Escolar Documentos

Profissional Documentos

Cultura Documentos

Assignment Weng 5

Enviado por

dampalit malabonDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Assignment Weng 5

Enviado por

dampalit malabonDireitos autorais:

Formatos disponíveis

WHAT IS FINANCIAL PERFORMANCE?

Financial performance is a subjective measure of how well a firm can use assets from its

primary mode of business and generate revenues. This term is also used as a general measure

of a firms overall financial health over a given period. Analysts and investors use financial

performance to compare similar firms across the same industry or to compare industries or

sectors in aggregate.

UNDERSTANDING FINANCIAL PERFORMANCE

There are many ways to measure financial performance but all measure should be taken in

aggregate. Line items such as revenue from operations operating income or cash flow from

operations can be used as well as total unit sales. Furthermore the analyst or investor may

wish to look deeper into financial statements and seek out margin growth rates or any

declining debt.

There are many stakeholders in a company, including trade creditors, bondholders,

investors, employee and management. Each group has its own interest in tracking the financial

performance of a company. Analysts learn about financial performance from data published

by the company in form 10k form. The purpose of the report is to provide stakeholders with

accurate and reliable financial statements that provide an overview of the company’s financial

performance. In addition company leaders audit and sign these statements and other

disclosure documents. In this way the 10 k represents the most comprehensive source of

information on financial performance made available to investors annually. Included in the 10k

are three financial statements: the balance sheet, the income statement and the cash flow

statement.

The financial performance identifies how well a company generates revenues and

manages its assets, liabilities, and the financial interests of its stakeholders.

The Balance Sheet is a snapshot of the financial balances of an organization. It provides an

overview of how well the company manages its assets and liabilities. Analysts can find

information about long-term vs. short-term debt on the balance sheet. They can also find

information about what kind of assets the company owns and what percentage of assets are

financed with liabilities vs. stockholder’s equity.

The Income Statement provides a summary of operations for the entire year. The income

statement starts with sales or revenues and ends with net income. Also referred to as the

profit and loss statement the income statement provides the gross profit margin, the cost of

goods sold, operating profit margin and net profit margin. It also provides an overview of the

number of shares outstanding as well as comparison against prior year performance.

The Cash Flow Statement is a combination of both the income statement and the balance

sheet. For some analysts the cash flow statement is the most important financial statement

because it provides reconciliation between net income and cash flow from operations,

investing and financing.

Você também pode gostar

- Financial Modelling: Types of Financial ModelsDocumento7 páginasFinancial Modelling: Types of Financial ModelsNavyaRaoAinda não há avaliações

- Financial Statement AnalysisDocumento4 páginasFinancial Statement AnalysisYasir ABAinda não há avaliações

- Financial Statement AnalysisDocumento22 páginasFinancial Statement AnalysisHazell DAinda não há avaliações

- Module 1 Interpretations of Financial StatementsDocumento21 páginasModule 1 Interpretations of Financial StatementsPushpaAinda não há avaliações

- What Is An Annual Report?Documento4 páginasWhat Is An Annual Report?Evanjo NuquiAinda não há avaliações

- What Are Financial StatementsDocumento4 páginasWhat Are Financial StatementsJustin Era ApeloAinda não há avaliações

- Meaning of Financial StatementsDocumento44 páginasMeaning of Financial Statementsparth100% (1)

- LAGRIMAS - Activity 2Documento4 páginasLAGRIMAS - Activity 2Sarah Nicole S. LagrimasAinda não há avaliações

- HCL StudyDocumento13 páginasHCL StudyJyotirmay SahuAinda não há avaliações

- FM TermpaoerDocumento34 páginasFM TermpaoerFilmona YonasAinda não há avaliações

- Finance AnalysisDocumento11 páginasFinance Analysissham_codeAinda não há avaliações

- What Are Financial Statements?: AssetsDocumento4 páginasWhat Are Financial Statements?: AssetsRoselyn Joy DizonAinda não há avaliações

- Financial Analysis: Submitted byDocumento18 páginasFinancial Analysis: Submitted bybernie john bernabeAinda não há avaliações

- Ratio Analysis Note Acc 321-2Documento20 páginasRatio Analysis Note Acc 321-2Adedeji MichaelAinda não há avaliações

- Financial Statement AnalysisDocumento3 páginasFinancial Statement AnalysisShreya VermaAinda não há avaliações

- Ratio Analysis Draft 1Documento9 páginasRatio Analysis Draft 1SuchitaSanghviAinda não há avaliações

- Understanding Financial StatementsDocumento5 páginasUnderstanding Financial StatementsMark Russel Sean LealAinda não há avaliações

- Financial Statement AnalysisDocumento2 páginasFinancial Statement AnalysisPrincess Neharah NuskaAinda não há avaliações

- Lecture 2.1 Financial Statement AnalysisDocumento3 páginasLecture 2.1 Financial Statement AnalysisEric CauilanAinda não há avaliações

- FAR 4rth UNITDocumento47 páginasFAR 4rth UNITBhavana PedadaAinda não há avaliações

- Financial Performance AnalysisDocumento110 páginasFinancial Performance AnalysisNITHIN poojaryAinda não há avaliações

- DevaDocumento15 páginasDevagokulraj0707cmAinda não há avaliações

- Sarah Finance Project 6th SemesterDocumento24 páginasSarah Finance Project 6th Semestersarah IsharatAinda não há avaliações

- Financial Analysis of Wipro LTD PDFDocumento25 páginasFinancial Analysis of Wipro LTD PDFMridul sharda100% (2)

- Principles of Finance Chapter07 BlackDocumento115 páginasPrinciples of Finance Chapter07 BlackLim Mei Suok100% (1)

- Muzzamil Janjua SAP ID 42618Documento9 páginasMuzzamil Janjua SAP ID 42618Muzzamil JanjuaAinda não há avaliações

- Lecture 1 Accounts (Fundamentals of Accounting)Documento38 páginasLecture 1 Accounts (Fundamentals of Accounting)Saleha Javed KayaniAinda não há avaliações

- FSA3e HW Answers Modules 1-4Documento39 páginasFSA3e HW Answers Modules 1-4bobdole0% (1)

- Unit - 10 Financial Statements and Ratio AnalysisDocumento18 páginasUnit - 10 Financial Statements and Ratio AnalysisAayushi Kothari100% (1)

- Financial AccDocumento2 páginasFinancial AccPoleAinda não há avaliações

- Proj 3.0 2Documento26 páginasProj 3.0 2Shivam KharuleAinda não há avaliações

- Financial Statements AnalysisDocumento42 páginasFinancial Statements AnalysisSulle DadyAinda não há avaliações

- Financial Statement Analysis (Nov-20)Documento51 páginasFinancial Statement Analysis (Nov-20)Aminul Islam AmuAinda não há avaliações

- A Study On Financial Statement Analysis in J.q.tyreDocumento79 páginasA Study On Financial Statement Analysis in J.q.tyrek eswariAinda não há avaliações

- INTRODUCTIONDocumento80 páginasINTRODUCTIONparth100% (1)

- A Comprehensive Projecect ON A COMPARATIVE STUDY ON Financial Performance "Tata Motors LTD." and "Bajaj Auto LTD." Submitted ToDocumento27 páginasA Comprehensive Projecect ON A COMPARATIVE STUDY ON Financial Performance "Tata Motors LTD." and "Bajaj Auto LTD." Submitted ToPatel RuchitaAinda não há avaliações

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"Ainda não há avaliações

- Financial Statement AnalysisDocumento3 páginasFinancial Statement AnalysisAmit KumarAinda não há avaliações

- A Study On Financial Statement Analysis in Mokshwa Soft Drinks at CoimbatoreDocumento23 páginasA Study On Financial Statement Analysis in Mokshwa Soft Drinks at Coimbatorek eswariAinda não há avaliações

- Financial-Reporting Under New ApprochDocumento5 páginasFinancial-Reporting Under New ApprochSumon AhmedAinda não há avaliações

- Sources of Finance and Impact On Financial Statements Finance EssayDocumento12 páginasSources of Finance and Impact On Financial Statements Finance EssayHND Assignment Help50% (2)

- Financial Leverage Ratios, Sometimes Called Equity or Debt Ratios, MeasureDocumento11 páginasFinancial Leverage Ratios, Sometimes Called Equity or Debt Ratios, MeasureBonDocEldRicAinda não há avaliações

- Fa4e SM Ch01Documento21 páginasFa4e SM Ch01michaelkwok1100% (1)

- Every Limited Company Prepares An Annual Report On Its Accounts and State ofDocumento4 páginasEvery Limited Company Prepares An Annual Report On Its Accounts and State ofSuraj SharmaAinda não há avaliações

- Annual ReportDocumento11 páginasAnnual ReportbalqisAinda não há avaliações

- Types of Financial Statements: Statement of Profit or Loss (Income Statement)Documento4 páginasTypes of Financial Statements: Statement of Profit or Loss (Income Statement)LouiseAinda não há avaliações

- Financial Statement AnalysisDocumento4 páginasFinancial Statement AnalysisLea AndreleiAinda não há avaliações

- Accounting For Managers ExtraDocumento6 páginasAccounting For Managers ExtraNantha KumaranAinda não há avaliações

- Financial: StatementDocumento31 páginasFinancial: StatementGrace Joy100% (1)

- Qaisar - Ch-6Documento9 páginasQaisar - Ch-6Qaisar BasheerAinda não há avaliações

- Financial Statement AnalysisDocumento89 páginasFinancial Statement AnalysiseshuAinda não há avaliações

- Muzzamil Janjua SAP ID 42618Documento9 páginasMuzzamil Janjua SAP ID 42618Muzzamil JanjuaAinda não há avaliações

- A Study On Financial Statement Analysis in Tensile Pro Pipes Manufacturing Inudustry at TrichyDocumento62 páginasA Study On Financial Statement Analysis in Tensile Pro Pipes Manufacturing Inudustry at TrichyeshuAinda não há avaliações

- Fs Sem 5Documento7 páginasFs Sem 5Pradumn AgarwalAinda não há avaliações

- What Is Financial Statement AnalysisDocumento4 páginasWhat Is Financial Statement AnalysisDivvy JhaAinda não há avaliações

- 05 BSAIS 2 Financial Management Week 10 11Documento9 páginas05 BSAIS 2 Financial Management Week 10 11Ace San GabrielAinda não há avaliações

- Fiscal Management - Financial Statement AnalysisDocumento60 páginasFiscal Management - Financial Statement AnalysisBCC 27 AccountAinda não há avaliações

- Financial StatementDocumento7 páginasFinancial StatementJan Marini Lopez MiguelAinda não há avaliações

- Financial StatementsDocumento4 páginasFinancial StatementsConrad DuncanAinda não há avaliações

- Exhibit 3 - Search Fund Formation - Private Placement Memorandum (Sample)Documento21 páginasExhibit 3 - Search Fund Formation - Private Placement Memorandum (Sample)Lior100% (1)

- Excercise Chapter 2Documento2 páginasExcercise Chapter 2Loan VũAinda não há avaliações

- 101 - 255 - 93 - 94-Annual Report 2017 PT Panca Budi Idaman Tbk.Documento236 páginas101 - 255 - 93 - 94-Annual Report 2017 PT Panca Budi Idaman Tbk.RianSastianAndrianaAinda não há avaliações

- Under Variable Costing:: Question 1Documento35 páginasUnder Variable Costing:: Question 1Iris FenelleAinda não há avaliações

- PRDocumento26 páginasPRAayush ShrivastavAinda não há avaliações

- Kelayakan Finansial Dan Analisis Nilai Tambah Pada Pengolahan Biji Kakao Kupas Tanpa Sangrai Di Ud. Harta Sari Selemadeg Tabanan BaliDocumento8 páginasKelayakan Finansial Dan Analisis Nilai Tambah Pada Pengolahan Biji Kakao Kupas Tanpa Sangrai Di Ud. Harta Sari Selemadeg Tabanan BaliKhafidz HidayatullohAinda não há avaliações

- Sebi Review PDFDocumento44 páginasSebi Review PDFKashish PandiaAinda não há avaliações

- CH0620100916181206Documento4 páginasCH0620100916181206Shubharth BharadwajAinda não há avaliações

- Ratio AnalysisDocumento21 páginasRatio AnalysisSupreet PurohitAinda não há avaliações

- Depletion RevaluationDocumento2 páginasDepletion RevaluationIm In TroubleAinda não há avaliações

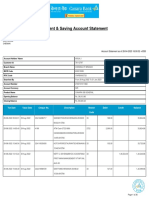

- Current & Saving Account Statement: Arun J Plot No 366 13Th Street Astalakshmi Nagar 3Rd Main RD Alapakkam ChennaiDocumento26 páginasCurrent & Saving Account Statement: Arun J Plot No 366 13Th Street Astalakshmi Nagar 3Rd Main RD Alapakkam ChennaiArun Jayaprakash NarayananAinda não há avaliações

- Sebi Faq Substantial Acquisition of Shares and TakeoversDocumento31 páginasSebi Faq Substantial Acquisition of Shares and TakeoversRahul SharmaAinda não há avaliações

- Instant Download Ebook PDF Financial Management Concepts and Applications PDF ScribdDocumento41 páginasInstant Download Ebook PDF Financial Management Concepts and Applications PDF Scribdcheryl.morgan378100% (43)

- Finance Mohit Rajput PDFDocumento60 páginasFinance Mohit Rajput PDFArjun ChouhanAinda não há avaliações

- Task Sheet 2.1-2Documento3 páginasTask Sheet 2.1-2Sweetzel PrecinioAinda não há avaliações

- CH 07Documento43 páginasCH 07Kluaris - 备课专用小号 LiAinda não há avaliações

- Brandon Company: Margin of Safety Is 44.4%Documento4 páginasBrandon Company: Margin of Safety Is 44.4%Abdulmajed Unda MimbantasAinda não há avaliações

- Chapter 3: Financial Statements and The Reporting EntityDocumento4 páginasChapter 3: Financial Statements and The Reporting EntityMack Jigo DiazAinda não há avaliações

- Fundamentals of Financial AccountingDocumento40 páginasFundamentals of Financial AccountingEYENAinda não há avaliações

- Introduction To Financial AccountingDocumento14 páginasIntroduction To Financial AccountingMohd Azhari Hani SurayaAinda não há avaliações

- Mutual Fund: Course Learning OutcomesDocumento19 páginasMutual Fund: Course Learning OutcomesJohnVerjoGeronimoAinda não há avaliações

- Delta Project and Repco AnalysisDocumento9 páginasDelta Project and Repco AnalysisvarunjajooAinda não há avaliações

- Feasib ScriptDocumento3 páginasFeasib ScriptJeremy James AlbayAinda não há avaliações

- PDF Ap Investments Quizzer QDocumento80 páginasPDF Ap Investments Quizzer QJune KooAinda não há avaliações

- M & A Solutions PDFDocumento28 páginasM & A Solutions PDFayushmehtha7Ainda não há avaliações

- General Overview IFRS 17Documento172 páginasGeneral Overview IFRS 17Jefri SAinda não há avaliações

- Portfolio SummaryDocumento3 páginasPortfolio SummaryPravin AwalkondeAinda não há avaliações

- SBI Mutual Funds: Financial ServicesDocumento9 páginasSBI Mutual Funds: Financial ServicesShivam MutkuleAinda não há avaliações

- BMW AG Financial Statements 2022 enDocumento60 páginasBMW AG Financial Statements 2022 enNitesh SinghAinda não há avaliações

- Chapter 5 ActivityDocumento2 páginasChapter 5 ActivityMika MolinaAinda não há avaliações