliações

- 24746-Article Text-75357-1-10-20190705Documento10 páginas24746-Article Text-75357-1-10-20190705ashAinda não há avaliações

- Stock Market AnalysisDocumento7 páginasStock Market AnalysisSoumyasri MeruguAinda não há avaliações

- Investors Perception Towards Stock MarketDocumento2 páginasInvestors Perception Towards Stock MarketAkhil Anilkumar0% (1)

- Chapter 1Documento12 páginasChapter 1Sanaullah M SultanpurAinda não há avaliações

- Behavioral Biases in Investment Decision MakingDocumento24 páginasBehavioral Biases in Investment Decision MakingERika PratiwiAinda não há avaliações

- Behavioral Finance An Impact of Investors Unpredictable Behavior On Stock MarketDocumento5 páginasBehavioral Finance An Impact of Investors Unpredictable Behavior On Stock MarketBinayKPAinda não há avaliações

- Review of The LiteratureDocumento44 páginasReview of The Literaturesneha shuklaAinda não há avaliações

- Factors Effecting Investment Decision in Stock Exchange by Individual InvestorDocumento17 páginasFactors Effecting Investment Decision in Stock Exchange by Individual InvestorSami Rasheed100% (4)

- Factors Influencing Investment Decisions of Nepalese InvestorsDocumento16 páginasFactors Influencing Investment Decisions of Nepalese InvestorsHappyGautamAinda não há avaliações

- "Volatility & Factors Affecting Indian Stock Market": SynopsisDocumento12 páginas"Volatility & Factors Affecting Indian Stock Market": Synopsisarpitchawla24x7Ainda não há avaliações

- International Journal of Management (Ijm) : ©iaemeDocumento7 páginasInternational Journal of Management (Ijm) : ©iaemeIAEME PublicationAinda não há avaliações

- A Study On Factors Influencing Buying Behavior of Securities in Indian Stock MarketsDocumento9 páginasA Study On Factors Influencing Buying Behavior of Securities in Indian Stock MarketsShivam Singh RajputAinda não há avaliações

- SynopsisDocumento10 páginasSynopsisMohit RawatAinda não há avaliações

- 1.1 Introduction To The Report: Chapter-1Documento6 páginas1.1 Introduction To The Report: Chapter-1Yashas JAinda não há avaliações

- PGDFM Project Final 1Documento61 páginasPGDFM Project Final 1Nitesh ChauhanAinda não há avaliações

- Stock Market Crash and An Individual Inv PDFDocumento7 páginasStock Market Crash and An Individual Inv PDFSaloni Jain 1820343Ainda não há avaliações

- BF Kerala Q 7Documento21 páginasBF Kerala Q 7SarikaAinda não há avaliações

- 42 81 1 SMDocumento17 páginas42 81 1 SMharryAinda não há avaliações

- How Behavioural Finance Affects Investment DecisionDocumento1 páginaHow Behavioural Finance Affects Investment DecisionSimran MaheshwariAinda não há avaliações

- Factors Influencing Investors' Decisions in Stock MarketDocumento7 páginasFactors Influencing Investors' Decisions in Stock MarketJeetAinda não há avaliações

- A simple approach to passive investing: An Introductory Guide to the Theoretical and Operational Principles of Passive Investing for Building Lazy Portfolios that Perform Over TimeNo EverandA simple approach to passive investing: An Introductory Guide to the Theoretical and Operational Principles of Passive Investing for Building Lazy Portfolios that Perform Over TimeAinda não há avaliações

- Behavioral Finance How Psychological Factors can Influence the Stock MarketNo EverandBehavioral Finance How Psychological Factors can Influence the Stock MarketNota: 5 de 5 estrelas5/5 (1)

- Madanapalle Institute of Technology & Science, (Autonomous)Documento4 páginasMadanapalle Institute of Technology & Science, (Autonomous)vijay vijAinda não há avaliações

- VUSSENIDocumento6 páginasVUSSENIvijay vijAinda não há avaliações

- Name: Vennela Keerthi. E ROLL NO: 17691E00L4Documento3 páginasName: Vennela Keerthi. E ROLL NO: 17691E00L4Rama RammuAinda não há avaliações

- Name: Vennela Keerthi. E ROLL NO: 17691E00L4Documento3 páginasName: Vennela Keerthi. E ROLL NO: 17691E00L4Rama RammuAinda não há avaliações

- Project 00Documento1 páginaProject 00vijay vijAinda não há avaliações

- Significance of Cross Elasticity of DemandDocumento4 páginasSignificance of Cross Elasticity of Demandvijay vijAinda não há avaliações

- ProjectDocumento1 páginaProjectvijay vijAinda não há avaliações

- Uploaded by VJDocumento1 páginaUploaded by VJvijay vijAinda não há avaliações

- Tesla Is A ScienceDocumento1 páginaTesla Is A Sciencevijay vijAinda não há avaliações

- VJ EncryptionDocumento1 páginaVJ Encryptionvijay vijAinda não há avaliações

- Tesla Is A ScienceDocumento1 páginaTesla Is A Sciencevijay vijAinda não há avaliações

- Resume VijayDocumento2 páginasResume Vijayvijay vijAinda não há avaliações

- Inb372-Sla Case-Sec14-Summer20Documento5 páginasInb372-Sla Case-Sec14-Summer20Zayedul Haque Zayed100% (1)

- Karta: Position, Duties and PowersDocumento9 páginasKarta: Position, Duties and PowersSamiksha PawarAinda não há avaliações

- Lesson 4 Agile Estimating Planning Monitoring and ControllingDocumento51 páginasLesson 4 Agile Estimating Planning Monitoring and Controllingbharath S SAinda não há avaliações

- CK40N Edit Costing Run InstructionDocumento37 páginasCK40N Edit Costing Run InstructionPeter Sand100% (2)

- Uber - Pune - Airport - Home - Friday Afternoon Trip With UberDocumento3 páginasUber - Pune - Airport - Home - Friday Afternoon Trip With UberamolAinda não há avaliações

- CS Receive and Store Kitchen Supplies and Food StockDocumento8 páginasCS Receive and Store Kitchen Supplies and Food StockabisaptadinataAinda não há avaliações

- Case Study Report Sheet - Timmons TemplateDocumento3 páginasCase Study Report Sheet - Timmons TemplateEmmanuel DianaAinda não há avaliações

- Case 2 - Efficiency Gains - Manila WaterDocumento4 páginasCase 2 - Efficiency Gains - Manila WaterJulan CastroAinda não há avaliações

- Joint Stock CompanyDocumento22 páginasJoint Stock Companypawanraygrd098Ainda não há avaliações

- A'lla Zahwa Andewi Nugraheni - 464977 - Tugas FM CH 14 & 15Documento7 páginasA'lla Zahwa Andewi Nugraheni - 464977 - Tugas FM CH 14 & 15PRA MBAAinda não há avaliações

- PVR 3 1118007194 Amit Kumar SinhaDocumento7 páginasPVR 3 1118007194 Amit Kumar SinhaSHAHABAJ ALAMAinda não há avaliações

- Bridging Players and Investors To Capture The Rise of NFT GamesDocumento15 páginasBridging Players and Investors To Capture The Rise of NFT GamesAdetunji TaiwoAinda não há avaliações

- SHRM ReviewDocumento18 páginasSHRM ReviewjirnalAinda não há avaliações

- Asian RegionalismDocumento17 páginasAsian RegionalismKurtny GarciaAinda não há avaliações

- Strengths: Company Strengths and WeaknessessDocumento2 páginasStrengths: Company Strengths and WeaknessessexquisiteAinda não há avaliações

- Xerox-Od Xerox-Od1 MergedDocumento2 páginasXerox-Od Xerox-Od1 MergedFor My YouTubeAinda não há avaliações

- NRF National Retail Security Survey 2023Documento24 páginasNRF National Retail Security Survey 2023Veronica Silveri100% (1)

- Consumers, Producers, and The Efficiency of Markets: Multiple ChoiceDocumento36 páginasConsumers, Producers, and The Efficiency of Markets: Multiple ChoiceHuy BảoAinda não há avaliações

- The Level of Satisfaction On The Electronic Filing and Payment System of Bir by The Public Practitioner Cpas in Baguio CityDocumento14 páginasThe Level of Satisfaction On The Electronic Filing and Payment System of Bir by The Public Practitioner Cpas in Baguio Cityjovelyn labordoAinda não há avaliações

- Research Issues Within Contemporary Management 1044243Documento26 páginasResearch Issues Within Contemporary Management 1044243Ravi Kumawat100% (1)

- Ceteris ParibusDocumento2 páginasCeteris ParibusRosemarie CardonaAinda não há avaliações

- Economics Class 01 (Abc of Economics) PDFDocumento10 páginasEconomics Class 01 (Abc of Economics) PDFmakbul rahmanAinda não há avaliações

- Production ManagementDocumento4 páginasProduction ManagementJoanna Phaye VilbarAinda não há avaliações

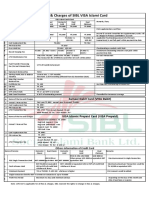

- Fees and Charges of SIBL Islami CardDocumento1 páginaFees and Charges of SIBL Islami CardMd YusufAinda não há avaliações

- Index: GD251222-en 2 1 14Documento14 páginasIndex: GD251222-en 2 1 14'PeRsona NoUn GraTa'Ainda não há avaliações

- Tab Washers For B.A. Aircraft and B.S.W. Hexagons ForDocumento10 páginasTab Washers For B.A. Aircraft and B.S.W. Hexagons ForcoolkaisyAinda não há avaliações

- Banking Law AssignmentDocumento18 páginasBanking Law AssignmentsrdtrsrtdAinda não há avaliações

- P2P SOD List PDFDocumento27 páginasP2P SOD List PDFfaridfarzanaAinda não há avaliações

- Ford Motor Company by RaghavendraDocumento22 páginasFord Motor Company by RaghavendraRaghavendra yadav KMAinda não há avaliações

- Velasco Vs Ca - DigestDocumento2 páginasVelasco Vs Ca - DigestJoshhh rcAinda não há avaliações