Escolar Documentos

Profissional Documentos

Cultura Documentos

Cotton Marketing News

Enviado por

Brittany Etheridge0 notas0% acharam este documento útil (0 voto)

60 visualizações1 página- Weather conditions in May have negatively impacted the 2019 US cotton crop, with drought in the Southeast and planting delays in the Mid-South due to heavy rainfall.

- New crop cotton futures prices have risen slightly in response, up 2-3 cents, but this small rally does not indicate the market is ready for recovery.

- The next key data will be the June 28th USDA estimate of actual cotton acres planted, as current conditions have raised concerns about reduced plantings and yields.

Descrição original:

Cm n 05302019

Título original

Cm n 05302019

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documento- Weather conditions in May have negatively impacted the 2019 US cotton crop, with drought in the Southeast and planting delays in the Mid-South due to heavy rainfall.

- New crop cotton futures prices have risen slightly in response, up 2-3 cents, but this small rally does not indicate the market is ready for recovery.

- The next key data will be the June 28th USDA estimate of actual cotton acres planted, as current conditions have raised concerns about reduced plantings and yields.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

60 visualizações1 páginaCotton Marketing News

Enviado por

Brittany Etheridge- Weather conditions in May have negatively impacted the 2019 US cotton crop, with drought in the Southeast and planting delays in the Mid-South due to heavy rainfall.

- New crop cotton futures prices have risen slightly in response, up 2-3 cents, but this small rally does not indicate the market is ready for recovery.

- The next key data will be the June 28th USDA estimate of actual cotton acres planted, as current conditions have raised concerns about reduced plantings and yields.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 1

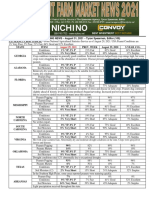

REPRESENTING COTTON GROWERS THROUGHOUT ALABAMA, FLORIDA, GEORGIA, NORTH CAROLINA, SOUTH CAROLINA, AND VIRGINIA

COTTON MARKETING NEWS

Volume 17, No. 7 May 30, 2019

201919

neighborhood. The improvement is in-part due to the weather

Sponsored by uncertainties. While the improvement is welcome, a 2-3 cent

“rally” is not sufficient to make us feel like this market is ready to

“recover”. The next numbers to watch will be the first USDA

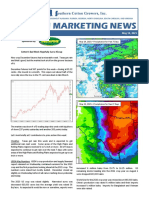

Weather Has Some, But Little Price Impact Thus Far estimate of actual acres planted released on June 28th.

Weather wise, the month of May has not been kind. The US

cotton production area has experienced extremes in weather.

New crop futures prices have seen a bit of a bounce but nothing

to say we’re on the road to “recovery” yet.

The Southeast is in a moderate drought with the non-irrigated

crop being hammered by a combination of well below normal

rainfall and record high temperatures. The entire “Coastal Plain”

area from southeast Alabama and the Florida panhandle through

south and east Georgia through the Carolinas and Virginia is

extremely dry with May rainfall well below normal.

USDA’s May numbers contained some positive aspects—2019

crop year US exports are forecast at 17 million bales (a good level

given the China uncertainties) and World use/demand at a record

level. The 2019 US crop was pegged at 22 million bales and early

thoughts have been that the crop will have potential to do more

than that—but the crop is off to a rocky start in many areas.

Combine the “positives” in the May numbers with an uncertain US

crop and THAT might be what sparks further rally. On the other

hand, if those positives don’t pan out and the US ends up with a

23+ million bale crop, prices might be hard pressed to see a “7” as

the front number.

Dry conditions extend into west Tennessee while most areas of

the Mid-South have received heavy rainfall. Rainfall has been Talking with a few producers and gin managers, it seems

mostly above normal for most portions of Texas and Oklahoma. producers might not be as far along in pricing and risk

management of this year’s crop as we would like (back when

So, over the past 30 days, we have had near drought conditions in Dec19 was in the 77-cents area). Some producers, for example,

some parts of the US cotton area but much above normal rainfall did not feel comfortable pricing because they were still waiting on

in other areas. As of May 26, Georgia is ahead of average in financing for this year’s production. Producers who missed the

planting but producers are going into dry conditions and the crop opportunity at 77 cents, seem in no hurry to price now and wait

will need moisture soon for a good start. The Mid-South is well and hope for a “rally” whatever that turns out to be.

behind normal due to abundant rainfall and planting delays

(Arkansas and Louisiana—8 to 13 points behind; Mississippi and We will eventually get the WHIP disaster funding once all the

Missouri—21 to 37 points behind). political posturing is out of the way. The trade assistance program

for 2019 has been announced but with little details yet as to

Overall, in the Mid-South there are questions and concerns about specifically how it will work and payments determined. This adds

planting delays, prevented plantings, and the acres that ultimately to the cash-flow uncertainty facing producers for 2019.

will be planted or not planted. In the Southeast, there are

concerns about the dry start, a dry May, and the outlook for Cotton Economist- Retired

enough rainfall to give marked improvement. Professor Emeritus of Cotton Economics

After dropping to the 65 to 66-cents area, prices (Dec19 futures)

have solidified somewhat and are currently in the 68 cents

Você também pode gostar

- Regenerative Agriculture: Farming with Benefits. Profitable Farms. Healthy Food. Greener Planet. Foreword by Nicolette Hahn Niman.No EverandRegenerative Agriculture: Farming with Benefits. Profitable Farms. Healthy Food. Greener Planet. Foreword by Nicolette Hahn Niman.Ainda não há avaliações

- Cotton Marketing NewsDocumento1 páginaCotton Marketing NewsBrittany EtheridgeAinda não há avaliações

- Focus On Ag (7-22-19)Documento2 páginasFocus On Ag (7-22-19)FluenceMediaAinda não há avaliações

- Cotton Marketing NewsDocumento1 páginaCotton Marketing NewsBrittany EtheridgeAinda não há avaliações

- Focus On Ag (7-23-18)Documento2 páginasFocus On Ag (7-23-18)FluenceMediaAinda não há avaliações

- Cotton Marketing NewsDocumento1 páginaCotton Marketing NewsBrittany EtheridgeAinda não há avaliações

- Cotton Marketing NewsDocumento1 páginaCotton Marketing NewsBrittany EtheridgeAinda não há avaliações

- Focus On Ag (7-08-19)Documento2 páginasFocus On Ag (7-08-19)FluenceMediaAinda não há avaliações

- Focus On Ag: August 26, 2019 2019 Crop Yields Remain A Big QuestionDocumento2 páginasFocus On Ag: August 26, 2019 2019 Crop Yields Remain A Big QuestionFluenceMediaAinda não há avaliações

- Cotton Marketing NewsDocumento1 páginaCotton Marketing NewsBrittany EtheridgeAinda não há avaliações

- Focus On Ag (10-21-19)Documento2 páginasFocus On Ag (10-21-19)FluenceMediaAinda não há avaliações

- Focus On Ag (9-23-19)Documento2 páginasFocus On Ag (9-23-19)FluenceMediaAinda não há avaliações

- South America To Dominate SoybeansDocumento2 páginasSouth America To Dominate SoybeansSamyakAinda não há avaliações

- Cotton Marketing NewsDocumento1 páginaCotton Marketing NewsBrittany EtheridgeAinda não há avaliações

- Cotton Marketing NewsDocumento1 páginaCotton Marketing NewsBrittany EtheridgeAinda não há avaliações

- Cotton Marketing NewsDocumento1 páginaCotton Marketing NewsBrittany EtheridgeAinda não há avaliações

- Focus On Ag (4-15-19)Documento2 páginasFocus On Ag (4-15-19)FluenceMediaAinda não há avaliações

- PEANUT MARKETING NEWS - August 17, 2020 - Tyron Spearman, EditorDocumento1 páginaPEANUT MARKETING NEWS - August 17, 2020 - Tyron Spearman, EditorBrittany EtheridgeAinda não há avaliações

- Focus On Ag: Written by Kent Thiesse Farm Management Analyst and Senior Vice President, Minnstar BankDocumento2 páginasFocus On Ag: Written by Kent Thiesse Farm Management Analyst and Senior Vice President, Minnstar BankFluenceMediaAinda não há avaliações

- Focus On Ag (6-28-21)Documento3 páginasFocus On Ag (6-28-21)FluenceMediaAinda não há avaliações

- Rev CM N 06282019Documento1 páginaRev CM N 06282019Brittany EtheridgeAinda não há avaliações

- Focus On Ag: Written by Kent Thiesse Farm Management Analyst and Vice President, Minnstar BankDocumento2 páginasFocus On Ag: Written by Kent Thiesse Farm Management Analyst and Vice President, Minnstar BankFluenceMediaAinda não há avaliações

- Cotton Marketing NewsDocumento1 páginaCotton Marketing NewsBrittany EtheridgeAinda não há avaliações

- Focus On Ag (6-29-20)Documento2 páginasFocus On Ag (6-29-20)FluenceMediaAinda não há avaliações

- Focus On Ag (5-23-22)Documento3 páginasFocus On Ag (5-23-22)FluenceMediaAinda não há avaliações

- Focus On Ag (6-27-22)Documento3 páginasFocus On Ag (6-27-22)FluenceMediaAinda não há avaliações

- Focus On Ag (6-07-21)Documento2 páginasFocus On Ag (6-07-21)FluenceMediaAinda não há avaliações

- Focus On Ag (8-01-22)Documento2 páginasFocus On Ag (8-01-22)FluenceMediaAinda não há avaliações

- Focus On Ag (7-31-23)Documento2 páginasFocus On Ag (7-31-23)Mike MaybayAinda não há avaliações

- Focus On Ag: October 29, 2018 Harvest Finally Progressing in Late OctoberDocumento2 páginasFocus On Ag: October 29, 2018 Harvest Finally Progressing in Late OctoberFluenceMediaAinda não há avaliações

- Focus On Ag (9-06-21)Documento3 páginasFocus On Ag (9-06-21)FluenceMediaAinda não há avaliações

- Focus On Ag: Written by Kent Thiesse Farm Management Analyst and Senior Vice President, Minnstar BankDocumento2 páginasFocus On Ag: Written by Kent Thiesse Farm Management Analyst and Senior Vice President, Minnstar BankFluenceMediaAinda não há avaliações

- Spring 2020 Agronomy Outlook Mar2020Documento5 páginasSpring 2020 Agronomy Outlook Mar2020Brittany EtheridgeAinda não há avaliações

- Cotton Marketing NewsDocumento1 páginaCotton Marketing NewsBrittany EtheridgeAinda não há avaliações

- Cotton Marketing NewsDocumento1 páginaCotton Marketing NewsBrittany EtheridgeAinda não há avaliações

- Focus On Ag (8-09-21)Documento3 páginasFocus On Ag (8-09-21)FluenceMediaAinda não há avaliações

- Cotton Marketing NewsDocumento1 páginaCotton Marketing NewsBrittany EtheridgeAinda não há avaliações

- Focus On Ag (7-20-20)Documento2 páginasFocus On Ag (7-20-20)FluenceMediaAinda não há avaliações

- Cotton Marketing NewsDocumento1 páginaCotton Marketing NewsBrittany EtheridgeAinda não há avaliações

- Cotton Marketing NewsDocumento1 páginaCotton Marketing NewsBrittany EtheridgeAinda não há avaliações

- Focus On Ag (8-30-21)Documento2 páginasFocus On Ag (8-30-21)FluenceMediaAinda não há avaliações

- Focus On Ag: October 8, 2018 Harvest Season Progressing Slowly in Many AreasDocumento2 páginasFocus On Ag: October 8, 2018 Harvest Season Progressing Slowly in Many AreasFluenceMediaAinda não há avaliações

- Focus On Ag (4-16-18)Documento2 páginasFocus On Ag (4-16-18)FluenceMediaAinda não há avaliações

- Kantar FMCG Pulse March 2023Documento9 páginasKantar FMCG Pulse March 2023ChinmayAinda não há avaliações

- Weekly Cotton Market Review: Vol. 103 No. 26 February 4, 2022Documento9 páginasWeekly Cotton Market Review: Vol. 103 No. 26 February 4, 2022Abbas BananiAinda não há avaliações

- Focus On Ag (8-12-19)Documento2 páginasFocus On Ag (8-12-19)FluenceMediaAinda não há avaliações

- Cotton Marketing NewsDocumento2 páginasCotton Marketing NewsBrittany EtheridgeAinda não há avaliações

- Cotton Marketing NewsDocumento1 páginaCotton Marketing NewsMorgan IngramAinda não há avaliações

- Focus On Ag (6-08-20)Documento2 páginasFocus On Ag (6-08-20)FluenceMediaAinda não há avaliações

- Focus On Ag (7-10-23)Documento2 páginasFocus On Ag (7-10-23)Mike MaybayAinda não há avaliações

- Cotton Marketing NewsDocumento1 páginaCotton Marketing NewsMorgan IngramAinda não há avaliações

- CMN08242020Documento1 páginaCMN08242020Morgan IngramAinda não há avaliações

- Weeklyagreport Weeklyagreport Weeklyagreport Weeklyagreport: Week Ended On Jun. 27, 2013Documento2 páginasWeeklyagreport Weeklyagreport Weeklyagreport Weeklyagreport: Week Ended On Jun. 27, 2013api-164524372Ainda não há avaliações

- Cotton Marketing NewsDocumento2 páginasCotton Marketing NewsMorgan IngramAinda não há avaliações

- 30 Sfu 07 24 19Documento8 páginas30 Sfu 07 24 19nwberryfoundationAinda não há avaliações

- Weeklyagreport Weeklyagreport Weeklyagreport Weeklyagreport: Week Ended On Sep.06, 2012Documento3 páginasWeeklyagreport Weeklyagreport Weeklyagreport Weeklyagreport: Week Ended On Sep.06, 2012api-164524372Ainda não há avaliações

- Ag Puts Up Trade Surplus, But Industry Not Immune To Global Economic WoesDocumento8 páginasAg Puts Up Trade Surplus, But Industry Not Immune To Global Economic Woesapi-26109205Ainda não há avaliações

- USDA Commodity OutlookDocumento28 páginasUSDA Commodity OutlookprasoonragAinda não há avaliações

- Focus On Ag (7-06-20)Documento2 páginasFocus On Ag (7-06-20)FluenceMediaAinda não há avaliações

- PEANUT MARKETING NEWS - September 17, 2020 - Tyron Spearman, EditorDocumento1 páginaPEANUT MARKETING NEWS - September 17, 2020 - Tyron Spearman, EditorMorgan IngramAinda não há avaliações

- Said Jeremy Mayes, General Manager For American Peanut Growers IngredientsDocumento1 páginaSaid Jeremy Mayes, General Manager For American Peanut Growers IngredientsBrittany EtheridgeAinda não há avaliações

- Cotton Marketing NewsDocumento2 páginasCotton Marketing NewsBrittany EtheridgeAinda não há avaliações

- October 17, 2021Documento1 páginaOctober 17, 2021Brittany EtheridgeAinda não há avaliações

- October 24, 2021Documento1 páginaOctober 24, 2021Brittany Etheridge100% (1)

- Cotton Marketing NewsDocumento1 páginaCotton Marketing NewsBrittany EtheridgeAinda não há avaliações

- U.S. PEANUT EXPORTS - TOP 10 - From USDA/Foreign Agricultural Service (American Peanut Council)Documento1 páginaU.S. PEANUT EXPORTS - TOP 10 - From USDA/Foreign Agricultural Service (American Peanut Council)Brittany EtheridgeAinda não há avaliações

- 1,000 Acres Pounds/Acre TonsDocumento1 página1,000 Acres Pounds/Acre TonsBrittany EtheridgeAinda não há avaliações

- Sept. 26, 2021Documento1 páginaSept. 26, 2021Brittany EtheridgeAinda não há avaliações

- Dairy Market Report - September 2021Documento5 páginasDairy Market Report - September 2021Brittany EtheridgeAinda não há avaliações

- World Agricultural Supply and Demand EstimatesDocumento40 páginasWorld Agricultural Supply and Demand EstimatesBrittany EtheridgeAinda não há avaliações

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.4ct/lbDocumento1 páginaShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.4ct/lbBrittany EtheridgeAinda não há avaliações

- Cotton Marketing NewsDocumento1 páginaCotton Marketing NewsBrittany EtheridgeAinda não há avaliações

- October 10, 2021Documento1 páginaOctober 10, 2021Brittany EtheridgeAinda não há avaliações

- Shelled MKT Price Weekly Prices: Same As Last WeekDocumento1 páginaShelled MKT Price Weekly Prices: Same As Last WeekBrittany EtheridgeAinda não há avaliações

- October 3, 2021Documento1 páginaOctober 3, 2021Brittany EtheridgeAinda não há avaliações

- Sept. 12, 2021Documento1 páginaSept. 12, 2021Brittany EtheridgeAinda não há avaliações

- YieldDocumento1 páginaYieldBrittany EtheridgeAinda não há avaliações

- 2021 Export Update - Chinese Future Prices Have Gotten Weaker. This Is Not SurprisingDocumento1 página2021 Export Update - Chinese Future Prices Have Gotten Weaker. This Is Not SurprisingBrittany EtheridgeAinda não há avaliações

- Sept. 19, 2021Documento1 páginaSept. 19, 2021Brittany EtheridgeAinda não há avaliações

- Export Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) : Down - 11.8 % Down - 16.1%Documento1 páginaExport Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) : Down - 11.8 % Down - 16.1%Brittany EtheridgeAinda não há avaliações

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,174,075 Tons, Up 3.0 % UP-$01. CT/LBDocumento1 páginaShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,174,075 Tons, Up 3.0 % UP-$01. CT/LBBrittany EtheridgeAinda não há avaliações

- NicholasDocumento1 páginaNicholasBrittany EtheridgeAinda não há avaliações

- August 22, 2021Documento1 páginaAugust 22, 2021Brittany EtheridgeAinda não há avaliações

- Sept. 5, 2021Documento1 páginaSept. 5, 2021Brittany EtheridgeAinda não há avaliações

- World Agricultural Supply and Demand EstimatesDocumento40 páginasWorld Agricultural Supply and Demand EstimatesBrittany EtheridgeAinda não há avaliações

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.4ct/lbDocumento1 páginaShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.4ct/lbBrittany EtheridgeAinda não há avaliações

- FPAC Honeybee Brochure August2021Documento4 páginasFPAC Honeybee Brochure August2021Brittany EtheridgeAinda não há avaliações

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.6ct/lbDocumento1 páginaShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.6ct/lbBrittany EtheridgeAinda não há avaliações

- August 29, 2021Documento1 páginaAugust 29, 2021Brittany EtheridgeAinda não há avaliações

- Export Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) : Down - 10.8 % Down - 15.0%Documento1 páginaExport Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) : Down - 10.8 % Down - 15.0%Brittany EtheridgeAinda não há avaliações

- 35 Childrens BooksDocumento4 páginas35 Childrens Booksapi-710628938Ainda não há avaliações

- Internship Final Students CircularDocumento1 páginaInternship Final Students CircularAdi TyaAinda não há avaliações

- Sencor-Scooter-One-App-EN YeaaDocumento7 páginasSencor-Scooter-One-App-EN Yeaaeh smrdimAinda não há avaliações

- Students and Sports Betting in Nigeria (2020)Documento57 páginasStudents and Sports Betting in Nigeria (2020)Nwaozuru JOHNMAJOR Chinecherem100% (1)

- (Digest) Marcos II V CADocumento7 páginas(Digest) Marcos II V CAGuiller C. MagsumbolAinda não há avaliações

- Deadlands - Hell On Earth - BrainburnersDocumento129 páginasDeadlands - Hell On Earth - BrainburnersKS100% (1)

- G.R. No. L-6393 January 31, 1955 A. MAGSAYSAY INC., Plaintiff-Appellee, ANASTACIO AGAN, Defendant-AppellantDocumento64 páginasG.R. No. L-6393 January 31, 1955 A. MAGSAYSAY INC., Plaintiff-Appellee, ANASTACIO AGAN, Defendant-AppellantAerylle GuraAinda não há avaliações

- CrackJPSC Mains Paper III Module A HistoryDocumento172 páginasCrackJPSC Mains Paper III Module A HistoryL S KalundiaAinda não há avaliações

- ObliconDocumento3 páginasObliconMonica Medina100% (2)

- David - sm15 - Inppt - 01Documento33 páginasDavid - sm15 - Inppt - 01ibeAinda não há avaliações

- Determinate and GenericDocumento5 páginasDeterminate and GenericKlara Alcaraz100% (5)

- Ebook4Expert Ebook CollectionDocumento42 páginasEbook4Expert Ebook CollectionSoumen Paul0% (1)

- Alcpt 27R (Script)Documento21 páginasAlcpt 27R (Script)Matt Dahiam RinconAinda não há avaliações

- Dax CowartDocumento26 páginasDax CowartAyu Anisa GultomAinda não há avaliações

- Assignment 10Documento2 páginasAssignment 10Kristina KittyAinda não há avaliações

- Politics of BelgiumDocumento19 páginasPolitics of BelgiumSaksham AroraAinda não há avaliações

- Walt DisneyDocumento56 páginasWalt DisneyDaniela Denisse Anthawer Luna100% (6)

- Nivea Case StudyDocumento15 páginasNivea Case StudyShreyas LigadeAinda não há avaliações

- FY2011 Sked CDocumento291 páginasFY2011 Sked CSunnyside PostAinda não há avaliações

- Faith in GenesisDocumento5 páginasFaith in Genesischris iyaAinda não há avaliações

- A Comparison of The Manual Electoral System and The Automated Electoral System in The PhilippinesDocumento42 páginasA Comparison of The Manual Electoral System and The Automated Electoral System in The PhilippineschaynagirlAinda não há avaliações

- Player's Guide: by Patrick RenieDocumento14 páginasPlayer's Guide: by Patrick RenieDominick Bryant100% (4)

- BPM at Hindustan Coca Cola Beverages - NMIMS, MumbaiDocumento10 páginasBPM at Hindustan Coca Cola Beverages - NMIMS, MumbaiMojaAinda não há avaliações

- Social Inequality and ExclusionDocumento3 páginasSocial Inequality and ExclusionAnurag Agrawal0% (1)

- Motion To Compel Further Discovery Responses From Fannie MaeDocumento71 páginasMotion To Compel Further Discovery Responses From Fannie MaeLee Perry100% (4)

- Boone Pickens' Leadership PlanDocumento2 páginasBoone Pickens' Leadership PlanElvie PradoAinda não há avaliações

- Forn VännenDocumento14 páginasForn VännenDana KoopAinda não há avaliações

- Grandparents 2Documento13 páginasGrandparents 2api-288503311Ainda não há avaliações

- Randy C de Lara 2.1Documento2 páginasRandy C de Lara 2.1Jane ParaisoAinda não há avaliações

- Lea3 Final ExamDocumento4 páginasLea3 Final ExamTfig Fo EcaepAinda não há avaliações