Escolar Documentos

Profissional Documentos

Cultura Documentos

Ad. Entry PRB 2

Enviado por

Shuvro ChakravortyTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Ad. Entry PRB 2

Enviado por

Shuvro ChakravortyDireitos autorais:

Formatos disponíveis

1.

Problems on adjusted Trial Balance

“X” companies Trial Balance on June 30, 2012 are as follows:

Accounts No Accounts Name Debit Credit

1. Cash 7150

2. Accounts Receivable 6000

3. Prepaid Insurance 3000

4. Supplies 2000

5. Office Equipment 15000

6. Accounts payable 4500

7. Unearned Service Revenue 4000

8. “X” Capital 21750

9. Service Revenue 7900

1. Salaries Expense 4000

11. Rent Expense 1000

Total 38150 38150

Other Data:

1. Supplies on hand at June, 30 are Tk. 1100.

2. A utility bill for Tk. 150 has not been recorded and will not be paid until next month.

3. The insurance policy is for a year.

4. Tk. 2500 of earned revenue has been earned at the end of the month.

5. Salaries of Tk. 1500 are accrued at june,30,

6. The office equipment has a 5 year life. It is being depreciated Tk. 250 per month.

7. Invoices representing Tk.2000 of service performed during the month have not been recorded as

of June, 30.

Requirements:

(a) Prepare adjusting entries.

(b) Prepare an adjusted Trial Balance at june30, 2012.

Requirement: (a)

“X” Company

Adjusting Entry

June 30, 2012

Date Accounts Name Ref Debit Credit

No

2012

June-30 Supplies expense……………………………………..Dr 900

Supplies…………………………………………..Cr 900

June-30 Utility expense……………………………………….Dr 150

Utility payable……………………………………..Cr 150

June-30 Insurance expense……………………………………Dr 250

Prepaid insurance………………………………….Cr 250

June-30 Unearned revenue…………………………………….Dr 2500

Service revenue…………………………………….Cr 2500

June-30 Salary expense……………………………………….Dr 1500

Salary payable…………………………………….Cr 1500

June-30 Depreciation expense………………………………..Dr 250

Accumulated depreciation office equipment……..Cr 250

June-30 Accounts receivable…………………………………Dr 2000

Service revenue…………………………………..Cr 2000

Requirement: (b)

“X” Company

Adjusted Trial Balance

December 31, 2012

Accounts Title Debit Credit

Cash 7,150

Accounts receivable 8,000

Prepaid insurance 2,750

Supplies 1100

Office equipment 15,000

Accounts payable 4,500

Unearned service revenue 1,500

X capital 21,750

Service revenue 12,400

Utility payable 150

Salary payable 1,500

Accumulated depreciation office equipment 250

Salary expense 5,500

Rent expense 1,000

Supplies expense 900

Utility expense 150

Insurance expense 250

Depreciation expense 250

Total 42,050 42,050

Você também pode gostar

- 2095 - Chi - Nguyen - Phuong - 10200092 - Nguyen - PHuong - Chi - 9589 - 1660271688 ..Documento13 páginas2095 - Chi - Nguyen - Phuong - 10200092 - Nguyen - PHuong - Chi - 9589 - 1660271688 ..Nguyen Phuong ChiAinda não há avaliações

- Jawab-Latihan - Siklus AkuntansiDocumento26 páginasJawab-Latihan - Siklus AkuntansiSumarsono Booming FotocopyAinda não há avaliações

- Chapter 3 ExercisesDocumento8 páginasChapter 3 ExercisesNguyen Khanh Ly K17 HLAinda não há avaliações

- Chapter-3: Practical ProblemsDocumento2 páginasChapter-3: Practical ProblemsMd. Rokon KhanAinda não há avaliações

- FABM 2 HANDOUTS 1st QRTRDocumento17 páginasFABM 2 HANDOUTS 1st QRTRDanise PorrasAinda não há avaliações

- Date Accounts Debit Credit: AnswerDocumento3 páginasDate Accounts Debit Credit: AnswerLiu CellAinda não há avaliações

- Accounting Group Assignment 1Documento7 páginasAccounting Group Assignment 1Muntasir AhmmedAinda não há avaliações

- Full Set of Financial AccountingDocumento8 páginasFull Set of Financial AccountingmaiAinda não há avaliações

- Adjusting Entry Math LatestDocumento4 páginasAdjusting Entry Math LatestOyon Nur newazAinda não há avaliações

- mgt101 Questions With AnswersDocumento11 páginasmgt101 Questions With AnswersKinza LaiqatAinda não há avaliações

- Acc HWDocumento5 páginasAcc HWHasan NajiAinda não há avaliações

- Unit 3 Tutorial Worksheet (Session 1)Documento15 páginasUnit 3 Tutorial Worksheet (Session 1)MingxAinda não há avaliações

- 8625adjusting Entries PracticeDocumento4 páginas8625adjusting Entries PracticeNajia SalmanAinda não há avaliações

- PT BaDocumento18 páginasPT BaJasmine Merthel Masmila ObstaculoAinda não há avaliações

- PT BaDocumento18 páginasPT BaJasmine Merthel Masmila ObstaculoAinda não há avaliações

- 605701b41234414fbf70f2a0d6734ae1Documento3 páginas605701b41234414fbf70f2a0d6734ae1BabaAinda não há avaliações

- Work Sheet 1 PDFDocumento9 páginasWork Sheet 1 PDFProtik SarkarAinda não há avaliações

- Principles of Accounting (A B E)Documento3 páginasPrinciples of Accounting (A B E)r kAinda não há avaliações

- Group Assignment - Questions - RevisedDocumento6 páginasGroup Assignment - Questions - Revised31231023949Ainda não há avaliações

- Problem No 5 (Acctg. 1)Documento5 páginasProblem No 5 (Acctg. 1)Ash imoAinda não há avaliações

- Homework 4題目Documento2 páginasHomework 4題目劉百祥Ainda não há avaliações

- Problem Sheet 4 Summer 22Documento4 páginasProblem Sheet 4 Summer 22Md Tanvir AhmedAinda não há avaliações

- Use Perpetual Inventory System For P6.3Documento15 páginasUse Perpetual Inventory System For P6.3Giang LinhAinda não há avaliações

- Adjusting EntriesDocumento5 páginasAdjusting EntriesM Hassan BrohiAinda não há avaliações

- ACT 501 AssignmentDocumento6 páginasACT 501 AssignmentEasin Mohammad RomanAinda não há avaliações

- Adjusting Solution 1Documento5 páginasAdjusting Solution 1Umer SiddiquiAinda não há avaliações

- FS SaplanDocumento16 páginasFS SaplanMarilyn Cercado FernandezAinda não há avaliações

- Saplan - Danilyn - Final OutputDocumento16 páginasSaplan - Danilyn - Final OutputMarilyn Cercado FernandezAinda não há avaliações

- Journal EntryDocumento9 páginasJournal Entrytrisha joy de laraAinda não há avaliações

- ACC101 - Accounting CycleDocumento3 páginasACC101 - Accounting CycleJade PielAinda não há avaliações

- Performance Task #8 Preparation of Trial BalanceDocumento2 páginasPerformance Task #8 Preparation of Trial BalancetineAinda não há avaliações

- Unit 2 WorksheetDocumento13 páginasUnit 2 WorksheetHhvvgg BbbbAinda não há avaliações

- ISSo FPDocumento6 páginasISSo FPabbeangedesireAinda não há avaliações

- Accounting Worksheet: Business Name: Accounting PeriodDocumento5 páginasAccounting Worksheet: Business Name: Accounting Periodhgiang2308Ainda não há avaliações

- MGT 101Documento13 páginasMGT 101MuzzamilAinda não há avaliações

- Financial Accounting - Tugas 1Documento6 páginasFinancial Accounting - Tugas 1Alfiyan100% (1)

- Accounting Compeleting The CycleDocumento14 páginasAccounting Compeleting The CyclecamilleAinda não há avaliações

- Financial Accounting - Assignment #1#Documento5 páginasFinancial Accounting - Assignment #1#Hasan NajiAinda não há avaliações

- Exercise 5 - Completing The Accounting Cycle For Merchandising and Service BusinessDocumento4 páginasExercise 5 - Completing The Accounting Cycle For Merchandising and Service BusinessShiela Rengel0% (2)

- E34Documento9 páginasE34Nguyen Nguyen KhoiAinda não há avaliações

- Adjusting Entries: Asistensi Pengantar Akuntansi IDocumento4 páginasAdjusting Entries: Asistensi Pengantar Akuntansi Isinta agnes100% (1)

- Activity #6Documento20 páginasActivity #6JEWELL ANN PENARANDAAinda não há avaliações

- ACC705 Corporate Accounting AssignmentDocumento9 páginasACC705 Corporate Accounting AssignmentMuhammad AhsanAinda não há avaliações

- ABC Law FirmDocumento7 páginasABC Law FirmMuhammad Bin AshrafAinda não há avaliações

- Class ExerciseDocumento14 páginasClass ExerciseAbdul Basit MalikAinda não há avaliações

- MODULE 8 Learning ActivitiesDocumento5 páginasMODULE 8 Learning ActivitiesChristian Cyrous AcostaAinda não há avaliações

- Adjusting EntryDocumento8 páginasAdjusting EntryRaeha Tul Jannat BuzdarAinda não há avaliações

- Discussion For Adjustment Entries - QuestionsDocumento6 páginasDiscussion For Adjustment Entries - QuestionsMUHAMMAD ZAIM ILYASA KASIMAinda não há avaliações

- FA1 Financial StatementsDocumento5 páginasFA1 Financial StatementsamirAinda não há avaliações

- Pembahasan CH 3 4 5Documento30 páginasPembahasan CH 3 4 5bella0% (1)

- Ahsan Saleem 18-Arid-2445 Finn..Documento11 páginasAhsan Saleem 18-Arid-2445 Finn..HumnaZaheer muhmmadzaheerAinda não há avaliações

- PA-1 Adjusments and Worksheet (Problems)Documento5 páginasPA-1 Adjusments and Worksheet (Problems)Safira ChairunnisaAinda não há avaliações

- Financial Accounting-I Assignment 2: InstructionsDocumento3 páginasFinancial Accounting-I Assignment 2: InstructionsMemes CreatorAinda não há avaliações

- Adjusting Entries Class Problem 2 (Class-4)Documento9 páginasAdjusting Entries Class Problem 2 (Class-4)Mahmudul HasanAinda não há avaliações

- CH03Documento3 páginasCH03Fuyiko Kaneshiro HosanaAinda não há avaliações

- ACCTBA1 - Quiz 3Documento2 páginasACCTBA1 - Quiz 3Marie Beth BondestoAinda não há avaliações

- Act 110 Bonus Activity (Dimalawang)Documento10 páginasAct 110 Bonus Activity (Dimalawang)Kilwa DyAinda não há avaliações

- Jolly Company's Accounts Have The Following Balances As of December 31, 2018Documento3 páginasJolly Company's Accounts Have The Following Balances As of December 31, 2018Allen CarlAinda não há avaliações

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineAinda não há avaliações

- Covid LabResultDocumento1 páginaCovid LabResultShuvro ChakravortyAinda não há avaliações

- Order Related To Development WorkDocumento3 páginasOrder Related To Development WorkShuvro ChakravortyAinda não há avaliações

- SureCash Agent List PDFDocumento18 páginasSureCash Agent List PDFShuvro ChakravortyAinda não há avaliações

- Adm. Pro. For Foreign NationalsDocumento6 páginasAdm. Pro. For Foreign NationalsPushan PaulAinda não há avaliações

- Rules and Regulation of Transmission and Distribution of Natural Gas and Its Application in BangladeshDocumento11 páginasRules and Regulation of Transmission and Distribution of Natural Gas and Its Application in BangladeshShuvro ChakravortyAinda não há avaliações

- Cfliil I: Cam CeDocumento4 páginasCfliil I: Cam CeShuvro ChakravortyAinda não há avaliações

- UE Electrical Layout Model 1 PDFDocumento1 páginaUE Electrical Layout Model 1 PDFShuvro ChakravortyAinda não há avaliações

- SD-9 Drain Fill and Filter-Dec13Documento2 páginasSD-9 Drain Fill and Filter-Dec13Shuvro ChakravortyAinda não há avaliações

- Bcs Written Syllabus LatestDocumento168 páginasBcs Written Syllabus LatestSagar SahaAinda não há avaliações

- Current AffairsDocumento12 páginasCurrent AffairsShuvro ChakravortyAinda não há avaliações

- Summary Pilot Pile 30Documento1 páginaSummary Pilot Pile 30Shuvro ChakravortyAinda não há avaliações

- 525 MCQ On English Literature (Without Option)Documento41 páginas525 MCQ On English Literature (Without Option)Mus'ab Ahnaf100% (2)

- Description Total Bazar (TK.) "+/-" Meal Rate (TK.)Documento1 páginaDescription Total Bazar (TK.) "+/-" Meal Rate (TK.)Shuvro ChakravortyAinda não há avaliações

- Sheet 1-4Documento3 páginasSheet 1-4Shuvro ChakravortyAinda não há avaliações

- Weygandt Kimmel Keiso 9 EditionDocumento11 páginasWeygandt Kimmel Keiso 9 EditionShuvro ChakravortyAinda não há avaliações

- CE206 Lecture 02 Basics PDocumento4 páginasCE206 Lecture 02 Basics PShuvro ChakravortyAinda não há avaliações

- Format of Classified Income Statement and Balance SheetDocumento5 páginasFormat of Classified Income Statement and Balance SheetShuvro ChakravortyAinda não há avaliações

- Cost AccountingDocumento23 páginasCost AccountingShuvro ChakravortyAinda não há avaliações

- 5.10.4 Marshall Mix Design Calc 03.24Documento14 páginas5.10.4 Marshall Mix Design Calc 03.24Seble GetachewAinda não há avaliações

- at The End of Its First Month of Operations, Watson Answering Services Has The Following UnadjustedDocumento11 páginasat The End of Its First Month of Operations, Watson Answering Services Has The Following UnadjustedShuvro Chakravorty100% (1)

- The Recording Process: Reference Book: Weygandt Kimmel Keiso (9 Edition)Documento21 páginasThe Recording Process: Reference Book: Weygandt Kimmel Keiso (9 Edition)Shuvro ChakravortyAinda não há avaliações

- Accounting AssignmentDocumento13 páginasAccounting AssignmentShuvro ChakravortyAinda não há avaliações

- Chapter 4Documento12 páginasChapter 4Saqeeb AdnanAinda não há avaliações

- Accounting - Afia NoteDocumento30 páginasAccounting - Afia NoteShuvro ChakravortyAinda não há avaliações

- Apendix - 2 of IRC 75Documento3 páginasApendix - 2 of IRC 75Shuvro ChakravortyAinda não há avaliações

- Code No ListDocumento11 páginasCode No ListShuvro ChakravortyAinda não há avaliações

- Apendix - 2 of IRC 75Documento3 páginasApendix - 2 of IRC 75Shuvro ChakravortyAinda não há avaliações

- LRFD Guide eDocumento91 páginasLRFD Guide eJACKAinda não há avaliações

- Lecture CE401 RH 2 TeamsDocumento39 páginasLecture CE401 RH 2 TeamsShuvro ChakravortyAinda não há avaliações

- Assignment 1 - Introduction To Process CostingDocumento7 páginasAssignment 1 - Introduction To Process Costingprettygurl_jenn12Ainda não há avaliações

- 6 Rectification of ErrorsDocumento33 páginas6 Rectification of Errorsniraj jainAinda não há avaliações

- Navneet Tally 1 FINALDocumento42 páginasNavneet Tally 1 FINALnons57Ainda não há avaliações

- Audit Agreement Format 2Documento17 páginasAudit Agreement Format 2sudhier9Ainda não há avaliações

- Introduction To Askari Commercial BankDocumento42 páginasIntroduction To Askari Commercial BankMajid Yaseen0% (1)

- ISO 9000-1994 NustDocumento9 páginasISO 9000-1994 NustNativity MabasaAinda não há avaliações

- Strata, JMB & MCDocumento19 páginasStrata, JMB & MCaniza zazaAinda não há avaliações

- Effect of Computerised Accounting Systems On Audit Risk 2013 PDFDocumento10 páginasEffect of Computerised Accounting Systems On Audit Risk 2013 PDFHasmiati SAinda não há avaliações

- Test Bank - Chapter 4 Process CostingDocumento51 páginasTest Bank - Chapter 4 Process Costingmaisie laneAinda não há avaliações

- Uniform Cpa Examination Blueprints 1 3 23Documento115 páginasUniform Cpa Examination Blueprints 1 3 23Pulokesh GhoshAinda não há avaliações

- Assignment For Managing Financial Resources and Decisions.22490Documento9 páginasAssignment For Managing Financial Resources and Decisions.22490vanvitloveAinda não há avaliações

- Controller Accounting Manager CPA in Detroit MI Resume Michele MarshDocumento1 páginaController Accounting Manager CPA in Detroit MI Resume Michele MarshMicheleMarshAinda não há avaliações

- LOSAP Investigative ReportDocumento32 páginasLOSAP Investigative ReportAsbury Park PressAinda não há avaliações

- MCQ All 25 Accounts XiDocumento36 páginasMCQ All 25 Accounts XiSuraj GuptaAinda não há avaliações

- Creation Versus Evolution EssayDocumento8 páginasCreation Versus Evolution Essayafibooxdjvvtdn100% (2)

- Manager Project Financial Advertising in Chicago IL Resume Deborah KozieDocumento2 páginasManager Project Financial Advertising in Chicago IL Resume Deborah KozieDeborah KozieAinda não há avaliações

- KM Code of Business Conduct and EthicsDocumento17 páginasKM Code of Business Conduct and Ethicspriyansh4mhellAinda não há avaliações

- An Introduction To Assurance and Financial Statement AuditingDocumento22 páginasAn Introduction To Assurance and Financial Statement AuditingAleks HyunAinda não há avaliações

- Economic Legislation I 1004Documento28 páginasEconomic Legislation I 1004api-26541915Ainda não há avaliações

- TEA RulesDocumento820 páginasTEA RulesCBS Austin WebteamAinda não há avaliações

- OpAudCh02 CBET 01 501E ToraldeMa - KristineE.Documento4 páginasOpAudCh02 CBET 01 501E ToraldeMa - KristineE.Kristine Esplana ToraldeAinda não há avaliações

- Khushnam Datta: Work ExperienceDocumento1 páginaKhushnam Datta: Work ExperienceAdnan MirzaAinda não há avaliações

- Supplementary Guidance Note On Tax Audit Under Section 44AB of The Income-Tax Act, 1961Documento38 páginasSupplementary Guidance Note On Tax Audit Under Section 44AB of The Income-Tax Act, 1961Honey AgarwalAinda não há avaliações

- Journal EntriesDocumento63 páginasJournal EntriesTwinkle Kashyap50% (2)

- Group 4 Presentation Lect - 04 Overhead AnalysisDocumento25 páginasGroup 4 Presentation Lect - 04 Overhead AnalysisHumphrey OsaigbeAinda não há avaliações

- 10 Accounting ConceptsDocumento9 páginas10 Accounting ConceptsVijaya ShreeAinda não há avaliações

- Board CommitteesDocumento42 páginasBoard CommitteesKhusbuAinda não há avaliações

- Factors To Consider When Designing A Monitoring and Evaluation SystemDocumento3 páginasFactors To Consider When Designing A Monitoring and Evaluation SystemFrank Macharia73% (11)

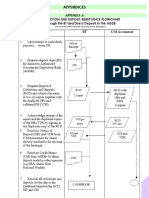

- Appendix A Collection and Deposit/Remittance Flowchart Through The BT and Direct Deposit To The AGDBDocumento75 páginasAppendix A Collection and Deposit/Remittance Flowchart Through The BT and Direct Deposit To The AGDBJayAinda não há avaliações

- Group 1 Handout RectifiedDocumento11 páginasGroup 1 Handout RectifiedNe BzAinda não há avaliações