Escolar Documentos

Profissional Documentos

Cultura Documentos

Corpo 6

Enviado por

KL0 notas0% acharam este documento útil (0 voto)

50 visualizações2 páginasCorpo hw 6

Título original

corpo 6

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

DOCX, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoCorpo hw 6

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

50 visualizações2 páginasCorpo 6

Enviado por

KLCorpo hw 6

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

Você está na página 1de 2

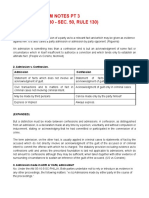

CORPORATION LAW

Atty. Solomon M. Hermosura

The Revised Corporation Code (“RCC”), which took effect on

February 23, 2019, paved the way for the creation of the “One Person

Corporation” (“OPC”). As this concept is new, the SEC released two

memorandum circulars seeking to regulate the formation and

establishment of this novel business organization.

REVISED CORPORATION CODE

The Revised Corporation Code is the guidepost for the

establishment of the One Person Corporation, particularly Chapter III of

Title XII, which primarily governs its formation. An OPC is defined as “a

corporation with a single stockholder”.

Only Natural Persons (of legal age), Trust and Estate may form an

OPC. Even a foreign natural person may put up an OPC, however, it

remains subject to the constitutional and statutory restrictions on foreign

ownership. The trust elucidated under this title pertains to the “subject

being managed by the trustee.” The single stockholder shall become the

President and Sole Director of the OPC, and may be appointed as the

Treasurer. Nevertheless, a single stockholder cannot be the Corporate

Secretary.

The requirements for the Articles of Incorporation in Sec 14 of the

RCC shall apply to OPCs and shall also contain additional requirements

stated in the chapter.

An OPC shall not be required to have a Minimum Authorized

Capital Stock. But, if the stockholder assumes the position of treasurer,

the draft circulars provide that he must post a surety bond based on the

authorized capital stock, subject to renewal every two years, and upon

review of annual financial statements. Parenthetically, those with

authorized capital stocks between P1 and P250,000 shall shall give a bond

of P250,000. The bond shall be equal to the authorized capital stock when

the latter breaches P5 million.

While foreign natural persons may form OPCs, albeit subject to

restrictions as earlier mentioned, it is only the domestic corporations,

organized as stock corporation, that may be converted into a One Person

Corporation. The process shall be the same as amending the Articles of

Incorporation. As the inclusion of the suffix “OPC” is required under the

provisions of the code for names of this kind of corporation, its

conversion would necessarily render the same effect. Further, the number

of directors would naturally be reduced, the nominee and alternate

nominee shall be named, and the corporation shall adopt the distinctive

features of the OPC as provided for in the code.

AREÑO, Kim Louise 3C 1

CORPORATION LAW

Atty. Solomon M. Hermosura

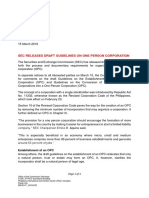

In sum, the memorandum circulars, when taken in view and aligned

with of the provisions of a One Person corporations, aims to provide

further clarification. As this is a novel chapter of the code, conceived in

the RCC, such draft guidelines remain essential as it gives the necessary

additional information needed to thresh out any ambiguities. The RCC

provides for its defining characteristics; and where there exists any

question, particularly on the requisites, and conversion of an existing

corporation to an OPC, the draft circular construes the steps needed to

integrate this entity into an actual One Person Corporation.

THE POWERS AND FUCTIONS OF THE SEC

The Securities and Exchange Commission is armed with the power

to “Approve, reject, suspend, revoke or require amendments to

registration statements, and registration and licensing applications.” In

view of such power, the memorandum circular provides for the guidelines

and documentary requirements to satisfy the conversion from an already

existing corporation to an OPC. It shall include the amended Articles of

Incorporation, including pertinent changes which characterize the nature

of an OPC, as provided in the RCC. The commission also requires a

Secretary’s Certificate to evidence the acquisition of all the outstanding

shares by the single stockholder, the settlement of taxes and all other

obligations in favor of government, and free from intra-corporate dispute.

Other requirements that have been provided in the code must also be

complied with.

PUBLIC POLICY FOR ALLOWING THE ORGANIZATION OF OPCs

The primary purpose for the organization of the One Person

Corporation is to give ease in doing business in the country. It provides

for platform for entrepreneurs to form their own corporation. What makes

this a viable and advantageous option for persons who wish to engage in

business is the limited liability of the stockholder. The corporate entity is

separate and distinct from the person comprising it, making the personal

properties of the stockholder independent from that of the corporation.

This means that creditors of the corporation may not come after the assets

of the single stockholder. However, the stockholder must prove that the

corporation is sufficiently adequately financed. Such restriction aims to

prevent the stockholder from abusing the system by converting corporate

properties to personal properties, intentionally keeping it away from the

reach of his creditors. The Doctrine of Piercing the Veil of Corporate

Fiction applies to OPCs, as well as Corporate Income Tax.

AREÑO, Kim Louise 3C 2

Você também pode gostar

- Business Organizations: Outlines and Case Summaries: Law School Survival Guides, #10No EverandBusiness Organizations: Outlines and Case Summaries: Law School Survival Guides, #10Ainda não há avaliações

- The Memorandum and Articles of AssociationDocumento15 páginasThe Memorandum and Articles of Associationshakti ranjan mohantyAinda não há avaliações

- Tax Reviewer: Law of Basic Taxation in The Philippines Chapter 1: General PrinciplesDocumento93 páginasTax Reviewer: Law of Basic Taxation in The Philippines Chapter 1: General PrinciplesAnonymous oTRzcSSGunAinda não há avaliações

- Company Law NOTES UONDocumento74 páginasCompany Law NOTES UONLuke Shaw80% (5)

- Memorandum of Association PresentationDocumento62 páginasMemorandum of Association PresentationUsman Syed100% (1)

- Disposal of Unserviceable AssetsDocumento6 páginasDisposal of Unserviceable AssetsJOHAYNIEAinda não há avaliações

- News Articles - OPCDocumento46 páginasNews Articles - OPCJuan FrivaldoAinda não há avaliações

- Securities Regulation CodeDocumento9 páginasSecurities Regulation CodeKLAinda não há avaliações

- ATP ReviewerDocumento31 páginasATP ReviewerKLAinda não há avaliações

- Revised Corporation CodeDocumento3 páginasRevised Corporation CodeEM DOMINGOAinda não há avaliações

- Matrix Comparison Amendment To Rules of Court 2020 FMS PDFDocumento192 páginasMatrix Comparison Amendment To Rules of Court 2020 FMS PDFRyuan Suzuki100% (5)

- Comm Rev Abella NotesDocumento65 páginasComm Rev Abella NotesRoger Montero Jr.Ainda não há avaliações

- Differences of Cooperative and Corporatio1Documento7 páginasDifferences of Cooperative and Corporatio1Compas RenAinda não há avaliações

- 4C Rem Cram Notes PT 3Documento14 páginas4C Rem Cram Notes PT 3KLAinda não há avaliações

- Remrev Digest Mod1Documento111 páginasRemrev Digest Mod1KLAinda não há avaliações

- Corpo Outline 2Documento36 páginasCorpo Outline 2Edmart VicedoAinda não há avaliações

- Memorandum of AssociationDocumento17 páginasMemorandum of AssociationFaraz Siddiqui100% (1)

- Warren E. Buffett, 2005: Case Studies in FinanceDocumento2 páginasWarren E. Buffett, 2005: Case Studies in FinanceNakonoaAinda não há avaliações

- Specpro Digest 2Documento29 páginasSpecpro Digest 2KLAinda não há avaliações

- Case 16 Group 56 FinalDocumento54 páginasCase 16 Group 56 FinalSayeedMdAzaharulIslamAinda não há avaliações

- Cost Behavior and Cost-Volume-Profit Analysis: ObjectivesDocumento44 páginasCost Behavior and Cost-Volume-Profit Analysis: ObjectivestechnicaleducationAinda não há avaliações

- TOC of Pre Feasibility Report On Five Star HotelDocumento6 páginasTOC of Pre Feasibility Report On Five Star Hotelbrainkrusherz0% (1)

- Global Cities and Developmental StatesDocumento29 páginasGlobal Cities and Developmental StatesmayaAinda não há avaliações

- Specpro Case DigestDocumento82 páginasSpecpro Case DigestKLAinda não há avaliações

- On Memorandum of AssociationDocumento17 páginasOn Memorandum of AssociationSatyajeet Suman100% (1)

- Republic Act No. 11232: REVISED CORPORATION CODEDocumento4 páginasRepublic Act No. 11232: REVISED CORPORATION CODELoren MandaAinda não há avaliações

- Maricalum V FlorentinoDocumento2 páginasMaricalum V FlorentinoKLAinda não há avaliações

- 2 Sarmiento V ZaratanDocumento2 páginas2 Sarmiento V ZaratanKLAinda não há avaliações

- 2 Sarmiento V ZaratanDocumento2 páginas2 Sarmiento V ZaratanKLAinda não há avaliações

- Paredes v. Verano, G.R. No. 164375, October 12, 2006Documento2 páginasParedes v. Verano, G.R. No. 164375, October 12, 2006KLAinda não há avaliações

- 25 Palmiano-Salvador V AngelesDocumento1 página25 Palmiano-Salvador V AngelesKLAinda não há avaliações

- Single Member Companies & Limited Liability PartnershipDocumento15 páginasSingle Member Companies & Limited Liability PartnershipAnju PanickerAinda não há avaliações

- Baroja - Asynchronous Activity 9Documento1 páginaBaroja - Asynchronous Activity 9Migui BarojaAinda não há avaliações

- BA Reading ListDocumento20 páginasBA Reading ListCaleb MukasaAinda não há avaliações

- Something About CorpDocumento3 páginasSomething About CorpWarren WarrenAinda não há avaliações

- Response - Joint Forum On The Revised Corporation Code - 03252019Documento4 páginasResponse - Joint Forum On The Revised Corporation Code - 03252019Rea Rosario G. MaliteAinda não há avaliações

- Revised Corporation Code of The PhilippinesDocumento3 páginasRevised Corporation Code of The PhilippinesJohn Ivan CominguezAinda não há avaliações

- Alteration of Memorandum of AssociationDocumento8 páginasAlteration of Memorandum of Associationmiku aroraAinda não há avaliações

- Who Can Put Up An OPC?: Republic Act 11232 or The Revised Corporation CodeDocumento2 páginasWho Can Put Up An OPC?: Republic Act 11232 or The Revised Corporation CodeMarvi RoaAinda não há avaliações

- Corporate Law Lecture No. 2Documento6 páginasCorporate Law Lecture No. 2Muhammad Shoaib KhanAinda não há avaliações

- Alteration of Registered Office ClauseDocumento15 páginasAlteration of Registered Office ClauseTanya RajAinda não há avaliações

- LW Saudi Arabia New Companies LawDocumento20 páginasLW Saudi Arabia New Companies LawMuhammad RashedAinda não há avaliações

- Statutory Contract Embodied in The Articles of AssociationDocumento6 páginasStatutory Contract Embodied in The Articles of AssociationSoham MajumderAinda não há avaliações

- Company Law NOTES-UONDocumento113 páginasCompany Law NOTES-UONAyushi Dodhia100% (1)

- I. Definition and ClassificationDocumento97 páginasI. Definition and ClassificationJeannAinda não há avaliações

- Company Law PPT 4.5Documento76 páginasCompany Law PPT 4.5Shubham PandeyAinda não há avaliações

- Analyzing The Concept of Articles of Association Under The Companies Act, 1994Documento10 páginasAnalyzing The Concept of Articles of Association Under The Companies Act, 1994Rafsan NahinAinda não há avaliações

- The Essential Steps For Formation of A Company According To The Company Act, 1994Documento9 páginasThe Essential Steps For Formation of A Company According To The Company Act, 1994Akib IslamAinda não há avaliações

- Company 2015Documento10 páginasCompany 2015felixmuyoveAinda não há avaliações

- Moa, Aoa and DoctrinesDocumento50 páginasMoa, Aoa and DoctrineskritiAinda não há avaliações

- Some of The Notable Changes in The 2019 Revised Corporation Code (RCC)Documento16 páginasSome of The Notable Changes in The 2019 Revised Corporation Code (RCC)Agapito De AsisAinda não há avaliações

- Corporate Laws & Practices - MA-2023 - Suggested - AnswersDocumento8 páginasCorporate Laws & Practices - MA-2023 - Suggested - AnswersadctgAinda não há avaliações

- Regulates Incorporation of A CompanyDocumento11 páginasRegulates Incorporation of A CompanySandip SenAinda não há avaliações

- Ans 1 B: Illustration 2 - Holds Preference Shares Half of The Voting Powers, Similar To EquityDocumento9 páginasAns 1 B: Illustration 2 - Holds Preference Shares Half of The Voting Powers, Similar To EquityAbid FayazAinda não há avaliações

- Corporate Law. Memorandum of Association and Articles of AssociationDocumento8 páginasCorporate Law. Memorandum of Association and Articles of AssociationMehwish RasheedAinda não há avaliações

- Assignment On CompanyDocumento8 páginasAssignment On CompanyHossainmoajjemAinda não há avaliações

- Revised Corporation Code of The Philippines NotesDocumento4 páginasRevised Corporation Code of The Philippines NotesAlexis SosingAinda não há avaliações

- Assignment of MemorandumDocumento17 páginasAssignment of MemorandumFatima ArshadAinda não há avaliações

- LBA Compiled NotesDocumento172 páginasLBA Compiled NotesGladys OpondoAinda não há avaliações

- 9229 - One Person Corporation - SEC CircularDocumento2 páginas9229 - One Person Corporation - SEC CircularAi NatangcopAinda não há avaliações

- PP PP PPPPP PPPPP P P PPP PP PPPPPPP P PPPP PDocumento4 páginasPP PP PPPPP PPPPP P P PPP PP PPPPPPP P PPPP PMuneer TooriAinda não há avaliações

- One Person CompanyDocumento73 páginasOne Person Companyraajsekhar020Ainda não há avaliações

- A Peek Into The Revised Corporation Code of The Philippines: Amicus CuriaeDocumento5 páginasA Peek Into The Revised Corporation Code of The Philippines: Amicus CuriaejbandAinda não há avaliações

- NuDocumento27 páginasNuOTS EnterprisesAinda não há avaliações

- Veil of IncorporationDocumento9 páginasVeil of IncorporationmfabbihaAinda não há avaliações

- Assignment On Company LawDocumento15 páginasAssignment On Company Lawতাসমুন ইসলাম প্রান্তAinda não há avaliações

- Company LawDocumento9 páginasCompany Lawtriptisahu1196Ainda não há avaliações

- Forming A One Person Corporation Under The Revised Corporation CodeDocumento5 páginasForming A One Person Corporation Under The Revised Corporation CodeElaiza Jamez PucateAinda não há avaliações

- Corporate AccountingDocumento14 páginasCorporate AccountingMohammad AzanAinda não há avaliações

- Memorandum of AssociationDocumento9 páginasMemorandum of Associationkanchan GoondliAinda não há avaliações

- Lab Study Note-2021Documento78 páginasLab Study Note-2021elizabeth shrutiAinda não há avaliações

- Clauses in The Memorandum of Association: 1. Name ClauseDocumento4 páginasClauses in The Memorandum of Association: 1. Name ClauseRishi ChandakAinda não há avaliações

- Company Law NotesDocumento89 páginasCompany Law NotesKen BiiAinda não há avaliações

- BL Unit VDocumento13 páginasBL Unit VkhurshidsharifAinda não há avaliações

- Black Texts Are Discussions of The InstructorDocumento25 páginasBlack Texts Are Discussions of The InstructorGlory Grace Obenza-NodadoAinda não há avaliações

- Salient Features of The Amended RCCDocumento3 páginasSalient Features of The Amended RCCPastolero JanineAinda não há avaliações

- Textbook of Urgent Care Management: Chapter 6, Business Formation and Entity StructuringNo EverandTextbook of Urgent Care Management: Chapter 6, Business Formation and Entity StructuringAinda não há avaliações

- The LLC Launchpad: Navigate Your Business Journey with ConfidenceNo EverandThe LLC Launchpad: Navigate Your Business Journey with ConfidenceAinda não há avaliações

- Affidavit of IdentityDocumento1 páginaAffidavit of IdentityfrozenwizardAinda não há avaliações

- Bar Bar: Chanrobles Internet Bar Review: Chanrobles Professional Review, IncDocumento16 páginasBar Bar: Chanrobles Internet Bar Review: Chanrobles Professional Review, IncChristopher DizonAinda não há avaliações

- Reading Assignment: Up To Doctrine of State ImmunityDocumento67 páginasReading Assignment: Up To Doctrine of State ImmunityHoney SamaniegoAinda não há avaliações

- 2017 Tax Transcript PDFDocumento138 páginas2017 Tax Transcript PDFIelBarnacheaAinda não há avaliações

- New Central Bank ActDocumento34 páginasNew Central Bank ActKLAinda não há avaliações

- 2010 - 2015 - Income Tax PDFDocumento31 páginas2010 - 2015 - Income Tax PDFExequielCamisaCrusperoAinda não há avaliações

- Primanila Plans Inc. v. SecuritiesDocumento8 páginasPrimanila Plans Inc. v. SecuritiesArjayAinda não há avaliações

- New Central Bank ActDocumento34 páginasNew Central Bank ActKLAinda não há avaliações

- Can You Sell Shares Which You Do Not Own? InsiderDocumento4 páginasCan You Sell Shares Which You Do Not Own? InsiderKLAinda não há avaliações

- 4C Rem Cram Notes PT 5: (Rule 131-132, Child Witness, Electronic Evidence, Dna Evidence)Documento22 páginas4C Rem Cram Notes PT 5: (Rule 131-132, Child Witness, Electronic Evidence, Dna Evidence)KLAinda não há avaliações

- SRC, Ppsa, LocDocumento7 páginasSRC, Ppsa, LocKLAinda não há avaliações

- 171505-2015-Securities and Exchange Commission v. Laigo20190408-5466-8u9lqhDocumento18 páginas171505-2015-Securities and Exchange Commission v. Laigo20190408-5466-8u9lqhBingkat MacarimbangAinda não há avaliações

- SEC v. CAP GR 202052, March 07, 2018Documento16 páginasSEC v. CAP GR 202052, March 07, 2018Reginald Matt Aquino SantiagoAinda não há avaliações

- Remedial Law Review Case Digest Topic Case Title GR NO. G.R. No. 118438 DATE: December 4, 1998 DoctrineDocumento1 páginaRemedial Law Review Case Digest Topic Case Title GR NO. G.R. No. 118438 DATE: December 4, 1998 DoctrineKLAinda não há avaliações

- Remedial Law Review Case Digest Topic Case Title GR NO. G.R. No. 118438 DATE: December 4, 1998 DoctrineDocumento1 páginaRemedial Law Review Case Digest Topic Case Title GR NO. G.R. No. 118438 DATE: December 4, 1998 DoctrineKLAinda não há avaliações

- 48 Oposa V FactoranDocumento2 páginas48 Oposa V FactoranKLAinda não há avaliações

- IC 1928-2020union MudraDocumento11 páginasIC 1928-2020union Mudraamit_200619Ainda não há avaliações

- Multinational CorporationsDocumento26 páginasMultinational CorporationsHarshal ShindeAinda não há avaliações

- TBChap 005Documento61 páginasTBChap 005trevorAinda não há avaliações

- Gopal Krishna GokhaleDocumento11 páginasGopal Krishna GokhalenaviAinda não há avaliações

- FM Project ReportDocumento16 páginasFM Project Reportharitha hnAinda não há avaliações

- AMUL Case Study in Context of Financial Management, Cost and Management Accounting, Production & Operation ManagementDocumento26 páginasAMUL Case Study in Context of Financial Management, Cost and Management Accounting, Production & Operation ManagementtwinkalAinda não há avaliações

- Euro MarketDocumento34 páginasEuro MarketKushal PandyaAinda não há avaliações

- GST Retail InvoiceDocumento1 páginaGST Retail Invoicesachin sharmaAinda não há avaliações

- Kanika Khurana: 2018. Clients Experience IncludesDocumento3 páginasKanika Khurana: 2018. Clients Experience IncludesjfrAinda não há avaliações

- Solved After Graduating From College Tina Works Briefly As A Salesperson PDFDocumento1 páginaSolved After Graduating From College Tina Works Briefly As A Salesperson PDFAnbu jaromiaAinda não há avaliações

- Candle TradingDocumento2 páginasCandle Tradingkaushikpoojari1012Ainda não há avaliações

- Chapter 1 - Role of Financial Markets and InstitutionsDocumento33 páginasChapter 1 - Role of Financial Markets and InstitutionsJenniferAinda não há avaliações

- Chapter 7 - Dynamics of Financial Crises in Emerging Economies and ApplicationsDocumento49 páginasChapter 7 - Dynamics of Financial Crises in Emerging Economies and ApplicationsJane KotaishAinda não há avaliações

- FNSTPB401 Assessment Tasks 2Documento4 páginasFNSTPB401 Assessment Tasks 2maya hartonoAinda não há avaliações

- CH 12Documento30 páginasCH 12ReneeAinda não há avaliações

- Macro-Finance 3. Equity Premium Puzzle: Dmitry KuvshinovDocumento52 páginasMacro-Finance 3. Equity Premium Puzzle: Dmitry KuvshinovMicheal GoAinda não há avaliações

- Cash Management Cover LetterDocumento9 páginasCash Management Cover Letterrqaeibifg100% (2)

- Qo M Pass White PaperDocumento40 páginasQo M Pass White Papersaurav.iseAinda não há avaliações

- Gaia Iar 2020Documento114 páginasGaia Iar 2020m_edas4262Ainda não há avaliações

- 7110 w12 Ms 22Documento7 páginas7110 w12 Ms 22mstudy123456Ainda não há avaliações

- Pension Rules & Regulation - EngDocumento4 páginasPension Rules & Regulation - EngMinsannAinda não há avaliações

- FA1 Basic MCQsDocumento8 páginasFA1 Basic MCQsamir100% (3)

- VVD and Sons Private Limited: Rating AdvisoryDocumento6 páginasVVD and Sons Private Limited: Rating AdvisorySANJAY KHATRIAinda não há avaliações

- Acca f3 BPP Question Amp Answer BankDocumento45 páginasAcca f3 BPP Question Amp Answer BankHải LongAinda não há avaliações