Escolar Documentos

Profissional Documentos

Cultura Documentos

Ratio Analysis Sample

Enviado por

Aprile AnonuevoDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Ratio Analysis Sample

Enviado por

Aprile AnonuevoDireitos autorais:

Formatos disponíveis

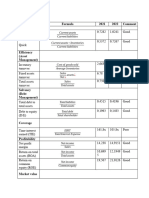

SOLUTIONS FOR RATIO ANALYSIS:

Ratio Tests 2008 2007

Current Ratio =582,695/784,792 =555,801/771,474

=Current Assets / Current =0.74248 =0.72044

Liabilities

Quick Ratio =(336,818+134,569)/784,792 =(319,978+127,841)/771,474

=Quick Assets / Current = 0.6007 =0.5805

Liabilities

Receivable Turnover =8,079,445/ (134,569/360) =7,756,268/(127,841/360)

=Net Credit Sales / =21614.35 =21841.64

Average Receivables

Inventory Turnover =0 =0

=Cost of Goods sold / (Service Entity) (Service Entity)

Average Merchandise

Inventory

Raw Materials Turnover =0 =0

=Cost of Raw Materials / (Service Entity) (Service Entity)

Average Raw Materials

Inventory

Goods in Process =0 =0

Turnover (Service Entity) (Service Entity)

=Cost of Goods

Manufactured / Average

Goods in Process

Manufactured

Finished Goods =0 =0

Turnover (Service Entity) (Service Entity)

=Cost of Goods Sold /

Average Finished Goods

Inventory

Payables Turnover =0 =0

=Net Credit Purchases / (Service Entity) (Service Entity)

Average Trade Payables

Current Asset Turnover =(7,945,326-122,001) / =(7,620,193-115,901) /

=(Cost of Sales+ (582,695 / 360) (555,801 / 360)

Operating Expenses) / =4833.398 =4860.6

Average Current Assets

Times Interest Earned = 45,458 + 72,301 / 72,301 = 52,094 + 68,439 / 68,439

=(Income Before Tax + =1.628733 =1.7612

Interest Expense) / Interest

Expense

Debt-Equity Ratio =1,121,601/95,013 =1,070,826/79,113

= Total Liabilities / Total =11.805 =13.535

Owner’s Equity

Debt Ratio =1,121,601/1,216,614 =1,070,826/1,149,939

=Total Liabilities / Total =0.9219 =0.9312

Assets

Equity Ratio =95,013/1,216,614 =79,113/1,149,939

=Totals Owner’s Equity/ = 0.0781 =0.0688

Total Assets

Net Profit Ratio =23,581/8,079,445 =31,024/7,756,268

=Net Profit/Net Sales =0.0029 =0.004

Gross Profit Ratio =8,079,445/8,079,445 =7,756,268/7,756,268

=Gross Profit/ Sales =1 =1

Return on Asset =(117,759+21,877) / =(120,533+21,070)/

=(Income Before Interest 1,216,614+1,149,939)/2 1,149,939

Expense + Income Tax)/ =0.118 =0.12313958

Average Total Assets

Return on Owner’s =23,581/(95,013+79,113) =31,024/79,113

Equity =0.1354 =0.3921

=Net Income / Average

Owner’s Equity

Earnings Per Share Not Corporation Not Corporation

=Net Income – Preferred /

Weighted Average

Number of Common

Shares

Price-Earnings Ratio Not Corporation Not Corporation

=Price Per share/Earnings

Per Share

Dividend Yield Not Corporation Not Corporation

=Dividend Per share/Price

per Share

Dividend Payout Not Corporation Not Corporation

=Common Dividend Per

Share/Earnings Per Share

Liberty Medical Group

Ratio Analysis - Two-Year Comparison

2008 2007

Liquidity Ratios

Current Ratio 0.7 0.7

Acid Test Ratio- Quick Ratio 0.6 0.6

Receivable Turnover 21.61 21.84

Inventory Turnover 0 0

Raw Materials Turnover 0 0

Goods in Process Turnover 0 0

Finished Goods Turnover 0 0

Payables Turnover 0 0

Current Asset Turnover 4833.40 4860.6

Test of Solvency

Times Interest Earned 1.63 1.76

Debt-Equity Ratio 11.81 13.54

Debt Ratio 0.92 0.93

Equity Ratio 0.08 0.07

Net Profit Ratio 0.003 0.004

Gross Profit Ratio 1 1

Test of Profitability

Return on Asset 0.12 0.12

Return on Owner’s Equity 0.14 0.39

Earnings Per Share N/A N/A

Market Test

Price-Earnings Ratio N/A N/A

Dividend Yield N/A N/A

Dividend Payout N/A N/A

Você também pode gostar

- Tower and TowerDocumento6 páginasTower and TowerAprile AnonuevoAinda não há avaliações

- Tower and TowerDocumento6 páginasTower and TowerAprile AnonuevoAinda não há avaliações

- Structural Analysis Cheat SheetDocumento5 páginasStructural Analysis Cheat SheetByram Jennings100% (1)

- Project Proposal - Hospital Management SystemDocumento20 páginasProject Proposal - Hospital Management SystemDilanka Liyanage95% (19)

- Punjab Rubber ProductDocumento9 páginasPunjab Rubber ProductSohail GhakkarAinda não há avaliações

- Financial Statement Analysis HomeworkDocumento2 páginasFinancial Statement Analysis HomeworkHiếu NguyễnAinda não há avaliações

- Anandam Manufacturing CompanyDocumento9 páginasAnandam Manufacturing CompanyAijaz AslamAinda não há avaliações

- Gloria and DeloriaDocumento5 páginasGloria and DeloriaAprile AnonuevoAinda não há avaliações

- Finance Group AssignmentDocumento7 páginasFinance Group AssignmentAreej AJAinda não há avaliações

- Financial Management Ratio Analysis - 29121289 - Simon ErickDocumento7 páginasFinancial Management Ratio Analysis - 29121289 - Simon ErickSimon ErickAinda não há avaliações

- Chapter 6 For CUP Financial AccountingDocumento15 páginasChapter 6 For CUP Financial Accountingratanak_kong1-9Ainda não há avaliações

- P14-5A. Selected Financial Data For Black & Decker and Snap-On Tools For 2003 Are Presented HereDocumento6 páginasP14-5A. Selected Financial Data For Black & Decker and Snap-On Tools For 2003 Are Presented HereEvie ASMRAinda não há avaliações

- Working Capital Management of RINLDocumento3 páginasWorking Capital Management of RINLSneha GuptaAinda não há avaliações

- PT Fabm 2 AND BFDocumento12 páginasPT Fabm 2 AND BFLushelle JiAinda não há avaliações

- ACCOUNTING FOR F&B AND HR FOR FOOD BUSINESS - by Thomas DavisDocumento28 páginasACCOUNTING FOR F&B AND HR FOR FOOD BUSINESS - by Thomas DavisTesda CACSAinda não há avaliações

- Exhibit 2Documento1 páginaExhibit 2Vijendra Kumar DubeyAinda não há avaliações

- ICI Pakistan AnalysisDocumento19 páginasICI Pakistan AnalysisAffan AnwarAinda não há avaliações

- New York Stock ExchangeDocumento9 páginasNew York Stock Exchangeapi-589525395Ainda não há avaliações

- FABM2-WPS OfficeDocumento2 páginasFABM2-WPS OfficeAliza KhateAinda não há avaliações

- Citsit MankeuDocumento14 páginasCitsit MankeuAgna AegeanAinda não há avaliações

- Financial AnalysisDocumento6 páginasFinancial AnalysismahmoudAinda não há avaliações

- Sheet1: Workings 2013 2012 Liquidity RatiosDocumento1 páginaSheet1: Workings 2013 2012 Liquidity RatiosAbhishek SuranaAinda não há avaliações

- Genting Malaysia Berhad 110220Documento51 páginasGenting Malaysia Berhad 110220BT GOHAinda não há avaliações

- Final AssignmentDocumento54 páginasFinal AssignmentValentin PicavetAinda não há avaliações

- Attock Cement Ratio Analysis 2019 by RizwanDocumento8 páginasAttock Cement Ratio Analysis 2019 by RizwanHayat budhoooAinda não há avaliações

- Financial Ratios Activity Answer KeyDocumento8 páginasFinancial Ratios Activity Answer KeyMarienell YuAinda não há avaliações

- Financial Statement AnalysisDocumento3 páginasFinancial Statement AnalysisUrooj MustafaAinda não há avaliações

- Introduction To Business Finance Final Project Ratio Analysis of Al Abbas Sugar MillsDocumento23 páginasIntroduction To Business Finance Final Project Ratio Analysis of Al Abbas Sugar MillsUmer Ali SangiAinda não há avaliações

- ASSET LIABILITY MANAGEMENTppt FinalDocumento27 páginasASSET LIABILITY MANAGEMENTppt Finaln__dAinda não há avaliações

- Balance Sheet: Liquidity Analysis RatiosDocumento7 páginasBalance Sheet: Liquidity Analysis RatiosJan OleteAinda não há avaliações

- Hi Growth FixedDocumento36 páginasHi Growth FixedVikram GulatiAinda não há avaliações

- Jubilant FoodsDocumento24 páginasJubilant FoodsMagical MakeoversAinda não há avaliações

- Financial RatiosDocumento4 páginasFinancial RatiosNguyễn Như NgọcAinda não há avaliações

- Financial Statement AnalysisDocumento10 páginasFinancial Statement AnalysisAli Gokhan Kocan100% (1)

- Aamra Network LTDDocumento31 páginasAamra Network LTDisrat jahanAinda não há avaliações

- SHELL Pakistan: Finnacial Ratios Formulas YearDocumento2 páginasSHELL Pakistan: Finnacial Ratios Formulas YearAbdullah QureshiAinda não há avaliações

- Formula Sheet 2016Documento5 páginasFormula Sheet 2016api-505775092Ainda não há avaliações

- Book 1Documento4 páginasBook 1pjdevicenteAinda não há avaliações

- Accounting For ManagersDocumento14 páginasAccounting For ManagersHimanshu Upadhyay AIOA, NoidaAinda não há avaliações

- RaymondDocumento3 páginasRaymondAkankshaAinda não há avaliações

- Session 2 (Ratio Analsysis) SolutionDocumento14 páginasSession 2 (Ratio Analsysis) SolutionBintang David SusantoAinda não há avaliações

- Chapter 1Documento27 páginasChapter 1Eldar AlizadeAinda não há avaliações

- Math Solution Ratio AnalysisDocumento4 páginasMath Solution Ratio Analysisraju710@gmail.comAinda não há avaliações

- Ratio Analysis Toyota Indus Motors Company Limited: Lquidity RatiosDocumento9 páginasRatio Analysis Toyota Indus Motors Company Limited: Lquidity RatiosArsl331Ainda não há avaliações

- Financial Management FinalDocumento14 páginasFinancial Management FinalNeal KAinda não há avaliações

- Particular Formulae RatiosDocumento13 páginasParticular Formulae RatiosRahul SinghAinda não há avaliações

- ACC314 Revision Ratio Questions - SolutionsDocumento8 páginasACC314 Revision Ratio Questions - SolutionsRukshani RefaiAinda não há avaliações

- Ratios Unit Formula December 31, 2015 December 31, 2014 December 31, 2013 December 31, 2012 December 31, 2011 Profitability RatiosDocumento5 páginasRatios Unit Formula December 31, 2015 December 31, 2014 December 31, 2013 December 31, 2012 December 31, 2011 Profitability RatiosYasir AamirAinda não há avaliações

- Ringkasan Laporan Keuangan Ratio Analysis PT Nippon Indosari Corpindo Tbk. PT Nippon Indosari Corpindo Tbk. Dec-14 Dec-13Documento14 páginasRingkasan Laporan Keuangan Ratio Analysis PT Nippon Indosari Corpindo Tbk. PT Nippon Indosari Corpindo Tbk. Dec-14 Dec-13Anna KholibbiyahAinda não há avaliações

- Hira Karim Malik Section B - Financial Ratios Practice AssignmentDocumento7 páginasHira Karim Malik Section B - Financial Ratios Practice AssignmenthirakmalikAinda não há avaliações

- RatioDocumento2 páginasRationol3odyAinda não há avaliações

- Final Exam Ibrahim Helmy, Advanced FinanceDocumento30 páginasFinal Exam Ibrahim Helmy, Advanced FinanceIbrahim HelmyAinda não há avaliações

- Financial Ratios For Dar Al Shefaa Corporation 2015Documento6 páginasFinancial Ratios For Dar Al Shefaa Corporation 2015Lina Jardaneh (Lina Jardaneh)Ainda não há avaliações

- Ratio Analysis: Liquidity RatiosDocumento2 páginasRatio Analysis: Liquidity RatiosHira SiddiqueAinda não há avaliações

- SAS AirlineDocumento9 páginasSAS AirlinejamilkhannAinda não há avaliações

- Balance SheetDocumento11 páginasBalance SheetZy EllisAinda não há avaliações

- Learning Activity 1 - Analysis of Financial StatementsDocumento3 páginasLearning Activity 1 - Analysis of Financial StatementsAra Joyce PermalinoAinda não há avaliações

- Mini CaseDocumento4 páginasMini CaseHesham MansourAinda não há avaliações

- Manajemen Keuangan-Modul 2Documento59 páginasManajemen Keuangan-Modul 2Rian syaeful anwarAinda não há avaliações

- Interpretation of Final Accounts: Ratio AnalysisDocumento25 páginasInterpretation of Final Accounts: Ratio AnalysisNguyễn Hạnh LinhAinda não há avaliações

- Overall Profitability RatiosDocumento20 páginasOverall Profitability RatiosShobika RAinda não há avaliações

- Why Need Performance MeasurementDocumento8 páginasWhy Need Performance MeasurementKhalil ManiarAinda não há avaliações

- Topic 13 Financial Statement AnalysisDocumento32 páginasTopic 13 Financial Statement AnalysisAbd AL Rahman Shah Bin Azlan ShahAinda não há avaliações

- Annual Financials For Pearson PLCDocumento6 páginasAnnual Financials For Pearson PLCMustansar IqbalAinda não há avaliações

- Business Metrics and Tools; Reference for Professionals and StudentsNo EverandBusiness Metrics and Tools; Reference for Professionals and StudentsAinda não há avaliações

- Literature in The PhilippinesDocumento9 páginasLiterature in The PhilippinesAprile AnonuevoAinda não há avaliações

- Cash ReviewerDocumento35 páginasCash ReviewerAprile AnonuevoAinda não há avaliações

- 3) Psa 210 - Agreeing The Terms of Audit EngagementsDocumento1 página3) Psa 210 - Agreeing The Terms of Audit EngagementsAprile AnonuevoAinda não há avaliações

- Cost ReviewerDocumento2 páginasCost ReviewerAprile AnonuevoAinda não há avaliações

- Cost Concepts and TerminologiesDocumento13 páginasCost Concepts and TerminologiesAprile AnonuevoAinda não há avaliações

- Accountancy LawDocumento6 páginasAccountancy LawAprile AnonuevoAinda não há avaliações

- Assertion SummaryDocumento3 páginasAssertion SummaryAprile AnonuevoAinda não há avaliações

- Aptitude TestDocumento19 páginasAptitude TestSANAAinda não há avaliações

- (After The Reading of The Quote) : For The Entrance of The Philippine National Flag!Documento4 páginas(After The Reading of The Quote) : For The Entrance of The Philippine National Flag!JV DeeAinda não há avaliações

- Debate QuestionsDocumento7 páginasDebate Questionsapi-522661051Ainda não há avaliações

- Catherine The Great: Catherine II, Empress of RussiaDocumento7 páginasCatherine The Great: Catherine II, Empress of RussiaLawrence James ParbaAinda não há avaliações

- Principles of Learning: FS2 Field StudyDocumento8 páginasPrinciples of Learning: FS2 Field StudyKel Li0% (1)

- Music TherapyDocumento13 páginasMusic TherapyXavier KiranAinda não há avaliações

- Batallon de San PatricioDocumento13 páginasBatallon de San PatricioOmar Marín OropezaAinda não há avaliações

- Principles and Methods of Effective TeachingDocumento5 páginasPrinciples and Methods of Effective TeachingerikaAinda não há avaliações

- Thesis Project Management SoftwareDocumento7 páginasThesis Project Management Softwarehollyschulzgilbert100% (2)

- TaTa TeA Ad AnaLysiSDocumento3 páginasTaTa TeA Ad AnaLysiSAmiya RautAinda não há avaliações

- Data ListDocumento239 páginasData Listpriyanka chithran100% (1)

- Concrete Batching and MixingDocumento8 páginasConcrete Batching and MixingIm ChinithAinda não há avaliações

- 1.CH 211 IntraductionDocumento13 páginas1.CH 211 IntraductionCarlos BuchwaAinda não há avaliações

- Schedule Standard and Syllabus: Section A: Geomorphology and Remote SensingDocumento6 páginasSchedule Standard and Syllabus: Section A: Geomorphology and Remote SensingPankaj SharmaAinda não há avaliações

- Types of Drills PDFDocumento8 páginasTypes of Drills PDFSummer nightsAinda não há avaliações

- Criminal Law Book 2 Titles 1-8Documento146 páginasCriminal Law Book 2 Titles 1-8Minato NamikazeAinda não há avaliações

- System Design PrimerDocumento60 páginasSystem Design PrimerPendyala SrinivasAinda não há avaliações

- 9709 w06 Ms 6Documento6 páginas9709 w06 Ms 6michael hengAinda não há avaliações

- Diabetes Mellitus in Pediatric: Dr. Wasnaa Hadi AbdullahDocumento30 páginasDiabetes Mellitus in Pediatric: Dr. Wasnaa Hadi AbdullahLily AddamsAinda não há avaliações

- Education Is The Foundation For Women Empowerment in IndiaDocumento111 páginasEducation Is The Foundation For Women Empowerment in IndiaAmit Kumar ChoudharyAinda não há avaliações

- The Meaning of LifeDocumento1 páginaThe Meaning of LifeJayas SharmaAinda não há avaliações

- The Effect of Carbon Black On The Oxidative Induction Time of Medium-Density PolyethyleneDocumento8 páginasThe Effect of Carbon Black On The Oxidative Induction Time of Medium-Density PolyethyleneMIRELLA BOERYAinda não há avaliações

- 07 Indian WeddingDocumento2 páginas07 Indian WeddingNailah Al-FarafishahAinda não há avaliações

- Chapter 1 To 3. Methods of ResearchDocumento18 páginasChapter 1 To 3. Methods of ResearchMaryAnnLasquiteAinda não há avaliações

- XM 301 StudDocumento594 páginasXM 301 StudNarendar ReddyAinda não há avaliações

- TIFR Pamphlet On Homological MethodsDocumento105 páginasTIFR Pamphlet On Homological MethodsRAMJANAinda não há avaliações

- MLB From 3G SideDocumento16 páginasMLB From 3G Sidemalikst3Ainda não há avaliações

- University of Mumbai: Bachelor of Management Studies (Finance) Semester VIDocumento73 páginasUniversity of Mumbai: Bachelor of Management Studies (Finance) Semester VIPranay ShettyAinda não há avaliações