Escolar Documentos

Profissional Documentos

Cultura Documentos

Quantitative Methods For Business and Management

Enviado por

Adam BourneDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Quantitative Methods For Business and Management

Enviado por

Adam BourneDireitos autorais:

Formatos disponíveis

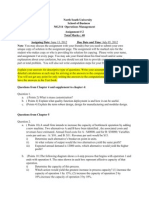

Unit Title: Quantitative Methods for Business Unit Code: QM

and Management

Level: 5 Learning Hours: 160

Learning Outcomes and Indicative Content:

Candidates will be able to:

1. Distinguish between different types of data and different data

collection processes

1.1 Explain the main sources and types of data (including primary

and secondary data, discrete and continuous data, quantitative

and categorical data)

1.2 Distinguish between alternative measurement scales (nominal,

ordinal, interval and ratio scales)

1.3 Compare and contrast alternative sampling methods and

understand the main features of surveys, questionnaire design

and the concept of sampling error and bias

2. Present data effectively and compute and interpret a range of

summary statistics

2.1 Construct appropriate tables and charts, including frequency

and cumulative frequency distributions and their graphical

representations

2.2 Calculate and interpret measures of location, dispersion, relative

dispersion and skewness for ungrouped and grouped data

2.3 Compute unweighted and weighted index numbers and

understand their applications

2.4 Change the base period of an index number series

3. Explain the basic concepts of probability and probability

distributions and compute probabilities

3.1 Demonstrate an understanding of the basic rules of probability

3.2 Explain the conditions under which the binomial and Poisson

distributions may be used and apply them to compute

probabilities

3.3 Explain the characteristics of the normal distribution and apply it

to compute probabilities

4. Apply concepts of probability to analyse business decision-

making under conditions of uncertainty

4.1 Explain and calculate expected monetary values (EMVs) and

construct probability trees

4.2 Construct decision trees and show how they can be used as an

aid to business decision-making under uncertainty

4.3 Discuss the limitations of EMV analysis in business decision-

making

5. Apply the normal and t distributions in estimation and hypothesis

testing and conduct chi-squared tests

5.1 Explain and discuss the importance of sampling theory and the

central limit theorem

5.2 Construct and interpret confidence intervals, using the normal or

t distribution, as appropriate, and calculate the sample size

required to estimate population values to within given limits

5.3 Conduct hypothesis tests of a single mean, a single proportion,

the difference between two means and the difference between

two proportions

5.4 Conduct chi-squared tests of goodness-of-fit and independence

and interpret the results

6. Apply correlation and regression analysis to identify the strength

and form of relationships between variables

6.1 Construct scatter diagrams to illustrate linear association

between two variables and comment on the shape of the graph

6.2 Calculate and interpret Pearson’s coefficient of correlation and

Spearman’s ‘rank’ correlation coefficient and distinguish

between correlation and causality

6.3 Estimate the ‘least squares’ regression line for a two-variable

model and interpret basic results from simple and multiple

regression models

6.4 Use an estimated regression equation to make predictions and

comment on their likely accuracy

7. Demonstrate how time-series analysis can be used in business

forecasting

7.1 Distinguish between the various components of a time series

(trend, cyclical variation, seasonal variation and random

variation)

7.2 Estimate a trend by applying the method of moving averages

and simple linear regression

7.3 Apply the additive and multiplicative models to estimate

seasonal factors

7.4 Use estimates of the trend and seasonal factors to forecast

future values (and comment on their likely accuracy) and to

compute seasonally adjusted data

8. Explain how mathematical relationships can be applied in the

solution of economic and business problems

8.1 Use algebraic and graphical representations of demand and

supply functions to determine the equilibrium price and quantity

in a competitive market

8.2 Analyse the effects of changes in the market (e.g. the imposition

of a sales tax) on the equilibrium price and quantity

8.3 Apply break-even analysis to determine the output decisions of

firms and to analyse the effects of changes in the cost and

revenue functions

8.4 Discuss the importance and explain the limitations of simple

break-even analysis

Throughout, students will be expected to be able to define relevant terms,

discuss the importance of statistical and mathematical concepts in business

decision-making and to interpret all results.

Assessment Criteria:

• Assessment method: written examination

• Length of examination: three hours

• Candidates should answer four questions from a choice of eight, each

question carrying equal marks

Recommended Reading

ABE, ABE Study Manual –Quantitative Methods, ABE

Curwin J, Slater R, Quantitative Methods for Business Decisions (2001),

Thomson Learning

ISBN: 1861525311

Burton G, Carrol G, Wall S, Quantitative Methods for Business and

Economics (2001), Prentice Hall

ISBN: 0273655701

Você também pode gostar

- Pre AssessmentDocumento16 páginasPre Assessmentaboulazhar50% (2)

- Corp Fin Test PDFDocumento6 páginasCorp Fin Test PDFRaghav JainAinda não há avaliações

- Quantitative Methods Management TutorialsDocumento167 páginasQuantitative Methods Management Tutorialssyedfahad11133% (3)

- Finance Exam 1Documento2 páginasFinance Exam 1yolanda davisAinda não há avaliações

- 3Documento20 páginas3Faraz AliAinda não há avaliações

- Lecture 1 (Final) - Chapter 1 - Introduction To Quantitative AnalysisDocumento24 páginasLecture 1 (Final) - Chapter 1 - Introduction To Quantitative Analysisvivi AnAinda não há avaliações

- Regression ModelsDocumento26 páginasRegression Modelssbc100% (2)

- ASSIGNMENT 3 A and 3B PDFDocumento9 páginasASSIGNMENT 3 A and 3B PDFBilal BilalAinda não há avaliações

- Rule of MultiplicationDocumento23 páginasRule of MultiplicationbheakantiAinda não há avaliações

- Supply Chain Management - Quiz 2 - 2020 v1Documento7 páginasSupply Chain Management - Quiz 2 - 2020 v1Raj BafnaAinda não há avaliações

- CS507 Mid Term Without RepeatedDocumento22 páginasCS507 Mid Term Without RepeatedvuqamarAinda não há avaliações

- CH 07 Interviewing CandidatesDocumento30 páginasCH 07 Interviewing CandidatesKashif Ullah KhanAinda não há avaliações

- Marketing & Customer ValueDocumento16 páginasMarketing & Customer Valuevir13janAinda não há avaliações

- MGT603 Sloved MCQsDocumento11 páginasMGT603 Sloved MCQsRASHIDWAHEEDAinda não há avaliações

- 05 - Demand Estimation and ForecastingDocumento52 páginas05 - Demand Estimation and ForecastingRistianiAniAinda não há avaliações

- Quantitative MethodsDocumento42 páginasQuantitative Methodsravich9Ainda não há avaliações

- Quantitative Analysis Ch 1 IntroDocumento12 páginasQuantitative Analysis Ch 1 IntroAngelo VilladoresAinda não há avaliações

- Scenario:: Assignment 2Documento3 páginasScenario:: Assignment 2Biya Kazmi0% (1)

- Correct Option Creditors Expected Claim Is $37,800Documento2 páginasCorrect Option Creditors Expected Claim Is $37,800Neeta Joshi100% (1)

- Case 13-5: Chemical BankDocumento4 páginasCase 13-5: Chemical BankRajesh K. PedhaviAinda não há avaliações

- MBA Managerial Economics Distance Mode Presessional Assignment 2016Documento2 páginasMBA Managerial Economics Distance Mode Presessional Assignment 2016Tawanda Zimbizi0% (1)

- Ethics Predetermined Overhead Rate and Capacity Pat MirandaDocumento3 páginasEthics Predetermined Overhead Rate and Capacity Pat MirandaMargaret CabreraAinda não há avaliações

- ProblemsDocumento12 páginasProblemsshagunparmarAinda não há avaliações

- Chap 1 Quantiative Analysis Test BankDocumento29 páginasChap 1 Quantiative Analysis Test BankCATHY MAE ACAS BUSTAMANTEAinda não há avaliações

- Understanding Statistical Hypothesis Testing ErrorsDocumento3 páginasUnderstanding Statistical Hypothesis Testing ErrorsArun MannurAinda não há avaliações

- ACC501 Quiz SolvedDocumento16 páginasACC501 Quiz SolvedIshaqZadeAinda não há avaliações

- Pareto Chart: Basic Tools For Process ImprovementDocumento49 páginasPareto Chart: Basic Tools For Process ImprovementGirish RajAinda não há avaliações

- Chapter 10Documento8 páginasChapter 10Ayoub BokhabrineAinda não há avaliações

- Week 5 - Queuing TheoryDocumento36 páginasWeek 5 - Queuing TheoryHenry Tian100% (1)

- Ch08 Linear Programming SolutionsDocumento26 páginasCh08 Linear Programming SolutionsVikram SanthanamAinda não há avaliações

- BSS056-3 Supply Network DesignDocumento13 páginasBSS056-3 Supply Network DesignNehari Senanayake0% (1)

- The "Mincer Equation" Thirty Years After Schooling, Experience, and EarningDocumento32 páginasThe "Mincer Equation" Thirty Years After Schooling, Experience, and EarningluizhdoreAinda não há avaliações

- BEPP250 Final TestbankDocumento189 páginasBEPP250 Final TestbankMichael Wen100% (2)

- Relevant PopulationDocumento3 páginasRelevant PopulationMarsya Chikita LestariAinda não há avaliações

- 4 6032630305691534636 PDFDocumento254 páginas4 6032630305691534636 PDFDennisAinda não há avaliações

- Financial Management-Capital Budgeting:: Answer The Following QuestionsDocumento2 páginasFinancial Management-Capital Budgeting:: Answer The Following QuestionsMitali JulkaAinda não há avaliações

- BCM 2104 Exam QuestionsDocumento12 páginasBCM 2104 Exam QuestionsBehind SeriesAinda não há avaliações

- Diss-700 Homework #7 Interprets Data Analyses of Sales OrganizationDocumento10 páginasDiss-700 Homework #7 Interprets Data Analyses of Sales OrganizationaddislibroAinda não há avaliações

- Anova BiometryDocumento33 páginasAnova Biometryadityanarang147Ainda não há avaliações

- Capital Budgeting Evaluation Criteria Exercise Guide - NPV, IRR, Replacement Chain ApproachDocumento4 páginasCapital Budgeting Evaluation Criteria Exercise Guide - NPV, IRR, Replacement Chain ApproachAnshuman AggarwalAinda não há avaliações

- CH 5Documento10 páginasCH 5Miftahudin MiftahudinAinda não há avaliações

- Demand forecasting methods and productivity analysisDocumento24 páginasDemand forecasting methods and productivity analysisnitish07singhAinda não há avaliações

- Case 10-24Documento5 páginasCase 10-24Tao0809Ainda não há avaliações

- eco 文書Documento19 páginaseco 文書Cindy LamAinda não há avaliações

- Immediate Predecessor(s) Estimated Activity Duration (In Days)Documento5 páginasImmediate Predecessor(s) Estimated Activity Duration (In Days)OB HIAinda não há avaliações

- 2.1 SQTM FCM MetricsDocumento4 páginas2.1 SQTM FCM MetricsEngr Ernest AppiahAinda não há avaliações

- Operations Management SyllabusDocumento10 páginasOperations Management SyllabusMukundMultaniAinda não há avaliações

- Design a data warehouse for retail sales analysisDocumento22 páginasDesign a data warehouse for retail sales analysisJason LouiseAinda não há avaliações

- Finance Final ExamDocumento3 páginasFinance Final Exambips99Ainda não há avaliações

- NPV: Cortland Manufacturing Company Net Present Value Case AnalysisDocumento1 páginaNPV: Cortland Manufacturing Company Net Present Value Case AnalysisPricelda VillaAinda não há avaliações

- MG314 Operations Management Assignment SolutionsDocumento2 páginasMG314 Operations Management Assignment Solutionsdip_g_007Ainda não há avaliações

- Suppose We Want To Change The Formula SUM (A2:A10) To SUM (A$2:A$10) - After Selecting A2:A10 We Should Click On The - Key. - F4Documento2 páginasSuppose We Want To Change The Formula SUM (A2:A10) To SUM (A$2:A$10) - After Selecting A2:A10 We Should Click On The - Key. - F4varshavishuAinda não há avaliações

- Management Control SystemsDocumento9 páginasManagement Control SystemsKetan BhandariAinda não há avaliações

- Manufacturing Management Forecasting MethodsDocumento55 páginasManufacturing Management Forecasting Methodspavan hydAinda não há avaliações

- CH 01 TestDocumento22 páginasCH 01 TestNeeti GurunathAinda não há avaliações

- L5 Quantitative Methods For Business Managament Learning OutcomeDocumento4 páginasL5 Quantitative Methods For Business Managament Learning OutcomemjAinda não há avaliações

- Subject CS1 - Actuarial Statistics For 2022 Examinations: Institute of Actuaries of IndiaDocumento6 páginasSubject CS1 - Actuarial Statistics For 2022 Examinations: Institute of Actuaries of Indiasankar KAinda não há avaliações

- Stats SyllabusDocumento7 páginasStats Syllabusmaroof khanAinda não há avaliações

- CM201Documento188 páginasCM201M K QureshiAinda não há avaliações

- Biostatistics and Computer-based Analysis of Health Data using RNo EverandBiostatistics and Computer-based Analysis of Health Data using RAinda não há avaliações

- Business Case On Pronto PizzaDocumento5 páginasBusiness Case On Pronto PizzashrutiAinda não há avaliações

- Landslide Characteristics and Slope Instability Modeling Using GISDocumento16 páginasLandslide Characteristics and Slope Instability Modeling Using GISadela2012100% (1)

- Introduction To Econometrics, 5 Edition: Chapter 3: Multiple Regression AnalysisDocumento38 páginasIntroduction To Econometrics, 5 Edition: Chapter 3: Multiple Regression AnalysisRamarcha KumarAinda não há avaliações

- Strahler - 1952Documento8 páginasStrahler - 1952BMAT82Ainda não há avaliações

- Sample Selection Bias As A Specification Erro-HeckmanDocumento10 páginasSample Selection Bias As A Specification Erro-HeckmanJoan José Monegro MedinaAinda não há avaliações

- Statistics SummaryDocumento10 páginasStatistics SummaryAhmed Kadem ArabAinda não há avaliações

- Tirmizi - 2009 - An Empirical Study of Consumer Impulse Buying Behavior in Local MarketsDocumento11 páginasTirmizi - 2009 - An Empirical Study of Consumer Impulse Buying Behavior in Local MarketsNelson PutraAinda não há avaliações

- Investigation Into Laboratory Scale Tests For The Sizing of HPGRDocumento19 páginasInvestigation Into Laboratory Scale Tests For The Sizing of HPGRNicolas PerezAinda não há avaliações

- Research Paper of MotivationDocumento23 páginasResearch Paper of Motivationakhatr100% (21)

- HSC6055 Survival Analysis of PBC DataDocumento28 páginasHSC6055 Survival Analysis of PBC DataAndrés García ArceAinda não há avaliações

- Areslab Adaptive Regression Splines Toolbox For Matlab/OctaveDocumento33 páginasAreslab Adaptive Regression Splines Toolbox For Matlab/OctaveSaujanya Kumar SahuAinda não há avaliações

- Latent Variable Moderation: Techniques for Assessing Interactions in SEMDocumento6 páginasLatent Variable Moderation: Techniques for Assessing Interactions in SEMMarium KhanAinda não há avaliações

- BBA Digital Marketing SchemeDocumento100 páginasBBA Digital Marketing SchemeRAMESH KUMARAinda não há avaliações

- Prognosis and Prognostic Research - Developing A Prognostic Model - The BMJDocumento10 páginasPrognosis and Prognostic Research - Developing A Prognostic Model - The BMJAdriana BispoAinda não há avaliações

- MCom PI-2 Quantitative Techniques For BusinessDocumento2 páginasMCom PI-2 Quantitative Techniques For BusinessMuhammad BilalAinda não há avaliações

- Generalized Linear ModelDocumento9 páginasGeneralized Linear Modelharrison9Ainda não há avaliações

- Vessel Tracking Using GP PDFDocumento14 páginasVessel Tracking Using GP PDFfahim6285Ainda não há avaliações

- Role of MATLAB in Crop Yield Estimation: Raorane A.A. and Kulkarni R.VDocumento8 páginasRole of MATLAB in Crop Yield Estimation: Raorane A.A. and Kulkarni R.VDhendup ChetenAinda não há avaliações

- ABCDEmail Prashant 61710779 13 March 2017Documento8 páginasABCDEmail Prashant 61710779 13 March 2017Prashant Pratap Singh100% (1)

- Jurnal Bakat MinatDocumento5 páginasJurnal Bakat Minat072Awalina ridha nabilaAinda não há avaliações

- BCA SEM-3 (Syallabus)Documento17 páginasBCA SEM-3 (Syallabus)Depple TestAinda não há avaliações

- Predicting Concrete Strength with Cloud MonitoringDocumento43 páginasPredicting Concrete Strength with Cloud Monitoringsai vandan100% (1)

- Validation of Analytical Methods Using A Regression ProcedureDocumento4 páginasValidation of Analytical Methods Using A Regression Procedureleizar_death64Ainda não há avaliações

- Lemma PublicationDocumento11 páginasLemma PublicationDame TolossaAinda não há avaliações

- 2 The Relationship Between Church Marketing - PDFDocumento9 páginas2 The Relationship Between Church Marketing - PDFstephen sowahAinda não há avaliações

- Delta Wire Corporation IA-1 Anmol Singh, Anjali VermaDocumento11 páginasDelta Wire Corporation IA-1 Anmol Singh, Anjali VermaAnmol SinghAinda não há avaliações

- System Approaches To Water, Sanitation, and Hygiene A Systematic Literature ReviewDocumento18 páginasSystem Approaches To Water, Sanitation, and Hygiene A Systematic Literature ReviewDicky Estosius TariganAinda não há avaliações

- Regression Analysis with Cross-Sectional Data ExplainedDocumento0 páginaRegression Analysis with Cross-Sectional Data ExplainedGabriel SimAinda não há avaliações

- EconomicsDocumento49 páginasEconomicsRebinAinda não há avaliações