Escolar Documentos

Profissional Documentos

Cultura Documentos

Interview Questions - Answered

Enviado por

Jesus Emanuel0 notas0% acharam este documento útil (0 voto)

10 visualizações1 páginaTítulo original

Interview Questions - answered.docx

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

DOCX, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

10 visualizações1 páginaInterview Questions - Answered

Enviado por

Jesus EmanuelDireitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

Você está na página 1de 1

1. Net Debt is gross Debt less cash.

It used along equity value to calculate the total enterprise

value, because it represents the part destinated to the debtholders

2. Systematic risk, which is included in the market risk premium

3. 7,5degress (clockwise)

4. Deferred taxes are taxes to be paid in the future. They might originate from time differences

between the book and taxable profit

5. I think they will slightly decrease. Central bank might get a little aggressive, given that

inflation is under control, to stimulate further growth

6. WHAT DOES LIQUIDITY ALLOW AN INVESTOR¿ It allows the investor to have more fast

transactions and short periods to receive sales from assets

7. US treasury is backed by the American government, so, theoretically, these securities are

risk-free

8. Components include the cost of equity and debt after taxes, besides the capital structure

9. Increase leveraged increases the total amount of debt in the capital structure. Depending

on the cost of new debt, the final wacc might decrease, because cost of debt is lower than

the cost of equity

10. About the utility company, I would see the Cash flow statement at first. These kinds of

company need heavy investments, and capex should be high. Cash flow statement would

tell if the company is able to generate cash flow above capex

11.What industry do you follow¿

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

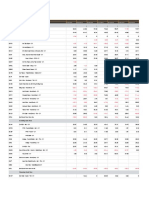

- Cash Flow Report - Operating, Investing & Financing Cash Flows in 8 PeriodsDocumento3 páginasCash Flow Report - Operating, Investing & Financing Cash Flows in 8 PeriodsJesus EmanuelAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Irati EnergiaDocumento1 páginaIrati EnergiaJesus EmanuelAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Modelling and Numerical Simulation of Flow Through Artificial Heart ValvesDocumento10 páginasModelling and Numerical Simulation of Flow Through Artificial Heart ValvesJesus EmanuelAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- Projeto Medições An-ArduinoDocumento1 páginaProjeto Medições An-ArduinoJesus EmanuelAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Resumo Dos ArtigosDocumento1 páginaResumo Dos ArtigosJesus EmanuelAinda não há avaliações

- Legumes TrabalhoDocumento8 páginasLegumes TrabalhoJesus EmanuelAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Revisão LiteraturaDocumento8 páginasRevisão LiteraturaJesus EmanuelAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Vocabulario InglesDocumento1 páginaVocabulario InglesJesus EmanuelAinda não há avaliações

- Maximizing Advantages of China JV for HCFDocumento10 páginasMaximizing Advantages of China JV for HCFLing PeNnyAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- Global Dis Trip Arks ProspectusDocumento250 páginasGlobal Dis Trip Arks ProspectusSandeepan ChaudhuriAinda não há avaliações

- T3-Sample Answers-Consideration PDFDocumento10 páginasT3-Sample Answers-Consideration PDF--bolabolaAinda não há avaliações

- Saral Gyan Stocks Past Performance 050113Documento13 páginasSaral Gyan Stocks Past Performance 050113saptarshidas21Ainda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Responsibility Accounting and Profitability RatiosDocumento13 páginasResponsibility Accounting and Profitability RatiosKhrystal AbrioAinda não há avaliações

- Chapter-Iii Company Profile: Motilal Oswal Financial Services Ltd. (BSE, NIFTY, NASDAQ, Dow Jones, Hang Seng)Documento8 páginasChapter-Iii Company Profile: Motilal Oswal Financial Services Ltd. (BSE, NIFTY, NASDAQ, Dow Jones, Hang Seng)MubeenAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Megaworld Corporation Shelf Registration of Up to P30B Debt SecuritiesDocumento117 páginasMegaworld Corporation Shelf Registration of Up to P30B Debt SecuritiesEunji eunAinda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Project Financing AssignmentsDocumento17 páginasProject Financing AssignmentsAlemu OlikaAinda não há avaliações

- Banking - HL - CBA 0979 - GOROKAN (01 Jan 23 - 28 Feb 23)Documento5 páginasBanking - HL - CBA 0979 - GOROKAN (01 Jan 23 - 28 Feb 23)Adrianne JulianAinda não há avaliações

- P4 Taxation New Suggested CA Inter May 18Documento27 páginasP4 Taxation New Suggested CA Inter May 18Durgadevi BaskaranAinda não há avaliações

- Ratio Analysis Pankaj 180000502015Documento64 páginasRatio Analysis Pankaj 180000502015PankajAinda não há avaliações

- Solutions To Exercises and Problems - Budgeting: GivenDocumento8 páginasSolutions To Exercises and Problems - Budgeting: GivenTiến AnhAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Flyleaf BooksDocumento32 páginasFlyleaf BooksAzhar MajothiAinda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- Elements of Financial StatementsDocumento31 páginasElements of Financial StatementsThelearningHightsAinda não há avaliações

- Modifying Restrictive CovenantsDocumento45 páginasModifying Restrictive CovenantsLonaBrochenAinda não há avaliações

- B7AF102 Financial Accounting May 2023Documento11 páginasB7AF102 Financial Accounting May 2023gerlaniamelgacoAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Chapter 6Documento17 páginasChapter 6MM M83% (6)

- Inventory Trading SampleDocumento28 páginasInventory Trading SampleRonald Victor Galarza Hermitaño0% (1)

- Technopreneurship in Small Medium EnterprisegrouptwoDocumento50 páginasTechnopreneurship in Small Medium EnterprisegrouptwoKurt Martine LacraAinda não há avaliações

- The Logical Trader Applying A Method To The Madness PDFDocumento137 páginasThe Logical Trader Applying A Method To The Madness PDFJose GuzmanAinda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Alagappa University DDE BBM First Year Financial Accounting Exam - Paper2Documento5 páginasAlagappa University DDE BBM First Year Financial Accounting Exam - Paper2mansoorbariAinda não há avaliações

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocumento2 páginasIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsAinda não há avaliações

- A Study On Investors Buying Behaviour Towards Mutual Fund PDF FreeDocumento143 páginasA Study On Investors Buying Behaviour Towards Mutual Fund PDF FreeRathod JayeshAinda não há avaliações

- Excel Worksheet - Session 9 - Sestion CDocumento108 páginasExcel Worksheet - Session 9 - Sestion CSOURABH DEAinda não há avaliações

- Yodlee User Guide PDFDocumento211 páginasYodlee User Guide PDFy2kmvrAinda não há avaliações

- Issue of SharesDocumento53 páginasIssue of SharesKanishk GoyalAinda não há avaliações

- LatAm Fintech Landscape - 2023Documento3 páginasLatAm Fintech Landscape - 2023Bruno Gonçalves MirandaAinda não há avaliações

- Referral PolicyDocumento2 páginasReferral PolicyDipikaAinda não há avaliações

- Future and Option MarketDocumento21 páginasFuture and Option MarketKunal MalodeAinda não há avaliações

- Cash Flow Statements PDFDocumento101 páginasCash Flow Statements PDFSubbu ..100% (1)