Escolar Documentos

Profissional Documentos

Cultura Documentos

Exercises - Individual IT - TL

Enviado por

Clyde SaulDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Exercises - Individual IT - TL

Enviado por

Clyde SaulDireitos autorais:

Formatos disponíveis

1.

Shiela, a mixed income earner provided the following date for taxable year 2018:

Compensation Income

Salaries – (net of SSS, PHIC and HDMF Contribution of P25,000)

and withholding tax of 120,500) P795,500

13th Month Pay 65,000

Clothing allowance 10,000

Rice subsidy 24,000

Christmas Bonus 5,000

Other compensation income 8,000

Overtime Pay 90,000

Business and Professional Income

Sales P1,500,000

Cost of sales 800,000

Business expenses 200,000

Professional Fess – (net of P100,000 w/tax) 900,000

Expenses – practice of profession 300,000

Disregarding business and professional income, how much is the gross compensation income of Shiela for

taxable year 2018:

a. P1,143,000 b. P997,500 c. P1,022,500 d. P1,053,000

2. Disregarding business and professional income, compute the gross taxable compensation income for taxable

year 2018:

a. P868,500 b. P1,014,000 c. P893,500 d. P924,000

3. Based on No. 2, compute the income tax due:

a. P194,200 b. P158,050 c. P150,550 d. P167,200

4. Based on No. 3, compute the income tax payable:

a. P46,700 b. P73,700 c. P37,550 d. P30,050

5. Disregarding compensation income, compute the income tax payable of Shiela for taxable year 2018

a. P250,000 b. P180,000 c. P150,000 d. P80,000

6. Assuming in No. 5, Shiela opted to choose the 8% gross income taxation, her income tax payable is:

a. P250,000 b. P180,000 c. P150,000 d. P80,000

7. Based on the original problem, but the professional fees is net of P50,000 withholding tax, compute the income

tax payable of Shiela for taxable year 2018:

a. P371,980 b. P182,480 c. P198,480 d. P317,980

8. Based on the original problem, but the professional fees is only P350,000 gross of P50,000 withholding tax and

Shiela opted to choose the 8% gross income taxation, her income tax payable is:

a. P171,700 b. P194,200 c. P148,000 d. P342,200

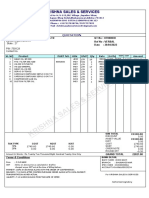

PROGRESSIVE INCOME TAX TABLE Section 24 of the NIRC as amended by RA No. 10963 – Train Law

OVER BUT NOT OVER TAX SHALL BE PLUS OF EXCESS OVER

0.00 P 250,000.00 P 0.00 0.% P 0.00

P 250,000.00 400,000.00 0.00 20% 250,000.00

400,000.00 800,000.00 30,000.00 25% 400,000.00

800,000.00 2,000,000.00 130,000.00 30% 800,000.00

2,000,000.00 8,000,000.00 490,000.00 32% 2,000,000.00

8,000,000.00 0.00 2,410,000.00 35% 8,000,000.00

Você também pode gostar

- Taxation - Final ExamDocumento4 páginasTaxation - Final ExamKenneth Bryan Tegerero Tegio100% (1)

- Individuals Assign3Documento7 páginasIndividuals Assign3jdAinda não há avaliações

- Taxation - Corporation - Quizzer - 2018Documento4 páginasTaxation - Corporation - Quizzer - 2018Kenneth Bryan Tegerero Tegio100% (4)

- Cases On Taxation For Individualss AnswersDocumento11 páginasCases On Taxation For Individualss AnswersMitchie Faustino100% (2)

- Income Tax TableDocumento6 páginasIncome Tax TableMarian's PreloveAinda não há avaliações

- Tax ProblemsDocumento14 páginasTax Problemsrav dano100% (1)

- New Microsoft Office Excel WorksheetDocumento26 páginasNew Microsoft Office Excel WorksheetMac Ferds100% (1)

- Assignment 1 Taxes On IndividualsDocumento7 páginasAssignment 1 Taxes On IndividualsMarynissa CatibogAinda não há avaliações

- Chapter 7 Regular Income Tax Activity Valdez KJ PDFDocumento5 páginasChapter 7 Regular Income Tax Activity Valdez KJ PDFBisag Asa50% (4)

- Illustration: The Following Data Were Reported For 200A Business Activities of Western UniversitiesDocumento3 páginasIllustration: The Following Data Were Reported For 200A Business Activities of Western UniversitiesCarlo QuiambaoAinda não há avaliações

- ACTIVITY 1 Capital BudgetingDocumento12 páginasACTIVITY 1 Capital BudgetingkmarisseeAinda não há avaliações

- Income Taxation 1Documento4 páginasIncome Taxation 1nicole bancoroAinda não há avaliações

- Prefinals Exam in Income TaxationDocumento3 páginasPrefinals Exam in Income TaxationYen YenAinda não há avaliações

- Income Taxation Answer ExamDocumento5 páginasIncome Taxation Answer Examyezaquera100% (1)

- TaxDocumento24 páginasTaxAnonymous aRheeMAinda não há avaliações

- Vergara, Gian Bianca F. BSAT-4A Recitation: Compensation IncomeDocumento4 páginasVergara, Gian Bianca F. BSAT-4A Recitation: Compensation Incomelena cpaAinda não há avaliações

- Vergara, Gian Bianca F. BSAT-4A Recitation: Compensation IncomeDocumento3 páginasVergara, Gian Bianca F. BSAT-4A Recitation: Compensation Incomelena cpa100% (2)

- Far First PB 1017Documento25 páginasFar First PB 1017Din Rose Gonzales100% (1)

- Ama Aia - Tax01-Final Exam-Casilla 2nd Sem Ay 2021-2022Documento9 páginasAma Aia - Tax01-Final Exam-Casilla 2nd Sem Ay 2021-2022Meg CruzAinda não há avaliações

- Assessment 4 Tax 1Documento3 páginasAssessment 4 Tax 1Judy Ann Gaceta0% (1)

- Module 4 IntaxDocumento14 páginasModule 4 IntaxPark MinyoungAinda não há avaliações

- Interim Financial Reporting and Operating Segment Discussion Problems and Answer KeyDocumento4 páginasInterim Financial Reporting and Operating Segment Discussion Problems and Answer Keyprincess QAinda não há avaliações

- Lim Tax 5 Quiz AnswerDocumento4 páginasLim Tax 5 Quiz AnswerIvan AnaboAinda não há avaliações

- 8.6 Assignment - Regular Income Tax On CorporationsDocumento3 páginas8.6 Assignment - Regular Income Tax On CorporationsRoselyn LumbaoAinda não há avaliações

- Chapter 2 AssignmentDocumento8 páginasChapter 2 AssignmentRoss John JimenezAinda não há avaliações

- 1 Taxation PreweekDocumento25 páginas1 Taxation PreweekJc Quismundo100% (1)

- Lesson 1 - 2 Tax On The Self Employed Andor Professional 2Documento4 páginasLesson 1 - 2 Tax On The Self Employed Andor Professional 2Aaron HernandezAinda não há avaliações

- Income Tax ExercisesDocumento3 páginasIncome Tax ExercisesLaguna HistoryAinda não há avaliações

- TAXN 2000 SECOND TERM EXAM SY22 23 QuestionnaireDocumento15 páginasTAXN 2000 SECOND TERM EXAM SY22 23 QuestionnaireGrace Love Yzyry LuAinda não há avaliações

- Revenue Regulations No. 8 Section 2C: Theories RITX IndividualDocumento5 páginasRevenue Regulations No. 8 Section 2C: Theories RITX IndividualChristine Joyce ArevaloAinda não há avaliações

- CpaDocumento37 páginasCparav danoAinda não há avaliações

- Philhealth Contribution (Table) : Illustration: Mr. C Has The Following Monthly CompensationDocumento5 páginasPhilhealth Contribution (Table) : Illustration: Mr. C Has The Following Monthly CompensationMaraiah InciongAinda não há avaliações

- DocxDocumento5 páginasDocxJohn Vincent CruzAinda não há avaliações

- CPAT Reviewer - TRAIN (Tax Reform) #1Documento8 páginasCPAT Reviewer - TRAIN (Tax Reform) #1Zaaavnn VannnnnAinda não há avaliações

- TAÑOTE Daisy AEC7 MEPIIDocumento9 páginasTAÑOTE Daisy AEC7 MEPIIDaisy TañoteAinda não há avaliações

- Percentage Tax KeyDocumento5 páginasPercentage Tax KeyLeisleiRagoAinda não há avaliações

- OSD and NOLCODocumento2 páginasOSD and NOLCOAccounting FilesAinda não há avaliações

- Answer: The Company Remitted P 22,400 VAT To The BIR. SolutionDocumento3 páginasAnswer: The Company Remitted P 22,400 VAT To The BIR. SolutionGreyzon AbdonAinda não há avaliações

- IA3 - REVIEWER - Internediate 3Documento38 páginasIA3 - REVIEWER - Internediate 3Mujahad QuirinoAinda não há avaliações

- 92 08 DeductionsDocumento18 páginas92 08 DeductionsNikkoAinda não há avaliações

- Taxation CompressDocumento3 páginasTaxation CompressJulie BagaresAinda não há avaliações

- Auditing ProblemsDocumento29 páginasAuditing ProblemsPrincesAinda não há avaliações

- Income TAX: Prof. Jeanefer Reyes CPA, MPADocumento37 páginasIncome TAX: Prof. Jeanefer Reyes CPA, MPAmark anthony espiritu75% (4)

- TaxationDocumento3 páginasTaxationHamot KentAinda não há avaliações

- TaxationDocumento3 páginasTaxationHamot KentAinda não há avaliações

- Tax Computations SampleDocumento5 páginasTax Computations Samplelcsme tubodaccountsAinda não há avaliações

- Mary Joy Asis QUIZ 1Documento6 páginasMary Joy Asis QUIZ 1Joseph AsisAinda não há avaliações

- Tax On Individuals Quiz - ProblemsDocumento3 páginasTax On Individuals Quiz - ProblemsJP Mirafuentes100% (1)

- Quiz 1 - StrataxDocumento3 páginasQuiz 1 - Strataxspongebob SquarepantsAinda não há avaliações

- TAXDocumento10 páginasTAXJeana Segumalian100% (3)

- CHAPTER 4 (Accounts)Documento14 páginasCHAPTER 4 (Accounts)lcAinda não há avaliações

- TAX Final Preboard SolutionDocumento25 páginasTAX Final Preboard SolutionLaika Mae D. CariñoAinda não há avaliações

- ASSIGNMENT NO. 3 Chapter 7 Regular Income TaxationDocumento4 páginasASSIGNMENT NO. 3 Chapter 7 Regular Income TaxationElaiza Jayne PongaseAinda não há avaliações

- W8 - AS5 - Statement of CashFlowsDocumento1 páginaW8 - AS5 - Statement of CashFlowsJere Mae MarananAinda não há avaliações

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocumento4 páginasSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureNoorodden50% (2)

- ERROR CORRECTION Answer PDFDocumento3 páginasERROR CORRECTION Answer PDFreenza velasco100% (2)

- ACC401-Basic Conso SPLDocumento4 páginasACC401-Basic Conso SPLOhene Asare PogastyAinda não há avaliações

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineAinda não há avaliações

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionAinda não há avaliações

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionAinda não há avaliações

- Joint Arrangement HandoutDocumento5 páginasJoint Arrangement HandoutClyde SaulAinda não há avaliações

- Homework #1 1. Define Physical Fitness (At Least 5) : Kai Chenaniah D. Orpilla 11 - EuclidDocumento5 páginasHomework #1 1. Define Physical Fitness (At Least 5) : Kai Chenaniah D. Orpilla 11 - EuclidClyde SaulAinda não há avaliações

- Joint Arrangement HandoutDocumento5 páginasJoint Arrangement HandoutClyde Saul100% (1)

- Report - Handout (Sample)Documento5 páginasReport - Handout (Sample)Clyde SaulAinda não há avaliações

- Law On Partnership ReviewerDocumento29 páginasLaw On Partnership ReviewerClyde SaulAinda não há avaliações

- Auditing IT Governance ControlsDocumento30 páginasAuditing IT Governance ControlsClyde SaulAinda não há avaliações

- Concept Paper Fungal eDocumento34 páginasConcept Paper Fungal eClyde SaulAinda não há avaliações

- READMEDocumento1 páginaREADMEClyde SaulAinda não há avaliações

- Waiting Lines & Queuing: Presented byDocumento9 páginasWaiting Lines & Queuing: Presented byClyde SaulAinda não há avaliações

- Questions To Chapter 1Documento3 páginasQuestions To Chapter 1Clyde Saul100% (6)

- 15 Sep 2022.PROPERTY - TAX - 0517 17 1201 0001 R3108942281157440176Documento1 página15 Sep 2022.PROPERTY - TAX - 0517 17 1201 0001 R3108942281157440176DHANU DANGIAinda não há avaliações

- BIR Ruling (DA-433-07) - APIC As DividendsDocumento3 páginasBIR Ruling (DA-433-07) - APIC As DividendsCkey ArAinda não há avaliações

- Answer Keys For Midterm Exam PART 2Documento3 páginasAnswer Keys For Midterm Exam PART 2Angel MaghuyopAinda não há avaliações

- Webinar On SST Changes On Taxable Service, Tax Rate & Transional PeriodDocumento2 páginasWebinar On SST Changes On Taxable Service, Tax Rate & Transional PeriodFiza. MNorAinda não há avaliações

- Income Recognition, Measurement and Reporting and Taxpayer ClassificationsDocumento27 páginasIncome Recognition, Measurement and Reporting and Taxpayer ClassificationsAries Queencel Bernante BocarAinda não há avaliações

- NPS Contribution Form PDFDocumento1 páginaNPS Contribution Form PDFratan203Ainda não há avaliações

- ISA Manager Transfer FormDocumento2 páginasISA Manager Transfer FormAlessioNavarraAinda não há avaliações

- Sample Payroll System Codes Via Visual Fox ProDocumento6 páginasSample Payroll System Codes Via Visual Fox ProDiana Hermida100% (1)

- Income Tax Fundamentals 2019 37Th Edition Whittenburg Test Bank Full Chapter PDFDocumento36 páginasIncome Tax Fundamentals 2019 37Th Edition Whittenburg Test Bank Full Chapter PDFacrania.dekle.z2kajy100% (8)

- DinnerDocumento1 páginaDinnerSunlight FoundationAinda não há avaliações

- CLWM4100 - T3 - 2021 - Questions - Week 03Documento2 páginasCLWM4100 - T3 - 2021 - Questions - Week 03Thi Van Anh VUAinda não há avaliações

- 2 - William Mcgarey Paystub 2022 02 28Documento1 página2 - William Mcgarey Paystub 2022 02 28sulaimon2023Ainda não há avaliações

- 2316 JAKEDocumento1 página2316 JAKEJM HernandezAinda não há avaliações

- Set Off & Carry Forward of LossesDocumento21 páginasSet Off & Carry Forward of LossesanchalAinda não há avaliações

- HGH NBDocumento21 páginasHGH NBAakash GuptaAinda não há avaliações

- Custom FormDocumento1 páginaCustom Formluisa100% (1)

- Soalan Assignment 3Documento2 páginasSoalan Assignment 3Nodiey YanaAinda não há avaliações

- Do You Have To File A File A Federal Tax Return or Pay An Income Tax? These Experts Say "No"!Documento1 páginaDo You Have To File A File A Federal Tax Return or Pay An Income Tax? These Experts Say "No"!BZ Riger75% (4)

- Municipality of Tumauini: (Based On 1991 LGC Rate of Disposition)Documento4 páginasMunicipality of Tumauini: (Based On 1991 LGC Rate of Disposition)Genesis MaggayAinda não há avaliações

- TopCoder Member Tax Form W-8BENDocumento1 páginaTopCoder Member Tax Form W-8BENAnonymous LsohjUSo100% (1)

- RV ICE S: Krishna Sales & ServicesDocumento1 páginaRV ICE S: Krishna Sales & ServicesSaikatAinda não há avaliações

- OD426681185912189100Documento1 páginaOD426681185912189100SethuAinda não há avaliações

- Tut Q Extra TrustDocumento3 páginasTut Q Extra Trustchunlun87Ainda não há avaliações

- Summary of Final Income: Tax TableDocumento3 páginasSummary of Final Income: Tax TableRealEXcellence71% (7)

- 2021 Tax Rates SwitzerlandDocumento4 páginas2021 Tax Rates SwitzerlandKamil JanasAinda não há avaliações

- Net Pay Calculator: The "NIC" and "Income Tax" Tabs Are For Calculation Purposes Only - You Do Not Need To Look at These!Documento7 páginasNet Pay Calculator: The "NIC" and "Income Tax" Tabs Are For Calculation Purposes Only - You Do Not Need To Look at These!abhi1648665Ainda não há avaliações

- BAM-031 Problems Part-1Documento2 páginasBAM-031 Problems Part-1Rica Jane Oraiz LlorenAinda não há avaliações

- Amount Chargeable (In Words) E. & O.EDocumento1 páginaAmount Chargeable (In Words) E. & O.EManish JaiswalAinda não há avaliações

- Tax Exemption Rules in The PhilippinesDocumento1 páginaTax Exemption Rules in The PhilippinesEllen Glae DaquipilAinda não há avaliações