Escolar Documentos

Profissional Documentos

Cultura Documentos

Bonds - April 11 2019

Enviado por

Tiso Blackstar Group0 notas0% acharam este documento útil (0 voto)

12 visualizações3 páginasBonds - April 11 2019

Direitos autorais

© © All Rights Reserved

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documento0 notas0% acharam este documento útil (0 voto)

12 visualizações3 páginasBonds - April 11 2019

Enviado por

Tiso Blackstar GroupVocê está na página 1de 3

Markets and Commodity figures

11 April 2019

Total Market Turnover Statistics

Standard Turnover REPO 1 Turnover

Deals Nominal Consideration Deals Nominal Consideration

Current Day 972 36.23 bn Rbn 38.09 255 34.46 bn Rbn 35.52

Week to Date 3,303 115.35 bn Rbn 118.96 1,649 226.79 bn Rbn 226.87

Month to Date 11,180 341.37 bn Rbn 347.89 3,631 508.07 bn Rbn 502.52

Year to Date 78,774 2,519.12 bn Rbn 2,539.39 25,387 3,514.04 bn Rbn 3,392.02

Foreign Client Market Turnover Statistics

Standard Turnover REPO 1 Turnover

Party Deals Nominal Consideration Deals Nominal Consideration

Buy 68 4.85 bn Rbn 5.14 19 1.96 bn Rbn 2.22

Current Day Sell 39 3.26 bn Rbn 3.44 3 0.27 bn Rbn 0.29

Net 29 1.59 bn Rbn 1.71 16 1.70 bn Rbn 1.94

Buy 206 15.15 bn Rbn 15.97 73 12.47 bn Rbn 12.33

Week to Date Sell 177 10.99 bn Rbn 11.67 28 8.39 bn Rbn 7.91

Net 29 4.16 bn Rbn 4.30 45 4.08 bn Rbn 4.42

Buy 1,070 45.67 bn Rbn 47.84 152 20.98 bn Rbn 20.67

Month to Date Sell 1,238 37.43 bn Rbn 38.68 102 39.95 bn Rbn 39.31

Net -168 8.24 bn Rbn 9.16 50 -18.97 bn Rbn -18.64

Buy 5,861 317.15 bn Rbn 322.86 1,456 308.04 bn Rbn 291.58

Year to Date Sell 5,713 292.49 bn Rbn 300.10 341 123.42 bn Rbn 122.88

Net 148 24.65 bn Rbn 22.76 1,115 184.63 bn Rbn 168.71

Index Levels

Code Index Yield Index Previous Return MTD Return YTD

ALBI20 9.043%

All Bond Index Top 664.697

20 Composite 666.505 1.13% 4.98%

GOVI 9.144%Split - 658.415

ALBI20 Issuer Class GOVI 660.276 1.16% 5.07%

OTHI 8.649%

ALBI20 Issuer Class Split - 688.978

OTHI 690.564 1.01% 4.63%

CILI15 3.242%

Composite Inflation 255.441

Linked Index Top 15 255.404 0.27% 0.78%

ICOR 3.847%

CILI15 Issuer Class 295.123

Split - ICOR 295.064 0.61% 1.86%

IGOV 3.204%

CILI15 Issuer Class 253.688

Split - IGOV 253.652 0.26% 0.74%

ISOE 3.985%

CILI15 Issuer Class 264.502

Split - ISOE 264.460 0.45% 0.81%

MMI JSE Money Market Index

0 254.462 254.411 0.27% 2.08%

ALBI Constituent Bonds

Bond Issuer Maturity MTM Previous YTD Low YTD High

R159 REPUBLIC OF SOUTH

Sep 2020

AFRICA 8.080% 8.075% 8.08% 8.87%

R203 REPUBLIC OF SOUTH

Mar 2021

AFRICA 6.850% 6.845% 6.85% 7.19%

ES18 ESKOM HOLDINGSJanLIMITED

2023 8.795% 8.750% 8.75% 9.31%

R204 REPUBLIC OF SOUTH

Feb 2023

AFRICA 8.625% 8.580% 8.58% 9.22%

R207 REPUBLIC OF SOUTH

Feb 2023

AFRICA 7.625% 7.580% 7.58% 8.15%

R208 REPUBLIC OF SOUTH

Aug 2025

AFRICA 9.975% 9.945% 9.95% 10.64%

ES23 ESKOM HOLDINGSAprLIMITED

2026 9.725% 9.695% 9.70% 10.19%

DV23 DEVELOPMENT DecBANK

2026

OF SOUTHERN

8.475% AFRICA 8.445% 8.45% 8.94%

R2023 REPUBLIC OF SOUTH

Jan 2030

AFRICA 9.035% 8.995% 9.00% 9.47%

ES26 ESKOM HOLDINGSFebLIMITED

2031 9.155% 9.115% 9.12% 9.58%

R186 REPUBLIC OF SOUTH

Mar 2032

AFRICA 9.265% 9.225% 9.23% 9.69%

R2030 REPUBLIC OF SOUTH

Sep 2033

AFRICA 10.710% 10.665% 10.67% 11.10%

R213 REPUBLIC OF SOUTH

Feb 2035

AFRICA 9.460% 9.420% 9.42% 9.84%

R2032 REPUBLIC OF SOUTH

Mar 2036

AFRICA 9.410% 9.365% 9.37% 9.80%

ES33 ESKOM HOLDINGSJanLIMITED

2037 9.545% 9.500% 9.50% 9.92%

R209 REPUBLIC OF SOUTH

Jan 2040

AFRICA 9.625% 9.580% 9.58% 10.00%

R2037 REPUBLIC OF SOUTH

Feb 2041

AFRICA 9.610% 9.565% 9.57% 9.98%

R214 REPUBLIC OF SOUTH

Apr 2042

AFRICA 10.980% 10.935% 10.94% 11.35%

R2044 REPUBLIC OF SOUTH

Jan 2044

AFRICA 9.645% 9.600% 9.60% 10.02%

R2048 REPUBLIC OF SOUTH

Feb 2048

AFRICA 9.590% 9.550% 9.55% 9.99%

Other Rates

Code Description Rate Previous YTD Low YTD High

SAFEX SAFEX Overnight Deposit Rate6.600% 6.600% 6.59% 6.60%

JIBAR1 JIBAR 1 Month 6.975% 6.975% 6.96% 6.98%

JIBAR3 JIBAR 3 Month 7.158% 7.158% 7.15% 7.16%

JIBAR6 JIBAR 6 Month 7.700% 7.700% 7.70% 7.75%

RSA 2 year retail bond 8.00% 0 0 0

RSA 3 year retail bond 8.25% 0 0 0

RSA 5 year retail bond 8.75% 0 0 0

RSA 3 year inflation linked retail

3.50%

bond 0 0 0

RSA 5 year inflation linked retail

3.75%

bond 0 0 0

RSA 10 year inflation linked retail

4.00%

bond 0 0 0

Nominal Bond Curves (NACS)

9.62

9.12

8.62

8.12

7.62

7.12 Zero

6.62 Par/Swap

6.12

5.62

5.12

4.62

2015 2020 2026 2031 2037 2042 2048 2053 2059

DATA DISCLAIMER

To the extent allowed by law, JSE Limited (the JSE) does not (expressly, tacitly or implicitly) guarantee or warrant the availability,

sequence, accuracy, completeness, reliability or any other aspect of any of the data (Data), or that any Data is up to date.

To the extent allowed by law, neither the JSE nor any of its directors, officers, employees, contractors, agents or representatives are

liable in any way to the reader or to any other natural or juristic person (Person) for any loss or damage as a result of (i) the display

of any Data in this bulltetin, or (ii) any Data being unavailable in this bulletin at any time and for any reason, or (iii) any delay,

inaccuracy, error, or omission in relation to any Data, or (iv) any actions taken or not taken by or on behalf of any Person in reliance

on any Data. The JSE is entitled to terminate the production of any Data at any time, without notice and without liability to any Person.

These figures are supplied by parties external to Business Day. Business Day will not warrant the accuracy of the figures.

Você também pode gostar

- Bonds - May 9 2019Documento3 páginasBonds - May 9 2019Tiso Blackstar GroupAinda não há avaliações

- Bonds - May 22 2019Documento3 páginasBonds - May 22 2019Tiso Blackstar GroupAinda não há avaliações

- Markets and Commodity Figures: Total Market Turnover StatisticsDocumento3 páginasMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupAinda não há avaliações

- Bonds - April 10 2019Documento3 páginasBonds - April 10 2019Tiso Blackstar GroupAinda não há avaliações

- Bonds - September 4 2019Documento3 páginasBonds - September 4 2019Lisle Daverin BlythAinda não há avaliações

- Bonds - January 15 2019Documento3 páginasBonds - January 15 2019Tiso Blackstar GroupAinda não há avaliações

- Bonds - April 9 2019Documento3 páginasBonds - April 9 2019Tiso Blackstar GroupAinda não há avaliações

- Bonds - July 10 2018Documento3 páginasBonds - July 10 2018Tiso Blackstar GroupAinda não há avaliações

- Bonds - February 13 2019Documento3 páginasBonds - February 13 2019Tiso Blackstar GroupAinda não há avaliações

- Markets and Commodity Figures: Total Market Turnover StatisticsDocumento6 páginasMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupAinda não há avaliações

- Markets and Commodity Figures: Total Market Turnover StatisticsDocumento6 páginasMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupAinda não há avaliações

- Bonds - May 26 2019Documento3 páginasBonds - May 26 2019Lisle Daverin BlythAinda não há avaliações

- Bonds - May 14 2019Documento3 páginasBonds - May 14 2019Tiso Blackstar GroupAinda não há avaliações

- Bonds - February 5 2019Documento3 páginasBonds - February 5 2019Tiso Blackstar GroupAinda não há avaliações

- Markets and Commodity Figures: Total Market Turnover StatisticsDocumento3 páginasMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupAinda não há avaliações

- Bonds - February 6 2019Documento3 páginasBonds - February 6 2019Tiso Blackstar GroupAinda não há avaliações

- Bonds - July 24 2018Documento3 páginasBonds - July 24 2018Tiso Blackstar GroupAinda não há avaliações

- Bonds PDFDocumento6 páginasBonds PDFTiso Blackstar GroupAinda não há avaliações

- Bonds - May 15 2019Documento3 páginasBonds - May 15 2019Lisle Daverin BlythAinda não há avaliações

- Markets and Commodity Figures: Total Market Turnover StatisticsDocumento3 páginasMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupAinda não há avaliações

- Markets and Commodity Figures: Total Market Turnover StatisticsDocumento3 páginasMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupAinda não há avaliações

- Bonds - May 29 2019Documento3 páginasBonds - May 29 2019Tiso Blackstar GroupAinda não há avaliações

- Bonds - April 28 2019Documento3 páginasBonds - April 28 2019Lisle Daverin BlythAinda não há avaliações

- Bonds - July 18 2019Documento3 páginasBonds - July 18 2019Lisle Daverin BlythAinda não há avaliações

- Markets and Commodity Figures: Total Market Turnover StatisticsDocumento3 páginasMarkets and Commodity Figures: Total Market Turnover StatisticsLisle Daverin BlythAinda não há avaliações

- Bonds - September 6 2019Documento3 páginasBonds - September 6 2019Anonymous ZXo7Xf4Ainda não há avaliações

- Bonds - May 21 2019Documento3 páginasBonds - May 21 2019Tiso Blackstar GroupAinda não há avaliações

- Bonds - November 5 2019Documento3 páginasBonds - November 5 2019Lisle Daverin BlythAinda não há avaliações

- Bonds - April 17 2019Documento3 páginasBonds - April 17 2019Tiso Blackstar GroupAinda não há avaliações

- Bonds - April 3 2019Documento3 páginasBonds - April 3 2019Tiso Blackstar GroupAinda não há avaliações

- Bonds - August 17 2021Documento3 páginasBonds - August 17 2021Lisle Daverin BlythAinda não há avaliações

- BondsDocumento3 páginasBondsTiso Blackstar GroupAinda não há avaliações

- Bonds - August 5 2019Documento3 páginasBonds - August 5 2019Tiso Blackstar GroupAinda não há avaliações

- Bonds - September 10 2019Documento3 páginasBonds - September 10 2019Tiso Blackstar GroupAinda não há avaliações

- Bonds - January 16 2019Documento3 páginasBonds - January 16 2019Tiso Blackstar GroupAinda não há avaliações

- Bonds - January 28 2019Documento3 páginasBonds - January 28 2019Tiso Blackstar GroupAinda não há avaliações

- Bonds - February 21 2019Documento3 páginasBonds - February 21 2019Tiso Blackstar GroupAinda não há avaliações

- Bonds - May 1 2019Documento3 páginasBonds - May 1 2019Lisle Daverin BlythAinda não há avaliações

- Bonds - April 8 2019Documento3 páginasBonds - April 8 2019Tiso Blackstar GroupAinda não há avaliações

- Bonds - October 18 2020Documento3 páginasBonds - October 18 2020Lisle Daverin BlythAinda não há avaliações

- Bonds - April 23 2019Documento3 páginasBonds - April 23 2019Tiso Blackstar GroupAinda não há avaliações

- Markets and Commodity Figures: Total Market Turnover StatisticsDocumento3 páginasMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupAinda não há avaliações

- Bonds - July 17 2018Documento6 páginasBonds - July 17 2018Tiso Blackstar GroupAinda não há avaliações

- Bonds - October 14 2021Documento3 páginasBonds - October 14 2021Lisle Daverin BlythAinda não há avaliações

- Markets and Commodity Figures: Total Market Turnover StatisticsDocumento3 páginasMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupAinda não há avaliações

- Bonds - April 22 2019Documento3 páginasBonds - April 22 2019Lisle Daverin BlythAinda não há avaliações

- Bonds - May 28 2019Documento3 páginasBonds - May 28 2019Tiso Blackstar GroupAinda não há avaliações

- Bonds - March 19 2019Documento3 páginasBonds - March 19 2019Tiso Blackstar GroupAinda não há avaliações

- Bonds - November 20 2022Documento3 páginasBonds - November 20 2022Lisle Daverin BlythAinda não há avaliações

- Bonds - January 11 2019Documento3 páginasBonds - January 11 2019Tiso Blackstar GroupAinda não há avaliações

- Bonds - October 4 2019Documento3 páginasBonds - October 4 2019Lisle Daverin BlythAinda não há avaliações

- Bonds - March 24 2019Documento3 páginasBonds - March 24 2019Anonymous 7A1d7fjj3Ainda não há avaliações

- Bonds - May 3 2020Documento3 páginasBonds - May 3 2020Lisle Daverin BlythAinda não há avaliações

- Bonds - May 28 2020Documento3 páginasBonds - May 28 2020Lisle Daverin BlythAinda não há avaliações

- Markets and Commodity Figures: Total Market Turnover StatisticsDocumento3 páginasMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupAinda não há avaliações

- Bonds - October 15 2019Documento3 páginasBonds - October 15 2019Lisle Daverin BlythAinda não há avaliações

- Bonds - March 21 2019Documento3 páginasBonds - March 21 2019Tiso Blackstar GroupAinda não há avaliações

- Bonds - November 1 2018Documento3 páginasBonds - November 1 2018Tiso Blackstar GroupAinda não há avaliações

- Bonds - April 11 2017Documento6 páginasBonds - April 11 2017Tiso Blackstar GroupAinda não há avaliações

- Taxation and Tax Policies in the Middle East: Butterworths Studies in International Political EconomyNo EverandTaxation and Tax Policies in the Middle East: Butterworths Studies in International Political EconomyNota: 5 de 5 estrelas5/5 (1)

- Arena Holdings Pty LTD - BBBEE Certificate - 2023Documento2 páginasArena Holdings Pty LTD - BBBEE Certificate - 2023Tiso Blackstar GroupAinda não há avaliações

- Shoprite Food Index 2023Documento19 páginasShoprite Food Index 2023Tiso Blackstar GroupAinda não há avaliações

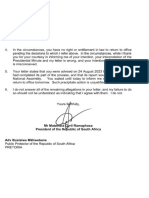

- Ramaphosa's Letter To MkhwebaneDocumento1 páginaRamaphosa's Letter To MkhwebaneTiso Blackstar GroupAinda não há avaliações

- Ramaphosa's Letter To MkhwebaneDocumento1 páginaRamaphosa's Letter To MkhwebaneTiso Blackstar GroupAinda não há avaliações

- JudgmentDocumento30 páginasJudgmentTiso Blackstar GroupAinda não há avaliações

- Letter From Reuel Khoza Chairman of The Eskom Board 1999Documento2 páginasLetter From Reuel Khoza Chairman of The Eskom Board 1999Tiso Blackstar GroupAinda não há avaliações

- Statement From The SA Tourism BoardDocumento1 páginaStatement From The SA Tourism BoardTiso Blackstar GroupAinda não há avaliações

- Shoprite Food Index 2023Documento19 páginasShoprite Food Index 2023Tiso Blackstar GroupAinda não há avaliações

- Ramaphosa's Letter To MkhwebaneDocumento1 páginaRamaphosa's Letter To MkhwebaneTiso Blackstar GroupAinda não há avaliações

- Anti Corruption Working GuideDocumento44 páginasAnti Corruption Working GuideTiso Blackstar GroupAinda não há avaliações

- JP Verster's Letter To African PhoenixDocumento2 páginasJP Verster's Letter To African PhoenixTiso Blackstar GroupAinda não há avaliações

- BondsDocumento3 páginasBondsTiso Blackstar GroupAinda não há avaliações

- Collective InsightDocumento10 páginasCollective InsightTiso Blackstar GroupAinda não há avaliações

- Open Letter To President Ramaphosa - FinalDocumento3 páginasOpen Letter To President Ramaphosa - FinalTiso Blackstar GroupAinda não há avaliações

- Letter From Reuel Khoza Chairman of The Eskom Board 1999Documento2 páginasLetter From Reuel Khoza Chairman of The Eskom Board 1999Tiso Blackstar GroupAinda não há avaliações

- FuelPricesDocumento1 páginaFuelPricesTiso Blackstar GroupAinda não há avaliações

- Tobacco Bill - Cabinet Approved VersionDocumento41 páginasTobacco Bill - Cabinet Approved VersionTiso Blackstar GroupAinda não há avaliações

- LibertyDocumento1 páginaLibertyTiso Blackstar GroupAinda não há avaliações

- Sanlam Stratus Funds - August 6 2020Documento2 páginasSanlam Stratus Funds - August 6 2020Lisle Daverin BlythAinda não há avaliações

- FuelPricesDocumento1 páginaFuelPricesTiso Blackstar GroupAinda não há avaliações

- LibertyDocumento1 páginaLibertyTiso Blackstar GroupAinda não há avaliações

- Collective Insight September 2022Documento14 páginasCollective Insight September 2022Tiso Blackstar GroupAinda não há avaliações

- BondsDocumento3 páginasBondsTiso Blackstar GroupAinda não há avaliações

- Sanlam Stratus Funds - July 15 2020Documento2 páginasSanlam Stratus Funds - July 15 2020Lisle Daverin BlythAinda não há avaliações

- Sanlam Stratus Funds - June 1 2021Documento2 páginasSanlam Stratus Funds - June 1 2021Lisle Daverin BlythAinda não há avaliações

- Critical Skills List - Government GazetteDocumento24 páginasCritical Skills List - Government GazetteTiso Blackstar GroupAinda não há avaliações

- FairbairnDocumento2 páginasFairbairnTiso Blackstar GroupAinda não há avaliações

- The ANC's New InfluencersDocumento1 páginaThe ANC's New InfluencersTiso Blackstar GroupAinda não há avaliações

- Bonds - June 8 2022Documento3 páginasBonds - June 8 2022Lisle Daverin BlythAinda não há avaliações

- Markets and Commodity Figures: Liberty Excelsior InvestmentsDocumento1 páginaMarkets and Commodity Figures: Liberty Excelsior InvestmentsTiso Blackstar GroupAinda não há avaliações

- LGSP Auditor Training - 1Documento27 páginasLGSP Auditor Training - 1Iqbal Hasan100% (1)

- Ross4ppt ch19Documento36 páginasRoss4ppt ch19씨나젬Ainda não há avaliações

- Mahindra Mahindra Annual Report 2018 19 PDFDocumento392 páginasMahindra Mahindra Annual Report 2018 19 PDFMUHAMMED RABIHAinda não há avaliações

- Wala LangDocumento8 páginasWala LangMax Dela TorreAinda não há avaliações

- Chapter 11 MKTG MGMT QuizDocumento5 páginasChapter 11 MKTG MGMT QuizDaneyal MirzaAinda não há avaliações

- 4 Letter Words - Four Letter Scrabble WordsDocumento3 páginas4 Letter Words - Four Letter Scrabble WordsTolution OdujinrinAinda não há avaliações

- Case Hotel Royal V Tina Travel - by Lokman Aiman PDFDocumento2 páginasCase Hotel Royal V Tina Travel - by Lokman Aiman PDFkeira100% (1)

- Civpro Table of Contents (Complete)Documento12 páginasCivpro Table of Contents (Complete)Christian CabreraAinda não há avaliações

- Glass Ceiling Converted Into Glass Transparency A Study On The Factors Making Women Executives Successful in The Indi-An Banking SectorDocumento6 páginasGlass Ceiling Converted Into Glass Transparency A Study On The Factors Making Women Executives Successful in The Indi-An Banking SectorRakesh DwivediAinda não há avaliações

- Lecture 1 - Introduction To TechnopreneurshipDocumento26 páginasLecture 1 - Introduction To Technopreneurshipjezra amanda laigoAinda não há avaliações

- Agenda For Annual General Meeting 2019 at Parshwanath Atlantis ParkDocumento4 páginasAgenda For Annual General Meeting 2019 at Parshwanath Atlantis ParkYogendra OzaAinda não há avaliações

- Leadership Development & Executive Coaching: Dr. Marshall GoldsmithDocumento7 páginasLeadership Development & Executive Coaching: Dr. Marshall Goldsmithsaurs24231Ainda não há avaliações

- 662 Idea Bill JuneDocumento2 páginas662 Idea Bill Junegautamsarkar10100% (1)

- Adi GodrejDocumento6 páginasAdi GodrejRuta TakalkarAinda não há avaliações

- Project Report On Customer Satisfaction On Reliance CommunicationDocumento36 páginasProject Report On Customer Satisfaction On Reliance CommunicationSakshi Behl80% (5)

- AC295 Flexible Real Estate ManagementDocumento394 páginasAC295 Flexible Real Estate Managementskanth248100% (1)

- Cheque Collection PolicyDocumento5 páginasCheque Collection Policymuraligm2003Ainda não há avaliações

- Effectiveness of ONGC's CSR ActivitiesDocumento100 páginasEffectiveness of ONGC's CSR ActivitiesAkshay JiremaliAinda não há avaliações

- Anti Money Laundering NotesDocumento2 páginasAnti Money Laundering NotesMarjorie MayordoAinda não há avaliações

- IT Val Framework GuideDocumento43 páginasIT Val Framework GuideHilsen Castañeda SantosAinda não há avaliações

- A/c No. 0042-79001976-03 Habib Bank Limited A/c No. 0042-79001976-03 Habib Bank LimitedDocumento2 páginasA/c No. 0042-79001976-03 Habib Bank Limited A/c No. 0042-79001976-03 Habib Bank LimitedHassaan ArshadAinda não há avaliações

- A.C. Project - Five BrandsDocumento40 páginasA.C. Project - Five BrandsNitinAgnihotriAinda não há avaliações

- Fas 167 PDFDocumento2 páginasFas 167 PDFLisaAinda não há avaliações

- Marriott: Individual Strategic AnalysisDocumento61 páginasMarriott: Individual Strategic AnalysisErica PoyauanAinda não há avaliações

- CATALOGUE 2012 - 2013: Chopard High Jewellery CollectionDocumento162 páginasCATALOGUE 2012 - 2013: Chopard High Jewellery CollectionArnaud DutchAinda não há avaliações

- Wealth Management Brochure PDFDocumento16 páginasWealth Management Brochure PDFJohn RockefellerAinda não há avaliações

- Control Obj For Non-Current AssetsDocumento6 páginasControl Obj For Non-Current AssetsTrần TùngAinda não há avaliações

- Ch1 Financial Management Lawrence J GitmanDocumento29 páginasCh1 Financial Management Lawrence J GitmanGözde Çetinkol100% (1)

- Sap FicoDocumento44 páginasSap Ficomalik_naseerullah100% (1)