Escolar Documentos

Profissional Documentos

Cultura Documentos

YouTube Video explaining risk measures for industries

Enviado por

Sindy Jimenez0 notas0% acharam este documento útil (0 voto)

44 visualizações7 páginasbetas emergentes

Título original

Betas Emerg

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

XLS, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentobetas emergentes

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato XLS, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

44 visualizações7 páginasYouTube Video explaining risk measures for industries

Enviado por

Sindy Jimenezbetas emergentes

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato XLS, PDF, TXT ou leia online no Scribd

Você está na página 1de 7

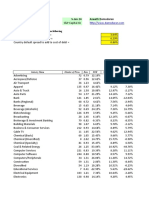

Date updated: 5-Jan-19 YouTube Video explaining estimation choices and process.

Created by: Aswath Damodaran, adamodar@stern.nyu.edu

What is this data? Beta, Unlevered beta and other risk measures Emerging Markets

Home Page: http://www.damodaran.com

Data website: http://www.stern.nyu.edu/~adamodar/New_Home_Page/data.html

Companies in each industry: http://www.stern.nyu.edu/~adamodar/pc/datasets/indname.xls

Variable definitions: http://www.stern.nyu.edu/~adamodar/New_Home_Page/datafile/variable.htm

Do you want to use marginal or effective tax rates in unlevering betas? Marginal

If marginal tax rate, enter the marginal tax rate to use 26.79%

Effective

Induistry Name Number of firms Beta D/E Ratio Tax rate Unlevered beta Cash/Firm value Unlevered beta corrected for cash HiLo Risk Standard deviation of equity

Advertising 91 1.40 19.19% 13.43% 1.22 11.83% 1.39 0.4162 42.62%

Aerospace/Defense 82 1.18 20.30% 11.05% 1.02 9.87% 1.14 0.3500 36.57%

Air Transport 87 0.99 115.88% 14.13% 0.53 6.99% 0.57 0.3224 26.77%

Apparel 898 0.82 34.26% 15.04% 0.65 9.71% 0.72 0.3719 36.81%

Auto & Truck 81 1.47 49.04% 14.92% 1.08 15.13% 1.28 0.3365 30.45%

Auto Parts 453 1.22 25.33% 16.56% 1.03 11.30% 1.16 0.3528 34.67%

Bank (Money Center) 463 0.67 144.59% 19.99% 0.33 22.35% 0.42 0.2403 22.06%

Banks (Regional) 82 0.80 407.01% 20.84% 0.20 42.99% 0.35 0.2548 29.94%

Beverage (Alcoholic) 114 1.01 4.96% 21.00% 0.97 7.82% 1.05 0.3140 29.28%

Beverage (Soft) 35 0.58 22.56% 12.16% 0.50 5.37% 0.53 0.2819 29.32%

Broadcasting 59 0.86 27.59% 16.90% 0.72 8.61% 0.78 0.3632 30.69%

Brokerage & Investment Banki 392 1.10 190.26% 14.26% 0.46 9.79% 0.51 0.3725 37.03%

Building Materials 213 0.96 39.67% 17.16% 0.74 9.29% 0.82 0.3574 33.91%

Business & Consumer Services 240 1.21 19.98% 16.35% 1.06 9.94% 1.18 0.3938 43.40%

Cable TV 32 1.07 10.40% 11.51% 0.99 6.27% 1.06 0.4176 37.11%

Chemical (Basic) 605 1.06 32.36% 17.15% 0.86 10.28% 0.96 0.3363 33.17%

Chemical (Diversified) 35 1.01 32.41% 20.72% 0.82 5.34% 0.86 0.3327 31.46%

Chemical (Specialty) 505 1.17 33.29% 17.81% 0.94 8.61% 1.03 0.3413 36.33%

Coal & Related Energy 108 1.30 57.27% 16.08% 0.91 19.46% 1.13 0.3576 38.70%

Computer Services 449 1.15 18.76% 13.15% 1.01 5.31% 1.06 0.3700 39.29%

Computers/Peripherals 209 1.52 26.90% 13.48% 1.27 17.08% 1.53 0.3690 36.22%

Construction Supplies 518 1.14 56.57% 15.27% 0.81 15.73% 0.96 0.3501 35.24%

Diversified 229 0.82 131.44% 17.28% 0.42 10.81% 0.47 0.2707 25.83%

Drugs (Biotechnology) 179 1.43 5.15% 6.84% 1.38 4.62% 1.45 0.3909 42.01%

Drugs (Pharmaceutical) 626 1.17 16.35% 16.39% 1.04 8.34% 1.14 0.3461 33.86%

Education 100 1.34 20.39% 14.57% 1.17 11.74% 1.32 0.3877 43.00%

Electrical Equipment 574 1.27 47.37% 15.41% 0.94 11.27% 1.06 0.3762 36.14%

Electronics (Consumer & Office 92 1.53 85.87% 12.16% 0.94 18.41% 1.15 0.3947 39.13%

Electronics (General) 812 1.49 27.30% 13.69% 1.24 16.30% 1.49 0.3759 37.57%

Engineering/Construction 797 1.26 116.67% 17.15% 0.68 23.74% 0.89 0.3823 39.55%

Entertainment 286 1.43 17.46% 10.69% 1.27 9.70% 1.40 0.4303 43.32%

Environmental & Waste Service 117 1.25 43.27% 15.63% 0.95 10.22% 1.06 0.4154 41.61%

Farming/Agriculture 284 0.84 58.91% 13.08% 0.59 7.37% 0.63 0.3391 33.87%

Financial Svcs. (Non-bank & In 559 0.78 142.17% 17.64% 0.38 9.88% 0.42 0.3366 35.61%

Food Processing 829 0.82 28.97% 16.20% 0.67 6.98% 0.73 0.3388 34.19%

Food Wholesalers 82 0.90 67.67% 17.04% 0.60 10.36% 0.67 0.3926 38.78%

Furn/Home Furnishings 218 1.06 22.35% 16.45% 0.91 18.12% 1.11 0.3477 32.98%

Green & Renewable Energy 90 1.06 84.82% 12.03% 0.66 3.49% 0.68 0.3338 32.03%

Effective

Induistry Name Number of firms Beta D/E Ratio Tax rate Unlevered beta Cash/Firm value Unlevered beta corrected for cash HiLo Risk Standard deviation of equity

Healthcare Products 198 1.34 9.32% 11.62% 1.26 6.55% 1.34 0.3830 38.25%

Healthcare Support Services 134 1.14 32.84% 16.77% 0.92 11.21% 1.04 0.3322 33.68%

Heathcare Information and Tec 83 1.78 3.63% 9.30% 1.73 3.77% 1.80 0.4172 42.85%

Homebuilding 34 0.98 62.12% 13.63% 0.67 11.62% 0.76 0.3426 38.11%

Hospitals/Healthcare Facilities 107 0.85 19.70% 18.72% 0.74 4.40% 0.78 0.2574 27.04%

Hotel/Gaming 396 0.94 39.70% 14.57% 0.73 11.42% 0.82 0.3069 33.56%

Household Products 257 0.99 7.31% 14.63% 0.94 4.04% 0.98 0.3472 34.76%

Information Services 70 1.19 13.44% 19.57% 1.08 8.87% 1.19 0.3749 38.02%

Insurance (General) 140 0.52 36.60% 12.90% 0.41 12.45% 0.47 0.2496 25.57%

Insurance (Life) 71 0.91 58.23% 13.60% 0.63 11.78% 0.72 0.2610 26.61%

Insurance (Prop/Cas.) 138 0.47 30.81% 18.07% 0.39 11.52% 0.44 0.2355 27.88%

Investments & Asset Managem 334 0.87 442.92% 8.41% 0.21 2.17% 0.21 0.3602 36.94%

Machinery 723 1.24 28.82% 16.33% 1.02 10.04% 1.14 0.3538 36.13%

Metals & Mining 311 1.42 61.21% 14.31% 0.98 11.08% 1.10 0.3805 39.52%

Office Equipment & Services 72 0.84 21.46% 15.28% 0.72 9.31% 0.80 0.3301 36.39%

Oil/Gas (Integrated) 24 1.19 53.56% 24.66% 0.85 10.88% 0.96 0.2757 28.14%

Oil/Gas (Production and Explor 133 1.62 44.87% 9.22% 1.22 7.19% 1.32 0.4037 45.25%

Oil/Gas Distribution 84 1.27 85.08% 14.51% 0.78 8.46% 0.86 0.3202 32.29%

Oilfield Svcs/Equip. 236 1.40 48.55% 11.95% 1.03 6.02% 1.10 0.3935 40.48%

Packaging & Container 278 0.80 38.12% 16.03% 0.62 7.41% 0.67 0.3619 35.57%

Paper/Forest Products 194 0.97 72.36% 15.30% 0.63 7.70% 0.69 0.3742 36.24%

Power 360 0.85 103.44% 17.91% 0.48 6.05% 0.52 0.2569 27.07%

Precious Metals 89 1.44 37.81% 11.79% 1.13 6.66% 1.21 0.4448 44.06%

Publishing & Newspapers 170 1.06 12.57% 14.52% 0.97 15.29% 1.14 0.3757 37.24%

R.E.I.T. 203 0.44 52.11% 2.95% 0.32 2.77% 0.33 0.1473 14.78%

Real Estate (Development) 701 1.21 164.89% 18.75% 0.55 20.36% 0.69 0.3360 34.50%

Real Estate (General/Diversifie 262 1.09 75.09% 13.78% 0.71 11.23% 0.79 0.3609 32.20%

Real Estate (Operations & Servi 297 0.86 65.02% 14.07% 0.58 6.54% 0.63 0.3054 31.96%

Recreation 133 0.98 54.99% 14.08% 0.70 14.85% 0.82 0.3795 34.85%

Reinsurance 30 0.96 19.02% 13.63% 0.85 11.87% 0.96 0.3030 27.60%

Restaurant/Dining 126 1.10 21.84% 14.81% 0.94 6.84% 1.01 0.3441 37.99%

Retail (Automotive) 87 1.05 88.66% 18.28% 0.64 11.48% 0.72 0.3304 32.78%

Retail (Building Supply) 23 1.24 17.66% 21.70% 1.10 3.92% 1.14 0.3905 27.70%

Retail (Distributors) 575 0.94 100.32% 15.51% 0.54 13.48% 0.62 0.3828 39.20%

Retail (General) 136 1.13 51.55% 22.82% 0.82 8.40% 0.90 0.2774 27.19%

Retail (Grocery and Food) 64 0.83 27.97% 18.55% 0.69 5.68% 0.73 0.2955 33.14%

Retail (Online) 60 1.33 8.80% 11.19% 1.25 14.35% 1.46 0.4285 38.83%

Retail (Special Lines) 163 1.18 44.42% 18.29% 0.89 10.59% 1.00 0.3332 33.94%

Rubber& Tires 74 0.87 49.92% 19.14% 0.64 9.74% 0.70 0.2962 26.83%

Semiconductor 399 1.71 15.49% 10.84% 1.53 11.47% 1.73 0.3830 38.00%

Semiconductor Equip 183 1.84 37.96% 12.07% 1.44 13.28% 1.66 0.3981 37.60%

Shipbuilding & Marine 231 1.07 100.95% 11.97% 0.62 10.54% 0.69 0.3232 34.33%

Shoe 60 0.98 22.64% 18.92% 0.84 7.80% 0.91 0.3521 36.41%

Software (Entertainment) 40 1.79 8.00% 10.70% 1.70 4.93% 1.78 0.4864 50.52%

Software (Internet) 30 0.88 17.45% 10.90% 0.78 7.81% 0.85 0.3546 32.71%

Software (System & Application 335 1.41 5.83% 11.35% 1.35 7.67% 1.46 0.4243 42.31%

Steel 508 1.21 68.18% 15.21% 0.80 9.51% 0.89 0.3686 37.36%

Effective

Induistry Name Number of firms Beta D/E Ratio Tax rate Unlevered beta Cash/Firm value Unlevered beta corrected for cash HiLo Risk Standard deviation of equity

Telecom (Wireless) 60 0.99 47.56% 14.41% 0.74 3.53% 0.76 0.3155 29.42%

Telecom. Equipment 296 1.45 15.80% 11.40% 1.30 10.46% 1.45 0.3963 39.50%

Telecom. Services 128 0.99 39.00% 17.31% 0.77 4.93% 0.81 0.3409 31.26%

Tobacco 27 0.82 1.35% 22.46% 0.81 2.23% 0.83 0.2787 27.56%

Transportation 176 1.11 56.41% 19.94% 0.78 10.03% 0.87 0.3378 31.77%

Transportation (Railroads) 11 1.45 23.06% 26.15% 1.24 4.65% 1.30 0.2304 22.11%

Trucking 100 0.94 58.92% 17.62% 0.66 8.34% 0.72 0.3168 31.74%

Utility (General) 10 1.12 273.97% 16.84% 0.37 8.63% 0.41 0.2673 25.32%

Utility (Water) 66 1.11 67.05% 18.17% 0.74 9.47% 0.82 0.2897 35.31%

Total Market 21855 1.11 73.74% 15.19% 0.72 13.92% 0.84 0.3504 35.31%

Total Market (without financia 19676 1.14 50.59% 15.12% 0.84 10.66% 0.93 0.3551 35.72%

Standard deviation in operating income (last 10 years)

42.48%

21.92%

59.04%

26.90%

30.37%

31.68%

44.94%

-1851.65%

42.90%

35.13%

27.74%

49.45%

26.41%

43.91%

48.35%

29.29%

22.90%

21.60%

37.49%

28.57%

47.80%

21.46%

39.31%

41.09%

38.30%

55.01%

21.74%

47.94%

47.42%

36.49%

51.12%

74.55%

17.48%

37.89%

26.08%

29.35%

45.12%

43.69%

Standard deviation in operating income (last 10 years)

46.66%

52.92%

108.64%

81.80%

28.92%

32.39%

30.44%

22.25%

41.78%

54.79%

47.66%

49.04%

31.52%

35.38%

17.10%

35.58%

41.15%

26.09%

37.65%

19.99%

35.30%

29.20%

41.03%

20.52%

38.49%

51.32%

28.96%

25.87%

43.81%

48.32%

41.23%

32.66%

50.75%

21.23%

20.26%

24.68%

92.44%

26.85%

42.03%

64.27%

67.92%

42.99%

14.43%

79.22%

146.88%

36.38%

46.42%

Standard deviation in operating income (last 10 years)

16.98%

33.75%

3.97%

16.37%

27.47%

17.09%

27.16%

22.02%

25.12%

22.45%

21.29%

Effective

Marginal

Você também pode gostar

- Date Updated: Created By: What Is This Data? Home Page: Data Website: Companies in Each Industry: Variable DefinitionsDocumento7 páginasDate Updated: Created By: What Is This Data? Home Page: Data Website: Companies in Each Industry: Variable DefinitionsvicoraulAinda não há avaliações

- Finance Beta - IndiaDocumento4 páginasFinance Beta - Indiag9573407Ainda não há avaliações

- IAS 36 WACC Calculation ExampleDocumento36 páginasIAS 36 WACC Calculation ExampleJessyRityAinda não há avaliações

- Date Updated: Created By: What Is This Data? Home Page: Data Website: Companies in Each Industry: Variable DefinitionsDocumento6 páginasDate Updated: Created By: What Is This Data? Home Page: Data Website: Companies in Each Industry: Variable DefinitionsJose Hines-AlvaradoAinda não há avaliações

- Tabla 01 - Beta Del SectorDocumento2 páginasTabla 01 - Beta Del SectorGambi LopezAinda não há avaliações

- Bottom-Up BetaDocumento15 páginasBottom-Up BetaMihael Od SklavinijeAinda não há avaliações

- BetasDocumento1 páginaBetaslu acoriAinda não há avaliações

- Bottom up unlevered beta calculationDocumento18 páginasBottom up unlevered beta calculationTimothy NguyenAinda não há avaliações

- Betas by SectorDocumento2 páginasBetas by SectorTrose Li100% (1)

- BetasDocumento4 páginasBetasRICARDO ANDRES ROJAS ALARCONAinda não há avaliações

- Date Updated: 5-Jan-14 Aswath DamodaranDocumento3 páginasDate Updated: 5-Jan-14 Aswath DamodaranHillary DayanAinda não há avaliações

- BetasDocumento8 páginasBetasHillary DayanAinda não há avaliações

- Bottom Up Unlevered BetaDocumento12 páginasBottom Up Unlevered BetaUyen HoangAinda não há avaliações

- Betas DamodaranDocumento2 páginasBetas DamodaranFabiola Brigida Yauri QuispeAinda não há avaliações

- BetasDocumento7 páginasBetasJulio Cesar ChavezAinda não há avaliações

- Betas by Industry and Sector AnalysisDocumento4 páginasBetas by Industry and Sector AnalysisVanessa José Claudio IsaiasAinda não há avaliações

- BetasDocumento7 páginasBetasWendy FernándezAinda não há avaliações

- Aggregate Market Data for Various IndustriesDocumento3 páginasAggregate Market Data for Various IndustriesVadinee TailorAinda não há avaliações

- Linde India Ltd quarterly financial analysisDocumento18 páginasLinde India Ltd quarterly financial analysisvishalAinda não há avaliações

- CSR Budget and Financial Performance Cleaned v3Documento89 páginasCSR Budget and Financial Performance Cleaned v3Nobita Trót Yêu XukaAinda não há avaliações

- Gloria-Grupo 5Documento424 páginasGloria-Grupo 5giban mendozaAinda não há avaliações

- Yuken IndiaDocumento18 páginasYuken IndiaVishalPandeyAinda não há avaliações

- Info SysDocumento18 páginasInfo SysVishalPandeyAinda não há avaliações

- Clase 6 de Abril 2021Documento12 páginasClase 6 de Abril 2021Wendy Paola Arrieta EscobarAinda não há avaliações

- Industry Financial RatiosDocumento6 páginasIndustry Financial RatiosAndres ZAinda não há avaliações

- Projections 2023Documento8 páginasProjections 2023DHANAMAinda não há avaliações

- Johanny Pareto analysis of exercise teamsDocumento2 páginasJohanny Pareto analysis of exercise teamsJohanny RoseAinda não há avaliações

- Indicadores 2023 08Documento21 páginasIndicadores 2023 08Maria Fernanda TrigoAinda não há avaliações

- Accidentes Motocicletas: Regiondepartamentos. 2016 2017 2016 Casos FR Casos FR FRDocumento4 páginasAccidentes Motocicletas: Regiondepartamentos. 2016 2017 2016 Casos FR Casos FR FRjulio sanchezAinda não há avaliações

- Apollo HospitalsDocumento18 páginasApollo HospitalsvishalAinda não há avaliações

- Zen TechnologiesDocumento18 páginasZen TechnologiesVishalPandeyAinda não há avaliações

- Industry Name Number of Firms Beta D/E Ratio Tax RateDocumento6 páginasIndustry Name Number of Firms Beta D/E Ratio Tax RateIngebusas IngebusasAinda não há avaliações

- Uso de SueloDocumento5 páginasUso de Suelochelon_33Ainda não há avaliações

- RATIOS (Common Size Balance Sheet)Documento4 páginasRATIOS (Common Size Balance Sheet)meenakshi vermaAinda não há avaliações

- Company Name ROE (%) Payout Ratio (%) Retention Ratio (%) : Regression StatisticsDocumento19 páginasCompany Name ROE (%) Payout Ratio (%) Retention Ratio (%) : Regression StatisticsSHIKHA CHAUHANAinda não há avaliações

- UltraTech CemDocumento18 páginasUltraTech CemvishalAinda não há avaliações

- OCL IndiaDocumento18 páginasOCL IndiavishalAinda não há avaliações

- Covid DataDocumento4 páginasCovid DataBangur Palash KamalkishorAinda não há avaliações

- Liberty Shoes Ltd quarterly financial performance analysisDocumento18 páginasLiberty Shoes Ltd quarterly financial performance analysisvishalAinda não há avaliações

- Kansai NerolacDocumento18 páginasKansai NerolacVishalPandeyAinda não há avaliações

- Narration Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Trailing Best Case Worst CaseDocumento18 páginasNarration Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Trailing Best Case Worst CasevishalAinda não há avaliações

- Company Na Beta Market D/E Tax Rate Fixed/Variab Market Cap Market Weighticker Symb Industry Sic Market Cap Current Pe Trailing PeDocumento5 páginasCompany Na Beta Market D/E Tax Rate Fixed/Variab Market Cap Market Weighticker Symb Industry Sic Market Cap Current Pe Trailing PeAnjali BhatiaAinda não há avaliações

- LIC Housing Finance Ltd Financial AnalysisDocumento18 páginasLIC Housing Finance Ltd Financial AnalysisvishalAinda não há avaliações

- BetasDocumento10 páginasBetasVilmaCastilloMAinda não há avaliações

- Date Updated: 5-Jan-14 Aswath Damodaran: To Update This Spreadsheet, Enter The FollowingDocumento9 páginasDate Updated: 5-Jan-14 Aswath Damodaran: To Update This Spreadsheet, Enter The FollowingTony BrookAinda não há avaliações

- Ashok LeylandDocumento18 páginasAshok LeylandVishalPandeyAinda não há avaliações

- BetasDocumento19 páginasBetasasesor2009Ainda não há avaliações

- Narration Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Trailing Best Case Worst CaseDocumento18 páginasNarration Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Trailing Best Case Worst CaseVishalPandeyAinda não há avaliações

- PNB HousingDocumento18 páginasPNB HousingvishalAinda não há avaliações

- Edad FR Fra Fra% Cuatrimestre FR Fra FR% Peso FR Fra Fra% Estatura FR Fra Fra% Calzado FR Fra Fra%Documento1 páginaEdad FR Fra Fra% Cuatrimestre FR Fra FR% Peso FR Fra Fra% Estatura FR Fra Fra% Calzado FR Fra Fra%Johanny RoseAinda não há avaliações

- Asian PaintsDocumento18 páginasAsian PaintsVishalPandeyAinda não há avaliações

- XPRO INDIA LTD financial analysis from 2009-2018Documento18 páginasXPRO INDIA LTD financial analysis from 2009-2018vishalAinda não há avaliações

- Guj. ContainersDocumento10 páginasGuj. Containersdipyaman patgiriAinda não há avaliações

- Yes BankDocumento18 páginasYes BankVishalPandeyAinda não há avaliações

- Amara Raja BattDocumento18 páginasAmara Raja BattvishalAinda não há avaliações

- Xchanging SolDocumento18 páginasXchanging SolvishalAinda não há avaliações

- Distribucion Probabilistica Gumbel: Potosi (Cuenca Coa Coa)Documento4 páginasDistribucion Probabilistica Gumbel: Potosi (Cuenca Coa Coa)marcerus blackAinda não há avaliações

- Coal IndiaDocumento18 páginasCoal IndiavishalAinda não há avaliações

- Lecture Notes 6 - Culture As A Social InstitutionDocumento3 páginasLecture Notes 6 - Culture As A Social Institutionpowerdgnflag75% (4)

- VBB User ManualDocumento146 páginasVBB User ManualHugo CarhuallanquiAinda não há avaliações

- Bluechip Beat DownDocumento5 páginasBluechip Beat Downnand kishorAinda não há avaliações

- PWM ZVT BUCK/BOOSTDocumento11 páginasPWM ZVT BUCK/BOOSTsatya_vanapalli3422Ainda não há avaliações

- Suzuki Grand Vitara Workshop Manual Vol 2Documento474 páginasSuzuki Grand Vitara Workshop Manual Vol 2Roy Rk89% (9)

- US Internal Revenue Service: Prime-ContractDocumento63 páginasUS Internal Revenue Service: Prime-ContractIRSAinda não há avaliações

- Rashi WiproDocumento24 páginasRashi Wiprorashigupta94Ainda não há avaliações

- Kitemarks (TQM)Documento47 páginasKitemarks (TQM)Kashif Farid100% (1)

- AVEVA Enterprise Licensing: Getting Started GuideDocumento28 páginasAVEVA Enterprise Licensing: Getting Started GuidempadliAinda não há avaliações

- Adding Virtual Network Adapter - Windows 7 ForumsDocumento3 páginasAdding Virtual Network Adapter - Windows 7 Forumsnpereira24Ainda não há avaliações

- PPO Features Fact SheetDocumento4 páginasPPO Features Fact SheetMid ConnectAinda não há avaliações

- N120P3Documento12 páginasN120P3Reeja MathewAinda não há avaliações

- 01a Architecture 3.0Documento25 páginas01a Architecture 3.0daniel correa berriosAinda não há avaliações

- manual-750-662-000003-pdf-5b2803f4e207bDocumento134 páginasmanual-750-662-000003-pdf-5b2803f4e207bThughu GhuAinda não há avaliações

- DQ 4Documento7 páginasDQ 4GS々DEVIL NeeruttarAinda não há avaliações

- E10 User ManualDocumento30 páginasE10 User ManualRodrygo BortottiAinda não há avaliações

- 50 ZPB Carrier-PaqueteDocumento5 páginas50 ZPB Carrier-PaqueteJorge SandovalAinda não há avaliações

- OsiSense XS & XT - XS618B1MAL2Documento6 páginasOsiSense XS & XT - XS618B1MAL2mamonetoAinda não há avaliações

- 512 Kbit SPI Serial SRAM With Battery Backup and SDI InterfaceDocumento31 páginas512 Kbit SPI Serial SRAM With Battery Backup and SDI InterfaceVishu PatilAinda não há avaliações

- BIL Levels For Switchgear - Siemens Tech Topics Rev 0Documento2 páginasBIL Levels For Switchgear - Siemens Tech Topics Rev 0Peter DyckAinda não há avaliações

- Ch02 - Development of ERP SystemsDocumento34 páginasCh02 - Development of ERP SystemsSha EemAinda não há avaliações

- Project Meets The Organization: Integrated Project Management IPM (Without IPPD)Documento18 páginasProject Meets The Organization: Integrated Project Management IPM (Without IPPD)vicky_vrocksAinda não há avaliações

- Head IT & Digital Banking Audit - Job Description - Sele GyangDocumento4 páginasHead IT & Digital Banking Audit - Job Description - Sele GyangTanisha GargAinda não há avaliações

- "What Is Computer-Mediated Communication?"-An Introduction To The Special IssueDocumento5 páginas"What Is Computer-Mediated Communication?"-An Introduction To The Special IssueerikAinda não há avaliações

- Kia BookletfDocumento20 páginasKia BookletfVali LeruAinda não há avaliações

- Monitor Tire Pressure with SensorsDocumento6 páginasMonitor Tire Pressure with SensorsDan DanielAinda não há avaliações

- 9th Edition FireNET Installation Manual v1 92Documento218 páginas9th Edition FireNET Installation Manual v1 92mas zak danielAinda não há avaliações

- Documentum Server 7.2 Release NotesDocumento37 páginasDocumentum Server 7.2 Release NotesmaneshkandukuriAinda não há avaliações

- Digital Marketing Companies in DubaiDocumento3 páginasDigital Marketing Companies in DubaiDENNIS KIHUNGIAinda não há avaliações

- Academics and Career Guidance Chart: India Literacy ProjectDocumento1 páginaAcademics and Career Guidance Chart: India Literacy ProjectBabu100% (1)