Escolar Documentos

Profissional Documentos

Cultura Documentos

422 - Summary by Harsh Gupta - Part 1

Enviado por

Kumar SwamyDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

422 - Summary by Harsh Gupta - Part 1

Enviado por

Kumar SwamyDireitos autorais:

Formatos disponíveis

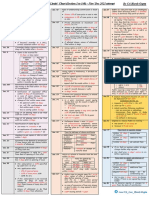

Section 149 Number of Directors Woman Director Resident Director

(Company to have At least 1-woman director in every

Board of Directors) Minimum - Every company must

3 Public Public company having have 1 resident

2 Private Listed company or P ≥ 100 crore director

1 OPC T ≥ 300 crore - Meaning – who has

Intermittent vacancy filled by Board stayed in India for ≥

Maximum – 15 182 days during the

- Immediate next BM, or whichever is

(can be increased by SR)

- 3 months }later FY

Note – Limit of maximum N.A. to Sec. 8

& Govt. company

Independent director (ID)

149(4) 149(6)

Public company having a. Person of integrity, expertise & experience

Listed Public P ≥ 10 crore b. - Not a promoter of CASH

company L ≥ 50 crore - Not related to P or D of CASH

T ≥ 100 crore c. No pecuniary relation with CASH Remuneration allowed

≥ 1/3rd of total or their P or D - 2 years

directors

≥ 2 ID Transactions up to 10% of his

total income allowed

d. His relative is not

Intermittent vacancy filled by Board

1. holding Security in CASH – 2 1. May hold upto FV 50 lakh or

- Immediate next BM, or whichever

- 3 months } is later years 2% of paid-up capital

2. Indebted to CASH or P or D– 2 2. Exception - 50 lakh

If above limits breached once, will have years

to appoint ID for next 3 years

JV, WOS, Dormant company is NOT 3. Guarantee or Security to CASH 3. Exception - 50 lakh

covered or P or D – 2 years

Other points 4. Any other pecuniary relation 4. Exception – 2% of turnover or

with CASH income in combination of above

- Must give a declaration of his

independence

- Comply with Schedule IV e. He or his relative is not

- Not entitled to ESOP 1. KMP or employee of CASH – 3 years – However, relative can be

- Not liable to retire by rotation employee

2. Not an Employee/ Proprietor/ Partner – 3 years

- Auditor/ CS/ Cost auditor of CASH

- Consulting firm of CASH deriving ≥ 10% of income

3. Holds with his relatives ≥ 2% voting power in company

4. CEO/ Director of NPO that

- receives ≥ 25% from CASH or P or D of company

- holds ≥ 2% voting power in Company

f. Possesses other prescribed qualification – appropriate skills in

specified fields

Term

First term of maximum 5 years (1st term by OR)

And maximum 2 terms permitted (2nd term by SR)

Cooling-off period of 3 years

Section 150 CG may notify an institute, which will maintain a data bank of persons eligible and willing to become independent director

(Data Bank) However, the responsibility of exercising due diligence before selecting a person is of the company

Section 151 Applicability Procedure to appoint

(Small Every listed company Application to appoint SSD by These small shareholders shall

Shareholders’

Director, SSD) It may appoint 1 director elected ≥ 1,000 small shareholders, or whichever

give a notice for appointing SSD

by small shareholders at least 14 days before meeting

Meaning of small shareholder –

≥ 1/10th of total small } is lower SSD need not be a shareholder

shareholders

one who holds shares of If satisfies section 149(6) &

NOMINAL VALUE ≤ INR 20,000 (7) will be independent director

SSD is not liable to retire by rotation A person can be SSD of maximum 2 companies provided

1 tenure of maximum 3 years these companies are not in competing business

No association with company for next 3 years

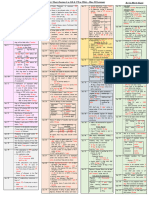

Section 152 First Directors Other provisions

(Appointment of Written in AOA DIN is compulsory for a director

Directors)

If not written, individual subscribers become the first directors Appointed director to give his consent in DIR-2

In case of OPC – the member becomes the first director Company to file such consent with RoC in DIR-12

These directors to hold office until director(s) appointed in GM

Retirement by Rotation – Applicable only to PUBLIC company

i AOA may provide that ALL When to retire At AGM

directors to retire How many 1/3rd of those 2/3rd shall retire

directors to retire Note – In this case, nearest rounding off is done

CA HARSH GUPTA (I.G.P.) Appointment & Qualification of Directors

ii Else, ≥ 2/3rd of TNOD shall retire Which director to

by rotation + should have been retire first

appointed in GM

Note – TNOD to exclude Independent

director

Note – For 2/3rd higher rounding off Who will fill such Retiring director himself or some other person may fill. Further

is done vacancy meeting may resolve NOT to fill the vacancy

Automatic re-appointment of retiring director

If the vacancy is not so filled or it is not resolved not to fill the vacancy, meeting stands adjourned to the next week (same

day, time & place if that day is a national holiday, then to the next succeeding day which is not a holiday)

If vacancy is not filled or it is not resolved not to fill the vacancy at adjourned meeting retiring director stands

automatically reappointed UNLESS

Resolution for his appointment was lost He is unwilling He is disqualified

Section 162 is applicable OR/ SR is required for his appointment as per provision of the Act

Section 153 Every person intending to become director must Section 154 CG to allot DIN within 1 month

apply for DIN in DIR-3

Section 155 No person shall obtain more than 1 DIN Section 156 Director must intimate his DIN to the company within 1

month

Section 157 Company to intimate details of DIN to RoC within Section 158 DIN must be mentioned in every return, information etc.

15 days

Section 159 For contravention of section 152, 155 & 156; - Imprisonment upto 6 months or fine upto INR 50,000

(Punishment) - If continuing one, further fine of INR 500/ day

Section 160 - Any person himself may apply for Conditions Deposit refunded if

(Candidature for directorship, or - 14 days’ notice before the meeting Gets elected, or

directorship) - A member may propose him as director - Deposit of INR 1 lakh Gets > 25% votes

Note - Section N.A. to a Private company & not No need of deposit is candidate

applicable in case of RETIRING DIRECTOR 1. In case of independent director

2. Director proposed by NRC

3. If no NRC, director proposed by Board

Section 161 (1) – Additional Director (2) – Alternate Director

Authorised by AOA Authorised by

Appointed by Board - AOA or

Hold office upto AGM - OR

Appointed by Board

(3) – Nominee Director Appointed to act as an alternate for a director outside India for ≥ 3

Authorised by AOA months

Appointed by Board Existing director can’t act as alternate director for any director

Appointed pursuant to some agreement or Person shall be alternate director for only 1 director in the company

law Alternate director for an Independent director must be independent as

(4) – Casual Vacancy well

Casual vacancy of a director appointed in GM Automatic re-appointment N.A. to alternate director

may be filled by Board at a MEETING Hold office

It is subsequently approved inimmediate next

- Upto tenure of original director

GM

- Original director returns to India } whichever is earlier

Hold office upto the date the director whose

vacancy is filled would have held office

Section 162 2 or more directors shall not be appointed by a single resolution, unless approved without any vote being cast against it

(Single Resolution)

If still appointed, the resolution shall be void

Section 163 AOA may provide for appointment of ≥ 2/3rd directors by proportional representation

(Proportional

Representation) Appointment made once in every 3 years & casual vacancy filled u/s 161(4)

Section 164 164(1) 164(2)

(Disqualifications)

No person who is or has been a director of a company,

shall be re-appointed in the company or appointed in any

other company as a director for 5 years, if that company

has not filed financial statements or annual

return for 3 continuous financial years

has failed to repay 3D’s for 1 year

(Deposit, debenture, dividend)

Note – Any person newly appointed as director of company

mentioned above shall not incur the disqualification for 6

months

164(3)

Private company may, by its articles, provide for any other

ground for disqualification

CA HARSH GUPTA (I.G.P.) Appointment & Qualification of Directors

Section 165 Maximum directorships = 20 But, maximum 10 directorships in

(Number of

Directorships) Section 8 & Dormant company - Public company or - Private company which is Holding or subsidiary of a Public

not counted in 20 company

Section 166

(Duties of a Act in accordance with AOA Act in good faith Exercise duties with due care

director) Shall not involve in conflicting interest No undue advantage Shall not assign his office

Section 167 Grounds for vacation

(Vacation of

office) Disqualified u/s 164 Absent from BM Act in Fails to disclose interest u/s 184

But in case of 164(2), director shall vacate in for 12 months contravention

all companies, except in which default incurs of 184

Disqualified by Court Convicted for ≥ 6 Removed u/s Ceases to hold office in Holding/

months 169 subsidiary/ associate pursuant to

which appointed

Section 168 Director may resign by giving a notice in writing to the Company + MAY forward a copy to RoC in DIR-11

(Resignation)

Further, company shall also file DIR-12 with RoC + place the fact of resignation in next General Meeting

Effective date of resignation is

Date on which notice is received by the company } whichever is later

Date, if any, specified in the notice

Director to remain liable for past offences

If ALL directors resign or vacate their office promoter, else CG, shall appoint required number of directors

Section 169 A SPECIAL NOTICE (u/s 115) is required to Right of representation by Director being removed

(Removal) Remove a director; or Director has right to be heard at the meeting

To appoint somebody else in his place Further, he also has the right to make representation

OR is passed for removal - Fact of representation shall be mentioned in the

But to remove re-appointed Independent director, SR is notice

required - If received timely – also sent to every member

Filing of vacancy - If not received timely – must be read out at meeting

A new director may be appointed at the same GM by - Provided it need not be sent/ read out if NCLT is

giving special notice satisfied that representation is being used to secure

needless publicity for defamatory matter

If not so appointed, filled as casual vacancy

Term – date upto which predecessor would have held

office

Section 170 Register of Director Every company shall maintain a Register containing particulars of director/ KMP +

(Register of their shareholding

Directors, KMP & Return of Particulars A return shall also be filed with RoC within 30 days of appointment or any change

their shareholding) taking place

Section 171 Right to inspect register u/s 170(1) - Member shall have right to inspect during business hours + can take extracts

(Members’ right to - Also, it should be open for inspection at every AGM

inspect) - If company refuses RoC, on application, shall order inspection

Section 172 Residuary penalty for contravention of

(Punishment) this Chapter Fine

On whom

Minimum Maximum

- Company; and

INR 50,000 INR 5 lakh

- Every officer in default

CA HARSH GUPTA (I.G.P.) Appointment & Qualification of Directors

Section 173 Frequency of BM Video conferencing

(Board Meetings) - 1st meeting within 30 days of incorporation Directors may participate through video conferencing except

- 4 meetings in every calendar year + max. gap of 120 days for the following –

b/w 2 meetings

- Section 8 company Approval of annual financial Approval of Board's

2 meetings in every 6 calendar months statements report

- Following companies to hold 2 meetings in every 6 calendar Audit committee meeting to Approval of prospectus

months + min. gap of 90 days consider financials

Approve merger, demerger, etc.

Small Dormant

Note – If quorum physically present, remaining director can

OPC Start-up participate through video conferencing even for these businesses

Notice

Section 174 For section 8 company

(Quorum) 1/3rd of its total

whichever 8 members, or

strength, or

2 directors

} is higher 25% of total strength } whichever is

less

BUT ≥ 2 members

If directors fall below quorum If interested directors < Meeting adjourned for the want of quorum

1/3rd of total strength - Unless AOA specifies, adjourned to next week,

continuing director may continue to act

only for Non-interested directors same day, same time & place

- Increasing the directors to quorum, or (being ≥ 2) shall be quorum - If national holiday, to next succeeding day (not

- Calling GM being a holiday)

Section 175 Resolution to be circulated in draft to ALL the directors at Resolution to be moved at MEETING if 1/3rd directors

(Resolution by their registered address require the same

Circulation, RBC)

Approved by MAJORITY of directors ENTITLED to vote Resolution passed by RBC to be noted at subsequent

meeting

Section 176 Past acts of directors not to be invalid if it is subsequently However, once notice, then future acts will not be valid

(Defects in notice that appointment was invalid because of

appointment - defect - disqualification - termination - AOA

Section 177 Companies required to appoint Audit Committee Composition of Audit Committee

(Audit committee Min. 3 directors I.D. forming majority

& Vigil Mechanism)

Similar to that prescribed for Independent director (I.D.) Majority members + Chairman must be able to read

& understand financials

Functions/ Roles of Audit Committee Powers of Audit committee

Call comments of auditor on internal control, scope of

Appointment & Monitor auditor’s Examine audit, financial statement etc.

remuneration of Auditor independence financials & Discuss related issues with auditor or management

audit report

End use of funds raised Scrutinize inter- Valuation Authority to investigate

in Public offer corporate loans Authority to seek any professional advise

Internal financial Approve RPT*

controls Transactions other than 188

may be referred to Board

*Note – Directors can enter RPT ≤ 1 crore and get it subsequently

ratified by Audit Committee

*Note – No approval for RPT with WOS (other than transactions

referred in section 188)

Vigil mechanism – Formed by following companies Objectives

Listed; or Mechanism for directors/ employees to report concerns

Accepting Public deposits; or Safeguard against victimisation

Borrowings from Banks/ FI > INR 50 crore Direct access to Chairman in exception cases

Section 178 NRC Composition of NRC Functions of NRC

Companies required to appoint Audit Committee Min. 3 Non-executive Identify persons qualified to become

directors ≥ 50% I.D. director

Chairperson of company Lay down criteria for qualifications &

NRC Similar to that prescribed for I.D. & Audit independence

can be member but shall

Committee not chair NRC Formulate remuneration policy

Policy disclosed in Board’s report

SRC

Constituted by companies Headed by Chairperson being Non-executive Objective

having >1,000 security-holders director and other members as decided by Board Resolving grievances of security-holders

CA HARSH GUPTA (I.G.P.) Meetings of Board & its Powers

Section 179 Powers of Board are co- Following powers to be exercised only at Board MEETING

(Powers of Board) extensive with that of the

company (a) Making calls on shareholder

Power does not exercise (b) Authorising Buy-back

powers reserved for GM (c) Issue securities

(d) Borrow monies

Exemption to Banking (e) Invest funds

company Can be delegated

(f) Grant LGS

- Accepting deposits

repayable on demand (g) Approve financials & Board report

(h) Diversify business

- Placing deposits with

other banks (i) Approve amalgamation, merger etc. Note – For O/D & C/C, borrowing

(j) Approve takeover means availing such facility &

- Taking loans from other not their day-to-day operation

banks (k) - political contribution – Appoint/ remove KMP

- appoint internal or secretarial auditor

Section 180 Special Resolution is required for Safeguard

(Restriction on

Powers of Board) Buyer who acquired undertaking in good faith

Sale or lease of undertaking in normal course of

Not applicable to business

Private company Debt incurred in excess of prescribed limit will be

valid if lender gave the loan in good faith

Section 181 Donation ≤ 5% of Average Net profits of past 3 years – Board resolution

(Charitable

donantions) > 5% Average Net Profits of past 3 years - Ordinary Resolution

Section 182 Cases covered Companies excluded Limit

(Political Donation to Political party Any purpose Max. 7.5% of Average Net Profits for last 3 years

contribution) Government

company by passing resolution at BM

Donation to Any person Political purpose Company been in Note – This limit has been removed by FA, 2017

existence < 3 years

Section 183 Board can contribute ANY amount to National Défense Fund or any other fund approved by CG for national defence

(NDF)

Section 184 (1) – Disclosure of interest by Director (2) – No Participation by director if interest in a

(Disclosure of Sub- Applicability Every director shall disclose his concern contract/ arrangement

interest by section or interest in any body corporate or

Director) (1) Public + With a Body corporate in which such director holds

association in > 2% or is a Promoter, manager, CEO

Private Co. First BM

(2) Public Co. With other entity in which such director is partner,

First BM every in FY owner or member

Change in disclosures If contract still entered voidable at the option of

the company

Section 185 Excpetions to sub-section (1) & (2)

(LGS to Directors 185(1) 185(2)

etc.) LGS - NOT ALLOWED LGS – ALLOWED if

SR passed + Loand to MD/ Condition of service; or

WTD Scheme approved by SR

used for principal business

1. DIRECTOR of Co. 1. PRIVATE COMPANY of which such LGS in ordinary Minimum interest charged as

Director of Holding Co. director is Director or member course of business per 1/ 3/ 5/ 10 years

Partner or Relative of 2. BODY CORPORATE – director government security

such director together with other holds ≥ 25%

of voting power LGS to WOS Used for principal business

activities

2. FIRM in which such 3. BODY CORPORATE – directors of

director or relative is which accustomed to act

GS to subsidiary Against loan taken from

partner bank or financial

institution

Note – Prescribed Private companies are exempt from this section Used for principal business

activities

Note – Sale of flat on instalment basis to a director

is NOT a loan (Fredie Ardshire Mehta)

Section 186 Maximum 2 layers of Investment Co. is allowed

(LGSI)

Exception –

Acquiring any company outside India where laws of

such country allows more layers

Subsidiary can have investment subsidiary if any law

requires

CA HARSH GUPTA (I.G.P.) Meetings of Board & its Powers

Conditions to make LGSI

1. Unanimous Resolution 3. PFI approval if term loan subsisting

2. If exceeds below limit – SR (No approval if within limit + no default)

4. ROI ≥ 1/ 3/ 5/ 10 year GOI securities’ yield

- 60% of its (PSC + FR + SP) whichever is 5. No default of deposits

or } MORE 6. Register should be maintained

- 100% of its (FR + SP)

Exemption from ALL the above conditions Exemption from passing SR

LGSI by banking, insurance, Housing finance company

LGS by company engaged in financing or providing LGS to WOS or JV

infrastructure facilities Investment in securities of WOS

Investment by NBFC (principal business being investment)

Investment by investment company

Rights issue

Section 187 All investments made by company shall be in its own name Exceptions

(Investment in own However, to meet statutory limit, shares in subsidiary can be Securities given to bank to collect dividend/ interest

name) held in the name of nominee Securities given to bank to facilitate transfer

Depositing securities as a security against loan

Holding investments in Demat form

Section 188

(RPT) Related Party Transactions covered

Director/ KMP or his Relative

Firm Where Director/ Manager/ Relative is Partner a Sale, purchase, supply of GOODS

Private Co. Where Director/ Manager/ Relative is b Sale, purchase or PROPERTY of any kind

Director/ Member c Leasing of PROPERTY of any kind

Public Co. Where Diirector/ Manager d Availing or rendering any service

is a director; and e Appointing AGENT for a-d

Holds with relative > 2% PSC f Office or Place of Profit (OPP)

Body Corporate Whose Board or MD or Manager is g Underwriting of securities

accustomed to act according to Director/

Manager CONDITIONS

Any Person On whose advise our Director / Manager is Board resolution at MEETING required

accustomed to act

Body corporate Holding/ Subsidiary/ Associate/ Co- If RPT exceeds below limits, OR also required

which is subsidiary/ Investing/ Venturer company Interested member shall not participate except in Private

Co.

Director (other of Holding company, or

than ID) + KMP Interested member may participate if ≥ 90% members

his relative are relatives of promoters or related parties

Lower of -

a+e - 10% turnover, or

Exception - INR 100 crore

Section not applicable on transactions entered at ALP Lower of

OR is not required in case of RPT with WOS whose accounts are b+e - 10% NW, or

consolidated - INR 100 crore

Lower of

Consequences of violation - 10% turnover, or

c - 10% NW, or

Contract is voidable at the option of the Board - INR 100 crore

If contract entered with a director or employee he shall Lower of -

make good the loss d+e - 10% turnover, or

- INR 50 crore

f INR 2,50,000

g 1% NW

Section 189 Every company shall maintain a register for contracts to Register is open to inspection by any MEMBER

(Register of

contracts in which

which 184(2) & 188 applies Also, register is produced at every AGM

director interested) Register shall be placed in next BM & signed by ALL directors Exceptions

Nothing applies to –

Every director/ KMP shall within 30 days of his appointment Sale/ purchase of goods & services ≤ INR 5 lakh in a FY

or relinquishment disclose particulars u/s 184(1) Banking company for collection of bills

Section 190 Every company to keep at registered office – The contract is open to inspection by any member

(Employment Contract of service with MD/WTD if it is in writing, Section is not applicable to a Private company

contract with MD

or WTD) Else, a written memorandum setting out the terms

Section 191 No director is entitled to any compensation for loss of office

resulting from Disclosed to members & their approval has been obtained

Transfer of undertaking or property, or unless in GM

Transfer of shares Note – Nothing affects payment to MD/ WTD/ Manager

CA HARSH GUPTA (I.G.P.) Meetings of Board & its Powers

Section 192 A company AND director of the company/ holding/ subsidiary/ associate/ Consequences of contravention

(Non-cash a person connected shall not enter into non-cash transactions unless – Contract is VOIDABLE at the option of the company

transactions Prior approval in GM is obtained, & unless –

involving directors)

If director of Holding Co. – approval in GM of Holding Co. also required Restitution not possible + Co. is indemnified; or

Rights acquired bona-fide for value

Section 193 Where OPC enters into contract with sole member & it is not in writing then Ensure terms contained in memorandum or

(Contract by OPC) recorded in first BM

Nothing applies to transactions entered in the ordinary course of business

Section 194 ---- Omitted ----

Section 195

---- Omitted ----

CA HARSH GUPTA (I.G.P.) Meetings of Board & its Powers

Section 196 No company shall appoint MD as Disqualifications

(Appointment of well as Manager

MD/ WTD/ Min. age 21 years; Max. age 70 years

Manager) Tenure – 1 term of 5 years (can appoint if > 70 years by passing SR)

(cooling period - 1 year) Undischarged insolvent + adjudged insolvent

Suspended payment to creditors or made compromise with them

Procedure for Appointment Convicted for > 6 months for any offence

1 Resolution at BM Schedule V

2 Approval by OR at next GM Not subject to imprisonment or fine > INR 1,000 under the prescribed 16 Acts

3; or CG approval; or Not detained for smuggling

4 Follow Schedule V

Min. age 21 years; Max. age – 70 years (can appoint if > 70 years by SR)

Note - File MR-1 within 60 days If appointed in more than 1 company comply with section V Part II of Schedule V

Resident in India

Section 197 Limit to director’s salary Note - Salary is exclusive of any sitting Mode of paying remuneration

(Director’s fees Monthly remuneration; or

remuneration) % of Sitting fees % of Net profits; or

Conditions Net

Profits Max. which Board can prescribe is Mix of both

Overall 11% INR 1 lakh per meeting

1 MD/ WTD/ Manager 5% Sitting fees to I.D. and Woman Other points

> 1 MD/ WTD/ Manager 10% director can’t be less than others I.D. not entitled to ESOP

Non-executive director(s) Director is liable to refund any excess

If MD/ WTD there 1% Note – Salary includes remuneration salary (Co. can waive it by CG approval)

If MD/ WTD not there 3% payable in any other capacity, other Listed Co. to disclose ratio with median

than salary in Board’s report

Net Profit – Computed u/s 198 w/o - Services of professional nature + Insurance premium paid for indemnity

requisite qualification is there

deducting director’s remuneration

- Guarantee commission insurance included in salary only if

director is proved guilty

Options to pay salary in case of NO or Inadequate profits

Option 1 – CG approval Option 2 – Part II of Section II of Schedule V

Part A Part B

Option 3 – Part 111 of Functioning in professional capacity

Section II of Schedule V Effective capital # Yearly remuneration

< 5 cr 60 lakhs No direct or indirect interest in share capital

≥ 5 cr but < 100 cr 84 lakhs of Co./ Holding/ Subsidiary

Option 4 – Rule 7(2) ≥ 100 cr but < 250 cr 120 lakhs (can hold upto 0.5% pursuant to ESOP etc.)

≥ 250 cr 120 lakhs+ 0.01% of No direct or indirect interest in Director or

excess capital Promoter of Co./ Holding/ Subsidiary in last 2

years

Note – Limits can be doubled by passing SR

Possess graduate level experience with

expertise & specialised knowledge

i. Payment approved by NRC or Board, as the case may be

ii. No default in debts/ debentures/ interest for 30 days in preceding FY if defaulted, obtained

approval of creditor(s) for payment of remuneration

iii. Part A – OR/ SR is passed, as the case may be

Part B – SR is passed

iv. Requisite disclosures made in Explanatory Statement

# Meaning of Effective Capital

Paid-up share capital xxx

(excluding share application pending allotment)

+ Share premium account xxx

+ Reserves & Surplus xxx

(excluding revaluation reserve)

+ Long term loans & deposits payable after 1 year xxx

(excluding working capital loans, O/D etc.)

(-) Investments (except in case of Investment company) (xxx)

(-) Accumulated losses (xxx)

(-) Preliminary expenses not written-off (xxx)

Effective Capital xxx

Section 198 In computing Net Profits 1 – Added 2 – Not added

(Calculation of 1 Added Bounties & subsidies Premium on issue or sale of shares or debentures

Profits) 2 Not added Profit on sale of forfeited shares

3 Deducted Profit on sale of undertaking

4 Not deducted Profit on sale of fixed assets of capital nature (unless in

ordinary course of business)

Change in carrying amount of asset/ liability

CA HARSH GUPTA (I.G.P.) Appointment & Remuneration of Managerial Personnel

3- Deducted 4 – Not deducted

Working charges, director’s remuneration Income-tax

Bonus or commission Compensation or damages paid voluntarily

Tax on abnormal profits, Loss of capital nature

Tax on business profits for special reasons Change in carrying amount of asset or liability

Interest on debentures, mortgages, loans & advances

Repairs, donation to charitable funds

Depreciation, compensation for legal liability

Past losses, insurance & bad debts

Section 199 If company is required to re-state its financial statements due to Company shall recover excess remuneration from MD/

(Recovery of fraud or non-compliance WTD/ Manager/ CEO

remuneration)

Section 200 CG or Company may, while Certain factors to be considered while fixing limits, which inter-alia includes -

(CG or company giving approval, fix limits

may fix limit on on remuneration in cases Financial position of company Remuneration drawn in any other capacity

remuneration) of inadequate or no profits. Remuneration drawn from other company Professional qualifications & experience

Financial & operating performance in 3 FYs Relationship b/w remuneration & performance

Section 201 Every application to CG under this Before giving application, general notice to members shall be given + it shall also be

(Filing with CG) chapter shall be in Form MR-2 published and their copies are attached with the application

Section 202 A company may pay Non-eligibility Limits on compensation

(Compensation for compensation for loss of Director resigns in case of reconstruction &

loss of office of office to MD/ WTD/ Manager, gets employed with reconstructed company Lower of average remuneration* for

MD/ WTD/ but NOT to any other director

Director resigns in any other case - Remainder of his term; or

Manager) - 3 years

Vacation of office u/s 167(1)

Company wound up due to default of director *Average remuneration means average

salary during the lesser of

Director guilty of fraud or breach of trust

Period of office; or

He instigated in termination of his office

3 years

Section 203 Following whole-time KMPs

(Appointment of mandatory in Listed company; or

KMP) MD or CEO or Manager or WTD Public company Whole-time CS Any company having

having PSC ≥ INR 10 mandatory in PSC ≥ INR 5 crore

CS

crore

CFO

Chairperson + MD/ CEO Conditions for appointment Casual Vacancy

Same person shall not be Chairperson & MD/ CEO, unless Every whole time KMP appointed by Vacancy of whole-

AOA provides; or resolution at BM time KMP shall be

filled up by Board

Company carries on single business He shall not hold office in more than one within 6 months

company except subsidiary company

Further above restriction N.A. for following companies, if

into multiple businesses & has CEOs for each business A person may be appointed as MD, if he

is MD/ Manager of one other company

Public companies having with UNANIMOUS resolution with consent

- PSC ≥ INR 100 cr; and of ALL the directors present

- Turnover ≥ INR 1,000 cr

Section 204 Following companies shall get Secretarial Duty of Company

Listed company

(Secretarial Audit) audit done and annex secretarial audit Company shall give assistance to CS in

report to Board’s report. Public Co. having practice

- PSC ≥ INR 50 cr Explain any qualifications or

Note – Secretarial audit can be done by

only CS in practice. - Turnover ≥ INR 250 cr observation in Board’s report

Section 205

(Functions of CS) Report to Board about compliance Provide needed guidance to Board Obtain requisite approvals

with Act, rules etc.

Ensure compliance with Secretarial Convene meetings & make minutes Represent company before various

Standards authorities

Assist Board in conduct of affairs Ensure good corporate governance Do such other duties assigned

CA HARSH GUPTA (I.G.P.) Appointment & Remuneration of Managerial Personnel

Você também pode gostar

- CA FINAL Audit Revision: Summary Charts Cover All TopicsDocumento151 páginasCA FINAL Audit Revision: Summary Charts Cover All TopicsKumar SwamyAinda não há avaliações

- Company Law Last Day Revision Notes CA InterDocumento2 páginasCompany Law Last Day Revision Notes CA InterGANESH KUNJAPPA POOJARI100% (1)

- Ferguson - Trian Partners White PaperDocumento23 páginasFerguson - Trian Partners White PaperBonnieAinda não há avaliações

- CA Inter GST Smart Summary Notes For Nov 23 May 24 & OnwardsDocumento107 páginasCA Inter GST Smart Summary Notes For Nov 23 May 24 & OnwardsPriyanshu tripathi100% (3)

- 422 - Summary by Harsh Gupta - Part 1Documento9 páginas422 - Summary by Harsh Gupta - Part 1Kumar Swamy0% (2)

- Accounting for Hire PurchaseDocumento48 páginasAccounting for Hire PurchaseWilliam C Jacob100% (1)

- Audit Smart Notea PDFDocumento324 páginasAudit Smart Notea PDFTheLatentGamer100% (1)

- 10 Pages Directors' Summary - by CA Harsh GuptaDocumento10 páginas10 Pages Directors' Summary - by CA Harsh Guptagovarthan1976Ainda não há avaliações

- CA Inter Corporate & Other Laws Chart Book With Index FinalDocumento237 páginasCA Inter Corporate & Other Laws Chart Book With Index Finalpari maheshwari100% (3)

- 424 - Summary by Harsh Gupta - Part 3Documento2 páginas424 - Summary by Harsh Gupta - Part 3Shubham ShuklaAinda não há avaliações

- Audit Saar Preview PDFDocumento41 páginasAudit Saar Preview PDFSadik Basha0% (2)

- Ca-Final-Summary-Notes Mahesh Gour PDFDocumento168 páginasCa-Final-Summary-Notes Mahesh Gour PDFAmey Mehta50% (2)

- Company Law Limits' Chart Section 1 to 148 Nov/Dec 2021Documento3 páginasCompany Law Limits' Chart Section 1 to 148 Nov/Dec 2021Udaykiran BheemaganiAinda não há avaliações

- Corporate Finance Case 1 (Contract Services Division)Documento2 páginasCorporate Finance Case 1 (Contract Services Division)needdocs7Ainda não há avaliações

- Capital Budgeting John A. DoukasDocumento232 páginasCapital Budgeting John A. DoukasĐorđo VosapAinda não há avaliações

- Concepts of Bot, Bolt, BootDocumento30 páginasConcepts of Bot, Bolt, BootTarun Patel50% (2)

- Sec 10-27 NotesDocumento8 páginasSec 10-27 NotesJohn Paul StevenAinda não há avaliações

- Company Law Limits - May 21Documento2 páginasCompany Law Limits - May 21Nupur Singla100% (1)

- Limits Chart For Nov 2023Documento2 páginasLimits Chart For Nov 2023aaryanmallick161Ainda não há avaliações

- Notes CA+Inter+Audit+May+24Documento280 páginasNotes CA+Inter+Audit+May+24carlsen magAinda não há avaliações

- @CACell CA Inter Audit Correct OR Incorrect Nov22Documento28 páginas@CACell CA Inter Audit Correct OR Incorrect Nov22Srushti Agarwal100% (1)

- CA FINAL PAPER 3 MNEMONICSDocumento17 páginasCA FINAL PAPER 3 MNEMONICSKhundrakpam SatyabartaAinda não há avaliações

- 5 6057497367471456479Documento59 páginas5 6057497367471456479Sachin Dixit100% (1)

- Law 50 Imp. QuestionsDocumento51 páginasLaw 50 Imp. QuestionsMayakuntla NeeladriAinda não há avaliações

- Audit SA Chart Notes For IPCC CA Inter CA FinalDocumento116 páginasAudit SA Chart Notes For IPCC CA Inter CA FinalShwetha Balaji100% (1)

- CA Final Law - Charts by Swapnil Patni PDFDocumento37 páginasCA Final Law - Charts by Swapnil Patni PDFDinesh Tokas0% (1)

- Corporate and Economic Law MCQ PDFDocumento157 páginasCorporate and Economic Law MCQ PDFraj kumarAinda não há avaliações

- Chapter 1 The Ultimate Solution Summary NotesDocumento20 páginasChapter 1 The Ultimate Solution Summary NotesSunny SinghAinda não há avaliações

- Director Notes...Documento20 páginasDirector Notes...Rukaiya ParweenAinda não há avaliações

- Limits Chart_Companies Law_May 2024 (1)Documento2 páginasLimits Chart_Companies Law_May 2024 (1)karanbharda2005Ainda não há avaliações

- Chapter 3 Corporate & Economic LawDocumento7 páginasChapter 3 Corporate & Economic LawCA Mohit SharmaAinda não há avaliações

- 5 6273750783301256946Documento2 páginas5 6273750783301256946Partibha GehlotAinda não há avaliações

- As 20 Earning Per Share Full NotesDocumento37 páginasAs 20 Earning Per Share Full NotesKumar SwamyAinda não há avaliações

- 35 Marks of Directors in Just 55 PagesDocumento55 páginas35 Marks of Directors in Just 55 PagesSakshiK ChaturvediAinda não há avaliações

- Limits Chart - May 2023Documento2 páginasLimits Chart - May 2023KingAinda não há avaliações

- Important LimitsDocumento5 páginasImportant LimitsRaghav BangaAinda não há avaliações

- SME PRODUCT GUIDEDocumento4 páginasSME PRODUCT GUIDEjyottsnaAinda não há avaliações

- Directors and Economic Laws Summary Paper 4 Nov 2022 PDFDocumento126 páginasDirectors and Economic Laws Summary Paper 4 Nov 2022 PDFNick VincikAinda não há avaliações

- Directors 149-172Documento63 páginasDirectors 149-172sakshi chauhanAinda não há avaliações

- Mandatory Compliance Checklist For Private Limited CompanyDocumento14 páginasMandatory Compliance Checklist For Private Limited CompanyCA Mohit GargAinda não há avaliações

- Director at A Glance.: Vote Being Given Against It +Documento3 páginasDirector at A Glance.: Vote Being Given Against It +Naman. PatelAinda não há avaliações

- Directors Summary (Sanidhya Saraf)Documento40 páginasDirectors Summary (Sanidhya Saraf)Chirag JainAinda não há avaliações

- Bhubaneswar 120715Documento79 páginasBhubaneswar 120715mehakmathur2003Ainda não há avaliações

- CompanyAmendmentOrdinance, DPT 3, MSME SangrurDocumento40 páginasCompanyAmendmentOrdinance, DPT 3, MSME SangrurShashank goyalAinda não há avaliações

- Compliance CalenderDocumento4 páginasCompliance CalenderNaresh BabuAinda não há avaliações

- Threshold LimitDocumento2 páginasThreshold Limitsomya.sharmaAinda não há avaliações

- Mangerial RemunerationDocumento28 páginasMangerial Remunerationsumathi psgcasAinda não há avaliações

- CA Final Law SummaryDocumento80 páginasCA Final Law SummaryManogna PAinda não há avaliações

- The Bank Company ActDocumento8 páginasThe Bank Company ActMazharul Islam RafiAinda não há avaliações

- Managerial Remuneration, Appointment of MD/WTD/Manager and Company SecretaryDocumento7 páginasManagerial Remuneration, Appointment of MD/WTD/Manager and Company SecretaryottffsAinda não há avaliações

- A Beginner Stock MarketDocumento15 páginasA Beginner Stock MarketRam IyerAinda não há avaliações

- (As Per 117 (3) (A) For All SR, MGT-14 Is Required.)Documento3 páginas(As Per 117 (3) (A) For All SR, MGT-14 Is Required.)Pranzali GuptaAinda não há avaliações

- Important Provisions of Companies Act 2013 PDFDocumento7 páginasImportant Provisions of Companies Act 2013 PDFurvashiAinda não há avaliações

- Concept-1 Threshold Limits - Companies Act, 2013 PDFDocumento4 páginasConcept-1 Threshold Limits - Companies Act, 2013 PDFAkshayaa B. R.Ainda não há avaliações

- RITES Limited Schedule of Powers 2022Documento29 páginasRITES Limited Schedule of Powers 2022SaiinzAinda não há avaliações

- Final Ca: Revision NotesDocumento23 páginasFinal Ca: Revision NotesKumar SwamyAinda não há avaliações

- LAW LectureDocumento5 páginasLAW LectureCamie YoungAinda não há avaliações

- CooperativesDocumento4 páginasCooperativesKwinzy Anne remularAinda não há avaliações

- Credit Sassion PL PolicyDocumento2 páginasCredit Sassion PL PolicyVishal BawaneAinda não há avaliações

- CAFCINTER CAFINAL CA DIRECTORS AND BOARD MEETING BOTHDocumento30 páginasCAFCINTER CAFINAL CA DIRECTORS AND BOARD MEETING BOTHKumar SwamyAinda não há avaliações

- Int I: IittmoDocumento13 páginasInt I: IittmoCS shreyans JainAinda não há avaliações

- CA Final Law Penalties ChartDocumento5 páginasCA Final Law Penalties ChartPankaj PathakAinda não há avaliações

- AccountsDocumento41 páginasAccountskomalc2026Ainda não há avaliações

- Consisting of Individuals As Directors Appointed To The Board Collective Body of DirectorsDocumento14 páginasConsisting of Individuals As Directors Appointed To The Board Collective Body of Directorsankit jainAinda não há avaliações

- Constitutional Scheme of The ActDocumento7 páginasConstitutional Scheme of The ActRamanah VAinda não há avaliações

- Statement Showing Some Key Points of Differences in Applicability of Various Provisions of The Companies ActDocumento4 páginasStatement Showing Some Key Points of Differences in Applicability of Various Provisions of The Companies ActRoshni SinghAinda não há avaliações

- L&T Detailed Policy - SMB - Credit Norms - DSA-DST - July 2022Documento15 páginasL&T Detailed Policy - SMB - Credit Norms - DSA-DST - July 2022Tejas GaubaAinda não há avaliações

- Activity Based Costing Suits Melody's Piano and Keyboard DivisionsDocumento16 páginasActivity Based Costing Suits Melody's Piano and Keyboard DivisionsKumar SwamyAinda não há avaliações

- Law and Audit Notes in Easy FormatDocumento43 páginasLaw and Audit Notes in Easy FormatKumar SwamyAinda não há avaliações

- Other Laws - Chart PDFDocumento34 páginasOther Laws - Chart PDFBharathAinda não há avaliações

- How To Memorize Theory Subjects For CA Students by CA Ammit AggarwalDocumento5 páginasHow To Memorize Theory Subjects For CA Students by CA Ammit AggarwalKumar SwamyAinda não há avaliações

- 51082bos40777 cp6 PDFDocumento19 páginas51082bos40777 cp6 PDFKumar SwamyAinda não há avaliações

- Appointment & Remuneration of Managerial PersonnelDocumento24 páginasAppointment & Remuneration of Managerial Personnelnaga jaganAinda não há avaliações

- Chapter 5: Acquisition, Development and Implementation Ofinformtion SystemsDocumento1 páginaChapter 5: Acquisition, Development and Implementation Ofinformtion SystemsKumar SwamyAinda não há avaliações

- NCLT Law PDFDocumento1 páginaNCLT Law PDFKumar SwamyAinda não há avaliações

- Appeals Chart by Darshan Khare 1.PDF 1Documento1 páginaAppeals Chart by Darshan Khare 1.PDF 1Kumar SwamyAinda não há avaliações

- As 20 Earning Per Share Full NotesDocumento37 páginasAs 20 Earning Per Share Full NotesKumar SwamyAinda não há avaliações

- Auditing Paper May 2019 Old SyllabusDocumento7 páginasAuditing Paper May 2019 Old SyllabusKumar SwamyAinda não há avaliações

- 138 Summary Indas Vs AsDocumento32 páginas138 Summary Indas Vs AsKumar SwamyAinda não há avaliações

- Audit Faster CoeDocumento70 páginasAudit Faster CoeKumar SwamyAinda não há avaliações

- Companies (Auditors' Report) Order, 2015 (CARO) : Requirements of Sec 143 Requirements of CARODocumento28 páginasCompanies (Auditors' Report) Order, 2015 (CARO) : Requirements of Sec 143 Requirements of CAROCA Rishabh DaiyaAinda não há avaliações

- Ca Final - MAY 2019: Abc Analysis Indirect TaxationDocumento2 páginasCa Final - MAY 2019: Abc Analysis Indirect TaxationKumar SwamyAinda não há avaliações

- Accounting Standard - 20 Earning Per Share Full NotesDocumento16 páginasAccounting Standard - 20 Earning Per Share Full NotesKumar SwamyAinda não há avaliações

- AMA May 2019Documento15 páginasAMA May 2019Kumar SwamyAinda não há avaliações

- Ca Final IscaDocumento130 páginasCa Final IscaKumar SwamyAinda não há avaliações

- Transportation Problem SolverDocumento24 páginasTransportation Problem SolverKumar SwamyAinda não há avaliações

- Direct Tax Amendments May Nov 19 New by CA Siddartha SuranaDocumento17 páginasDirect Tax Amendments May Nov 19 New by CA Siddartha SuranaKumar SwamyAinda não há avaliações

- Accounting Standard 18 - Related Party Disclosures PDFDocumento9 páginasAccounting Standard 18 - Related Party Disclosures PDFKumar SwamyAinda não há avaliações

- ABC Analysis FR Old M19 2 PDFDocumento2 páginasABC Analysis FR Old M19 2 PDFKumar SwamyAinda não há avaliações

- 2 Sec 164 167 Disqualification VacationDocumento7 páginas2 Sec 164 167 Disqualification VacationKumar SwamyAinda não há avaliações

- Accounting Standard 18 - Related Party DisclosuresDocumento3 páginasAccounting Standard 18 - Related Party DisclosuresKumar SwamyAinda não há avaliações

- Allied Law SectionsDocumento18 páginasAllied Law SectionsKumar SwamyAinda não há avaliações

- 201 SFM Past Exam Analysis For Nov 2018Documento1 página201 SFM Past Exam Analysis For Nov 2018Kumar SwamyAinda não há avaliações

- Allied Law Competation ActDocumento26 páginasAllied Law Competation ActKumar SwamyAinda não há avaliações

- Law and Audit Notes in Easy FormatDocumento4 páginasLaw and Audit Notes in Easy FormatKumar SwamyAinda não há avaliações

- An Overview of Sonali Bank LimitedDocumento5 páginasAn Overview of Sonali Bank LimitedCapricious ShovonAinda não há avaliações

- Tamboran PresentationDocumento31 páginasTamboran PresentationGood Energies Alliance IrelandAinda não há avaliações

- By Dr. Mahendra Parihar Associate Professor, Department of Economics Manipal University JaipurDocumento18 páginasBy Dr. Mahendra Parihar Associate Professor, Department of Economics Manipal University Jaipuraditya bariAinda não há avaliações

- Eoc Solutions Chapter 2Documento12 páginasEoc Solutions Chapter 2Albert Alcantara BernardoAinda não há avaliações

- Internal ReconstructionDocumento8 páginasInternal Reconstructionsmit9993Ainda não há avaliações

- Partnership: INTPRAB Notes From Brian Lim HDV/DNGDocumento28 páginasPartnership: INTPRAB Notes From Brian Lim HDV/DNGAbegail Llobo Gitana100% (1)

- Expenditure Multipliers: ("Notes 7" - Comes After Chapter 6)Documento57 páginasExpenditure Multipliers: ("Notes 7" - Comes After Chapter 6)hongphakdeyAinda não há avaliações

- Od Abl FPF 23 12 2015Documento77 páginasOd Abl FPF 23 12 2015Anum AkmalAinda não há avaliações

- A Project Report On Depository: in Partial Fulfilment of The Degree in Master of Business Administration (MBA)Documento88 páginasA Project Report On Depository: in Partial Fulfilment of The Degree in Master of Business Administration (MBA)Ekta AnejaAinda não há avaliações

- Ratio Analysis About Ganesh Metals CompanyDocumento41 páginasRatio Analysis About Ganesh Metals CompanyshaileshAinda não há avaliações

- Universal Banking in IndiaDocumento6 páginasUniversal Banking in IndiaashwanidusadhAinda não há avaliações

- Accounting concepts and principles in financial statementsDocumento6 páginasAccounting concepts and principles in financial statementskartikbhaiAinda não há avaliações

- Strategy Formulation and Implementation For An Expansion Strategy BlaBlaCar Middle East Aboud KhederchahDocumento9 páginasStrategy Formulation and Implementation For An Expansion Strategy BlaBlaCar Middle East Aboud KhederchahaboudgkAinda não há avaliações

- The Benami Transactions (Prohibition) Amendment Act, 2016: India - PropertyDocumento2 páginasThe Benami Transactions (Prohibition) Amendment Act, 2016: India - Propertysubhash parasharAinda não há avaliações

- Baird Staffing Research - March 2012.Documento65 páginasBaird Staffing Research - March 2012.cojones321Ainda não há avaliações

- Asia Amalgamated Holdings Corporation Financials - RobotDoughDocumento6 páginasAsia Amalgamated Holdings Corporation Financials - RobotDoughKeith LameraAinda não há avaliações

- Hup Seng Industries BerhadDocumento5 páginasHup Seng Industries Berhadkghn 5678Ainda não há avaliações

- Startup India Standup India: Opportunities, Challenges and National SeminarDocumento6 páginasStartup India Standup India: Opportunities, Challenges and National SeminarabhaybittuAinda não há avaliações

- Understanding the P/E RatioDocumento2 páginasUnderstanding the P/E Ratioclinton junkAinda não há avaliações

- Chapter 3Documento73 páginasChapter 3Mark Arceo0% (1)

- BU111 Final December 4 /5 2018: Megan Corbett, Sam Sells, Lauren Carroll, Alex ClaytonDocumento97 páginasBU111 Final December 4 /5 2018: Megan Corbett, Sam Sells, Lauren Carroll, Alex ClaytonJugaadAinda não há avaliações

- Financial Ratio AnalysisDocumento32 páginasFinancial Ratio AnalysisTriechia LaudAinda não há avaliações

- Comparison of Mutual Funds With Other Investment OptionsDocumento56 páginasComparison of Mutual Funds With Other Investment OptionsDiiivya86% (14)

- Chapter 2Documento17 páginasChapter 2Amanuel GenetAinda não há avaliações

- Test BankDocumento14 páginasTest BankJi YuAinda não há avaliações