Escolar Documentos

Profissional Documentos

Cultura Documentos

How to Calculate Share Price Using DCF Model

Enviado por

Md Rasel Uddin ACMA0 notas0% acharam este documento útil (0 voto)

28 visualizações2 páginasThis document outlines the steps to perform a discounted cash flow (DCF) valuation. It includes:

1) Forecasting free cash flows over the projection period. Free cash flow is calculated as EBIT (1-tax) + depreciation - change in working capital - capital expenditures.

2) Calculating the terminal value using either a perpetuity growth model or multiples approach.

3) Discounting all free cash flows and terminal value back to the present using the weighted average cost of capital (WACC) as the discount rate.

4) Calculating implied equity value, share price, and comparing to the market price per share.

Descrição original:

Título original

DCF.pdf

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoThis document outlines the steps to perform a discounted cash flow (DCF) valuation. It includes:

1) Forecasting free cash flows over the projection period. Free cash flow is calculated as EBIT (1-tax) + depreciation - change in working capital - capital expenditures.

2) Calculating the terminal value using either a perpetuity growth model or multiples approach.

3) Discounting all free cash flows and terminal value back to the present using the weighted average cost of capital (WACC) as the discount rate.

4) Calculating implied equity value, share price, and comparing to the market price per share.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

28 visualizações2 páginasHow to Calculate Share Price Using DCF Model

Enviado por

Md Rasel Uddin ACMAThis document outlines the steps to perform a discounted cash flow (DCF) valuation. It includes:

1) Forecasting free cash flows over the projection period. Free cash flow is calculated as EBIT (1-tax) + depreciation - change in working capital - capital expenditures.

2) Calculating the terminal value using either a perpetuity growth model or multiples approach.

3) Discounting all free cash flows and terminal value back to the present using the weighted average cost of capital (WACC) as the discount rate.

4) Calculating implied equity value, share price, and comparing to the market price per share.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 2

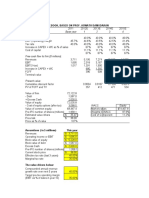

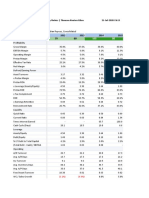

Discounted Cash Flow (DCF) Model (Academic Quality)

Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Term

Revenue 100.0 110.0 116.6 121.3 124.9 127.4

% Growth YoY 10% 6% 4% 3% 2% 2%

COGS 40.0 44.0 46.6 48.5 50.0 51.0

% COGS Margin 40% 40% 40% 40% 40% 40%

GPM 60.0 66.0 70.0 72.8 74.9 76.4

Op Ex 20.0 22.0 23.3 24.3 25.0 25.5

% OpEx Margin 20% 20% 20% 20% 20% 20%

EBITDA Step 1: Forecast Free Cash Flows

40.0 44.0 46.6 48.5 50.0 51.0 52.0

DA 10.0 11.0 11.7 12.1 12.5 12.7

EBIT 30.0 33.0 35.0 36.4 37.5 38.2

NOPAT aka. EBIT(1-T) 19.5 21.5 22.7 23.6 24.4 24.8

DA 10.0 11.0 11.7 12.1 12.5 12.7

Change in [O]WC -5.0 -5.5 -5.8 -6.1 -6.2 -6.4

Capex -12.0 -13.2 -14.0 -14.6 -15.0 -15.3

FCF 12.5 13.8 14.6 15.2 15.6 15.9 16.2

FCF (Discounted) 11.6 11.8 11.6 11.1 10.6 10.0

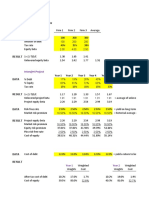

Terminal Value (Growth Model) Tax 35%

Terminal Value @ 6 kd 7.0%

FCF(next) 16.2 wd 30%

WACC 8.0% RFR 3.5%

Step 2: Calculate

g

Terminal EV

2%

270.0

beta

ERP

Step 3: Discount all 1.2

5.0%

Implied EV / EBITDA 5.2x ke 9.5%

Terminal Value we values to PV 70%

Terminal Value (Multiple Method) WACC 8.0%

EV / EBITDA Multiple 5.0x

EBITDA 52.0 Value of Cash Flows $66.7 29%

Implied Terminal EV 259.9 Terminal Value $166.8 71%

Total Enterprise Value $233.5 100%

Average Terminal EV 265.0

PV of Terminal EV 166.8 Total Debt $70.1

Step 4: Calculate Implied

Excess Cash

Net Debt

$30.0

$40.1

Share Price

Implied Equity Value $193.5

Number of Shares 100

Implied Share Price $1.93

Download DCF guide and model at http://amgstr.blogspot.com/2010/12/dcf.html

1. How do you calculate Free Cash Flow?

Unlevered Free Cash Flow = EBIT (1 – Tax) + DA – Change in Working Capital – Capital Expenditure

2. How do you calculate terminal value?

Method 1: Growth Model

FCF1 / (WACC – g)

Method 2: Multiples

EV = EV Multiple x EBITDA

3. What discount rate do you use?

Weighted average cost of capital (WACC) – use a discount rate whose stakeholders match the free cash

flow. Note: if you use free cash flow to equity (FCFE), the appropriate rate is the cost of equity (ke).

3.a How do you calculate WACC?

WACC = kd x (1 – Tax Rate) x wd + ke x we

kd = cost of debt

wd = weight of debt

ke = cost of equity

we = weight of equity

3.b How do you calculate cost of equity (ke)

Using Capital Asset Pricing Model (CAPM):

ke = RFR + beta x (ERP)

3.c What would you use for the Risk Free Rate?

10 or 30 year government treasury yield

3.d How do you find beta for an IPO?

Beta is based on historic data, so an IPO won’t have an observable or equity beta. Unlever comparable

company betas, average (as industry or asset betas should be the same) and relever based on new

company capital structure.

4. How do you get to share price from EV?

EV = Market Cap + Net Debt

Net Debt = Total Debt – Cash

Market Cap = EV – Nebt Debt = Price per share x Number of shares

Download DCF guide and model at http://amgstr.blogspot.com/2010/12/dcf.html

Você também pode gostar

- 107 10 DCF Sanity Check AfterDocumento6 páginas107 10 DCF Sanity Check AfterDavid ChikhladzeAinda não há avaliações

- DCF AnalysisDocumento3 páginasDCF AnalysisJerry YoungAinda não há avaliações

- Is Excel Participant - Simplified v2Documento9 páginasIs Excel Participant - Simplified v2dikshapatil6789Ainda não há avaliações

- Sample DCF Valuation TemplateDocumento2 páginasSample DCF Valuation TemplateTharun RaoAinda não há avaliações

- Sample DCF Valuation TemplateDocumento2 páginasSample DCF Valuation TemplateTharun RaoAinda não há avaliações

- Sample DCF Valuation TemplateDocumento2 páginasSample DCF Valuation TemplateTharun RaoAinda não há avaliações

- IS Excel Participant - Simplified v2Documento9 páginasIS Excel Participant - Simplified v2Art EuphoriaAinda não há avaliações

- DCF Analysis Discounted Cash Flow ValuationDocumento4 páginasDCF Analysis Discounted Cash Flow ValuationChristopher GuidryAinda não há avaliações

- Manaal - Commercial Banking W J.P MorganDocumento9 páginasManaal - Commercial Banking W J.P Morganmanaal.murtaza1Ainda não há avaliações

- Target ExerciseDocumento18 páginasTarget ExerciseJORGE PUENTESAinda não há avaliações

- Is Excel Participant Samarth - Simplified v2Documento9 páginasIs Excel Participant Samarth - Simplified v2samarth halliAinda não há avaliações

- IS Excel Participant - Simplified v2Documento9 páginasIS Excel Participant - Simplified v2animecommunity04Ainda não há avaliações

- Davis Industries Financial Summary 2015-2017Documento10 páginasDavis Industries Financial Summary 2015-2017Aaron Pool0% (2)

- IS Excel Participant (Risit Savani) - Simplified v2Documento9 páginasIS Excel Participant (Risit Savani) - Simplified v2risitsavaniAinda não há avaliações

- DCF ModelDocumento58 páginasDCF Modelishaan0311Ainda não há avaliações

- Task 1 AnswerDocumento9 páginasTask 1 AnswerSiddhant Aggarwal0% (4)

- (More Like This) : KEY FIGURES (Latest Twelve Months - LTM) Balance Sheet (At A Glance) in MillionsDocumento4 páginas(More Like This) : KEY FIGURES (Latest Twelve Months - LTM) Balance Sheet (At A Glance) in MillionsKrishna JalanAinda não há avaliações

- Company Valuation and Sensitivity Analysis TableDocumento5 páginasCompany Valuation and Sensitivity Analysis TableKhushi singhalAinda não há avaliações

- Is Excel Participant - Simplified v2Documento9 páginasIs Excel Participant - Simplified v2Yash JasaparaAinda não há avaliações

- Masonite Corp DCF Analysis FinalDocumento5 páginasMasonite Corp DCF Analysis FinaladiAinda não há avaliações

- Appendix 1 Conservative Approach: (In FFR Million)Documento6 páginasAppendix 1 Conservative Approach: (In FFR Million)Sarvagya JhaAinda não há avaliações

- IS Excel Participant - Simplified v2Documento9 páginasIS Excel Participant - Simplified v2deepika0% (1)

- AirThreads Valuation SolutionDocumento20 páginasAirThreads Valuation SolutionBill JoeAinda não há avaliações

- How to use the DCF model tutorialDocumento9 páginasHow to use the DCF model tutorialTanya SinghAinda não há avaliações

- Total TemplateDocumento35 páginasTotal TemplateQuinn CoughlinAinda não há avaliações

- Can Enterprise Value Be Negative? Sure!: Discounted Cash Flow (DCF) Analysis - Assumptions and OutputDocumento1 páginaCan Enterprise Value Be Negative? Sure!: Discounted Cash Flow (DCF) Analysis - Assumptions and OutputziuziAinda não há avaliações

- DCF Base Year 1 2 3 4 Assumptions:: Valuation of Facebook, Based On Prof. Aswath DamodaranDocumento12 páginasDCF Base Year 1 2 3 4 Assumptions:: Valuation of Facebook, Based On Prof. Aswath DamodaranSahaana VijayAinda não há avaliações

- Suggested End of Chapter Problems and QuestionsDocumento4 páginasSuggested End of Chapter Problems and QuestionsThe oneAinda não há avaliações

- RatioDocumento11 páginasRatioAnant BothraAinda não há avaliações

- Breaking Events: Building MaterialsDocumento5 páginasBreaking Events: Building Materialsapi-26443191Ainda não há avaliações

- Business Valuation ModelDocumento14 páginasBusiness Valuation Modeldagagovind7Ainda não há avaliações

- Nike Inc Cost of Capital Blaine KitchenwDocumento11 páginasNike Inc Cost of Capital Blaine KitchenwAlvaro Gallardo FernandezAinda não há avaliações

- Airbus ValoDocumento19 páginasAirbus ValobendidisalaheddineAinda não há avaliações

- Soumya Lokhande 1353 - Manmouth CaseDocumento13 páginasSoumya Lokhande 1353 - Manmouth CasednesudhudhAinda não há avaliações

- DCF Model NotesDocumento3 páginasDCF Model NotesAkshit SoniAinda não há avaliações

- Colgate Palmolive ModelDocumento51 páginasColgate Palmolive ModelAde FajarAinda não há avaliações

- FCFF vs. FCFE CompletedDocumento1 páginaFCFF vs. FCFE CompletedPragathi T NAinda não há avaliações

- Valuation-FCFF-FCFEDocumento14 páginasValuation-FCFF-FCFEMeriam HaouesAinda não há avaliações

- Nike Inc - Cost of Capital - Syndicate 10Documento16 páginasNike Inc - Cost of Capital - Syndicate 10Anthony KwoAinda não há avaliações

- Discounted Cash Flow-Model For ValuationDocumento9 páginasDiscounted Cash Flow-Model For ValuationPCM StresconAinda não há avaliações

- Emv Case Study 1Documento8 páginasEmv Case Study 1ViddhiAinda não há avaliações

- Company Name LBO Model Summary & ReturnsDocumento13 páginasCompany Name LBO Model Summary & ReturnsGabriel AntonAinda não há avaliações

- Complete Private Equity ModelDocumento16 páginasComplete Private Equity ModelMichel MaryanovichAinda não há avaliações

- Company Name LBO Model | July 25, 2022Documento12 páginasCompany Name LBO Model | July 25, 2022ousmaneAinda não há avaliações

- 2019-09-21T174353.577Documento4 páginas2019-09-21T174353.577Mikey MadRat100% (1)

- Income Statement Projections: Step 2: Calculate Historical Growth Rates and MarginsDocumento2 páginasIncome Statement Projections: Step 2: Calculate Historical Growth Rates and MarginsNamitAinda não há avaliações

- 1958-1977 Financial Analysis and NPV Calculations of a Potential New ProductDocumento6 páginas1958-1977 Financial Analysis and NPV Calculations of a Potential New ProductDHRUV SONAGARAAinda não há avaliações

- FCFF Vs FCFE Reconciliation TemplateDocumento2 páginasFCFF Vs FCFE Reconciliation TemplateLalit KheskwaniAinda não há avaliações

- FCFF Vs FCFE Reconciliation Template: Strictly ConfidentialDocumento2 páginasFCFF Vs FCFE Reconciliation Template: Strictly ConfidentialvishalAinda não há avaliações

- The Warren Buffett Spreadsheet Final-Version - PreviewDocumento335 páginasThe Warren Buffett Spreadsheet Final-Version - PreviewHari ganesh RAinda não há avaliações

- Samsung Electronics: Earnings Release Q2 2016Documento8 páginasSamsung Electronics: Earnings Release Q2 2016Syed Mohd AliAinda não há avaliações

- Momo Operating Report 2Q20Documento5 páginasMomo Operating Report 2Q20Wong Kai WenAinda não há avaliações

- Analisis FinancieroDocumento124 páginasAnalisis FinancieroJesús VelázquezAinda não há avaliações

- Plantillas Excel Vio - IiDocumento29 páginasPlantillas Excel Vio - IiEduardo Lopez-vegue DiezAinda não há avaliações

- FMO M5 Soln.sDocumento16 páginasFMO M5 Soln.sVishwas ParakkaAinda não há avaliações

- Comparable Companies: Inter@rt ProjectDocumento9 páginasComparable Companies: Inter@rt ProjectVincenzo AlterioAinda não há avaliações

- Discounted Cash Flow Analysis of NvidiaDocumento27 páginasDiscounted Cash Flow Analysis of NvidiaLegends MomentsAinda não há avaliações

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachNo EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachNota: 3 de 5 estrelas3/5 (3)

- Equity Valuation: Models from Leading Investment BanksNo EverandEquity Valuation: Models from Leading Investment BanksJan ViebigAinda não há avaliações

- Kanban Change Leadership: Creating a Culture of Continuous ImprovementNo EverandKanban Change Leadership: Creating a Culture of Continuous ImprovementAinda não há avaliações

- Presentation 3Documento8 páginasPresentation 3Md Rasel Uddin ACMAAinda não há avaliações

- Presentation 2Documento7 páginasPresentation 2Md Rasel Uddin ACMAAinda não há avaliações

- Presentation 1Documento9 páginasPresentation 1Md Rasel Uddin ACMAAinda não há avaliações

- Book 14Documento1 páginaBook 14Md Rasel Uddin ACMAAinda não há avaliações

- Book 11Documento1 páginaBook 11Md Rasel Uddin ACMAAinda não há avaliações

- UtilitarianDocumento1 páginaUtilitarianMd Rasel Uddin ACMAAinda não há avaliações

- ParadoxDocumento1 páginaParadoxMd Rasel Uddin ACMAAinda não há avaliações

- Book 15Documento1 páginaBook 15Md Rasel Uddin ACMAAinda não há avaliações

- PristineDocumento1 páginaPristineMd Rasel Uddin ACMAAinda não há avaliações

- Integrated Reports: Disclosure Level and Explanatory Factors Integrated Reporting Disclosure Scores and Explanatory FactorsDocumento1 páginaIntegrated Reports: Disclosure Level and Explanatory Factors Integrated Reporting Disclosure Scores and Explanatory FactorsMd Rasel Uddin ACMAAinda não há avaliações

- Theories in IRDocumento1 páginaTheories in IRMd Rasel Uddin ACMAAinda não há avaliações

- Book 13Documento1 páginaBook 13Md Rasel Uddin ACMAAinda não há avaliações

- Note 2Documento1 páginaNote 2Md Rasel Uddin ACMAAinda não há avaliações

- SPEE Recommended Evaluation Practice #10 - Calculating Internal Rate of ReturnDocumento3 páginasSPEE Recommended Evaluation Practice #10 - Calculating Internal Rate of ReturnMd Rasel Uddin ACMAAinda não há avaliações

- Book 12Documento1 páginaBook 12Md Rasel Uddin ACMAAinda não há avaliações

- Mayes 8e CH11 Problem SetDocumento6 páginasMayes 8e CH11 Problem SetMd Rasel Uddin ACMA0% (2)

- Book 10Documento1 páginaBook 10Md Rasel Uddin ACMAAinda não há avaliações

- Notes 4Documento1 páginaNotes 4Md Rasel Uddin ACMAAinda não há avaliações

- Book 3Documento1 páginaBook 3Md Rasel Uddin ACMAAinda não há avaliações

- Note 3Documento1 páginaNote 3Md Rasel Uddin ACMAAinda não há avaliações

- Book 7Documento1 páginaBook 7Md Rasel Uddin ACMAAinda não há avaliações

- Note 5Documento1 páginaNote 5Md Rasel Uddin ACMAAinda não há avaliações

- Book 6Documento1 páginaBook 6Md Rasel Uddin ACMAAinda não há avaliações

- Book 1Documento1 páginaBook 1Md Rasel Uddin ACMAAinda não há avaliações

- Book 5Documento1 páginaBook 5Md Rasel Uddin ACMAAinda não há avaliações

- Chapter 14: Capital Structure in A Perfect Market-1Documento7 páginasChapter 14: Capital Structure in A Perfect Market-1Md Rasel Uddin ACMAAinda não há avaliações

- Book 4Documento1 páginaBook 4Md Rasel Uddin ACMAAinda não há avaliações

- Coc Problems SolutionsDocumento1 páginaCoc Problems SolutionsJitendra SharmaAinda não há avaliações

- OcfDocumento2 páginasOcfMd Rasel Uddin ACMAAinda não há avaliações

- Financial strategy - buy vs lease assetDocumento3 páginasFinancial strategy - buy vs lease assetMd Rasel Uddin ACMAAinda não há avaliações

- Factors Affecting Cost of CapitalDocumento40 páginasFactors Affecting Cost of CapitalKartik AroraAinda não há avaliações

- Previous Years QuestionsDocumento80 páginasPrevious Years QuestionsDeepika SinghAinda não há avaliações

- FalseDocumento13 páginasFalseJoel Christian MascariñaAinda não há avaliações

- Sensitivity and Scenario AnalysisDocumento3 páginasSensitivity and Scenario AnalysisSohail AjmalAinda não há avaliações

- Calculating Market Value of FirmsDocumento7 páginasCalculating Market Value of Firmsdev guptaAinda não há avaliações

- Tutorial 1 - SolutionDocumento3 páginasTutorial 1 - SolutionSuganti100% (1)

- WACC ModuleDocumento10 páginasWACC ModuleJay Aubrey PinedaAinda não há avaliações

- Insights From The Balanced Scorecard An Introduction To The Enterprise Risk ScorecardDocumento11 páginasInsights From The Balanced Scorecard An Introduction To The Enterprise Risk ScorecardEngMohamedReyadHelesyAinda não há avaliações

- DCF AAPL Course Manual PDFDocumento175 páginasDCF AAPL Course Manual PDFShivam KapoorAinda não há avaliações

- Dupont Model and Product Profitability Analysis Based On Activity-Based Costing and Economic Value AddedDocumento12 páginasDupont Model and Product Profitability Analysis Based On Activity-Based Costing and Economic Value AddedGaurav SonkeshariyaAinda não há avaliações

- TB - Chapter21 Mergers and AcquisitionsDocumento12 páginasTB - Chapter21 Mergers and AcquisitionsPrincess EspirituAinda não há avaliações

- Cost of Capital Questions AnsweredDocumento7 páginasCost of Capital Questions Answeredsmoky 22Ainda não há avaliações

- Mba Semester I To IV CbcegsDocumento64 páginasMba Semester I To IV CbcegsDavinder SinghAinda não há avaliações

- Discuss Whether The Dividend Growth Model or The Capital Asset Pricing Model Offers The Better Estimate of Cost of Equity of A Company3Documento24 páginasDiscuss Whether The Dividend Growth Model or The Capital Asset Pricing Model Offers The Better Estimate of Cost of Equity of A Company3Henry PanAinda não há avaliações

- Acc 501Documento10 páginasAcc 501Devyansh GuptaAinda não há avaliações

- Ch18.Outline ShareDocumento9 páginasCh18.Outline ShareCahyo PriyatnoAinda não há avaliações

- Sources of Financing A ProjectDocumento8 páginasSources of Financing A ProjectAbhijith PaiAinda não há avaliações

- Cost of CapitalDocumento18 páginasCost of CapitalRajesh NangaliaAinda não há avaliações

- Fin 439 SyllabusDocumento4 páginasFin 439 Syllabuschocolatedoggy12Ainda não há avaliações

- Chapter 9 Financial ManagementDocumento18 páginasChapter 9 Financial ManagementAshish GangwalAinda não há avaliações

- Diploma in Financial Management: Project Db2, Incorporating Subject Areas - Financial Strategy - Risk ManagementDocumento7 páginasDiploma in Financial Management: Project Db2, Incorporating Subject Areas - Financial Strategy - Risk ManagementMatthew Lewis0% (1)

- Project Report On Working Capital ManagementDocumento76 páginasProject Report On Working Capital ManagementVikas Dalvi100% (1)

- Marriott's Financial Strategy AnalysisDocumento5 páginasMarriott's Financial Strategy AnalysisVysh PujaraAinda não há avaliações

- Master of Business Administration Case 1 - Pinkerton Group 7Documento8 páginasMaster of Business Administration Case 1 - Pinkerton Group 7ndiazlAinda não há avaliações

- Feasibility Analysis of New Priok Port Project Phase 2 of Indonesia Port Corporation IiDocumento12 páginasFeasibility Analysis of New Priok Port Project Phase 2 of Indonesia Port Corporation IinobitaenokiAinda não há avaliações

- Cost of Capital: © 2019 Mcgraw-Hill Education Limited. All Rights ReservedDocumento43 páginasCost of Capital: © 2019 Mcgraw-Hill Education Limited. All Rights Reservedbusiness docAinda não há avaliações

- Docslide - Us Fof Im Chapter 08 7thDocumento20 páginasDocslide - Us Fof Im Chapter 08 7thErnesto Rodriguez DiazAinda não há avaliações

- Chapter 5 DCF With Inflation, Taxation and Working Capital: SyllabusDocumento29 páginasChapter 5 DCF With Inflation, Taxation and Working Capital: SyllabusCoc GamingAinda não há avaliações

- Chapter 2 - Capital StructureDocumento19 páginasChapter 2 - Capital StructureNguyễn Ngàn NgânAinda não há avaliações

- Cost of Capital, NPV, IRR, WACC, Payback Period, Dividend Growth ModelDocumento2 páginasCost of Capital, NPV, IRR, WACC, Payback Period, Dividend Growth ModeliyerchandraAinda não há avaliações