Escolar Documentos

Profissional Documentos

Cultura Documentos

Eastern Theatrical Co

Enviado por

Benedick LedesmaTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Eastern Theatrical Co

Enviado por

Benedick LedesmaDireitos autorais:

Formatos disponíveis

Eastern Theatrical Co. vs.

Alfonso GR L-1104, 31 May 1944

Second Division, Perfecto (J): 5 concur

Facts:

The municipal board of Manila enacted Ordinance 2958 (series of 1946) imposing a fee on the price of

every admission ticket sold by cinematograph theaters, vaudeville companies, theatrical shows and

boxing exhibitions, in addition to fees imposed under Sections 633 and 778 of Ordinance 1600. Eastern

Theatrical Co., among others, question the validity of ordinance, on the ground that it is unconstitutional

for being contrary to the provisions on uniformity and equality of taxation and the equal protection of

the laws in as much as the ordinance does not tax other kinds of amusement, such as race tracks,

cockpits, cabarets, concert halls, circuses, and other places of amusement.

Issue:

Whether the ordinance violates the rule on uniformity and equality of taxation.

Held:

Equality and uniformity in taxation means that all taxable articles or kinds of property of the same class

shall be taxed at the same rate. The taxing power has the authority to make reasonable and natural

classifications for purposes of taxation; and the theater companies cannot point out what places of

amusement taxed by the ordinance do not constitute a class by themselves and which can be confused

with those not included in the ordinance. The fact that some places of amusement are not taxed while

others, like the ones herein, are taxed is no argument at all against the equality and uniformity of the tax

imposition.

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

- CIVPRO Case DigestDocumento2 páginasCIVPRO Case DigestBenedick LedesmaAinda não há avaliações

- CIVPRO Case DigestDocumento3 páginasCIVPRO Case DigestBenedick LedesmaAinda não há avaliações

- CIVPRO Case DigestDocumento3 páginasCIVPRO Case DigestBenedick LedesmaAinda não há avaliações

- CIVPRO Case DigestDocumento1 páginaCIVPRO Case DigestBenedick LedesmaAinda não há avaliações

- CIVPRO Case DigestDocumento3 páginasCIVPRO Case DigestBenedick LedesmaAinda não há avaliações

- CIVPRO Case DigestDocumento4 páginasCIVPRO Case DigestBenedick LedesmaAinda não há avaliações

- CIVPRO Case DigestDocumento3 páginasCIVPRO Case DigestBenedick LedesmaAinda não há avaliações

- Encarnacion Vs Amigo FactsDocumento2 páginasEncarnacion Vs Amigo FactsBenedick LedesmaAinda não há avaliações

- CIVPRO Case DigestDocumento2 páginasCIVPRO Case DigestBenedick LedesmaAinda não há avaliações

- CIVPRO Case DigestDocumento2 páginasCIVPRO Case DigestBenedick LedesmaAinda não há avaliações

- CIVPRO Case DigestDocumento3 páginasCIVPRO Case DigestBenedick LedesmaAinda não há avaliações

- CIVPRO CAse DigestDocumento2 páginasCIVPRO CAse DigestBenedick LedesmaAinda não há avaliações

- CIVPRO Case DigestDocumento1 páginaCIVPRO Case DigestBenedick LedesmaAinda não há avaliações

- CIVPRO I ActionsDocumento2 páginasCIVPRO I ActionsBenedick LedesmaAinda não há avaliações

- Provos Vs Court of AppealsDocumento1 páginaProvos Vs Court of AppealsBenedick LedesmaAinda não há avaliações

- Anacleto R. Meneses Secretary of Agrarian ReformsDocumento2 páginasAnacleto R. Meneses Secretary of Agrarian ReformsBenedick LedesmaAinda não há avaliações

- Cir V. Boac (Tax) : Issue: Whether The Revenue Derived by BOAC From Ticket Sales in The Philippines, Constitute Income ofDocumento7 páginasCir V. Boac (Tax) : Issue: Whether The Revenue Derived by BOAC From Ticket Sales in The Philippines, Constitute Income ofBenedick LedesmaAinda não há avaliações

- Case 5Documento1 páginaCase 5Benedick LedesmaAinda não há avaliações

- Republic v. Asset Privatization Trust: For Brevity) in A Shipyard Business Named PHILSECO, With A ShareholdingDocumento1 páginaRepublic v. Asset Privatization Trust: For Brevity) in A Shipyard Business Named PHILSECO, With A ShareholdingBenedick LedesmaAinda não há avaliações

- Case 5Documento5 páginasCase 5Benedick LedesmaAinda não há avaliações

- Case 2Documento1 páginaCase 2Benedick LedesmaAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- CES 6 Common Elements of Statistical Legislation Guidance For Consultation For UploadDocumento187 páginasCES 6 Common Elements of Statistical Legislation Guidance For Consultation For UploadErnesto GuiñazuAinda não há avaliações

- Hindu Muslim UnityDocumento37 páginasHindu Muslim UnityNandini DiwakarAinda não há avaliações

- 1 StandardReportDocumento12 páginas1 StandardReportPolo Delehandro YogAjunoAinda não há avaliações

- Full Download Starting Out With Python 2nd Edition Gaddis Solutions ManualDocumento7 páginasFull Download Starting Out With Python 2nd Edition Gaddis Solutions Manualjosiahdunnmg100% (33)

- There May Be More Students, Did The Same Things. We Will Also Do Rti If Institute Don'T Take Any MeasuresDocumento4 páginasThere May Be More Students, Did The Same Things. We Will Also Do Rti If Institute Don'T Take Any MeasuresSouvik MondalAinda não há avaliações

- CM1 Specimen Questions and SolutionsDocumento5 páginasCM1 Specimen Questions and SolutionsBakari HamisiAinda não há avaliações

- Abello vs. CIRDocumento2 páginasAbello vs. CIRluis capulongAinda não há avaliações

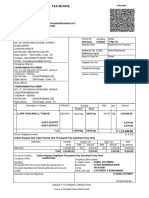

- Tax InvoiceDocumento2 páginasTax InvoiceTechnetAinda não há avaliações

- Aatc 2023-357 Private (Indigo-3) - Atr 72-600 Type Rating With MCC (Dgca) Course - 23 Nov - 5 JanDocumento1 páginaAatc 2023-357 Private (Indigo-3) - Atr 72-600 Type Rating With MCC (Dgca) Course - 23 Nov - 5 Janvalue pointAinda não há avaliações

- Ucsp - ReviewerDocumento2 páginasUcsp - ReviewerLucille Maye ArceAinda não há avaliações

- Francisco vs. HerreraDocumento3 páginasFrancisco vs. Herreragen1Ainda não há avaliações

- Adorna Properties SDN BHD V Boonsom Boonyanit at Sun Yok EngDocumento6 páginasAdorna Properties SDN BHD V Boonsom Boonyanit at Sun Yok EngqilaAinda não há avaliações

- DL PromptDocumento3 páginasDL Promptlee tranAinda não há avaliações

- Family Law ProjectDocumento20 páginasFamily Law Projectsomya100% (1)

- Case Law (Paventhan 131902004)Documento2 páginasCase Law (Paventhan 131902004)Rajalakshmi TNAinda não há avaliações

- Toni Morrison - Main ThemesDocumento4 páginasToni Morrison - Main ThemesVanessa RidolfiAinda não há avaliações

- CHAPTER 14 of CPADocumento8 páginasCHAPTER 14 of CPAAluve MbiyozoAinda não há avaliações

- Memorandum of Agreement Driver BokodDocumento2 páginasMemorandum of Agreement Driver BokodTrils InsuranceAgencyAinda não há avaliações

- Adrabo v. MadiraDocumento36 páginasAdrabo v. Madiraosenda brianAinda não há avaliações

- SPA SampleDocumento2 páginasSPA Samplecathy cardozaAinda não há avaliações

- Annex A Application Form - P3Documento37 páginasAnnex A Application Form - P3Dorina TicuAinda não há avaliações

- Theories of International BusinessDocumento6 páginasTheories of International Businessrgayathri16100% (2)

- Hostel Allotment Circular - II III IV V Years of All Other Programmes-V2Documento4 páginasHostel Allotment Circular - II III IV V Years of All Other Programmes-V2Saiei eiAinda não há avaliações

- Letter Responding To Cosmopolis Fire Department Volunteer ResignationDocumento2 páginasLetter Responding To Cosmopolis Fire Department Volunteer ResignationKING 5 NewsAinda não há avaliações

- Joint Entrance Examination (Main) - 2021 Score Card Paper-1 (B.E./B.Tech.)Documento1 páginaJoint Entrance Examination (Main) - 2021 Score Card Paper-1 (B.E./B.Tech.)tarunAinda não há avaliações

- LBP Vs TapuladoDocumento3 páginasLBP Vs Tapuladojun junAinda não há avaliações

- KBP Program Announcers in Am - Radio Stations, Best Practices and ViolationsDocumento65 páginasKBP Program Announcers in Am - Radio Stations, Best Practices and ViolationsMICHELLE DIALOGOAinda não há avaliações

- FIDP TemplateDocumento3 páginasFIDP Templatemarlon anzanoAinda não há avaliações

- Certificate Private Hire 2020Documento2 páginasCertificate Private Hire 2020raj6912377Ainda não há avaliações

- تجليات ثقافة المقاومة في فكر محمد البشير الإبراهيمي وأدبهDocumento14 páginasتجليات ثقافة المقاومة في فكر محمد البشير الإبراهيمي وأدبهجبالي أحمدAinda não há avaliações