Escolar Documentos

Profissional Documentos

Cultura Documentos

BPI & FGU Insurance vs. Yolanda Laingo

Enviado por

Joseph FullTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

BPI & FGU Insurance vs. Yolanda Laingo

Enviado por

Joseph FullDireitos autorais:

Formatos disponíveis

BPI & FGU Insurance vs.

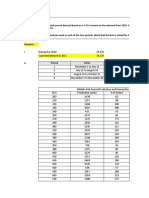

Yolanda Laingo necessary documents but also the necessary endorsement for

G.R. No. 205206 prompt approval of the insurance coverage without any other

March 16, 2016 action on the part of the deceased. The deceased did not

Justice Carpio interact with FGU directly and every action was coursed

through BPI. The acts of the agent on behalf of the principal

F: Rheozel (Respondents son), opened an Savings and within the scope o

Insurance account with BPI, Davao Branch. This type of f the delegated authority have the same legal effect and

account automatically covers insurance against disability and consequence as though the principal had been the one so

death by FGU Insurance. acting in the given situation.

9/25/2000, Rheozel died in a vehicular accident and as part BPI and FGU had the responsibility to ensure that the

of a affluent family this was highlighted in the newspaper, account be reasonably carried out with full disclosure to the

“Daily Mirror”. parties concerned, particularly the beneficiaries. Thus it was

incumbent upon them to give proper notice of the existence

Respondent then instructed her secretary about to inquire of the insurance coverage upon the death of the deceased.

about the subject account so she can use the amount therein

for the funeral expense of the deceased. And due to their Upon the death of the deceased which was properly

existing relationship and standing with the bank, the communicated to BPI by the respondent, BPI in turn should

respondent was allowed to withdraw 995k from the account have fulfilled its duty as agent of FGU Insurance about the

of Rehozel. The bank even sent one of their employees to the added benefit of insurance coverage. This notification is how

wake to have the respondent sign documents pertaining to a good father of a family should have acted within the scope

the withdrawn amount. of its business dealings with its clients.

2 years later, Rhealyn, the sister of the deceased arranged the Following the “doctrine of representation”, notice to the

personal things of the deceased and found the Insurance agent is notice to the principal. BPI was informed of the

policy issued by FGU Insurance, and immediately informed death of the deceased thus it was considered as notice to FGU

the respondent about this. Respondent then wrote 2 letters to as well. BPI had ample opportunity to inform the respondent

BPI and FGU about this and requested the processing of their regarding the existence of the policy. It was in the headline

claim as beneficiary of the deceased. of the newspaper, there was an inquiry and allowed

withdrawal about the account of the deceased, and BPI’s

FGU denied the claim, stating that the claim must have been employee even went to the wake of the deceased to have the

filed within 3 months of the death of the deceased as required respondent sign documents. Despite all this, BPI neglected

in the policy. its duty to inform the respondent. Hence, respondent had no

means to learn of her entitlement to the proceeds. It is unfair

A case for specific performance was thus filed before the to respondent to suffer when it was petitioner who was

RTC against BPI and FGU. The RTC ruled in favor of the remising on their duty to notify her.

bank and insurer. The CA then reversed the RTC.

Ruling: BPI issued a 2-in-1 Savings and Insurance account,

that after the required documents were submitted and after

approval thereof, there will be automatic insurance coverage.

Under the law an “agent” is one who bids himself to render

some service or to do something in representation of another.

The basis of agency is representation. Agency may even be

implied from the words and conduct of the parties and

circumstances of every case.

Thus in this case, the deceased directly communicated with

BPI, the Agent of FGU regarding the formers commercial

product (2 in 1 account). BPI not only facilitated the

processing of the deposit account and the collection of the

Você também pode gostar

- 65 Bpi V LaingoDocumento2 páginas65 Bpi V LaingoKylie Kaur Manalon DadoAinda não há avaliações

- BPI v. LaingoDocumento2 páginasBPI v. LaingoJen Sara Villa100% (2)

- Chunky Monkeys: CM DigestDocumento3 páginasChunky Monkeys: CM DigestAleezah Gertrude RaymundoAinda não há avaliações

- Bank of The Philippine Islands vs. Laingo Case DigestDocumento4 páginasBank of The Philippine Islands vs. Laingo Case DigestMaria Francheska Garcia100% (1)

- 16 BPI V LaingoDocumento2 páginas16 BPI V LaingoKim CajucomAinda não há avaliações

- Bpi CaseDocumento2 páginasBpi Caseinna andresAinda não há avaliações

- BANK OF PHILIPPINE ISLANDS v. YOLANDA LAINGODocumento2 páginasBANK OF PHILIPPINE ISLANDS v. YOLANDA LAINGOFlordel L. AlejandroAinda não há avaliações

- Atap Case DigestDocumento5 páginasAtap Case DigestMichelle Dulce Mariano CandelariaAinda não há avaliações

- Bank of The Philippine Islands vs. Laingo, 787 SCRA 541Documento2 páginasBank of The Philippine Islands vs. Laingo, 787 SCRA 541amareia yapAinda não há avaliações

- BPI Vs LAINGODocumento2 páginasBPI Vs LAINGOmaggiAinda não há avaliações

- Bank of The Philippine Island and FGU Insurance Corporation v. Yolanda LaingoDocumento2 páginasBank of The Philippine Island and FGU Insurance Corporation v. Yolanda LaingoVener Angelo MargalloAinda não há avaliações

- Bpi vs. LaingoDocumento1 páginaBpi vs. LaingoJeorge Ryan MangubatAinda não há avaliações

- Civrev 2 FinaldayDocumento64 páginasCivrev 2 FinaldayCalagui Tejano Glenda JaygeeAinda não há avaliações

- Assignment 2 InsuranceDocumento15 páginasAssignment 2 InsuranceKing AlduezaAinda não há avaliações

- Second DivisionDocumento13 páginasSecond Divisioninno KalAinda não há avaliações

- BPI LaingoDocumento2 páginasBPI LaingoVan GoghAinda não há avaliações

- Facts:: 1. Cia de Seguros Vs ChristernDocumento2 páginasFacts:: 1. Cia de Seguros Vs ChristernShieremell DiazAinda não há avaliações

- 1 BPI v. Laingo, 787 SCRA 541, March 16, 2016Documento11 páginas1 BPI v. Laingo, 787 SCRA 541, March 16, 2016Lance LagmanAinda não há avaliações

- BPI v. Yolanda LaingoDocumento2 páginasBPI v. Yolanda Laingok santosAinda não há avaliações

- Notes Sept 19-2019Documento14 páginasNotes Sept 19-2019Lorenz Moises EnrickAinda não há avaliações

- Facts:: Case DigestDocumento4 páginasFacts:: Case DigestjackAinda não há avaliações

- Bank of The Philippine Islands Vs LaingoDocumento2 páginasBank of The Philippine Islands Vs LaingoBeverlyn Jamison50% (2)

- 4.bpi V LaingoDocumento5 páginas4.bpi V LaingoAnonymous XsaqDYDAinda não há avaliações

- Insurance CasesDocumento28 páginasInsurance Casesnicole5anne5ddddddAinda não há avaliações

- Great Pacific Life V. Ca: Facts: Ruling: YesDocumento11 páginasGreat Pacific Life V. Ca: Facts: Ruling: YesMark Joseph M. VirgilioAinda não há avaliações

- BPI v. LaingoDocumento3 páginasBPI v. LaingoWV Gamiz Jr.Ainda não há avaliações

- Insurance 14-26 CasesDocumento40 páginasInsurance 14-26 CasesMarkey MarqueeAinda não há avaliações

- Great Pacific Life Assurance vs. CADocumento1 páginaGreat Pacific Life Assurance vs. CAJohn Mark RevillaAinda não há avaliações

- Annum Shall Be Imposed Until Fully PaidDocumento41 páginasAnnum Shall Be Imposed Until Fully PaidZengardenAinda não há avaliações

- 542 Supreme Court Reports Annotated Bank of The Philippine Islands vs. LaingoDocumento11 páginas542 Supreme Court Reports Annotated Bank of The Philippine Islands vs. LaingodanexrainierAinda não há avaliações

- Great Pacific Life Assurance Company VsDocumento12 páginasGreat Pacific Life Assurance Company VsMD LebriaAinda não há avaliações

- Insurance: Insurable Interest CasesDocumento10 páginasInsurance: Insurable Interest CasesKTAinda não há avaliações

- The Insular Life Assurance Company, Ltd. vs. Carponia T. Ebrado & Pascuala Vda. de EbradoDocumento34 páginasThe Insular Life Assurance Company, Ltd. vs. Carponia T. Ebrado & Pascuala Vda. de EbradoHeather LunarAinda não há avaliações

- Perez v. CA-Perfection of The Contract of Insurance: 323 SCRA 613 (2000)Documento6 páginasPerez v. CA-Perfection of The Contract of Insurance: 323 SCRA 613 (2000)nathAinda não há avaliações

- Sun Life Ass Co Vs CADocumento4 páginasSun Life Ass Co Vs CACharlesAinda não há avaliações

- Enriquez vs. Sun Life Insurance of CanadaDocumento3 páginasEnriquez vs. Sun Life Insurance of CanadaNelson LaurdenAinda não há avaliações

- Bancassurance IC Provisions and JurisprudenceDocumento7 páginasBancassurance IC Provisions and JurisprudenceAprilAinda não há avaliações

- DADs Insurance DigestsDocumento12 páginasDADs Insurance DigestsNicole PTAinda não há avaliações

- Insurance Digest CaseDocumento6 páginasInsurance Digest CaseDelbertBaldescoAinda não há avaliações

- Perez v. CADocumento3 páginasPerez v. CAJohn Mark RevillaAinda não há avaliações

- INSU Module 2 Digests 2Documento32 páginasINSU Module 2 Digests 2Kate HizonAinda não há avaliações

- Insurance Digest 2nd SetDocumento4 páginasInsurance Digest 2nd SetMis DeeAinda não há avaliações

- Insurance Cases 3rd YrDocumento7 páginasInsurance Cases 3rd YrMary Ann IsananAinda não há avaliações

- Case Digests2Documento5 páginasCase Digests2Stephen MagallonAinda não há avaliações

- Life Insurance Jacqueline Jimenez Vda. de Gabriel v. Court of Appeals & Fortune Insurance G.R. No. 103883 - November 14, 1996Documento4 páginasLife Insurance Jacqueline Jimenez Vda. de Gabriel v. Court of Appeals & Fortune Insurance G.R. No. 103883 - November 14, 1996Jay-ar Rivera BadulisAinda não há avaliações

- Great Pacific Life v. CADocumento6 páginasGreat Pacific Life v. CABeya AmaroAinda não há avaliações

- Case Digest ConcealmentDocumento5 páginasCase Digest ConcealmentMadeleine Flores Bayani0% (1)

- Naughty - INS - Case Digests Batch 3 (20-30)Documento7 páginasNaughty - INS - Case Digests Batch 3 (20-30)Joesil Dianne SempronAinda não há avaliações

- Part I - E. BeneficiaryDocumento16 páginasPart I - E. BeneficiaryChristine JoyAinda não há avaliações

- Panaton VDocumento2 páginasPanaton VEdward Kenneth KungAinda não há avaliações

- Pacific Banking Corp. vs. CA G.R. No. L-41014 November 28, 1988 FactsDocumento6 páginasPacific Banking Corp. vs. CA G.R. No. L-41014 November 28, 1988 FactsJohn Mark RevillaAinda não há avaliações

- Arabella Bunch Wiley v. United States of America, and Mrs. J. R. Scott, 399 F.2d 844, 10th Cir. (1968)Documento5 páginasArabella Bunch Wiley v. United States of America, and Mrs. J. R. Scott, 399 F.2d 844, 10th Cir. (1968)Scribd Government DocsAinda não há avaliações

- Assignment #1 Case DigestDocumento5 páginasAssignment #1 Case DigestRegine LangrioAinda não há avaliações

- LABOR 1 Case Digests 2.04-5.07Documento87 páginasLABOR 1 Case Digests 2.04-5.07Martin EspinosaAinda não há avaliações

- Case Digests InsuranceDocumento6 páginasCase Digests InsuranceCharisma DejesusAinda não há avaliações

- Concealment and MisrepresentationDocumento8 páginasConcealment and Misrepresentationcrystine jaye senadreAinda não há avaliações

- Case Digests: Legal EthicsDocumento21 páginasCase Digests: Legal EthicsJohnlery O. Pugao100% (1)

- Color Blocking Presentation 12Documento2 páginasColor Blocking Presentation 12Joseph FullAinda não há avaliações

- Color Blocking Presentation 10Documento2 páginasColor Blocking Presentation 10Joseph FullAinda não há avaliações

- Color Blocking Presentation 11Documento2 páginasColor Blocking Presentation 11Joseph FullAinda não há avaliações

- MakeAnimated PowerPoint Slide by PowerPoint SchoolDocumento7 páginasMakeAnimated PowerPoint Slide by PowerPoint SchoolDee BrarAinda não há avaliações

- VAT Digests and NotesDocumento20 páginasVAT Digests and NotesJoseph FullAinda não há avaliações

- Rescouse FIles of Animated PowerPoint Slide (PowerPoint School)Documento7 páginasRescouse FIles of Animated PowerPoint Slide (PowerPoint School)Marvin Tan MaglinaoAinda não há avaliações

- Retainer ProposalDocumento3 páginasRetainer ProposalJoseph Full100% (1)

- Insruance DigestsDocumento9 páginasInsruance DigestsJoseph FullAinda não há avaliações

- Cir Vs Toshiba Information Equipment Phils IncDocumento1 páginaCir Vs Toshiba Information Equipment Phils IncJoseph FullAinda não há avaliações

- ORRRRRRDocumento1 páginaORRRRRRJoseph FullAinda não há avaliações

- Bureau of Internal Revenue: Deficiency Tax AssessmentDocumento9 páginasBureau of Internal Revenue: Deficiency Tax AssessmentXavier Cajimat UrbanAinda não há avaliações

- San Lucas OrdinanceDocumento2 páginasSan Lucas OrdinanceJoseph FullAinda não há avaliações

- Affidavit of Undertaking FormDocumento1 páginaAffidavit of Undertaking Formpope_catsup77% (30)

- Sps. Pacquiao Vs CTA DigestDocumento10 páginasSps. Pacquiao Vs CTA DigestCyrus67% (3)

- Guide To Participants-Cdos 9.12-13.18Documento5 páginasGuide To Participants-Cdos 9.12-13.18Joseph FullAinda não há avaliações

- Letter RequestDocumento1 páginaLetter RequestJoseph FullAinda não há avaliações

- Notice: Name of PersonDocumento1 páginaNotice: Name of PersonJoseph FullAinda não há avaliações

- Insruance DigestsDocumento7 páginasInsruance DigestsJoseph FullAinda não há avaliações

- Reminder LetterDocumento1 páginaReminder LetterJoseph FullAinda não há avaliações

- Bill of RightsDocumento1 páginaBill of RightsJoseph FullAinda não há avaliações

- Insruance DigestsDocumento7 páginasInsruance DigestsJoseph FullAinda não há avaliações

- Republic of The PhilippinesDocumento2 páginasRepublic of The PhilippinesJoseph FullAinda não há avaliações

- Cir Vs Toshiba Information Equipment Phils IncDocumento1 páginaCir Vs Toshiba Information Equipment Phils IncJoseph FullAinda não há avaliações

- Philippine ReportsDocumento3 páginasPhilippine ReportsJoseph FullAinda não há avaliações

- RA No. 6646Documento5 páginasRA No. 6646Joseph FullAinda não há avaliações

- Bill of RightsDocumento1 páginaBill of RightsJoseph FullAinda não há avaliações

- Nego Batch 1Documento1 páginaNego Batch 1Joseph FullAinda não há avaliações

- Digest - Govt. of Hongkong vs. OlaliaDocumento2 páginasDigest - Govt. of Hongkong vs. OlaliaPaul Vincent CunananAinda não há avaliações

- RA No. 6646Documento5 páginasRA No. 6646Joseph FullAinda não há avaliações

- ICFR Presentation - Ernst and YoungDocumento40 páginasICFR Presentation - Ernst and YoungUTIE ELISA RAMADHANI67% (3)

- Mse Return DemonstrationDocumento7 páginasMse Return DemonstrationMaggay LarsAinda não há avaliações

- Interpretation of Statutes 2023 Question PaperDocumento4 páginasInterpretation of Statutes 2023 Question PaperNisha BhartiAinda não há avaliações

- Assisted Reproductive Technology945Documento35 páginasAssisted Reproductive Technology945Praluki HerliawanAinda não há avaliações

- Practice Quiz 5 Module 3 Financial MarketsDocumento5 páginasPractice Quiz 5 Module 3 Financial MarketsMuhire KevineAinda não há avaliações

- Task 1: Choose The Present Simple, The Present Continuous, The PresentDocumento5 páginasTask 1: Choose The Present Simple, The Present Continuous, The PresentAlexandra KupriyenkoAinda não há avaliações

- The City of GodDocumento16 páginasThe City of GodJei Em MonteflorAinda não há avaliações

- Sound Culture: COMS 350 (001) - Winter 2018Documento12 páginasSound Culture: COMS 350 (001) - Winter 2018Sakshi Dhirendra MishraAinda não há avaliações

- Multigrade Lesson Plan MathDocumento7 páginasMultigrade Lesson Plan MathArmie Yanga HernandezAinda não há avaliações

- Tradingfxhub Com Blog How To Trade Supply and Demand Using CciDocumento12 páginasTradingfxhub Com Blog How To Trade Supply and Demand Using CciKrunal ParabAinda não há avaliações

- Athletic KnitDocumento31 páginasAthletic KnitNish A0% (1)

- Phil. Organic ActDocumento15 páginasPhil. Organic Actka travelAinda não há avaliações

- HDFCDocumento60 páginasHDFCPukhraj GehlotAinda não há avaliações

- King of Chess American English American English TeacherDocumento6 páginasKing of Chess American English American English TeacherJuliana FigueroaAinda não há avaliações

- Strama-Ayala Land, Inc.Documento5 páginasStrama-Ayala Land, Inc.Akako MatsumotoAinda não há avaliações

- Reinforcing Steel and AccessoriesDocumento4 páginasReinforcing Steel and AccessoriesTheodore TheodoropoulosAinda não há avaliações

- 4TES-9Y 20KW With InverterDocumento4 páginas4TES-9Y 20KW With InverterPreeti gulatiAinda não há avaliações

- SMTP/POP3/IMAP Email Engine Library For C/C++ Programmer's ManualDocumento40 páginasSMTP/POP3/IMAP Email Engine Library For C/C++ Programmer's Manualadem ademAinda não há avaliações

- Richard Steele: 2 in PoliticsDocumento4 páginasRichard Steele: 2 in PoliticszunchoAinda não há avaliações

- Philosophies PrinceDocumento4 páginasPhilosophies PrincePrince CuetoAinda não há avaliações

- MSDS Blattanex GelDocumento5 páginasMSDS Blattanex GelSadhana SentosaAinda não há avaliações

- Meter BaseDocumento6 páginasMeter BaseCastor JavierAinda não há avaliações

- GiftsDocumento189 páginasGiftsÜJessa Villaflor100% (2)

- Pyridine Reactions: University College of Pharmaceutialsciences K.U. CampusDocumento16 páginasPyridine Reactions: University College of Pharmaceutialsciences K.U. CampusVã RãAinda não há avaliações

- DockerDocumento35 páginasDocker2018pgicsankush10Ainda não há avaliações

- Project Management Pro: Powerpoint SlidesDocumento350 páginasProject Management Pro: Powerpoint SlidesJosephAinda não há avaliações

- CTY1 Assessments Unit 6 Review Test 1Documento5 páginasCTY1 Assessments Unit 6 Review Test 1'Shanned Gonzalez Manzu'Ainda não há avaliações

- Learning TheoryDocumento7 páginasLearning TheoryIMS AcadAinda não há avaliações

- RBConcept Universal Instruction ManualDocumento19 páginasRBConcept Universal Instruction Manualyan henrique primaoAinda não há avaliações

- Millwright Local Union 2158 PAC - 8048 - VSRDocumento10 páginasMillwright Local Union 2158 PAC - 8048 - VSRZach EdwardsAinda não há avaliações