Escolar Documentos

Profissional Documentos

Cultura Documentos

Digest of RMO NO 34-2014 PDF

Enviado por

Cliff Daquioag0 notas0% acharam este documento útil (0 voto)

15 visualizações1 páginaTítulo original

Digest of RMO NO 34-2014.pdf

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

15 visualizações1 páginaDigest of RMO NO 34-2014 PDF

Enviado por

Cliff DaquioagDireitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 1

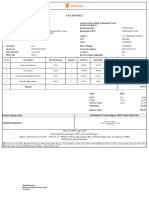

REVENUE MEMORANDUM ORDER NO.

34-2014 issued on September 18, 2014, clarifies

certain provisions of Revenue Memorandum Order (RMO) No. 20-2013, as amended by RMO

No. 28-2013, on the issuance of Tax Exemption Rulings for qualified non-stock, non-profit

corporations and associations under Section 30 of the National Internal Revenue Code (NIRC) of

1997, as amended.

Tax Exemption Rulings may discuss the tax treatment of any income generated from

activities which are conducted for profit. Non-stock, non-profit entities with valid and existing

Tax Exemption Rulings are presumably compliant with the conditions for availment of tax

exemption with respect to any income earned as such.

Consistent with the nature of Tax Exemption Rulings, the absence of a valid, current and

subsisting Tax Exemption Ruling will not operate to divest qualified entities of the tax

exemption provided under the Constitution or Section 30 of the NIRC.

Non-stock, non-profit entities which fail to secure a Tax Exemption Ruling for a given

taxable year or shorter period (as in the case of late filers) are duty bound to prove compliance

with the conditions laid down by the law and other pertinent administrative issuances in the

event of a tax investigation.

Non-stock, non-profit entities which fail to renew their Tax Exemption Ruling before the

lapse of its validity period may, nevertheless, file their applications with the Revenue District

Office where they are registered as soon as they are able to do so. In the processing of these

applications for Tax Exemption Rulings, the presentation of the previously issued Tax

Exemption Ruling or certificate is not necessary. In such case, BIR processing offices shall treat

the same as a new application.

In accordance with Revenue Memorandum Circular No. 8-2014, failure of the non-stock,

non-profit entity to present its valid, current and subsisting Tax Exemption Ruling to the

appropriate withholding agents shall subject such entity to the payment of the Withholding Taxes

due on their transactions. On the other hand, the withholding agents’ failure to withhold

notwithstanding the lack of Tax Exemption Ruling shall cause the imposition of penalties under

Section 251 and other pertinent Sections of the NIRC.

Applications for Tax Exemption Rulings may be filed by umbrella organizations or

confederations which are duly recognized by the BIR on behalf of any of its members-non-stock,

non-profit entities subject to the submission of the appropriate Board Resolution authorizing said

organization or confederation to file the said application, as well as all documentary

requirements provided under RMO No. 20-2013.

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Eco 101 Question and Answer PDFDocumento28 páginasEco 101 Question and Answer PDFOlawale100% (3)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- 1889 Spanish Civil CodeDocumento225 páginas1889 Spanish Civil CodeJ DAinda não há avaliações

- Infrastructure Development Plan for Chhattisgarh - Road Project Viability OptionsDocumento3 páginasInfrastructure Development Plan for Chhattisgarh - Road Project Viability Optionsjavedarzoo50% (2)

- Prilipin.r Department: GtutationDocumento4 páginasPrilipin.r Department: GtutationCliff DaquioagAinda não há avaliações

- Subject: Bureau RevenueDocumento1 páginaSubject: Bureau RevenueCliff DaquioagAinda não há avaliações

- @urdior: DepartmatDocumento3 páginas@urdior: DepartmatCliff DaquioagAinda não há avaliações

- Gluratior: Srruilltdtdc?!Flffilr DepartmedDocumento2 páginasGluratior: Srruilltdtdc?!Flffilr DepartmedCliff DaquioagAinda não há avaliações

- RAO No.1-2020Documento1 páginaRAO No.1-2020nathalie velasquezAinda não há avaliações

- Inffit'Rl: ?-2oig ofDocumento1 páginaInffit'Rl: ?-2oig ofCliff DaquioagAinda não há avaliações

- Revised Administrative Code of 1987 On The Civil Service CommissionDocumento42 páginasRevised Administrative Code of 1987 On The Civil Service CommissionCSC Public Assistance and Information Office100% (1)

- JDMC, DA 2023 DOST-SEI Undergraduate Scholarship Program 0334 - October 28, 2022Documento1 páginaJDMC, DA 2023 DOST-SEI Undergraduate Scholarship Program 0334 - October 28, 2022Cliff DaquioagAinda não há avaliações

- Iaecetveb: I TL:' FMDocumento1 páginaIaecetveb: I TL:' FMCliff DaquioagAinda não há avaliações

- RAO No. 2-2018Documento16 páginasRAO No. 2-2018Cliff DaquioagAinda não há avaliações

- RAO No. 2-2020Documento2 páginasRAO No. 2-2020nathalie velasquezAinda não há avaliações

- The Spanish Civil Code PDFDocumento9 páginasThe Spanish Civil Code PDFTimothy YuAinda não há avaliações

- Ra, XG TR-FZ: Stejgo+.R@F, EDocumento1 páginaRa, XG TR-FZ: Stejgo+.R@F, ECliff DaquioagAinda não há avaliações

- RAO No. 1-2019Documento22 páginasRAO No. 1-2019Cliff DaquioagAinda não há avaliações

- Of Of: Areas Ni/VaoDocumento1 páginaOf Of: Areas Ni/VaoCliff DaquioagAinda não há avaliações

- Bir 1701Documento4 páginasBir 1701Vanesa Calimag ClementeAinda não há avaliações

- #.Ciq Of: Revenue The CollectionDocumento6 páginas#.Ciq Of: Revenue The CollectionCliff DaquioagAinda não há avaliações

- 1701 January 2018 Consov4Documento2 páginas1701 January 2018 Consov4RAS ConsultancyAinda não há avaliações

- Bir 1701a FormDocumento2 páginasBir 1701a FormChe CacatianAinda não há avaliações

- RAO No. 2-2020 - DigestDocumento1 páginaRAO No. 2-2020 - Digestnathalie velasquezAinda não há avaliações

- RAO No. 1-2021Documento5 páginasRAO No. 1-2021Cliff DaquioagAinda não há avaliações

- Annual Income Tax ReturnDocumento2 páginasAnnual Income Tax ReturnRAS ConsultancyAinda não há avaliações

- RR No. 12-2018: New Consolidated RR on Estate Tax and Donor's TaxDocumento20 páginasRR No. 12-2018: New Consolidated RR on Estate Tax and Donor's Taxjune Alvarez100% (1)

- IAS 34 Interim Financial ReportingDocumento18 páginasIAS 34 Interim Financial ReportingSoleil LeisolAinda não há avaliações

- Operating Segments: Ifrs 8Documento18 páginasOperating Segments: Ifrs 8Carmel ThereseAinda não há avaliações

- IAS Plus: IFRS 8 Operating SegmentsDocumento4 páginasIAS Plus: IFRS 8 Operating SegmentsScarlet FoxAinda não há avaliações

- RMO No.16-2018Documento1 páginaRMO No.16-2018Cliff DaquioagAinda não há avaliações

- Presentation of Financial Statements: IAS 1 (r2007) Compliance ChecklistDocumento24 páginasPresentation of Financial Statements: IAS 1 (r2007) Compliance ChecklistAnonymous 7HGskNAinda não há avaliações

- RMO No.16-2018Documento1 páginaRMO No.16-2018Cliff DaquioagAinda não há avaliações

- 2023 Harmony Residential Rebate App PacketDocumento2 páginas2023 Harmony Residential Rebate App PacketSanta Teresa SumapazAinda não há avaliações

- Dayana FD HDFCDocumento1 páginaDayana FD HDFCchrisj 99Ainda não há avaliações

- Municipalities & Cities Reclaim Foreshore LandsDocumento2 páginasMunicipalities & Cities Reclaim Foreshore LandsIELTSAinda não há avaliações

- Critical Analysis in FITTADocumento36 páginasCritical Analysis in FITTASuman Sivakoti100% (1)

- Budget AssignmentDocumento9 páginasBudget Assignmentapi-537656189Ainda não há avaliações

- Renshaw4e Furtherexercises ch03Documento7 páginasRenshaw4e Furtherexercises ch03SentiNals PrImEAinda não há avaliações

- Income From Business and Profession HandoutDocumento29 páginasIncome From Business and Profession HandoutAnantha Krishna BhatAinda não há avaliações

- Ind As 12Documento74 páginasInd As 12Akhil AkhyAinda não há avaliações

- Penang Realty Case Against IRBDocumento15 páginasPenang Realty Case Against IRBsimson singawahAinda não há avaliações

- Design-Build Stipulated Price ContractDocumento35 páginasDesign-Build Stipulated Price ContractEDEN22030% (1)

- 3Documento26 páginas3JDAinda não há avaliações

- Cir Vs Boac DigestDocumento1 páginaCir Vs Boac DigestkarlonovAinda não há avaliações

- Ani SecDocumento149 páginasAni SecMarivic ChuangAinda não há avaliações

- Correcting Erroneous Information Returns, Form #04.001Documento144 páginasCorrecting Erroneous Information Returns, Form #04.001Sovereignty Education and Defense Ministry (SEDM)50% (2)

- 07-19-11 EditionDocumento28 páginas07-19-11 EditionSan Mateo Daily JournalAinda não há avaliações

- CHAN, James L. Government Accounting - An Assessment of Theory, Purposes and StandardsDocumento9 páginasCHAN, James L. Government Accounting - An Assessment of Theory, Purposes and StandardsHeloisaBianquiniAinda não há avaliações

- SKU - DDE - UG Prospectus - 2011 - 12Documento53 páginasSKU - DDE - UG Prospectus - 2011 - 12divakar.rsAinda não há avaliações

- SMPL 212210027Documento1 páginaSMPL 212210027kk singhAinda não há avaliações

- The Course of The CashDocumento3 páginasThe Course of The CashGE NoeliaAinda não há avaliações

- Invoice SpeakerDocumento1 páginaInvoice Speakeranil kalraAinda não há avaliações

- Chapter 8 Computation of Total Income and Tax PayableDocumento8 páginasChapter 8 Computation of Total Income and Tax PayablePrabhjot KaurAinda não há avaliações

- WINRO154 BudgetLetterRequest - Semi MonthlyCashAssistanceBudgetCalculation - SNAPBudgetCalculationForCA&CA SSICases 585277954Documento6 páginasWINRO154 BudgetLetterRequest - Semi MonthlyCashAssistanceBudgetCalculation - SNAPBudgetCalculationForCA&CA SSICases 585277954schwartzdaven7Ainda não há avaliações

- Pria Soft OrissaDocumento40 páginasPria Soft OrissawkAinda não há avaliações

- Taco 0088166061500044Documento1 páginaTaco 0088166061500044Sourav ChakrabortyAinda não há avaliações

- Invoice TemplateDocumento9 páginasInvoice Templaten100% (1)

- PPT W3Documento33 páginasPPT W3Hilda mayang sariAinda não há avaliações

- Bir Ruling No. 013-05Documento3 páginasBir Ruling No. 013-05Anonymous gyYqhBhCvsAinda não há avaliações

- Ongc Product Experience.Documento1 páginaOngc Product Experience.harvinder singhAinda não há avaliações