Escolar Documentos

Profissional Documentos

Cultura Documentos

4.profit or Loss Prior To Incorporation PDF

Enviado por

Anupam DasDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

4.profit or Loss Prior To Incorporation PDF

Enviado por

Anupam DasDireitos autorais:

Formatos disponíveis

No.

1 for CA/CWA & MEC/CEC MASTER MINDS

4. PROFIT OR LOSS PRIOR TO INCORPORATION

SOLUTIONS TO ASSIGNMENT PROBLEMS

Problem No. 1

Trading A/c and Profit and loss a/c for the year ending 31.3.2002

Particulars Pre post Particulars Pre post

To cost of goods sold (WN 2) 2,10,000 5,67,000 By sales (WN 1) 2,40,000 7,20,000

To gross profit c/d 30,000 1,53,000

2,40,000 7,20,000 2,40,000 7,20,000

To rent (WN 3) 7,000 33,000 By gross profit b/d 30,000 1,53,000

To salaries (WN 4) 4,200 16,800

To sales promotion expenses 600 1,800

(WN 5)

To travelling expenses(WN 5) 2,000 4,000

To deprecation (WN 6) 1,500 3,300

To carriage out ward (1:3) 100 300

To printing and stationary 800 1,600

(1:2)

To advertisements(1:3) 2,000 6,000

To miscellaneous 4,200 8,400

expenditures (1:2)

To directors fee (post) - 600

To managing directors - 4,100

remuneration (post)

To bad debts (1:3) 400 1,200

To commission and brokerage 2,000 6,000

(1:3)

To audit fee (post) - 3,000

To interest paid to vendors 1,400 700

(2:1)

To interest on debentures - 1,500

(post)

To selling and distribution 3,000 9,000

expenses(1:3)

To preliminary expenditure - 500

(post)

To underwriting commission - 300

(post)

To capital reserve 800 -

To net profit - 50,900

30,000 1,53,000 30,000 1,53,000

IPCC_34e_Accounts_Group.I_Profit or Loss Prior to Incorporation_Assignment Solutions ___1

Ph: 98851 25025/26 www.mastermindsindia.com

Working Notes :

1. Computation of sales ratio :

Let the average monthly sales be ‘x’

Pre Post

April -X Aug-X

May-X sep –X

June -X 2 5X

Oct, Nov, Dec, Jan, Feb, Mar. X + X= × 6 =10X

3 3

July-X

4X 2X+10X =12X

4 12

1 3

Sales Ratio = 1:3

2. Computation of cost of goods ratio :

Pre Post

Cost per unit X X – 0.1X = 0.9X

No. of units 1 3

X 2.7X

10 27

Cost of goods Ratio = 10:27

3.

40,000

Original Space Additional Space

13,000 27,000 (3,000 X 9m)

Pre Post

Pre - July 3,000 Post - Aug. to

Rs. 4,000 Rs. 9,000

March 24,000

Pre Post

April –X August –X

May –X September -X

June -X October -X

July -X November to March = 1.2x X 5 = 6X

4X 3X + 6X = 9X

IPCC_34e_Accounts_Group.I_Profit or Loss Prior to Incorporation_Assignment Solutions ___2

No.1 for CA/CWA & MEC/CEC MASTER MINDS

Rent Ratio = 4:9

Copy Rights Reserved

Rent for pre = 4,000+3,000 =7,000

Rent for post = 9,000+24,000 =33,000

To MASTER MINDS, Guntur

4. Computation of salaries ratio :

Pre Post

April –X

May -X

June -X August to March = 3x X 8 = 24x

July – 3X

6X

Salaries Ratio = 6:24 = 1:4

5. Travelling expenses :

Travelling Expenses – 8,400

Selling 2,400 (1:3) 6,000 (1:2)

600 Pre 1,800 Post 2,000 Pre 4,000 Post

6.

Depreciation

300 (Post) 4,500 (1:2)

1,500 (pre) 3,000 post

7. Interest paid to vendors:

6M

Apr. to July 4M Aug. to Sept 2M

4:2 = 2:1

8. Audit fees assumed to be belongs to company audit, hence charged to post period.

IPCC_34e_Accounts_Group.I_Profit or Loss Prior to Incorporation_Assignment Solutions ___3

Ph: 98851 25025/26 www.mastermindsindia.com

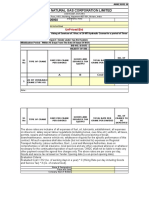

Problem No. 2

Pre-incorporation period is for four months, from 1st January, 2010 to 30th April, 2010. 8 months’ period

(from 1st May, 2010 to 31st December, 2010) is post-incorporation period.

Statement showing calculation of profit/losses for pre and post incorporation periods

Particulars Pre Post

Gross Profit (9:19) 3,42,000 7,22,000

Interest on Investments 36,000 -

Bad debts Recovery 7,000 -

3,85,000 7,22,000

Less : Rent and Taxes(1:2) 30,000 60,000

Salaries :

Manager’s salary (WN g) 23,000 62,000

Other salaries (WN g) 82,000 1,64,000

Printing and stationery (1:2) 6,000 12,000

Audit fees (post) - 45,000

Carriage outwards (9:19) 4,500 9,500

Sales commission (9:19) 9,900 20,900

Bad Debts (91,000 + 7,000) (9:19) 31,500 66,500

Interest on Debentures (finance costs) - 25,000

Underwriting Commission (post) - 26,000

Preliminary expenses (post) - 28,000

Loss on sale of investments (pre) 11,200 −

Net Profit 1,86,900* 2,03,100

* Pre-incorporation profit is a capital profit and will be transferred to Capital Reserve.

Working Notes:

a. Calculation of ratio of Sales

Let average monthly sales be x.

Pre Post

Jan – 1.5X May, June, July, Aug & Sep – 5X

Feb -X Oct - 1.5X

Mar -X Nov - X

April – 3X Dec - 2X

4.5X 9.5X

Thus Sales from January to April are 4½ x and sales from May to December are 9½ x. Sales are in

the ratio of 9/2x : 19/2x or 9 : 19.

b. Gross profit, carriage outwards, sales commission and bad debts written off have been allocated in

pre and post incorporation periods in the ratio of Sales i.e. 9 : 19.

c. Rent, salaries, printing and stationery, audit fees are allocated on time basis.

d. Interest on debentures, underwriting commission and preliminary expenses are allocated in post

incorporation period.

IPCC_34e_Accounts_Group.I_Profit or Loss Prior to Incorporation_Assignment Solutions ___4

No.1 for CA/CWA & MEC/CEC MASTER MINDS

e. Interest on investments, loss on sale of investments and bad debt recovery are allocated in pre-

incorporation period.

f. Audit fees assumed to be relating to company audit, hence charged to post period. Hence charged

to post period.

g. Total salaries paid Rs.3,31,000

Total Salaries Paid Rs. 3,31,000

Managers Salary Rs.85,000 Others Salary Rs.2,46,000

23,000 (pre) 62,000 (post) 82,000 (pre) 1,64,000 (post)

Problem No.3

Time ratio:

Pre incorporation period (01.04.2009 to 01.08.2009) = 4 months

Post incorporation period (01.08.2009 to 31.03.2010) = 8 months

Time Ratio = 4 : 8 or 1 : 2

Sales ratio: Average monthly sales before incorporation was twice the average sale per month of the

post incorporation period. If weightage for each post-incorporation month is x, then

Weighted sales ratio = 4 X 2x : 8 X 1x

= 8x : 8x or 1 : 1 Copy Rights Reserved

To MASTER MINDS, Guntur

Problem No.4

Statement showing calculation of profits for pre and post incorporation periods for the year

ended 31.3.2010

Pre-incorporation Post-incorporation

Particulars

period (Rs.) period (Rs.)

Gross profit (1:3) 80,000 2,40,000

Less: Salaries (1:2) 16,000 32,000

Stationery (1:2) 1,600 3,200

Advertisement (1:3) 4,000 12,000

Travelling expenses (W.N.3) 4,000 8,000

Sales promotion expenses (W.N.3) 1,200 3,600

Misc. trade expenses (1:2) 12,600 25,200

Rent (office building) (W.N.2) 8,000 18,400

Electricity charges (1:2) 1,400 2,800

Director’s fee (post) - 11,200

Bad debts (1:3) 800 2,400

IPCC_34e_Accounts_Group.I_Profit or Loss Prior to Incorporation_Assignment Solutions ___5

Ph: 98851 25025/26 www.mastermindsindia.com

Selling agents commission (1:3) 4,000 12,000

Audit fee (1:3)(note 6) 1,500 4,500

Debenture interest (post) - 3,000

Interest paid to vendor (2:1) (W.N.4) 2,800 1,400

Selling expenses (1:3) 6,300 18,900

Depreciation on fixed assets (W.N.5) 3,000 6,600

Capital reserve (bal. Fig.) 12,800 -

Net profit (Bal.Fig.) - 74,800

Working Notes:

st st

Pre incorporation period = 1 April , 2009 to 31 July, 2009

i.e. 4 months

1. Time Ratio = 4 months : 8 months i.e. 1 : 2

2. Sales ratio:

Let the monthly sales for first 6 months (i. e. from 1.4..2009 to 30.9.09) be = x

Then, sales for 6 months = 6x

2 5

Monthly sales for next 6 months (i.e. from 1.10.09 to 31.3.2010) = x + x = x

3 3

5

Then, sales for next 6 months = x X6 = 10 x

3

Total sales for the year = 6x + 10x = 16x

Monthly sales in the pre incorporation period = Rs.19,20,000 / 16 = Rs.1,20,000

Total sales for pre-incorporation period = Rs.1,20,000 X 4 = Rs.4,80,000

Total sales for post incorporation period = Rs.19,20,000 – Rs.4,80,000 = Rs.14,40,000

Sales Ratio = 4,80,000 : 14,40,000 = 1 : 3

3. Rent:

Particulars Rs. Rs.

Rent for pre-incorporation period (Rs. 2,000 X 4) 8,000

(pre)

Rent for post incorporation period

August, 2009 & September, 2009 (Rs.2,000 X 2) 4,000

October, 2009 to March, 2010 (Rs.2,400 X 6) 14,400 18,400

(post)

4. Travelling expenses and sales promotion expenses:

Particulars Pre (Rs.) Post (Rs.)

Traveling expenses Rs.12,000 (i.e. Rs.16,800 – Rs.4,800) 4,000 8,000

distributed in 1:2 ratio

Sales promotion expenses Rs.4,800 distributed in 1:3 1,200 3,600

ratio

IPCC_34e_Accounts_Group.I_Profit or Loss Prior to Incorporation_Assignment Solutions ___6

No.1 for CA/CWA & MEC/CEC MASTER MINDS

th

5. Interest paid to vendor till 30 September, 2009:

Particulars Pre (Rs.) Post (Rs.)

Rs.4,200 2,800

Interest for pre-incorporation period X 4

6

Interest for post incorporation period i.e. for August, 2009 1,400

Rs.4,200

& September, 2009 = X 2

6

6. Depreciation:

Pre Post

Particulars Rs.

(Rs.) (Rs.)

Total depreciation 9,600 - -

Less: Depreciation exclusively for post incorporation period 600 - 600

9,000 - -

4 - 3,000 -

Depreciation for pre-incorporation period 9,000 X

12

8 - - 6,000

Depreciation for post incorporation period 9,000 X

12

- 3,000 6,600

Audit fees is assumed to be Tax audit fees, hence allocated on Sales ratio. i.e. 1 : 3

Problem No.5

st

Statement showing pre and post incorporation profit for the year ended 31 March, 2012

Total Pre Post-

Basis of

Particulars Amount incorporation Incorporation

Allocation

(Rs.) Rs. Rs.

Gross Profit(Wn 3) 5,40,000 2:7 1,20,000 4,20,000

Less: Depreciation 1,08,000 1:2 36,000 72,000

Director’s Fees 50,000 Post - 50,000

Preliminary Expenses 12,000 Post- - 12,000

Office Expenses 78,000 1:2 26,000 52,000

Interest to vendors 5,000 Actual 4,000 1,000

Net Profit (Rs.54,000 being 2,87,000 54,000 2,33,000

pre incorporation profit is

transferred to capital reserve

Account)

Working Notes:

1. Sales ratio: The sales per month in the first half year were half of what they were in the later half

year. If in the later half year, sales per month is Re.1 then it should be 50 paise per month in the

st st

first half year. So sales for the first four months (i.e. from 1 April, 2011 to 31 July, 2011) will be 4

X .50 = Rs.2. Thus sales ratio is 2:7. Post period sales Aug. to Sep=1x , Oct to mar=6x , Total=7x.

IPCC_34e_Accounts_Group.I_Profit or Loss Prior to Incorporation_Assignment Solutions ___7

Ph: 98851 25025/26 www.mastermindsindia.com

2. Time ratio:

st st st st

1 April, 2011 to 31 July, 2011:1 August, 2011 to 31 March, 2012

= 4 months : 8 months = 1:2

Thus, time ratio is 1:2 Copy Rights Reserved

To MASTER MINDS, Guntur

3. Gross profit:

Gross profit = Net profit + All expenses

= Rs.2,00,000 + Rs.(1,08,000 + 15,000 + 50,000 + 12,000 + 78,000 + 72,000 + 5,000)

= Rs.2,00,000 + Rs.3,40,000 = Rs.5,40,000

4.

Particulars Basis Pre (Rs.) Post (Rs.)

Dividend sales ratio 5,40,000 X 2 / 9 5,40,000X 7/9

1,20,000 4,20,000

5.

Particulars Basis Pre (Rs.) Post (Rs.)

Audit fees Time ratio 5,000 5,000

6.

Particulars Basis Pre (Rs.) Post (Rs.)

Selling expenses sales ratio 16,000 56,000

Problem No.6

(a) Sales of first 6 months = Rs.4,80,000. Average sale of first 6 months = Rs.4,80,000/6 = Rs.80,000

per month. Pre-incorporation period consist of 3 months (i.e., April, May and June). The sales of

those 3 months = Rs.80,000 x 3 = Rs.2,40,000. Sales of remaining 9 months = Rs.24,00,000 –

Rs.2,40,000 = Rs.21,60,000.

Therefore, the ratio of sales = Rs.2,40,000 : Rs.21,60,000 or 1: 9.

(b) Let the average of monthly sales = X. The sales of different months can be shown as follows:

Month Jan Feb Mar. April May June July Aug Sept Oct Nov Dec

Sales 1x 0.5x 1x 0.5x 1x 1x 1x 1x 1x 1x 1.5x 1.5x

Date of incorporation is May, 2013

Pre incorporation period is from January to April i.e. 3 x

Post - incorporation period is from May to December i.e 9x

The ratio of Sales = 3x : 9x or 1:3.

(c) Let the average monthly sales be x. The sales of different months can be shown as follows:

Month April May June July Aug Sept Oct Nov Dec Jan Feb Mar.

Sales 2x 1x 1x 1x 1x 1x 1x 1x 1x 1x 2x 2x

Date of incorporation is 1 July, 2013

Pre incorporation period is from April to June i.e. 4 x

Post - incorporation period is from July to March i.e. 11x

The ratio of Sales = 4x : 11x or 4:11

IPCC_34e_Accounts_Group.I_Profit or Loss Prior to Incorporation_Assignment Solutions ___8

No.1 for CA/CWA & MEC/CEC MASTER MINDS

Problem No.7

Statement showing the calculation of Profits for the pre-incorporation and post incorporation

Periods:

Total Basis of Pre- Post-

Particulars

Amount Allocation incorporation incorporation

Gross Profit (25% of Rs.1,600) 400 Sales 100 300

Less: Salaries 69 Time 23 46

Rent, rates and Insurance 24 Time 8 16

Sundry office expenses 66 Time 22 44

Travellers’ commission 16 Sales 4 12

Discount allowed 12 Sales 3 9

Bad debts 4 Sales 1 3

Directors’ fee 25 Post - 25

Audit Fees 9 Sales* 2.25 6.75

Depreciation on tangible assets 12 Time 4 8

Debenture interest 11 Post - 11

Net Profit 152 32.75 119.25

Working Notes:

1. Sales ratio

Particulars (Rs.in lakh)

Sales for the whole year 1,600

st

Sales upto 31 July, 2012 400

st st

Therefore, sales for the period from 1 August, 2012 to 31 March, 2013 1,200

Thus, sale ratio = 400:1200 = 1:3

2. Time ratio

st st st st

1 April, 2012 to 31 July, 2012 : 1 August, 2012 to 31 March, 2013

= 4 months: 8 months = 1:2 , Thus, time ratio is 1:2.

Verified By: Amaranth Garu

Executed By: Mr. Uday

THE END

Copy Rights Reserved

To MASTER MINDS, Guntur

IPCC_34e_Accounts_Group.I_Profit or Loss Prior to Incorporation_Assignment Solutions ___9

Você também pode gostar

- Let's Practise: Maths Workbook Coursebook 7No EverandLet's Practise: Maths Workbook Coursebook 7Ainda não há avaliações

- Solutions QA - 06: Ratio - 2: CEX-Q-0207/21Documento4 páginasSolutions QA - 06: Ratio - 2: CEX-Q-0207/21Alpha PubgAinda não há avaliações

- Factoring and Algebra - A Selection of Classic Mathematical Articles Containing Examples and Exercises on the Subject of Algebra (Mathematics Series)No EverandFactoring and Algebra - A Selection of Classic Mathematical Articles Containing Examples and Exercises on the Subject of Algebra (Mathematics Series)Ainda não há avaliações

- Chapter 12 Share-Based Payments 1Documento11 páginasChapter 12 Share-Based Payments 1Thalia Rhine AberteAinda não há avaliações

- IE 3108 Problem Set 1Documento2 páginasIE 3108 Problem Set 1Fria Lelaine TevesAinda não há avaliações

- Homework 1 AMATH 301 UWDocumento2 páginasHomework 1 AMATH 301 UWargo82Ainda não há avaliações

- F5PM MT1A As - s17 A18Documento7 páginasF5PM MT1A As - s17 A18Irina NuzhnovaAinda não há avaliações

- Sol. Man. - Chapter 15 - Eps - 2021Documento20 páginasSol. Man. - Chapter 15 - Eps - 2021Crystal Rose TenerifeAinda não há avaliações

- Business Maths ScopeDocumento9 páginasBusiness Maths ScopeAbdul Razzaq KhanAinda não há avaliações

- Kayes Arman11-6265-Term PaperDocumento7 páginasKayes Arman11-6265-Term PaperTAWHID ARMAN100% (1)

- Made Krisna Purna Nugraha - Manajemen Keuangan C4Documento5 páginasMade Krisna Purna Nugraha - Manajemen Keuangan C4Dekna NugrahaAinda não há avaliações

- Chapter 12 - Sh. Based Payments (Part 1)Documento6 páginasChapter 12 - Sh. Based Payments (Part 1)Xiena100% (1)

- 120 hw2 PDFDocumento2 páginas120 hw2 PDFZergham Haider KhanAinda não há avaliações

- EARNINGS PER SHARE-Answer KeyDocumento2 páginasEARNINGS PER SHARE-Answer KeyMikaela FraniAinda não há avaliações

- Chapter 4 HomeworkDocumento6 páginasChapter 4 HomeworkAndreaaAAaa TagleAinda não há avaliações

- Mathematics 10 (Las 3)Documento4 páginasMathematics 10 (Las 3)Justiniano SalicioAinda não há avaliações

- Test Your Knowledge - 6Documento2 páginasTest Your Knowledge - 6KIDSEYE GAMINGAinda não há avaliações

- Chapter (1) - Ahmed SamyDocumento6 páginasChapter (1) - Ahmed SamyMostafa KaghaAinda não há avaliações

- Problems On Interest Calculation P: (A) When Rate of Interest and Total Cash Price Are GivenDocumento9 páginasProblems On Interest Calculation P: (A) When Rate of Interest and Total Cash Price Are GivenSubham Jaiswal100% (2)

- Kayes Arman11-6265-Term PaperDocumento7 páginasKayes Arman11-6265-Term PaperTAWHID ARMANAinda não há avaliações

- Test Far570 Feb2021 - SsDocumento4 páginasTest Far570 Feb2021 - SsPutri Naajihah 4GAinda não há avaliações

- Jethro S. Cortado BSA 1B Property and EquipmentDocumento9 páginasJethro S. Cortado BSA 1B Property and EquipmentJi Eun VinceAinda não há avaliações

- Fin mgt-st-02 AssignmentDocumento6 páginasFin mgt-st-02 AssignmentSyed Sadaf AlamAinda não há avaliações

- Chapter 3 Equations POYO (Solutions)Documento6 páginasChapter 3 Equations POYO (Solutions)AMELIA SHAHANA RIZAL ABDULLAH (TJC)Ainda não há avaliações

- Intermediate Accounting 2 (Chapter 16 Answers)Documento30 páginasIntermediate Accounting 2 (Chapter 16 Answers)Jamaica FloresAinda não há avaliações

- Share-Based Payments (Part 2) : Problem 1: True or FalseDocumento12 páginasShare-Based Payments (Part 2) : Problem 1: True or FalseJean Mira AribalAinda não há avaliações

- Complete ICAP SolutionsDocumento88 páginasComplete ICAP Solutionssecret studentAinda não há avaliações

- Sevilla Unit10 Topic2 AssessmentDocumento7 páginasSevilla Unit10 Topic2 AssessmentClaudine LobrigasAinda não há avaliações

- 1 2021 FAR FinalsDocumento6 páginas1 2021 FAR FinalsZatsumono YamamotoAinda não há avaliações

- Sol. Man. - Chapter 13 - Share Based Payments (Part 2) - 2021Documento14 páginasSol. Man. - Chapter 13 - Share Based Payments (Part 2) - 2021Crystal Rose TenerifeAinda não há avaliações

- 3.0 Estimation On The Allocation Spending On The Program/Project/Policy Implementation Based On: 3.1 Operational BudgetDocumento3 páginas3.0 Estimation On The Allocation Spending On The Program/Project/Policy Implementation Based On: 3.1 Operational BudgetYasier AimanAinda não há avaliações

- Ration AnalysisDocumento35 páginasRation AnalysisMuhammad EjazAinda não há avaliações

- Ma1103 8THWDocumento15 páginasMa1103 8THWDanur WendaAinda não há avaliações

- Linear Programming ApplicationsDocumento40 páginasLinear Programming ApplicationsShyamlee KanojiaAinda não há avaliações

- Assignment1 WorkbookDocumento6 páginasAssignment1 WorkbookmurariAinda não há avaliações

- Halifean Rentap - 2020836444 - Toturial 3 (A) - (B)Documento4 páginasHalifean Rentap - 2020836444 - Toturial 3 (A) - (B)halifeanrentapAinda não há avaliações

- 1 Dear Fellows in Business and Academia!Documento36 páginas1 Dear Fellows in Business and Academia!Nyajena MurozviAinda não há avaliações

- 1 Dear Fellows in Business and Academia!Documento36 páginas1 Dear Fellows in Business and Academia!Nyajena MurozviAinda não há avaliações

- Sanam MathDocumento13 páginasSanam MathAbrar Ahmed KhanAinda não há avaliações

- Answer Keys - Excercise QuestionsDocumento6 páginasAnswer Keys - Excercise QuestionsHan ZhongAinda não há avaliações

- CA Inter FM SM A MTP 2 May 2024 Castudynotes ComDocumento19 páginasCA Inter FM SM A MTP 2 May 2024 Castudynotes ComsanjanavijjapuAinda não há avaliações

- Equations and Inequalities: 1.2 Setting Up Equations: ApplicationsDocumento15 páginasEquations and Inequalities: 1.2 Setting Up Equations: ApplicationsLeonard AbellaAinda não há avaliações

- Solution Manual For Quantitative Methods For Business 13th EditionDocumento7 páginasSolution Manual For Quantitative Methods For Business 13th Editionrichardthu912ouAinda não há avaliações

- Model Test Paper-2 (Ans.) (21.3.2023)Documento18 páginasModel Test Paper-2 (Ans.) (21.3.2023)SihecAinda não há avaliações

- Optimization Examples PDFDocumento4 páginasOptimization Examples PDFSalman GillAinda não há avaliações

- Solutions DepreciationDocumento5 páginasSolutions DepreciationMaria Sarah RevecoyAinda não há avaliações

- Solution Maf503 - Jun 2018Documento8 páginasSolution Maf503 - Jun 2018anis izzati100% (1)

- VOHRA2Documento20 páginasVOHRA2HiteshAinda não há avaliações

- B MathDocumento2 páginasB MathHerman PecassaAinda não há avaliações

- Properties: Ab CD EF CD EF ABDocumento4 páginasProperties: Ab CD EF CD EF ABtae hyungAinda não há avaliações

- CMAT 2021 Slot 2 SolutionsDocumento23 páginasCMAT 2021 Slot 2 SolutionsJheel VisariaAinda não há avaliações

- Finding The Present Value For N Not An Integer: SolutionDocumento7 páginasFinding The Present Value For N Not An Integer: Solutiondame wayneAinda não há avaliações

- Econ11 HW PDFDocumento207 páginasEcon11 HW PDFAlbertus MuheuaAinda não há avaliações

- Formulae Class 10Documento10 páginasFormulae Class 10Sayan DuttaAinda não há avaliações

- Solution Problemset 4Documento5 páginasSolution Problemset 4Usiel VelaAinda não há avaliações

- Solutions To ExercisesDocumento12 páginasSolutions To Exercisesyangbear004Ainda não há avaliações

- Exercise Elasticity Concept Name: Balingit, Nathalia Yr/Crs/Sec: 1 True or False. Score: Date: April 1, 2021Documento2 páginasExercise Elasticity Concept Name: Balingit, Nathalia Yr/Crs/Sec: 1 True or False. Score: Date: April 1, 2021NATHALIA BALINGITAinda não há avaliações

- Module 6Documento2 páginasModule 6Honey TolentinoAinda não há avaliações

- 1 - Linear Programming Problem: SolutionDocumento12 páginas1 - Linear Programming Problem: Solution'Hady' HadiyantoAinda não há avaliações

- Project Cost Estimating 1aDocumento52 páginasProject Cost Estimating 1aShalik WalkerAinda não há avaliações

- Center For Strategic and International Studies (CSIS)Documento13 páginasCenter For Strategic and International Studies (CSIS)Judy Ann ShengAinda não há avaliações

- KONTRAK KERJA 2 BahasaDocumento12 páginasKONTRAK KERJA 2 BahasaStanley RusliAinda não há avaliações

- Chapter 7Documento6 páginasChapter 7jobhihtihjrAinda não há avaliações

- A Real Driver of US CHINA Trade ConflictDocumento8 páginasA Real Driver of US CHINA Trade ConflictSabbir Hasan EmonAinda não há avaliações

- Guidance Note On GSTDocumento50 páginasGuidance Note On GSTkjs gurnaAinda não há avaliações

- BANK 3009 CVRM Workshop 1 ExercisesDocumento3 páginasBANK 3009 CVRM Workshop 1 Exercisesjon PalAinda não há avaliações

- Appendix 'A' To NITDocumento8 páginasAppendix 'A' To NITAbhishekAinda não há avaliações

- Mackinac Center Exposed: Who's Running Michigan?Documento19 páginasMackinac Center Exposed: Who's Running Michigan?progressmichiganAinda não há avaliações

- ToC - Smart Hospitality Market - Global Industry Analysis, Size, Share, Gr...Documento14 páginasToC - Smart Hospitality Market - Global Industry Analysis, Size, Share, Gr...PalawanBaliAinda não há avaliações

- Indian MFTrackerDocumento1.597 páginasIndian MFTrackerAnkur Mittal100% (1)

- DELIVERY Transfer of Risk and Transfer of TitleDocumento2 páginasDELIVERY Transfer of Risk and Transfer of TitleLesterAinda não há avaliações

- Abre Viation SDocumento62 páginasAbre Viation SAlinaAinda não há avaliações

- Project 4 Sem 3 Danda Yoga KrishnaDocumento70 páginasProject 4 Sem 3 Danda Yoga Krishnadanda yoga krishnaAinda não há avaliações

- Utility BillDocumento2 páginasUtility BillMST FIROZA BEGUMAinda não há avaliações

- Industrialisation in RajasthanDocumento4 páginasIndustrialisation in RajasthanEditor IJTSRDAinda não há avaliações

- MphasisDocumento2 páginasMphasisMohamed IbrahimAinda não há avaliações

- PPF in SAP EWM 1Documento10 páginasPPF in SAP EWM 1Neulers0% (1)

- Why Europe Planned The Great Bank RobberyDocumento2 páginasWhy Europe Planned The Great Bank RobberyRakesh SimhaAinda não há avaliações

- Annexure V Bidder Response SheetDocumento2 páginasAnnexure V Bidder Response SheetAshishAinda não há avaliações

- External Query LetterDocumento2 páginasExternal Query LetterRohan RedkarAinda não há avaliações

- Oceanic Wireless Vs CirDocumento6 páginasOceanic Wireless Vs CirnazhAinda não há avaliações

- BFSI Chronicle 3rd Annual Issue (14th Edition) September 2023Documento132 páginasBFSI Chronicle 3rd Annual Issue (14th Edition) September 2023amanchauhanAinda não há avaliações

- 2019 Apr 20 Dms Aiu MasterDocumento25 páginas2019 Apr 20 Dms Aiu MasterIrsyad ArifiantoAinda não há avaliações

- India Timber Supply and Demand 2010-2030Documento64 páginasIndia Timber Supply and Demand 2010-2030Divyansh Rodney100% (1)

- Credit by Debraj RayDocumento35 páginasCredit by Debraj RayRigzin YangdolAinda não há avaliações

- Economics 100 Quiz 1Documento15 páginasEconomics 100 Quiz 1Ayaz AliAinda não há avaliações

- JournalsDocumento6 páginasJournalsharmen-bos-9036Ainda não há avaliações

- Acceptance Payment Form: Tax Amnesty On DelinquenciesDocumento1 páginaAcceptance Payment Form: Tax Amnesty On DelinquenciesJennyMariedeLeonAinda não há avaliações

- Althusser and 'Theoretical Anti Humanism' of MarxDocumento9 páginasAlthusser and 'Theoretical Anti Humanism' of Marxverumindexsuietfalsi100% (1)

- 2023 - Forecast George FriedmanDocumento17 páginas2023 - Forecast George FriedmanGeorge BestAinda não há avaliações