Escolar Documentos

Profissional Documentos

Cultura Documentos

Moneylife 7 December 2017 PDF

Enviado por

Devendra GhodkeTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Moneylife 7 December 2017 PDF

Enviado por

Devendra GhodkeDireitos autorais:

Formatos disponíveis

SUCHETA DALAL ON:

A COERCIVE STATE DESPITE PANAMA - PARADISE

IN FULL FLOW BLACK MONEY STILL HIDDEN

Personal Finance Magazine 24 November-7 December 2017 Rs 45

Pages 68 (SUBSCRIBER COPY NOT FOR RESALE) www.moneylife.in

Investors have put in more than Rs52,000 crore in

these mutual fund schemes. Are they good for you too?

STOCKS

IFB Agro Excel Crop Care Saint-Gobain Sekurit India Amara Raja Batteries D-Link

Cover Page_307.indd 1 17-11-2017 19:51:01

wi

th

00

a s little as `5

HOW CAN I ADD BALANCE

TO MY FINANCIAL LIFE?

Why choose between strong returns and low risk, when you can have both? The right balance of growth and safety can help you

feel more confident and add stability to your investment portfolio. Which leads to one big question.

So what do I do with my money?

Gain from the strategic approach of investing in a balanced combination of the high-return potential of equities along with the

low-risk benefits of fixed income.

BALANCED FUND

GROWTH POTENTIAL: At least 65% invested in a well

diversified equity portfolio

50

0 100

LOW RISK: Up to 35% invested in quality debt and money

market securities

TAX FREE: Save tax on capital gains when you stay

invested for more than 12 months

To know more, speak to your investment advisor or

visit dspblackrock.com/balance

RISKOMETER

THIS OPEN ENDED BALANCED SCHEME IS SUITABLE FOR INVESTORS WHO ARE SEEKING^

Capital growth and income over a long term investment horizon

Investment primarily in equity/ equity related securities, with balance exposure in money market and debt securities

^Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

Advertisements.indd 2 13-11-2017 16:46:58

Advertisements.indd 1 13-11-2017 16:46:34

ISSUE CONTENTS

24 Nov-7 Dec 2017

The Smart Place To Park Your

Money

B ank fixed deposits and liquid schemes of

mutual funds have always been the easiest

choice, to park surplus money without worrying

much. But, being debt products, they don’t suit

every investor’s tax appetite. While investors

in the 5% tax bracket have more reasons to

invest in liquid schemes over other alternatives,

what about the taxpayers in the higher tax

categories? Do they have options? In this Cover

Story, we extensively discuss the features of an

alternative which offers higher returns with low

risk, while attracting lower tax. This is a must-

30 Cover Story

read for investors in higher tax brackets who

are constantly trying to juggle safe investment

returns and save tax.

A year after demonetisation, Sucheta’s

Different Strokes column is about how hasty Where Do Smart Investors Park Their Money?

and coercive decisions are inflicting pain on Investors have put in more than Rs52,000 crore in these mutual

people and businesses. When government fund schemes. Are they good for you too? Debashis Basu and

Clinton Fernandes explain

officials do not accept mistakes, the chances of

repetition are high. In Crosshairs, she writes

about how Indian black money hoarders

seem to slip through Panama, Paradise and

demonetisation even when the government

12 Public Interest

– How To Eliminate Tedious TDS Errors

– Air Travel Travails

seems earnest in its crackdown. Is it time to try

– Madras High Court Order Protects the Dignity of

out-of-the-box ways to bring this money back? Retirees

Bala’s column, this time, is very interesting

as always; he has an interesting rule-of-thumb

for understanding overvaluation. He says use

the valuation based either on profit or balance

14 Your Money

– Government Says Home-buyers Can Seek Damages in

sheet, as the case may be, to measure your risk. Ongoing Projects

For example, for companies that are valued – Aadhaar Linking Compulsory for Life, Non-life

highly because of growth, compare the price-to- Insurance Policies: IRDAI

earnings ratio (P/E) and return on equity (RoE). – New Minimum Balance for HDFC Premium Customers

The bigger the gap between the P/E and the – Kasa Isles Welfare Association Bids for Completion of a

Part of Jaypee Infratech Project

RoE, the higher is the risk. On the other hand, – HDFC Bank Makes Online Transactions Free for RTGS

for most commodity companies, the farther and NEFT

away from book value + debt per share, the – Indians Working Abroad Will Also Be Covered under

higher is your risk. EPFO

From this issue, we welcome back Mehrab – Delay in 62% of Housing Projects in 50 Indian Cities

– Supreme Court Asks Banks, Telecom Companies Not To

Irani to our regular list of contributors, which Create Panic among Customers

will strengthen our personal finance coverage.

Also, don’t miss Prasanna’s fascinating coverage

of the shocking developments in the Supreme

Court about corruption charges, which the

mainstream media has kept rather quiet on.

16 MONEYLIFE

QUIZ

Debashis Basu Disclaimer: Moneylife has a policy of not allowing its editorial staff to

buy and sell stocks that are written about in the magazine. All personal

transactions in individual stocks are subjected to internal disclosure rules.

MONEYLIFE | 24 Nov-7 Dec 2017 | 4

Content.indd 2 17-11-2017 18:54:09

Advertisements.indd 5 15-11-2017 21:02:44

CONTENTS

20 FUND FACTS xUSEFUL APPS

25 Hot 56 Mobile

From Panama to Paradise –

No Sign of the Bulk of Indian and Cold Stocks of

Black Money Mutual Funds in October Ticketing

2017 App for

Booking

Unreserved Tickets

22 Different Strokes

INSURANCE

A Coercive State, in Full Flow

30 Insurance

Trends

– How To Make Any

Song Your Ringtone

Life Insurance

– PNB MetLife ‘Mera Jeevan Suraksha – Share Your Current

FUND POINTERS Plan’ Location via Google

Maps

24 Why Do These Liquid

Funds Have 1% Expense

Regulation

– Aadhaar Link with Insurance Can

Be a Challenge

– Get

Suggestions

Ratios? Motor Insurance

about Similar Sites

– HC Directs IRDAI To Enhance

Accident PA Cover to Rs15 Lakh

STOCKS PULSE BEAT

Fine Print

26 Smart Money

Preserving

58 Deadly

ly

Sugarr

Capital… MONEY MANTRA

– Are Statins

and Sanity Overrated?

in a Bull

Market 40 8forSecrets

Women LEGALLY SPEAKING

44 Stock Watch To Achieve

IFB Agro: Super Growth from

Financial

Nirvana 59 Consumer

Raises Storm

Seafood Exports in a Tea Cup

Excel Crop Care: Better Growth TAX / FIXED INCOME

TECHNOLOGY

Prospects

Saint-Gobain Sekurit India:

41 Will NRIs Dump

Their PPF and 62 Mobile

Data

Growth in Sept Quarter but It NSC? Cheats

Could Be Fragile

– G-Sec Yields Up

PS

Amara Raja Batteries: Will It

Get Energised?

CIVIC ISSUES

66 Tweeting to Lobby

D-Link: No Growth Drivers

52 Judiciary

in Turmoil

– English TV: Few Viewers, Big

Advertisers

Market Manipulation: Best Steel

Logistics

TAX HELPLINE

DEPARTMENTS

Market Trend: A Third Big Readers’ Response ........... 8

Cheer for Bulls

54 Queries at Moneylife

Foundation’s Tax Helpline

Book Review ....................60

Money Facts ....................64

Content.indd 4 17-11-2017 18:54:38

MONEYLIFE

ADVISORY

FIX YOUR FINANCES, FOREVER

Investor Club Videos

Dr Vijay Malik: “How To Ayush & Pratyush

Prof Sanjay Bakshi: R Balakrishnan: “How Assess the Management Mittal: “How To

“Investing Traps & How To Read an Annual Quality before Buying Effectively Use screener.

To Avoid Them” Report for Investing” Stocks” in”

Vijay Kedia: “My

Investment Journey so Prof Sanjay Bakshi: Vijay Kedia: An Open

for & what I learnt from “What Happens After Session With successful

my Failures” You Buy a Stock?” investor Vijay Kedia

How to Access the Videos

These videos are uploaded on a private channel of YouTube. You will not be able to

download but there are no restrictions on the number of times you can view them. You

can pay using any email id but you will need to use a gmail id to access the videos

https://advisor.moneylife.in/icvideos/

Speaker Event Amount

Prof Sanjay Bakshi Investing Traps & How To Avoid Them Rs.800

R Balakrishnan How To Read an Annual Report for Investing Rs.650

Dr Vijay Malik How To Assess the Management Quality before Buying Stocks Rs.700

Ayush & Pratyush Mittal How To Effectively Use screener.in Rs.700

Vijay Kedia My Investment Journey so for & what I learnt from my Failures Rs.700

Prof Sanjay Bakshi What Happens After You Buy a Stock? Rs.850

Vijay Kedia An Open Session With successful investor Vijay Kedia Rs.600

Investor Club Video Ad.indd 3 14-06-2017 20:38:17

Volume 12, Issue 21

24 November–7 December 2017

Debashis Basu

Editor & Publisher

editor@moneylife.in

Sucheta Dalal

Managing Editor

sucheta@moneylife.in

Editorial Consultant

Dr Nita Mukherjee

nitamuk@gmail.com

Editorial, Advertisement,

Circulation & Subscription Office

315, 3rd Floor, Hind Service Industries

Premises, Off Veer Savarkar Marg, Shivaji

Park, Dadar (W), Mumbai - 400 028 SHED WHITE ELEPHANTS?

Tel: 022 49205000 This is with regard to “Abolish income-tax,

Fax: 022 49205022

E-mail: mail@moneylife.in levy 8% GST after bringing black money from

abroad, says Dr Swamy”. As an ex-government

employee, I have seen such wastefulness and

E-mail: extravagance in government expenditure that

sales@moneylife.in Mutual Fund investments

Subscription e-mail words like criminal negligence would not do are subject to market risks,

read all scheme related

subscribe@moneylife.in justice to them. Forget running after impossible documents carefully.

dreams like black money recovery or income-

tax abolition. Just create laws about fiduciary

New Delhi

DDA Flats, J-3/66, Kalkaji, responsibility of government-funded projects, using

New Delhi - 110 019 means like RTI (Right to Information), and we Write to

will see government expenses shrink by 40%-60%. the Editor!

Bengaluru

Instead of fuelling the inflation and corruption

cycle, government will chase innovation to take

WIN

a prize

1st Floor, 13/1, 7th Main Road,

1st Cross, Saibabanagar, Srirampuram, up only productive projects and will, of its own,

Bengaluru - 560 021

shed the white elephants. That will improve the

taxman’s credibility and, hence, compliance.

Kolkata I know what I am suggesting is avant-garde; but

395, Lake Gardens, Kolkata - 700 045 someone like prime minister Narendra Modi can,

Tel: 033 2422 1173/4064 4318

at least, do this. It is totally within his control.

But no; he, too, just like the Congress, is going

Moneylife is printed and published by on announcing thousands of crores of projects

Debashis Basu on behalf of to each state, and letting money be siphoned

Moneywise Media Pvt Ltd and

published at 315, 3rd Floor, off from these projects because they are not

Hind Service Industries Premises, going to be beneficial to the economy in any

Off Veer Savarkar Marg, Shivaji Park,

Dadar (W), Mumbai - 400 028 way.

Editor: Debashis Basu

Manoj Khare, by email

LIGHT AT THE END OF THE TUNNEL?

This is with regard to “Why a New Consumer Protection Law Alone

Total no of pages - 68, Including Covers Is Not Enough” by Sucheta Dalal. While it’s well known that India

has the most voluminous Constitution of all nations in the world, I

doubt if any other nation has as many laws as India. Besides, despite

RNI No: MAHENG/2006/16653

MONEYLIFE | 24 Nov–7 Dec 2017 | 8

Letters.indd 2 14-11-2017 19:09:26

+

Moneylife Foundation AD.indd 1 26-07-2017 11:09:05

LETTERS

Appalling Reality

the

Best

letter

T his is with regard to

“Auditor, Regulator, Rater:

and Exchange

Board of India),

Can They Get Away with a PFRDA (Pension

Mutual Fund investments

Consent Plea?” by Sucheta Dalal. Fund Regulatory are subject to market risks,

read all scheme related

In the last paragraph, she has and Development documents carefully.

said, “...would make us seem like Authority), IRDAI

a banana republic.” As a senior

journalist, I suppose, she has used

(Insurance Regulatory

and Development Congratulations

all her wisdom and experience in the statement. If so, Authority of India), Sharad Shah

it is an appalling reality of India! TRAI (Telecom

All regulators, auditors, bankers, raters, SROs (self- Regulatory Authority

YOU WIN A

PERSONALISED

regulatory organisations), etc, make tall claims of of India), CBFC CLOCK

‘protecting small/ retail investor’ or in the name of (Central Board of

common man. But, in reality, all of them are for Film Certification),

‘chairs’, and the power/pelf that can be drawn from etc. They are all an

the chair, during their tenure and post-retirement. additional burden on

No one really cares for the common citizen and for the common citizens,

values/ethics! while they take them

Look around, and you will see that banks are the for a ride, generation Sharad Shah

biggest mis-sellers of all products of insurance, after generation.

mutual funds, etc, and what is the result of such acts Banana republic

by banks? Those who fight may get their dues and all or not, I am

others are likely to be cheated and would go down as convinced by my

losers. experiences that

Check out, how all regulators have failed in the India is not a vibrant, robustt ddemocracy

emo

em

mocra

ocra

racycy tthat holds

hat ho

hat

ha h

hol

olds

ld

ld

simple basic duties that they are supposed to uphold: its citizens first, in any sphere of life!

RBI (Reserve Bank of India), SEBI (Securities Sharad Shah, by email

‘fighting’ for ‘independence’ for over 100 years, India BAD DEBTS GROW!

continues to have most laws that were enacted during This is with regard to “Why It’s TimeTo Revisit Income

the very same British rule that they opposed. Our Tax on Individuals” by R Balakrishnan. A businessman

politicians have done the greatest disservice to the never invests anything from his pocket. Most of the

nation by not reviewing and overhauling these archaic businesses run on the money of the banks. Businessmen

laws of the British era and replacing them with laws get richer day-by-day and the banks get poorer as

more in tune with our times. bad debts grow. The common man, the bakra, the

India has the worst legal system (I refuse to call it a scapegoat, has to pay the taxes to run this drama. This

criminal justice system, as it doesn’t dispense justice) is our type of luxurious most liberal, socialist, secular,

among large countries in the world. Unless law democratic peoples’ republic.

enforcement is robust and the legal system delivers TC Shivswamy, online comment

prompt verdicts, instead of after decades, having more

laws has no meaning. Also, every single law is made ANXIOUSLY AWAITING THE VERDICT ON

with enough loopholes for protecting rogue politicians, AADHAAR

if and when they get caught. India’s legal system is The judgement on validity of Aadhaar is heading

sold-out to the rich and powerful, while millions of towards the slog overs and, definitely, towards a

poor and helpless people languish in jails well beyond nail-biting finish. In the meanwhile, a whole lot of

the period they would have served even on conviction. us, including Moneylife readers like me, are resisting

I don’t see any light at the end of the tunnel! attempts from numerous agencies to force us to link

Ramesh I, online comment up with Aadhaar. At the workplace, it was resisting

MONEYLIFE | 24 Nov-7 Dec 2017 | 10

Letters.indd 4 14-11-2017 19:10:15

LETTERS

seeding of the PF (provident fund) account with vehicles dirty and filthy. They take a bath and ease

Aadhaar; with the bankers, it is a daily barrage of themselves in the open.

SMSs and emails pushing a link with Aadhaar; I-T The whole idea of swachch Bharat comes to naught

(income-tax) returns, a hurried filing before linking with commercial vehicles’ illegal parking. Not even a

Aadhaar and the PAN (permanent account number) single case of such violation—towing away or other

became mandatory; and, now, to handle the mobile legal measures—is ever seen on the records of the

operator’s pressure to link the number with Aadhaar. authorities concerned for violations of law. It is the

Not to forget, the mutual fund and insurance linking as duty of the government to provide enough parking

well. I can try and resist and ask my spaces. Parking, in fact, should be free for

wife to put up with this for a few all vehicles, as one-time parking charges

weeks; but it is a struggle to explain are collected at the time of buying a car!

the logic to my aged pension-earning Further, it is a fallacy that higher parking

parents who get stressed at the mere charges will help in solving parking

mention of a deadline. problems. A lot of black money is created

It is like they say in a Kenyan by the parking mafia at present—where

proverb, ‘when elephants fight, it is there are no authorised car parking

the grass that gets hurt’. The ordinary charges, this mafia collects it illegally. To

citizen is not at all given a thought control the parking mafia, authorities

by the heartless system. Anxiously must take suitable action and advertise in

awaiting a decision that impacts the media—newspapers, TV and FM radio,

lives of sava sau karod deshwasi. etc—giving a complete list of authorised

Rajaram, online comment parking sites and rates, until the whole

country is made free parking for all

DUTY OF GOVERNMENT TO vehicles!

PROVIDE ENOUGH PARKING SPACE M Kumar, by email

This is with reference to Your Money snippet,

“Roadside Parking in Specific Residential Areas in HOST FAMILY WAS GOOD

Delhi Will Be Paid Parking” (Moneylife, 13-26 October This is with reference to “Airbnb: Home Stays

2017). The idea of charging a fee for parking of cars Anywhere in the World” by Yazdi Tantra. My cousin,

in Delhi colonies is an abandoned thought; in March who travelled France for about 10 days, had booked

2017, it was, rightly, dropped. It is most absurd and accommodation through Airbnb. As I also travel

is not a viable solution. If parking attendants are regularly within and outside India, he suggested to

expected to manage the arrangement, it would only me that I try Airbnb. I booked Coorg/Karnataka;

add to the problems of residents’ security concerns. everything was as good as claimed/shown on the site.

In fact, commercial vehicles parked around colonies Again, I booked for Pune home-stay with the charge

and on roadsides must be charged; such vehicles just 25% of what I used to pay to any reasonably

should be towed away, rather than private vehicles. good three-star hotel. At both places, Coorg and Pune,

Commercial vehicles—like tempos, trucks—light the host family was cordial and saw to it that I was

vehicles’ drivers and attendants, often, collude and this comfortable.

results in petty crimes and makes whole area near such Bharat Gandhi, online comment

HOW TO REACH US

Letters: Mumbai 400 028 or faxed to 022- complaints about current 400 028 or call 022-49205000 or

Letters to the Editor can be 49205022. Letters must include subscription and books, write to fax to 022-49205022.

emailed to editor@moneylife. the writer’s full name, address us at subscribe@moneylife.in

in or can be posted to: The Editor, and telephone number and may or to Subscription Manager, Unit Advertising: For information and

Moneylife Magazine, Unit No. 316, be edited. No. 316, 3rd Floor, Hind Service rates, email us at

3rd Floor, Hind Service Industries, Subscription Service: Industries, Off Veer Savarkar sales@moneylife.in or call

Off Veer Savarkar Marg, Dadar(W), For new subscription requests, Marg, Dadar (W), Mumbai 91-022-49205000.

11 | 24 Nov-7 Dec 2017 | MONEYLIFE

Letters.indd 5 14-11-2017 19:10:41

Public Interest

How To Eliminate Tedious TDS Errors

W

hy are depositors plagued been computerised, customers find An internal newsletter of

by mistakes banks commit that TDS is wrongly computed, the Corporation Bank Officer’s

in deducting tax on fixed or wrongly deducted, despite Organisation (CBOO) reveals that

deposits (FDs)? Banks are mandated submitting the relevant forms, or TDS compilation is done by each

to deduct tax at source (TDS) on wrong deductions happen, especially branch with very little time given to

annual interest income of Rs10,000 when FDs are being renewed. This the officers to verify and remit the

and above, when a depositor has is a serious harassment, because tax collected. This leads to errors,

which not only anger customers

but have stressed out bank officials

as well, because, if collections

from customers fall short, or TDS

remittance is delayed, it attracts

a penalty. The draconian tax

rules are leading to mistakes and

haunting bank officials when wrong

deductions are made. A further

twist arises from the fact that bank

branches are burdened with the job

of compiling TDS and transferring

no permanent account number banks cannot refund the wrong it to a temporary current account

(PAN) or has not submitted deduction; the tax refund can only which has its own issues in

Form 15G or 15H (applications be claimed by individuals filing a remittance through netbanking.

to ensure no deduction of tax if needless tax return to claim it, even The CBOO general secretary,

income is not taxable). In practice, when the income is below the tax Satish Shetty, has now demanded

although banking operations have threshold. that TDS must be compiled and

empowered to cause permanent

Air Travel Travails damage by threatening to classify

him/her as unruly and be put on a

T he viral video of Indigo Airlines

staff manhandling a passenger

and pinning him to the ground

the passenger could well be at the

mercy of the airline which has been

‘no-fly list’.

A sharp social media message

that has found plenty for

has triggered a giant stream of ‘forwards’ lists how the silence

jokes and memes about how of customers has given airlines

the Indigo treats its staff. The the upper hand allowing

incident also brought home the them to charge for every

fact that disaggregated airline service (premium-priced food,

customers are increasingly at convenience fee for booking

the mercy of airlines due to online when it ought to be

their inability to get together discounted, seat selection fee,

to demand their rights. In the surge pricing, which makes

Indigo case, the ill-treatment of travel on holidays unaffordable,

the passenger caused outrage and reduction in free hand

and inquiry, only because it was baggage and check-in baggage

recorded and released on social allowance). Since there are

media. When no such visual only a few airlines which can

documentation is available, gang up, competition no

MONEYLIFE | 24 Nov-7 Dec 2017 | 12

Public Interest.indd 2 16-11-2017 20:54:44

remitted from the head office, which

has all the data in the core banking Madras High Court Order

software. He also wants a resolution

to the issue of TDS being deducted Protects the Dignity of Retirees

with relevant forms submitted,

without holding officers responsible

for the error which are not really

O n 5th November, the Madras High Court took suo moto cognisance of a

letter written by a senior citizen and, treating it as a PIL (public interest

litigation), ordered the Tamil Nadu government to, periodically, inspect all

their fault. Why this has not been old-age homes in the state and ensure compliance of rules in accordance

done, despite TDS issues being faced with the law. A status report is to be submitted in two weeks. The Court

by customers of all banks is the order asked the government to ensure that senior citizens residing in such

big question. The problem is not homes are not denied basic amenities of a life of dignity.

limited to Corporation Bank. For The order is a big step forward in the fight for their rights by elders

instance, State Bank of India’s (SBI’s) residing in the retirement townships of Coimbatore. Moneylife readers may

customers, especially those whose recall our detailed coverage (Cover Story, 9-22 June 2017) of the victorious

bank was merged with the giant legal battle S Krishnamurthy, an 80-year old, in the Madras High Court (Writ

SBI, find that bank officials are not Petition Number 22967 of 2015) in 2015. He had asked the Court to direct

familiar with the software and are the Tamil Nadu government to set up a specific regulatory authority for

making mistakes in TDS compilation senior citizens’ homes in the state. Although S Krishnamurthy won the court

and deduction. A few banks battle, the war to have the order implemented carries on.

harass senior citizens by making it This time, the bench comprising Chief Justice Indira Banerjee and Justice

mandatory to submit Form 15H M Sundar

online when they are unfamiliar with took suo moto

computers. Between draconian and action on a

impractical tax rules and bankers letter written by

working on faulty systems, it is the Sangameswaran

ordinary customer, especially the Krishnan,

senior citizen, who is the scapegoat. resident of

But who is listening? Dhyanaprashta

Foundation,

another

longer works. According to social retirement

media posts, airlines are coming home in

up with new gimmicks that seem Coimbatore

aimed at fattening their bottom- that had failed

line. For instance, one post says that to deliver on the promises made to his family, including nutritious food

airlines callously offer no support to and medical care. He has paid an interest-free security deposit of Rs13

passengers stuck in long check-in lakh for a 20-year lease deal. While the action by the Madras High Court is

queues causing them to miss flights; an important step forward, one needs a mechanism to ensure that elders

they are then offered the next flight do not have to approach the courts every time for redress. Moreover,

ticket at a steep price difference. retirement homes have sprung up across the country on the promise of

We don’t know if this is a deliberate allowing affluent or middle-class elders a serene, hassle-free retirement.

strategy; but the fact is that there is The relatively nascent business (barring some shining exceptions) is high

little recourse if you are the victim on promises but not bound by any regulation to deliver on them, over the

of such a strategy. The government long term. The need of the hour is a set of regulations issued by the Central

rarely reacts until public outrage government. Moneylife Foundation, which had conducted the first ever

snowballs into a huge controversy. In study of retirement homes in India, took up the issue with Hardeep Singh

the Indigo case, the issue has already Puri, minister of state for housing and urban development. Mr Puri has

died down which means that we agreed to have the issue examined and was very positive about the need

should not expect any change until for appropriate regulations to protect middle-class Indians who pay for such

a bigger incident causes even more homes in the expectation of hassle-free silver years.

outrage!

13 | 24 Nov-7 Dec 2017 | MONEYLIFE

Public Interest.indd 3 16-11-2017 20:55:25

Your Money

REAL ESTATE INSURANCE

Government Says Home-buyers Can Aadhaar Linking Compulsory

for Life, Non-life Insurance

Seek Damages in Ongoing Projects Policies: IRDAI

B uyers in ongoing projects can

seek compensation from a builder

under the Real Estate Regulatory Act

builder for acts committed prior to

registration, in an ongoing project.

How many penalties will he have to

T he Insurance Regulatory and Development

Authority of India (IRDAI),India’s insurance

regulator, has mandated all insurers—life

(RERA) even if the developer had pay?” They asked, “If a builder whose and non-life—to link the Aadhaar number

committed a breach and failed to registration is revoked—as allowed of policyholders to their policies. A circular

give possession before the Act came under RERA for defaults or ‘unfair informed life, non-life and stand-alone health

into force, practice or insurers that linking of Aadhaar number to

the Central irregularities’— insurance

government will he only policies is

informed the have to pay mandatory

Bombay High compensation under the

Court. or an interest Prevention

The per month to of Money-

government, an allottee or laundering

through buyer? Why (Maintenance

additional should he be of Records)

advocate general Anil Singh, is made to pay, especially, if it is not Second Amendment Rules 2017.

presenting its arguments to defend, known how long it takes for the The amended rules make Aadhaar linking

justify and explain why RERA, building to be completed then?” What mandatory for availing financial services

enacted last year, is reasonable, valid happens when a registration is revoked including insurance and also linking existing

and a vital statute to rein in rogue ,was another query. insurance policies. However, IRDAI has not

builders. The High Court is hearing a “It is the original builder who specified any deadline for linking of Aadhaar

clutch of constitutional challenges to will have to pay the compensation or number with the existing policies. It will be

the law. A bench of Justices Naresh interest and not the new builders who a major task for the non-life insurers to link

Patil and RG Ketkar, assigned the task, will only serve as contractors with no Aadhaar with motor insurance policies, given

had a series of questions to ask. rights in the project. Can a bona fide the huge number of vehicles that are insured.

Keen on understanding the buyer who has not received his flat be

intention of the lawmakers, the judges punished and the defaulting builder

BANKING

observed, “You are penalising a protected?” asked Mr Singh.

New Minimum Balance for

Kasa Isles Welfare Association Bids for HDFC Premium Customers

Completion of a Part of Jaypee Infratech Project H DFC Bank has changed the requirement

for its premium customers by mandating

that they now keep Rs1-lakh balance a month

A group of flat-buyers from Kasa Isles, a Jaypee Infratech project, are pitching to

take over some of the apartment blocks and construct it themselves. Over 600

buyers from the 16 towers of the project in Noida’s Sector 129 have come together

from the earlier requirement of Rs1-lakh

balance a quarter. Changing the eligibility for

under the umbrella of Kasa Isles Welfare Association and submitted their proposal to its ‘Classic’ banking programme, HDFC Bank

the resolution professional appointed by the National Company Law Tribunal. now requires that customers would have to

They have approached the insolvency resolution professional with a formal offer. maintain the new minimum balance from

Aman Behal, a core committee member, said that the Association will need around 9th December, according to mailers sent to

Rs200 crore to complete the project and is hoping to scale up the membership to customers. Customers of Classic banking

over 1,200 members. The Association’s proposal has met with scepticism as far as account get waivers on some services—

the court-appointed interim resolution professional and the lenders to Jaypee are cheque deposit, stop payment of cheque and

concerned who want to avoid splitting the assets as part of the resolution plan. standing instructions.

MONEYLIFE | 24 Nov-7 Dec 2017 | 14

Your Money.indd 2 17-11-2017 17:46:04

BANKING

On chequebook issuance, HDFC

HDFC Bank Makes Online Bank said a customer can avail one

chequebook of 25 leaves free only

Transactions Free for RTGS and NEFT once in a year in contrast to two

such chequebooks earlier. However,

H DFC Bank has made online

transactions through Real Time

Gross Settlement (RTGS) and National

online transactions through RTGS

and the NEFT from 1 November

2017. However, any NEFT or RTGS

the cost of requesting an additional

chequebook (25 leaves) has been kept

unchanged at Rs75 each. Also, if a

Electronics Funds Transfer cheque is returned due

(NEFT) free of cost. On to insufficient funds,

the other hand, various such cheques will now

charges for cheque-related attract a penalty of

transactions as well as Rs500 each.

request for additional leaves “The revision

will become costly from in chequebook and

December 2017 for non- cheque return charges

managed savings and salary is applicable only to

accounts. non-managed resident

According to the revised savings and salary

fees and charges for savings customers effective

and salary accounts, customers transaction carried out at the Bank December 1, 2017,” read the Bank’s

will not have to pay any charge for branch will be payable. notice.

RETIREMENT REAL ESTATE

Delay in 62% of

Indians Working Abroad Will Also Be Housing Projects in

Covered under EPFO 50 Indian Cities

I ndians working abroad can

exempt themselves from their

host country’s social security

(CoC). They can apply for the CoC

online and can get it too,” he said.

Mr Joy said there is a simple one-

A ccording to the findings of a survey by

Liases Foras, an independent non-

brokerage real estate company in India, 62% of

scheme and get covered by EPFO page application form available under-construction housing projects across 50

(Employees on EPFO’s Indian cities are delayed. The percentage for

Provident Fund website for the delayed flats/apartments stands slightly higher

Organisation), purpose. at 64%. Nearly 30% of under-construction

Central Explaining apartments are delayed by two or more years.

provident fund the benefits The government had recently informed the

commissioner of the scheme Bombay High Court that, in Maharashtra alone,

(CPFC), VP Joy, he said, “The 530,000 apartments in under-construction

said. An online scheme is of projects were delayed, and that more than

facility to avail great help for one-fifth of these were delayed by more than

the benefit has Indian workers three years. The Court had asked the housing

been made going overseas and urban development ministry to provide

functional. for a limited period of time. The details and the number of delayed projects. The

“We have made the whole biggest benefit they get from Bombay HC is holding daily hearing of cases

process employee-friendly. opting for the CoC is that their filed by real estate developers challenging

Employees going abroad to work money is not blocked for a long RERA and seeking to keep incomplete projects

can get a certificate of coverage time in the host country.” out of the Central law.

15 | 24 Nov-7 Dec 2017 | MONEYLIFE

Your Money.indd 3 17-11-2017 17:46:27

Your Money

BANKING companies for creating panic by

sending customers messages

Supreme Court Asks Banks, Telecom Companies saying their accounts will be

deactivated if they don’t link them to

Not To Create Panic among Customers Aadhaar.

“I don’t want to say (so) but I

T he Supreme Court sought the

government’s response on four

petitions challenging the constitutional

also get messages,” said Justice Sikri,

referring to the sometimes umpteen-

a-day text messages threatening

validity of the Aadhaar Act and deactivation for not linking one’s

linking of bank accounts and mobile Aadhaar to one’s bank account and

numbers with the 12-digit biometric mobile phone number. The top court

identification number. asked these institutions to avoid

A bench comprising Justices scaring people in this manner, while it

AK Sikri and Ashok Bhushan, however, was hearing a plea from social activists

said that banks and mobile service- to restrain the Centre from linking

providers must mention the deadlines their accounts to the Aadhaar Aadhaar to bank accounts and mobile

– December 31 and February 6 – in numbers. The apex court, however, phone numbers until a Constitution

SMSs sent to customers on linking pulled up banks and mobile telephone bench decides its validity.

Moneylife

MONEYLIFE

Quiz no

272

QUIZ Answer

Correctly! Win

Another quiz to tease your brain. The answers are in a personalised

sed

this very issue. The winner will be chosen by a lucky clock with an Rajendra Phophalia

investmentnt

draw from correct entries and answers published in the Mutual Fund

investments are quote!

issue dated 4 January 2018. Send in your answers to subject to market risks,

read all scheme related

quiz@moneylife.in with the Quiz no., name, address & documents carefully.

telephone number before 13 December 2017.

1. In the Moneylife analysis of liquid mutual fund (MF) 5. How much are the assets under management (AUMs) of

schemes, what is the lowest TER (total expense ratio) for ICICI Prudential Liquid Scheme, according to the latest data

regular plan schemes? available?

a. 0.56% b. 0.78% a. Rs27,409 crore b. Rs27,964 crore

c. 0.19% d. 1.05% c. Rs27,998 crore d. Rs26,556 crore

2. Among liquid MF schemes in the Moneylife analysis, what is 6. Who is the author of the book, Mad Money Journey?

the highest TER (total expense ratio) for direct plan schemes? a. Amish Tripathi b. Rashmi Bansal

a. 0.19% b. 0.11% c. Mehrab Irani d. MG Parameswaran

c. 0.09% d. 0.78%

7. What is the meaning of voilà?

3. When was Republic TV launched? a. There it is b. It has vanished

a. 1 May 2017 b. 5 May 2017 c. Abracadabra d. End of magic show

c. 5 May 2016 d. 1 May 2015

8. Under which Section of the Income-tax Act can a revised

4. In which town of Gujarat was Mohitraj Prabhatsinh Rathod return be filed after an error is noticed?

a driver? a. Section 80-G b. Section 143(1)

a. Surat b. Valsad c. Section 80-D d. Section 6

c. Rajkot d. Junagadh

In all, 12 readers got all the answers right last time. The answers to Moneylife Quiz-270 are: • 1-d. Debt mutual fund

The winner of Quiz-270 is Rajendra Phophalia from schemes are free of risk • 2-b. Rs4,28,000 crore • 3-d. 63%

Jodhpur. Congrats! You win a personalised clock with • 4-b. London • 5-d. Section 80-G of the Income Tax Act • 6-a. Vishal

an investment quote! Sikka • 7-c. 1950 • 8-a. Dartmouth University

MONEYLIFE | 24 Nov-7 Dec 2017 | 16

Your Money.indd 4 17-11-2017 17:47:15

www.moneylife.in

News & views with a big difference

them are considered non-maintainable,

Shocking! Banking

probably because of the cumbersome

Ombudsman awards 24 process to be followed before filing a

orders out of 119,758 complaint. The numbers are shocking.

complaints During FY16-17, BO offices across

the country received over 119,758

Although the Reserve Bank of India complaints; but there were awards in only

(RBI) has recently amended the Banking 24 cases—a shocking 0.02% of cases filed.

Ombudsman (BO) scheme, fresh data on bank customer at all. The numbers show This data was obtained by Hardik Vasani

complaints filed with it reveal a system that the BO continues to close and reject based in Ghatlodia through a query filed

that does not work for the depositor or thousands of complaints—over half of under Right to Information (RTI) Act

DS Kulkarni Default: Liabilities could be as high as Rs5,400 crore

Pune-based DS Kulkarni (DSK) group, which had defaulted on repayments to numerous depositors, owes thousands of

crores of rupees to banks and financial institutions. These will get top priority, in case Deepak Sakharam Kulkarni, the

group promoter, wants to repay. Depositors will be at the end of debtors’ line and would get their money, only if DSK

group has assets more than its liabilities which seems unlikely

SAT quickly sets aside SEBI order on Gujarat CM Rupani for market manipulation; Rupani

had failed to reply to SEBI Notices

The Securities Appellate Tribunal (SAT) has set aside an order passed by the adjudicating officer of Securities and

Exchange Board of India (SEBI) against 22 entities for alleged manipulation in trading in Sarang Chemicals Ltd.

Pincon Spirits admits arrest of its chairman Monoranjan Roy, but mum on why it failed

to update the exchanges

Kolkata-based Pincon Spirits Ltd has admitted that its chairman Monoranjan Roy was arrested by the police on

2nd November from Bengaluru airport and is in the custody of Jaipur Police till 9 November 2017. The company gave this

clarification as sought by BSE, based on a news item published by Moneylife

RTI Empowerment: Patients are scarce at Pt Bhimsen Joshi Hospital in Mira Bhaindar,

finds activist Krishna Gupta

Probably for the first time, a Right to Information (RTI) activist has used the Section 2(j) of the RTI Act to conduct

a physical inspection of a public premise. The premises in question were that of the 100-bed Pandit Bhimsen Joshi

(Temba) Hospital, a new facility run by the Mira Bhaindar Municipal Corp (MBMC)

RTI exposes flaws un-calibrated speed guns used by Delhi traffic police

The next time you are accused of speeding, when you believe you are within the rules, you could well be right—no

matter what the reading on the speed guns used by the traffic police to catch you and impose a fine. When Delhi-based

Savyasachi Marwaha was intercepted and fined for speeding, even when he was driving his car at low speed, he decided

to get to the bottom of how the system worked.

EXCLUSIVE VIEWS On issues that matter to you

Banks Recapitalisation: Why can’t EPFO link Employee

The need is Rs5 lakh different PF accounts appreciation and

crore to meet Basel III through one UAN? recognition: How

capital norms Veeresh Malik to go about it

Dr B Yerram Raju Jayant Kadambi

For the latest news, exclusives and reports on our activities TO GET THIS AND MUCH MORE INSTANTLY,

twitter.com/MoneylifeIndia http://www.facebook.com/moneylife.in SUBSCRIBE TO OUR DAILY & WEEKLY

NEWSLETTER FREE

Web Content.indd 1 17-11-2017 17:45:17

HAVE YOU

SUBSCRIBED YET?

Trusted to keep

Your Saving Safe

(Subscription Form overleaf)

Magazine Subscription revised 28 April 15.indd 2 29-07-2016 16:02:58

Our boldness comes at a small price

Go

Digital subscription Digital

We have stopped taking print subscriptions. Now!

Here is how you benefit

1. Avoid the traps of mis-selling w

which

hich burn a hole need financial help. So, Moneylife is extremely

in your savings useful for NRIs too

2. Get our fair and unbiased information with no 5. Automatically be a member of Moneylife

hidden agenda Foundation and receive our daily newsletters

3. Access the magazine online immediately on the 6. Automatic basic membership of Moneylife

release date Advisory Services, financial advisory service

4. Persons of Indian origin have family here who

Period No. of Issues Annual Subscription

1Year Subscription (Only Digital Access) Rs1,170

26 Issues

(Please tick) NEW SUBSCRIBER EXISTING SUBSCRIBER

YOUR SUBSCRIPTION NO.

NAME: ______________________________________________________________________________________ GENDER: ___________________

ADDRESS: _____________________________________________________________________________________________________________

DETAILS

BASIC

_____________________________________________________________________________________________________________________

PHONE: (Office):_______________________Phone (Res): _________________________E-mail address: ______________________________________

DATE OF BIRTH: _______________________(MM) (DD) (YY)

PROFESSION:_________________________DESIGNATION: ________________________

( ) Please find enclosed ( ) Cash ( ) Cheque / ( ) Demand draft number ____________ Dated: _____________ for Rs1,170 Favouring Moneywise Media Pvt Ltd

PAYMENT

DETAILS

DATE: _________________ SIGNATURE: ________________________________

Please fill in this order form and mail it with your remittance to Moneywise Media Pvt Ltd, 316, 3rd Floor, Hind Service Industries Premises, Off Veer Savarkar Marg, Shivaji Park, Dadar (W),

Mumbai 400 028. #All disputes shall be subject to Mumbai jurisdiction only.

Subscription Form 12 Oct 2017.indd 3 03-11-2017 18:35:05

CROSSHAIRs

Exclusive news, the stories behind the

headlines and the truth between the

lines by Sucheta Dalal

From Panama to Paradise – No Sign of

the Bulk of Indian Black Money

Y

et another big global leak of confidential papers Paradise papers, is a British citizen. Ms Radia made

exposing rampant tax evasion and hardly any headlines for the leaks of her taped conversation

really big names from India—isn’t it strange? lobbying for ministerial portfolios, pushing policy

And, yet, India ranks a high 19, out of 180 countries, changes and influencing media on behalf of her

in terms of the number of people named in the clients—Mukesh Ambani and Ratan Tata.

documents. The Paradise papers, a leak of 13.4 million The Indian names, published so far, include those

confidential documents pertaining to clients of two of the Sun group founded by NL Khemka (according

law firms—Appleby, based in Bermuda and Asiaciti to The Indian Express, it has 118 offshore entities

of Singapore—were released by the International and is the second largest client of Appleby), which is

Consortium of Investigative Journalists (ICIJ) earlier likely to face detailed scrutiny. There is the flamboyant

this month. The leaked documents, allegedly, reveal Vijay Mallya, whose troubles continue to mount. The

tax evasion by rich and powerful individuals and Indian Express alleges that Vijay Mallya diverted

companies across the world through artificial entities over $1.5 billion through four offshore subsidiaries

registered in 19 tax havens. of United Spirits Limited (USL), India as loans. When

The Indian government was extremely swift in Diageo acquired control of USL for Rs1,225 crore,

announcing a multi-disciplinary committee last year to these funds, shown as debts were waived. In effect,

investigate the Panama papers (a similar leak in 2016 the Appleby documents indicate that Diageo paid

of 11.5 million files from the Panama-based law firm over Rs10,000 crore to Mr Mallya which has been

of Mossack Fonseca & Co which included the names hidden from the Indian shareholders, regulators and

of several leading politicians around the world but tax authorities. This is bound to come up, with Mr

nothing of great significance from India). It has, once Mallya’s extradition hearings in the United Kingdom

again, been quick in announcing the reconstitution of begin shortly.

this committee, in response to Paradise papers. The Superstar Amitabh Bachchan figures again in the

committee comprises officials of the Reserve Bank of Paradise papers (he and daughter-in-law Aishwarya

India (RBI), central board of direct taxes, enforcement Rai figured in the Panama papers too); but, since

directorate and the financial intelligence unit of the he has chosen to remain silent, it is not clear if any

finance ministry. But, having offshore accounts is not, wrongdoing would eventually be established. Similarly,

in itself, a crime; the government permits setting up what is reported so far, about several political figures,

of overseas bodies for bonafide business activities and including Jayant Sinha, Manyata Sanjay Dutt (wife

Indians are also allowed to invest as much as $250,000 of actor Sanjay Dutt), or BJP member of Parliament

overseas. Ravindra Kishore Singh, appears so tiny that the

Moreover, although the Paradise papers threw investments could easily be done under the limits

up 714 Indian names (only a few have been released permitted by the government for individuals. The

so far), all Indian-sounding names needn’t be Indian Indian Express reports that Dr Ashok Seth, chairman

citizens. For instance, corporate lobbyist Niira Radia, of Fortis-Escorts and Padma Bhushan awardee, had

whose companies figure in what are now called the shares in a Singapore-based company whose stents he

MONEYLIFE | 24

27Nov-7

November

Dec 2017

2014 | 20

14

Crosshair.indd 2 17-11-2017 18:53:20

prescribes to patients. He has, since, sold the shares. An the Panama papers, had found that only 147 are

investigation by the committee would reveal whether actually actionable and its investigation has led to the

there is any financial impropriety, although it raises disclosure of Rs792 crore so far. The I-T department

issues about moral propriety. Entities being investigated has already launched criminal prosecution in five cases

in what is known as the Rajasthan ambulance scam, and conducted searches, or issued notices, in several

including politically exposed persons (PEPs) figure in others. Amang these is Vijay Choudhary, promoter of

the Appleby papers. The documents ought to provide Zoom Developers, one of the biggest bank defaulters

additional ballast to the probe. (which owes nearly Rs3,000 crore), was arrested by

Unfortunately, none of this adds up to huge the enforcement directorate in May this year under the

revelations about laundered money. We have all Prevention of Money Laundering Act (PMLA).

seen the stupendous increase in wealth flaunted by And, yet, none of this adds up to the big war on

politicians across the spectrum without any visible black money that one expects. The numbers cited,

means of income to justify their lifestyle and spending. over the years, are mind-boggling. A Hindustan Times

Even Subrata Roy, Amitabh Bachchan’s s former buddy, report in November 2016 said, “Goods and services

still has plenty of money to splash on advertisements, worth at least Rs17 trillion were exported by Indians

hoardings and hiring stadiums for public meetings in over the past four decades but did not remit an

18 cities, despite spending two years in jail for failing equivalent amount in foreign exchange.” This money

to make bail payments in accordance with a Supreme was probably siphoned abroad through phoney export

Court order. deals or under- and over-invoicing of goods. Other,

Remember, India is apparently hard at work trying more modest estimates of black money have ranged

to track down black money since 2008, when we from $181 billion to $1.8 trillion, according to Prof R

(albeit reluctantly) obtained information from Germany Vaidyanathan’s book Black Money and Tax Havens. A

on those who had accounts with LGT, a Liechtenstein 2014 study by the Associated Chambers of Commerce

bank. There were three other lists of money stashed and Industry had estimated black money stashed

overseas even before the Panama and Paradise leaks. abroad at $2 trillion.

There was a list of 700-odd names from data stolen The Panama or Paradise papers are a step forward,

from HSBC’s Geneva branch that was handed over by but still not the bombshell one has been led to

the French government; two other lists of stolen data expect. So what is the way forward? Dr Subramanian

were available from Denmark and Finland. Swamy, member of parliament, has outlined four

Although these were non-serious efforts under the ways, in an article in The Hindu. First, use the Swiss

previous government, the NDA (National Democratic government’s cooperation to confiscate money held in

Alliance) has shown greater determination. A new Swiss bank accounts by using Switzerland’s Law on

Black Money Act was passed in 2015; a voluntary International Judicial Assistance in Criminal Matters.

disclosure with very steep penalties coincided with Secondly, follow the French or German method of

the harsh demonetisation of currency that threw the using ‘inducements’ to secure leaks of information

country in turmoil;; none of these has led to from specific banks and act on it. Unfortunately, India

any significant revelations.

elations. The multi- has not done much even when these governments

disciplinary group (MDG) probing information. Third, use the US

offered specific inf

black money stashed ed overseas has arresting and accusing Swiss bankers

method of arresti

already submitted five reports to the of espionage and forcing the government to hand

Supreme Court appointed

pointed special over information about Americans holding illegal

investigation team (SIT) headed by Swiss bank accounts.

accou The fourth suggestion,

two former judges of the apex court. says Dr Swamy, w was made by the jurist Fali S

The SIT, in turn, hasas submitted Nariman; it was tto invoke a resolution of the

a sealed cover report

ort to the UN Convention against Corruption and to

Supreme Court. pass a law to nationalise all bank accounts

Further, the of Indian citizens

c in the 90-odd nations

income-tax (I-T) where black

bla money is stashed. Next,

department, on get possession

poss of the money through

inquiring into bilateral

bilatera negotiations with each of

426 names these countries.

c

revealed by The

T Modi government is high on

rhetoric

rheto about black money, but will

Subramanian Swamy it dare

d to experiment with these

has the answers for

how to unearth black bolder

bo suggestions to get real

money

results?

re

21 | 24 Nov-7 Dec 2017 | MONEYLIFE

Crosshair.indd 3 17-11-2017 18:53:40

DIFFERENT STROKES SUCHETA DALAL

A Coercive State, in Full Flow

I

t was, finally, the anniversary of the currency objections raised by industry associations to the oppressive

demonetisation that brought out some truths about the and punitive provisions in the statute were ignored as

source of the many goof-ups that put people through the Bill was rushed through parliament. Moneylife had

untold harassment. Ironically, the truth was told in a huge, published a Cover Story ( Moneylife 4-19 September 2013)

self-laudatory article that had the temerity to dismiss the on the implications of these brutal provisions. There is a

mistakes, as almost inconsequential. Before we go into it, lot worse in the Companies Act, 2013, which gives the

let’s look at a couple of issues, to put into perspective how government power to cripple company directors through

hasty decisions have thrown people and companies into fines and imprisonment.

turmoil. This is not limited to demonetisation (where new Let us return to the drastic decision to demonetise

rules and circulars were issued almost 84% of currency that first exposed

every day), or to the ill-prepared launch this regime’s penchant for rash

of the Goods and Services Tax (GST) and harsh decisions. The best that

where, again, the government is back- supporters of demonetisation can

peddling furiously, correcting mistakes claim is that the benefits will come

and trying to smoothen things after it later. The government argues that

is clear that business and industry was laundered money is now sitting in

hurting badly and struggling to cope. bank accounts and this leaves a trail

The haste to trap black money which it is unearthing. The decision

credited to bank accounts has led to a to de-register 200,000 shell companies

decision to disqualify 300,000 directors (a good and bold decision), and the

of companies merely for delayed filing foolish one to disqualify directors,

of annual accounts. This is a separate is a part of the attempt to bolt the

exercise from the decision to strike stable doors.

off 200,000 shell companies that the Whether it succeeds will depend

prime minister (PM) has mentioned A good chunk of the on whether the tax machinery is

in many of his speeches. Since this money credited to bank able to prevent this money from

has not made media headlines, the being withdrawn without paying tax

accounts will be quietly

government is in no hurry to find a or even paying just 33% like other

solution. Innumerable large, medium,

converted in connivance law-abiding taxpayers. Ultimately,

small and tiny companies are in deep with tax officials while a everything is in the hands of individual

turmoil along with a few lakh other few raids will keep up the tax assessing officers and, at this level,

companies where the disqualified façade of recovery anecdotal reports indicate that there

persons are directors. Company is no visible reduction in corruption

officials crowding registrar of companies’ (RoC) offices or the tendency to harass taxpayers.

are told that the government recognises the problem and We recently had the opportunity to listen to two bulge-

some palliative will be offered, but nobody knows when. bracket taxpayers, who are routinely harassed, despite

Meanwhile, companies are scrambling to find new paying tens of crores of rupees in tax. The first one said

directors to replace those who have been disqualified there is an improvement under this government—not

without so much of a warning or a show-cause notice. because there was no attempt to harass him, but because,

And, if any of our readers believes this is a criticism of when he yelled back and asked a senior tax official whether

this government’s functioning, it is. But let me also point he ‘seriously wanted to harass a law-abiding taxpayer?’,

out that these draconian provisions were pushed through the officer backed off. There is fear of action, he concludes.

in the Companies Act, 2013, piloted by Sachin Pilot, a The second one said he has no time or inclination to face

Wharton School (US) alumnus, when he was minister harassment and humiliation, despite paying full tax (I must

of corporate affairs under the terrible second term of mention here that there is no scope anymore to fudge tax

the United Progressive Alliance (UPA). Thousands of liability on income from investments). So his accountant

MONEYLIFE | 24 Nov-7 Dec 2017 | 22

DIFFERENT STROKES.indd 2 17-11-2017 17:50:05

DIFFERENT STROKES SUCHETA DALAL

is allowed to make reasonable payments (bribes or speed drama about Rs500 and Rs1,000 being declared tools

money) that are routinely demanded. Clearly, a good of hoarding black money?

chunk of the money credited to bank accounts will be 2. Secondly, he claims, “lower denomination notes were

quietly converted in connivance with tax officials while a issued in plenty.” If that were true, why were 12 billion

few raids will keep up the façade of recovery. Senior tax pieces of lower denomination pieces pushed into the

officials tell us that this is happening already. market in a hurry only after public anger began to

This brings us back to whether blundering officials at mount?

the Reserve Bank of India (RBI) increased our hardship by 3. Had Mr Gandhi’s grand plan anticipated the large

botching up the implementation of demonetisation. In a gap between Rs100 and Rs2,000, creating a void in

jaw-dropping claim, R Gandhi, former deputy governor of denominations for daily transactions? If so, shouldn’t

the RBI who was in charge of the demonetisation exercise, the Rs200 note have been put into circulation before the

claims in an article in The Economic Times that large-scale demonetisation exercise, since it was unlikely to arouse

preparation preceded demonetisation and its “execution suspicion. Instead, Rs200 has been introduced last,

was to the script; and unanticipated almost as an afterthought and is still

mid-course corrections were minimal.” not available in sufficient numbers.

He also says that the many policy 4. Outrageously, Mr Gandhi writes:

reversals, course-corrections, etc, “Yet another blow to our plans was

were also part of the plan and even the public behaviour (or should I say

the misuse of Jan-Dhan accounts non-behaviour) relating to digital

(people being used as ‘money mules’ payments.” He had ‘factored’ that

to launder money) and corruption of with people’s cash vanishing overnight

bank officials was anticipated and and stringent limits on withdrawal,

factored in! In other words, if asked to people would switch to ‘RTGS/NEFT,

do it all over again, the same hardship, Internet and mobile banking. Since

or worse, will be inflicted on people, RBI does not speak to people, he is

because RBI thinks everything went In a jaw-dropping clueless about the fact that most of

as per plan. If some lives were lost, claim, R Gandhi, who these transactions need some learning

that was mere collateral damage. In was in charge of the and confidence level; while people

another media interview, he said, the demonetisation in RBI, did open PayTM and other e-wallets,

only thing he would do differently is claims that large-scale RBI itself did not put in place digital

to print more Rs500 notes (this was preparation preceded safety regulations until Moneylife

done by asking the RBI security press it and its “execution Foundation campaigned vociferously

at Mysuru to take up printing of Rs500 for it, long after the demonetisation

was to the script, and

after public anger began to explode). exercise was over. Does this indicate

The preposterousness of these claims

unanticipated mid-course meticulous planning?

requires some response. So here are a

corrections were minimal” 5. Mr Gandhi’s article omits

few quick points. uncomfortable issues that are still

1. Mr Gandhi explains that stocking 200,000 ATM unsettled. For instance, many non-resident Indians

machines with 2000-rupee notes was expected to (NRIs) and those who were not in the country in

increase the number of ‘touch points’ to withdraw November 2016 and deposited demonetised currency

money. But that didn’t happen when it was needed, in designated RBI branches are still waiting for their

did it? The biggest goof-up of failing to stock ATM money to be credited into their accounts. Why didn’t

machines, anticipating the need to calibrate each the plan consider this? Or is it okay for the State to

one physically for smaller size notes is probably the make ones hard-earned money worthless for things

biggest blunder in handling demonetisation. Mr Gandhi beyond their control?

dismisses this as a minor issue saying, “with the benefit Clearly, when a coercive State is in action, planning is

of hindsight, I wish we had handled it differently.” He not necessary; people are expected to put up with hardship

has also claimed elsewhere, that introduction of 2000- in the nation’s moral and ethical interest.

rupee note was irrespective of demonetisation and

RBI had even recommended introduction of notes of Sucheta Dalal is the managing editor of Moneylife. She was

Rs5,000 and Rs10,000 denominations. If so, doesn’t awarded the Padma Shri in 2006 for her outstanding contribution

it make you wonder about the timing, sequence and to journalism. She can be reached at sucheta@moneylife.in

23 | 24 Nov-7 Dec 2017 | MONEYLIFE

DIFFERENT STROKES.indd 3 17-11-2017 19:30:58

MUTUAL FUNDS POINTERS

Why Do These Liquid Funds Have

1% Expense Ratios?

W

hen the equity markets are expensive, some a minimum.

investors re-balance their portfolios and shift Though this practice is spread across all liquid schemes,

to liquid schemes or bank fixed deposits. This this has effectively reduced the difference in the returns

is done with the anticipation of re-entering equities when between the regular and direct plans. Yet, there are a couple

the market becomes reasonably priced. But if the liquid of schemes that have a big difference in the expense ratios

scheme delivers 6%, an investor in the highest tax bracket which has created a gap in performance. Here are the three

will make a meagre 4.2% by way of annual post-tax returns. liquid schemes whose regular plans’ expense ratios are

High Expense Schemes

Scheme Name Regular Plan TER 1-year Returns Direct Plan TER 1-year Returns

Reliance Liquid- Cash Plan 1.05% 5.80% 0.11% 6.80%

Principal Money Manager 1.14% 6.50% 0.31% 7.20%

L&T Cash 0.78% 5.40% 0.09% 6.25%

TER: total expense ratio as on 31 October 2017

We already have liquid schemes which have dropped from higher than those of their direct plans.

6% and are now delivering 5.5%. But there is another angle When it comes to liquid schemes, even a 0.25%

to liquid schemes. Imagine if one were to be careless about difference in returns can mean a lot. Individual investors

how one is investing and continues to invest via regular may initially find investing in direct plans tricky compared

plans. What would be the returns and can investing via to the normal distributor route. There are a few platforms

direct plans improve it? which charge an annual fee to purchase direct plans; but

Well, think of this. Does it make sense to pay a there is a free service-provider also, viz., MF Utilities. We

distributor 1% out of the 5%-6% you make on a category have shortlisted a few liquid schemes with low gap in

of investment which is low-effort and offers similar returns expense ratios of their regular and direct plans, coupled

across its category? Asset management companies have with good returns. You can park your surplus in any of

observed this and kept the difference in the expense these schemes’ regular plans through your mutual fund

ratios of regular and direct plans of liquid schemes at distributor. — Clinton Fernandes

Liquid Schemes

Scheme Name AUM (Rs Cr) Regular Plan TER (%) Returns (%)

1-year 3-year 5-year

Axis Liquid 20,503 0.12 6.60 7.49 8.03

Kotak Liquid 12,564 0.03 6.54 7.46 8.02

ICICI Prudential Liquid 31,633 0.24 6.54 7.47 8.04

DHFL Pramerica Insta Cash Plus 6,938 0.09 6.58 7.51 8.02

Kotak Floater 11,223 0.07 6.59 7.53 8.08

L&T Liquid 14,513 0.14 6.58 7.48 8.02

Tata Money Market 12,105 0.14 6.57 7.48 8.06

HSBC Cash 4,780 0.15 6.55 7.44 8.02

Invesco India Liquid 10,268 0.12 6.58 7.50 8.05

Reliance Liquid 27,343 0.19 6.57 7.48 8.04

AUM: assets under management as on 31 October 2017

MONEYLIFE | 24 Nov-7 Dec 2017 | 24

Fund Pointer.indd 2 17-11-2017 18:56:31

MUTUAL FUNDS FUND FACTS

Hot and Cold Stocks of Mutual Funds in October 2017

In October 2017, Axis Bank and SBI Life Insurance Company were the most preferred stocks of Indian

mutual funds. The net purchases of Axis Bank were Rs814.51 crore, of which HDFC Mutual Fund made net

purchases worth Rs539 crore and Franklin Templeton Mutual Fund bought shares worth Rs236 crore. Yes

Bank and HCL Technologies were the most sold companies. The net sales of Yes Bank shares were Rs327

crore, of which HDFC Mutual Fund sold shares worth Rs41 crore.

Top Buys (Rs Crore) Top Sales (Rs Crore)

Axis Bank 814.51 Yes Bank (326.98)

SBI Life Insurance Company 462.34 HCL Technologies (298.56)

Apollo Tyres 434.36 UPL (262.11)

GAIL (India) 422.94 ICICI Bank (258.96)

Cyient 384.62 Adani Ports and Special Economic Zone (218.47)

Reliance Industries 337.02 IndusInd Bank (205.33)

PI Industries 295.57 Zee Entertainment Enterprises (198.35)

Bharti Airtel 289.21 Coal India (195.01)

Larsen & Toubro 287.03 Hindalco Industries (185.68)

ICICI Lombard General Insurance Company 237.15 Tata Steel (174.92)

HDFC Mutual Fund

Axis Bank 539.38 Adani Ports and Special Economic Zone (186.97)

Edelweiss Financial Services 143.69 Maruti Suzuki India (151.93)

RBL Bank 140.04 UPL (142.79)

Tata Chemicals 121.84 Aurobindo Pharma (43.55)

Larsen & Toubro 121.76 Yes Bank (41.27)

ICICI Prudential Mutual Fund

HCL Technologies 137.14 Kotak Mahindra Bank (147.18)

Infosys 136.39 Bajaj Finserv (131.28)

Exide Industries 132.36 Coal India (102.11)

Housing Development Finance Corporation 88.61 Rain Industries (89.36)

HDFC Bank 80.14 Tata Motors (85.77)

Reliance Mutual Fund

Cyient 264.65 HCL Technologies (388.31)

NLC India 137.22 UPL (159.31)

Bharti Airtel 132.47 HDFC Bank (157.63)

Tata Motors 121.12 Tata Steel (122.75)

Larsen & Toubro 112.31 Infosys (109.29)

Franklin Templeton Mutual Fund

Axis Bank 236.21 State Bank of India (250.00)

Oberoi Realty 102.75 IndusInd Bank (218.13)

Dr Lal PathLabs 92.68 Gujarat Pipavav Port (105.39)

BASF India 64.81 Exide Industries (88.12)

Housing Development Finance Corporation 61.65 Coal India (86.38)

25 | 24 Nov-7 Dec 2017 | MONEYLIFE

Fund Facts.indd 2 17-11-2017 18:57:57

SMART MONEY R BALAKRISHNAN

Preserving Capital… and

Sanity in a Bull Market

B

ull markets show us as being very smart. All our In a bull market, what I will talk about is the rate

chosen stocks work out very well or at least the of earnings growth, the attractiveness of the sector and

majority of them. The change from one week to the justify a buy decision. The stock has moved up nearly

next is on the quantum of gain we see in our portfolio. five times in a year.

Good times call for temporary suspension of logic and work However, I take a deeper look and I see that the business

on improving our ‘hearing’ skills. We have to hear the name is contracting; debtors and sales are sometimes estimated

of the stock before the others. But, while we celebrate the numbers. The company has increased its total indebtedness

joys of a bull market, let me try and engage your attention more than proportionate with its sales growth. And,

with some mundane things going by my experience,

about investment analysis. it unlikely to be able to

At a recent get-together on keep the show going, at

balance sheet analyses, we this rate. What it means

were discussing the section is that the company will

on analysis of cash flow. constantly need cash more

I had cited examples than its sales growth, since

of companies that are it generates its revenue

apparently profitable, only by deploying more

but it takes some detailed fixed assets. So it has to

analysis to predict where reach a scale and size that

the company is headed. The is such that it can reduce

profit & loss and balance its incremental growth

sheet analysis has to take us to a size that is smaller

beyond the obvious. What than its realised profits.

happens is that in a bull Cash flows tell the story

run, even a bhangar, or kachra company looks like a great of ‘probable’ success or failure. When companies keep

company. There are similarities on the surface. But, deep accessing the markets frequently for raising money, the

inside, there are killer differences. Let me reproduce the probability of longevity is low. Unless the total leverage

‘What you see’ in a company that is in a ‘hot’ sector and keeps reducing, the risks continue to be very high. Of

is on the hi-speed price elevator in this market: course, one can always argue about a bright future, so

investing or not investing in the stock is a function of an

investor’s gullibility.

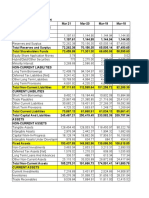

A Hot Stock FY15-16 FY16-17

Similarly, in this market, we see people looking at

EPS (Rs ) 20 26

the book value of the share and commenting on the

Share Price (Rs) 1,000 — replacement price. They conveniently forget the total

P/E 50 38 debt. Maybe, the assumption is that banks are not to be

Dividend Per Share (Rs) — 1.00 taken seriously. Recently, there was a discussion on old

9 Research Reports with Buy ‘brands’. In the marketplace, ‘brands’ and ‘virtual space’

seem to give the best valuations. So everyone is busy

trying to locate once-popular brands like BPL, Garden,

Maharajah, Kelvinator, etc, and place their bets on them.

FY17-18 FY18-19

Of course, it is imprudent to speak about the financials. It

EPS Forecast 31 40

is very unlikely that we will see old brands coming back.

One Year Ago Price (Rs) 226 At best, someone business rival may emerge as a ‘buyer’

Steady Upward Moving Curve No Jerks and simply kill the brand. These companies would have

a lot of debt, lost key people and need a lot of resources

MONEYLIFE | 24 Nov-7 Dec 2017 | 26

column_Balakrishnan.indd 2 17-11-2017 17:03:09

SMART MONEY R BALAKRISHNAN

to fight for space. You have to hope that there are others who have similar

As the bull market keeps rolling on, there is a constant thoughts and chase the stocks that you buy. We all probably

search for themes. Commodity plays become value and know how to board a running train. The more difficult

‘growth’ plays. And the action is far higher on the mid- part is knowing when to get off. There is no one who can

cap and small-cap space because this is where sketchy predict when the bull gets tired and the bear takes over.

information works best and it is easy to plant stories. No one can forecast which will be the proverbial ‘straw on

Mostly, these shares are illiquid and, very often, it is easy the camel’s back’. A bull market that ignores all warnings

to move prices. Thanks to social media, today, a large body may cool off for no reason and it does not take long for

of the unsuspecting public investors also are roped into panic among the weak and late buyers to set in. Further,

the ‘pump & dump’ game. The fixers never had it so easy. in a market where many buyers are leveraged, the leverage

Most of us lose our bearings in a acts as a panic accelerator when the

bull market. We forget that two and tide turns. And, when the selling

two is always four. The arithmetic of A simple rule for this starts, you will only see constant

investment returns does not change. lower circuits on the stocks that

Measuring returns is still a function

market: use either the seemed to defy gravity.

of what profits come in on invested valuation based on A simple rule for this market: use

money. It is not about some vague profit or the balance either the valuation based on profit

matrices like eyeballs, footfalls and or the balance sheet, as the case may

brand value. All of these have to,

sheet, to measure your be, to measure your risk. For most

finally, result in a single number that risk. The bigger the gap commodity companies, the farther

can be measured. It is not very wise between the P/E and away from book value + debt per

to compare equity with the way, share, the higher is your risk. For

say, a painting is valued. Going to

the RoE, the higher is companies that you buy because of