Escolar Documentos

Profissional Documentos

Cultura Documentos

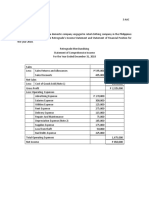

Gabuat ITR

Enviado por

Danica GabuatDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Gabuat ITR

Enviado por

Danica GabuatDireitos autorais:

Formatos disponíveis

HO 1 Review Of Risk And Returns Page| 1

COMPONENTS OF RISK

Stand-Alone Risk = Market Risk + Firm-Specific Risk

= Non-diversifiable Risk + Diversifiable Risk

= Systematic Risk + Non-systematic Risk

EFFECT OF MARKET DIVERSIFICATION TO FIRM-SPECIFIC AND MARKET RISKS

TWO BASIC RULES IN BASIC RISK MANAGEMENT

1 REQUIRE RETURNS AT LEAST EQUAL TO THE RISK ONE IS WILLING TO TAKE.

TO MEASURE RISK IS TO MEASURE RETURN

2

THE EXPECTED VALUE OF RETURNS

Expected value describes the numerical average of a probability distribution of estimated future cash receipts

from an investment project. This method is employed to estimate the most likely amount of future cash receipts

by:

(1) Estimating the various amounts of cash receipts from the project each year under different assumptions or

operating conditions

(2) Assigning probabilities to the various amounts estimated for one year, and

(3) Determining the mean value. The expected present value of all, future receipts could then be determined

by summing the expected discounted value of all years.

The GREATER the Expected Value or Pay-off, the BETTER. (i.e. given the same amount of Investment Risk to

be absorbed, a wise investor will select the project with the higher return.)

VARIOUS MEASUREMENTS OF RISK

1. Variance (σ2) is a measure of the dispersion of a distribution around its expected value. It may be measured

using the “standard deviation” or the “coefficient of variation”.*

n

½

(ki kˆ )2 Pi .

i 1

* when ungrouped data then variance = sum of squared differences divided by (n-1)

Prepared by: Ms. Jackqui R. Moreno, CPA, MBA

HO 1 Review Of Risk And Returns Page| 2

The HIGHER the σ2, the HIGHER the risk.

σ

2. Standard deviation (represented by the symbol, “ ”) is another measure of the tightness of a distribution

around its mean, is often used as an alternative to variance. The standard deviation is found by taking the square

root of the variance.

(k

i 1

i kˆ ) 2 Pi .

* when ungrouped data then standard deviation = square root of the sum of squared differences divided by (n-1)

The smaller the standard deviation, the tighter the distribution and the lesser it is associated with the investment.

The HIGHER the σ, the HIGHER the risk.

3. Coefficient of variation (CV) is a better measure of total risk than the standard deviation, especially when

comparing investments with different expected returns

CV = Standard Deviation = Standard Deviation

Mean Return Expected Return

THE INVESTMENT WITH THE HIGHER CV HAS MORE TOTAL RISK PER UNIT OF EXPECTED RETURN.

4. Beta Estimation(β) of an individual stock is the correlation between the volatility (price variation) of the

stock market and the volatility of the price of the individual stock. The beta is the measure of the

undiversifiable, systematic market risk.

Security Market Line (SML) is the line on s graph that shows the relationship between risk as measured by

beta and the required rate of return for individual securities. The slope of the regression line is defined as the

beta coefficient.

The SML commonly adopts the CAPM model: SML: ki = kRF + (kM – kRF) β i .

The following interpretations are made when given a value of beta:

If β = 1.0, then the Asset is an average asset.

If β > 1.0, then the Asset is riskier than average.

If β < 1.0, then the Asset is less risky than average.

1

Most stocks have betas in the range of 0.5 to 1.5.

Beta is affected by an entity’s capital structure. The beta we use in the CAPM is the levered one, in case the

entity uses debt financing. The Hamada equation below is used to compute for new beta shall there be

changes in capital structure.

β u= Current, levered β .

[1 + {(1-tax rate)(Debt/Equity)}]

For a portfolio:

The expected return is equal to the WEIGHTED AVERAGE returns of the assets in the

portfolio.

The variance of a 2-asset portfolio is equal to

=wi2 (σi) 2 + w22 (σ2) 2 + 2 (wi)(σi) (w2)(σ2) (r2)

=wi2 (σi) 2 + w22 (σ2) 2 + 2 (wi) (w2)(Cov)

The standard deviation is equal to the square root of the variance of the portfolio.

5. Covariance (Cov) is a measure of the general movement relationship between two variables. It is usually

measured in terms of correlation coefficient and asset allocation.

1

Can a beta be negative? Answer: Yes, if beta is negative. Then in a “beta graph” the regression line will slope downward. Though, a

negative beta is highly unlikely.

Prepared by: Ms. Jackqui R. Moreno, CPA, MBA

HO 1 Review Of Risk And Returns Page| 3

=

Solved Illustrative Problem on the Various Measurement of Risks

Problem:

Demand for the Probability of this Rate of Return on stock

company's products demand occurring if this demand occurs

Company 1 Company 2

Strong 0.30 100% 20%

Normal 0.40 15% 15%

Weak 0.30 -70% 10%

1.00

Given the preceding data, solve for the following:

a. Expected or Average Stock Return of each of the Companies 1 and 2

b. Variance of Stock returns of each of the Companies 1 and 2

c. Standard Deviation of Stock returns of each of the Companies 1 and 2

d. Coefficient of Variation of Stock Returns of each of the companies

e. Covariance

f. Assuming that you are to invest 30% of your investment funds in Company 1 and 70% in Company 2, and their

r2 is 0.351 compute for the:

(1) Variance of the 2-Asset Portfolio

(2) Standard Deviation of the 2-Asset Portfolio

Answer:

a. Expected Returns

Demand for the Probability of this Rate of Return on stock Average Rate of

company's products demand occurring if this demand occurs Return

COMPANY 1

Strong 0.30 100% 30%

Normal 0.40 15% 6%

Weak 0.30 -70% -21%

1.00 15%

Demand for the Probability of this Rate of Return on stock Average Rate of

company's products demand occurring if this demand occurs Return

COMPANY 2

Strong 0.30 20% 6%

Normal 0.40 15% 6%

Weak 0.30 10% 3%

1.00 15%

b. Variance of Stock returns of each of the Companies 1 and 2

Demand for the Probability of this Rate of Return on stock Average Rate of

company's products demand occurring if this demand occurs Return

COMPANY 1

Strong 0.30 100% 30%

Normal 0.40 15% 6%

Weak 0.30 -70% -21%

1.00 15%

Demand for the Probability of this Rate of Return on stock Average Rate of

company's products demand occurring if this demand occurs Return

COMPANY 2

Strong 0.30 20% 6%

Normal 0.40 15% 6%

Weak 0.30 10% 3%

1.00 15%

c. Standard Deviation of Stock returns of each of the Companies 1 and 2

=Rate of Return - Expected Rate of Return

Demand for the Probability of this Deviation from k hat Squared deviation Sq Dev X Prob.

Prepared by: Ms. Jackqui R. Moreno, CPA, MBA

HO 1 Review Of Risk And Returns Page| 4

company's products demand occurring COMPANY 1

Strong 0.3 85% 72.25% 21.68%

Normal 0.4 0% 0.00% 0.00%

Weak 0.3 -85% 72.25% 21.68%

Sum: 43.35%

Std. Dev. = Square root of sum 65.84%

Probability of this

demand occurring COMPANY 2

Strong 0.3 ??? ??? ???

Normal 0.4 ??? ??? ???

Weak 0.3 ??? ??? ???

Std. Dev. = Square root of sum 0.0387

d. Coefficient of Variation

Std. Deviation ÷ Expected return = CV

COMPANY 1 65.84% 15% 4.39

COMPANY 2 ???? 3.87% ???? 15% ??? 0.258

e. Covariance

Correlation S.D. Cov

Company 1 0.351 65.84% 0.351 x 0.6584 x 0.0387

Company 2 0.351 3.87%

f. Portfolio S.D. given the asset mix

σ2= ???(0.3)2 (0.6584)2+(0.7) 2(0.0387)2+2(0.3)(0.7)(0.6584)(0.0387)(0.351) = 0.043504292

σ = ???0.208576825

The Capital Asset Pricing Model (CAPM)

ks = kRF + (kM – kRF)b.

Notes to remember on CAPM application:

1. The ks is equal to the required rate of return.

2. kRF = Risk-free rate ; The preferred proxy for kRF is the Rate on long-term Treasury bonds.

3. b = The stock's beta coefficient is used as the measure of risk.

4. kM = The required rate of return on the market, or an "average" stock.

5. Key Assumptions under CAPM model:

a. Individuals diversify and hold portfolios

b. To test the CAPM, one has to observe and be able to measure this efficient market portfolio.

c. The risk of a security is the risk it adds to the portfolio

d. Everybody holds the market portfolio

e. The covariance between an asset "i" and the market portfolio (Covim) is a measure of this added risk.

The higher the covariance the higher the risk.

BRIEF EXERCISES ON RETURNS, STANDARD DEVIATION AND VARIANCES

1. The following table summarizes the annual returns you would have made on two companies: Scientific

Atlanta, a satellite and data equipment manufacturer, and AT&T, the telecommunications giant, from 1999 to

2008.

Scientific Scientific Scientific

Year Atlanta AT&T Year Atlanta AT&T Year Atlanta AT&T

1999 80.95% 58.26% 2003 32.02% 2.94% 2007 11.67% 48.64%

2000 -47.37% -33.79% 2004 25.37% -4.29% 2008 36.19% 23.55%

2001 31.00% 29.88% 2005 -28.57% 28.86%

2002 132.44% 30.35% 2006 0.00% -6.36%

a. Estimate the average and standard deviation in annual returns in each company.

The average return over the ten years is 27.37% for Scientific Atlanta and 17.8%

for AT&T. The standard deviations are 51.36% and 27.89% respectively.

b. If the correlation of these two investments is 0.54069, estimate the variance of a portfolio composed, in

equal parts, of the two investments.

c.

Prepared by: Ms. Jackqui R. Moreno, CPA, MBA

HO 1 Review Of Risk And Returns Page| 5

d.

e.

f.

g.

h.

i.

j. The variance of a portfolio composed equally of the two investments equals (0.

k. 5)2 (51.36)2 +(0.5)2 (27.89)2 +2(51.36)(27.89)(0.5)(0.5)(0.54) = 1240.68; the standard deviation is 35.22%

The variance of a portfolio composed equally of the two investments equals (0.5) 2 (51.36)2 +(0.5)2 (27.89)2

+2(51.36)(27.89)(0.5)(0.5)(0.54) = 1240.68; the standard deviation is 35.22%

2.

2. Zuni-GAS is a regulated utility serving Northern Luzon. The following table lists the stock prices and

dividends on Unicorn from 1999 to 2008.

Year Price Dividends Year Price Dividends Year Price Dividends

1999 36.10 3.00 2003 26.80 1.60 2006 28.50 1.60

2000 33.60 3.00 2004 24.80 1.60 2007 24.25 1.60

2001 37.80 3.00 2005 31.60 1.60 2008 35.60 1.60

2002 30.90 2.30

a. Estimate the average annual return you would have made on your investment 8.25%

b.

c.

d.

e.

f.

g.

h.

i.

j.

k.

l.

m.

n.

o.

p.

q.

r.

s.

t.

u.

v.

w.

x.

y.

z.

aa.

bb.

cc.

dd.

ee.

ff.

gg.

hh.

ii.

jj.

kk.

ll.

mm.

nn.

oo.

pp.

Prepared by: Ms. Jackqui R. Moreno, CPA, MBA

HO 1 Review Of Risk And Returns Page| 6

qq.

rr.

ss.

tt.

uu.

vv.

ww.

xx.

yy.

zz.

aaa.

bbb.

ccc. b. Estimate the standard deviation and variance in annual returns. 42.49%

3. Assume you have all your wealth (P1 million) invested in the Vanguard 500 index fund, and you expect to

earn an annual return of 12 percent with a standard deviation in returns of 25 percent. Because you have become

more risk averse, you decide to shift P200,000 from the Vanguard fund to Treasury bills. The T bill rate is 5%.

Estimate the expected return and standard deviation of your new portfolio. The expected return on the new portfolio =

0.2(5) + (0.8)12 = 10.6% The standard deviation of returns on the new portfolio = 0.8(25) = 20%

ILLUSTRATIVE PROBLEMS ON EXPECTED RETURNS, BETA, AND RISK PREMIUMS: SET A

In December 200B, AAA’s stock had a beta of 0.95. The Treasury bill rate at that time was 5.8%. The firm had a

debt outstanding of P1.7B and a market value of equity of P1.5B; the corporate marginal tax rate was 36%. The

registered risk premium at December 200B is 8.5%.

Requirements:

a. Estimate the expected return on the stock.

b. Assume that a decrease in risk-free rate occurs and is attributed to an improvement in inflation rates,

but that by January of 200C, the inflation rate deteriorates or increases by 1.25%, compute for the

required rate of return of a marginal investor. 2

Therefore, the risk-free rate becomes 7.05% (i.e. 5.8% + 1.25%).

= 7.05% + β {(14.3 + 1.25) – 7.05}

= 7.05% + 0.95{15.55 – 7.05}

= 15.13%

c. Assume that marginal investors become more risk-averse and thus require a change in the risk

premium by 4%, what will be the effect on their required rate of return? 3

= 5.8% + {0.95(8.5%+ 4%)}

= 17.68%

d. The current beta is 0.95. This is assumed to be a levered beta since this has been registered even if

there is outstanding debt of P1.7B. Compute for the unlevered beta by using this model:

= 0.95 .

[1+ {1-0.36}{1.7/1.5}]

=0.95 / 1.7253 = 0.55

e. How much of the risk measured by beta in “g” above can be attributed to (1) business risk, and (2)

financial leverage risk?

Therefore, the business risk is = 0.55, while the financial leverage risk is = 0.40 (0.95-0.55).

ILLUSTRATIVE PROBLEMS ON EXPECTED RETURNS, BETA, AND RISK PREMIUMS: SET B

1. Use the SML to calculate the required returns.

Securities Expected Returns Beta

A 17.4% 1.29

B 13.8 0.68

C 1.7 -0.86

D (T-bills) 8.0 0.00

Market 15.0 1.00

Hint:

A. Assume kRF = 8%. B. Note that kM = kM is 15%. (Equil.)

2

The inflation adjustment shall cause a change in both the risk-free rate and the old market return.

3

The change in the investors’ behavior in avoiding risk shall cause only the “risk premium” to change.

Prepared by: Ms. Jackqui R. Moreno, CPA, MBA

HO 1 Review Of Risk And Returns Page| 7

C. RPM = kM – kRF = 15% – 8% = 7%.

Required rates of return:

kA = 8.0% + (15.0% – 8.0%)(1.29)

= 8.0% + (7%)(1.29)

= 8.0% + 9.0% = 17.0%.

kM = 8.0% + (7%)(1.00) = 15.0%.

kB = 8.0% + (7%)(0.68) = 12.8%.

kT-bill = 8.0% + (7%)(0.00) = 8.0%.

kC = 8.0% + (7%)(-0.86) = 2.0%.

When the required returns by the investors (i.e. what they demand) is less than what is expected (i.e. “promised”

to them), then the investors can call it a “bargain”, wherein the securities are undervalued.

2. Which of the securities are overvalued? fairly valued?

Securities Expected Required Remarks

Returns returns

A 17.4% 17.0% Undervalued / bargain

Market 15.0 15.0 Fairly valued

B 13.8 12.8 Undervalued /bargain

D(T-bills) 8.0 8.0 Fairly valued

C 1.7 2.0 Overvalued

3. Calculate beta for a portfolio with 50% A Securities and C Securities

bp= Weighted average

= 0.5(bHT) + 0.5(bColl)

= 0.5(1.29) + 0.5(-0.86)

= 0.22.

4. How much will be the required return on the A/C portfolio is:

kp = Weighted average k

= 0.5(17%) + 0.5(2%) = 9.5%.

Or use SML:

kp= kRF + (kM – kRF) bp

= 8.0% + (15.0% – 8.0%)(0.22)

= 8.0% + 7%(0.22) = 9.5%.

5. If investors raise inflation expectations by 3%, what would happen to the SML?

INCREASE (PARALLEL)

6. If inflation did not change but risk aversion increased enough to cause the market risk premium to increase by 3

percentage points, what would happen to the SML?

SLOPE IS STEEPER

ILLUSTRATIVE PROBLEMS ON EXPECTED RETURNS, BETA, AND RISK PREMIUMS: SET C

1. Safecorp which owns and operates grocery stores across the Philippines, currently has P50 million in debt and

P100 million in equity outstanding. Its stock has a beta of 1.2. It is planning a leveraged buyout (LBO) , where it

will increase its debt/equity ratio of 8. If the tax rate is 40%, what will the beta of the equity in the firm be after

the LBO?

Unlevered Beta = 1.20 / (1 + (1-0.4) (50/100)) = 0.923076923

New Beta = 0.923 (1 + (1-0.4) (8)) = 5.35

2. Novell which had a market value of equity of P2 billion and a beta of 1.50, announced that it was acquiring

WordPerfect, which had a market value of equity of P 1 billion, and a beta of 1.30. Neither firm had any debt in

its financial structure at the time of the acquisition, and the corporate tax rate was 40%.

a. Estimate the beta for Novell after the acquisition, assuming that the entire acquisition was financed with equity.

Unlevered Beta for Novell = 1.50 ! Firm has no debt

Unlevered Beta for WordPerfect = 1.30 ! Firm has no debt

Unlevered Beta for Combined Firm = 1.50 (2/(2+1)) + 1.30 (1/(2+1)) = 1.43

Prepared by: Ms. Jackqui R. Moreno, CPA, MBA

HO 1 Review Of Risk And Returns Page| 8

This would be the beta of the combined firm if the deal is all-equity.

b. Assume that Novell had to borrow the P 1 billion to acquire WordPerfect. Estimate the beta after the

acquisition.

If the deal is financed with debt,

New Debt/Equity Ratio = 1/2 = 0.5

New Beta = 1.43 (1 + (1-.4) (0.5)) = 1.86

Therefore, the risk-free rate becomes 7.05% (i.e. 5.8% + 1.25%).

= 7.05% + β {(14.3 + 1.25) – 7.05}

= 7.05% + 0.95{15.55 – 7.05}

= 15.13%

Therefore, the business risk is = 0.55, while the financial leverage risk is = 0.40 (0.95-0.55).

jrm

Prepared by: Ms. Jackqui R. Moreno, CPA, MBA

Você também pode gostar

- Projected Income Statement For 12 MonthsDocumento5 páginasProjected Income Statement For 12 Monthsblueviolet21Ainda não há avaliações

- The Safe Mortgage Loan Originator National Exam Study Guide Second Edition 2nd Edition Ebook PDFDocumento62 páginasThe Safe Mortgage Loan Originator National Exam Study Guide Second Edition 2nd Edition Ebook PDFalec.black13997% (33)

- CH 8Documento56 páginasCH 8Sufyan KhanAinda não há avaliações

- Accounting PretestDocumento4 páginasAccounting PretestseymourwardAinda não há avaliações

- Restatement of Property:MortgagesDocumento771 páginasRestatement of Property:Mortgagesmason rush100% (1)

- Final ProjectDocumento64 páginasFinal ProjectprashanthAinda não há avaliações

- CH 21 TBDocumento18 páginasCH 21 TBJessica Garcia100% (1)

- GlowCorp CaseDocumento25 páginasGlowCorp CaseJAMES WILLIAM BALAOAinda não há avaliações

- Return: 4 - 1 - D e F I N I T I o N o F R I S K A N D R e T U R NDocumento10 páginasReturn: 4 - 1 - D e F I N I T I o N o F R I S K A N D R e T U R NHenok FikaduAinda não há avaliações

- 4chapter 4 FM1Documento6 páginas4chapter 4 FM1TIZITAW MASRESHAAinda não há avaliações

- Risk & Rates of ReturnDocumento30 páginasRisk & Rates of ReturnasifanisAinda não há avaliações

- Chapter 4Documento7 páginasChapter 4Tofik SalmanAinda não há avaliações

- Ch03-5 Portifolio Theory - Risk Return AnalysisDocumento113 páginasCh03-5 Portifolio Theory - Risk Return AnalysismupiwamasimbaAinda não há avaliações

- Risk and Return TheoryDocumento45 páginasRisk and Return Theoryanshika rathoreAinda não há avaliações

- Chapter Five: Advanced Risk Analysis: Firm Risk and Market RiskDocumento15 páginasChapter Five: Advanced Risk Analysis: Firm Risk and Market RisktemedebereAinda não há avaliações

- Risk and Return Risk and ReturnDocumento46 páginasRisk and Return Risk and ReturnYasir KhosaAinda não há avaliações

- 6-7. Risk and ReturnDocumento29 páginas6-7. Risk and ReturnFaxri MammadovAinda não há avaliações

- Risk and Return Risk and ReturnDocumento30 páginasRisk and Return Risk and ReturnKIM RODAAinda não há avaliações

- Chapter 04 Risk, Return, and The Portfolio TheoryDocumento55 páginasChapter 04 Risk, Return, and The Portfolio TheoryAGAinda não há avaliações

- Risk and ReturnDocumento43 páginasRisk and ReturnAbubakar OthmanAinda não há avaliações

- Chapter 13 Notes - Risk and Capital BudgetingDocumento5 páginasChapter 13 Notes - Risk and Capital BudgetingrbarronsolutionsAinda não há avaliações

- Risk Return SaimDocumento57 páginasRisk Return SaimKhushi TyagiAinda não há avaliações

- M-I-3.Risk & ReturnDocumento23 páginasM-I-3.Risk & Returnmonalisha mishraAinda não há avaliações

- 1.1 Risk and ReturnDocumento23 páginas1.1 Risk and Returnmd.samsul alamAinda não há avaliações

- Trade-Off Between Risk & ReturnDocumento23 páginasTrade-Off Between Risk & Returnmarlon ventulanAinda não há avaliações

- Risk and Return Concepts PDFDocumento3 páginasRisk and Return Concepts PDFyvonneberdosAinda não há avaliações

- MidtermDocumento16 páginasMidtermNicole ReintegradoAinda não há avaliações

- FM Lecture 3Documento33 páginasFM Lecture 3ski_leo82Ainda não há avaliações

- R P - P - + C: Chapter Seven Basics of Risk and ReturnDocumento13 páginasR P - P - + C: Chapter Seven Basics of Risk and ReturntemedebereAinda não há avaliações

- Chapter 5Documento19 páginasChapter 5gasim kerimovAinda não há avaliações

- Chapter 7 StudentDocumento61 páginasChapter 7 StudentLinh HoangAinda não há avaliações

- IPS Group3Documento29 páginasIPS Group3KHOA LÊ VŨ CHÂUAinda não há avaliações

- Chapter 7 PortfolioTheoryDocumento42 páginasChapter 7 PortfolioTheoryAanchalAinda não há avaliações

- CH 6 SolDocumento14 páginasCH 6 Solroha_rizvi5972Ainda não há avaliações

- FIN 300 - Lecture 12Documento32 páginasFIN 300 - Lecture 12Hồng KhanhAinda não há avaliações

- S.Chapter 3 RRDocumento57 páginasS.Chapter 3 RRNgọc HuyềnAinda não há avaliações

- CH 2, InvestmentDocumento10 páginasCH 2, Investmenthaftomgebrekidan203Ainda não há avaliações

- Week 7 Week 8 - Intro To Portfolio TheoryDocumento24 páginasWeek 7 Week 8 - Intro To Portfolio TheoryJoshua NemiAinda não há avaliações

- Portfolio Risk & ReturnDocumento37 páginasPortfolio Risk & ReturnAnonymous100% (1)

- CH - 4 Risk, Return and Portfolio TheoryDocumento44 páginasCH - 4 Risk, Return and Portfolio TheoryBerhanu ShankoAinda não há avaliações

- IIMC Corp Finance 2018-19Documento54 páginasIIMC Corp Finance 2018-19Ambuj AgrawalAinda não há avaliações

- Chapter 7 Risk and Rates of ReturnDocumento16 páginasChapter 7 Risk and Rates of Returnsekolah futsalAinda não há avaliações

- FM Unit 3 Lecture Notes - Risk and ReturnDocumento6 páginasFM Unit 3 Lecture Notes - Risk and ReturnDebbie DebzAinda não há avaliações

- IAPM CH 4 - Introduction To Portfolio ManagementDocumento46 páginasIAPM CH 4 - Introduction To Portfolio ManagementLencho GelgaluAinda não há avaliações

- Lecture 7 Risk - Return Stand Alone - 05042023 115110amDocumento30 páginasLecture 7 Risk - Return Stand Alone - 05042023 115110amMasoom AlamAinda não há avaliações

- Chapter 4 Risk and ReturnDocumento40 páginasChapter 4 Risk and ReturnmedrekAinda não há avaliações

- Ch. 4-WebCampus Risk and ReturnDocumento6 páginasCh. 4-WebCampus Risk and ReturnEng Stephen ArendeAinda não há avaliações

- FIB3005Documento10 páginasFIB3005Nga nguyen thiAinda não há avaliações

- Chapter - 7 Portfolio Management PDFDocumento47 páginasChapter - 7 Portfolio Management PDFShubham VarshneyAinda não há avaliações

- Quantitative MethodsDocumento28 páginasQuantitative MethodsGrace Sytio IIAinda não há avaliações

- Topic 2Documento28 páginasTopic 2Nivaashene SaravananAinda não há avaliações

- Risk and Rates of Return CH06 PDFDocumento16 páginasRisk and Rates of Return CH06 PDFLily DaniaAinda não há avaliações

- Topic 4Documento26 páginasTopic 420070304 Nguyễn Thị PhươngAinda não há avaliações

- FM Lecture - 6 - ch08 - 201819S2Documento48 páginasFM Lecture - 6 - ch08 - 201819S2ziqingyeAinda não há avaliações

- Chapter 5: Risk and ReturnDocumento31 páginasChapter 5: Risk and ReturnEyobedAinda não há avaliações

- ChapterDocumento15 páginasChapterMohamed DiabAinda não há avaliações

- FM Ch5 Risk & ReturnDocumento75 páginasFM Ch5 Risk & Returntemesgen yohannesAinda não há avaliações

- Hoa Sen University Department of Economics and CommercesDocumento96 páginasHoa Sen University Department of Economics and CommercesTrúc Đặng ThanhAinda não há avaliações

- UntitledDocumento90 páginasUntitledAnamAinda não há avaliações

- Portfolio Risk and Return - Part II RiskDocumento39 páginasPortfolio Risk and Return - Part II RiskНаиль ИсхаковAinda não há avaliações

- FRTB (Hull, Chapter 18, p.415)Documento130 páginasFRTB (Hull, Chapter 18, p.415)JoyAinda não há avaliações

- Chapter 3 FMDocumento23 páginasChapter 3 FMeferemAinda não há avaliações

- Chapter Six: Risk and Risk Aversion: Study Notes of Bodie, Kane & Marcus by Zhipeng YanDocumento24 páginasChapter Six: Risk and Risk Aversion: Study Notes of Bodie, Kane & Marcus by Zhipeng YanOblivionOmbreAinda não há avaliações

- Chapter 8 Risk and Rates of Return Part 1Documento15 páginasChapter 8 Risk and Rates of Return Part 1Nusrat JahanAinda não há avaliações

- WK 6.2 - Risk and Return CAPMDocumento18 páginasWK 6.2 - Risk and Return CAPMhfmansour.phdAinda não há avaliações

- Uncertainty and Consumer Behavior - Chapter 5Documento17 páginasUncertainty and Consumer Behavior - Chapter 5rizzzAinda não há avaliações

- Josef Estate Tax ReturnDocumento3 páginasJosef Estate Tax ReturnDanica GabuatAinda não há avaliações

- Danica StramaDocumento5 páginasDanica StramaDanica GabuatAinda não há avaliações

- Ifrs 10Documento1 páginaIfrs 10Danica GabuatAinda não há avaliações

- Gabuat ITRDocumento4 páginasGabuat ITRDanica GabuatAinda não há avaliações

- Group 2 PortfolioDocumento9 páginasGroup 2 PortfolioDanica GabuatAinda não há avaliações

- CH 3 Open Economy Macroeconomics (Chap 3-2017) NewDocumento63 páginasCH 3 Open Economy Macroeconomics (Chap 3-2017) NewLemma MuletaAinda não há avaliações

- Assignment Subject Code BM 0001 (4 Credits) 60 Marks Set I Subject: Financial Accounting - An IntroductionDocumento6 páginasAssignment Subject Code BM 0001 (4 Credits) 60 Marks Set I Subject: Financial Accounting - An IntroductionAbdul Lateef KhanAinda não há avaliações

- Share Capital, Share and MembershipDocumento17 páginasShare Capital, Share and Membershipakashkr619Ainda não há avaliações

- Groups 7 Changes in Group StructureDocumento10 páginasGroups 7 Changes in Group StructureSharmaine Rivera MiguelAinda não há avaliações

- Why Investors Must Wring Out HIGH Beta From Portfolio?Documento4 páginasWhy Investors Must Wring Out HIGH Beta From Portfolio?Yogesh V GabaniAinda não há avaliações

- Currency FuturesDocumento14 páginasCurrency Futurestelesor13Ainda não há avaliações

- Bank Baroda Project.Documento106 páginasBank Baroda Project.Ketul SahuAinda não há avaliações

- MSCI Equity Indexes November 2020 Index Review: Press ReleaseDocumento4 páginasMSCI Equity Indexes November 2020 Index Review: Press ReleaseAlbert Wilson DavidAinda não há avaliações

- Financing Strategy at Tata SteelDocumento23 páginasFinancing Strategy at Tata SteelSarangAinda não há avaliações

- A Guide To Business PHD ApplicationsDocumento24 páginasA Guide To Business PHD ApplicationsSampad AcharyaAinda não há avaliações

- Infra Finance Role Campus JDDocumento3 páginasInfra Finance Role Campus JDJohn DoeAinda não há avaliações

- Cancellation Acord Form - CX149661-Ramon Aguilar-Aguila Trucking PDFDocumento1 páginaCancellation Acord Form - CX149661-Ramon Aguilar-Aguila Trucking PDFBryan ArenasAinda não há avaliações

- Statute of Limitations For Collecting A DebtDocumento2 páginasStatute of Limitations For Collecting A DebtmikotanakaAinda não há avaliações

- Ala in Finacct 3Documento4 páginasAla in Finacct 3VIRGIL KIT AUGUSTIN ABANILLAAinda não há avaliações

- 52patterns - 7 Chart PatternsDocumento64 páginas52patterns - 7 Chart PatternspravinyAinda não há avaliações

- Slm-Strategic Financial Management - 0 PDFDocumento137 páginasSlm-Strategic Financial Management - 0 PDFdadapeer h mAinda não há avaliações

- Auditing Finance and Accounting FunctionsDocumento14 páginasAuditing Finance and Accounting FunctionsApril ManjaresAinda não há avaliações

- Canara Bank ProjectDocumento20 páginasCanara Bank ProjectSarika Sharma100% (1)

- Negotiating A Venture Capital Term SheetDocumento2 páginasNegotiating A Venture Capital Term SheetmikeslackenernyAinda não há avaliações

- Tutorial 5 TVM Application - SVDocumento5 páginasTutorial 5 TVM Application - SVHiền NguyễnAinda não há avaliações

- Fac4863 104 - 2020 - 0 - BDocumento93 páginasFac4863 104 - 2020 - 0 - BNISSIBETIAinda não há avaliações

- Quantitative Problems Chapter 5Documento5 páginasQuantitative Problems Chapter 5Fatima Sabir Masood Sabir ChaudhryAinda não há avaliações

- Audit Programme For Accounts ReceivableDocumento5 páginasAudit Programme For Accounts ReceivableDaniela BulardaAinda não há avaliações