Escolar Documentos

Profissional Documentos

Cultura Documentos

8 - Case 6 - Automated Fare Collection

Enviado por

Julan Castro0 notas0% acharam este documento útil (0 voto)

143 visualizações4 páginascase study

Título original

8 - Case 6- Automated Fare Collection

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentocase study

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

143 visualizações4 páginas8 - Case 6 - Automated Fare Collection

Enviado por

Julan Castrocase study

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 4

Public-Private Partnerships

Case Study #6

Automatic Fare Collection System (AFCS): The Case of Manila

By Mathieu Verougstraete and Ed MacDonagh (February 2016)

This case study examines how governments may benefit from involving the private

sector in integrated ticketing services for urban transport systems and how Public-

Private Partnership (PPP) structure can be used to introduce modern technology

BACKGROUND ADVANTAGES OF THE SYSTEM

Contactless smartcards, first implemented In Manila, the smartcard technology brings

in the late 1990s in Hong Kong and Seoul, now important benefits to the more than 1

are increasingly favoured for urban transport million daily passengers who use the light rail

fare collection systems.1 Typically the size of lines, to the authorities operating these lines,

a credit card, smartcards hold a microchip as well as to the wider public.3

which stores and transmits data through radio

frequency identification (RFID), allowing the Benefits for the government / operator

smartcard to communicate with a device

(within 10 centimetres) without physical Efficient fare collection:

contact. Smartcards are also able to store Traditionally, the cost of collecting cash from

enough information to process monetary multiple fare-collection points in a city has

transactions and profile a card holder’s details been considerable. Such a system requires

for security purposes. With these systems, security, and a lot of manpower is expended

users no longer need coins, tokens or paper counting coins and reconciling trips with

tickets. the amount collected.4 Smartcards can

reduce these expenses while allowing ticket

Recognizing the benefits of these smartcards, inspectors to spend more time in targeting

public authorities in the Philippines decided areas with higher incidence of illegal or

to introduce this technology for the three irregular card use.5 Accuracy of revenue ESCAP supports govern-

Urban Rail Transit Systems in Manila: namely collection is also greatly improved, as with ments in Asia-Pacific in

the Light Rail Transit Line No. 1 (LRT 1), the automatic fare collection systems, no money implementing measures

Light Rail Transit Line No. 2 (LRT 2), and the needs to be counted, and inconsistencies are to efficiently involve

Mass Rail Transit Line No. 3 (MRT 3). eradicated as there is an accurate record of the private sector in

every transaction. infrastructure develop-

All three lines (including 44 stations) have ment. This case study

been utilizing magnetic stripe card - fare Cases of fraud can also be greatly reduced – is part of this effort and

a UK Department for Transport study shows promotes exchange of

collection technology. However, this system

experience among the

is currently at the end of its usability. Such that since the introduction of the Oyster countries of the region

cards are more fragile than smartcards, Card (i.e. the smartcard system used on

easily damaged and no longer readable if public transport in London), the percentage For further information

scratched or bent. Furthermore, the memory of irregular travel (journeys made with consult our website

capacity of these cards is significantly lower either no ticket or the wrong ticket) fell by or contact

than smartcards. This not only limits the approximately 2.5% to 1.5% of total journeys

Transport Division

complexity and range of ticket types than can made. It was estimated that this reduction in United Nations ESCAP

be ascribed to the card, but also means that fraud represented cost savings of up to £40m

recording the identity of the card holder is not per year.6 Telephone:

usually practicable.2 (66) 2-288-1371

Email:

escap-ttd@un.org

More informed transport planning: Benefits for the passenger

AFCS data can Typically, the data used to inform transport

policy and the planning of service provision User friendly/integrated ticketing system:

help governments Smartcards are, first and foremost, simple to

understand has been gathered from sources such as

annual travel surveys, which are costly and use, allowing passengers seamless transfers

passenger travel from one line (or mode of transport) to

inevitably provide only a small sample of all

demands, providing journeys undertaken in the system.7 AFCS another, which in turn, can also allow for

enhanced planning data can supersede traditional manual greater flexibility in a passenger’s travel

& optimum asset surveys because its collection at the time of plans. A single multi-purpose card can

utilization transaction incurs essentially no marginal also encourage more people to use public

cost to the transport agency. AFCS data also transport as well as facilitate multimodal

represents a complete sample of journeys travel behaviour that is encouraged by

made by passengers using smartcards. operators and transport planners. Journeys

For these reasons, AFCS data is hugely no longer need to be pre-scheduled and

valuable and can support governments in tickets bought in advance. ‘Pay as you go’

understanding passenger travel demands, (PAYG) features also ensure that passengers

thus allowing for better operations and get exactly what they pay for, as the card is

planning and for optimum asset utilization.8 swiped at the beginning and end of every

journey.

Enhanced demand management:

Governments primarily aim to promote public Reduced journey time:

transport usage by investing in the supply A key advantage of smartcards for passengers

of new infrastructure and rolling stock. is shorter journey times (through faster

Implementing smartcard ticketing provides an transaction times and reduced queueing

opportunity for governments to considerably at ticket offices and barriers). Typically,

influence the demand for public transport a smartcard transaction takes just 150

and to support a move away from private cars. milliseconds to complete, and with public

With open access to complete travel data on transport employees no longer required to

the demand side, transport operators can collect fares and issue tickets, smartcard

provide discounts on journeys to and from ticketing systems enable substantial savings

specific locations at certain times to stimulate in boarding times. In London for example, the

the spread of demand across a network, Oyster Card has contributed to a significant

maximizing its revenue earning potential and reduction in queue times at ticket machines:

encouraging increased patronage in off peak the average ticket office queue time has gone

periods.9 down from 129 seconds pre-Oyster to 78

seconds post Oyster - a reduction of 40%;

this is in spite of a reduction in the number

of ticket offices in operation.10 An improved

daily passenger flow in and out of stations can Revenue streams

also, in turn, ease congestion - particularly The Philippine’s

in densely populated urban environments Importantly, the Philippine’s new AFCS new AFCS system

such as Manila, and cases where ridership system will come at no extra cost to the will come at no

is increasing year on year. Consequently, passenger, as well as to the government. The

extra cost to the

operators are able to increase service government support for this project in this

respect is very limited, with the government

passenger as

frequency, enhancing the utility of transport well as to the

assets. only providing a 5-year exclusivity right on the

ticketing services for the light rail systems. Government

The private operator will be installing the

PPP STRUCTURE new ticket gates as well as operating the

Where Manila’s AFCS system differs from system and is not expected to make any profit

its counterparts in Singapore and Hong- on fare transactions. In effect, the winning

Kong is that the provider of the fare system bidder pays the government a premium of

is not a subsidiary of the public operator. It Php1,088,103,900 (roughly $23.4 million)

is a private company contracted through a on top of the project cost of installing and

Public-Private Partnership (PPP) structure. operating the AFCS; probably a first in the

In January 2014, the AF Consortium, led history of this type of system.12

by Metro Pacific and Ayala, was awarded In return, the private consortium expects

the P1.72 billion / USD 38.22 million to make an appropriate return on capital

Automatic Fare Collection System contract invested out of areas it will expand into such

by the Department of Transportation and as commercial payment in shopping malls,

Communications. The AF Consortium will run customer loyalty schemes, etc. Indeed,

the system for 10 years, inclusive of 2 years the AFCS system has been designed to

development/delivery, and will be responsible accommodate a roll out into other modes

for the financing, installation, construction, of transport and/or micro-payment services

refurbishment, and maintenance of the outside of public transport.13 In this respect,

automatic gates for the existing LRT ½ and the large and widespread user base of the

MRT 3. A central clearing house system card system will make its expansion a highly

will also be introduced by the private sector viable option - as in the case of the Octopus

that will perform validation and clearing of Card in Hong Kong, which was initially

all transactions. In effect, the private sector launched in 1997 for use on buses and

will build, operate and maintain the fare MTR. Currently the Octopus Card is used by

collection system throughout its duration. 99 per cent of people in Hong Kong aged

between 16 and 64 and for over 13 million

Competitive tendering

transactions a day, valued at over HK$160

In the procurement of Manila’s new AFCS, million.14 A large share of revenues for the

the government of the Philippines was Octopus Card are coming from outside

able to induce healthy competition in the transport, with the card system currently

bid to operate the new AFCS system, with involving over 7,000 service providers.

33 prospective bidders and 5 prequalified For example, the Octopus card is used for

bidders initially competing for the payment in outlets such as supermarkets and

opportunity. This was perhaps a consequence convenient stores, for controlling access to

of the technology being in a well-developed buildings and as a platform for loyalty reward

market and standardized, with a number of schemes.15

suppliers providing these services already. The

high number of bidders may also have been System Implementation

a result of the Philippines attractive policy The first year of implementation, post-

environment which has improved considerably signing, is crucial, as it is during this

in recent years. In 2014 the Economist time where there is a real risk for PPPs.

Intelligence Unit (EIU) named the country Public authorities (particularly those new

as having the ‘most improved regulatory to PPPs) have a tendency to focus on the

and institutional frameworks’ and ‘improved transaction only, whilst losing focus on later

investment climate and financial facilities’.11 managing the contract once signed. Proper

Many bidders, including the winning AF implementation of the project, however,

Consortium, also saw the potential to expand depends on the quality of the post-signing

the AFCS system into other transport areas management so that governments do not

as well as the retail sector. As a result of the take on any unnecessary risks. Once the

number of bidders, operation costs were, contract is signed, senior government officials

therefore, driven down within such a highly and policy makers (in the executive office,

competitive environment. ministry of finance, ministry of planning,

transport ministries, etc.) have an important • Through accessing the efficiency of the

role to play in reviewing plans, protecting private sector, the new AFCS system brings

consumer rights, providing information, and a range of benefits for the government

so forth. There must be a shared vision on including risk transfer (to the private

implementation, a strong project management sector), enhanced demand management,

plan, clear defined roles and responsibilities more informed transport planning and

for all involved parties, and close efficient fare collection.

collaboration between public and private

bodies for a PPP project to be successful. • It will also provide a secure and reliable

With a PPP structure there is however a strong form of ticketing for passengers, both easier

incentive for the private sector to speed up to use and reducing journey times, thereby

the implementation as revenues can only be improving the overall passenger experience.

generated once the system is in operation. • Fundamentally, such benefits are coming

at no extra cost to either the government or

System expansion passenger, as the investment in this new

Large cities such as Manila are particularly system has come entirely from the private

well suited to AFCS implementation, owing sector.

to their high volume of people and large Manila is, therefore, an excellent case study

customer base. Such elements offer huge showing the positive potential of private sector

incentives for expansion and the new Manila investment as an alternative implementation

AFCS system is planned to service other method for governments. Learning from this

transport modes (i.e., buses, taxis, etc.) and experience, other countries in the region are

become the preferred payment method for considering a similar approach. For example,

each of them. After this, the new smartcard the Kyrgyz authorities hope to introduce

ticketing system may also be rolled out to an electronic payment system in public

parking, small merchants, vending machines, transportation. The estimated cost for this

etc. serving as an electronic micropayment project will be USD 2.4 million (currently at

solution in convenience stores and bringing the feasibility study stage) and the project is

multiple economic benefits with it. In also designed to apply contactless payment

doing so, the contactless smart card will for taxi fares, public parking, etc.

offer a single integrated card that meets

the requirements of both transit and retail-

financial payment applications: ease of use, End Notes

fast and accurate transactions, ability to 1

TCRP (2003), Report 94 - Fare Policies, Structures and

replace cash, security and data collection for Technologies: Update

improved customer identification and service. 2

European Commission (2011), Study on Public Transport

Smartcards – Final Report – European Commission

In order to be effective across multiple

3

Republic of the Philippines – Department of Transportation

markets, decision makers from both the

and Communications & Light Rail Transit Authority (2012),

public and private sector in this PPP project Project Information Memorandum.

will need to work closely together. For future 4

RFID Journal, http://www.rfidjournal.com/articles/view?12137

extension work to be done easily with other (Accessed November 10, 2015)

suppliers, it is essential that the system is 5

Hong, Y. (2006), Transition to Smart Card Technology: How Transit Op-

kept open by requesting the private operator erators Can Encourage the Take-Up of Smart Card Technology. Thesis, Master

of Science in Transportation, MIT.

to publicize the exact technical specifications 6&10

UK Department for Transport (2009), Smart and Integrated

of the system. However, the private Ticketing Strategy

companies concerned, may wish to keep it a 7&9

Tourism & Transport Forum (TTF) (July 2010), Position

closed system to ensure a monopoly position. Paper Smartcard ticketing on public transport.

8

Rail Transit OD Matrix Estimation and Journey Time Reli-

CONCLUSION AND OUTLOOK: ability Metrics Using Automated Fare Data (2007), Chan,

Joanne, S.M. Massachusetts Institute of Technology, Citable

URI: http://hdl.handle.net/1721.1/38955

For the Philippine government, the 11

Economist Intelligence Unit (EIU), Evaluating the environ-

introduction of a private partner to implement ment for public-private partnerships in Asia-Pacific The 2014

and run a new AFCS system was an ideal Infrascope

scenario in a number of respects: 12

Intervierw with Rebel Group

13

Project Information Memorandum, 2012, Department of

• Primarily, the PPP mechanism was a Transportation and Communications & Light Rail Transit Authority - http://

way of investing in much needed public www.dotc.gov.ph/images/PPP/2012/1.7BContactlessAFCS/Project%20

Information%20Memorandum%20(DP%2012-21-12).pdf

infrastructure, achieving efficiency

14

Octopus http://www.octopus.com.hk/web09_include/_document/en/com-

improvements, whilst limiting the impact on pany_profile.pdf - accessed February 2016

public budget. 15

http://www.intangiblebusiness.com/news/marketing/2005/06/smart-cards-cashing-

in-on-an-untapped-market & http://www.octopus.com.hk/octopus-for-businesses/

business-applications/en/index.html - accessed February 2016

Please note that this case study has been issued without formal editing

Você também pode gostar

- The Future of PaymentsDocumento40 páginasThe Future of Paymentsanon_903741391Ainda não há avaliações

- Integrated Transit LabDocumento112 páginasIntegrated Transit LabNaresh KurubaAinda não há avaliações

- Electronic Road PricingDocumento10 páginasElectronic Road PricingChakshu Agarwal100% (1)

- SmartCard Ticketing - FINAL PDFDocumento16 páginasSmartCard Ticketing - FINAL PDFtigeresnAinda não há avaliações

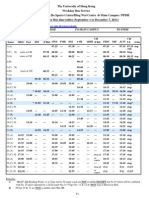

- Chapter 7 AnswerDocumento16 páginasChapter 7 AnswerKathy WongAinda não há avaliações

- Hongkong - Macau ItineraryDocumento1 páginaHongkong - Macau ItineraryMaritoni MedallaAinda não há avaliações

- Automatic Fare Collection System Main1Documento29 páginasAutomatic Fare Collection System Main1Harsh ShuklaAinda não há avaliações

- Business Plan "Electronic Payment System in Action"Documento36 páginasBusiness Plan "Electronic Payment System in Action"Hazman Aziz100% (2)

- E StatementDocumento2 páginasE StatementS3CH-14 Choy Pak MingAinda não há avaliações

- Accenture Rail 2020 IndustryDocumento8 páginasAccenture Rail 2020 Industrybenoit.lienart7076Ainda não há avaliações

- Elixir - A Fintech Banking Solution For MillennialsDocumento11 páginasElixir - A Fintech Banking Solution For MillennialsFeruz AkbarovAinda não há avaliações

- A Seminar On Intelligent Transport SystemDocumento15 páginasA Seminar On Intelligent Transport SystemOliver BenjaminAinda não há avaliações

- Technology: Automatic Fare Collection System (Beep Card) : Purpose/ObjectiveDocumento2 páginasTechnology: Automatic Fare Collection System (Beep Card) : Purpose/ObjectiveAllen AmoinAinda não há avaliações

- Convenience and Simplicity For The CommuterDocumento10 páginasConvenience and Simplicity For The CommuterKe LopezAinda não há avaliações

- E-Purse Transit Pass: The Potential of Public Transport Smart Card System in The PhilippinesDocumento6 páginasE-Purse Transit Pass: The Potential of Public Transport Smart Card System in The PhilippinesZenki FranciscoAinda não há avaliações

- Easychair Preprint: Desiree CendanaDocumento6 páginasEasychair Preprint: Desiree CendanaZenki FranciscoAinda não há avaliações

- Electronic+Fare+Payment+Systems-documentation CCDocumento14 páginasElectronic+Fare+Payment+Systems-documentation CCrajisumiAinda não há avaliações

- Utffs Sacog 07-042Documento180 páginasUtffs Sacog 07-042Sheila Repol SanitaAinda não há avaliações

- EASY GO "Automated Fare Collection System"Documento3 páginasEASY GO "Automated Fare Collection System"International Journal of Innovative Science and Research TechnologyAinda não há avaliações

- Smart Transit Payment For University CamDocumento8 páginasSmart Transit Payment For University CamFabeAinda não há avaliações

- Bus Management System ReportDocumento11 páginasBus Management System ReportMd. Mukatter Fuad MizuAinda não há avaliações

- ISSE System Proposal Group 5 IE 4BDocumento38 páginasISSE System Proposal Group 5 IE 4BThea PradoAinda não há avaliações

- Easychair Preprint: Desiree Cendana, Neriza Bustillo and Thelma PalaoagDocumento6 páginasEasychair Preprint: Desiree Cendana, Neriza Bustillo and Thelma Palaoaghori - sanAinda não há avaliações

- Easychair Preprint: Desiree Cendana, Neriza Bustillo and Thelma PalaoagDocumento6 páginasEasychair Preprint: Desiree Cendana, Neriza Bustillo and Thelma Palaoaghori - sanAinda não há avaliações

- F6 Hasan - RFID TicketingDocumento5 páginasF6 Hasan - RFID TicketingSathyanarayana RaoAinda não há avaliações

- Tends in Digital Age Land TransportDocumento5 páginasTends in Digital Age Land Transportanon_230648432Ainda não há avaliações

- Trend For Public Transportation in The PhilippinesDocumento1 páginaTrend For Public Transportation in The PhilippinesAl-juffrey Luis AmilhamjaAinda não há avaliações

- UTS Abstract G23Documento10 páginasUTS Abstract G23priyachoudhary1Ainda não há avaliações

- Smart E-Ticketing System For Public Transport BusDocumento17 páginasSmart E-Ticketing System For Public Transport BusManojAinda não há avaliações

- Visa 2013 The Future of TicketingDocumento48 páginasVisa 2013 The Future of TicketingmichaelonlineAinda não há avaliações

- Saikumar OrginalDocumento17 páginasSaikumar OrginalKomali Vidya KomaliAinda não há avaliações

- It-Based (Online) Bus Ticketing and Payment System PDFDocumento28 páginasIt-Based (Online) Bus Ticketing and Payment System PDFGabby0% (1)

- Upendra Reddy 2019 IOP Conf. Ser. Mater. Sci. Eng. 590 012036Documento7 páginasUpendra Reddy 2019 IOP Conf. Ser. Mater. Sci. Eng. 590 012036Hastavaram Dinesh Kumar ReddyAinda não há avaliações

- London Go ContactlessDocumento1 páginaLondon Go ContactlessSushil SirsatAinda não há avaliações

- Metrocard For Smart Rider Ticketing System Using Rfid: Intenal GuideDocumento11 páginasMetrocard For Smart Rider Ticketing System Using Rfid: Intenal GuidegopiAinda não há avaliações

- Sbro472 INFOSYS 110Documento10 páginasSbro472 INFOSYS 110Sam BrothersAinda não há avaliações

- Demystifying Ticketing and Payment in Public Transport: NOVEMBER - 2020Documento32 páginasDemystifying Ticketing and Payment in Public Transport: NOVEMBER - 2020vagnerstefanelloAinda não há avaliações

- Fare Media: (Citation Needed)Documento4 páginasFare Media: (Citation Needed)Roy Mitz BautistaAinda não há avaliações

- Eticketing 170408Documento20 páginasEticketing 170408Saurav RawatAinda não há avaliações

- Bus Tracking System and Ticket Generation Using QR Technology PDFDocumento5 páginasBus Tracking System and Ticket Generation Using QR Technology PDFResearch Journal of Engineering Technology and Medical Sciences (RJETM)Ainda não há avaliações

- The Optimal Carpool Planning, Based On Ios Platform: Her-Shing Wang, Chun-Tze Hsiao & Wei-Chen DongDocumento10 páginasThe Optimal Carpool Planning, Based On Ios Platform: Her-Shing Wang, Chun-Tze Hsiao & Wei-Chen DongTJPRC PublicationsAinda não há avaliações

- Cloud Based Bus Pass System Using Internet of ThingsDocumento4 páginasCloud Based Bus Pass System Using Internet of ThingsNadeesha AbeysekaraAinda não há avaliações

- It Sector ApplicationDocumento15 páginasIt Sector ApplicationNaresh Chandra PokhriyalAinda não há avaliações

- Fare Media: (Citation Needed)Documento4 páginasFare Media: (Citation Needed)Roy Mitz BautistaAinda não há avaliações

- Android Application For Online Non-Stop Bus Ticket Generation SystemDocumento5 páginasAndroid Application For Online Non-Stop Bus Ticket Generation SystemAnonymous izrFWiQAinda não há avaliações

- Public Transportation Automated Fare Collection Systems DesignDocumento7 páginasPublic Transportation Automated Fare Collection Systems DesignMehak ChhabraAinda não há avaliações

- DART Mobile Ticketing PresentationDocumento25 páginasDART Mobile Ticketing PresentationRobert WilonskyAinda não há avaliações

- Evolution and Innovations in The Tolling Industry - Unveilled at GFF 2023Documento19 páginasEvolution and Innovations in The Tolling Industry - Unveilled at GFF 2023Chintan GandhiAinda não há avaliações

- An Improvised Analysis of Smart Data For IoT-based Railway System Using RFIDDocumento13 páginasAn Improvised Analysis of Smart Data For IoT-based Railway System Using RFIDrana bakhshAinda não há avaliações

- The Impact of Information Technology On The Indian Railway SystemDocumento3 páginasThe Impact of Information Technology On The Indian Railway SystemTanmoy Duari0% (1)

- Application Areas of Intelligent Transport System: READ MORE: GIS in TransportationDocumento2 páginasApplication Areas of Intelligent Transport System: READ MORE: GIS in TransportationIonut CarstovAinda não há avaliações

- Electronic Chart For Indian RailwaysDocumento41 páginasElectronic Chart For Indian Railwaysarvindcs008Ainda não há avaliações

- GPS-Ticket: Automated Public-Transport Fare Collection System With Cellular Based Remote Transport Scheduling FacilityDocumento3 páginasGPS-Ticket: Automated Public-Transport Fare Collection System With Cellular Based Remote Transport Scheduling FacilityAbilash VakatiAinda não há avaliações

- A Study On Optimization of The Integrated Mode of Transport Using An Intelligent Transportation System To Reduce Traffic Congestion and PollutionDocumento12 páginasA Study On Optimization of The Integrated Mode of Transport Using An Intelligent Transportation System To Reduce Traffic Congestion and PollutionLeo MessiAinda não há avaliações

- Iot Based Toll Booth Management System: Aadish Joshi, Gaurav Bhide, Shreyas Patil, R. D. KomatiDocumento5 páginasIot Based Toll Booth Management System: Aadish Joshi, Gaurav Bhide, Shreyas Patil, R. D. Komatiakash mishraAinda não há avaliações

- Fzheng@home - Swjtu.edu - CN: ICTE 2015 513Documento7 páginasFzheng@home - Swjtu.edu - CN: ICTE 2015 513Jesus David VasquezAinda não há avaliações

- Briand2016 Article AMixtureModelClusteringApproacDocumento14 páginasBriand2016 Article AMixtureModelClusteringApproacRani Permata adiAinda não há avaliações

- Iot Based Crowd Management Framework For Departure Control FinalDocumento32 páginasIot Based Crowd Management Framework For Departure Control FinalArunAinda não há avaliações

- Case Study: Transport For London CountdownDocumento5 páginasCase Study: Transport For London CountdownIsmael SotoAinda não há avaliações

- Automated Bus Ticket Reservation System For Ethiopian Bus Transport SystemDocumento6 páginasAutomated Bus Ticket Reservation System For Ethiopian Bus Transport SystemJazmen folkAinda não há avaliações

- Teleport An Open, Accurate and Flexible PDFDocumento13 páginasTeleport An Open, Accurate and Flexible PDFRampajasdAinda não há avaliações

- Bus Pass White BookDocumento8 páginasBus Pass White BookNarayan LokeAinda não há avaliações

- Intelligent Transportation SystemDocumento27 páginasIntelligent Transportation SystemAngelica Suico MayolAinda não há avaliações

- Automatic Toll Management System Using NFC and Mobile ComputingDocumento7 páginasAutomatic Toll Management System Using NFC and Mobile ComputingBsr NashaAinda não há avaliações

- Automated Bus Ticket Reservation System For Ethiopian Bus Transport SystemDocumento7 páginasAutomated Bus Ticket Reservation System For Ethiopian Bus Transport SystemLiban ToleraAinda não há avaliações

- Name Netid Group Number: Website Link: Tutorial Details Time Spent On AssignmentDocumento10 páginasName Netid Group Number: Website Link: Tutorial Details Time Spent On Assignmentpli415Ainda não há avaliações

- IT Systems in Public Transport: Information Technology for Transport Operators and AuthoritiesNo EverandIT Systems in Public Transport: Information Technology for Transport Operators and AuthoritiesAinda não há avaliações

- Celebrating Spatial Planning at TU Delft 2008-2019Documento122 páginasCelebrating Spatial Planning at TU Delft 2008-2019Julan CastroAinda não há avaliações

- AIT Yearbook 2020Documento70 páginasAIT Yearbook 2020Julan CastroAinda não há avaliações

- FAQs On The Flexible ProgramDocumento5 páginasFAQs On The Flexible ProgramJulan CastroAinda não há avaliações

- ILC Learning ModulesDocumento217 páginasILC Learning ModulesJulan CastroAinda não há avaliações

- 4 Sustainable Development Goals Virtual Youth Summer Camp Syllabus and Participant GuideDocumento2 páginas4 Sustainable Development Goals Virtual Youth Summer Camp Syllabus and Participant GuideJulan CastroAinda não há avaliações

- 'Life' Review - Science FrictionDocumento9 páginas'Life' Review - Science FrictionJulan CastroAinda não há avaliações

- CookbookDocumento91 páginasCookbookJulan CastroAinda não há avaliações

- LTA Connect - Feb2019 - FA PDFDocumento18 páginasLTA Connect - Feb2019 - FA PDFJulan CastroAinda não há avaliações

- Land Transport Sustainability Update 2014Documento9 páginasLand Transport Sustainability Update 2014Julan CastroAinda não há avaliações

- Design Seminar - Plumbing PDFDocumento80 páginasDesign Seminar - Plumbing PDFJulan Castro100% (1)

- 9 - ESCAP PPP Readiness Tool PDFDocumento12 páginas9 - ESCAP PPP Readiness Tool PDFJulan CastroAinda não há avaliações

- Case 4 - Land Value - Hong-Kong MTRDocumento4 páginasCase 4 - Land Value - Hong-Kong MTRJulan CastroAinda não há avaliações

- Case Study #1: Public-Private PartnershipsDocumento4 páginasCase Study #1: Public-Private PartnershipsJulan CastroAinda não há avaliações

- Case 2 - Efficiency Gains - Manila WaterDocumento4 páginasCase 2 - Efficiency Gains - Manila WaterJulan CastroAinda não há avaliações

- Case 5 Regulator Port KlangDocumento4 páginasCase 5 Regulator Port KlangJulan CastroAinda não há avaliações

- Hong Kong - Macau Itinerary: May 24 To 27, 2016 (4 Days & 3 Nights)Documento3 páginasHong Kong - Macau Itinerary: May 24 To 27, 2016 (4 Days & 3 Nights)Aerwin AbesamisAinda não há avaliações

- Elixir CaseDocumento11 páginasElixir CaseAnoushkaBanavarAinda não há avaliações

- Towards A Cashless Society - A Design Science Research On Mobile WalletsDocumento145 páginasTowards A Cashless Society - A Design Science Research On Mobile Walletshar.san0% (1)

- Hong Kong X Macau: Itinerary by The THREE BROKE BEARSDocumento6 páginasHong Kong X Macau: Itinerary by The THREE BROKE BEARSMaureen CañeteAinda não há avaliações

- Tripomatic Free City Guide Hong KongDocumento14 páginasTripomatic Free City Guide Hong KongLLLAinda não há avaliações

- Lok 2015Documento214 páginasLok 2015JasmineTYPAinda não há avaliações

- Proof of Address (Credit Card)Documento2 páginasProof of Address (Credit Card)Jifty ParojinogAinda não há avaliações

- Fintech E-Wallet PIPE OpportunityDocumento10 páginasFintech E-Wallet PIPE OpportunitySaleh Al-GhamdiAinda não há avaliações

- Mid-Term Paper On Smart CityDocumento11 páginasMid-Term Paper On Smart CityEminAinda não há avaliações

- Passenger Guide and Octopus Fare 1005Documento2 páginasPassenger Guide and Octopus Fare 1005water_thiefAinda não há avaliações

- OctopushenDocumento20 páginasOctopushenMatias WolpiAinda não há avaliações

- ITW Stretch Wrapper Octopus - 1800-2800 - S-SFTS Data SheetDocumento4 páginasITW Stretch Wrapper Octopus - 1800-2800 - S-SFTS Data Sheetarun kumarAinda não há avaliações

- Barringer E4 Im 03 GE VersionDocumento26 páginasBarringer E4 Im 03 GE VersionZihan Fauji80% (25)

- Octopus Car Park SystemDocumento4 páginasOctopus Car Park Systemapi-9998671Ainda não há avaliações

- ShuttleDocumento3 páginasShuttleMavin TaiAinda não há avaliações

- List of Type Approval Requirement Documents For SP - 120719Documento1 páginaList of Type Approval Requirement Documents For SP - 120719miclau1123Ainda não há avaliações

- Security Analysis of Octopus Smart Card SystemDocumento6 páginasSecurity Analysis of Octopus Smart Card SystemMing ZhouAinda não há avaliações

- LCH1006 Test Notes Sample Questions (2021-2022) Updated 21 March 2022Documento9 páginasLCH1006 Test Notes Sample Questions (2021-2022) Updated 21 March 2022celesteheiiAinda não há avaliações

- The Role of Computers in BusinessDocumento7 páginasThe Role of Computers in BusinessAakshay KumarAinda não há avaliações

- Train Cards of The 10 Best Trains in The WorldDocumento14 páginasTrain Cards of The 10 Best Trains in The WorldKenWuAinda não há avaliações

- Hongkong GuideDocumento101 páginasHongkong GuideKevin Nave RiveraAinda não há avaliações

- Httpsoctoenergy Production User Documents.s3.Amazonaws - Combilling Statements20230520A 140A6EE9 143275850 1.PdfAWSAccessDocumento3 páginasHttpsoctoenergy Production User Documents.s3.Amazonaws - Combilling Statements20230520A 140A6EE9 143275850 1.PdfAWSAccessollythepolarbear71Ainda não há avaliações

- 27d Business Itinerary TemplateDocumento2 páginas27d Business Itinerary TemplateReyhan Savero PradietyaAinda não há avaliações