Escolar Documentos

Profissional Documentos

Cultura Documentos

Bank Reconciliation Statement

Enviado por

Nonilon M. RoblesDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Bank Reconciliation Statement

Enviado por

Nonilon M. RoblesDireitos autorais:

Formatos disponíveis

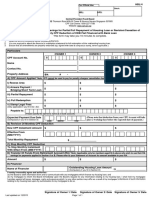

BANK RECONCILIATION STATEMENT

Company A's bank statement dated Dec 31, 2017 shows a balance of 12,297,360.00. The company's

cash records on the same date show a balance of 11,598,395.00 Following additional information is

available:

1. Following checks issued by the company to its customers are still outstanding:

No. 846 issued on Nov 29 160,000.00 2.

No. 875 issued on Dec 26 24,605.00

No. 878 issued on Dec 29 137,500.00

No. 881 issued on Dec 31 93,250.00

A deposit of 200,000.00 made on Dec 31 does not appear on bank statement.

3. An NSF check of 425,000.00 was returned by the bank with the bank statement.

4. The bank charged 25,000.00 as service fee.

5. Interest income earned on the company's average cash balance at bank was 618,610.00.

6. The bank collected a note receivable on behalf of the company. Amount received by the bank on

the note was 275,000.00. This includes 25,000.00 interest income. The bank charged a collection

fee of 5,000.00.

7. A deposit of 215,000.00 was incorrectly entered as 170,000.00 in the company's cash records.

Prepare a bank reconciliation statement using the above information.

Solution:

Company A

Bank Reconciliation

December 31, 2011

Balance as per Bank, Dec 31 1,229,736.00

Add: Deposit in Transit 20,000.00

1,249,736.00

Less: Outstanding Checks:

No. 846 issued on Nov 29 16,000.00

No. 875 issued on Dec 26 2,460.50

No. 878 issued on Dec 29 13,750.00

No. 881 issued on Dec 31 9,325.00

41,535.50

Adjusted Bank Balance 1,208,200.50

Balance as per Books, Dec 31 1,159,839.50

Add:

Interest Income from Bank 61,861.00

Note Receivable Collected by Bank 25,000.00

Interest Income from Note Receivable 2,500.00

Deposit Understated 4,500.00

93,861.00

1,253,700.50

Less:

NSF Check 42,500.00

Bank Service Fee 2,500.00

Bank Collection Fee 500.00

45,500.00

Adjusted Book Balance 1,208,200.50

Você também pode gostar

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Gumabon v. PNBDocumento2 páginasGumabon v. PNBVon Lee De LunaAinda não há avaliações

- 2013sep PDFDocumento68 páginas2013sep PDFmymanual100% (4)

- Testing PlanDocumento2 páginasTesting PlanAngMniAinda não há avaliações

- Spouses Francisco Sierra, Et Al Vs PAIC Savings and Mortgage Bank Inc, G.R. No. 197857Documento7 páginasSpouses Francisco Sierra, Et Al Vs PAIC Savings and Mortgage Bank Inc, G.R. No. 197857Janskie Mejes Bendero LeabrisAinda não há avaliações

- Practice Court - Joint Stipulation of FactsDocumento5 páginasPractice Court - Joint Stipulation of FactsKio Paulo San AndresAinda não há avaliações

- NI ActDocumento20 páginasNI ActshapnokoliAinda não há avaliações

- Calculo de Un Credito para HipotecaDocumento26 páginasCalculo de Un Credito para HipotecaREINALDO VELASQUEZAinda não há avaliações

- Cacib FX DailyDocumento5 páginasCacib FX DailyNova AnnuristianAinda não há avaliações

- Partnership Firm ProjectDocumento36 páginasPartnership Firm ProjectRkenterprise60% (10)

- Frequently Asked Questions - Maybank Visa DebitDocumento4 páginasFrequently Asked Questions - Maybank Visa DebitholaAinda não há avaliações

- AffidavitDocumento19 páginasAffidavitppghoshinAinda não há avaliações

- Critical Assessment of Performance of Mergers and AcquisitionsDocumento12 páginasCritical Assessment of Performance of Mergers and AcquisitionsThe IjbmtAinda não há avaliações

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocumento8 páginasTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalancePrathapa Naveen KumarAinda não há avaliações

- Case Study RaghavDocumento9 páginasCase Study RaghavrahultripathivnsAinda não há avaliações

- Difference Between Commercial & Islamic BankDocumento16 páginasDifference Between Commercial & Islamic BankArafat RaufAinda não há avaliações

- Form HBL4Documento3 páginasForm HBL4klerinetAinda não há avaliações

- Quy Trình Hàng SEADocumento4 páginasQuy Trình Hàng SEAVũMinhAinda não há avaliações

- Don Coxe Basic Points Two Days After Hallowe'en 101310Documento51 páginasDon Coxe Basic Points Two Days After Hallowe'en 101310B_U_C_KAinda não há avaliações

- Court upholds collection on promissory notesDocumento11 páginasCourt upholds collection on promissory notesJocelyn Desiar NuevoAinda não há avaliações

- Report on Introduction of Credit Default Swaps for Corporate BondsDocumento86 páginasReport on Introduction of Credit Default Swaps for Corporate Bondskrishnaj1967Ainda não há avaliações

- Manual PeachtreeDocumento724 páginasManual PeachtreeMaritza Valladares0% (2)

- Agriculture Finance in India - Issues & Future Perspectives: Haresh Barot & Kundan PatelDocumento6 páginasAgriculture Finance in India - Issues & Future Perspectives: Haresh Barot & Kundan PatelharpominderAinda não há avaliações

- FDI in India Attracts Top InvestorsDocumento13 páginasFDI in India Attracts Top InvestorsPraveen SehgalAinda não há avaliações

- Unit I - Overview of Finance and Financial Management: Notes 1 For Afm 101Documento5 páginasUnit I - Overview of Finance and Financial Management: Notes 1 For Afm 101MHIL RAFAEL DAUGDAUGAinda não há avaliações

- Home Loans GuideDocumento86 páginasHome Loans GuideMubeenAinda não há avaliações

- Crisologo-Jose v. Court of Appeals, G.R. No. 80599, September 15, 1989Documento9 páginasCrisologo-Jose v. Court of Appeals, G.R. No. 80599, September 15, 1989Krister VallenteAinda não há avaliações

- 80 Byte Population Guide - v15.94Documento216 páginas80 Byte Population Guide - v15.94HMAinda não há avaliações

- Practice Set - A3Documento6 páginasPractice Set - A3Dayanara VillanuevaAinda não há avaliações

- BranchDocumento2 páginasBranchkaviyapriyaAinda não há avaliações

- Documentary Stamp TaxDocumento2 páginasDocumentary Stamp TaxJoAnne Yaptinchay ClaudioAinda não há avaliações