Escolar Documentos

Profissional Documentos

Cultura Documentos

AAT AVBK Answers

Enviado por

Shailendra Kelani0 notas0% acharam este documento útil (0 voto)

101 visualizações3 páginasAAT AVBK Answers

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoAAT AVBK Answers

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

101 visualizações3 páginasAAT AVBK Answers

Enviado por

Shailendra KelaniAAT AVBK Answers

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 3

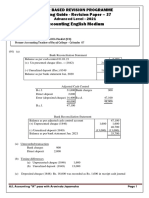

Answers

Test your understanding 1

(a) Profit or loss on disposal

£

Cost 12,000

Depreciation (5,000)

––––––

CV 7,000

––––––

Comparing the carrying value of £7,000 with the sale proceeds of

£4,000, there is a loss of (7,000 – 4,000) = £3,000.

(b) Ledger account entries

Disposal of non-current assets account

£ £

Car cost 12,000 Accumulated depreciation 5,000

Cash at bank a/c (sales

proceeds) 4,000

Loss on disposal 3,000

–––––– ––––––

12,000 12,000

–––––– ––––––

Car account

£ £

Balance b/d 12,000 Disposal a/c 12,000

–––––– ––––––

Car accumulated depreciation account

£ £

Disposal a/c 5,000 Balance b/d 5,000

–––––– ––––––

Cash at bank account

£ £

Disposal a/c 4,000

Test your understanding 2

Journal entry No 235

Date 13 June 20XX

Prepared by A Tech

Authorised by B Jones

Account Code Debit Credit

£ £

Disposals 0240 20,000

MV at cost 0130 20,000

MV acc dep'n 0140 7,500

Disposals 0240 7,500

Cash at bank 0163 10,000

Disposals 0240 10,000

Test your understanding 3

Disposals account

£ £

Motor vehicles 12,000 Accumulated depreciation 3,800

Profit on disposal 1,800 Motor vehicles (part ex) 10,000

–––––– ––––––

13,800 13,800

–––––– ––––––

Accumulated depreciation = £12,000 × 20% × 19/12 = 3,800

Você também pode gostar

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeAinda não há avaliações

- PartnersDocumento13 páginasPartnersvaloruroAinda não há avaliações

- Advanced Accounting QN 1,7 & 8Documento18 páginasAdvanced Accounting QN 1,7 & 8MAGOMU DAN DAVIDAinda não há avaliações

- Uk3 2009 Dec ADocumento6 páginasUk3 2009 Dec AApple ChinAinda não há avaliações

- T3uk 2009 Jun ADocumento8 páginasT3uk 2009 Jun AApple ChinAinda não há avaliações

- Uk3 2010 Jun ADocumento7 páginasUk3 2010 Jun AApple ChinAinda não há avaliações

- Uk3 2011 Jun ADocumento7 páginasUk3 2011 Jun AApple ChinAinda não há avaliações

- Madaraka Ltd. Statement of Comprehensive Income For The Year Ended 31 March 2020 KES'000' KES'000'Documento17 páginasMadaraka Ltd. Statement of Comprehensive Income For The Year Ended 31 March 2020 KES'000' KES'000'Maryjoy KilonzoAinda não há avaliações

- IPFMPSFR - Solutions 3 2023 Final - AADocumento31 páginasIPFMPSFR - Solutions 3 2023 Final - AASabAinda não há avaliações

- Acounting Revision QuestionsDocumento10 páginasAcounting Revision QuestionsJoseph KabiruAinda não há avaliações

- IA3 Chapter 14 Problem 31Documento3 páginasIA3 Chapter 14 Problem 31Bea TumulakAinda não há avaliações

- Intacc Cash Flow SolutionDocumento3 páginasIntacc Cash Flow SolutionMila MercadoAinda não há avaliações

- Accounting Assigment 01 IndividualDocumento2 páginasAccounting Assigment 01 IndividualOmari MaugaAinda não há avaliações

- Company Profit and LossDocumento6 páginasCompany Profit and LossFazal Rehman Mandokhail50% (2)

- Felix Fernando - C13-Q2Documento3 páginasFelix Fernando - C13-Q2Steve IdnAinda não há avaliações

- Jawaban Soal Latihan Ch.11Documento2 páginasJawaban Soal Latihan Ch.11Wira DinataAinda não há avaliações

- 4.3.2.3 Elaborate - Preparing Adjusting Entries From Unadjusted and Adjusted Trial BalanceDocumento3 páginas4.3.2.3 Elaborate - Preparing Adjusting Entries From Unadjusted and Adjusted Trial BalanceMa Fe Tabasa100% (2)

- Book1 xlsx1Documento4 páginasBook1 xlsx1Pian NasutionAinda não há avaliações

- 2009 S3 Ase2007Documento15 páginas2009 S3 Ase2007May CcmAinda não há avaliações

- Bba 122 Fai 11 AnswerDocumento12 páginasBba 122 Fai 11 AnswerTomi Wayne Malenga100% (1)

- Tutorial 10 CH 5.3.6 SolutionDocumento5 páginasTutorial 10 CH 5.3.6 SolutionenglishlessonsAinda não há avaliações

- QuizDocumento4 páginasQuizRinconada Benori ReynalynAinda não há avaliações

- Applied Auditing-Prelim FinalDocumento3 páginasApplied Auditing-Prelim FinalDominic E. BoticarioAinda não há avaliações

- T4 - (Assets) - Qs and SolutionDocumento22 páginasT4 - (Assets) - Qs and SolutionCalvin MaAinda não há avaliações

- Review2 Ch01 ADocumento1 páginaReview2 Ch01 AMayy ElleAinda não há avaliações

- Answer On AccountingDocumento6 páginasAnswer On AccountingShahid MahmudAinda não há avaliações

- Worksheet 4Documento6 páginasWorksheet 4Sneha KumariAinda não há avaliações

- MT2 Ch02Documento24 páginasMT2 Ch02api-3725162Ainda não há avaliações

- Asm ACCOUNTINGDocumento16 páginasAsm ACCOUNTINGVũ Khánh HuyềnAinda não há avaliações

- Acctg. Equation Puring CompanyDocumento8 páginasAcctg. Equation Puring CompanyAngelAinda não há avaliações

- Analysis of Financial StatementsDocumento27 páginasAnalysis of Financial StatementsnickcrokAinda não há avaliações

- Comprehensive Audit of Balance Sheet and Income Statement AccountsDocumento25 páginasComprehensive Audit of Balance Sheet and Income Statement AccountsLuigi Enderez Balucan100% (1)

- CH 2 Answers PDFDocumento5 páginasCH 2 Answers PDFLian Blakely CousinAinda não há avaliações

- Mark Scheme (Results) January 2014Documento19 páginasMark Scheme (Results) January 2014Fahrin NehaAinda não há avaliações

- Chapter 4 - Intermediate Accounting Volume 1Documento8 páginasChapter 4 - Intermediate Accounting Volume 1Buenaventura, Elijah B.Ainda não há avaliações

- Solutionchapter 18 - Advacc Solutionchapter 18 - AdvaccDocumento68 páginasSolutionchapter 18 - Advacc Solutionchapter 18 - AdvaccDvcLouisAinda não há avaliações

- Answers To Extra QuestionsDocumento8 páginasAnswers To Extra QuestionsHashani KumarasingheAinda não há avaliações

- Genuime Company Required 1 Debit CreditDocumento15 páginasGenuime Company Required 1 Debit CreditAnonnAinda não há avaliações

- Accountancy 12 - DS2 - Set - 1Documento15 páginasAccountancy 12 - DS2 - Set - 1Deepa Saravana KumarAinda não há avaliações

- Sesi 11 & 12 SharedDocumento28 páginasSesi 11 & 12 SharedDian Permata SariAinda não há avaliações

- Receivables Practice SolvingDocumento15 páginasReceivables Practice SolvingddalgisznAinda não há avaliações

- Intermediate Accounting 1 Second Grading Examination Key AnswersDocumento12 páginasIntermediate Accounting 1 Second Grading Examination Key AnswersAbegail Joy De GuzmanAinda não há avaliações

- Chapter 16: Additional Question Practice: Three of TheDocumento18 páginasChapter 16: Additional Question Practice: Three of TheHankhnilAinda não há avaliações

- Adobe Scan Mar 16, 2023Documento20 páginasAdobe Scan Mar 16, 2023Renalyn Ps MewagAinda não há avaliações

- Ans June 2018 Far410Documento8 páginasAns June 2018 Far4102022478048Ainda não há avaliações

- NyayDocumento3 páginasNyayJunneth Pearl HomocAinda não há avaliações

- June 2009 Fa4a1Documento9 páginasJune 2009 Fa4a1ksakala58Ainda não há avaliações

- Suggested Solutions June 2007Documento12 páginasSuggested Solutions June 2007kalowekamoAinda não há avaliações

- Accounting English Medium: Paper Based Revision Programme Marking Guide - Revision Paper - 37Documento6 páginasAccounting English Medium: Paper Based Revision Programme Marking Guide - Revision Paper - 37Malar SrirengarajahAinda não há avaliações

- Taxation - I: (Please Turn Over)Documento3 páginasTaxation - I: (Please Turn Over)Laskar REAZ100% (1)

- Quiz For Week 7 Answer Key PR 1 and 4Documento3 páginasQuiz For Week 7 Answer Key PR 1 and 4Joshuakenallen ricabuertaAinda não há avaliações

- 08chap 8 NP Farming Solutions 2020Documento3 páginas08chap 8 NP Farming Solutions 202044v8ct8cdyAinda não há avaliações

- MQP ANS 01 NDocumento13 páginasMQP ANS 01 NAVINASH ROYAinda não há avaliações

- Irc Kit JJ20Documento35 páginasIrc Kit JJ20Amir ArifAinda não há avaliações

- Sol. Man. - Chapter 4 - Accounts Receivable - Ia Part 1aDocumento19 páginasSol. Man. - Chapter 4 - Accounts Receivable - Ia Part 1aMiguel AmihanAinda não há avaliações

- Partnership Accounts:: Assets Revaluation, Dissolution & Conversion To Limited CompanyDocumento47 páginasPartnership Accounts:: Assets Revaluation, Dissolution & Conversion To Limited CompanyWen Xin GanAinda não há avaliações

- F2 Past Paper - Ans12-2006Documento8 páginasF2 Past Paper - Ans12-2006ArsalanACCAAinda não há avaliações

- Review of The Accounting Process Problems 2-1. (Tiger Company)Documento5 páginasReview of The Accounting Process Problems 2-1. (Tiger Company)Pauline Kisha CastroAinda não há avaliações

- Cash Flow Statement ProblemDocumento2 páginasCash Flow Statement Problemapi-3842194100% (2)

- AC191 Autumn 2011 FINALDocumento9 páginasAC191 Autumn 2011 FINALgerlaniamelgacoAinda não há avaliações

- Where Will Your Strategy Guru Lead YouDocumento2 páginasWhere Will Your Strategy Guru Lead YouShailendra KelaniAinda não há avaliações

- Toy Stories - Association For Psychological Science - APSDocumento5 páginasToy Stories - Association For Psychological Science - APSShailendra KelaniAinda não há avaliações

- Prework Leading Change (Gup 2)Documento2 páginasPrework Leading Change (Gup 2)Shailendra KelaniAinda não há avaliações

- Stores ManagementDocumento49 páginasStores ManagementsanshekhAinda não há avaliações

- BestPractices#6 Asset Management Feb2019Documento4 páginasBestPractices#6 Asset Management Feb2019Shailendra KelaniAinda não há avaliações

- 20 Sales Management Strategies To Lead Your Sales Team To SuccessDocumento17 páginas20 Sales Management Strategies To Lead Your Sales Team To SuccessShailendra KelaniAinda não há avaliações

- No33 Maximizingbenefitsofself-Assess GoodDocumento8 páginasNo33 Maximizingbenefitsofself-Assess GoodShailendra KelaniAinda não há avaliações

- 40 Strategic Questions To Ask To Evaluate Company DirectionDocumento7 páginas40 Strategic Questions To Ask To Evaluate Company DirectionShailendra Kelani100% (1)

- Life LessonsDocumento4 páginasLife LessonsShailendra KelaniAinda não há avaliações

- The Great TransformerDocumento2 páginasThe Great TransformerShailendra KelaniAinda não há avaliações

- Annexures Entreprenure QuestionnaireDocumento7 páginasAnnexures Entreprenure QuestionnaireShailendra KelaniAinda não há avaliações

- Blueprint To A BillionDocumento20 páginasBlueprint To A Billionolumakin100% (1)

- Life/Work Lessons: These Behaviors Can Improve Your Performance and Value To Your OrganizationDocumento1 páginaLife/Work Lessons: These Behaviors Can Improve Your Performance and Value To Your OrganizationShailendra KelaniAinda não há avaliações

- 9505-The Instant Sales ProDocumento1 página9505-The Instant Sales ProShailendra KelaniAinda não há avaliações

- IBM Transactional Sales MatrixDocumento24 páginasIBM Transactional Sales MatrixaviAinda não há avaliações

- Entrepreneurship and Entrepreneurial Motivation: Nadire YimamuDocumento45 páginasEntrepreneurship and Entrepreneurial Motivation: Nadire YimamuShailendra KelaniAinda não há avaliações

- Organizational Assessment: A Review of Experience: Universalia Occasional Paper No. 31, October 1998Documento16 páginasOrganizational Assessment: A Review of Experience: Universalia Occasional Paper No. 31, October 1998Shailendra KelaniAinda não há avaliações

- Syllabus: The Landmark ForumDocumento4 páginasSyllabus: The Landmark Forumcessna5538c100% (1)

- Super Productivity WorksheetDocumento2 páginasSuper Productivity WorksheetShailendra Kelani0% (1)

- Brief Summary of The Coaching Habit PDFDocumento6 páginasBrief Summary of The Coaching Habit PDFserkan kayaAinda não há avaliações

- ManageGrowth PDFDocumento98 páginasManageGrowth PDFShailendra KelaniAinda não há avaliações

- High-Impact Leadership Transitions PDFDocumento16 páginasHigh-Impact Leadership Transitions PDFShailendra KelaniAinda não há avaliações

- Robin Sharma Weekly Design SystemDocumento1 páginaRobin Sharma Weekly Design Systemgmsbhat100% (4)

- Landmark Forum Syl Lab UsDocumento1 páginaLandmark Forum Syl Lab UsShailendra KelaniAinda não há avaliações

- Principles of Management NotesDocumento16 páginasPrinciples of Management NotesShailendra KelaniAinda não há avaliações

- Principles of Management LECTURE NotesDocumento32 páginasPrinciples of Management LECTURE NotesPrasant BistAinda não há avaliações

- Process Understanding & Improvement: Excellence QualityDocumento9 páginasProcess Understanding & Improvement: Excellence Qualityvenky020377Ainda não há avaliações

- Staying Small SMEDocumento9 páginasStaying Small SMEShailendra KelaniAinda não há avaliações

- Business Growth Through People Growth 25thapr00 - tcm114-136023Documento8 páginasBusiness Growth Through People Growth 25thapr00 - tcm114-136023Vishnu PrasadAinda não há avaliações

- Tuhin StakeholdersDocumento3 páginasTuhin StakeholdersTauhidulIslamTuhin100% (1)

- Draft Business Plan TemplateDocumento6 páginasDraft Business Plan TemplateSanket MoteAinda não há avaliações

- Amortization Calculator - Wikipedia, The Free EncyclopediaDocumento3 páginasAmortization Calculator - Wikipedia, The Free Encyclopediaapi-3712367Ainda não há avaliações

- Project Report of Share KhanDocumento111 páginasProject Report of Share Khanchintan782% (11)

- Internship ReportDocumento39 páginasInternship ReportHusnain AwanAinda não há avaliações

- 2018 6 1Documento1 página2018 6 1HaseebPirachaAinda não há avaliações

- PaperDocumento4 páginasPaperamirAinda não há avaliações

- Chapter 19 - Test of ControlDocumento22 páginasChapter 19 - Test of ControlJhenna ValdecanasAinda não há avaliações

- CHP 1 NTRO ADVANCED FINANCIAL MANAGEMENTDocumento4 páginasCHP 1 NTRO ADVANCED FINANCIAL MANAGEMENTcuteserese roseAinda não há avaliações

- Introduction To Indian Financial SystemDocumento14 páginasIntroduction To Indian Financial SystemshrahumanAinda não há avaliações

- SME Bank 2012 Annual ReportDocumento247 páginasSME Bank 2012 Annual ReportSME Bank MalaysiaAinda não há avaliações

- Money and BankingDocumento16 páginasMoney and BankingSiddhi JainAinda não há avaliações

- Neft FormatDocumento2 páginasNeft FormatVinay Kumar100% (1)

- Report Header: Message 1Documento2 páginasReport Header: Message 1Yash EmrithAinda não há avaliações

- BPI vs. Intermediate Appellate Court GR# L-66826, August 19, 1988Documento2 páginasBPI vs. Intermediate Appellate Court GR# L-66826, August 19, 1988Jolet Paulo Dela CruzAinda não há avaliações

- Objective of The StudyDocumento13 páginasObjective of The StudyYogendra Kumar Jain100% (1)

- Business Plan RetailDocumento6 páginasBusiness Plan RetailaminshekoftiAinda não há avaliações

- Samity Accounts 250415Documento8 páginasSamity Accounts 250415Sumanta DeAinda não há avaliações

- Kalpana Bisen Paper On Dress CodeDocumento19 páginasKalpana Bisen Paper On Dress CodeKalpana BisenAinda não há avaliações

- What Is A Bank Reconciliation StatementDocumento4 páginasWhat Is A Bank Reconciliation StatementHsin Wua ChiAinda não há avaliações

- Account Statement From 14 Jan 2019 To 19 Jan 2019Documento2 páginasAccount Statement From 14 Jan 2019 To 19 Jan 2019NOOH EXPORTERAinda não há avaliações

- Total Number of Posts Advertised 575Documento11 páginasTotal Number of Posts Advertised 575Anil MehtaAinda não há avaliações

- Bank Reconciliation: Prepared By: Rezel A. Funtila R, LPTDocumento19 páginasBank Reconciliation: Prepared By: Rezel A. Funtila R, LPTRezel FuntilarAinda não há avaliações

- Functions of BanksDocumento8 páginasFunctions of BanksRanjeetha Vivek05Ainda não há avaliações

- Declaration of Deposit Capitalix enDocumento1 páginaDeclaration of Deposit Capitalix enYORDAN YAFFET ARAUJO ARAUJOAinda não há avaliações

- Banking Law (Part 7 Case Digests)Documento14 páginasBanking Law (Part 7 Case Digests)Justice PajarilloAinda não há avaliações

- Elc MCQDocumento8 páginasElc MCQVasanth KumarAinda não há avaliações

- Delegates Schedule of FeesDocumento1 páginaDelegates Schedule of FeesAngelo Mark Ordoña PorgatorioAinda não há avaliações

- Itinerary Print PDF File Name CustomerDocumento2 páginasItinerary Print PDF File Name CustomerBogdan George TeisanuAinda não há avaliações

- Sukanya Samriddhi Calculator VariableDocumento38 páginasSukanya Samriddhi Calculator VariableRam SewakAinda não há avaliações