Escolar Documentos

Profissional Documentos

Cultura Documentos

Asbi Sum

Enviado por

adjipramTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Asbi Sum

Enviado por

adjipramDireitos autorais:

Formatos disponíveis

ASBI Asuransi Bintang Tbk.

COMPANY REPORT : JANUARY 2018 As of 31 January 2018

Development Board Individual Index : 131.730

Industry Sector : Finance (8) Listed Shares : 348,386,472

Industry Sub Sector : Insurance (84) Market Capitalization : 101,728,849,824

534 | 0.10T | 0.001% | 99.97%

447 | 0.02T | 0.001% | 99.95%

COMPANY HISTORY SHAREHOLDERS (January 2018)

Established Date : 17-Mar-1955 1. PT Srihana Utama 123,522,776 : 35.46%

Listing Date : 29-Nov-1989 2. PT Ngrumat Bondo Utomo 87,302,164 : 25.06%

Underwriter IPO : 3. PT Warisan Kasih Bunda 73,323,888 : 21.05%

PT Aseam Indonesia 4. Public (<5%) 64,237,644 : 18.44%

PT Finconesia

PT Ficorinvest DIVIDEND ANNOUNCEMENT

PT Merchant Investment Corporation Bonus Cash Recording Payment

F/I

PT PDFCI Securities Year Shares Dividend Cum Date Ex Date Date Date

Securities Administration Bureau : 1990 75.00 28-Jun-90 29-Jun-90 06-Jul-90 18-Jul-90

PT Bima Registra 1991 100.00 16-Jul-92 17-Jul-92 24-Jul-92 03-Aug-92 F

Graha MIR Building, 6th Fl. Zona A2 1992 100.00 22-Jul-93 23-Jul-93 30-Jul-93 19-Aug-93 F

Jln. Pemuda No. 9 Rawamangun, Jakarta Timur 13220 1993 60.00 21-Jul-94 22-Jul-94 29-Jul-94 22-Aug-94 F

Phone : (021) 2956-9781 1994 180.00 21-Jul-95 24-Jul-95 01-Aug-95 01-Sep-95 F

Fax : (021) 2956-9872 1995 275.00 25-Jul-96 26-Jul-96 05-Aug-96 02-Sep-96 F

1996 300.00 23-Jul-97 24-Jul-97 01-Aug-97 23-Aug-97 F

BOARD OF COMMISSIONERS 1996 2:6 18-Sep-97 19-Sep-97 29-Sep-97 13-Oct-97 B

1. Shanti Lasminingsih Poesposoetjipto 1997 75.00 23-Jul-98 24-Jul-98 03-Aug-98 27-Aug-98 F

2. Chaerul D. Djakman *) 1998 75.00 22-Jun-99 23-Jun-99 01-Jul-99 30-Jul-99 F

3. Ieke C.H. Mandas *) 1999 210.00 04-Jul-00 05-Jul-00 13-Jul-00 18-Jul-00 F

4. Petronius Saragih 1999 2:5 17-Oct-00 18-Oct-00 23-Oct-00 01-Nov-00 B

*) Independent Commissioners 2000 70.00 28-May-01 29-May-01 01-Jun-01 18-Jun-01 F

2001 45.00 01-Jul-02 02-Jul-02 05-Jul-02 19-Jul-02 F

BOARD OF DIRECTORS 2002 45.00 03-Jul-03 04-Jul-03 08-Jul-03 22-Jul-03 F

1. Hastanto Sri Margi Widodo 2003 30.00 30-Jun-04 01-Jul-04 06-Jul-04 20-Jul-04 F

2. Jenry Cardo Manurung 2005 20.00 04-Jul-05 05-Jul-05 07-Jul-05 21-Jul-05

3. Reniwati Darmakusumah 2005 20.00 04-Jul-06 05-Jul-06 07-Jul-06 21-Jul-06 F

2005 500 : 359,72048 05-Sep-06 06-Sep-06 08-Sep-06 22-Sep-06 S

AUDIT COMMITTEE 2006 5.00 27-Jun-07 28-Jun-07 02-Jul-07 16-Jul-07 F

1. Chaerul D. Djakman 2011 20.00 24-Jul-12 25-Jul-12 27-Jul-12 09-Aug-12 F

2. Taufik Hidayat 2012 25.00 29-Jul-13 30-Jul-13 01-Aug-13 22-Aug-13 F

3. Yan Rahadian 2013 25.00 23-Jul-14 24-Jul-14 04-Aug-14 18-Aug-14 F

2014 20.00 08-May-15 11-May-15 13-May-15 04-Jun-15 F

CORPORATE SECRETARY 2015 25.00 08-Jun-16 09-Jun-16 13-Jun-16 01-Jul-16 F

Jenry Cardo Manurung 2016 12.50 22-Jun-17 03-Jul-17 05-Jul-17 19-Jul-17 F

1992 50.00 00-Jan-00 00-Jan-00 00-Jan-00 00-Jan-00 F

HEAD OFFICE

Jl. RS Fatmawati No. 32 ISSUED HISTORY

Jakarta Selatan Listing Trading

Phone : (021) 759-02777 No. Type of Listing Shares Date Date

Fax : (021) 759-02555; 765-6287 1. First Issue 1,000,000 29-Nov-89 29-Nov-89

2. Company Listing 3,600,000 13-Apr-94 13-Apr-94

Homepage : www.asuransibintang.com 3. Stock Split 4,600,000 13-Oct-97 13-Oct-97

Email : jenry.cardo@asuransibintang.com 4. Bonus Shares 13,800,000 14-Oct-97 14-Oct-97

5. Bonus Shares 57,499,994 01-Nov-00 01-Nov-00

6. Stock Dividend 61,075,668 22-Sep-06 22-Sep-06

7. Right Issue 32,617,574 27-Dec-06 27-Dec-06

8. Stock Split 174,193,236 26-Jul-16 26-Jul-16

ASBI Asuransi Bintang Tbk.

TRADING ACTIVITIES

Closing Price* and Trading Volume

Asuransi Bintang Tbk. Closing Price Freq. Volume Value

Day

Closing Volume

Price* January 2014 - January 2018 (Mill. Sh) Month High Low Close (X) (Thou. Sh.) (Million Rp)

780 16.0 Jan-14 505 450 500 40 289 171 13

Feb-14 580 485 490 57 5,228 3,593 17

683 14.0 Mar-14 580 475 475 23 85 41 10

Apr-14 505 470 499 35 91 45 7

May-14 510 478 497 40 128 62 10

585 12.0

Jun-14 515 481 515 44 298 150 14

Jul-14 645 515 640 389 1,160 665 18

488 10.0

Aug-14 1,050 620 950 298 1,789 1,451 20

Sep-14 1,550 930 1,300 246 535 688 18

390 8.0

Oct-14 1,300 1,000 1,090 42 178 210 10

Nov-14 1,000 930 950 9 44 43 4

293 6.0 Dec-14 950 950 950 1 0.1 0.1 1

195 4.0 Jan-15 900 575 775 26 61 42 9

Feb-15 800 535 585 26 288 179 7

98 2.0 Mar-15 700 465 465 15 155 93 6

Apr-15 465 465 465 2 4 2 1

May-15 475 450 475 2 0.6 0.3 1

Jun-15 450 440 441 3 8 3 2

Jan-14 Jan-15 Jan-16 Jan-17 Jan-18

Jul-15 - - 441 - - - -

Aug-15 440 440 440 2 0.5 0.2 1

Sep-15 440 440 440 2 4 2 1

Closing Price*, Jakarta Composite Index (IHSG) and Oct-15 445 440 440 10 13 6 5

Finance Index Nov-15 440 440 440 5 22 10 2

January 2014 - January 2018 Dec-15 440 440 440 2 1 0.6 1

245%

Jan-16 440 324 335 218 2,854 961 17

210% Feb-16 525 340 445 134 385 145 19

Mar-16 610 460 495 64 58 29 10

175% Apr-16 540 410 485 245 531 237 18

May-16 500 442 486 75 111 52 15

140% Jun-16 550 464 530 208 508 252 18

Jul-16 795 354 398 189 608 291 16

114.8% Aug-16 480 324 390 179 420 161 21

105%

Sep-16 480 360 440 62 87 37 18

Oct-16 420 282 312 249 631 210 21

70%

Nov-16 386 312 320 84 418 133 18

52.7% Dec-16 380 300 380 15 28 10 7

35%

20.4% Jan-17 388 302 378 15 8 3 6

- Feb-17 378 276 378 60 79 27 11

Mar-17 380 232 360 46 100 35 15

-35% Apr-17 446 330 330 62 59 22 12

Jan 14 Jan 15 Jan 16 Jan 17 Jan 18 May-17 486 306 378 155 152 55 19

Jun-17 396 350 372 34 282 108 10

Jul-17 452 330 332 19,176 20,836 8,691 15

SHARES TRADED 2014 2015 2016 2017 Jan-18 Aug-17 350 262 286 729 768 240 22

Volume (Million Sh.) 10 0.6 7 55 6 Sep-17 406 280 312 26,813 24,450 9,320 19

Value (Billion Rp) 7 0.3 3 21 2 Oct-17 336 282 284 5,477 7,077 2,227 22

Frequency (Thou. X) 1 0.10 2 53 4 Nov-17 306 282 294 505 849 248 21

Days 142 36 198 188 20 Dec-17 304 284 286 167 731 216 16

Price (Rupiah) Jan-18 306 270 292 4,289 6,338 1,886 20

High 1,550 900 795 486 306

Low 450 440 282 232 270

Close 950 440 380 286 292

Close* 475 220 380 286 292

PER (X) 19.87 2.72 13.92 7.94 8.10

PER Industry (X) 27.72 25.09 20.71 19.10 21.18

PBV (X) 1.25 0.48 0.80 0.39 0.39

* Adjusted price after corporate action

ASBI Asuransi Bintang Tbk.

Financial Data and Ratios Book End : December

Public Accountant : Mirawati Sensi Idris (Member of Moore Stephens International Limited)

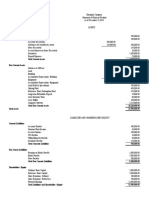

BALANCE SHEET Dec-13 Dec-14 Dec-15 Dec-16 Sep-17 TOTAL ASSETS AND LIABILITIES (Bill. Rp)

(Million Rp except Par Value) Assets Liabilities

Total Investment 418 188,144 57,743 215,711 42,230 750

Cash on hand and in Banks 6,420 11,761 6,984 20,921 22,965

Premium Receivables 73,325 87,145 118,252 120,212 124,606 600

Reinsurance Receivables 12,188 12,326 5,752 12,990 21,784

450

Other Receivable 15,137 11,412 9,839 6,934 13,994

Fixed Assets 34,057 32,490 32,215 32,790 108,364

300

Other Assets 2,254 2,987 1,431 3,347 2,879

Total Assets 398,948 439,681 494,003 525,899 700,358 150

Growth (%) 10.21% 12.35% 6.46% 33.17%

-

Claims payable 4,380 1,566 799 4,710 2,747 2013 2014 2015 2016 Sep-17

Reinsurance payables 14,374 39,773 47,571 29,602 53,242

Taxes payable 802 4,720 967 3,616 244

Total Liabilities 270,904 302,061 333,298 352,247 442,725 TOTAL EQUITY (Bill. Rp)

Growth (%) 11.50% 10.34% 5.69% 25.69% 258

258

Authorized Capital 160,000 160,000 320 640 640

Paid up Capital 87,097 87,097 87,097 87,097 87,097

205

174

161

Paid up Capital (Shares) 174 174 174 348 348 138

128

500 500 500 250 250

153

Par Value

Retained Earnings 45,069 50,337 74,632 87,422 92,174 100

Total Equity 128,044 137,620 160,705 173,652 257,633

Growth (%) 7.48% 16.77% 8.06% 48.36% 47

INCOME STATEMENTS Dec-13 Dec-14 Dec-15 Dec-16 Sep-17

-5

2013 2014 2015 2016 Sep-17

Underwriting Revenues 92,582 131,941 176,303 202,274 165,088

Growth (%) 42.51% 33.62% 14.73%

Underwriting Expenses 75,964 51,124 85,878 93,599 89,450 UNDERWRITING REVENUES (Bill. Rp)

Underwriting Income 16,618 80,817 90,425 108,674 75,638

202

Income from Investments 75,964 13,318 26,874 11,617 27,279 202

176

Operating Expenses 16,618 83,108 89,465 109,293 91,117 165

Income from Operating 6,873 11,027 27,835 10,999 11,801 161

132

Growth (%) 60.43% 152.44% -60.49%

120

93

Others Income 23,491 3,106 2,636 7,732 -3,022 78

Income before Tax 3,699 14,133 30,471 18,730 8,779

Tax - 4,291 2,272 3,426 -722 37

Profit for the period 19,792 9,842 28,199 15,305 9,501

Growth (%) -50.28% 186.53% -45.73% -4

2013 2014 2015 2016 Sep-17

Period Attributable 19,792 9,481 28,199 15,301 9,415

Comprehensive Income 13,902 14,149 27,346 17,519 88,644

PROFIT FOR THE PERIOD (Bill. Rp)

Comprehensive Attributable 13,901 14,149 27,346 17,515 88,558

28

RATIOS Dec-13 Dec-14 Dec-15 Dec-16 Sep-17

28

Dividend (Rp) 25.00 20.00 25.00 12.50 - 22

20

EPS (Rp) 113.62 54.43 161.88 43.92 27.02

BV (Rp) 735.07 790.04 922.57 498.45 739.50 17

15

DAR (X) 0.68 0.69 0.67 0.67 0.63

9.8 9.5

DER(X) 2.12 2.19 2.07 2.03 1.72 11

ROA (%) 4.96 2.24 5.71 2.91 1.36

ROE (%) 15.46 7.15 17.55 8.81 3.69

5

OPM (%) 7.42 8.36 15.79 5.44 7.15 -1

NPM (%) 21.38 7.46 15.99 7.57 5.76 2013 2014 2015 2016 Sep-17

Payout Ratio (%) 22.00 36.74 15.44 28.46 -

Yield (%) 5.15 2.11 5.68 3.29 -

Você também pode gostar

- Cost-Effective Pension Planning: Work in America Institute Studies in Productivity: Highlights of The LiteratureNo EverandCost-Effective Pension Planning: Work in America Institute Studies in Productivity: Highlights of The LiteratureAinda não há avaliações

- PPEDocumento30 páginasPPEJohn Kenneth AlicawayAinda não há avaliações

- 2-4 Audited Financial StatementsDocumento9 páginas2-4 Audited Financial StatementsJustine Joyce GabiaAinda não há avaliações

- MBA Corporate Finance SummariesDocumento37 páginasMBA Corporate Finance SummariesOnikaAinda não há avaliações

- Chapter 10 - Prior Period Errors: Problem 10-1 (IAA)Documento12 páginasChapter 10 - Prior Period Errors: Problem 10-1 (IAA)Asi Cas JavAinda não há avaliações

- Interim Financial ReportingDocumento3 páginasInterim Financial ReportingBernie Mojico CaronanAinda não há avaliações

- A Comparative Analysis of Performance of Mutual Funds Between Private and Public SectorsDocumento86 páginasA Comparative Analysis of Performance of Mutual Funds Between Private and Public Sectorssk912577002771% (7)

- ASBI Idx EmitenDocumento3 páginasASBI Idx EmitenRudi PramonoAinda não há avaliações

- Asbi PDFDocumento3 páginasAsbi PDFyohannestampubolonAinda não há avaliações

- Asuransi Bintang TBK Asbi: Company History Dividend AnnouncementDocumento3 páginasAsuransi Bintang TBK Asbi: Company History Dividend AnnouncementJandri Zhen TomasoaAinda não há avaliações

- Asuransi Ramayana TBKDocumento3 páginasAsuransi Ramayana TBKSanesAinda não há avaliações

- Multi Bintang Indonesia TBK.: Company Report: January 2017 As of 31 January 2017Documento3 páginasMulti Bintang Indonesia TBK.: Company Report: January 2017 As of 31 January 2017Solihul HadiAinda não há avaliações

- TgkaDocumento3 páginasTgkaWira WijayaAinda não há avaliações

- Asuransi Harta Aman Pratama TBK.: Company History SHAREHOLDERS (July 2012)Documento3 páginasAsuransi Harta Aman Pratama TBK.: Company History SHAREHOLDERS (July 2012)Marvin ArifinAinda não há avaliações

- Asuransi Dayin Mitra TBK Asdm: Company History Dividend AnnouncementDocumento3 páginasAsuransi Dayin Mitra TBK Asdm: Company History Dividend AnnouncementJandri Zhen TomasoaAinda não há avaliações

- Ekadharma International Tbk. (S)Documento3 páginasEkadharma International Tbk. (S)RomziAinda não há avaliações

- EkadDocumento3 páginasEkadErvin KhouwAinda não há avaliações

- AbdaDocumento3 páginasAbdahestiaa90Ainda não há avaliações

- Eratex Djaja TBK.: Company Report: January 2018 As of 31 January 2018Documento3 páginasEratex Djaja TBK.: Company Report: January 2018 As of 31 January 2018Frederico PratamaAinda não há avaliações

- Metrodata Electronics TBK.: Company Report: January 2019 As of 31 January 2019Documento3 páginasMetrodata Electronics TBK.: Company Report: January 2019 As of 31 January 2019Reza CahyaAinda não há avaliações

- Asgr PDFDocumento3 páginasAsgr PDFyohannestampubolonAinda não há avaliações

- LpgiDocumento3 páginasLpgiSyafira FirdausiAinda não há avaliações

- Brna PDFDocumento3 páginasBrna PDFyohannestampubolonAinda não há avaliações

- Maskapai Reasuransi Indonesia TBKDocumento3 páginasMaskapai Reasuransi Indonesia TBKisjonAinda não há avaliações

- RigsDocumento3 páginasRigssulaiman alfadliAinda não há avaliações

- Ramayana Lestari Sentosa TBK.: Company Report: January 2019 As of 31 January 2019Documento3 páginasRamayana Lestari Sentosa TBK.: Company Report: January 2019 As of 31 January 2019Paras FebriayuniAinda não há avaliações

- Delta Djakarta TBK.: Company Report: January 2017 As of 31 January 2017Documento3 páginasDelta Djakarta TBK.: Company Report: January 2017 As of 31 January 2017Solihul HadiAinda não há avaliações

- RalsDocumento3 páginasRalsulffah juliandAinda não há avaliações

- Abda PDFDocumento3 páginasAbda PDFyohannestampubolonAinda não há avaliações

- Gudang Garam TBK.: Company Report: January 2019 As of 31 January 2019Documento3 páginasGudang Garam TBK.: Company Report: January 2019 As of 31 January 2019LiuKsAinda não há avaliações

- Alk - Fika - Tugas Ke 1Documento3 páginasAlk - Fika - Tugas Ke 1fika rizkiAinda não há avaliações

- Bumi Resources TBKDocumento3 páginasBumi Resources TBKadjipramAinda não há avaliações

- TSPC PDFDocumento3 páginasTSPC PDFFITRA PEBRI ANSHORAinda não há avaliações

- Merck TBK.: Company Report: January 2019 As of 31 January 2019Documento3 páginasMerck TBK.: Company Report: January 2019 As of 31 January 2019hudaAinda não há avaliações

- Indofood Sukses Makmur TBK.: Company Report: January 2019 As of 31 January 2019Documento3 páginasIndofood Sukses Makmur TBK.: Company Report: January 2019 As of 31 January 2019Aryanto ArAinda não há avaliações

- Bank Pan Indonesia TBKDocumento3 páginasBank Pan Indonesia TBKParas FebriayuniAinda não há avaliações

- Kabelindo Murni TBKDocumento3 páginasKabelindo Murni TBKIstrinya TaehyungAinda não há avaliações

- Jaya Real Property TBK.: Company Report: January 2019 As of 31 January 2019Documento3 páginasJaya Real Property TBK.: Company Report: January 2019 As of 31 January 2019Denny SiswajaAinda não há avaliações

- TinsDocumento3 páginasTinsIman Nurakhmad FajarAinda não há avaliações

- Kalbe Farma TBKDocumento3 páginasKalbe Farma TBKK-AnggunYulianaAinda não há avaliações

- Aneka Tambang TBKDocumento3 páginasAneka Tambang TBKNing PhyAinda não há avaliações

- Laporan Keuangan ASSIDocumento3 páginasLaporan Keuangan ASSITiti MuntiartiAinda não há avaliações

- DildDocumento3 páginasDildPrasetyo Indra SuronoAinda não há avaliações

- Blta PDFDocumento3 páginasBlta PDFyohannestampubolonAinda não há avaliações

- Telekomunikasi Indonesia (Persero) TBK.: Company Report: January 2018 As of 31 January 2018Documento3 páginasTelekomunikasi Indonesia (Persero) TBK.: Company Report: January 2018 As of 31 January 2018natalia purnamaAinda não há avaliações

- Charoen Pokphand Indonesia TBK.: Company Report: January 2019 As of 31 January 2019Documento3 páginasCharoen Pokphand Indonesia TBK.: Company Report: January 2019 As of 31 January 2019ayyib12Ainda não há avaliações

- Aneka Tambang TBKDocumento3 páginasAneka Tambang TBKParas FebriayuniAinda não há avaliações

- Resource Alam Indonesia TBKDocumento3 páginasResource Alam Indonesia TBKsriyupiagustinaAinda não há avaliações

- Charoen Pokphand Indonesia TBK.: Company Report: July 2018 As of 31 July 2018Documento3 páginasCharoen Pokphand Indonesia TBK.: Company Report: July 2018 As of 31 July 2018tomo_dwi1Ainda não há avaliações

- Enseval Putera Megatrading TBK.: Company Report: January 2019 As of 31 January 2019Documento3 páginasEnseval Putera Megatrading TBK.: Company Report: January 2019 As of 31 January 2019Nur WahyudiAinda não há avaliações

- ASGR SD Jan 2019Documento3 páginasASGR SD Jan 2019Arina Kartika RizqiAinda não há avaliações

- Semen Indonesia (Persero) TBKDocumento3 páginasSemen Indonesia (Persero) TBKFarah DarmaAinda não há avaliações

- Bank CIMB Niaga TBKDocumento3 páginasBank CIMB Niaga TBKEka FarahAinda não há avaliações

- Aali PDFDocumento3 páginasAali PDFroy manchenAinda não há avaliações

- Astra Agro Lestari TBK Aali: Company History Dividend AnnouncementDocumento3 páginasAstra Agro Lestari TBK Aali: Company History Dividend AnnouncementJandri Zhen TomasoaAinda não há avaliações

- Astra Agro Lestari TBKDocumento3 páginasAstra Agro Lestari TBKsalmunAinda não há avaliações

- Asuransi Bina Dana Arta TBK.: Company History SHAREHOLDERS (July 2012)Documento3 páginasAsuransi Bina Dana Arta TBK.: Company History SHAREHOLDERS (July 2012)Marvin ArifinAinda não há avaliações

- Mrat PDFDocumento3 páginasMrat PDFHENI OKTAVIANIAinda não há avaliações

- Mustika Ratu TBK.: Company Report: January 2019 As of 31 January 2019Documento3 páginasMustika Ratu TBK.: Company Report: January 2019 As of 31 January 2019Febrianty HasanahAinda não há avaliações

- Fast Food Indonesia TBK.: Company Report: January 2019 As of 31 January 2019Documento3 páginasFast Food Indonesia TBK.: Company Report: January 2019 As of 31 January 2019marrifa angelicaAinda não há avaliações

- Indocement Tunggal Prakarsa TBKDocumento3 páginasIndocement Tunggal Prakarsa TBKRika SilvianaAinda não há avaliações

- Aqua Golden Mississippi TBK Aqua: Company History Dividend AnnouncementDocumento3 páginasAqua Golden Mississippi TBK Aqua: Company History Dividend AnnouncementJandri Zhen TomasoaAinda não há avaliações

- Darya-Varia Laboratoria TBKDocumento3 páginasDarya-Varia Laboratoria TBKArsyitaAinda não há avaliações

- Zebra Nusantara TBK.: Company Report: July 2018 As of 31 July 2018Documento3 páginasZebra Nusantara TBK.: Company Report: July 2018 As of 31 July 2018roxasAinda não há avaliações

- LKTT SC - 30 Jun 2020Documento146 páginasLKTT SC - 30 Jun 2020adjipramAinda não há avaliações

- Lpin SumDocumento3 páginasLpin SumadjipramAinda não há avaliações

- Growth, Profitability, and Financial Ratios For Citra Marga Nusaphala Persada TBK (CMNP) FromDocumento1 páginaGrowth, Profitability, and Financial Ratios For Citra Marga Nusaphala Persada TBK (CMNP) FromadjipramAinda não há avaliações

- CMNP SumDocumento3 páginasCMNP SumadjipramAinda não há avaliações

- Bumi Resources TBKDocumento3 páginasBumi Resources TBKadjipramAinda não há avaliações

- Pepse 2015Documento26 páginasPepse 2015adjipramAinda não há avaliações

- Arwana Citramulia Tbk. (S) : Company Report: July 2015 As of 31 July 2015Documento3 páginasArwana Citramulia Tbk. (S) : Company Report: July 2015 As of 31 July 2015adjipramAinda não há avaliações

- CMNP SumDocumento3 páginasCMNP SumadjipramAinda não há avaliações

- Indomobil Multi JasaDocumento167 páginasIndomobil Multi JasaadjipramAinda não há avaliações

- Workshop Poster Ilmiah 20112Documento3 páginasWorkshop Poster Ilmiah 20112adjipramAinda não há avaliações

- Growth, Profitability, and Financial Ratios For PT Samindo Resources TBK (MYOH) FromDocumento1 páginaGrowth, Profitability, and Financial Ratios For PT Samindo Resources TBK (MYOH) FromadjipramAinda não há avaliações

- Bumi Resources TBKDocumento3 páginasBumi Resources TBKadjipramAinda não há avaliações

- Diversified Mining ContractorsDocumento101 páginasDiversified Mining ContractorsadjipramAinda não há avaliações

- PX Jun 19Documento3 páginasPX Jun 19adjipramAinda não há avaliações

- SMRUDocumento3 páginasSMRUadjipramAinda não há avaliações

- SSMR 60-4 PDFDocumento10 páginasSSMR 60-4 PDFMohamed ElfawalAinda não há avaliações

- Nilai Penkes Kop Prov TB 2014 - Tahun 2015 - Real Triw IDocumento6 páginasNilai Penkes Kop Prov TB 2014 - Tahun 2015 - Real Triw IadjipramAinda não há avaliações

- Free Paper Contest: Oral PresentationDocumento1 páginaFree Paper Contest: Oral PresentationadjipramAinda não há avaliações

- xps-13-l321x - Owner's Manual - En-Us PDFDocumento74 páginasxps-13-l321x - Owner's Manual - En-Us PDFUmair AliAinda não há avaliações

- Railroad and CoalDocumento1 páginaRailroad and CoaladjipramAinda não há avaliações

- APLNDocumento3 páginasAPLNmirzaAinda não há avaliações

- Inpc SUMDocumento3 páginasInpc SUMadjipramAinda não há avaliações

- Asbi SumDocumento3 páginasAsbi SumadjipramAinda não há avaliações

- Penkes 2015Documento11 páginasPenkes 2015adjipramAinda não há avaliações

- Indonesia & Cambodia Textile & Garment On Crisis (Eng) PDFDocumento10 páginasIndonesia & Cambodia Textile & Garment On Crisis (Eng) PDFadjipramAinda não há avaliações

- Astra Otoparts TBK.: Company Report: January 2018 As of 31 January 2018Documento3 páginasAstra Otoparts TBK.: Company Report: January 2018 As of 31 January 2018adjipramAinda não há avaliações

- Wiim SUM PDFDocumento3 páginasWiim SUM PDFadjipramAinda não há avaliações

- Improving Indonesia's Competitiveness: Case Study of Textile and Farmed Shrimp IndustriesDocumento81 páginasImproving Indonesia's Competitiveness: Case Study of Textile and Farmed Shrimp IndustriesadjipramAinda não há avaliações

- Growth, Profitability, and Financial Ratios For PT Samindo Resources TBK (MYOH) FromDocumento1 páginaGrowth, Profitability, and Financial Ratios For PT Samindo Resources TBK (MYOH) FromadjipramAinda não há avaliações

- Kapco LTD: For The Year Ended 2007Documento10 páginasKapco LTD: For The Year Ended 2007Zeeshan AdeelAinda não há avaliações

- Performance Measurement: OutlineDocumento17 páginasPerformance Measurement: OutlineLưu Hồng Hạnh 4KT-20ACNAinda não há avaliações

- Nike Case StudyDocumento5 páginasNike Case StudyxluciastanAinda não há avaliações

- Chapter 3 Statement of Changes in EquityDocumento22 páginasChapter 3 Statement of Changes in EquityRonald De La RamaAinda não há avaliações

- Ceres Gardening - Case (1) ProfesorDocumento1 páginaCeres Gardening - Case (1) Profesorpeta8805Ainda não há avaliações

- Inventories Questions Edpalina-IsidroDocumento2 páginasInventories Questions Edpalina-IsidroAndrea Florence Guy VidalAinda não há avaliações

- Classic StatementDocumento1 páginaClassic StatementRamesh NatarajanAinda não há avaliações

- MSAW U.S Tax GuideDocumento17 páginasMSAW U.S Tax GuideHenri FontanaAinda não há avaliações

- ch13, Accounting PrinciplesDocumento63 páginasch13, Accounting PrinciplesH.R. RobinAinda não há avaliações

- ResearchDocumento4 páginasResearchIv YuhanAinda não há avaliações

- Fluxo 02Documento2 páginasFluxo 02GAME CRAFT vitorAinda não há avaliações

- Winding Up 1Documento2 páginasWinding Up 1AR JamesAinda não há avaliações

- 20221215111535D5271 - Auditing The Revenue CycleDocumento74 páginas20221215111535D5271 - Auditing The Revenue CycleBrenda FreitasAinda não há avaliações

- PPT2-Adjusting The Accounts and Completing The Accounting CycleDocumento46 páginasPPT2-Adjusting The Accounts and Completing The Accounting CycleGriselda Aurelie100% (1)

- 2 - Development - ClassificationDocumento21 páginas2 - Development - ClassificationzamirizulfachriAinda não há avaliações

- Partnership Operations (Additional Sample Problems)Documento5 páginasPartnership Operations (Additional Sample Problems)Pauline Anne LopezAinda não há avaliações

- RossCF9ce PPT Ch21Documento35 páginasRossCF9ce PPT Ch21js19imAinda não há avaliações

- Luxury Brand M&A CaseDocumento16 páginasLuxury Brand M&A CaseAditisawhney collegeAinda não há avaliações

- Exemplar Company - Fortunado PDFFDocumento1 páginaExemplar Company - Fortunado PDFFmitakumo uwuAinda não há avaliações

- Fundamentals of Accounting and Business Management 2: Statement of Financial Position Account FormDocumento6 páginasFundamentals of Accounting and Business Management 2: Statement of Financial Position Account Formmarcjann dialinoAinda não há avaliações

- Ulep - Uneven Cash PaymentsDocumento4 páginasUlep - Uneven Cash PaymentsNoel BajadaAinda não há avaliações

- Acc140 NotesDocumento72 páginasAcc140 NotesSalim Yusuf BinaliAinda não há avaliações

- Strategic Financial Management: SubjectDocumento7 páginasStrategic Financial Management: SubjectVijay SinghAinda não há avaliações

- (EDUCBA) Finance Analyst Courses PDFDocumento12 páginas(EDUCBA) Finance Analyst Courses PDFMudit NawaniAinda não há avaliações