Escolar Documentos

Profissional Documentos

Cultura Documentos

Ba 2yr Sem4 - Ia QP - Public Finance

Enviado por

Rajiv VyasTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Ba 2yr Sem4 - Ia QP - Public Finance

Enviado por

Rajiv VyasDireitos autorais:

Formatos disponíveis

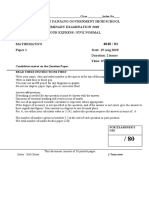

O.U.

INTERNAL ASSESSMENT EXAMINATION – MARCH 2019

B.A. 2nd YEAR SEM-4 PUBLIC ECONOMICS

ANSWER ALL QUESTIONS TOTAL MARKS: 15

PART – A: MULTIPLE CHOICE QUESTIONS (10 x ½ = 5 MARKS)

1. Government finance is called:

A. National finance

B. Public finance

C. Private finance

D. (a) and (b) of above

2. Govt. taxing and spending policies are called:

A. Monetary policy

B. Fiscal policy

C. Commercial policy

D. Finance policy

3. The difference between revenue expenditure and revenue receipts is

A. Revenue deficit

B. Fiscal deficit

C. Budget deficit

D. Primary deficit

4. The difference between total expenditure and total receipts is

A. Fiscal deficit

B. Budget deficit

C. Primary deficit

D. Revenue deficit

5. Govt. budget is balanced when:

A. Govt. expenditure outstrips tax receipts

B. Govt. tax receipts outstrips expenditure

C. Government expenditure equals tax revenue

D. None of the above

6. Effects of Public expenditure are

A. Consumption

B. Allocation of Resources

C. Production

D. All of the above

7. The concentrations effect explained in Peacock-Wiseman hypothesis implies

A. Public expenditure does not increase in smooth and continuous manner

B. The Central Government’s economic activity to grow faster than that of Regional

Governments

C. Public expenditure increases the necessity of increased revenue

D. Absolute level of public expenditure increases

8. Who is the exponent of the law of increasing state activities?

A. Dalton

B. Wagner

C. Seligman

D. Musgrave

9. A criterion by which public goods are distinguished from private goods:

A. Exclusion principle

B. Externality principle

C. Public choice principle

D. None of the above

10. Wiseman‐Peacock hypotheses supports in a much stronger manner the possibility of:

A. An upward trend in public expenditure

B. A downward trend in public expenditure

C. A constancy of public expenditure

D. A mixed trend in public expenditure

PART – B: FILL IN THE BLANKS (10 x ½ = 5 MARKS)

1. Important difference between public and private finance is with regard to nature of

______________.

2. The income of the state is referred to as ______________.

3. ______________ arises when the governments borrow when their expenditure is more than

revenue.

4. Now it is being increasingly recognized that government expenditure and revenue programme

exert influence upon the ______________.

5. Concepts of concentration and displacement effect in public expenditure is attributed to

______________.

6. Maximum Social Advantage is achieved when ___________________________.

7. According to Wagner, the state activities increase _____________________.

8. According to Wiseman and Peacock, the state activities increase ___________________.

9. An example of Toll goods is ________________.

10. Government engages in _____________ goods.

PART – C: SHORT QUESTIONS (1 x 5 = 5 MARKS)

1. What does Fiscal Policy refers to?

_________________________________________________________________________

_________________________________________________________________________

2. Define Public Goods.

_________________________________________________________________________

_________________________________________________________________________

3. What are the four functions as given by Richard Musgrave?

_________________________________________________________________________

_________________________________________________________________________

4. State the Principle of Maximum Social Advantage

_________________________________________________________________________

_________________________________________________________________________

5. State Peacock-Wiseman Hypothesis

_________________________________________________________________________

_________________________________________________________________________

Você também pode gostar

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Ba3 Sem5 2020 July-Dec Development Economics - SyllabusDocumento1 páginaBa3 Sem5 2020 July-Dec Development Economics - SyllabusRajiv VyasAinda não há avaliações

- Deveconomics - M1Documento10 páginasDeveconomics - M1Rajiv VyasAinda não há avaliações

- Deveconomics - M2Documento8 páginasDeveconomics - M2Rajiv VyasAinda não há avaliações

- Deveconomics - M4Documento6 páginasDeveconomics - M4Rajiv VyasAinda não há avaliações

- Deveconomics - M3Documento7 páginasDeveconomics - M3Rajiv VyasAinda não há avaliações

- Foreign Trade in India World Trade OrganizationDocumento4 páginasForeign Trade in India World Trade OrganizationRajiv VyasAinda não há avaliações

- Foreign Trade in India World Trade OrganizationDocumento4 páginasForeign Trade in India World Trade OrganizationRajiv VyasAinda não há avaliações

- 6th Eco Market Structures PDFDocumento82 páginas6th Eco Market Structures PDFRajiv VyasAinda não há avaliações

- TransferenceDocumento1 páginaTransferenceRajiv VyasAinda não há avaliações

- Fiscal Reforms SummaryDocumento1 páginaFiscal Reforms SummaryRajiv VyasAinda não há avaliações

- Characteristics of The Indian EconomyDocumento5 páginasCharacteristics of The Indian EconomyRajiv VyasAinda não há avaliações

- Ba3 Yr AssignmentDocumento1 páginaBa3 Yr AssignmentRajiv VyasAinda não há avaliações

- Equilibrium & Disequilibrium in Balance of PaymentsDocumento2 páginasEquilibrium & Disequilibrium in Balance of PaymentsRajiv VyasAinda não há avaliações

- Characteristics of The Indian EconomyDocumento5 páginasCharacteristics of The Indian EconomyRajiv VyasAinda não há avaliações

- Deveconomics - M1Documento8 páginasDeveconomics - M1Rajiv VyasAinda não há avaliações

- PUBFINDocumento2 páginasPUBFINRajiv VyasAinda não há avaliações

- Characteristics of The Indian EconomyDocumento5 páginasCharacteristics of The Indian EconomyRajiv VyasAinda não há avaliações

- The History of The Theory of Public Finance by Margaret DoyleDocumento4 páginasThe History of The Theory of Public Finance by Margaret DoyleFilipe BenjamimAinda não há avaliações

- Development Economics - M1Documento10 páginasDevelopment Economics - M1Rajiv VyasAinda não há avaliações

- Development Economics - M1Documento10 páginasDevelopment Economics - M1Rajiv VyasAinda não há avaliações

- Economics SyllabusDocumento16 páginasEconomics SyllabusRajiv VyasAinda não há avaliações

- h1 Public EconomicsDocumento9 páginash1 Public EconomicsRajiv VyasAinda não há avaliações

- h1 Public Finance - Meaning Scope DistinctionDocumento4 páginash1 Public Finance - Meaning Scope DistinctionRajiv VyasAinda não há avaliações

- Ou Syllabus Ba 2yr Sem4 - EconomicsDocumento3 páginasOu Syllabus Ba 2yr Sem4 - EconomicsRajiv VyasAinda não há avaliações

- Ou Syllabus Ba 2yr Sem4 - EconomicsDocumento3 páginasOu Syllabus Ba 2yr Sem4 - EconomicsRajiv VyasAinda não há avaliações

- S&T McqsDocumento7 páginasS&T McqsRajiv VyasAinda não há avaliações

- Engineering CollegesDocumento1 páginaEngineering CollegesRajiv VyasAinda não há avaliações

- Case Study DellDocumento2 páginasCase Study DellRajiv VyasAinda não há avaliações

- L 3 QCF Cnl99 - Unit 2 - BR - Assignment BriefDocumento12 páginasL 3 QCF Cnl99 - Unit 2 - BR - Assignment BriefRajiv VyasAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (120)

- RS485 Soil 7in1 Sensor ES SOIL 7 in 1 Instruction ManualDocumento15 páginasRS485 Soil 7in1 Sensor ES SOIL 7 in 1 Instruction ManualĐoàn NguyễnAinda não há avaliações

- Jane AustenDocumento2 páginasJane Austendfaghdfo;ghdgAinda não há avaliações

- Temple ManualDocumento21 páginasTemple Manualapi-298785516Ainda não há avaliações

- The Neuromarketing ConceptDocumento7 páginasThe Neuromarketing ConceptParnika SinghalAinda não há avaliações

- Ingrid Gross ResumeDocumento3 páginasIngrid Gross Resumeapi-438486704Ainda não há avaliações

- MoMA Learning Design OverviewDocumento28 páginasMoMA Learning Design OverviewPenka VasilevaAinda não há avaliações

- Bruxism Hypnosis Script No. 2Documento12 páginasBruxism Hypnosis Script No. 2Eva Jacinto100% (2)

- Order of Nine Angles: RealityDocumento20 páginasOrder of Nine Angles: RealityBrett StevensAinda não há avaliações

- CDS11412 M142 Toyota GR Yaris Plug-In ECU KitDocumento19 páginasCDS11412 M142 Toyota GR Yaris Plug-In ECU KitVitor SegniniAinda não há avaliações

- KCET MOCK TEST PHY Mock 2Documento8 páginasKCET MOCK TEST PHY Mock 2VikashAinda não há avaliações

- Life Without A Centre by Jeff FosterDocumento160 páginasLife Without A Centre by Jeff Fosterdwhiteutopia100% (5)

- UntitledDocumento2 páginasUntitledRoger GutierrezAinda não há avaliações

- Proyecto San Cristrobal C-479 Iom Manual StatusDocumento18 páginasProyecto San Cristrobal C-479 Iom Manual StatusAllen Marcelo Ballesteros LópezAinda não há avaliações

- Pedia Edited23 PDFDocumento12 páginasPedia Edited23 PDFAnnJelicaAbonAinda não há avaliações

- Lifetime Prediction of Fiber Optic Cable MaterialsDocumento10 páginasLifetime Prediction of Fiber Optic Cable Materialsabinadi123Ainda não há avaliações

- Cyber Ethics IssuesDocumento8 páginasCyber Ethics IssuesThanmiso LongzaAinda não há avaliações

- Nota 4to Parcial ADocumento8 páginasNota 4to Parcial AJenni Andrino VeAinda não há avaliações

- STD 4 Maths Half Yearly Revision Ws - 3 Visualising 3D ShapesDocumento8 páginasSTD 4 Maths Half Yearly Revision Ws - 3 Visualising 3D ShapessagarAinda não há avaliações

- Machiavelli's Political Philosophy and Jamaican PoliticsDocumento2 páginasMachiavelli's Political Philosophy and Jamaican PoliticsAndre RobinsonAinda não há avaliações

- Planning and Design of A Cricket StadiumDocumento14 páginasPlanning and Design of A Cricket StadiumTenu Sara Thomas50% (6)

- Wa0009.Documento14 páginasWa0009.Pradeep SinghAinda não há avaliações

- Asian Parliamentary DebateDocumento10 páginasAsian Parliamentary Debateryn hanakuroAinda não há avaliações

- Myocardial Concept MappingDocumento34 páginasMyocardial Concept MappingTHIRD YEARAinda não há avaliações

- MMWModule1 - 2023 - 2024Documento76 páginasMMWModule1 - 2023 - 2024Rhemoly MaageAinda não há avaliações

- Faculty of Computer Science and Information TechnologyDocumento4 páginasFaculty of Computer Science and Information TechnologyNurafiqah Sherly Binti ZainiAinda não há avaliações

- TAX Report WireframeDocumento13 páginasTAX Report WireframeHare KrishnaAinda não há avaliações

- E-Math Sec 4 Sa2 2018 Bukit Panjang - Short AnsDocumento36 páginasE-Math Sec 4 Sa2 2018 Bukit Panjang - Short AnsWilson AngAinda não há avaliações

- English Unit 7 MarketingDocumento21 páginasEnglish Unit 7 MarketingKobeb EdwardAinda não há avaliações

- How To Format Your Business ProposalDocumento2 páginasHow To Format Your Business Proposalwilly sergeAinda não há avaliações

- Conformity Observation Paper 1Documento5 páginasConformity Observation Paper 1api-524267960Ainda não há avaliações