Escolar Documentos

Profissional Documentos

Cultura Documentos

Traders Education Tutorial: Analysis and Trade Strategies From The DT Reports

Enviado por

alypatyTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Traders Education Tutorial: Analysis and Trade Strategies From The DT Reports

Enviado por

alypatyDireitos autorais:

Formatos disponíveis

Traders Education Tutorial – 4/05/03

Analysis and Trade Strategies From the DT Reports

Traders Education Tutorial

Analysis and Trade Strategies From the DT Reports

Each issue of the DT Daily Futures Report and DT Stock and ETF Report is a

trading education in itself. We usually provide a detailed description of how we do

the analysis and why we thing a market is in the position we believe it is in. We

also provide a summary of the current position and trade strategies.

This week’s Traders Education Tutorial is taken from the April 5, 2003 DT

Daily Futures Report.

Continued on the next page.

Copyright 2002, Dynamic Traders Group, Inc. – www.DynamicTraders.com

Traders Education Tutorial – 4/05/03

Analysis and Trade Strategies From the DT Reports

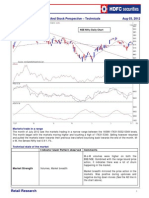

Gold (Weekly)

Feb. completed a five wave advance from the April 2001 low. The Feb. high

should be followed by at least a three wave correction. Gold is near the minimum

target for a corrective decline beginning at 320. However, the bear trend will

probably continue to Aug. or later. 320 is only the minimum target for a corrective

decline which could extend to around 280. The current decline off the Feb. high

should only be the wave-A of a three wave, ABC, correction lasting for several

more weeks or months.

The weekly Dtosc is in the extreme low zone signaling the current phase of

the bear trend should be near a low.

Gold has had a very regular 16-19 week low-low time rhythm since the April

2001 low. If this time rhythm continues, a temporary low followed by a 3-5 week

advance should be complete within two weeks. The short term trend position as

shown on the daily chart on the next page indicates the low is likely to be

complete by next week if it was not complete at last week’s low.

Copyright 2002, Dynamic Traders Group, Inc. – www.DynamicTraders.com

Traders Education Tutorial – 4/05/03

Analysis and Trade Strategies From the DT Reports

Gold (June) Daily

The wave count shown below is a bit different from the one we’ve recently shown

but makes the best sense as of this point in time, particularly considering the low-

low time target on the weekly chart.

Last week’s new low has met the minimum criteria for a W.5 low by trading

below the W.3 low. Since W.3 is shorter that W.1, W.5 must be shorter than W.3

and should not trade below 304.3..

The latest time target for a W.5 low is late next week which is the 100% ST,

low-low TCR (Time Cycle Ratio).

A trade over 337.5, the W.4 high signals W.5 is complete and a corrective

rally should follow over the next 3-5 weeks.

Copyright 2002, Dynamic Traders Group, Inc. – www.DynamicTraders.com

Traders Education Tutorial – 4/05/03

Analysis and Trade Strategies From the DT Reports

Gold and Silver Summary Position

Pattern The best count is March 31 as a W.4 high.

Price May Silver: 431-425: Ideal W.5 target.

June Gold: 319-314: Ideal W.5 target.

Time April 10-14: Maximum time target to complete a W.5 low. A low in this time

frame should only be a W.A of an ABC correction off the Feb. high.

Aug. – Oct.: Probable time target to complete a corrective low off the Feb. high.

Trade Intermediate Term (from Feb. 5 high): Short against a close above 371.

Strategies Short Term: The downside appears very limited but both gold and silver are

likely to make at least slight new lows next week before a W.5 low is complete.

The ideal trade set-up next week will be if gold/silver make new lows into the

ideal W.5 target zones followed by a daily reversal signal to exit short trades

and reverse to long trades.

Learn More

For a complete step-by-step education to the Dynamic Trading approach, study

the Dynamic Trading book, now available at the discounted price of $67 from our

Web site.

If you would like to be alerted to the major to minor trend targets and

reversals, consider the Dynamic Trading Stock and Futures Reports. More

information about these reports is available on our web site.

Copyright 2002, Dynamic Traders Group, Inc. – www.DynamicTraders.com

Você também pode gostar

- Inner Circle Trader - TPDS 5Documento18 páginasInner Circle Trader - TPDS 5Felix Tout Court100% (1)

- Monthly Market, Sectoral and Stock Perspective - Technicals June 29, 2013Documento6 páginasMonthly Market, Sectoral and Stock Perspective - Technicals June 29, 2013GauriGanAinda não há avaliações

- Aileron Market Balance: Issue 21Documento8 páginasAileron Market Balance: Issue 21Dan ShyAinda não há avaliações

- Monthly Market, Sectoral and Stock Perspective - Technicals Dec 08, 2012Documento5 páginasMonthly Market, Sectoral and Stock Perspective - Technicals Dec 08, 2012GauriGanAinda não há avaliações

- 10.4 CSS Info Page PDFDocumento22 páginas10.4 CSS Info Page PDFBoyan ZrncicAinda não há avaliações

- Master Trader Plan For Week 9-17-18Documento12 páginasMaster Trader Plan For Week 9-17-18tummalaajaybabuAinda não há avaliações

- Trading PlanDocumento11 páginasTrading PlanFloraAinda não há avaliações

- AHA Article - Review of TradesDocumento6 páginasAHA Article - Review of TradesMaheswarReddy SathelaAinda não há avaliações

- Best Examples of Chart Patterns For 2012Documento12 páginasBest Examples of Chart Patterns For 2012Peter L. Brandt100% (1)

- Monthly Market, Sectoral and Stock Perspective - Technicals Aug 03, 2012Documento5 páginasMonthly Market, Sectoral and Stock Perspective - Technicals Aug 03, 2012GauriGanAinda não há avaliações

- Dynamic Trader Daily Report: Today's LessonDocumento3 páginasDynamic Trader Daily Report: Today's LessonBudi MulyonoAinda não há avaliações

- Best Dressed 2014Documento24 páginasBest Dressed 2014Peter L. Brandt100% (1)

- Volume 9 Highlights: InsideDocumento20 páginasVolume 9 Highlights: InsidedpbasicAinda não há avaliações

- Candle TermDocumento3 páginasCandle Termlector_961Ainda não há avaliações

- Forex Trading Tips For BeginnerDocumento29 páginasForex Trading Tips For BeginnerHayden C.Smith100% (1)

- DTI Ratio SpreadsDocumento7 páginasDTI Ratio SpreadsFranklin HallAinda não há avaliações

- Paul Gallacher, Technical Analysis, November 3Documento64 páginasPaul Gallacher, Technical Analysis, November 3api-87733769Ainda não há avaliações

- The Cartography Corner, March 2021Documento9 páginasThe Cartography Corner, March 2021Speculation OnlyAinda não há avaliações

- Technically Speaking - May 13, 2015Documento12 páginasTechnically Speaking - May 13, 2015dpbasicAinda não há avaliações

- Trading The Monthly SignalsDocumento48 páginasTrading The Monthly SignalsAnonymous vy09RiAinda não há avaliações

- Big Picture by FMaggioniDocumento7 páginasBig Picture by FMaggioniFrancesco MaggioniAinda não há avaliações

- Thursday, February 6, 2014: Must Have Book For SubscribersDocumento10 páginasThursday, February 6, 2014: Must Have Book For Subscriberschr_maxmannAinda não há avaliações

- AMDDocumento6 páginasAMDagater321Ainda não há avaliações

- Technically Speaking - September 22, 2015Documento11 páginasTechnically Speaking - September 22, 2015dpbasicAinda não há avaliações

- Bet On Yen Appreciation - 20130325Documento11 páginasBet On Yen Appreciation - 20130325Min SungAinda não há avaliações

- CRB, Wtic & GoldDocumento25 páginasCRB, Wtic & GoldSoren K. GroupAinda não há avaliações

- Technically Speaking - April 21, 2016Documento13 páginasTechnically Speaking - April 21, 2016dpbasicAinda não há avaliações

- Gold MatketviewsDocumento8 páginasGold MatketviewsreadthemallAinda não há avaliações

- ICT MethodsDocumento66 páginasICT MethodsMohammed Nizam95% (75)

- Technically Speaking - October 21, 2015Documento12 páginasTechnically Speaking - October 21, 2015dpbasicAinda não há avaliações

- Trend Identification - GFT ForexDocumento4 páginasTrend Identification - GFT ForexSwamiAinda não há avaliações

- Trading NR7 SetupDocumento24 páginasTrading NR7 SetupQuyên NguyễnAinda não há avaliações

- Technical Analysis: Introduction: ITM, January 2011Documento7 páginasTechnical Analysis: Introduction: ITM, January 2011Renuka NuniaAinda não há avaliações

- Pivot Point TradingDocumento5 páginasPivot Point Tradingipins0% (1)

- Aileron Market Balance: Issue 18Documento6 páginasAileron Market Balance: Issue 18Dan ShyAinda não há avaliações

- DT Stock and ETF Report 1-9-2015Documento20 páginasDT Stock and ETF Report 1-9-2015chr_maxmannAinda não há avaliações

- DailyFX Guide Fundamentals Breakout TradingDocumento21 páginasDailyFX Guide Fundamentals Breakout TradingexercitusjesseAinda não há avaliações

- Best Dressed 2013 - v1.2Documento21 páginasBest Dressed 2013 - v1.2Peter L. BrandtAinda não há avaliações

- Gold's Unique Characteristics as a Monetary Asset and Store of ValueDocumento32 páginasGold's Unique Characteristics as a Monetary Asset and Store of ValueBaqar Zaidi100% (3)

- Capt Rahul - Secret Profit LevelDocumento17 páginasCapt Rahul - Secret Profit LevelAlpha TraderAinda não há avaliações

- Mahendra Sharma NewletterDocumento12 páginasMahendra Sharma NewletterNiraj KotharAinda não há avaliações

- GBP USD PersonalityDocumento13 páginasGBP USD PersonalityRieyz ZalAinda não há avaliações

- How To Properly Draw and Trade Trendlines: What Are Forex TrendlinesDocumento13 páginasHow To Properly Draw and Trade Trendlines: What Are Forex TrendlinesRafiq DarussalamAinda não há avaliações

- Elite Current Sea - Support and Resistance TradingDocumento20 páginasElite Current Sea - Support and Resistance TradingRameshKumarMuraliAinda não há avaliações

- Daily Edition: Ccle Llan ARK ET REP ORT THEDocumento4 páginasDaily Edition: Ccle Llan ARK ET REP ORT THERandall NuñezAinda não há avaliações

- EGX (30) Index: Trend Close CHG % CHG S/L 08-Oct-13Documento3 páginasEGX (30) Index: Trend Close CHG % CHG S/L 08-Oct-13api-237717884Ainda não há avaliações

- Click Here For: Full CurriculumDocumento76 páginasClick Here For: Full CurriculumSwinlife Winlife100% (1)

- A Top-Down Trade Executed Solely On RSI Trend Line Analysis - Trendline Mastery BlogDocumento12 páginasA Top-Down Trade Executed Solely On RSI Trend Line Analysis - Trendline Mastery BlogLờ TrươngAinda não há avaliações

- SS S&D Level Examples PDFDocumento256 páginasSS S&D Level Examples PDFItzjak Sarano94% (16)

- IM Project ICICI Bank Technical AnalysisDocumento9 páginasIM Project ICICI Bank Technical Analysisajay_sjceAinda não há avaliações

- Fakeout Pattern Slides From Moscow SeminarDocumento7 páginasFakeout Pattern Slides From Moscow SeminarAlex GreyAinda não há avaliações

- 2012 01 03 Migbank Daily Technical Analysis ReportDocumento15 páginas2012 01 03 Migbank Daily Technical Analysis ReportmigbankAinda não há avaliações

- Trading NR7 SetupDocumento24 páginasTrading NR7 Setupsangram2483% (6)

- How to Trade Gold: Gold Trading Strategies That WorkNo EverandHow to Trade Gold: Gold Trading Strategies That WorkNota: 1 de 5 estrelas1/5 (1)

- Investing in a Volatile Stock Market: How to Use Everything from Gold to Daytrading to Ride Out Today's Turbulent MarketsNo EverandInvesting in a Volatile Stock Market: How to Use Everything from Gold to Daytrading to Ride Out Today's Turbulent MarketsAinda não há avaliações

- Summary of Nishant Pant's $25K Options Trading Challenge, Second EditionNo EverandSummary of Nishant Pant's $25K Options Trading Challenge, Second EditionAinda não há avaliações

- Professional Day Trading & Technical Analysis Strategic System For Intraday Trading Stocks, Forex & Financial Trading.No EverandProfessional Day Trading & Technical Analysis Strategic System For Intraday Trading Stocks, Forex & Financial Trading.Ainda não há avaliações

- The Simplified Theory of The Time Factor in Forex TradingNo EverandThe Simplified Theory of The Time Factor in Forex TradingAinda não há avaliações

- SCC Issue 09 Sep 2015Documento15 páginasSCC Issue 09 Sep 2015alypatyAinda não há avaliações

- DeepTrading With TensorFlow 4 - TodoTraderDocumento14 páginasDeepTrading With TensorFlow 4 - TodoTraderalypatyAinda não há avaliações

- DeepTrading With TensorFlow 6 - TodoTraderDocumento50 páginasDeepTrading With TensorFlow 6 - TodoTraderalypatyAinda não há avaliações

- CT200905Documento42 páginasCT200905ist0Ainda não há avaliações

- DeepTrading With TensorFlow 2 - TodoTraderDocumento9 páginasDeepTrading With TensorFlow 2 - TodoTraderalypatyAinda não há avaliações

- DeepTrading With TensorFlow 5 - TodoTraderDocumento21 páginasDeepTrading With TensorFlow 5 - TodoTraderalypatyAinda não há avaliações

- DeepTrading With TensorFlow 3 - TodoTraderDocumento10 páginasDeepTrading With TensorFlow 3 - TodoTraderalypatyAinda não há avaliações

- Currency Trader March 2009Documento45 páginasCurrency Trader March 2009ist0Ainda não há avaliações

- Fixed Income Futures: Interest Rate DerivativesDocumento2 páginasFixed Income Futures: Interest Rate DerivativesalypatyAinda não há avaliações

- Kyrtsou and Terraza 2000Documento16 páginasKyrtsou and Terraza 2000alypatyAinda não há avaliações

- Currency Trader (April 2009, Vol 6, No. 4)Documento45 páginasCurrency Trader (April 2009, Vol 6, No. 4)Lucero GarciaAinda não há avaliações

- Spanishe2 PDFDocumento24 páginasSpanishe2 PDFalypatyAinda não há avaliações

- Optimal Number of Trials For Monte Carlo Simulation: by Marco Liu, CQFDocumento4 páginasOptimal Number of Trials For Monte Carlo Simulation: by Marco Liu, CQFalypatyAinda não há avaliações

- Currency Trends: Spot Check: Forex Watch 2009 The EuroDocumento45 páginasCurrency Trends: Spot Check: Forex Watch 2009 The EuroalypatyAinda não há avaliações

- Monte Carlo Simulations: Number of Iterations and Accuracy: by William OberleDocumento34 páginasMonte Carlo Simulations: Number of Iterations and Accuracy: by William OberlealypatyAinda não há avaliações

- Forwards As Spot PredictorsDocumento32 páginasForwards As Spot PredictorsalypatyAinda não há avaliações

- The Ted Spread - KawallerDocumento13 páginasThe Ted Spread - KawallerJohn HuttonAinda não há avaliações

- Spreading (October 26 2005 CBOT Presentation-General ED Overview)Documento39 páginasSpreading (October 26 2005 CBOT Presentation-General ED Overview)tahreek6775Ainda não há avaliações

- (Trading Forex) The Forex Profit System PDFDocumento10 páginas(Trading Forex) The Forex Profit System PDFalypatyAinda não há avaliações

- How Bond Prices Are DeterminedDocumento5 páginasHow Bond Prices Are DeterminedjujonetAinda não há avaliações

- FXStreet - Trade The News Series Inflation TheoryDocumento37 páginasFXStreet - Trade The News Series Inflation TheoryalypatyAinda não há avaliações

- Batfink Daily Range (A) PDFDocumento16 páginasBatfink Daily Range (A) PDFAbilio JoseAinda não há avaliações

- Anti-Scam Guide. The Book For Forex InvestorsDocumento5 páginasAnti-Scam Guide. The Book For Forex InvestorsalypatyAinda não há avaliações

- Forex Systems: Types of Forex Trading SystemDocumento35 páginasForex Systems: Types of Forex Trading SystemalypatyAinda não há avaliações

- Currency PersonalitiesDocumento7 páginasCurrency PersonalitiesAmber RuleyAinda não há avaliações

- "Big Ben" Strategy by Kristian KerrDocumento4 páginas"Big Ben" Strategy by Kristian Kerrapi-26247058100% (1)

- 9 Forex Systems PDFDocumento35 páginas9 Forex Systems PDFalypatyAinda não há avaliações

- Stop Loss ApplicationDocumento5 páginasStop Loss ApplicationalypatyAinda não há avaliações

- Explosive Profits: Revised Edition "Pre-Released" Version Published On October 24, 2004Documento19 páginasExplosive Profits: Revised Edition "Pre-Released" Version Published On October 24, 2004a3550808Ainda não há avaliações

- 4 Hour Trend LineDocumento11 páginas4 Hour Trend LineAnik Jayan Raj BoddedaAinda não há avaliações

- McKinsey. Analytics Comes of Age. March 2018 PDFDocumento100 páginasMcKinsey. Analytics Comes of Age. March 2018 PDFgcvela100% (1)

- India Personal Care Market - Case Study - Sakshi GuptaDocumento7 páginasIndia Personal Care Market - Case Study - Sakshi GuptaSakshi GuptaAinda não há avaliações

- Dividend Policy, Growth, and The Valuation of Shares M&M 1961Documento24 páginasDividend Policy, Growth, and The Valuation of Shares M&M 1961TarasAinda não há avaliações

- The Bombay Stock ExchangeDocumento10 páginasThe Bombay Stock ExchangeSnehal RunwalAinda não há avaliações

- FAB Analyst and Investor Day BiosDocumento17 páginasFAB Analyst and Investor Day BioskhuramrajpootAinda não há avaliações

- CPC Platform 2019Documento103 páginasCPC Platform 2019stephenmtaylor100% (1)

- Review Questions at Konting ProblemsDocumento26 páginasReview Questions at Konting ProblemsgeonardAinda não há avaliações

- Group Relief and Taxation of Associated CompaniesDocumento9 páginasGroup Relief and Taxation of Associated CompaniesHassan IjazAinda não há avaliações

- Cit Y of Bihać: Development Project: Business Zone Kamenica"Documento20 páginasCit Y of Bihać: Development Project: Business Zone Kamenica"Dzenita Hamzic HalilagicAinda não há avaliações

- Learn Financial Analysis Skills with WallStreetMojo's Comprehensive Online CourseDocumento16 páginasLearn Financial Analysis Skills with WallStreetMojo's Comprehensive Online Courseyogesh patilAinda não há avaliações

- Investments Introduction NotesDocumento17 páginasInvestments Introduction NotesVidhiGondaliaAinda não há avaliações

- Project Planning and ManagementDocumento39 páginasProject Planning and ManagementS.Rengasamy100% (12)

- Eastboro Case Write Up For Presentation1Documento4 páginasEastboro Case Write Up For Presentation1Paula Elaine ThorpeAinda não há avaliações

- Introduction of Indian Rupee 1) Introduction of Indian RupeeDocumento33 páginasIntroduction of Indian Rupee 1) Introduction of Indian RupeeRajesh GuptaAinda não há avaliações

- Demand TheoryDocumento19 páginasDemand TheoryRohit GoyalAinda não há avaliações

- Public ExpenditureDocumento6 páginasPublic ExpenditureMotilal HembramAinda não há avaliações

- Activity-Based Costing/management and Its Implications For Operations ManagementDocumento8 páginasActivity-Based Costing/management and Its Implications For Operations ManagementYeyAinda não há avaliações

- Bloomberg - Richest Hedge Funds 02 2011Documento6 páginasBloomberg - Richest Hedge Funds 02 2011Adam PedharAinda não há avaliações

- Jawaban UTS Manajemen KeuanganDocumento16 páginasJawaban UTS Manajemen KeuanganMikhail BarenovAinda não há avaliações

- Report Sritex 31 Dec 2018 2Documento161 páginasReport Sritex 31 Dec 2018 2Kris NaAinda não há avaliações

- Cirque Du SoleilDocumento4 páginasCirque Du SoleilSharfuddin Chowdhury ShajibAinda não há avaliações

- HDB Resale Prices and En Bloc FeverDocumento11 páginasHDB Resale Prices and En Bloc Fevergareth3yingAinda não há avaliações

- CH 12Documento48 páginasCH 12Nabila Putri PratamaAinda não há avaliações

- HL Master Prospectus 2017 FinalDocumento173 páginasHL Master Prospectus 2017 FinalhlamycomAinda não há avaliações

- IHCL SUBSIDIARY Annual Report 2009 10Documento348 páginasIHCL SUBSIDIARY Annual Report 2009 10raman86_netAinda não há avaliações

- This Study Resource WasDocumento6 páginasThis Study Resource WasKurtAinda não há avaliações

- GASB 34 Governmental Funds vs Government-Wide StatementsDocumento22 páginasGASB 34 Governmental Funds vs Government-Wide StatementsLisa Cooley100% (1)

- Types of Banks in IndiaDocumento20 páginasTypes of Banks in Indiavenkatsri1Ainda não há avaliações

- Maurice Levin Resume:CV Brief PDFDocumento1 páginaMaurice Levin Resume:CV Brief PDFMaurice LevinAinda não há avaliações

- 9959 A Review of Fast Growing Blockchain Hubs in AsiaDocumento16 páginas9959 A Review of Fast Growing Blockchain Hubs in AsiaImran JavedAinda não há avaliações