Escolar Documentos

Profissional Documentos

Cultura Documentos

NB Supplementary Proposal Form V0718

Enviado por

Xavier Alexen AseronDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

NB Supplementary Proposal Form V0718

Enviado por

Xavier Alexen AseronDireitos autorais:

Formatos disponíveis

PruCustomer Line: 1800 -333 0 333

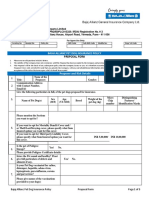

SUPPLEMENTARY PROPOSAL FORM (NEW BUSINESS)

Proposal Information

Proposal Number Name of Financial Consultant Agency Number

-

WARNING: PURSUANT TO SECTION 25(5) OF THE INSURANCE ACT (CAP 142), YOU ARE TO DISCLOSE IN THIS PROPOSAL FORM FULLY AND

FAITHFULLY, ALL THE FACTS WHICH YOU KNOW OR OUGHT TO KNOW, OTHERWISE YOU MAY RECEIVE NOTHING FROM THE POLICY.

Name of Life/Live(s) to be Assured* NRIC/Passport/BC No. Name of Proposer(s)* NRIC/Passport/BC No.

(if other than Life/Live(s) to be Assured)

* If there is more than one Life to be Assured/Proposer, please complete details, if applicable.

Section A: Details of Changes

Please provide details of changes below, where applicable.

1) Plan type, Sum Assured, Premium amount, revised premium, etc

2) Question number of proposal form, questionnaire, etc

Declaration

I/We declare that the information given in this supplementary proposal form is true and that such information and any other i nformation supplied to Prudential or to the Medical Examiner of

Prudential shall be the basis of the policy of assurance or revised policy of assurance, as applicable. I/We declare that no material facts, that are facts likely to influence the assessment and

acceptance of the proposal or revision of the policy of assurance, have been withheld and to the best of my/our knowledge and belief, the information given herein is true and complete and

in the case of a life of another assurance shall be the basis of the revised contract.

I/We agree to inform Prudential if there is any change in the state of health, occupation or activity of the Life to be Assured between the date of this supplementary proposal form or medical

examination and the issue of the policy. On receiving this information Prudential is entitled to accept or reject the proposal.

I/We agree and authorise

a) Any medical source, insurance office or organization to release to Prudential; and

b) Prudential to release to any medical source or insurance office

any relevant information concerning the Life to be Assured at any time, irrespective of whether the proposal is accepted by Prudential. A photographic copy of this authorisation shall be as

valid as the original.

I/We declare that I/we have received a copy of “Your Guide to Life Insurance”; or “Your Guide to Health Insurance” or both, “PruPlanner/Financial Need Analysis”, “Product Summary”, and

“Policy Illustration”; the contents of which had been explained to me/us to my/our satisfaction.

I/We further declare that I/we are not an undischarged bankrupt and that I/we have committed no act of bankruptcy within the last twelve months and that no receiving order or adjudication

in bankruptcy has been made against me/us during that period.

If a material fact is not disclosed in the proposal form or in this supplementary proposal form, any policy issued may not be valid. If you are in doubt as to whether a fact is material, you are

advised to disclose it. This includes any information that you may have provided to the adviser but was not included in the proposal form or in this supplementary proposal form. Please

check to ensure you are fully satisfied with the information declared in the proposal form and in this supplementary proposal form.

Signature of Life/Live(s) to be Assured** Signature of Proposer(s)**

(If other than Life/Live(s) to be Assured)

Dated in Singapore on Dated in Singapore on

N07/18

(DD/MM/YY): (DD/MM/YY):

**If there is more than one life to be Assured/Proposer, all lives to be assured/proposers are to sign within the box.

Prudential Assurance Company Singapore (Pte) Limited (Reg. No.: 199002477Z) L1SUPPF

Page 1 of 1

Você também pode gostar

- Life, Accident and Health Insurance in the United StatesNo EverandLife, Accident and Health Insurance in the United StatesNota: 5 de 5 estrelas5/5 (1)

- Letter To JP Morgan ChaseDocumento5 páginasLetter To JP Morgan ChaseBreitbart NewsAinda não há avaliações

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyNo EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyAinda não há avaliações

- Admin DigestsDocumento6 páginasAdmin DigestsXavier Alexen AseronAinda não há avaliações

- Model Consortium Agreement For APPROVALDocumento34 páginasModel Consortium Agreement For APPROVALSoiab KhanAinda não há avaliações

- How to Build an "Instant" Million-Dollar Direct Marketing Advertising Swipe File!No EverandHow to Build an "Instant" Million-Dollar Direct Marketing Advertising Swipe File!Nota: 3.5 de 5 estrelas3.5/5 (7)

- Nation State System Definition Characteristics and Historical BackgroudDocumento3 páginasNation State System Definition Characteristics and Historical BackgroudEmaan Shah0% (1)

- Civil Advance Hearing Petition Model 26th November2008Documento6 páginasCivil Advance Hearing Petition Model 26th November2008lakshmi100% (2)

- CD - Holy See vs. Rosario 238 SCRA 524Documento3 páginasCD - Holy See vs. Rosario 238 SCRA 524Sai Pastrana100% (2)

- Change of Life Assured Form 70000981Documento8 páginasChange of Life Assured Form 70000981Shareen TeoAinda não há avaliações

- Following Questions To Be Answered by The ProposerDocumento4 páginasFollowing Questions To Be Answered by The Proposeranurag655Ainda não há avaliações

- ProposalformDocumento6 páginasProposalformamitkumar.nayek28101989Ainda não há avaliações

- CCR 1695037892270Documento1 páginaCCR 1695037892270Manish NirwanAinda não há avaliações

- Application For ReinstatementDocumento1 páginaApplication For ReinstatementLALENE VALENTINAinda não há avaliações

- E-Term Plus Policy DocumentDocumento25 páginasE-Term Plus Policy DocumentsrikanthAinda não há avaliações

- Assignment of Policy Form For Corporate PolicyownerDocumento3 páginasAssignment of Policy Form For Corporate PolicyownerjedAinda não há avaliações

- Following Questions To Be Answered by The ProposerDocumento4 páginasFollowing Questions To Be Answered by The ProposerMunisekarAinda não há avaliações

- Life Insurance Corporation of India IPR-F300-V1.0Documento6 páginasLife Insurance Corporation of India IPR-F300-V1.0Rishikesh PrasadAinda não há avaliações

- CCD - Other Channels V5.1Documento2 páginasCCD - Other Channels V5.1Pranay ShitoleAinda não há avaliações

- HDFC ERGO General Insurance Company Limited: Easy Health - Proposal FormDocumento8 páginasHDFC ERGO General Insurance Company Limited: Easy Health - Proposal FormDilip ManiyarAinda não há avaliações

- Smart Health Insurance Policy Proposal DetailsDocumento4 páginasSmart Health Insurance Policy Proposal Detailsmr.suvarn764ssAinda não há avaliações

- Portability Form - RevisedDocumento2 páginasPortability Form - Revisedshirishkanhegaonkar2Ainda não há avaliações

- You Get Married. You Have Children. You Get Them Married. You Retire. Isn't Life Full of Certainties?Documento35 páginasYou Get Married. You Have Children. You Get Them Married. You Retire. Isn't Life Full of Certainties?srikanthAinda não há avaliações

- You Get Married. You Have Children. You Get Them Married. You Retire. Isn't Life Full of Certainties?Documento35 páginasYou Get Married. You Have Children. You Get Them Married. You Retire. Isn't Life Full of Certainties?srikanthAinda não há avaliações

- CO - Surrender or Cancellation of Policy (PPD-08-SURCAN-09-2018v1)Documento3 páginasCO - Surrender or Cancellation of Policy (PPD-08-SURCAN-09-2018v1)umairahAinda não há avaliações

- ProposalformDocumento6 páginasProposalformShivam SoniAinda não há avaliações

- Ihp FHP PF - 2023Documento8 páginasIhp FHP PF - 2023Mantra ServicesAinda não há avaliações

- IRDA Registration No. 133 CIN No: U66010MH2006PLC165288: Part A Forwarding LetterDocumento27 páginasIRDA Registration No. 133 CIN No: U66010MH2006PLC165288: Part A Forwarding LetterChandan KeshriAinda não há avaliações

- Happy Family FloaterformDocumento5 páginasHappy Family FloaterformWealthMitra Financial ServicesAinda não há avaliações

- Clinical Trials Proposal Form PDFDocumento8 páginasClinical Trials Proposal Form PDFNamrathaAinda não há avaliações

- Ipr F300 Re V12.0Documento6 páginasIpr F300 Re V12.0gtmlpatelAinda não há avaliações

- Form 700Documento4 páginasForm 700Abhishek ChattopadhyayAinda não há avaliações

- Form-No-700 English 0 PDFDocumento4 páginasForm-No-700 English 0 PDFMallappa.B MadihalliAinda não há avaliações

- Future Vector Care-Proposal Form (Single Member)Documento2 páginasFuture Vector Care-Proposal Form (Single Member)Arup GhoshAinda não há avaliações

- Proposal Form/Electronic Proposal Form For Single/Joint LifeDocumento5 páginasProposal Form/Electronic Proposal Form For Single/Joint LifeSurya AggarwalAinda não há avaliações

- You Get Married. You Have Children. You Get Them Married. You Retire. Isn't Life Full of Certainties?Documento23 páginasYou Get Married. You Have Children. You Get Them Married. You Retire. Isn't Life Full of Certainties?gkAinda não há avaliações

- ProposalForm PROPOSAL FORM New PDFDocumento7 páginasProposalForm PROPOSAL FORM New PDFcontent kingAinda não há avaliações

- PP CformDocumento4 páginasPP CformHihiAinda não há avaliações

- New Simplified Proposal Form - 1Documento2 páginasNew Simplified Proposal Form - 1Rakeshor NingthoujamAinda não há avaliações

- E-Term Policy DocumentDocumento23 páginasE-Term Policy DocumentpraveenAinda não há avaliações

- HDFCPolicyDocument 22Documento1 páginaHDFCPolicyDocument 22Web TechieAinda não há avaliações

- Bajaj Allianz Pet Dog Insurance Proposal FormDocumento3 páginasBajaj Allianz Pet Dog Insurance Proposal Formgd sreeAinda não há avaliações

- IndiaFirst Life Guaranteed Singgle Premiolicy DocumentDocumento20 páginasIndiaFirst Life Guaranteed Singgle Premiolicy DocumentPraveen MishraAinda não há avaliações

- Office Use OnlyDocumento3 páginasOffice Use OnlyDeep RajAinda não há avaliações

- Declaration of Good Health Form - With Covid QDocumento2 páginasDeclaration of Good Health Form - With Covid QRajnish YadavAinda não há avaliações

- COVID-19 Questionnaire: Dd/Mm/Yyyy Dd/Mm/YyyyDocumento1 páginaCOVID-19 Questionnaire: Dd/Mm/Yyyy Dd/Mm/Yyyyankit bhuvaAinda não há avaliações

- Application For Reinstatement or Policy ChangeDocumento2 páginasApplication For Reinstatement or Policy ChangeCristhelDelaTorreAinda não há avaliações

- Optima RestoreDocumento6 páginasOptima RestoreYOGESH SHARMAAinda não há avaliações

- RPLI FormDocumento7 páginasRPLI FormAngrez SinghAinda não há avaliações

- HSBC Death Claim FormDocumento5 páginasHSBC Death Claim Form健康生活園Healthy Life GardenAinda não há avaliações

- ProposalformDocumento5 páginasProposalformchandrasekar dAinda não há avaliações

- GMC Format - StarDocumento5 páginasGMC Format - StarVasanth VasantAinda não há avaliações

- Surrender - Cancellation Form Non ILK - ELIB - Eng Version - v1.2 (Upd)Documento1 páginaSurrender - Cancellation Form Non ILK - ELIB - Eng Version - v1.2 (Upd)Siti aisyah bt abdullahAinda não há avaliações

- Ti Claim FormDocumento8 páginasTi Claim FormHihiAinda não há avaliações

- In Case of Any Discrepancies in The Above Details Please Inform Us ImmediatelyDocumento38 páginasIn Case of Any Discrepancies in The Above Details Please Inform Us ImmediatelyNitesh SaxenaAinda não há avaliações

- Confirmation FormDocumento2 páginasConfirmation FormLi XiangAinda não há avaliações

- ProposalformDocumento5 páginasProposalformKushal BhatiaAinda não há avaliações

- Application For Insurance ChangesDocumento2 páginasApplication For Insurance Changesroodra singh ranawatAinda não há avaliações

- Welcome To Bajaj Allianz FamilyDocumento7 páginasWelcome To Bajaj Allianz Familyshivam wadhwaAinda não há avaliações

- Group Personal Accident Proposal Form-1Documento4 páginasGroup Personal Accident Proposal Form-1Suchisnata RathAinda não há avaliações

- Financial Amendment Form: 1 General InformationDocumento3 páginasFinancial Amendment Form: 1 General InformationyamAinda não há avaliações

- PA Covid EruwanDocumento2 páginasPA Covid EruwanAhmad EruwanAinda não há avaliações

- Financial Amendment Form: 1 General InformationDocumento3 páginasFinancial Amendment Form: 1 General InformationEjAinda não há avaliações

- CDF New PDFDocumento2 páginasCDF New PDFSachin KapoorAinda não há avaliações

- Health Care Reform Act: Critical Tax and Insurance RamificationsNo EverandHealth Care Reform Act: Critical Tax and Insurance RamificationsAinda não há avaliações

- Supergrowth PDFDocumento9 páginasSupergrowth PDFXavier Alexen AseronAinda não há avaliações

- 2019 Edition of Handbook On Workers Statutory Monetary BenefitsDocumento78 páginas2019 Edition of Handbook On Workers Statutory Monetary BenefitsAlvin ComilaAinda não há avaliações

- Practicum Adviser.: Name: Ledesma, Isabela Name: Urbano, Anna NameDocumento1 páginaPracticum Adviser.: Name: Ledesma, Isabela Name: Urbano, Anna NameXavier Alexen AseronAinda não há avaliações

- Singapore Dynamic Bond Fund: Investment ObjectiveDocumento2 páginasSingapore Dynamic Bond Fund: Investment ObjectiveXavier Alexen AseronAinda não há avaliações

- Supergrowth PDFDocumento9 páginasSupergrowth PDFXavier Alexen AseronAinda não há avaliações

- Asian Equity Fund: PRU May 2019Documento2 páginasAsian Equity Fund: PRU May 2019Xavier Alexen AseronAinda não há avaliações

- 2019 Edition of Handbook On Workers Statutory Monetary BenefitsDocumento78 páginas2019 Edition of Handbook On Workers Statutory Monetary BenefitsAlvin ComilaAinda não há avaliações

- Affidavit TemplateDocumento2 páginasAffidavit TemplateXavier Alexen AseronAinda não há avaliações

- 14-25 Quiz #5Documento2 páginas14-25 Quiz #5Xavier Alexen AseronAinda não há avaliações

- Banking Paper Oct 13Documento4 páginasBanking Paper Oct 13Xavier Alexen AseronAinda não há avaliações

- Affidavit TemplateDocumento2 páginasAffidavit TemplateXavier Alexen AseronAinda não há avaliações

- Conflicts Report AseronDocumento4 páginasConflicts Report AseronXavier Alexen AseronAinda não há avaliações

- Psych Inc TemplateDocumento3 páginasPsych Inc TemplateXavier Alexen AseronAinda não há avaliações

- Banking Paper Oct 13Documento2 páginasBanking Paper Oct 13Xavier Alexen AseronAinda não há avaliações

- Banking Paper Oct 13Documento2 páginasBanking Paper Oct 13Xavier Alexen AseronAinda não há avaliações

- Chi ChanDocumento1 páginaChi ChanXavier Alexen AseronAinda não há avaliações

- Chichi HWDocumento1 páginaChichi HWXavier Alexen AseronAinda não há avaliações

- Acknowledgemeleg Counnt Leg CounsDocumento1 páginaAcknowledgemeleg Counnt Leg CounsXavier Alexen AseronAinda não há avaliações

- Chich SpeechDocumento2 páginasChich SpeechXavier Alexen AseronAinda não há avaliações

- Acknowledgemeleg Counnt Leg CounsDocumento1 páginaAcknowledgemeleg Counnt Leg CounsXavier Alexen AseronAinda não há avaliações

- Acknowledgemeleg Counnt Leg CounsDocumento1 páginaAcknowledgemeleg Counnt Leg CounsXavier Alexen AseronAinda não há avaliações

- Banking Paper Oct 13Documento2 páginasBanking Paper Oct 13Xavier Alexen AseronAinda não há avaliações

- Batch 5Documento4 páginasBatch 5Xavier Alexen AseronAinda não há avaliações

- 02 Bdaypaper Hi 165Documento2 páginas02 Bdaypaper Hi 165Xavier Alexen AseronAinda não há avaliações

- Sales CasesDocumento5 páginasSales CasesXavier Alexen AseronAinda não há avaliações

- Corpo Cases Section 6 - 15Documento32 páginasCorpo Cases Section 6 - 15Xavier Alexen AseronAinda não há avaliações

- Case Digests NegoDocumento15 páginasCase Digests NegoXavier Alexen AseronAinda não há avaliações

- DenmarkDocumento2 páginasDenmarkXavier Alexen AseronAinda não há avaliações

- 7P's of Axis Bank - Final ReportDocumento21 páginas7P's of Axis Bank - Final ReportRajkumar RXzAinda não há avaliações

- Cfa Blank ContractDocumento4 páginasCfa Blank Contractconcepcion riveraAinda não há avaliações

- Assignment - 2 Cash Flow Analysis: Submitted by Group - 8Documento13 páginasAssignment - 2 Cash Flow Analysis: Submitted by Group - 8dheeraj_rai005Ainda não há avaliações

- BMSICL - PPE TenderDocumento55 páginasBMSICL - PPE TenderRafikul RahemanAinda não há avaliações

- Managing The IT Procurement Process - MDocumento12 páginasManaging The IT Procurement Process - MEli RayAinda não há avaliações

- PAC - BABE - UserManualDocumento15 páginasPAC - BABE - UserManualAvinash AviAinda não há avaliações

- Theme I-About EducationDocumento4 páginasTheme I-About EducationAlexandru VlăduțAinda não há avaliações

- Regional Ethics Bowl Cases: FALL 2018Documento2 páginasRegional Ethics Bowl Cases: FALL 2018alyssaAinda não há avaliações

- Edimburgh TicDocumento26 páginasEdimburgh TicARIADNA2003Ainda não há avaliações

- R Vs L.P.Documento79 páginasR Vs L.P.NunatsiaqNews100% (1)

- Questions and Every Right Explained in Simple Words in A Dialect or Language Known To The Person Under InvestigationDocumento2 páginasQuestions and Every Right Explained in Simple Words in A Dialect or Language Known To The Person Under InvestigationMark MlsAinda não há avaliações

- GM 4Q W4Documento24 páginasGM 4Q W4Charmaine GatchalianAinda não há avaliações

- Instructions & Commentary For: Standard Form of Contract For Architect's ServicesDocumento65 páginasInstructions & Commentary For: Standard Form of Contract For Architect's ServicesliamdrbrownAinda não há avaliações

- नवोदय िव ालय सिमित Navodaya Vidyalaya Samiti: Registration No. 25140400531Documento3 páginasनवोदय िव ालय सिमित Navodaya Vidyalaya Samiti: Registration No. 25140400531PintuAinda não há avaliações

- Faithfulness A Fruit of The Holy SpiritDocumento3 páginasFaithfulness A Fruit of The Holy SpiritImmanuel VictorAinda não há avaliações

- Fam Law II - CompleteDocumento103 páginasFam Law II - CompletesoumyaAinda não há avaliações

- Cybersecurity in Africa An AssessmentDocumento34 páginasCybersecurity in Africa An AssessmentTPK Studies & WorkAinda não há avaliações

- SSGC Bill JunDocumento1 páginaSSGC Bill Junshahzaib azamAinda não há avaliações

- MTLBDocumento121 páginasMTLBKIM KYRISH DELA CRUZAinda não há avaliações

- The Analysis of Foreign PolicyDocumento24 páginasThe Analysis of Foreign PolicyMikael Dominik AbadAinda não há avaliações

- Sapbpc NW 10.0 Dimension Data Load From Sap BW To Sap BPC v1Documento84 páginasSapbpc NW 10.0 Dimension Data Load From Sap BW To Sap BPC v1lkmnmkl100% (1)

- My Quiz For Negotiable InstrumentsDocumento2 páginasMy Quiz For Negotiable InstrumentsJamie DiazAinda não há avaliações

- Irish Independent Rate CardDocumento2 páginasIrish Independent Rate CardPB VeroAinda não há avaliações

- No Dues CertificateDocumento2 páginasNo Dues CertificateSatyajit BanerjeeAinda não há avaliações

- FCS Question Bank 2021-22Documento4 páginasFCS Question Bank 2021-22Dhananjay SinghAinda não há avaliações