Escolar Documentos

Profissional Documentos

Cultura Documentos

Past Paper 2015 BCom Part 2 Business Taxation PDF

Enviado por

dilbaz karimDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Past Paper 2015 BCom Part 2 Business Taxation PDF

Enviado por

dilbaz karimDireitos autorais:

Formatos disponíveis

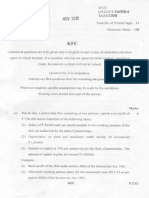

Past Paper 2015 BCom Part 2 Business Taxation

PU B.Com Past Papers, Punjab University 18,291 Views

Past Paper 2015 BCom Part 2 Business Taxation

Business Taxation 2015 —— Paper: BC-405

Time Allowed: 3 Hours —— New Course Marks: 100

Note: Note: Attempt any FIVE questions including question number which is compulsory. All questions

carry equal marks.

Q.1. Define and explain the following terms with reference to Income Tax Ordinance, 2001:

(a) Accumulated Profit

(b) Pakistan Source Income

(c) Dividend

(d) Principal Officer

Q.2. Discuss the legal provisions regarding the exemption of the following under the second schedule of

the Income Tax Ordinance, 2001.

(a) Agricultural Income

(b) Pension

(c) Profit on Debt

Q.3. What is Provident Fund? Discuss the treatement of various types of Provident Fund for inclusion in

total income and exemption from income tax.

Q.4. What are the various types of losses? How can these losses be set off and carry forward?

Q.5. “Federal Board of Revenue is the highest executive authority in the administration of Income Tax

Law.” Discuss in detail.

Q.6. Define and explain the following terms with reference to Sales Tax Act, 1990:

(a) Tax Invoice

(b) Input Tax

(c) Supply

(d) Tax Fraction

Q.7. From the following data of Mr. Abdul Jabbar, a registered manufacturer of goods, calculating his

liability of sales tax for August 2014:

01-Taxable turnover to registered perscin Rs.2500000

02-Taxable turnover to bon-registered person Rs.200000.

03-Taxable supplies to consumer on installment basis

(Open Market-Price Rs. 230000) Rs.275000

04-Sales to retailer Rs.250000

05-Taxable supplies to associated person

Rs.100000

(Open Market Price Rs: 120000)

06-Exempt Sale Rs.340000

07-Supplies to DIRE registered person R1000

08-Zero rated supplies OsW000

09-Taxable supplies @ 20% discount

(Discount on such supplies is a normal practice) Rs.150000

10-Taxable purchases from registered person Rs.500000

11-Taxable purchases from non-registered person Rs.280000

12-Taxable purchases from wholesaler Rs.175000

13-Purchase raw material

(Used Taxable and exempt Rs.400000 supplies)

14-Carry forward of input tax from previous month Rs.30000

15-Sales tax paid on electricity bills Rs.70000

16-Sales tax paid on sui gas bills Rs.50000

Note: National Tax Number is piinted on utility bills.

Q.8. The following information is available in respect of, Prof. Dr. Asif Habib senior citizen (working as full

time teacher in a recognized nonprofit educational

institution) for the Tax Year ended 30th June, 2014.

01-Basic Salary Rs.300000

02-Cost of living allowance Rs.100000

03-House rent allowance Rs.150000

04-Conveyance allowance Rs.40000

05-Senior Post allowance Rs.30000

06-Leave fare assistance Rs.10000

07-Property Income (Net) Rs.120000

08-Income from Business

(UK) (Tax paid in UK 500) Rs.20000

09-Gain on disposal of shares of private company (Disposed of within 12 months) Rs.50000

10-Profit on sale of inherited house Rs.150000

(holding period more than 2 years)

11-Donation to Recognized educational institution Rs.80000

12-Worker Welfare Fund Rs.30000

Required: Compute taxable income and tax payable

S.No. Taxable Income Rate of Tax

1. Rs.750000 to Rs.1500000 Rs.17500 + 10% of the amount exceeding Rs.750000

2. Rs.1400000 to Rs.1500000 Rs.82500 + 12.5% of the amount exceeding Rs.1400000

3. Rs.1500000 to Rs.1800000 Rs .95000+15 % of the amount exceeding Rs.1500000

Copy Protected by Chetan's WP-Copyprotect.

Você também pode gostar

- Volvo Truck - Penetrating The US MarketDocumento5 páginasVolvo Truck - Penetrating The US MarketKha NguyenAinda não há avaliações

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionAinda não há avaliações

- Archie's Innovations: Module Title: Systems DevelopmentDocumento3 páginasArchie's Innovations: Module Title: Systems DevelopmentLuzi RamosAinda não há avaliações

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionAinda não há avaliações

- Case Study 6 Revlon, Inc.Documento11 páginasCase Study 6 Revlon, Inc.Russell Olinares75% (4)

- Business Taxation Past Paper 2016 B Com Part 2Documento3 páginasBusiness Taxation Past Paper 2016 B Com Part 2dilbaz karim0% (1)

- QuickBooks For BeginnersDocumento9 páginasQuickBooks For BeginnersZain U DdinAinda não há avaliações

- Business Taxation Past Paper 2017 B.com Part 2 Punjab UniversityDocumento3 páginasBusiness Taxation Past Paper 2017 B.com Part 2 Punjab UniversityAdeel AhmedAinda não há avaliações

- Model Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFDocumento5 páginasModel Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFShah SujitAinda não há avaliações

- Business Taxation Past Paper 2019Documento2 páginasBusiness Taxation Past Paper 2019Adeel AhmedAinda não há avaliações

- Business Taxation Past Paper 2019 PDFDocumento2 páginasBusiness Taxation Past Paper 2019 PDFNouman BaigAinda não há avaliações

- INCOME TAX VALUE ADDED TAX ACTIVITY SolutionDocumento6 páginasINCOME TAX VALUE ADDED TAX ACTIVITY SolutionMarco Alejandro IbayAinda não há avaliações

- Taxation 2004 SolvedDocumento18 páginasTaxation 2004 Solvedapi-3832224100% (2)

- Indirect Taxes-May 2011: FIRST OF ALL Read CarefullyDocumento8 páginasIndirect Taxes-May 2011: FIRST OF ALL Read Carefully9811702789Ainda não há avaliações

- IPCC Taxation Guideline Answer Nov 2015 ExamDocumento16 páginasIPCC Taxation Guideline Answer Nov 2015 ExamSushant SaxenaAinda não há avaliações

- Requirements:: Taxation-Ii Time Allowed - 3 Hours Total Marks - 100Documento5 páginasRequirements:: Taxation-Ii Time Allowed - 3 Hours Total Marks - 100Srikrishna DharAinda não há avaliações

- Bachelor's Degree Programme (BDP) : Assignment 2015-16Documento4 páginasBachelor's Degree Programme (BDP) : Assignment 2015-16Paras JainAinda não há avaliações

- BC 501 Income Tax Law 740766763 PDFDocumento15 páginasBC 501 Income Tax Law 740766763 PDFSakshi JainAinda não há avaliações

- Scanner Ipcc Paper 4Documento34 páginasScanner Ipcc Paper 4Meet GargAinda não há avaliações

- AccountingDocumento4 páginasAccountingNaiya JoshiAinda não há avaliações

- RequiredDocumento1 páginaRequiredSR TGAinda não há avaliações

- Taxation of Employment IncomeDocumento7 páginasTaxation of Employment IncomeJamvy Jose FernandezAinda não há avaliações

- 8531Documento9 páginas8531Mudassar SaqiAinda não há avaliações

- Income Tax: Meenal P Wagle Swayam Siddhi College of Management and ResearchDocumento17 páginasIncome Tax: Meenal P Wagle Swayam Siddhi College of Management and ResearchMeenal Prasad WagleAinda não há avaliações

- Tax Assignment For Mar 7Documento3 páginasTax Assignment For Mar 7Marie Loise MarasiganAinda não há avaliações

- Taxation Review Dec2017Documento7 páginasTaxation Review Dec2017Shaiful Alam FCAAinda não há avaliações

- Briefing MADE EASY-LUCILLEDocumento51 páginasBriefing MADE EASY-LUCILLEJames Robert Marquez AlvarezAinda não há avaliações

- F Business Taxation 671079211Documento4 páginasF Business Taxation 671079211anand0% (1)

- 11 La 402 BTDocumento4 páginas11 La 402 BTmuhzahid786Ainda não há avaliações

- Model Question Set 1Documento2 páginasModel Question Set 1Destiny Tuition CentreAinda não há avaliações

- CONT .: (15 Minutes Extra Time Will Be Given Due To Slow Internet or Electricity Issues)Documento4 páginasCONT .: (15 Minutes Extra Time Will Be Given Due To Slow Internet or Electricity Issues)ALEEM MANSOORAinda não há avaliações

- CTPMDocumento13 páginasCTPMYogeesh LNAinda não há avaliações

- 895BCMMDocumento4 páginas895BCMMGanesh AganeshAinda não há avaliações

- Exam - Taxation MSA 206Documento4 páginasExam - Taxation MSA 206Juan FrivaldoAinda não há avaliações

- 0456Documento4 páginas0456Usman Shaukat Khan100% (1)

- PercentageDocumento18 páginasPercentage?????Ainda não há avaliações

- Application Level Corporate Laws Practices Nov Dec 2013Documento3 páginasApplication Level Corporate Laws Practices Nov Dec 2013Timothy GillespieAinda não há avaliações

- W9. After-Tax Analysis PDFDocumento31 páginasW9. After-Tax Analysis PDFCHRISTOPHER ABIMANYUAinda não há avaliações

- Examples On Taxable Services A To L (Chapter 59)Documento6 páginasExamples On Taxable Services A To L (Chapter 59)kapilchandanAinda não há avaliações

- Audit Revision Class of Tax Law-Al-SuffiansDocumento13 páginasAudit Revision Class of Tax Law-Al-SuffiansRao waqarAinda não há avaliações

- CPAT Reviewer - TRAIN (Tax Reform) #1Documento8 páginasCPAT Reviewer - TRAIN (Tax Reform) #1Zaaavnn VannnnnAinda não há avaliações

- Caf-6 TaxDocumento4 páginasCaf-6 TaxaskermanAinda não há avaliações

- 24979qp Ipcc Nov11gp1 4Documento11 páginas24979qp Ipcc Nov11gp1 4HAYAGRIVAS 23Ainda não há avaliações

- FA - Excercises & Answers PDFDocumento17 páginasFA - Excercises & Answers PDFRasanjaliGunasekeraAinda não há avaliações

- Section Three-2024Documento4 páginasSection Three-2024basuonyshowAinda não há avaliações

- Synthesis - Problem Solving QuizDocumento3 páginasSynthesis - Problem Solving QuizEren CuestaAinda não há avaliações

- pcc-2011 TaxDocumento19 páginaspcc-2011 TaxHeena NigamAinda não há avaliações

- Model Question BBS 3rd Taxation in NepalDocumento6 páginasModel Question BBS 3rd Taxation in NepalAsmita BhujelAinda não há avaliações

- Taxation, Business ExaminationDocumento4 páginasTaxation, Business ExaminationKevin Elrey ArceAinda não há avaliações

- f6pkn 2011 Dec QDocumento11 páginasf6pkn 2011 Dec Qabby bendarasAinda não há avaliações

- Taxation Situational ProblemsDocumento32 páginasTaxation Situational ProblemsMilo MilkAinda não há avaliações

- Mock Test-I: Office: S.C.O. 361 (Level-2), Sector 44-D, Chd. Section-ADocumento9 páginasMock Test-I: Office: S.C.O. 361 (Level-2), Sector 44-D, Chd. Section-AKanwar M KaurAinda não há avaliações

- Fundamental of Taxation and Auditing (Mgt.218) - BBS Third Year - 4 Years Program - Model Question - With SOLUTIONDocumento21 páginasFundamental of Taxation and Auditing (Mgt.218) - BBS Third Year - 4 Years Program - Model Question - With SOLUTIONRiyaz RangrezAinda não há avaliações

- ICAB Last Year Question (Knowledge Level)Documento5 páginasICAB Last Year Question (Knowledge Level)Fatema KanizAinda não há avaliações

- CORPORATE INCOME TAX (Answer Key)Documento5 páginasCORPORATE INCOME TAX (Answer Key)Rujean Salar AltejarAinda não há avaliações

- Reg. No.: Q.P. Code: (17 BBA 31/ 17 BBACA 31/17 BBARM 44/ 17 BBAIB 49/17 BBABPM 15)Documento10 páginasReg. No.: Q.P. Code: (17 BBA 31/ 17 BBACA 31/17 BBARM 44/ 17 BBAIB 49/17 BBABPM 15)AK GAMINGAinda não há avaliações

- N13 IPCC Tax Guideline Answers WebDocumento12 páginasN13 IPCC Tax Guideline Answers WebGeorge MooneyAinda não há avaliações

- Css Accountancy2 2018 PDFDocumento2 páginasCss Accountancy2 2018 PDFMaria NazAinda não há avaliações

- Suggested Tax Paper May 2011Documento11 páginasSuggested Tax Paper May 2011Sudhir PanigrahiAinda não há avaliações

- Business TaxationDocumento3 páginasBusiness TaxationatvishalAinda não há avaliações

- Test 9Documento4 páginasTest 9lalshahbaz57Ainda não há avaliações

- Mefa Mid 2Documento4 páginasMefa Mid 2Vadlamudi DhyanamalikaAinda não há avaliações

- Past Paper 2015 BComDocumento3 páginasPast Paper 2015 BComdilbaz karimAinda não há avaliações

- Advance Financial Accounting Past Paper 2016 B Com Part 2Documento2 páginasAdvance Financial Accounting Past Paper 2016 B Com Part 2dilbaz karimAinda não há avaliações

- Advance Financial Accounting Past Paper 2016 B Com Part 2Documento5 páginasAdvance Financial Accounting Past Paper 2016 B Com Part 2dilbaz karimAinda não há avaliações

- Business Law Past Paper 2014 B Com 2Documento2 páginasBusiness Law Past Paper 2014 B Com 2dilbaz karimAinda não há avaliações

- 5-1 Problem SolvingDocumento11 páginas5-1 Problem SolvingRianne GliocamAinda não há avaliações

- Chapter One Overview of Financial Management: 1.1. Finance As An Area of StrudyDocumento33 páginasChapter One Overview of Financial Management: 1.1. Finance As An Area of Strudysamuel kebedeAinda não há avaliações

- Qualified Theft and Estafa As Furtive CrimesDocumento37 páginasQualified Theft and Estafa As Furtive CrimesNikki Delgado100% (1)

- Review of Literature: Chapter-2Documento5 páginasReview of Literature: Chapter-2Juan JacksonAinda não há avaliações

- The Shawano Leader 0926Documento18 páginasThe Shawano Leader 0926WolfRiverMediaAinda não há avaliações

- Curriculum Vitae: Career ObjectiveDocumento3 páginasCurriculum Vitae: Career Objectiveknack marketechAinda não há avaliações

- Ifrs Objective Final 2020 Preview VersionDocumento42 páginasIfrs Objective Final 2020 Preview VersionMuhammad Haroon KhanAinda não há avaliações

- High Probability Trading Triggers For Gold & SilverDocumento52 páginasHigh Probability Trading Triggers For Gold & Silverabrar_90901Ainda não há avaliações

- PEFA 2016 Framework Final WEB 0Documento24 páginasPEFA 2016 Framework Final WEB 0Samer_AbdelMaksoudAinda não há avaliações

- FDNACCT Reflection Paper PDFDocumento4 páginasFDNACCT Reflection Paper PDFCrystal Castor LabragueAinda não há avaliações

- Philippine National Bank v. AmoresDocumento6 páginasPhilippine National Bank v. AmoresRoemma Kara Galang PaloAinda não há avaliações

- Managerial and Legal Economics: Debarchana ShandilyaDocumento28 páginasManagerial and Legal Economics: Debarchana ShandilyaPritam RoyAinda não há avaliações

- Interim Order in Respect of Nirmal Infrahome Corporation LTDDocumento24 páginasInterim Order in Respect of Nirmal Infrahome Corporation LTDShyam SunderAinda não há avaliações

- RoughDocumento4 páginasRoughrajivrvdAinda não há avaliações

- Petition For Extraordinary Writ of Mandate, Application For Temporary Stay...Documento61 páginasPetition For Extraordinary Writ of Mandate, Application For Temporary Stay...robertian100% (3)

- Emerging Trends, Threats, and Opportunities in International MarketingDocumento30 páginasEmerging Trends, Threats, and Opportunities in International MarketingBusiness Expert Press67% (3)

- B00o56n3bs EbokDocumento387 páginasB00o56n3bs EboksaeedayasminAinda não há avaliações

- Intercompany Accounting For Internal Order and Drop ShipmentDocumento51 páginasIntercompany Accounting For Internal Order and Drop Shipmentrachaiah.vr9878Ainda não há avaliações

- 4.2.18.2 Nigeria's Road To SDGsDocumento44 páginas4.2.18.2 Nigeria's Road To SDGsotuekong ekpoAinda não há avaliações

- Dr. Josse Mazo Et. Al. v. John Merritt Et. Al.: Defendants AnswerDocumento56 páginasDr. Josse Mazo Et. Al. v. John Merritt Et. Al.: Defendants AnswerMichael_Lee_RobertsAinda não há avaliações

- FABM2 - Q1 - Module 2 Statement of Comprehensive Income EditedDocumento23 páginasFABM2 - Q1 - Module 2 Statement of Comprehensive Income EditedJayson MejiaAinda não há avaliações

- Accounting Information SystemDocumento58 páginasAccounting Information SystemMohammed Akhtab Ul HudaAinda não há avaliações

- Banking Assignment: PGDM 2017-2019Documento14 páginasBanking Assignment: PGDM 2017-2019Pooja NagAinda não há avaliações

- Chapter 8 PDFDocumento22 páginasChapter 8 PDFJay BrockAinda não há avaliações

- Property Relations Between Husband and WifeDocumento11 páginasProperty Relations Between Husband and WifeKila AdameAinda não há avaliações

- Capital StructureDocumento4 páginasCapital StructureNaveen GurnaniAinda não há avaliações

- Reviewer in Intermediate Accounting Mam F Revised 1docxDocumento106 páginasReviewer in Intermediate Accounting Mam F Revised 1docxJessaAinda não há avaliações