Escolar Documentos

Profissional Documentos

Cultura Documentos

Gujarat-09072017 II PDF

Enviado por

Peace In YouTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Gujarat-09072017 II PDF

Enviado por

Peace In YouDireitos autorais:

Formatos disponíveis

INVOICING UNDER

GOODS AND SERVICE

TAX

Contents

S. No Particulars Page No

1. Type of Invoices under GST 3-5

2. Time Limit for issue of Invoice. 6-7

3. Particulars to be mentioned in Invoices 8-11

4. Manner of Issue of Invoice 12

5. Sample format for invoices. 13-21

Ashish Goyal & Company

2

Chartered Accountants

Type of Invoices

Tax Invoice

Bill of Supply

Receipt Voucher

Refund Voucher

Payment Voucher

Credit Note

Debit Note

Supplementary Invoice

Ashish Goyal & Company

3

Chartered Accountants

Type of invoices

• All registered persons other than supplier of exempted goods or exempted service and composite dealer

shall be liable to issue Tax Invoice.

Tax Invoice

• a registered person supplying exempted goods or services or both or paying tax under composition scheme

Bill of shall instead of a tax invoice, issue a bill of supply.

Supply

• a registered person shall, on receipt of advance payment with respect to any supply of goods or services or

Receipt both, shall issue a receipt voucher.

Voucher

• where, on receipt of advance payment with respect to any supply of goods or services or both the

registered person issues a receipt voucher, but subsequently no supply is made and no tax invoice is issued

Refund in pursuance thereof, the said registered person may issue to the person who had made the payment, a

Voucher refund voucher against such payment.

• a registered person who is liable to pay tax under reverse charge shall issue a payment voucher at the time

Payment of making payment to the supplier.

Voucher

Ashish Goyal & Company

4

Chartered Accountants

Type of invoices

• Every registered person may issue credit note for any revision in the tax invoice issued for

supply of goods or services on account of change in taxable value, tax charged thereon, or

Credit Note where the goods are returned or where goods or services found to be deficient

• Every registered person shall issue debit note where the taxable value and tax charged in

respect of supply is more than the taxable value and tax payable mentioned in the tax invoice

Debit Note

• Where in pursuance of any a contract entered into prior to the appointed day, the price of

any goods or services is revised upwards on or after the appointed day, the registered person

Supplementary who had removed or provided such goods or services shall issue to the recipient a

Invoice supplementary invoice or debit note within thirty days of such price revision

• Every registered person shall issue revised invoice against the invoices already issued during the

period beginning with the effective date of registration till the date of issuance of certificate of

Revised Invoice registration.

Ashish Goyal & Company

5

Chartered Accountants

Time limit for issuance of invoice –

Supply of Goods

Goods

Continuous Supply

where successive

Normal Supply statement of accounts

or successive payment

are involved

Involves movement Before or at the time

Before or at the time

Other cases of issuance of

of goods of receipt of such

statement of

successive payments

accounts.

Before or at the time Before or at the time

of removal of the of delivery or

Goods availability to the

recipient.

Ashish Goyal & Company

6

Chartered Accountants

Time limit for issuance of invoice –

Supply of Services

Services

Supply of

Continuous

Normal Supply Services ceases

Supply

before contract

In case where

Within 30 days In case of Banking In case where At the time

payment is

of provision of company or a Financial due date is Other cases when supply

linked with

Service. Institution including ascertained ceases.

completion

NBFC, within 45 days of

supply of service

On or Before When the

On or Before the date of

the due date of supplier of

completion of services receives

payment event the payment.

Ashish Goyal & Company

7

Chartered Accountants

Particulars to be mentioned in the invoice.

Tax Invoice Bill of Supply

(a) Name, address and GSTIN of the supplier; (a) Name, address and GSTIN of the supplier;

(b) A consecutive serial number not exceeding sixteen characters, in one (b) A consecutive serial number not exceeding sixteen characters, in

or multiple series, containing alphabets or numerals or special one or more multiple series, containing alphabets or numerals or

characters hyphen or dash and slash; special characters

(c) Date of its issue; (c) Date of its issue;

(d) Name, address and GSTIN or UIN, if registered, of the recipient; (d) Name, address and GSTIN or UIN, if registered, of the recipient;

(e) Name and address of the recipient and the address of delivery, along (e) HSN Code of goods or Accounting Code for services;

with the name of State and its code, if such recipient is un-registered (f) Description of goods or services or both;

and where the value of taxable supply is fifty thousand rupees or (g) Value of supply of goods or services or both taking into account

more; discount or abatement, if any; and

(f) HSN code of goods or Accounting Code of services; (h) Signature or digital signature of the supplier or his authorized

(g) Description of goods or services; representative:

(h) Quantity in case of goods and unit or Unique Quantity Code thereof;

(i) Total value of supply of goods or services or both;

(j) Taxable value of supply of goods or services or both taking into

account discount or abatement, if any;

(k) Rate of tax (central tax, State tax, integrated tax, Union territory tax

or cess);

(l) Amount of tax charged in respect of taxable goods or services (central

tax, State tax, integrated tax, Union territory tax or cess);

(m) Place of supply along with the name of State, in case of a supply in the

course of inter-State trade or commerce;

(n) Address of delivery where the same is different from the place of

supply;

(o) Whether the tax is payable on reverse charge basis; and

(p) Signature or digital signature of the supplier or his authorized

representative:

Ashish Goyal & Company

8

Chartered Accountants

Particulars to be mentioned in the invoice.

Receipt Voucher Refund Voucher

(a) name, address and GSTIN of the supplier; (a) name, address and GSTIN of the supplier;

(b) a consecutive serial number not exceeding sixteen (b) a consecutive serial number not exceeding sixteen

characters, in one or multiple series, containing alphabets characters, in one or multiple series, containing

or numerals or special characters; alphabets or numerals or special characters;

(c) date of its issue; (c) date of its issue;

(d) name, address and GSTIN or UIN, if registered, of the (d) name, address and GSTIN or UIN, if registered, of the

recipient; recipient;

(e) description of goods or services; (e) number and date of receipt voucher issued in

(f) amount of advance taken; accordance with provisions of sub- rule 5;

(g) rate of tax (central tax, State tax, integrated tax, Union (f) description of goods or services in respect of which

territory tax or cess); refund is made;

(h) amount of tax charged in respect of taxable goods or (g) amount of refund made;

services (central tax, State tax, integrated tax, Union (h) rate of tax (central tax, State tax, integrated tax, Union

territory tax or cess); territory tax or cess);

(i) place of supply along with the name of State and its code, (i) amount of tax paid in respect of such goods or services

in case of a supply in the course of inter-State trade or (central tax, State tax, integrated tax, Union territory tax

commerce; or cess);

(j) whether the tax is payable on reverse charge basis; and (j) whether the tax is payable on reverse charge basis; and

(k) signature or digital signature of the supplier or his (k) signature or digital signature of the supplier or his

authorized representative: authorized representative.

Ashish Goyal & Company

9

Chartered Accountants

Particulars to be mentioned in the invoice.

Payment Voucher Revised tax invoice and credit or debit notes

(a) name, address and GSTIN of the supplier if registered; (a) the word “Revised Invoice”, wherever applicable,

(b) a consecutive serial number not exceeding sixteen indicated prominently;

characters, in one or multiple series, containing alphabets (b) name, address and GSTIN of the supplier;

or numerals or special characters; (c) nature of the document;

(c) date of its issue; (d) a consecutive serial number not exceeding sixteen

(d) name, address and GSTIN of the recipient; characters, in one or multiple series, containing

(e) description of goods or services; alphabets or numerals or special characters;

(f) amount paid; (e) date of issue of the document;

(g) rate of tax (central tax, State tax, integrated tax, Union (f) name, address and GSTIN or UIN, if registered, of the

territory tax or cess); recipient;

(h) amount of tax payable in respect of taxable goods or (g) name and address of the recipient and the address of

services (central tax, State tax, integrated tax, Union delivery, along with the name of State and its code, if

territory tax or cess); such recipient is un-registered;

(i) place of supply along with the name of State and its code, (h) serial number and date of the corresponding tax invoice

in case of a supply in the course of inter-State trade or or, as the case may be, bill of supply;

commerce; and (i) value of taxable supply of goods or services, rate of tax

(j) signature or digital signature of the supplier or his and the amount of the tax credited or, as the case may

authorized representative be, debited to the recipient; and

(j) signature or digital signature of the supplier or his

authorized representative:

Ashish Goyal & Company

10

Chartered Accountants

Particulars to be mentioned in the invoice.

Transportation of goods without issue of invoice/Delivery Challan

For the Following purposes

(a) supply of liquid gas where the quantity at the time of removal from the place of business of the supplier is

not known,

(b)transportation of goods for job work,

(c) transportation of goods for reasons other than by way of supply, or

(d)such other supplies as may be notified by the Board,.

Particulars of Delivery Challan

(i) date and number of the delivery challan,

(ii) name, address and GSTIN of the consigner, if registered,

(iii) name, address and GSTIN or UIN of the consignee, if registered,

(iv) HSN code and description of goods,

(v) quantity (provisional, where the exact quantity being supplied is not known),

(vi) taxable value,

(vii) tax rate and tax amount – central tax, State tax, integrated tax, Union territory tax or cess, where the

transportation is for supply to the consignee,

(viii) place of supply, in case of inter-State movement, and

(ix) Signature

Ashish Goyal & Company

11

Chartered Accountants

Manner of issue of invoice

The invoice shall be prepared in Triplicate

(a) The Original Copy marked as “ ORIGINAL FOR RECIPIENT”

(b) The Duplicate copy marked as “DUPLICATE FOR TRANSPORTER (Not required in case of supply of service)

(c) The Triplicate copy marked as “ TRIPLICATE FOR SUPPLIER” (In case of supply of Service –”DUPLICATE FOR

SUPPLIER”)

In case of Export Invoice, the invoice shall carry an endorsement

“SUPPLY MEANT FOR EXPORT ON PAYMENT OF INTEGRATED TAX” or “SUPPLY MEANT FOR EXPORT UNDER

BOND OR LETTER OF UNDERTAKING WITHOUT PAYMENT OF INTEGRATED TAX” and shall contain the

following details

(i) name and address of the recipient;

(ii) address of delivery; and

(iii) name of the country of destination:

Ashish Goyal & Company

12

Chartered Accountants

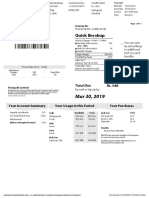

FORMATS OF INVOICES

Ashish Goyal & Company

Chartered Accountants

Ashish Goyal & Company

14

Chartered Accountants

Ashish Goyal & Company

15

Chartered Accountants

.

Ashish Goyal & Company

16

Chartered Accountants

Ashish Goyal & Company

17

Chartered Accountants

Ashish Goyal & Company

18

Chartered Accountants

Ashish Goyal & Company

19

Chartered Accountants

Ashish Goyal & Company

20

Chartered Accountants

Ashish Goyal & Company

21

Chartered Accountants

For Further clarification on any matter under GST please contact us at

Contact Person:- CA Ashish Goyal & CA Preeti Goyal

41A, GF, Ekta Enclave, Peera Garhi, Near Peera Garhi Metro Station, New

Delhi - 110087

+91-11-25276056, +91-9999461827, +91-9716118624

Caashishgoyal1@gmail.com, ca.preeti23@gmail.com

https://www.facebook.com/AshishGoyalCompany/?ref=bookmarks

Ashish Goyal & Company

Chartered

Accountants

Você também pode gostar

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- 02 OPTR - 2015-2017 - General-Report PDFDocumento106 páginas02 OPTR - 2015-2017 - General-Report PDFBoelckeAinda não há avaliações

- F. CIR vs. Solidbank Corp., G.R. No. 148191, Nov. 25, 2003Documento3 páginasF. CIR vs. Solidbank Corp., G.R. No. 148191, Nov. 25, 2003Rhenee Rose Reas SugboAinda não há avaliações

- PsudocodeDocumento58 páginasPsudocodeJimmy LieAinda não há avaliações

- System Analysis and Design AssignmentDocumento3 páginasSystem Analysis and Design AssignmentVictor OduorAinda não há avaliações

- Fitl /: How Out Form FnstructionsDocumento7 páginasFitl /: How Out Form Fnstructionslauren5maria100% (14)

- Return Filing ProcedureDocumento6 páginasReturn Filing ProcedureVishwanath HollaAinda não há avaliações

- Opinion On TRAIN LawDocumento9 páginasOpinion On TRAIN LawVia Maria MalapoteAinda não há avaliações

- JK Tir 00451058Documento3 páginasJK Tir 00451058Fanny SofiaAinda não há avaliações

- GST Module 2 - Collection and LevyDocumento19 páginasGST Module 2 - Collection and LevyPooja D AcharyaAinda não há avaliações

- Ackdog 333Documento18 páginasAckdog 333Czarina DonatoAinda não há avaliações

- Bsa 2 - Finman - Group 8 - Lesson 1Documento16 páginasBsa 2 - Finman - Group 8 - Lesson 1カイ みゆきAinda não há avaliações

- Rmo 13-12Documento60 páginasRmo 13-12Kris CalabiaAinda não há avaliações

- Monthly Statement: This Month's SummaryDocumento3 páginasMonthly Statement: This Month's SummarySibiviswa RajendranAinda não há avaliações

- Excel New Assignment PDFDocumento20 páginasExcel New Assignment PDFHimanshi VohraAinda não há avaliações

- Pagcor Vs BirDocumento2 páginasPagcor Vs BirMarie ChieloAinda não há avaliações

- CH 2 MCQDocumento22 páginasCH 2 MCQsocial sites100% (1)

- Forensics Sample ReportDocumento7 páginasForensics Sample ReportPranjal BagrechaAinda não há avaliações

- 1 347294427628 - 2019 03 14 - 1 PDFDocumento11 páginas1 347294427628 - 2019 03 14 - 1 PDFSiddiqueJoiyaAinda não há avaliações

- How To Start A Roller Skating RinkDocumento10 páginasHow To Start A Roller Skating RinkMadhuAinda não há avaliações

- CA2079ENDocumento8 páginasCA2079ENRohan TangriAinda não há avaliações

- Taxation System: A Comparison Between Thailand and PhilippinesDocumento2 páginasTaxation System: A Comparison Between Thailand and PhilippinesBeberlie LapingAinda não há avaliações

- Form 10BDocumento4 páginasForm 10BCA Vishal ThakkarAinda não há avaliações

- Small-Scale and Cottage IndustriesDocumento14 páginasSmall-Scale and Cottage Industries21 7034 Rishita JainAinda não há avaliações

- Percentage Taxation2Documento5 páginasPercentage Taxation2Ahleeya Ramos100% (2)

- Transfer Pricing For MASDocumento25 páginasTransfer Pricing For MASMatthew TiuAinda não há avaliações

- Lecture No 15Documento11 páginasLecture No 15Noor FatimaAinda não há avaliações

- History of Taxation in India: Key Milestones and ReformsDocumento226 páginasHistory of Taxation in India: Key Milestones and ReformsSreejith RajmohanAinda não há avaliações

- Case - Make in IndiaDocumento15 páginasCase - Make in IndiaMrinal Mantravadi100% (1)

- Garbage Charges Waive Off Communication and DecisionDocumento6 páginasGarbage Charges Waive Off Communication and Decisionabhinavg.astrologyAinda não há avaliações

- Tax DigestDocumento7 páginasTax Digestpvpogi100% (1)